There’s a quote that says “You can love me or hate me but.. you can’t ignore me” and it fits beautifully for Zomato. What started as a simple website that listed restaurants and cafe menu cards has today become a mammoth 2 lakh crore+ market cap company and would now be part of the prestigious Nifty 50 list that includes the top 50 companies of India. Zomato made its much-anticipated debut on Dalal Street in July 2021 and since then, it has been nothing short of a roller-coaster ride for the company. I clearly remember it was the peak of the bull run in India and Zomato IPO received a stellar response with 38 times subscriptions.

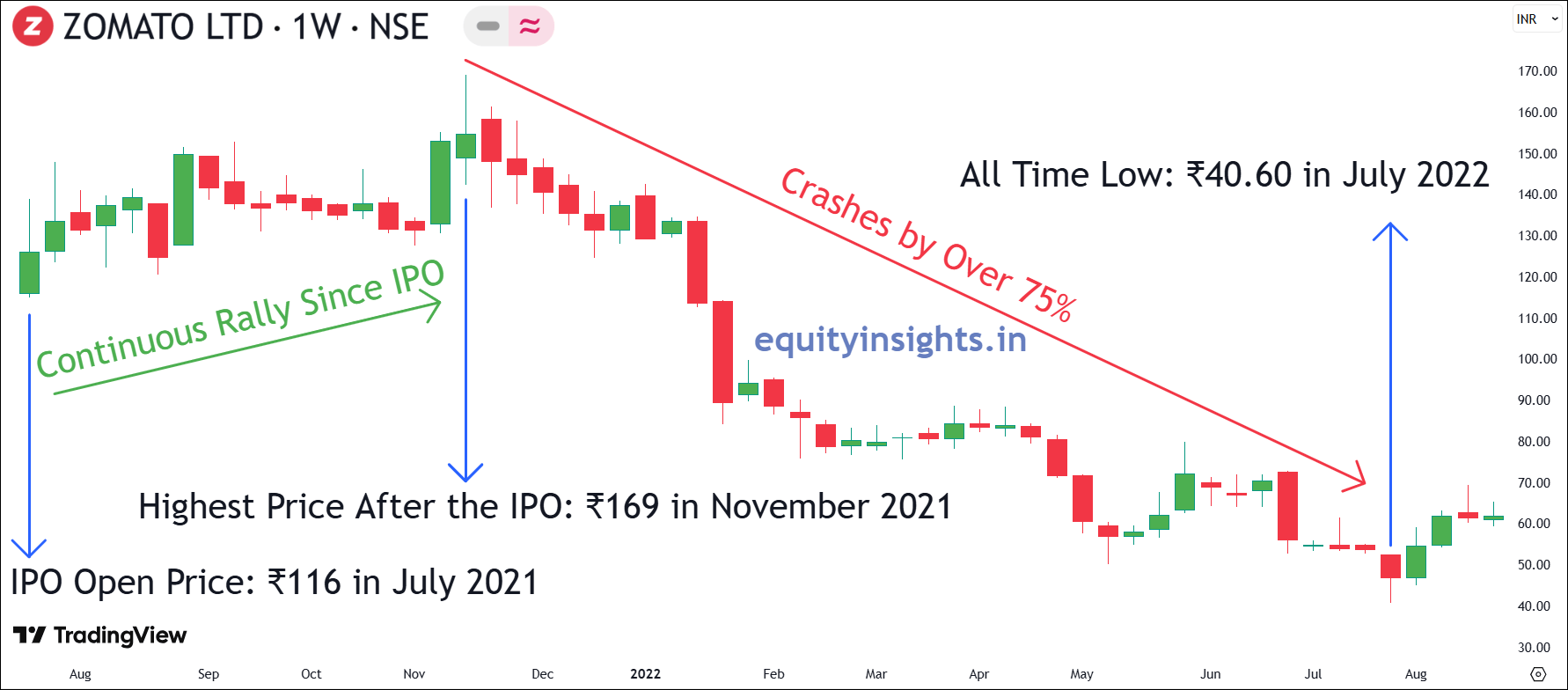

Its stock experienced a stellar rally, starting with an IPO price of ₹76 and making an impressive debut at ₹116. The momentum didn’t stop there—it continued its upward trajectory, reaching an all-time high of ₹169 within just a few months of listing, delivering exceptional returns to early investors. But then the company started facing headwinds and over the next 12 months, Zomato share price crashed to levels of ₹40. However, just when it seemed down for the count, it made a stunning comeback and again rose like a Phoenix, skyrocketing 7x in two years to hit ₹304.70. However, the volatility continues, with the stock now down about 30% from its peak.

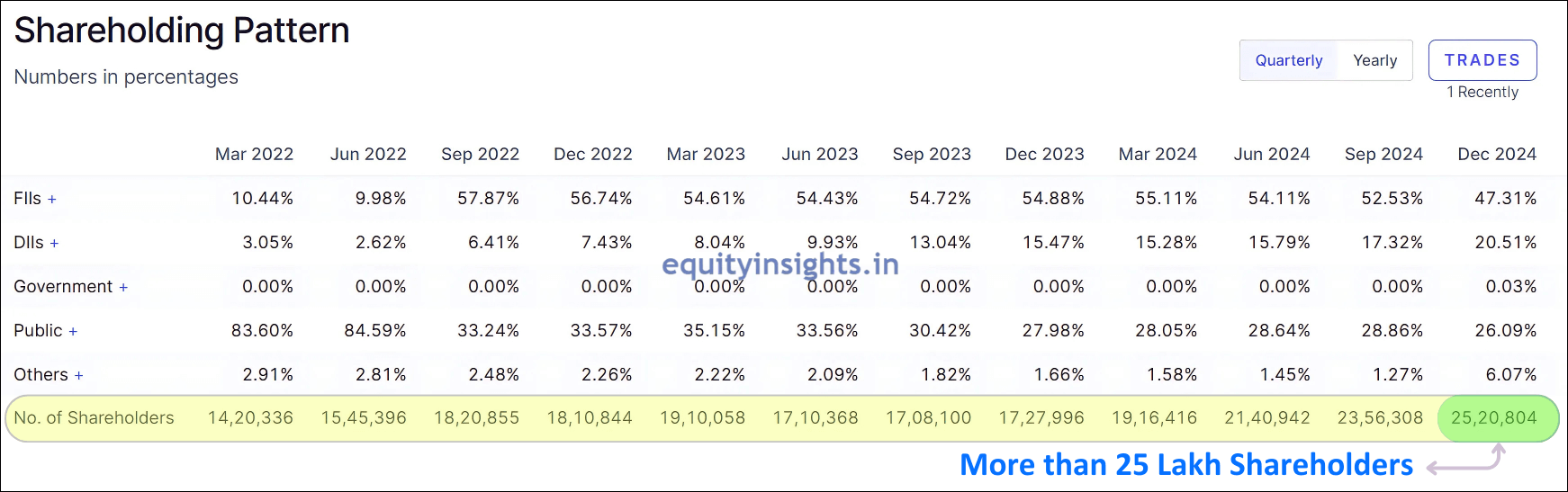

Even today, Zomato is one of the most discussed stocks in the market where public opinion is completely divided. Some believe that it still has a long way to go and create wealth for the investors whereas some argue that it is overvalued and a hype story now. Even the market experts are divided on its valuation and growth prospects. In any case, it is a fact that Zomato today has more than 25 lakh shareholders and even if you are not an investor, there’s a high probability that you are its customer and using its app for food delivery or Blinkit for household grocery. So, I thought of sharing a detailed analysis of Zomato.

I have divided this article into six engaging parts to break down Zomato’s fascinating journey and its investment potential:

- Business Model and Key Revenue Streams – Understanding how the company operates and generates revenue.

- Zomato’s FY24 Unit Economics per Order – Examining the company’s earnings per order across various business segments.

- The IPO Roller Coaster – A deep dive into the company’s much-hyped IPO, its meteoric rise and the subsequent fall.

- Zomato’s Rise with Quick Commerce – How Zomato reinvented itself with quick commerce and staged a strong comeback.

- SWOT Analysis of Zomato – A critical examination of company’s strengths, weaknesses, opportunities and threats to understand its business landscape.

- Valuation – The most debated topic: Is Zomato’s valuation justified? Is it still a good investment at current levels?

All right let’s get started.

Read More: Zaggle Prepaid Share: A Promising Investment or Risky Bet?

Table of Contents

Business Model and Key Revenue Streams

Zomato is one of the leading food technology platforms, providing food delivery, restaurant discovery and various value-added services across multiple countries such as India, UAE and the UK. The company operates on a multifaceted business model that integrates food ordering, restaurant partnerships, advertising, quick commerce, and B2B supply chain services to sustain profitability and growth.

1. Food Delivery

Zomato operates a food ordering and delivery platform that allows customers to search and discover local restaurants, order food and receive doorstep delivery. Orders placed by customers are prepared by restaurants and fulfilled through a last-mile delivery network consisting of independent delivery partners.

