Warren Buffett, one of the most respected investors of all time, once said, “It’s good to learn from your mistakes. It’s better to learn from other people’s mistakes.” However, when a person enters the market, he often ignores this point and does the complete opposite. Instead of learning from the mistakes and experiences of others, they tend to repeat the same mistakes over and over, which eventually leads to the erosion of their capital.

In the last blog, I highlighted the importance of investing and why it is crucial to begin today. If you haven’t read it yet, you can find it here: Investment: The Key to Secure Your Financial Future

Now, let’s move forward and build on that knowledge. In this blog, we’ll focus on the crucial factors to consider both before and after investing. We’ll dive into the key principles that every investor should follow to avoid common mistakes that result in loss and make more informed, effective choices.

Table of Contents

Introduction

Let’s have a look at few things to follow and avoid in the stock market:

1. Once you invest in a stock, if that stock declines continuously then you don’t have to assume that your analysis was wrong. The stock’s price movement whether up or down, shouldn’t be the sole basis for judging the validity of your analysis. Instead, the quality of the stock should be evaluated based on its financials, not its price.

2. There are two kinds of uncertainties in the market:

- Price uncertainty – Price uncertainty refers to the unpredictability of whether a stock will rise or fall, something we cannot know for sure so is categorized as an uncertainty.

- Holding period uncertainty – It means if your analysis is that the stock may reach your target in 1-2 years but the stock underperformed during this period and didn’t reach the target as per your expected time frame then this is called Holding period uncertainty.

This doesn’t necessarily mean that your analysis was incorrect. There will be times when a stock takes longer than expected to perform and as the stock is not performing under your expected time frame then you should focus on its financials. If financials are still looking good then it is a signal that you may continue to hold this stock until it reaches our target or until the financials begin to weaken. In many cases, your target may get hit in 3 months rather than your expectation of 1 year and that is how the market behaves.

So, avoid getting emotional if the stock isn’t performing as expected or if it does exceptionally well after you’ve invested. Therefore, your primary focus should be on the company’s financials and holding it if everything is alright.

3. The stock market requires wisdom more than intelligence. Humility is one of the most important qualities for success in the market. Being humble in the stock market means if the market is behaving against your expectations then you must accept the fact – this is how the market behaves.

Secondly, you must act differently from the crowd, and below mentioned are the things that could separate you from the crowd:

- Stop watching Television – Taking tips from the self-proclaimed experts on business channels won’t help you build your wealth. If you have ever watched a business news channel, you would have noticed that they just give price targets and stop-loss levels without any real explanation and this offers no value or knowledge. Therefore, stay away from TV for stock tips and It will automatically separate you from the 50% of the people in the market.

- Respect the Wealthy and Learn from their Actions – You must respect the rich and wealthy people and learn from their actions if you want to become rich. You must let go of any feelings of jealousy from anyone, not only to achieve success in the stock market but in any field you work.

- Read Books on the Stock Market and Beyond – To achieve success in life and the stock market, curiosity to learn should always be there in you, and the best way to gain knowledge is through books. Read books to gain wisdom and knowledge to succeed in the stock market. Also, you must focus on practical understanding as you can only earn by being practical in the stock market. Practical understanding is essential because theoretical knowledge has very little place in real stock market action.

- Avoid Social Media (Facebook and Instagram) to get the stock tips. Also, you should only be using YouTube and X for the stock market-related videos or posts, which could help you learn about the stock market. However, it’s important to set a fixed time limit for consuming these educational videos on these platforms too. You must have a fixed time like 1 or 2 hours a day as watching too many videos may lead you to spend time on entertaining content, like reels, which won’t contribute to your success and could distract you from your goals.

So, have a fixed schedule of 1-2 hours per day for these learning videos and use the rest of your time for in-depth research, such as analyzing financial statements, reading annual reports, going through quarterly conference call transcripts, and deepening your knowledge through books and blogs.

- We all know that only 1% of individuals are making significant profits in the stock market, while the vast majority—nearly 99% are not. So, we must have to admit that those who have succeeded in the stock market are lucky and may be benefiting from a bit of luck and rest because of their hard work. So for you to also achieve success, it’s important to invite that luck into your lives and work hard.

