Over the past 40 years, the Indian IT sector has created massive wealth for investors. Companies like TCS, Infosys, Wipro and HCL Technologies, which started as small players in the ’90s are now part of the top 50 companies in India. The biggest reason for their success is the availability of low-cost talent, which resulted in massive business for the Indian IT sector from the US and European countries. Investors who bought shares of these IT companies in the ’90s or early 2000s not only built significant wealth through stock returns but also enjoyed substantial dividends. However, these IT companies have now grown into mega-cap companies and their growth has slowed, but they still reward long-term investors.

While these tech giants would continue to compound at a steady 10-15% rate with the bonus of dividend income, but you can’t expect extraordinary growth of these companies today and that’s where the endeavour is to identify companies that can become the next TCS, Infosys, Wipro and HCL. While it’s not that easy to replicate the success of Indian IT leaders, there are still a few companies that are focused on innovation and research. Unlike traditional IT firms, which rely mainly on services, these companies are driving growth in a new sector called Engineering, Research and Development (ER&D).

The ER&D sector is dominated by four key players—KPIT Technologies, Tata Elxsi, Tata Technologies and L&T Technology Services—each serving the global market with cutting-edge solutions. Over the past 5-6 years, these ER&D companies have delivered massive wealth for investors. KPIT Technologies soared from below ₹100 pre-COVID to an astonishing ₹1,900 by July 2024, Tata Elxsi skyrocketed from under ₹900 to a remarkable ₹10,500 by August 2022, L&T Technology Services climbed from ₹1,600 to over ₹5,700 by January 2022, hitting a record high of ₹5,950 by August 2024 and Tata Technologies dazzled the market with a blockbuster IPO in November 2023, debuting above ₹1,150—more than double its ₹500 issue price and touching an all-time high of over ₹1,350.

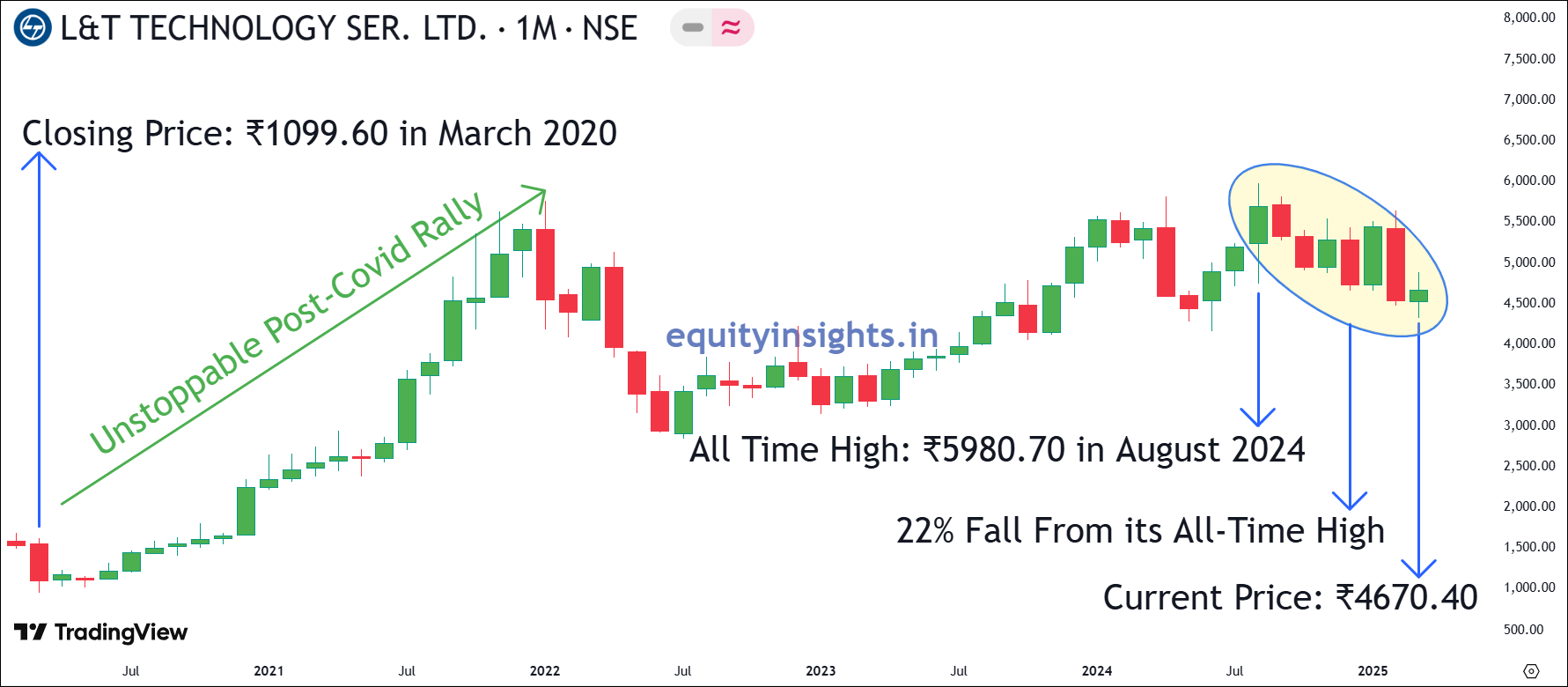

However, these stocks have now undergone a significant correction—KPIT is down 31% from its peak, Tata Elxsi has plunged 48% from its highs over the past 2.5 years, L&T Technology is trading 22% down from its peak of August 2024 and Tata Technologies has been in a consistent downtrend, dropping 50% from its post-listing high in November 2023.

Now, the big question is: Why is the ER&D sector facing such a sharp correction? More importantly, is this a buying opportunity? In this article, we’ll dive into the ER&D sector, its key growth drivers and the reasons behind this correction. We’ll also analyze what to expect in the near to mid-term and compare these four companies on key performance indicators to help make an informed decision on whether to buy, sell or hold. Let’s get started!

Read More: Zomato Share: Sizzling Opportunity or Overcooked Valuation?

Table of Contents

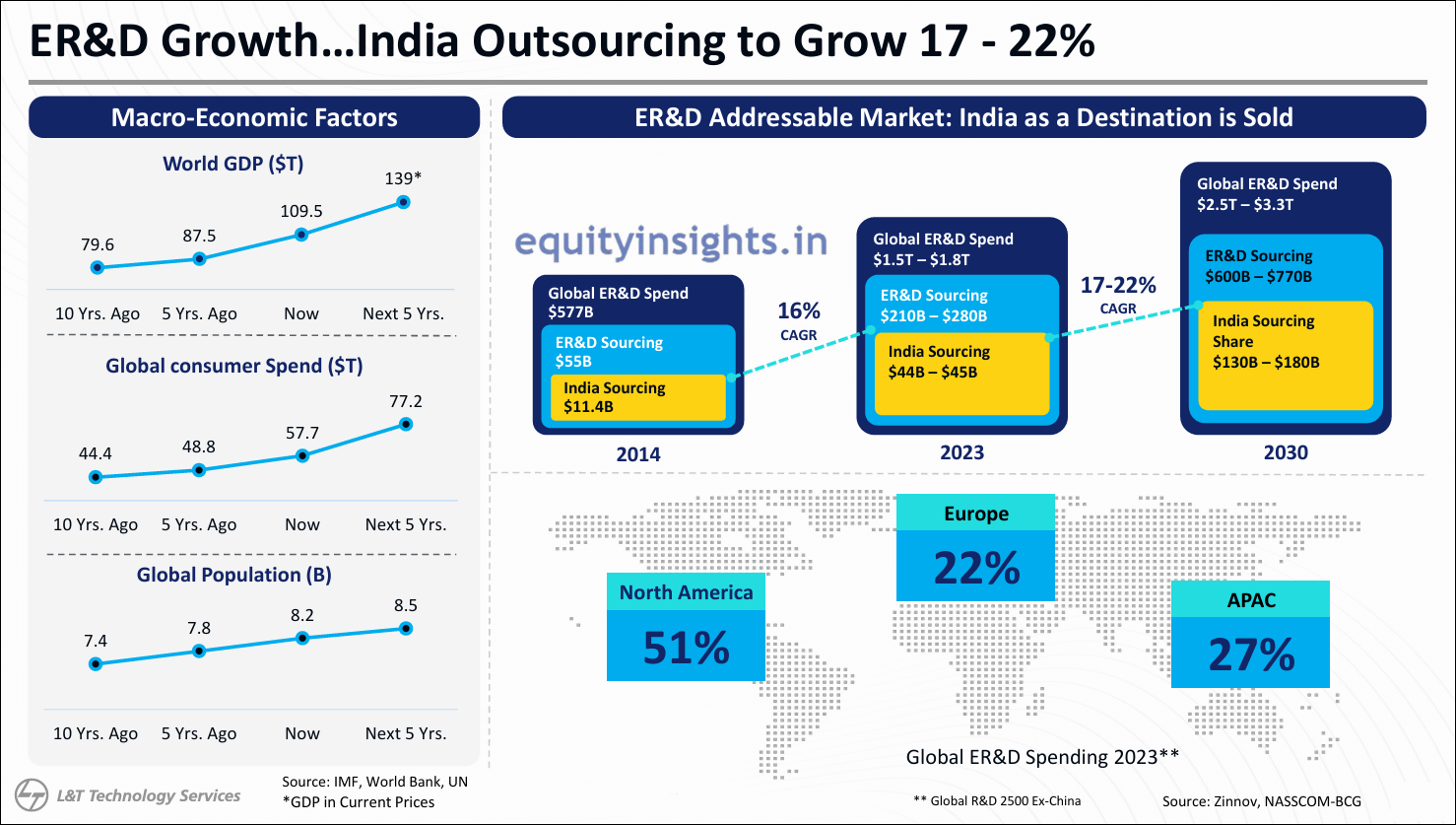

ER&D Industry Market Size

Globally, the ER&D industry has a massive market of nearly ₹1.5 to ₹1.8 trillion which is roughly around ₹174 lakh crore. Out of this, around 10-12% of the business is outsourced, which comes to around $180-$200 billion market. Within that, India is the largest outsourcing destination where as of 2023, India’s ER&D market is valued at approximately $44 to $45 billion and as per BCG (Boston Consulting Group) report, the Indian ER&D industry is expected to grow to $130-170 billion by 2030, which is around 15-19% CAGR growth.