Revenue Sources

The food delivery business of Zomato earns revenue from the following sources:

I. Commission-Based Revenue (Food Delivery Services)

Zomato’s primary revenue source comes from food delivery services. The platform seamlessly connects users with restaurants and charges a commission on each order placed, where the restaurant shares a part of its revenue as a commission with the company, while users pay a fixed platform fee per order. While the platform fee remains constant for users, the commission percentage for restaurants varies based on the following key factors:

- Restaurant Popularity & Exclusivity: Higher commission rates for premium and exclusive partner restaurants.

- Location & Demand: Restaurants in high-demand areas often pay more.

- Delivery Model: Zomato offers both self-managed delivery (charges delivery fees from customers and a commission from restaurants) and restaurant-managed delivery models (premium restaurants handle logistics while Zomato manages orders and payments), influencing commission structures.

II. Subscription-Based Revenue (Zomato Gold Membership)

Zomato Gold is a premium subscription program that offers members exclusive benefits, such as:

- Free delivery on select restaurants

- Discounts on dining and food orders

- Priority access to high-rated restaurants

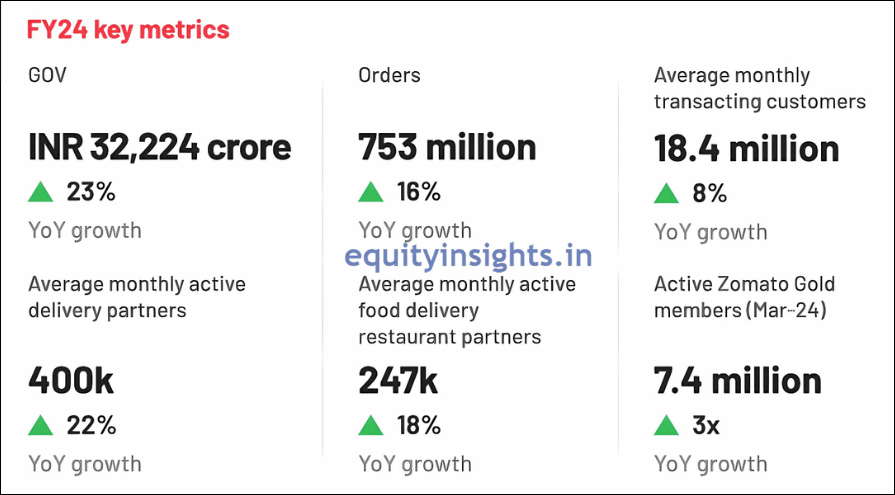

Restaurants also benefit from Zomato Gold as it drives more footfall and orders, leading to increased revenue. Zomato charges an annual membership fee from users and an onboarding fee from restaurants to be listed under the Zomato Gold program. As of March 2024, the company has 7.4 million active Gold members on their

platform.

III. Advertising & Sponsored Listings

Advertising is a significant revenue stream for Zomato. Restaurants pay for:

- Promoted Listings: Appear higher in search results and recommendations.

- Banner Advertisements: Displayed on the homepage and search results.

- Sponsored Reviews: Boosting visibility through influencer collaborations and promotions.

This model ensures additional revenue while enhancing restaurant reach and visibility.

FY24 Key Metrics

- Gross Order Value (GOV): ₹32,224 crore (23% YoY growth)

- Orders: 753 million (16% YoY growth)

- Average Monthly Transacting Customers: 18.4 million (8% YoY growth)

- Active Zomato Gold Members: 7.4 million (3x YoY growth)

- Monthly Active Delivery Partners: 400K (22% YoY growth)

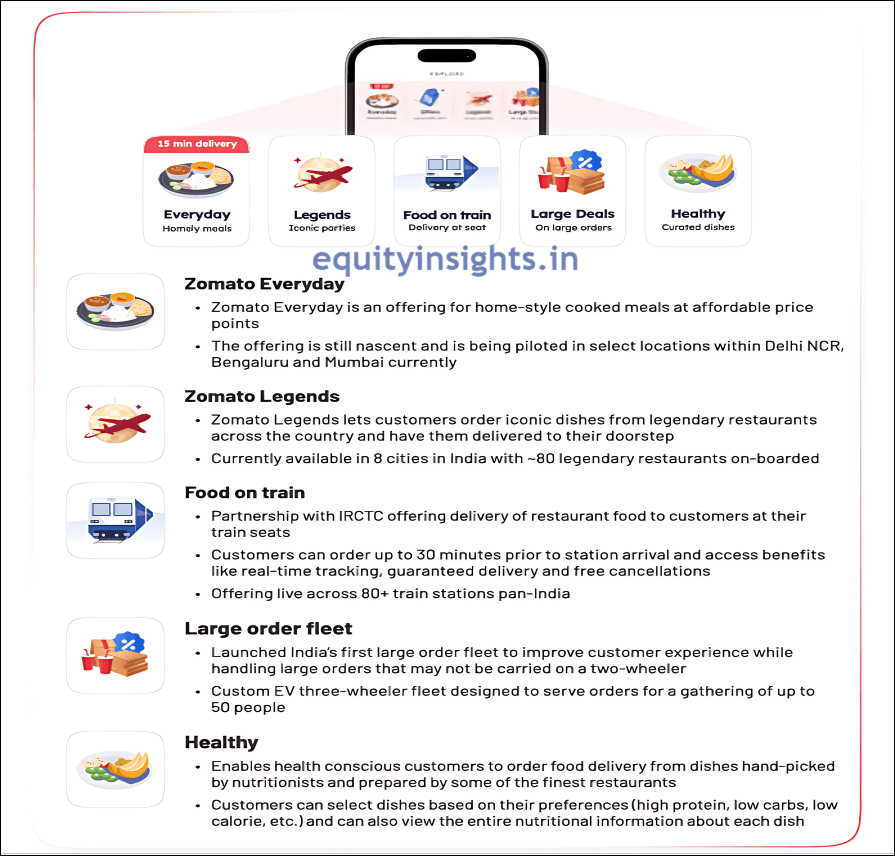

Additional Food Delivery Initiatives

- Zomato Everyday – Affordable home-style cooked meals (pilot in Delhi NCR, Mumbai and Bengaluru).

- Zomato Legends – Iconic dishes from legendary restaurants (available in 8 cities).

- Food on Train – Partnership with IRCTC for train seat deliveries (live across 80+ stations).

- Large Order Fleet – EV three-wheeler fleet for bulk food orders.

- Health-Focused Food – Curated meals with nutritional details.

2. Quick Commerce (Blinkit)

Zomato owns Blinkit, a quick commerce platform that delivers groceries, daily essentials, electronics, beauty & personal care, home decor, toys & games, general merchandise and other products within 10 minutes. The key aspects of Blinkit’s business model include:

- Hyperlocal Warehousing: Small warehouses located within 2-3 km of customers to fulfill orders quickly.

- AI-Driven Demand Forecasting: Predicts inventory needs to minimize delays.

- Partnerships with Local Vendors: Ensures a diverse range of products and competitive pricing.

- Commission-Based Revenue: Blinkit earns revenue through commissions from partnered brands and service fees from customers.

With the rapid growth of quick commerce, Blinkit is a crucial part of Zomato’s long-term strategy, contributing significantly to revenue and customer engagement.

Revenue Sources

- Commissions from partnered brands.

- Service fees from customers.

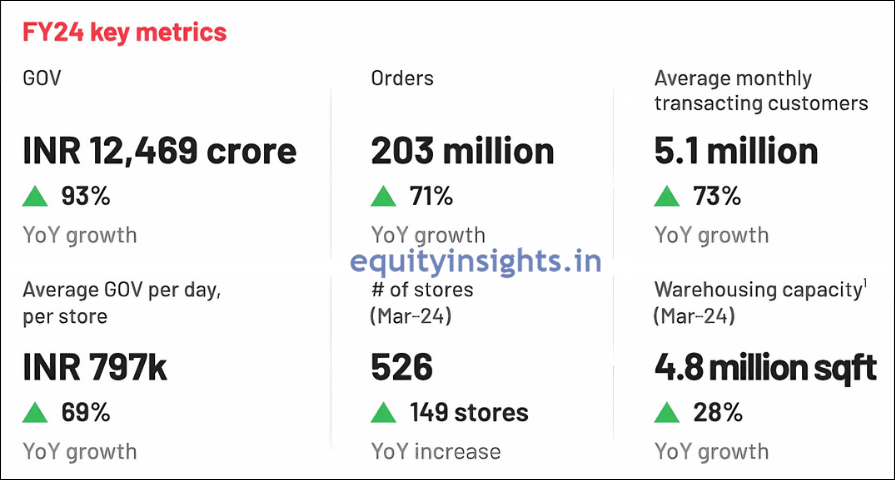

FY24 Key Metrics

- GOV: ₹12,469 crore (93% YoY growth)

- Orders: 203 million (71% YoY growth)

- Average Monthly Transacting Customers: 5.1 million (73% YoY growth)

- Average GOV per Store per Day: ₹797K (69% YoY growth)

- Total Warehousing Capacity: 4.8 million sq. ft. (28% YoY growth)

- Total Stores: 526 (149 new stores added)

Expansion & Product Diversification

- Added new categories like fashion jewellery, gaming, toys, sports, plants and bouquets, home improvement and print-outs.