For this, you will have to dedicate at least half an hour daily to chanting god’s name and following the actions of the successful people. You must also aim to treat everyone with kindness to get their blessings. In essence, only continuous learning and improving ourselves can help us attract good fortune.

All in all, you will have to do two things, that is follow the actions of 1% percent of people – the actions that lead to success and avoid the mistakes of 99% of people. This means we need to start chanting, stop discussing our trade or investment with anyone, and increase our knowledge base.

Warren Buffett once said “I always knew I was going to be rich” and also it is said, that you get what you think. So, if you think of Rs 100 crores then opportunities and reasons to achieve that goal will begin to appear and be created automatically as your thought process shapes your future. So, dream big to achieve best.

Difference between News and Opinion and How to Separate Both from Each Other

There is a significant difference between News and Opinion although they are often mistakenly considered the same. The news refers to the events that have already occurred means the ones that have either become the past or have happened in the past. Opinion on the other hand is a prediction that has a probability to happen in the future. While news helps us analyze the business (company), opinion represents someone’s thoughts or ideas on potential outcomes, which are not guaranteed to happen. This difference is often blurred and leads to confusion. So, it’s important to not mistake opinion for news as that may provoke you to make unnecessary decisions that are not at all required.

Let me give you an example of this:

The temperature tomorrow will be 30 degrees Celsius is an opinion because it has not happened but has a probability of happening in the future. On the other hand, if we say that the temperature yesterday was 30 degrees Celsius is News as it has already happened.

In the stock market, when there’s an announcement predicting that a company’s sales could increase by 20%, it’s merely an opinion, as the event has yet to occur. However, if the company actually achieves that 20% growth in its quarterly or annual results, it becomes a factual report, as the forecast has been realized.

Sources to Read News

The best source to read the stock market news is Screener.in as it automatically updates any information related to any changes in a business or a company that are reported by the companies to stock exchanges – NSE and BSE.

Another reliable source of news is The Economic Times (Only to follow the business updates and not for stock tips). There is no need to run after multiple sources to get information about the stock market because any news that has been published by The Times of India or Mint will also appear in The Economic Times. So, looking at the same information from too many sources can waste your valuable time which can rather be utilized to research different information about the company.

To analyze the chart of the stocks for price action, you can use TradingView as investing requires you to enter the stock at the right time and lowest price possible to avoid being stuck with it at a high price for an extended period.

So, overall The Economic Times provides business-related news, Screener.in helps track a company’s financial updates and TradingView is ideal for analyzing price action.

Things You Require to Become a Successful Person

You need three things to become a successful person in stock market:

- Time

- Focus

- Energy

If any one of these is missing, success becomes difficult to achieve, so it’s crucial to give equal importance to all three.

Also Read: The Psychology of Money: Key to Stock Market Success

Effective Stock Analysis Method

Before investing, it’s crucial to analyze the stock or company. One of the effective methods of stock analysis is comparing the stock price to the company’s financial performance.

A lot of times this may occur where a company with good financials would be recording the highest-ever profit on both quarterly and yearly basis but the stock is not moving at all and this could persist in that same stock for 1-5 years. However, if the financials of that company like net profit, sales or revenue are consistently improving in each quarter and year against previous trends, with no significant stock price movement for the last year then its chances to outperform increases. In such cases, the stock might eventually experience a surge, delivering returns that could equate to five years worth of gains in just one year.

Let’s look at examples of two stocks that have underperformed over the last 5 years but are financially strong:

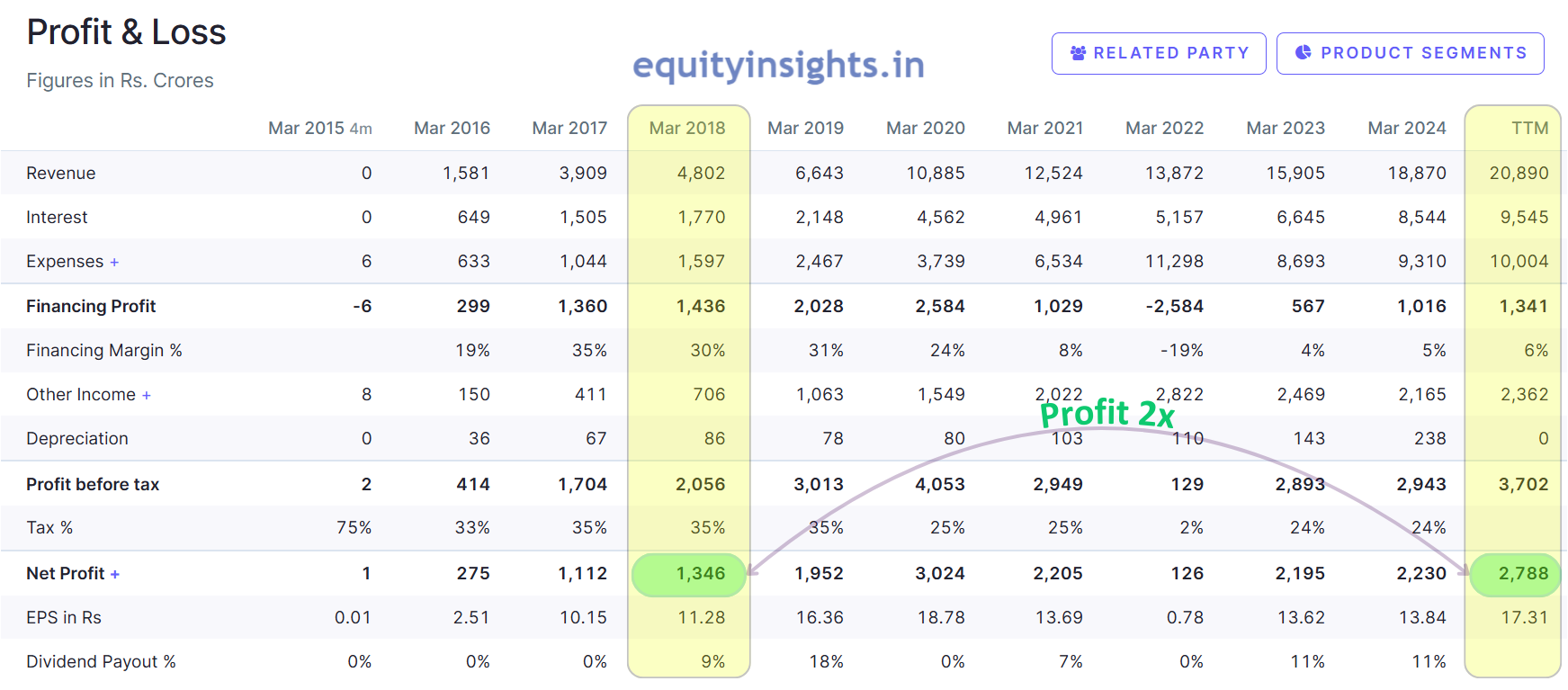

1. Bandhan Bank

A prime example of above case is Bandhan Bank. The company’s stock was priced around Rs 741.80, when it reported a profit of Rs 1,346 crores. However, during the COVID-19 pandemic, the stock price dropped to Rs 152.20. Although the pandemic has ended, the stock price has not returned to its previous all-time high, despite the company’s profits having doubled since 2018.

This suggests that even if we set a target of Bandhan Bank shares based on its previous all-time high, the stock could rise by around 340% from its current price (as of 1st December 2024) of Rs 169.08. This target is based on the fact that the company’s profits have doubled since 2018, yet we’re still considering the all-time high from that year.