The image above provides a clear breakdown of the global ER&D market and its geographic contributions, with the US leading the charge at over 50% market share. This dominance reflects a strong and healthy growth trajectory.

Growth Drivers

- Cost Efficiency and Access to Skill Talent: Global firms outsourced ER&D work to India for cost efficiency and access to skilled talent. Additionally, Indian ER&D companies have a very strong talent pool.

- Increasing Digital Adoption: New technologies like AI, Internet of Things (IoT), 5G and Cloud Computing are increasingly getting adopted and that requires a good amount of investment.

- Automation and EV Boom: Due to the adoption of autonomous driving, safety and connected mobility, the cars are essentially becoming software on wheels that is driving ER&D investment.

- Expansion Beyond The Auto sector: The adoption of advanced technology are not just limited to auto industry. There’s a high demand for ER&D and advanced technologies from sectors like healthcare, media, industrial sector, etc.

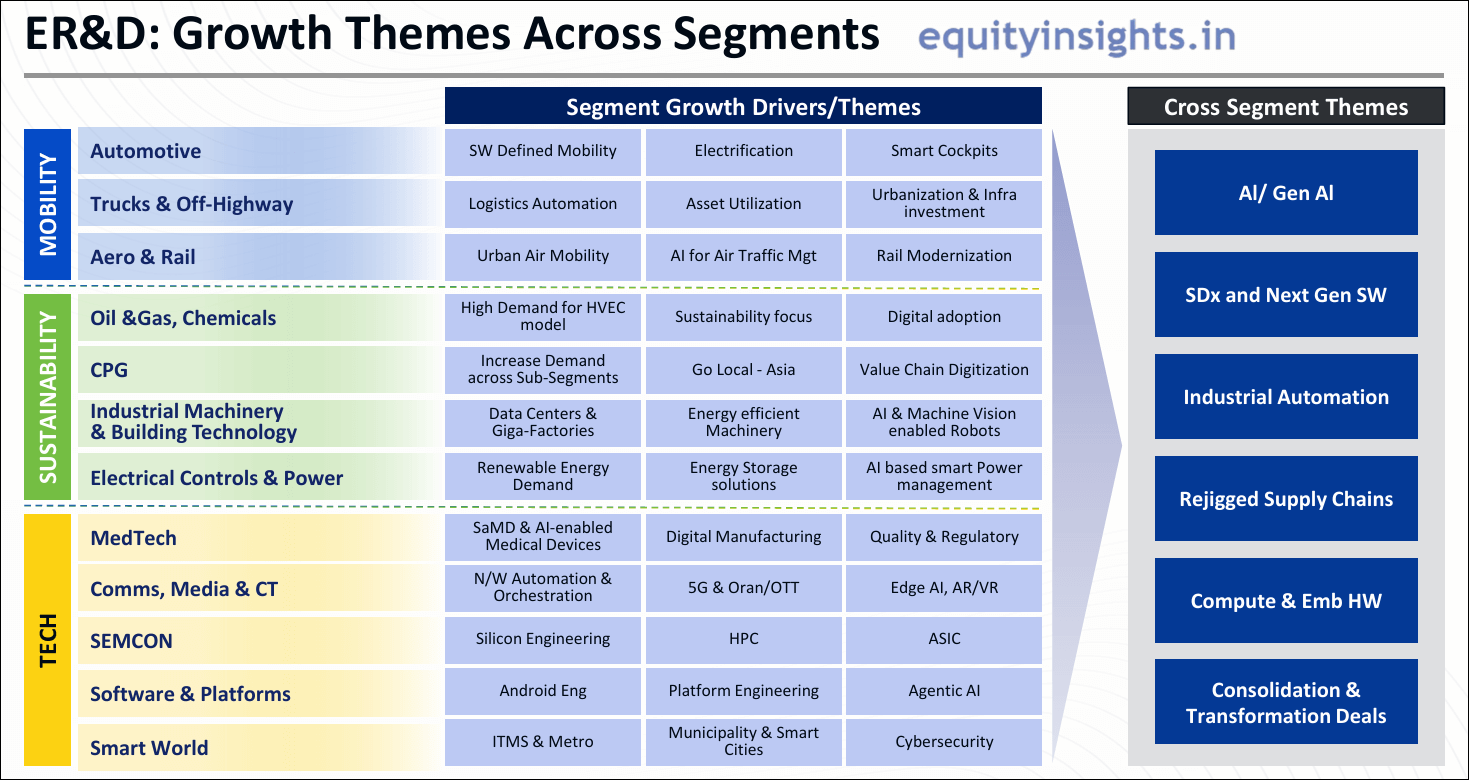

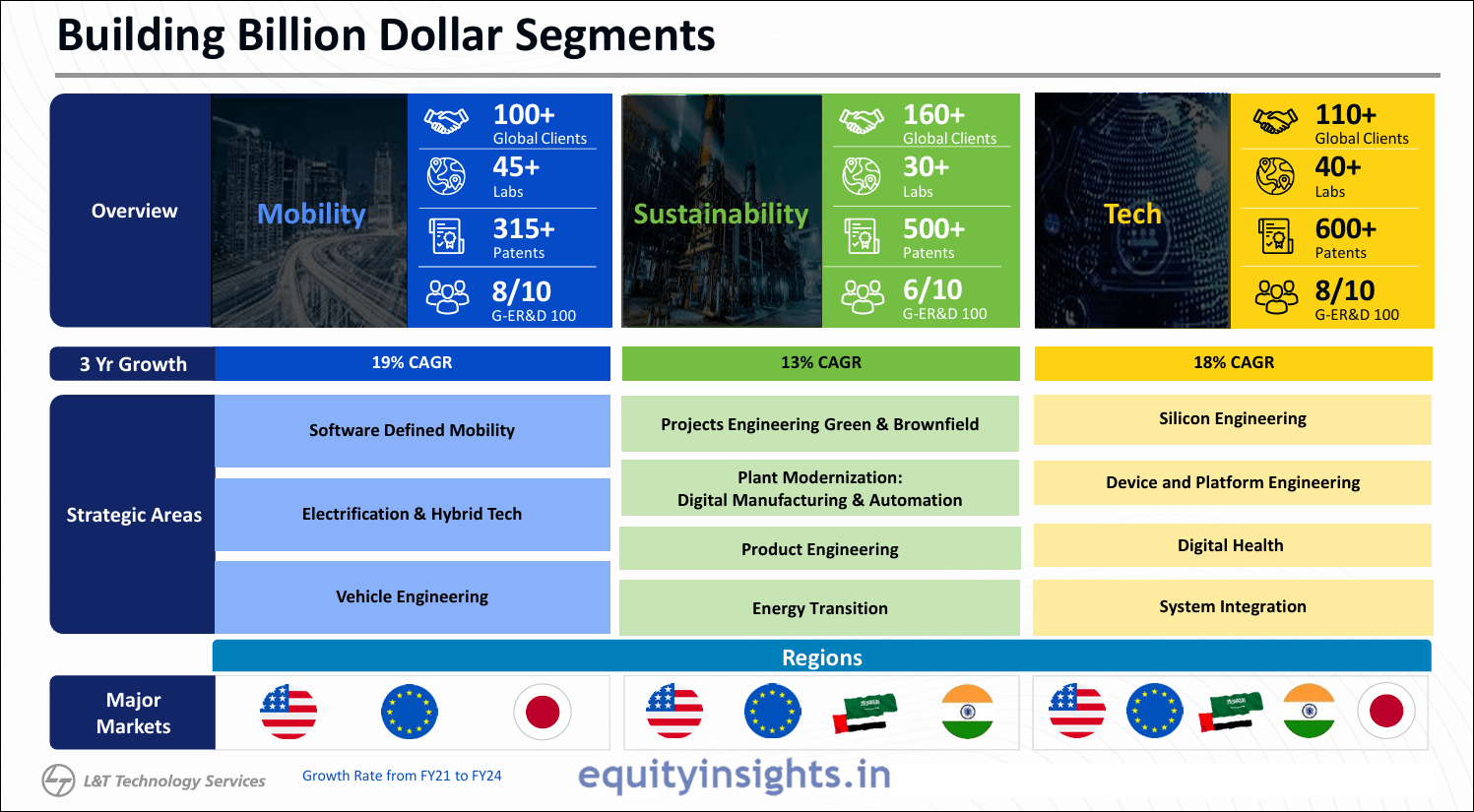

The image below shows a nice breakup of three key sectors for ER&D that include Mobility, Sustainability, Tech and various growth and cross segment themes like AI, SDx, Industrial Automation and so on.

So, there’s certainly a lot of potential in the ER&D sector which is also growing fast, creating big opportunities for Indian ER&D companies to expand and thrive. Now, let us look at the performance of Indian ER&D companies in the last few years.