3. Going-out Business (Dining-Out & Ticketing)

Going-out is Zomato’s third B2C business (after food delivery and quick commerce) and addresses the ‘going-out’

needs of the people. At present, the service includes:

- Dining Out: Zomato makes dining out effortless by allowing users to book tables at top restaurants across India and the UAE. It enables users to explore local restaurants by accessing reviews & ratings, and search for new dining-out options by browsing through curated restaurant collections. Users can conveniently reserve tables and avail exclusive offers by paying their dining bills via the Zomato app. The platform operates in over 40 Indian cities and the UAE, offering features such as map-based restaurant discovery, curated dining experiences, and group bookings.

- Zomato Live: A growing event ticketing platform that offers ticketing services primarily for events such as large-scale food carnivals, music concerts, comedy shows and others, making it easier to access live entertainment experiences. The ticketing platform has been launched in 13 cities in India and has hosted events like Russell Peters India Tour, Sneaker Convention and Zomaland.

Revenue Sources

- Commissions on restaurant bookings and dining-out transactions.

- Event sponsorships, ticket sales and partnered restaurant stalls.

FY24 Key Metrics

- Going-out GOV: ₹3,225 crore (136% YoY growth)

4. B2B Supplies (Hyperpure)

Zomato has expanded its business model into the B2B supplies with Hyperpure, a service that supplies high-quality food ingredients and kitchen essentials to restaurants. Benefits for restaurants include:

- Assurance of fresh and hygienic ingredients

- Competitive pricing

- Faster and reliable delivery of raw materials

Hyperpure adds value to restaurant partners while strengthening Zomato’s ecosystem by creating a vertically integrated supply chain.

Revenue Sources

- Direct sales to restaurants.

- Value-added product manufacturing.

- Logistics and warehousing services.

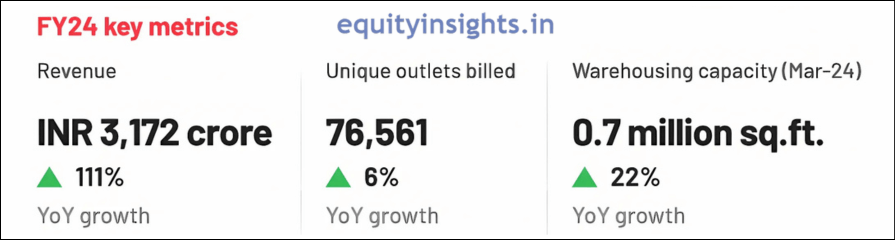

FY24 Key Metrics

- Revenue: ₹3,172 crore (111% YoY growth)

- Unique Outlets Billed: 76,561 (6% YoY growth)

- Warehousing Capacity: 0.7 million sq. ft. (22% YoY growth)

Expansion & New Initiatives

- 4PL Warehousing & Supply Chain Services – End-to-end logistics solutions for restaurants.

- Value-Added Products – In-house production of sauces, spreads, and pre-cut and semi-finished perishable products.

- Express B2B Delivery – Quick delivery of restaurant supplies within hours.

Read More: The Power Players: 6 Top HNIs Influencing the Stock Market!

Zomato’s FY24 Unit Economics per Order

Now, let’s understand how much Zomato earns from every order across its different business segments! Here’s a detailed breakdown of Zomato’s FY24 Unit Economics per Order as per FY24 Annual Report:

1. Food Delivery – FY24 (Per Order Economics)

Average Order Value (AOV): ₹428

- Restaurant Share: ₹325 (~76% of AOV)

- Zomato’s Total Revenue Per Order: ~₹103 (~24.2% of AOV)

- Restaurant Commission & Ad Revenue: ~₹86 (~20% of AOV)

- Delivery Fee (Paid by Customers): ~₹15 (~3.5% of AOV)

- Platform Fee: ~₹5 (~1% of AOV)

- Zomato’s Total Variable Costs (Expenses): ₹74 (~17% of AOV)

- Delivery Cost (Paid to Delivery Partners): ₹55 (~13% of AOV)

- Platform Discounts & Incentives: ₹6 (~1.5% of AOV)

- Payment Gateway & Other Costs: ₹13 (~3% of AOV)

- Profitability:

- Contribution (Revenue – Costs): ₹29 (~6.9% of AOV)

- Adjusted EBITDA (Net Profit Per Order): ₹1.2 (~0.3% of AOV)

Key Insights

- Zomato charges ~₹15 per order as a delivery fee, lower due to Zomato Gold discounts.

- Delivery partner payouts (~₹55 per order) are the biggest cost component.

- Ad revenue and platform fees have boosted profitability.

- A first full year of positive EBITDA in food delivery.

Despite earning ₹103 in revenue per order, Zomato’s actual profit is just ₹1.2 due to high operational costs.

2. Quick Commerce (Blinkit) – FY24 (Per Order Economics)

Average Order Value (AOV): ₹613

- Merchant Share: ₹500 (~81.5% of AOV)

- Blinkit’s Total Revenue Per Order: ₹113 (~18.5% of AOV)

- Marketplace Commission & Ad Revenue: ₹88 (~14.3% of AOV)

- Delivery Fee (Paid by Customers): ₹20 (~3.3% of AOV)

- Warehousing & Ancillary Income: ₹5 (~0.8% of AOV)

- Blinkit’s Total Variable Costs (Expenses): ₹85 (~14% of AOV)

- Delivery Cost (Paid to Delivery Partners): ₹40 (~6.5% of AOV)

- Warehouse & Logistics Costs: ₹35 (~5.5% of AOV)

- Platform Discounts & Incentives: ₹10 (~1.5% of AOV)

- Profitability:

- Contribution (Revenue – Costs): ₹13 (~2.1% of AOV)

- Adjusted EBITDA per Order: Negative, but turned positive in March 2024.

Key Insights

- Higher AOV (~₹613) compared to food delivery.

- Lower delivery fee (~₹13 per order) to remain competitive.

- Logistics and warehouse costs (~₹35 per order) are major expenses.

- Quick commerce turned EBITDA-positive in March 2024.

Blinkit earns ₹113 per order while spending ₹85 on variable costs, leaving a contribution margin of ₹13 per order. Despite previous losses, Blinkit’s Adjusted EBITDA turned positive in March 2024, marking a key milestone toward profitability.

3. Going-out (Dining & Ticketing) – FY24 (Estimated Per Order Economics)

It is a growing segment, driven by restaurant bookings and ticketing, and is expected to contribute significantly as adoption increases. Below is the estimated per-order economics for the business:

Average Ticket Size (Estimate): ₹800

- Event Organizers: ₹720 (~90% of ticket size)

- Total Revenue Per Order: ₹80 (~10% of ticket size)

- Dining-Out Commission & Ad Revenue: ₹55 (~5.5% of ticket size)

- Ticketing Fees (Zomato Live): ₹25 (~2.5% of ticket size)

- Event’s Total Variable Costs (Expenses): ₹82 (~8.2% of ticket size)

- Platform Costs (Tech, Support and Processing): ₹35 (~3.5% of ticket size)

- Marketing & Promotions (Dining Offers & Events): ₹30 (~3% of ticket size)

- Operational Costs (Customer Service & Refunds): ₹17 (~1.7% of ticket size)

- Profitability:

- Contribution (Revenue – Costs): -₹2 (Loss per Order) (~-0.2% of AOV)

- Adjusted EBITDA Per Order: -₹0.5 (Improved but still negative)

Key Highlights

- Food delivery is EBITDA-positive, with ₹1.2 profit per order.

- Quick commerce (Blinkit) improved significantly and turned EBITDA-positive in March 2024.

- Dining & ticketing (Going-out) is still developing but has long-term growth potential.

Zomato’s going-out business losses reduced to ₹6 crore in FY24 from ₹13 crore in FY23 which is still negative but shows improvement.