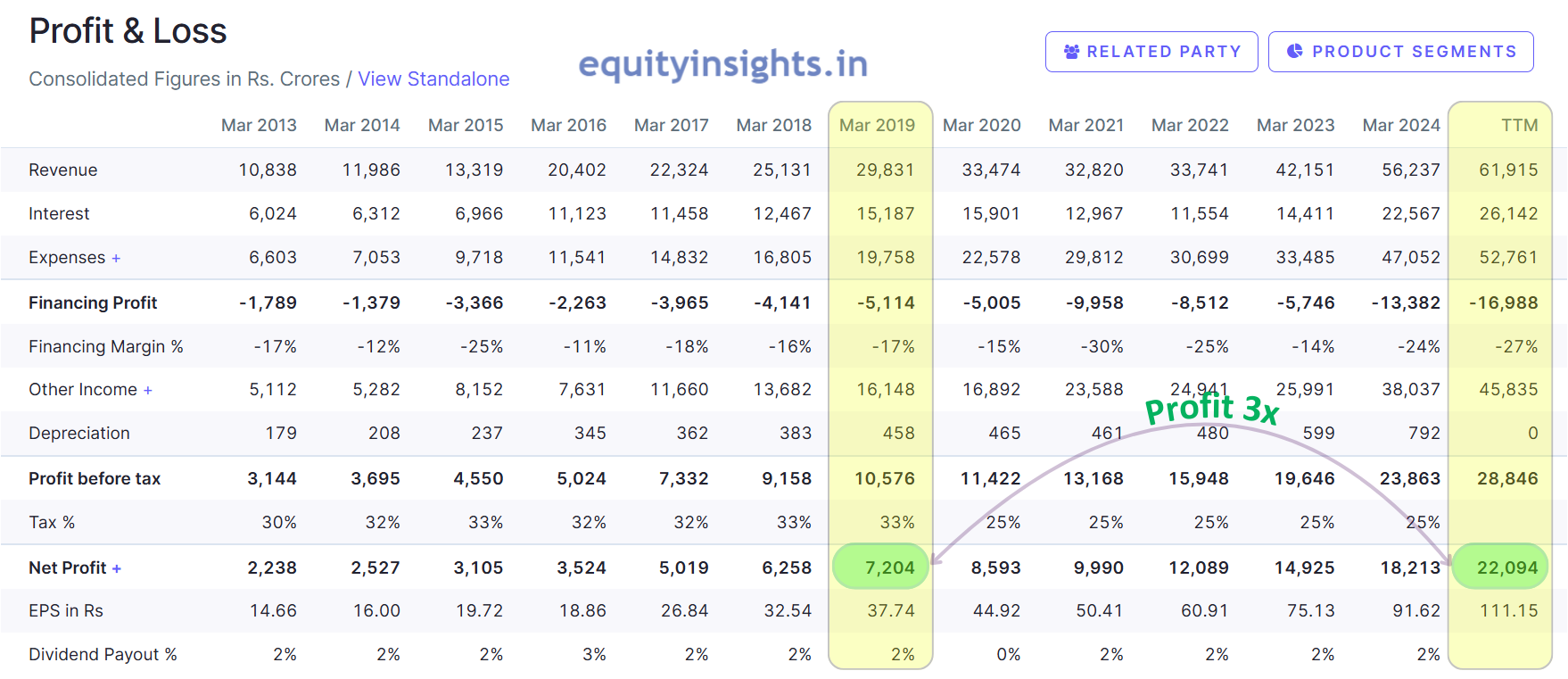

2. Kotak Mahindra Bank

The second example is of Kotak Mahindra Bank, where Kotak Mahindra Bank’s share is still trading at the same level as in December 2019. Over the past five years, the bank’s profit has tripled, suggesting that a rally in its stock could occur at any time, potentially making up for the entire five-year period.

You can also look at this situation in another light. While many other private banks since 2019 doubled in price, Kotak Mahindra Bank despite being the third largest private bank and having tripled their net profit, is available at the lowest price which presents a great opportunity as it can rally anytime. Additionally, it’s important to note that Kotak Mahindra Bank is a large-cap stock, which makes it a relatively low-risk investment, providing a strong reason to consider investing in it.

Two Key Reasons for Losing Money in the Stock Market

Losing money in the stock market can be frustrating. Therefore, it becomes important to understand the reasons so that it can help investors make more informed decisions and avoid costly mistakes. Two main reasons that lead to stock market losses are:

1. Stop Loss

While stop loss is necessary in trading, it can be a disadvantage, when investing. You’ve probably never heard of Warren Buffett using stop losses on the stocks he buys. Putting a stop loss in a stock of the company that you purchase can cut your position too early and immediately after you buy the stock and in that case even if the stock comes to your hand at the lowest price possible, it may trigger your stop loss and cut your position and then eventually goes for a rally to reach your target.

Therefore, instead of using stop loss in investing, take the risk of the amount that you can afford to lose. Ideally, no more than 5% of your overall capital should be invested in a single stock to ensure proper risk management.