Read More: Tata Motors Share Price Tanks 45% – Crash or Opportunity?

ER&D Companies of India

India’s ER&D sector is gaining momentum, driven by innovation and global demand. Let’s take a quick look at the country’s top ER&D companies leading the way.

1. KPIT Technologies

KPIT Technologies Limited is an Indian multinational corporation specializing in engineering, research and development (ER&D) services for the automotive industry. Founded in 1990 by Ravi Pandit and Kishor Patil, both chartered accountants, the company is headquartered in Pune, Maharashtra and operates development centers across Europe, the USA, Japan, China, Thailand and India.

Service Offerings and Expertise

KPIT focuses on providing software solutions that facilitate the transition towards autonomous, clean, smart and connected vehicles. Their service portfolio encompasses:

- Autonomous Driving: Developing technologies to enable self-driving capabilities.

- Connected Vehicles: Offering solutions that ensure seamless connectivity within vehicles.

- Electric and Conventional Power-trains: Engineering services for both electric and traditional vehicle power systems.

- Vehicle Diagnostics: Providing diagnostic tools and services for vehicle maintenance and performance monitoring.

- AUTOSAR: Specializing in the AUTOSAR (Automotive Open System Architecture) framework to standardize automotive software architecture.

- Vehicle Engineering and Design: Offering comprehensive vehicle design and engineering services.

The company positions itself as a leading independent software development and integration partner, specializing in embedded software, AI and digital solutions, aiming to accelerate the implementation of next-generation mobility technologies.

Recent Collaborations and Initiatives

In March 2025, KPIT Technologies partnered with Bharat Petroleum Corporation Limited (BPCL) to enhance hydrogen-based mobility initiatives in Kerala, India. This collaboration includes the establishment of hydrogen refueling stations, underscoring KPIT’s commitment to sustainable and clean energy solutions in the automotive sector.

KPIT Technologies offers specialized ER&D service in only one segment—Mobility and this company is a prime example of how a bold strategic shift can transform a company’s fortunes. Before 2019, it was a conventional IT services provider, catering to clients across various sectors. However, in 2019, the company took an extraordinary step and demerged its regular IT business to focus solely on the automobile industry. Though it was a risky move, it turned out to be a masterstroke.

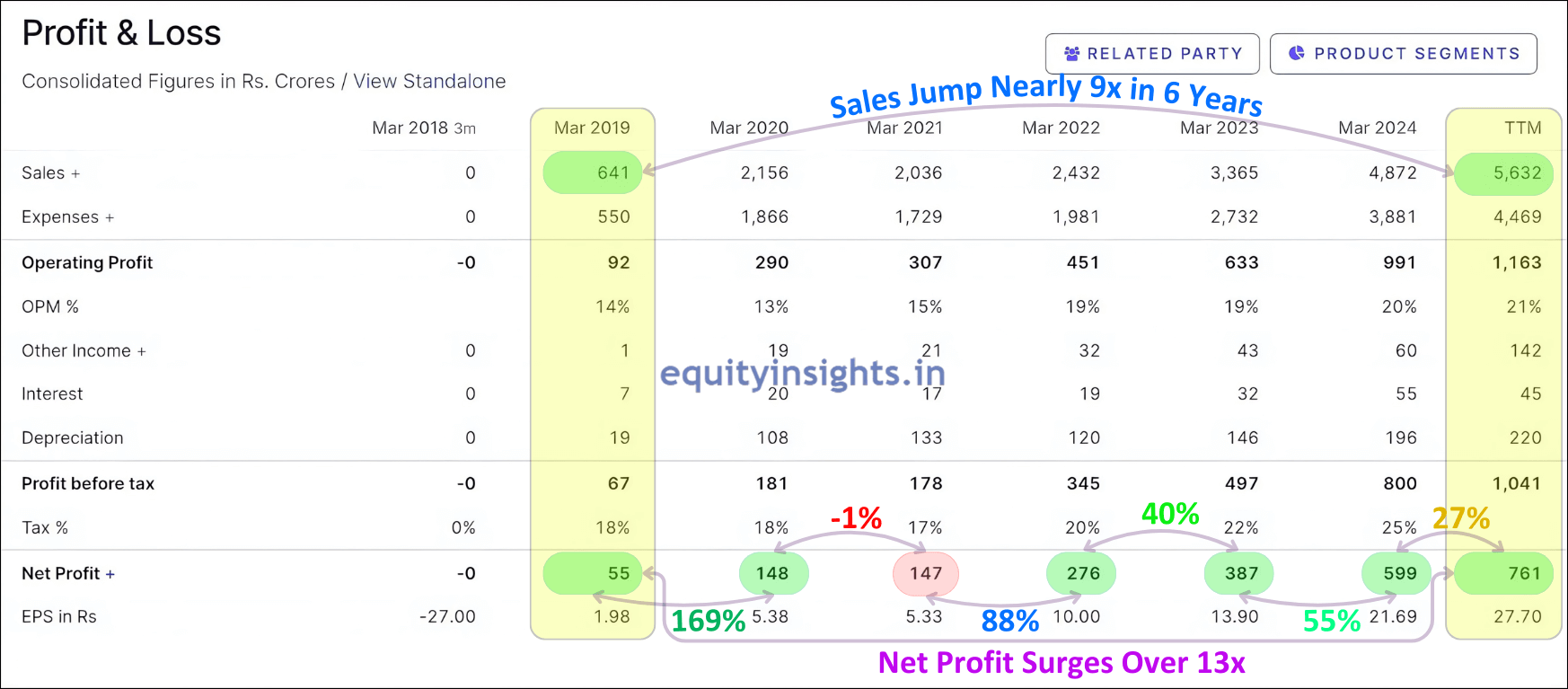

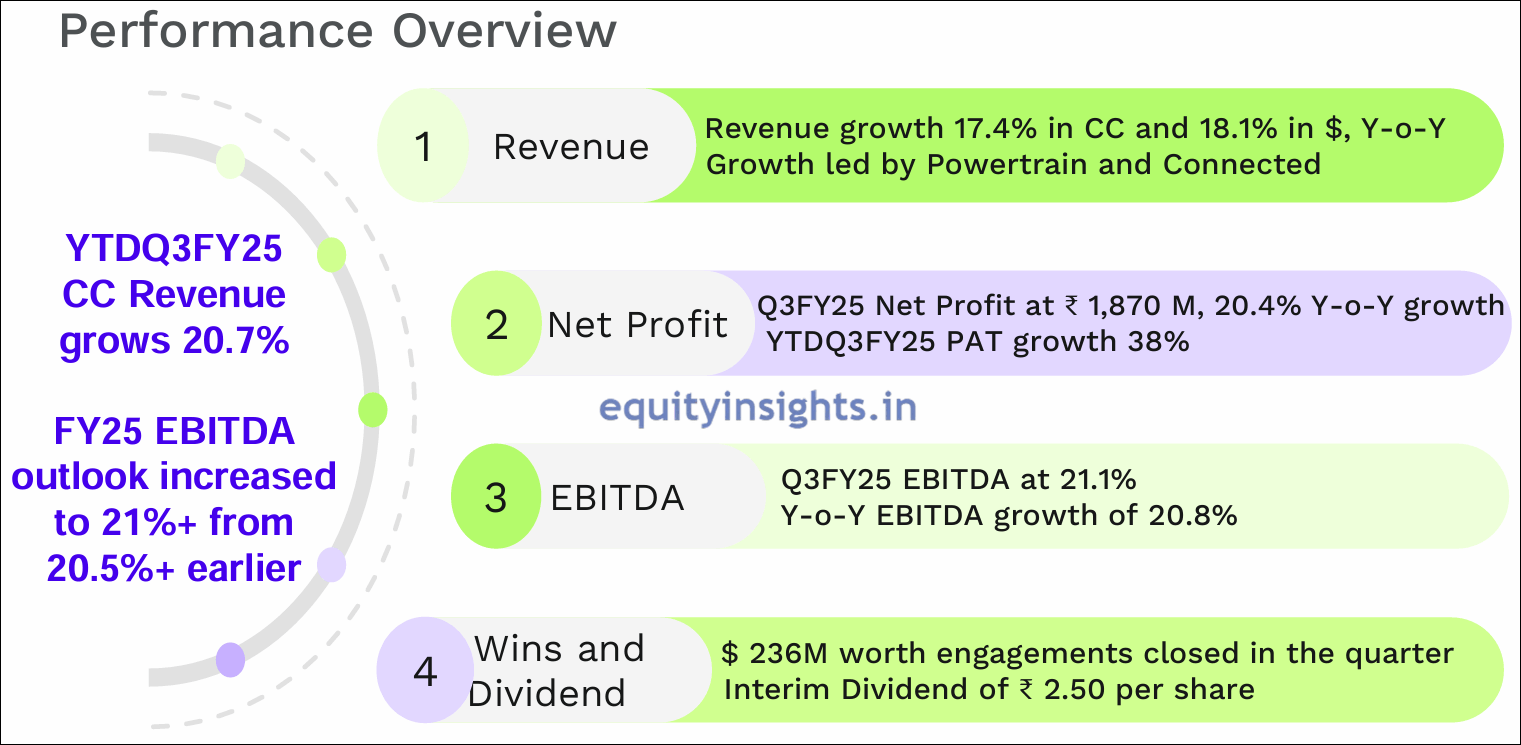

Following this pivot, the company’s revenue skyrocketed from ₹641 crore in 2019 to ₹5,632 crore in the trailing twelve months. Its net profit also surged from ₹55 crore to ₹761 crore during the same period. This growth was well appreciated by the market and its share price zoomed multi-fold times.