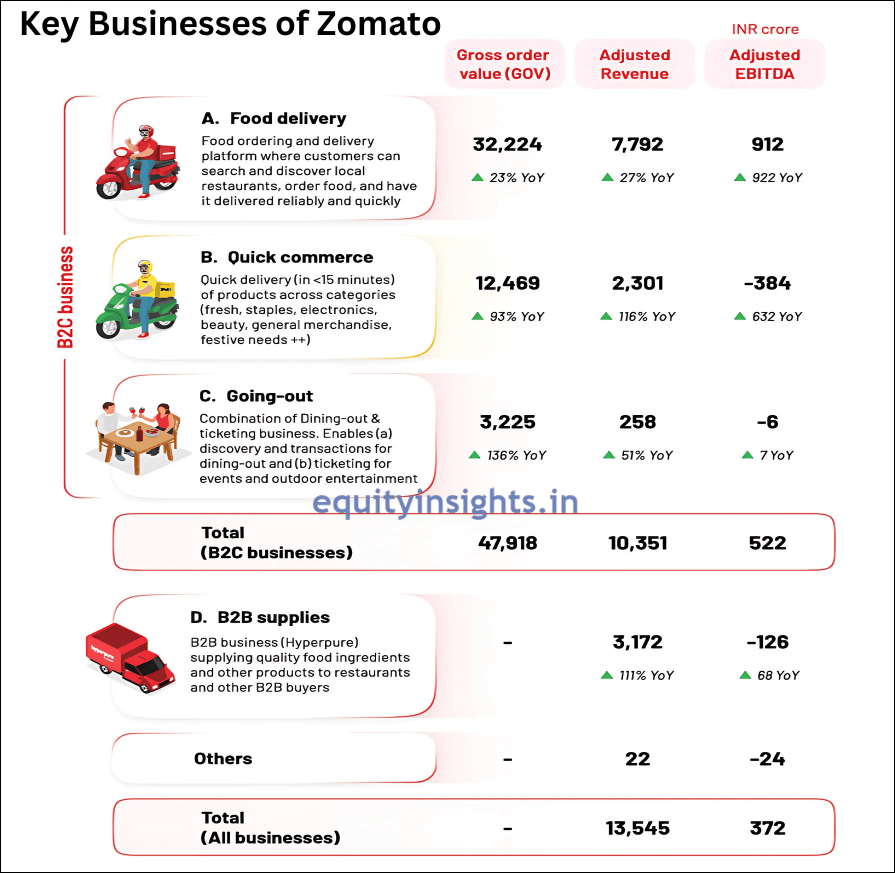

Overall, GOV (B2C business) grew 48% YoY to INR 47,918 crore in FY24 driven by growth across all three of our B2C businesses – food delivery, quick commerce and Going-out.

- Food delivery GOV grew 23% YoY to INR 32,224 crore in FY24

- Quick commerce GOV grew 169% YoY to INR 12,469 crore in FY24

- Going-out GOV grew 136% YoY to INR 3,225 crore in FY24

For deeper insights into Zomato’s business, explore its Annual Reports and Shareholders’ Letters here: Financial Reports & Presentations

The IPO Roller Coaster

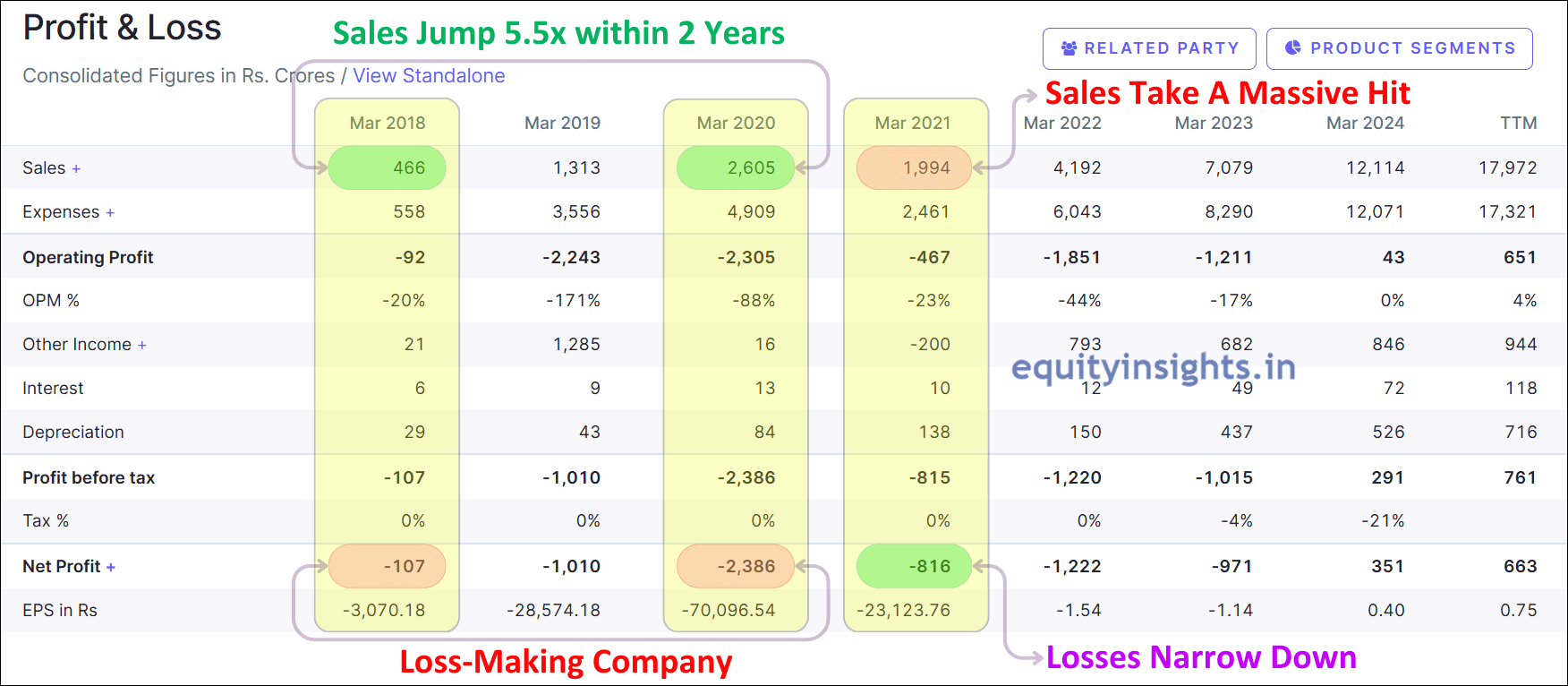

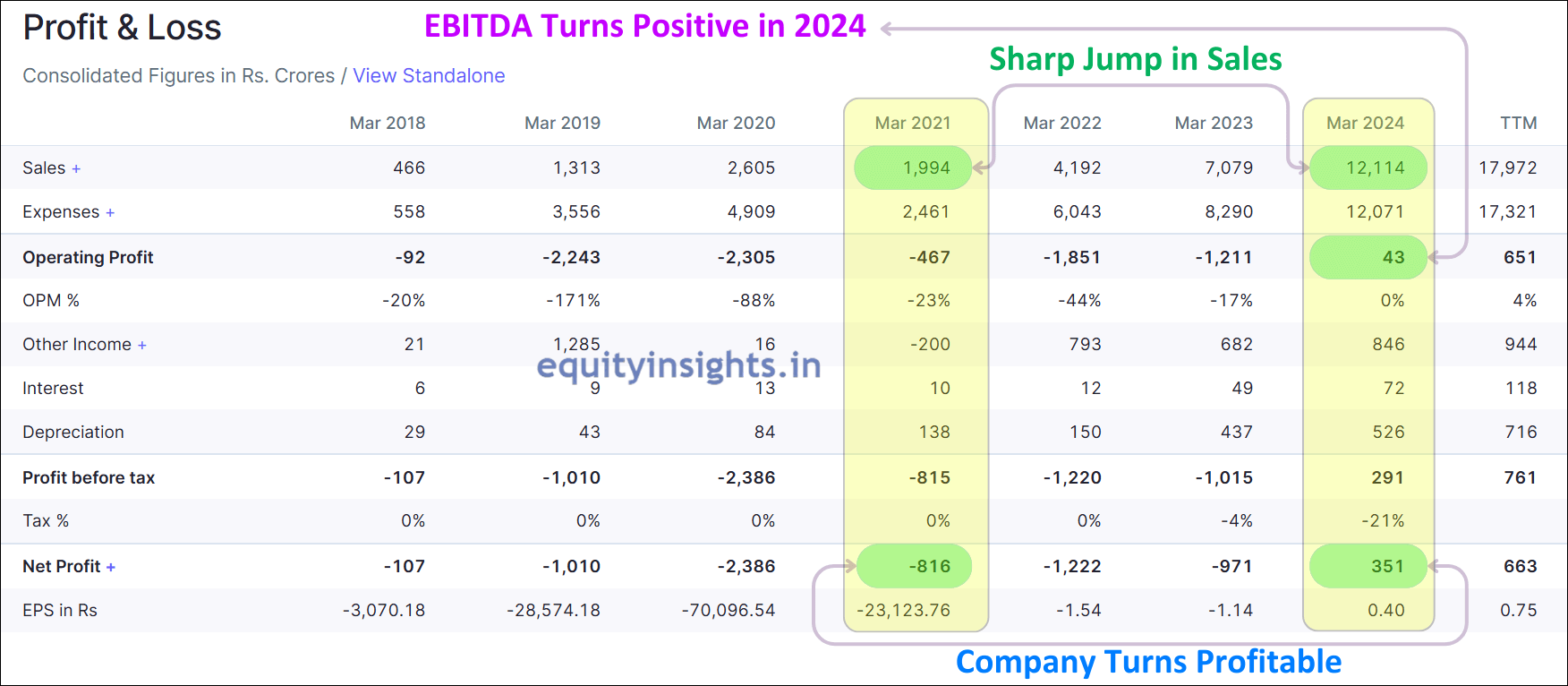

When Zomato launched its IPO in July 2021, it had already pivoted its business model from just a menu card listing platform to India’s largest online food delivery company and that disrupted the way people consume outside food. Now, you could order food online with just a few clicks and that would deliver the food within 30-40 minutes at your doorstep. Zomato gained a massive market in metro and tier-one cities where people preferred convenience. This was reflected in the company’s revenue growth, which surged from ₹466 crore in 2018 to ₹1313 crore in 2019 and then ₹2605 crore in 2020—an impressive 5.5x growth in just two years!