2. Linking the Movement of the Stock Price with the Financials of the Company

As the saying goes “Never judge a book by its cover,” the same applies to stocks wherein you must not judge the stock purely based on price movement. Just the decline in the price of the stock doesn’t mean the stock is bad and vice versa. Rather you should focus on the financials of the stock to determine its conditions. However, if the price of the stock declines due to some fraud allegations then the movement in price is to be considered to judge the stock, otherwise the sole focus has to be made on the financials of the company.

To properly evaluate the stock, it is important to understand the reasons for the downfall in stocks. For example – If the net profit appears to be lower in QoQ and YoY, you must search for the reasons for it as a lot of times the net profit could come down in a quarter due to one-time expenses like higher taxes in a particular quarter or reduced sales from lower demand. So, in that case, rather the decline in the price of stock presents you the opportunity to invest in that stock as these could be temporary issues created by market fluctuations or operators looking to acquire the stock at a lower price.

For example, in the manufacturing sector where decline in net profit could be attributed to rising raw material costs. Manufacturing companies are sensitive to these costs and this impacts the net profitability of these companies directly as this sector is often directly linked to fluctuations in raw material prices.

Like, if we talk about tyre companies, they use two products to manufacture the tyres and that is:

- Rubber

- Crude Oil

When crude oil prices go up, the INR loses value and this strengthens the USD. As a result, India has to pay more for crude oil in INR terms, which pushes inflation higher. To tackle the inflation, the RBI hikes interest rates which make raw materials pricier and which in turn hurts the bottom line (net profit) of tyre companies.

Now, this increase in raw material costs along with the rise in interest rates to combat inflation results in lower demand for cars due to which sales of cars reduce. As the car sales decline, the sales of related products, such as tyres, also drop and even though sales have reduced, a company’s fixed costs—such as employee salaries, rent, utility bills, and loan interest payments—remain unchanged. As a result, with declining sales and unchanged expenses, the company’s net profit is directly affected.

However, if we look at this situation of increased interest rates, it appears to be a temporary problem as when the inflation would lower down RBI would automatically reduce the interest rates and once it is done, the companies will start performing like earlier. Therefore, if you get the stock at lower prices due to these temporary reasons like the fall in net profit or sales provided that you know the reason for the fall then instead of getting scared, you should invest in the shares to enjoy the rally in future.

NOTE: If inflation reaches high levels, then it becomes a major concern for the government especially with elections approaching, and for that reason the government would every time ensure to keep the inflation lower as it directly impacts voters’ decisions that’s why, when inflation increases significantly, the government will act to bring it down to avoid negative political consequences.

Also Read: Trading Economics: How Economic Events Impact Stock Market?

Bonus Point

If news of a new player entering a sector comes, it doesn’t impact the value of the market leader of that sector in just a single day. Example – News of Grasim, one of the companies of Birla group entering the paint industry came on September 14, 2023, and that led to the decline in stock prices of most of the paint companies in India like Asian Paints, Berger Paints, etc. Specifically, Asian Paints, the market leader in the segment, saw its stock price fall by nearly 11% over the next 45 days following this announcement.

Although, it was just the news, as Grasim had not even started its operations, still it impacted the stock prices of most of the paint companies and so think how good of an opportunity it created for all of us to buy the paint companies at lower prices and guess what? Through this temporary news, a fear was created among the retailers by the stock operators to fill the stocks of paints companies in their portfolio and later the price went even above than the previous high giving a return of 16% in a time of just 2 months.

The second example is of Bajaj Finance and Bajaj Finserv, both of which witnessed a decline in stock price following the news that Reliance Industries was entering the same sector.

At last, I would just say that the next 20 years will be a period of rapid growth for India. During this time if the market witnesses a sharp decline, it should be seen as an opportunity to invest in the Indian economy as the bull run will emerge strongest after the sharp fall for the next 20 years and the market will be making new highs after every steep fall during these years.

Disclaimer: We are not a SEBI-registered research analyst. This article is intended for educational purposes only. Any mention of stock names is for informational purposes and should not be considered as financial advice or recommendations. Given the inherent risks in the stock market, we strongly advise consulting with a financial advisor before making any investment decisions.