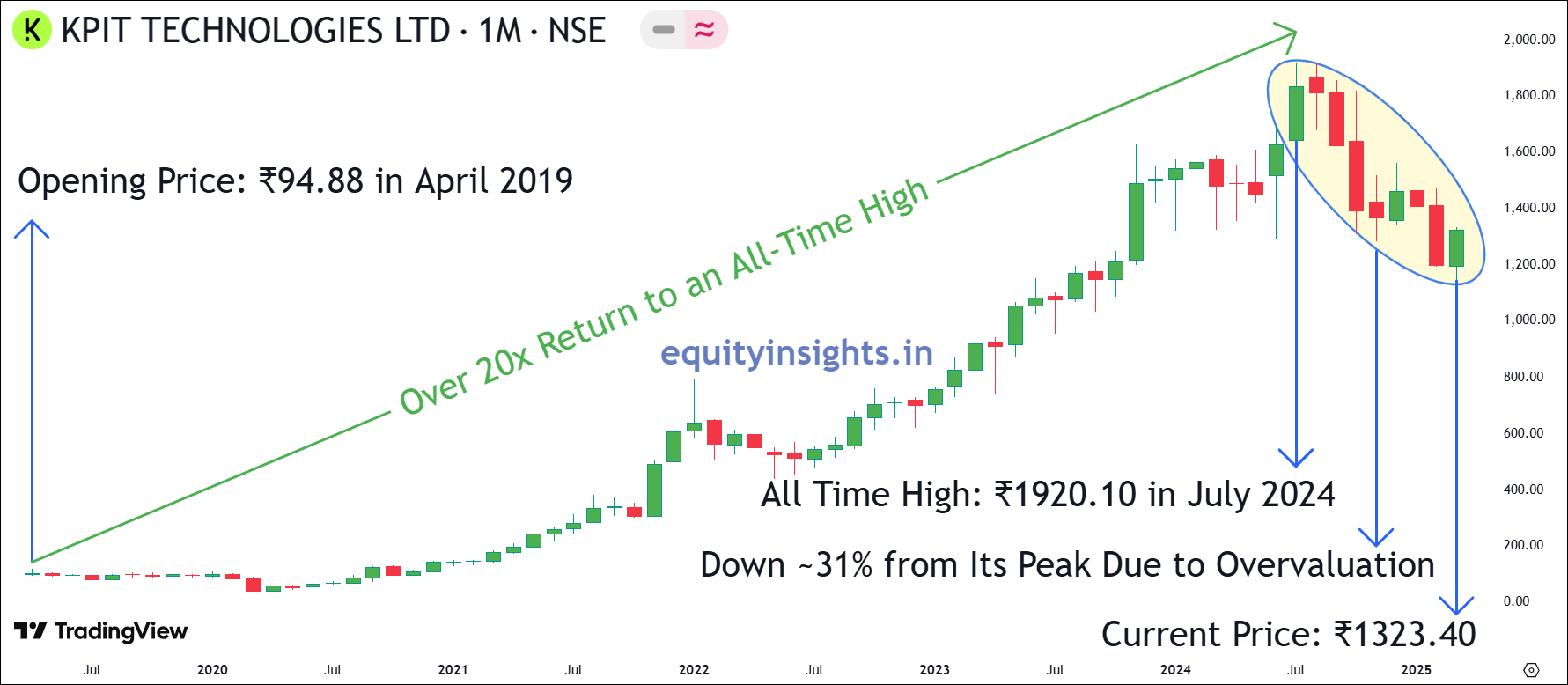

However, the challenge was the growth in share price was much more than the earnings growth. While KPIT Technologies has seen its earnings grow nearly 13 times over the last 5 years and 9 months, its share price skyrocketed over 20 times rising from ₹94.88 in April 2019 to an all-time high of ₹1920.10 in July 2024. Even after a steep correction of more than 31%, the stock still delivers an impressive 14x return as of March 23, 2025.

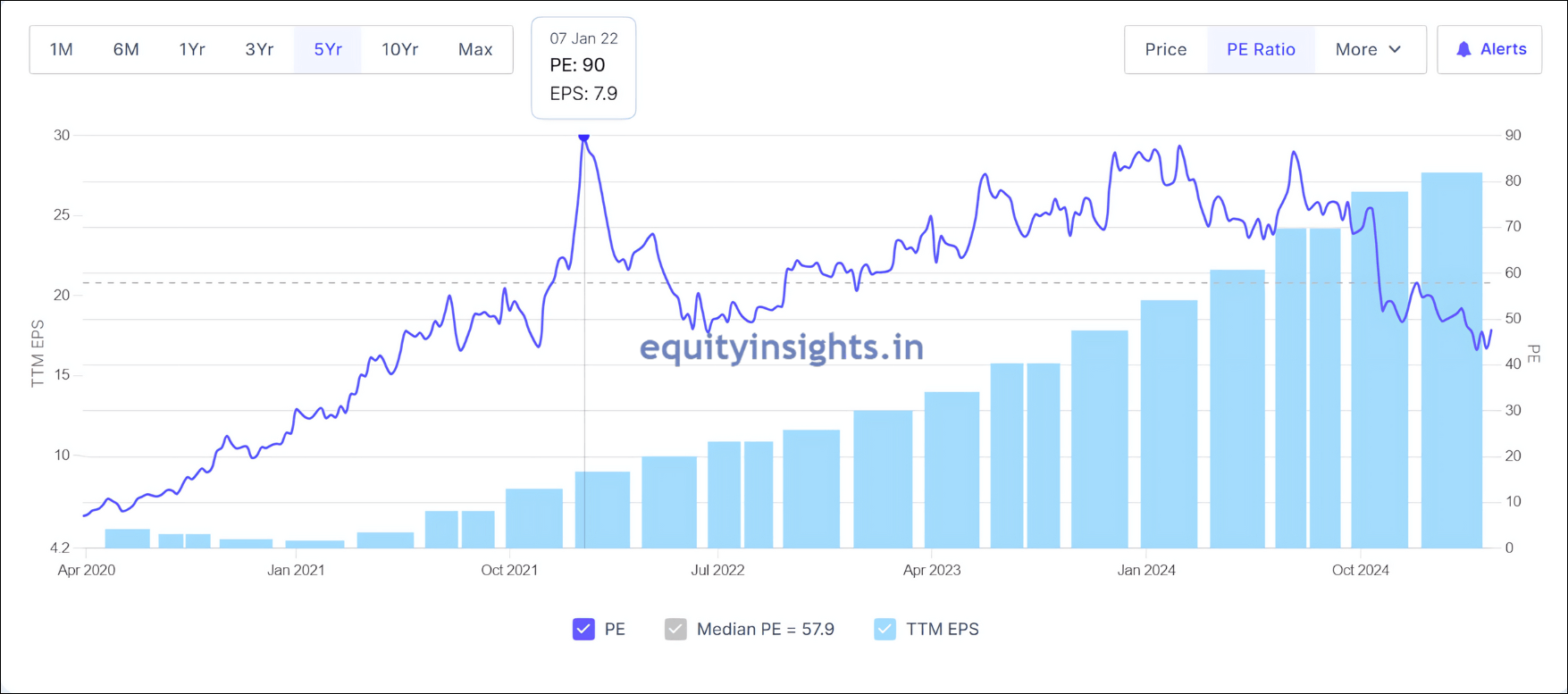

At its peak, KPIT’s P/E ratio soared to a staggering 90, reflecting the market’s exuberance far outpacing its earnings growth. We see this pattern play out in numerous stocks—when growth is strong, the market is willing to pay a premium. But the moment earnings start missing expectations, the market swiftly punishes the stock. The same trend is now evident in KPIT Technologies. Its revenue growth has begun to slow and for FY25, the company projects a top-line growth of around 18-20%, a significant deceleration compared to the 40% annual growth achieved over the past 5-6 years.

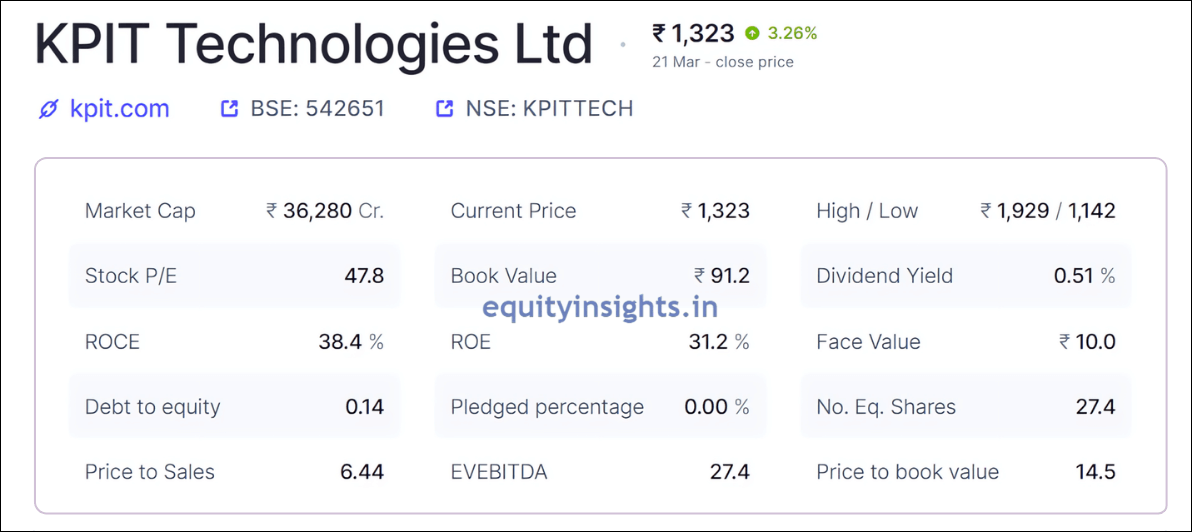

Obviously, you can’t pay a premium of 80-90 for a company that is growing at a 20% CAGR rate, hence KPIT Technologies share price corrected and is trading at ₹1323.40 as of March 23, 2025 and its P/E has fallen to around 48. This is the kind of analysis that the market looks at while valuing the company and that’s where it becomes very important to track the quarterly results.