The key narrative was that the company has just scratched the online food delivery market of India, with massive growth opportunities waiting to be seized in tier 2 and tier 3 cities. As a result, Zomato listed its IPO at ₹76 valuing the company at a market cap of ₹60,000 crore. Since it was also the period of a bull run in Indian stock market, its IPO received a stellar response and the company was listed at ₹116. The stock kept on rising for the next few months and tested highs of ₹169 in November 2021, even though it was a loss-making company.

Its losses kept mounting, skyrocketing from ₹107 crore in 2018 to ₹2,386 crore in 2020. Yet, management consistently reassured investors, stating, “Current loss is due to company’s massive expansion plans to capture the market. We intend to become profitable in the near term.” But then came 2021 — the year that witnessed a sharp fall in the company’s revenue growth. Although the net losses narrowed down significantly, the fall in revenue growth coupled with continued losses created doubts about the company’s future and its path to profitability.

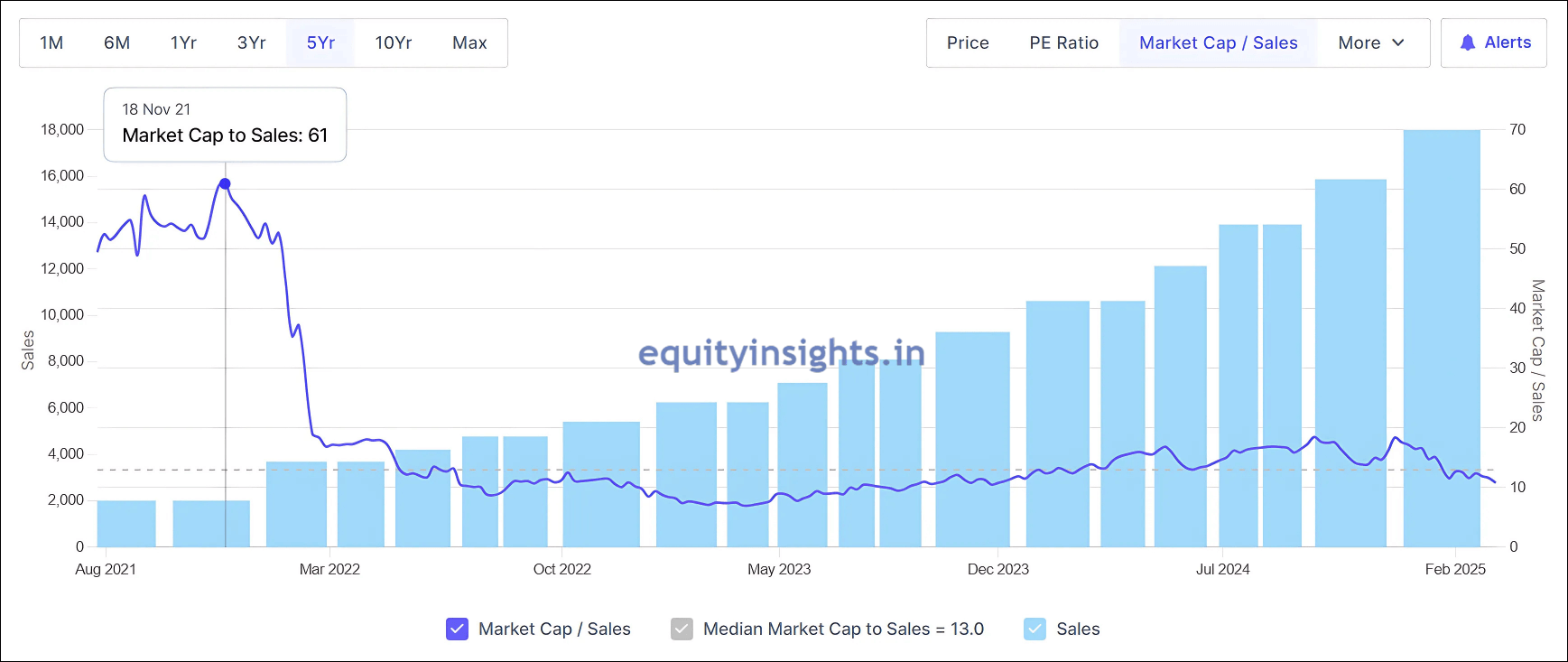

At that time, Zomato was commanding a market cap of over ₹1 lakh crore, despite generating just ₹2,000 crore in sales. This meant its Market Cap-to-Sales ratio soared past 50x—a valuation that raised quite a few eyebrows! Obviously, those were unsustainable levels and the P/E ratio could not be even calculated as the company was in losses. As a result, Dalal Street turned negative on the company and its share price kept on falling.

At one point, Zomato became the subject of jokes—some even compared it to tomatoes and then came a time when Zomato share price plunged over 75%, tumbling from a peak of ₹169 in November 2021 to just ₹40.60 by July 2022. But then the company made a game-changing move, that not only revived its business but also sent its stock price soaring once again!

Read More: Top 6 DIIs and Elite Fund Managers Making Market Waves!

Zomato’s Rise with Quick Commerce

Acquisition of Blinkit in August 2022

As Zomato was struggling between 2021 and 2022, with its stock price in free fall, the company’s management took a bold and controversial decision. In August 2022, they acquired Blinkit for ₹4,447 crore — a deal that sparked a lot of controversy as Zomato was already struggling with growth and mounting losses, yet it acquired another loss-making company for over ₹4,400 crore. Many investors questioned the move, but in the end, it proved to be a masterstroke by Deepinder Goyal—Zomato’s Co-Founder, CEO and Managing Director and what seemed like a risky bet turned out to be a game-changer for the company.

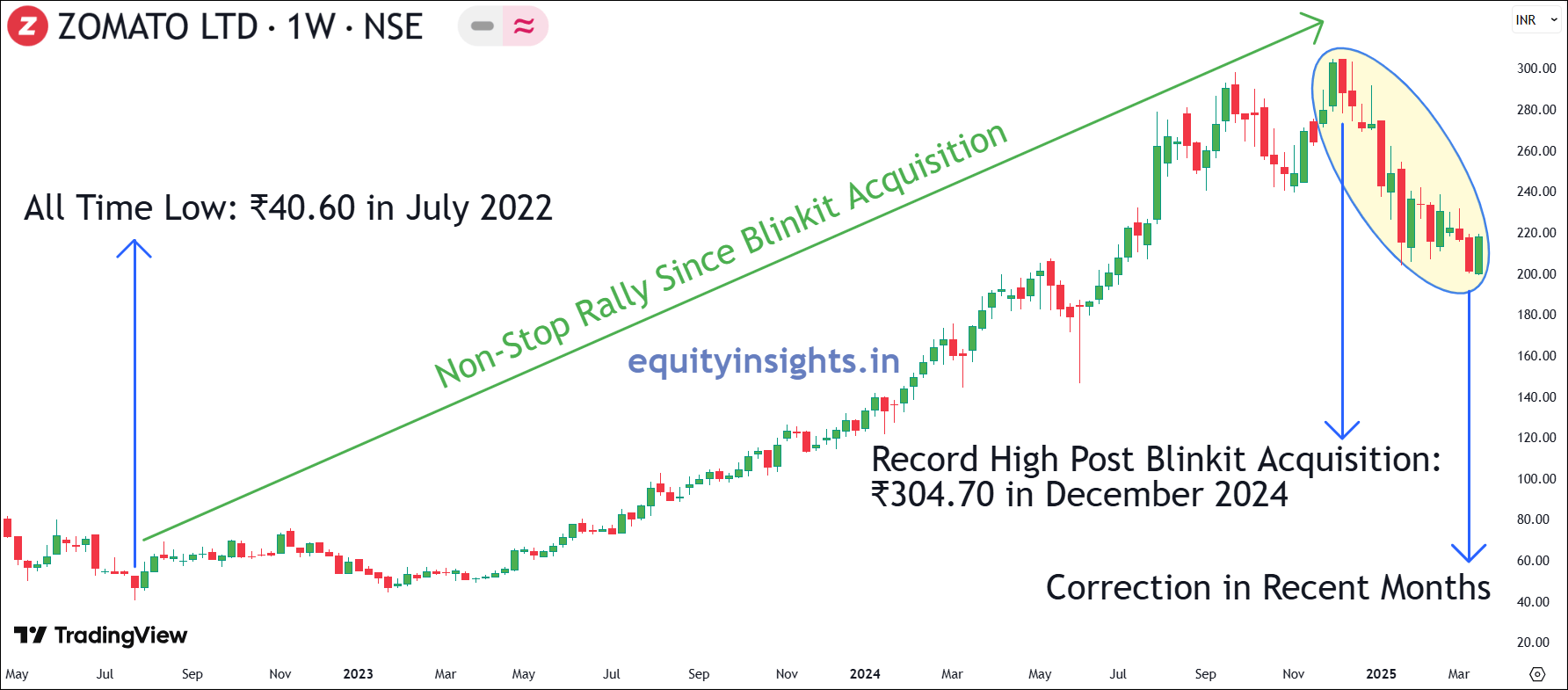

Zomato’s acquisition of Blinkit marked its entry into the booming quick commerce industry and that turned out to be the biggest growth engine for the company and the reason behind the exponential rise in its market cap. While Zomato’s food delivery business thrived initially—driven by rapid adoption in metro and Tier 1 cities, fueled by discounts and convenience. However, as growth began to slow due to market saturation and slower adoption in Tier 2 and Tier 3 cities, Blinkit emerged as a game-changer and unlocked a new world for Zomato with Quick Commerce business, delivering household essentials in just 10 minutes. This quick commerce model breathed new life into the business, opening doors to an entirely new market.