2. Tata Elxsi

Tata Elxsi Limited is a global design and technology services company, specializing in sectors such as automotive, media, communications and healthcare. Established in 1989, it operates as part of the Tata Group, providing end-to-end solutions that encompass research, strategy, electronics and mechanical design, software development, validation and deployment.

Service Offerings and Expertise

Tata Elxsi assists clients in re-imagining their products and services through design thinking and the application of digital technologies, including:

- Internet of Things (IoT)

- Cloud Computing

- Mobility Solutions

- Virtual Reality (VR)

- Artificial Intelligence (AI)

Recent Collaborations and Initiatives

Over the past three months, Tata Elxsi has forged several impactful collaborations and launched key initiatives. Notably, in February 2025, the company announced a series of strategic partnerships across diverse industries:

- Partnership with Garuda Aerospace: Tata Elxsi signed a Memorandum of Understanding (MoU) with Garuda Aerospace during Aero India 2025 to establish a Centre of Excellence for indigenized Unmanned Aerial Vehicle (UAV) design and development. This initiative aims to strengthen India’s aerospace capabilities and defense readiness.

- Collaboration with Minespider: Tata Elxsi partnered with Minespider to launch MOBIUS+, a platform designed for battery lifecycle traceability. This collaboration focuses on enhancing transparency and sustainability in battery supply chains.

- Strategic Partnership with National Aerospace Laboratories (NAL): Tata Elxsi entered into a strategic partnership with NAL to advance air mobility solutions. This collaboration aims to develop innovative technologies for the aerospace sector.

- Robotics and Automation Innovation Lab: In collaboration with DENSO and AAtek, Tata Elxsi inaugurated a ‘Robotics and Automation Innovation Lab’ in Frankfurt. This facility is dedicated to advancing automation technologies for various industries.

- Collaboration with Qualcomm: Tata Elxsi announced plans to accelerate the adoption of Software-Defined Vehicles (SDV) for next-generation mobility solutions using Qualcomm’s Snapdragon Automotive Platforms. This initiative aims to enhance the development of connected and autonomous vehicles.

These collaborations reflect Tata Elxsi’s commitment to innovation and its proactive approach to addressing emerging technological trends across various sectors.

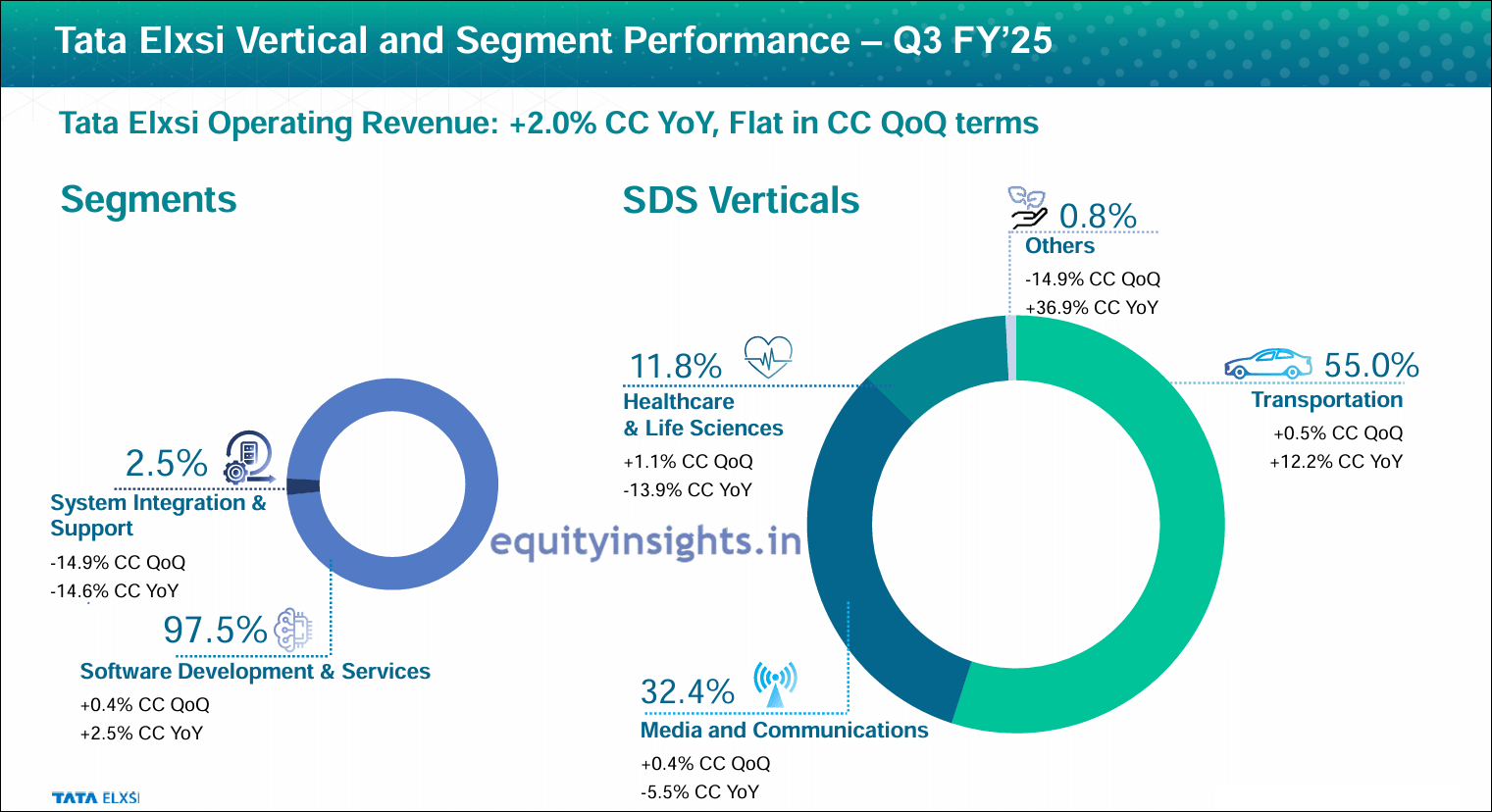

Unlike KPIT Technologies, which is laser-focused on the transportation sector, Tata Elxsi boasts a more diversified business model. As of Q3 FY25, transportation accounts for 55% of its revenue, while media & communication contribute 32.4% and healthcare adds another 11.8%. This broad-based approach gives Tata Elxsi a strategic edge by spreading risk across multiple industries.

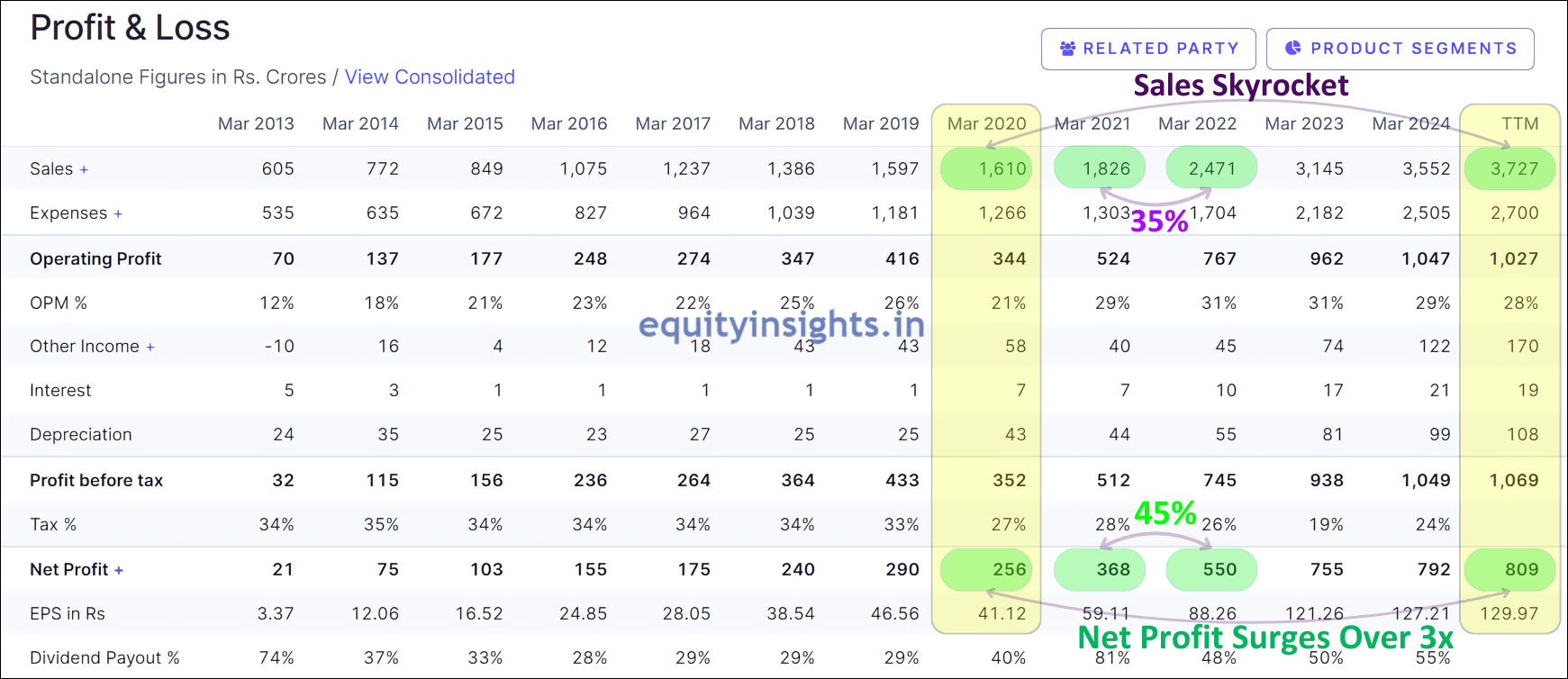

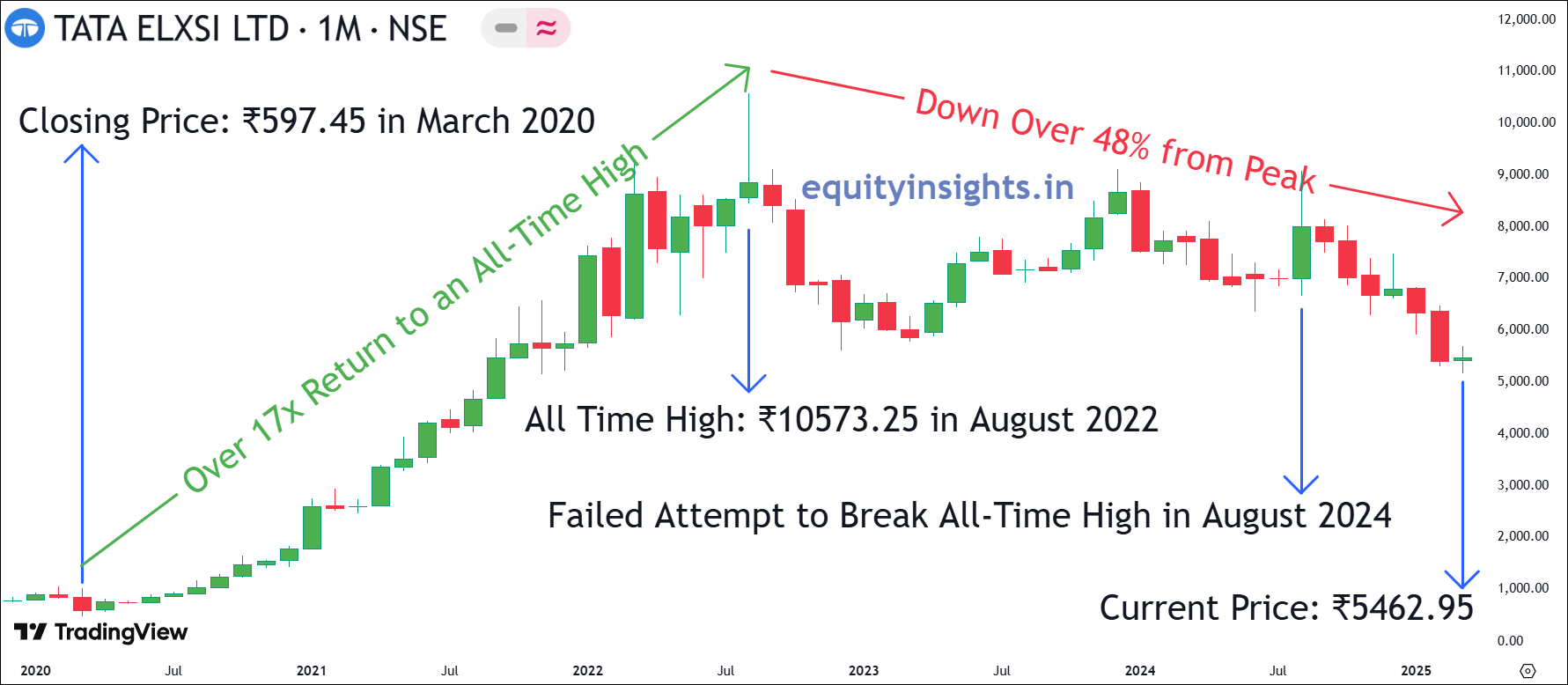

Post-pandemic, Tata Elxsi experienced a remarkable growth spurt. Between 2021 and 2022, its revenue surged at an impressive 35% annual rate, while net profits expanded at a stellar 45% pace—fueled by pent-up demand. The numbers tell a compelling story: from ₹1,610 crore in 2020 to ₹3,737 crore in the trailing twelve months (TTM), the company’s revenue more than doubled. Net profit followed suit, skyrocketing from ₹256 crore to ₹809 crore during the same period and that was the phase when its share price surged exponentially from ₹596.45 in March 2020 to an all-time high of ₹10573.25 in August 2022 as everyone wanted to have shares of this company in their portfolio.