Now, that expanded the TAM (Total Addressable Market) for Zomato because this time Blinkit received a stellar response and the market size was huge. It completely changed consumer habits because now consumers are getting everything at their doorsteps within 10 minutes. Additionally, the order frequency was much more than what it was for the food delivery as you can order food once in a while but household groceries and other items are required every single day. As a result, the company again witnessed a sharp jump in its revenue from ₹1,994 crore in 2021 to ₹12,114 crore in 2024.

Not only that, the company also turned EBITDA positive in 2024, which further instilled investors’ confidence in management’s promise of making the company profitable. This optimism was clearly reflected in its stock performance, as it surged from July 2022 lows of ₹40.60 to touch levels of ₹304.70 in December 2024, while its market cap soared to nearly ₹3 lakh crore, marking a phenomenal turnaround.

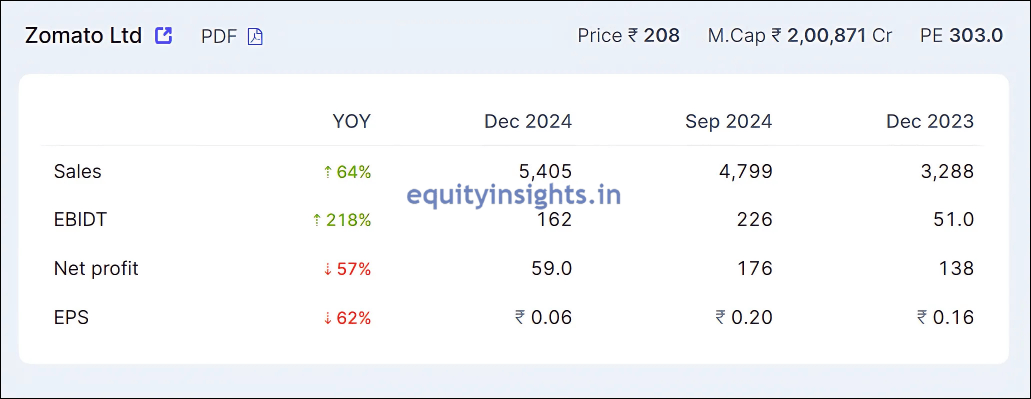

However, recently Zomato share price corrected around 30% from the peak and the reason for this correction is concern over profitability. In its latest Q3 FY25 results, the company reported an impressive 64% YoY surge in revenue and a staggering 218% YoY jump in EBITDA but still its net profit took a 57% hit, primarily due to intensifying competition in the market.

Top Rivals Challenging Blinkit in Quick Commerce

Today, Blinkit is facing stiff competition from other established players like Swiggy Instamart and Zepto. Tata is also aggressively foraying into Quick Commerce with Big Basket. Then Flipkart has already launched its quick commerce platform “Minutes“. Likewise, Amazon is already doing a pilot phase for its quick commerce platform “Tez“. So, on one side quick commerce is a very high-growth sector in India but on the other side, competition is getting intensified for Zomato’s Blinkit. As a result, the company’s path to profitable growth has been pushed forward. Earlier, Blinkit targeted 2,000 dark stores by December 2026 but with rising competition, it has pushed forward its 2,000 dark stores target to December 2025.

There was a question from one of the investors in the conference call “Do you expect losses to continue in the near term?” To which management replied “Yes we do. As we continue to bring forward store expansion, our networks may have to carry a greater load of under-utilized stores which will impact near-term profits in the next one or two quarters.” So, due to delay in Blinkit’s path to profitability, the market was a bit disappointed and that resulted in a 30% correction in share price of Zomato recently.

Read More: Top 5 FIIs You Can’t Miss For Multibagger Ideas

SWOT Analysis of Zomato

Zomato, one of India’s leading food delivery and quick commerce platforms, has evolved from a restaurant discovery service to a full-fledged tech-driven ecosystem. With its strategic acquisitions, aggressive expansion, and focus on profitability, the company has positioned itself as a key player in the competitive food delivery and quick commerce industry. However, like any business, it faces both opportunities and challenges. This SWOT analysis delves into Zomato’s strengths, weaknesses, opportunities and threats, offering a comprehensive view of its market position and future growth potential.

Strengths

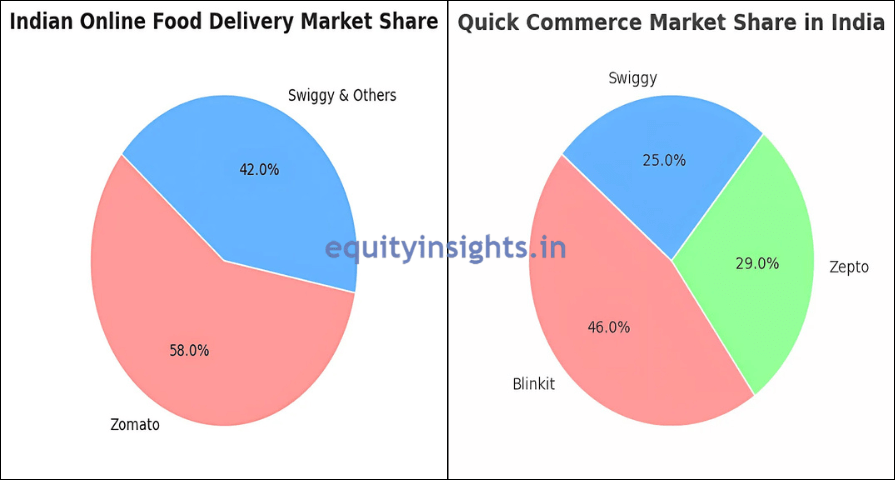

- Market Leadership: The biggest strength for Zomato is its market leadership in both food delivery and quick commerce business. As of today, Zomato enjoys a 58% market share in Indian online food delivery, with the rest primarily controlled by Swiggy and a few others. However, the high growth area is quick commerce where Blinkit currently holds 46% market share followed by Zepto at 29% and Swiggy close behind with 25%.

- Strong Brand Position: Zomato food delivery app and Blinkit both have become a trusted household brand in India with their very user-friendly app, extensive delivery network and very reliable service. Building a strong consumer brand is no easy feat, yet Zomato has mastered it, turning its name into a symbol of trust and convenience.

- Exceptional Leadership Team: Zomato is led by Mr. Deepinder Goyal, an IIT graduate with an excellent understanding of technology. The tech behind Zomato’s business is excellent, that includes providing personalized recommendations, real-time order tracking, online payment and so on. Also, Deepinder Goyal is young and hungry for growth, so that augurs well for the company’s future growth.

- Diversified Business Model: One of the important strengths that has even become its reason for profitability since 2024, is its diversified business model. Zomato is not just into food delivery and quick commerce, it also has its presence in the B2B (Business-to-Business) segment via Hyperpure where it supplies high-quality ingredients and kitchen products to restaurant partners. Then, the company has recently forayed into the event planning space with its new brand, District. Last year, it acquired Paytm’s ticketing business for ₹2,048 crore and rebranded it as District. This move opens up new growth opportunities for the company.

Weaknesses

Although, the company has fewer weaknesses compared to its strengths, considering its current position in the market, addressing these weaknesses is crucial to maintaining its leadership in this segment. Below are some of its weaknesses that need to be addressed by the company:

- Path to Profitability: At this point, the company is burning a lot of cash to offer discounts and attract customers. Personally, I feel there’s no differentiation between Blinkit, Zepto or Instamart. As a customer, I would be happy to order products where I get the maximum discount. I have all three apps on my phone. While the quick commerce is certainly a massive market and there is ample scope for growth of all the companies, I have doubt about customer loyalty on why someone should use Zomato or Blinkit only and that can be a challenge for profitability.

- Operational Challenges: Zomato has a complex business and it’s not easy to manage such a massive delivery team. Rider retention remains a major challenge, along with quality control and order delays, making it a tough business to operate.

Opportunities

Amidst its strengths and weaknesses, the company also has immense opportunities waiting to be seized. Here are some of them:

- Exponential Growth Potential in Quick Commerce Industry: Q Commerce has certainly emerged as a very fast-growing industry in India and this exponential growth should continue for the next few years. Interestingly, an industry that began with selling groceries is now rapidly expanding into cosmetics, electronics, household items and beyond, which is directly challenging the e-commerce industry. Blinkit is an undisputed leader in this space today with a 46% market share and expects to continue to grow its GOV (Gross Order Value) by more than 100% in FY25 and FY26.

- Decent Growth in Online Food Delivery Industry: Although, the online food delivery market growth won’t be exponential but there’s still enough room for growth in this industry as more and more people adapt online food delivery options.

- Growth of Live Events: Off late, the craze for live events in India has gone crazy. This was clearly visible from the demand for Coldplay and Diljit Dosanjh’s show tickets in India and going forward live events can be a big industry. Although, there are already established players in the segment like BookMyShow, Zomato with its District app has good potential to grow in this space. Not only that, the company is trying a lot of other things. For instance, recently they launched an app Bistro that would deliver food within 10 minutes. It mainly includes snacks, quick meals and beverages. So, the company is trying to identify multiple sources of revenue and increase its TAM size.

Threats

Like any fast-growing business, Zomato also faces a challenge that could impact its growth and stability. Below is one of the key threats the company is currently navigating:

- Cut Throat Competition: One of the key threats the company faces is intensifying competition. Zomato has certainly got the first mover advantage in both online food delivery and Q Commerce segment but the competition in both these industries is getting intensified with massive spending from Swiggy Instamart, Zepto, Tata, Flipkart and Amazon. In short, it is not going to be easy for Zomato to grow at a rapid rate along with maintaining a good profit margin.

Read More: Tata Motors Share Price Tanks 45% – Crash or Opportunity?

Valuation

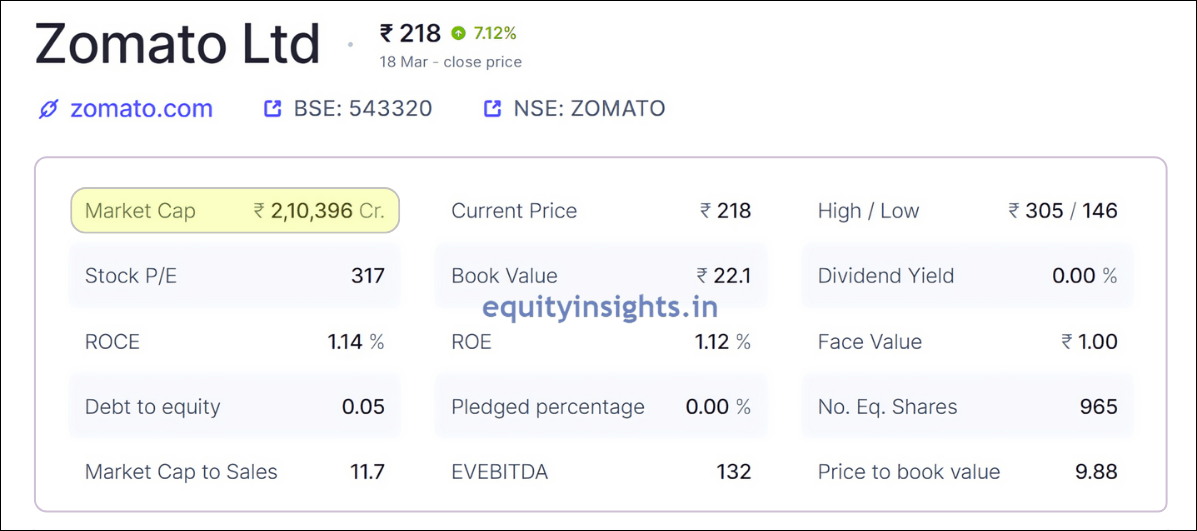

Let us finally discuss the valuation part. Today, the entire investor community is divided over Zomato’s valuation. Some say that the company should command a high valuation for its growth potential whereas some people are cautious of the current valuation concerning increasing competition in the industry and lack of profitability and honestly it’s not an easy task to gauge Zomato’s value. I mean, you can’t look at the P/E ratio as it it’s barely profitable and today P/E is showing more than 300. Additionally, with the kind of disruption happening in the industry, it’s a futile exercise to do the Discounted Cash Flow Analysis (DCF) analysis.

Note: Discounted Cash Flow Analysis is a financial valuation method used to estimate the intrinsic value of an investment based on its expected future cash flows, which are discounted to present value using a discount rate.

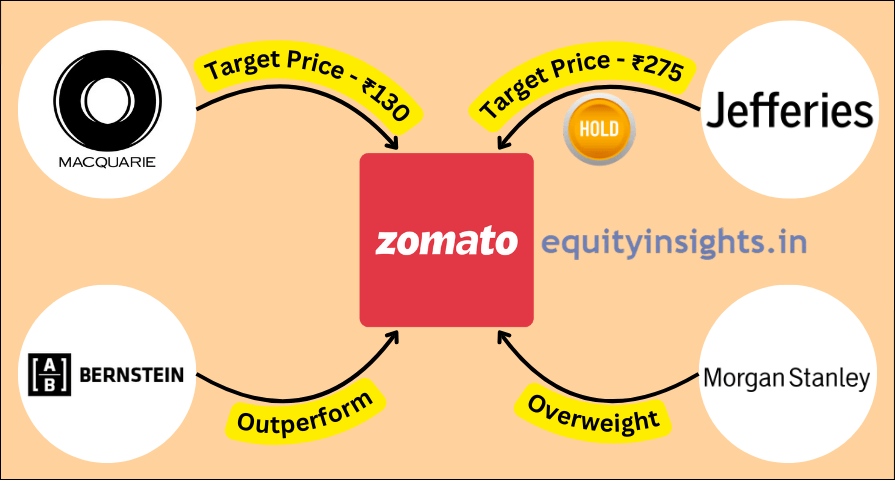

So, the near-term valuation of the company would totally depend upon its execution and market sentiments. Since the Q3 FY25 results were disappointing in terms of profitability, Macquarie slashed its target price to ₹130 and Jefferies also downgraded it to hold from buy, cutting its target to ₹275 from ₹335 earlier. However, some brokerages remained optimistic like Bernstein held on outperformance rating with ₹335 target and Morgan Stanley maintained overweight at ₹355.

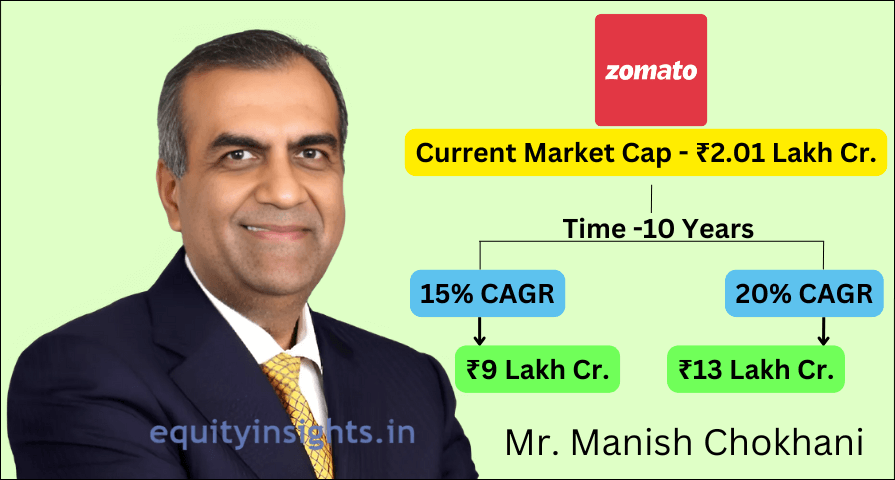

I believe that if Zomato continues to grow at a fast rate, market sentiments will remain positive in the near to mid-term and the company should do reasonably well. However, if you ask my long-term viewpoint, I believe that a majority of future earning growth is already discounted in its current valuation. Here, I’d like to share one of the thesis from industry veteran Mr. Manish Chokhani and I completely agree with his viewpoint. He says that if

- Zomato continues to compound investor wealth at a 15% rate: In the next 10 years, it will command a market cap of ₹9 lakh crore.

- It compounds investor wealth at a 20% rate: In the next 10 years, it will command a market cap of around ₹13 lakh crore.

Today’s market is giving it a premium because there’s a massive growth potential but 10 years down the line its growth would normalize. In that case, its fair P/E should be around 30. But how did I consider a fair P/E of 30 after 10 years? Well, that is debatable. You can give a P/E of 40 or 50, anything you like but mature businesses usually command a fair P/E of 30. I mean, you can look at companies like TCS and Infosys that also command similar P/E but again you can also consider a P/E of 40 or 50 based on what you like.

Zomato’s Profit Targets for Future Market Cap

1. At 20% Annual Growth (for ₹13 Lakh Crore Market Cap):

- P/E of 30: Needs to achieve a net profit of ₹43,300 crore after 10 years.

- P/E of 40: Needs to generate a net profit of ₹32,500 crore after 10 years.

2. At 15% Annual Growth (for ₹9 Lakh Crore Market Cap):

- P/E of 30: Needs to reach a net profit of ₹30,000 crore after 10 years.