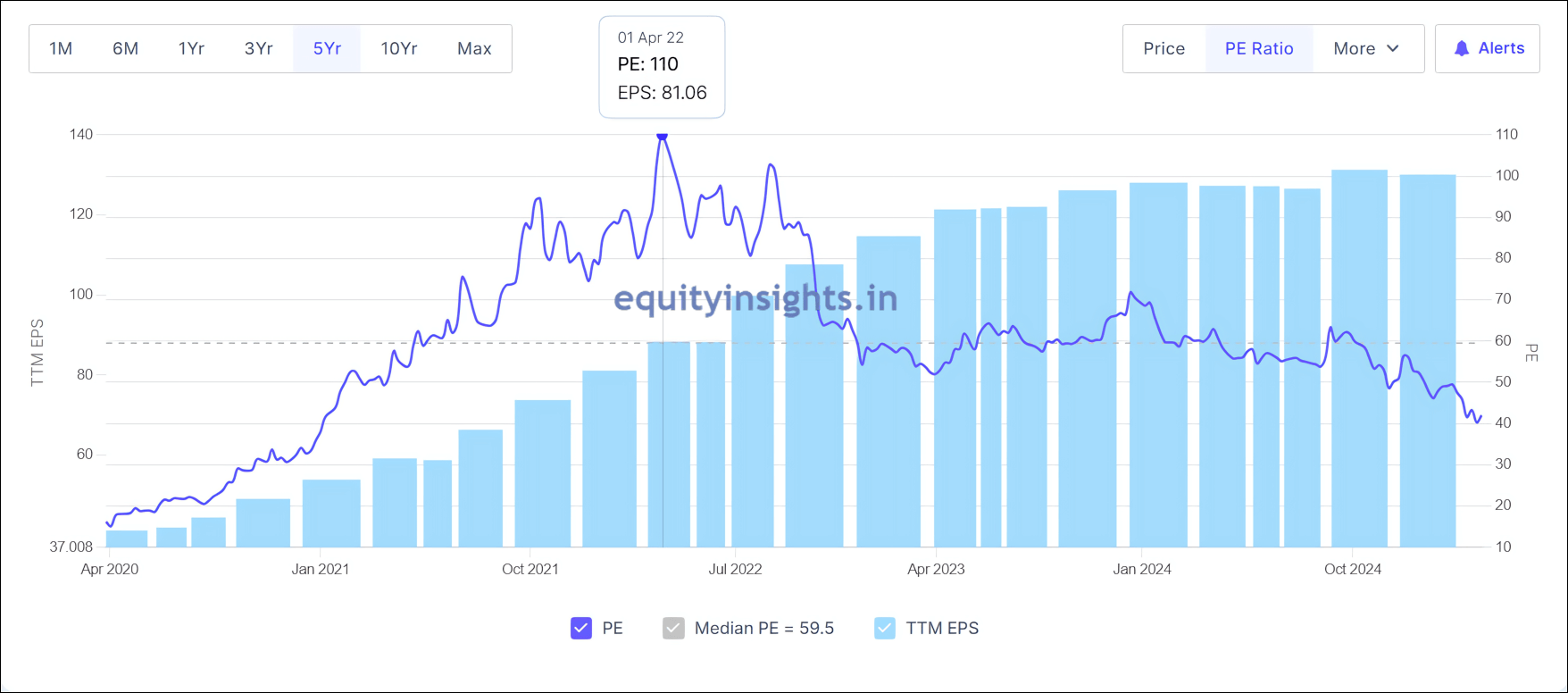

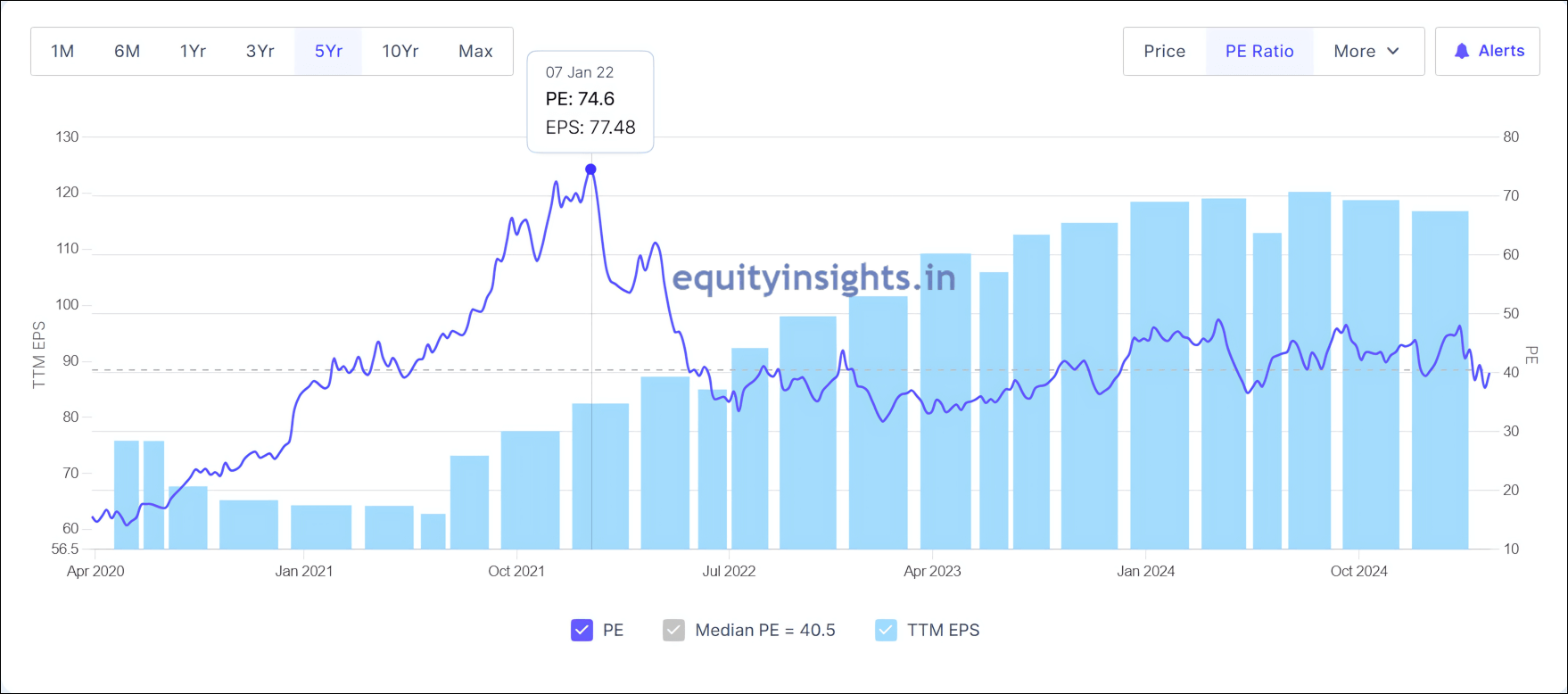

It neared its all-time high once again in August 2024, reaching an impressive ₹9080, reaffirming strong market confidence and investor enthusiasm. However, the growth started slowing down across revenue and net profit levels. In fact, both revenue and net profits are flat in the last one year. At the peak of demand, Tata Elxsi’s valuation soared to a price-to-earnings (P/E) ratio of 110. However, as earnings growth decelerated, Tata Elxsi share price declined and is trading at ₹5462.95 as of March 23, 2025, with the P/E multiple correcting to 42.

Read More: Zaggle Prepaid Share: A Promising Investment or Risky Bet?

3. Tata Technologies

Tata Technologies Limited, established in 1994, is a global engineering services company specializing in product development and digital solutions. As a subsidiary of Tata Motors, it operates across sectors such as automotive, aerospace, industrial machinery and more.

Service Offerings and Expertise

The company’s core services include outsourced engineering and digital transformation solutions, assisting global manufacturing clients in developing superior products. Notably, Tata Technologies has been involved in the development of two electric vehicles (EVs) for a Southeast Asian automotive original equipment manufacturer (OEM), with activities transitioning to launch support.

Recent Collaborations and Initiatives

Tata Technologies has been actively engaging in collaborations to enhance its technological capabilities. Similar to Tata Elxsi, in February 2025, the company announced a series of strategic partnerships across diverse industries:

- Partnership with National Aerospace Laboratories (NAL): Tata Technologies entered into a strategic partnership with NAL to advance air mobility solutions, focusing on developing innovative technologies for the aerospace sector.

- Collaboration with Garuda Aerospace: The company signed a Memorandum of Understanding (MoU) with Garuda Aerospace to establish a Centre of Excellence for indigenized Unmanned Aerial Vehicle (UAV) design and development, aiming to strengthen India’s aerospace capabilities and defense readiness.

- Robotics and Automation Innovation Lab: Tata Technologies, in collaboration with DENSO and AAtek, inaugurated a ‘Robotics and Automation Innovation Lab’ in Frankfurt, dedicated to advancing automation technologies for various industries.

These initiatives underscore Tata Technologies’ commitment to innovation and its proactive approach to addressing emerging technological trends across various sectors.

Interestingly, both Tata Elxsi and Tata Technologies are part of the Tata group but their focus areas and business models set them apart. Tata Elxsi is focused on design and engineering, on the other side Tata Technologies is focused on product engineering and manufacturing.

Tata Elxsi specializes in embedded systems, IoT and UX design, operating primarily on a service-based revenue model. Its key strengths lie in software-defined vehicles, AI-driven design and the OTT platforms. It has a strong foothold in both the automotive sector and OTT industry. On the other hand, Tata Technologies is deeply involved in product lifecycle management, manufacturing, engineering and supply chain solutions. Unlike Tata Elxsi, it follows a hybrid service + software revenue model, with its core strength being end-to-end product development. It is particularly strong in automotive engineering, playing a crucial role in vehicle design, manufacturing and innovation.

While both companies are leaders in their respective domains, their business approaches cater to different aspects of technology and innovation, making them distinct players in the Tata ecosystem.