- P/E of 40: Net profit needs to grow to ₹22,500 crore after 10 years.

Where Zomato Stands Today:

- Current Net Profit: ₹663 crore.

- The Journey Ahead: A major leap in growth is needed to hit these targets!

The question is Can Zomato grow its profits to such a massive level? Maybe, but considering the growing competitive intensity, I find it extremely challenging.

Recently, Zomato has changed its listing name to Eternal. I hope it does not take an eternity for Zomato to create that kind of profitability. So, from current levels, we are not even considering massive returns. Even a 15-20% CAGR return for the next 10 years is difficult for Zomato and that is the reason I said that the majority of future earning growth is already discounted in its valuation and I find it expensive as a long-term investor. It may go up or down in the near term based on results, execution and sentiments but long-term wealth creation from current levels even at a 15-20% CAGR rate is going to be very difficult.

Has Zomato’s Hyper-Growth Phase Already Passed?

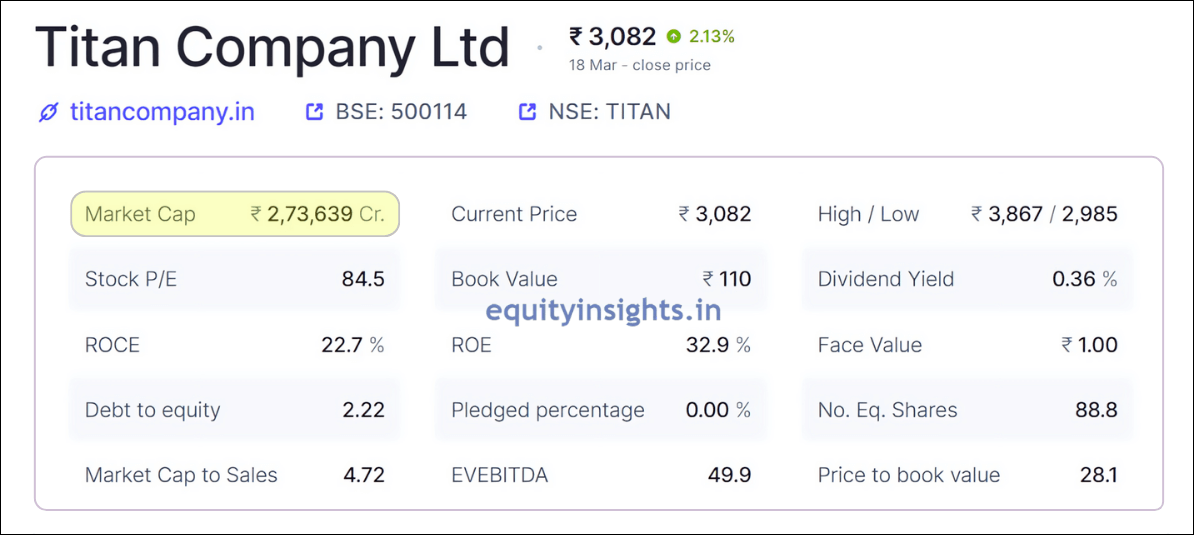

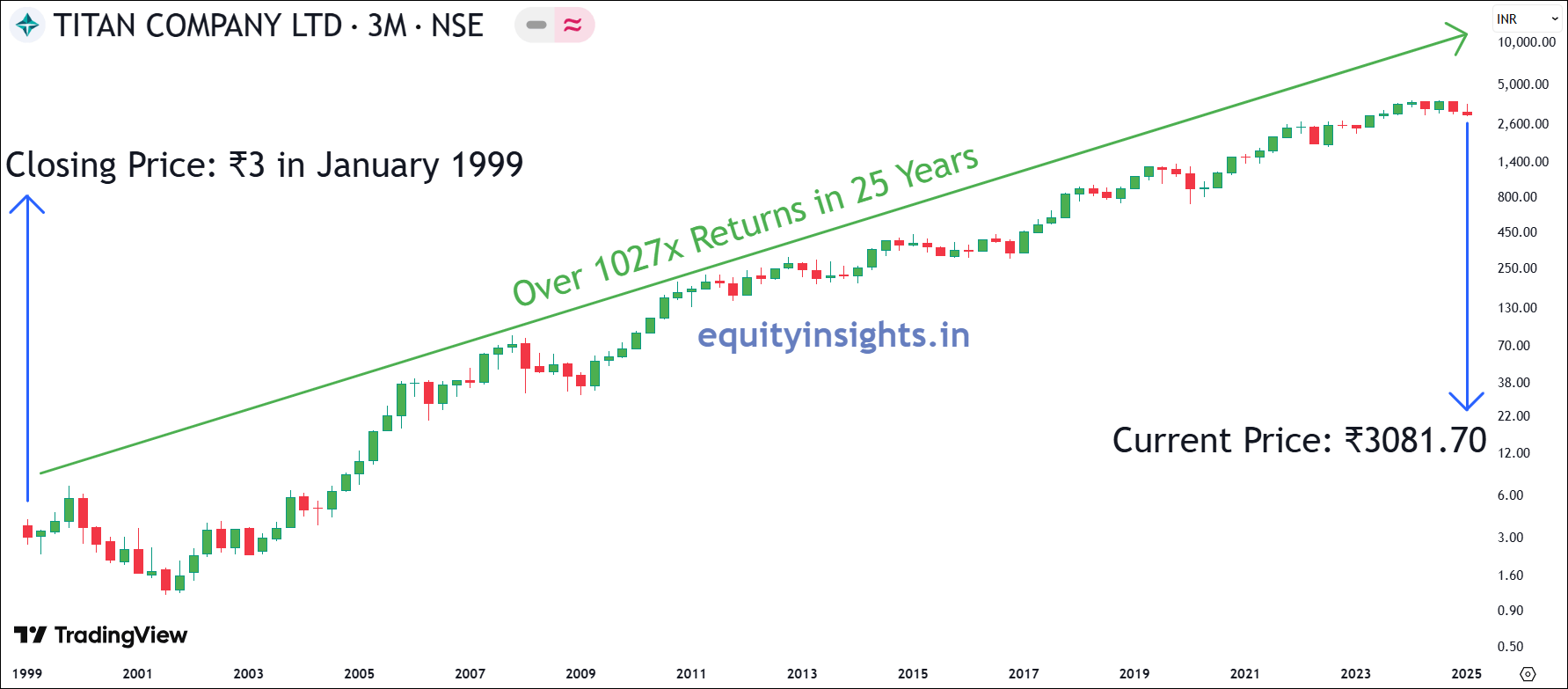

For comparison, look at Titan— a company with somewhat a similar market cap to Zomato. Over the last 25 years, Titan has been a phenomenal wealth creator, delivering nearly 1027x returns. However, back then, its market cap was a mere ₹266 crore, but today, it stands tall at ₹2,73,639 crore!

On the other hand, Zomato already boasts a hefty ₹2,10,396 crore valuation, meaning the bulk of its 700-800x growth has already been captured by early investors. So, for retail investors stepping in now, the upside may be limited to just 2-3x returns over the next decade and even that won’t come easy. That said, let me remind you again that this is my long-term analysis and I could be wrong. If you’re already a shareholder or considering an investment, the final decision should always be yours.

Conclusion

Zomato’s business model is a diversified and dynamic approach that integrates food delivery, quick commerce, dining-out, ticketing and B2B supplies. The company achieved strong revenue growth and profitability in FY24, driven by Blinkit’s rapid expansion, the rise of Zomato Gold and Hyperpure’s B2B success. With ongoing investments in AI, sustainability and logistics, the company aims to maintain its stronghold in the food-tech and quick commerce markets and there’s no doubt that the opportunity size is big with quick commerce business however competition is going to be a key threat for companies like Zomato going forward.

In the near to medium term, its share price movement would depend upon various factors like Blinkit’s growth, competition, profitability and finally of course the market sentiments. If Zomato can maintain its market leadership, improve profitability and adapt to changing consumer preferences, it can continue to do well in the near to medium-term. However, any failure to achieve these parameters would result in de-rating.

As far as the long-term picture is concerned, it would be very difficult for Zomato to compound at a 15-20% CAGR rate for the next 10-15 years because that would require massive profitability as discussed in our calculation. So, the current picture says that the majority of the company’s growth journey has already been enjoyed by early investors between 2010-2020 and the current valuation of the company already discounts a good amount of future earning growth.

That brings us to the end of this article! Today, we explored Zomato’s journey from its listing to the present, dived deep into its SWOT analysis and finally, took a deep dive into its valuation and future growth potential. Now, tell me in the comments what you think about Zomato, its valuations and whether can it continue to create wealth for the investor in the long term and did I miss any key point, let me know. If you find this article useful, do share it within your circle. Stay tuned for more useful articles. Happy Investing!

Disclaimer: We are not a SEBI-registered research analyst. The information provided in this article is intended solely for educational, illustrative and awareness purposes. Nothing contained herein should be construed as a recommendation. Users are encouraged to seek professional financial advice before making any decisions based on the content provided.