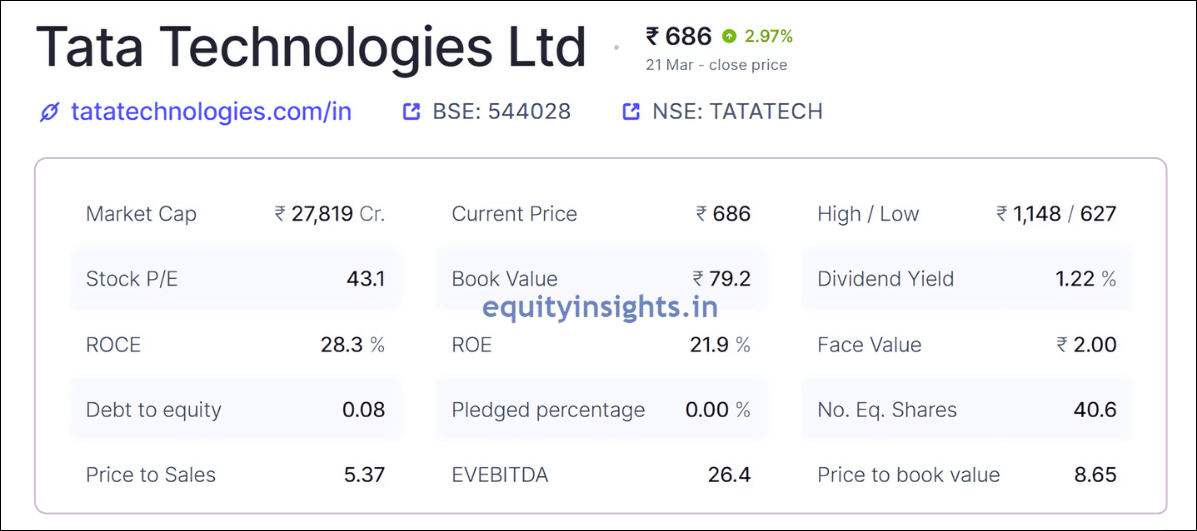

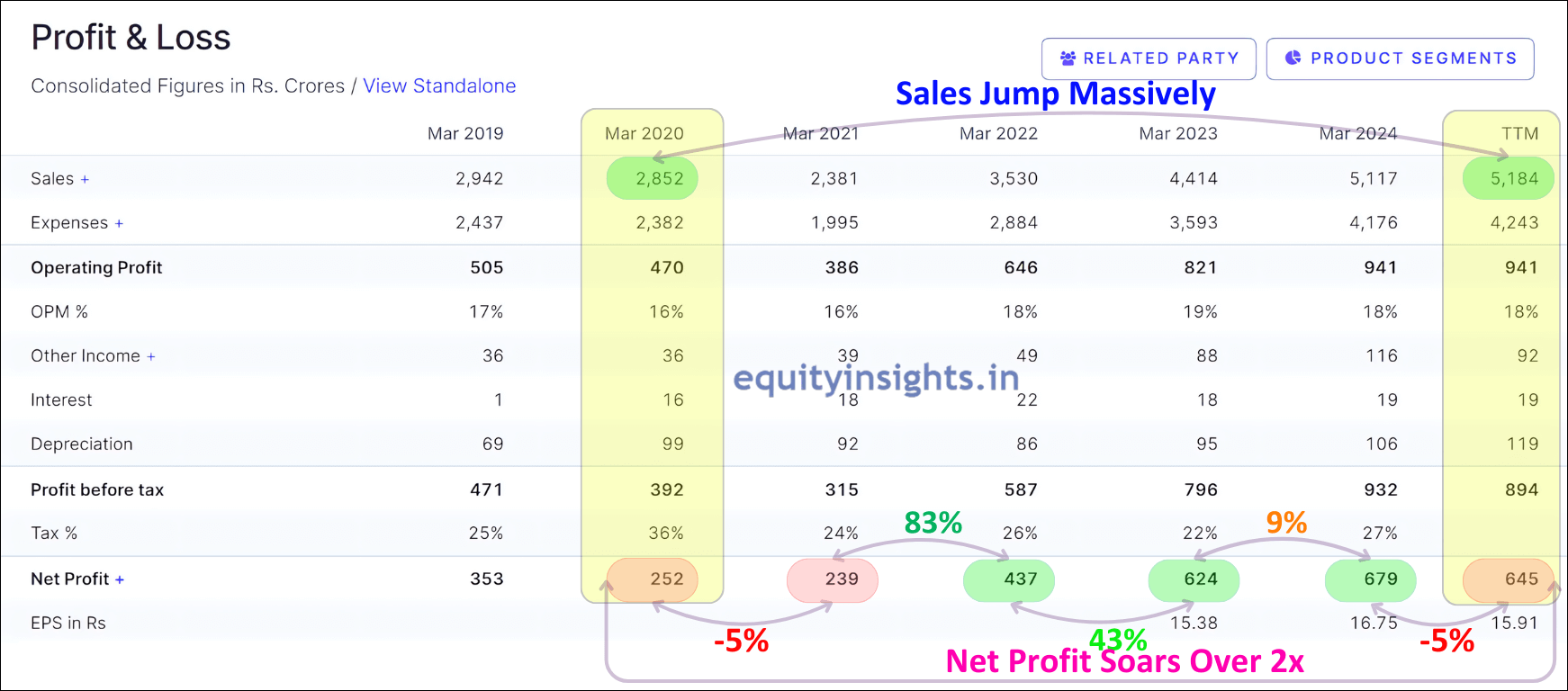

Similar to Tata Elxsi, Tata Technologies also experienced a remarkable financial upswing post-pandemic, driven by pent-up demand that fueled rapid growth in both revenue and net profit. From ₹2,852 crore in 2020, the company’s revenue surged to ₹5,184 crore in the trailing twelve months, while its net profit more than doubled during the same period.

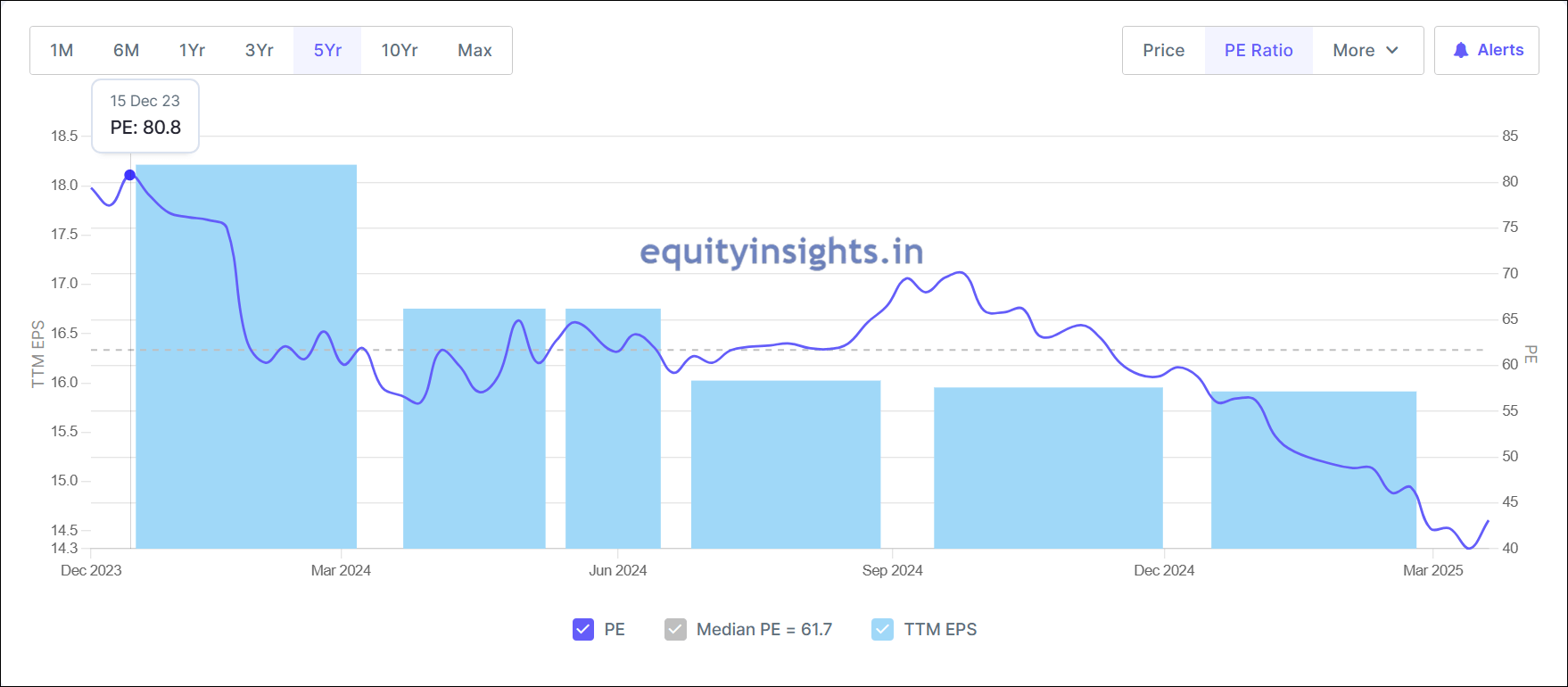

The company made a blockbuster debut on the stock market in November 2023, capitalizing on a raging bull run. Its shares soared by over 177% on listing day, reaching an all-time high of ₹1386.70 and pushing the P/E ratio to an eye-watering level of over 80. However, the momentum didn’t last. Over the past year, growth has slowed sharply and the company even reported de-growth in the trailing twelve months. Reflecting this slowdown, Tata Technologies share price has corrected by over 50% from its peak and is currently trading at ₹685.75 (as of March 23, 2025), bringing the P/E ratio down to 43.1—a stark contrast to its euphoric debut.

4. L&T Technology Services

L&T Technology Services (LTTS), a subsidiary of Larsen & Toubro, is a prominent Indian multinational specializing in engineering research and development (ER&D) services. Established in 2012 and headquartered in Vadodara, Gujarat, LTTS offers a diverse portfolio of services across sectors such as transportation, industrial products, telecom and hi-tech, medical devices and plant engineering.

Service Offerings and Expertise

The company is focused on multiple segments across mobility, sustainability and technology. LTTS provides comprehensive ER&D services, including engineering design, product development, smart manufacturing and digitalization solutions. The company caters to a global clientele, serving 69 Fortune 500 companies and 57 of the top ER&D firms across key sectors.

Recent Collaborations and Initiatives

Over the past three months, L&T Technology Services (LTTS) has engaged in several notable collaborations and initiatives:

- Collaboration with Intel to Scale Edge-AI Solutions: In March 2024, LTTS announced a partnership with Intel Corporation aimed at developing scalable edge-AI solutions, including Cellular Vehicle-to-Everything (CV2X) applications.

- Recognition for Diversity and Inclusion: LTTS was honored as one of the ‘Best Firms for Diversity & Inclusion in Tech’ at Rising 2024, reflecting the company’s commitment to fostering an inclusive workplace.

These developments underscore LTTS’s dedication to technological advancement and corporate responsibility.

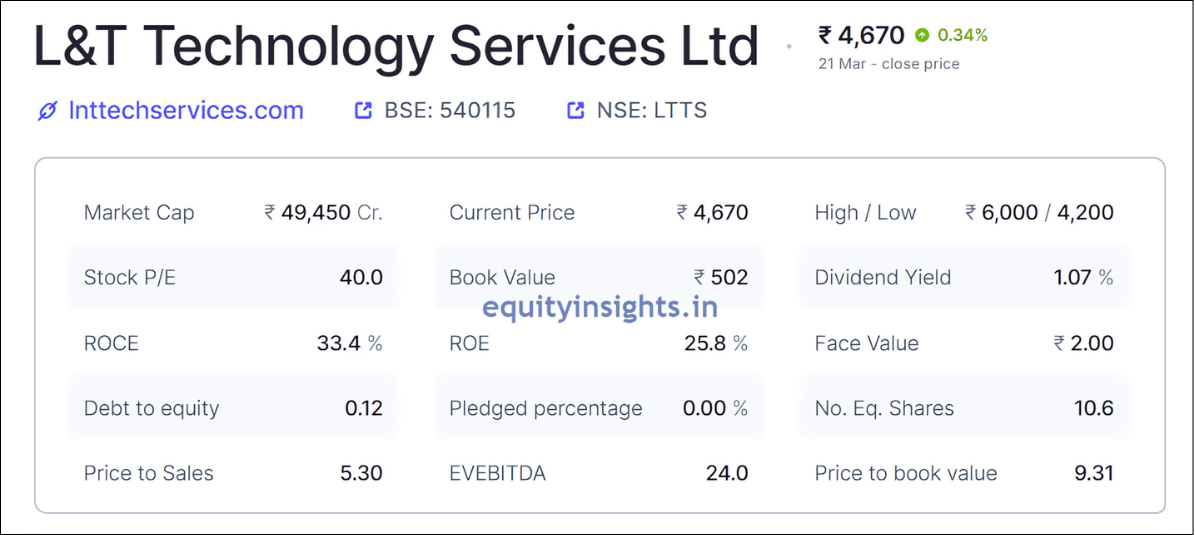

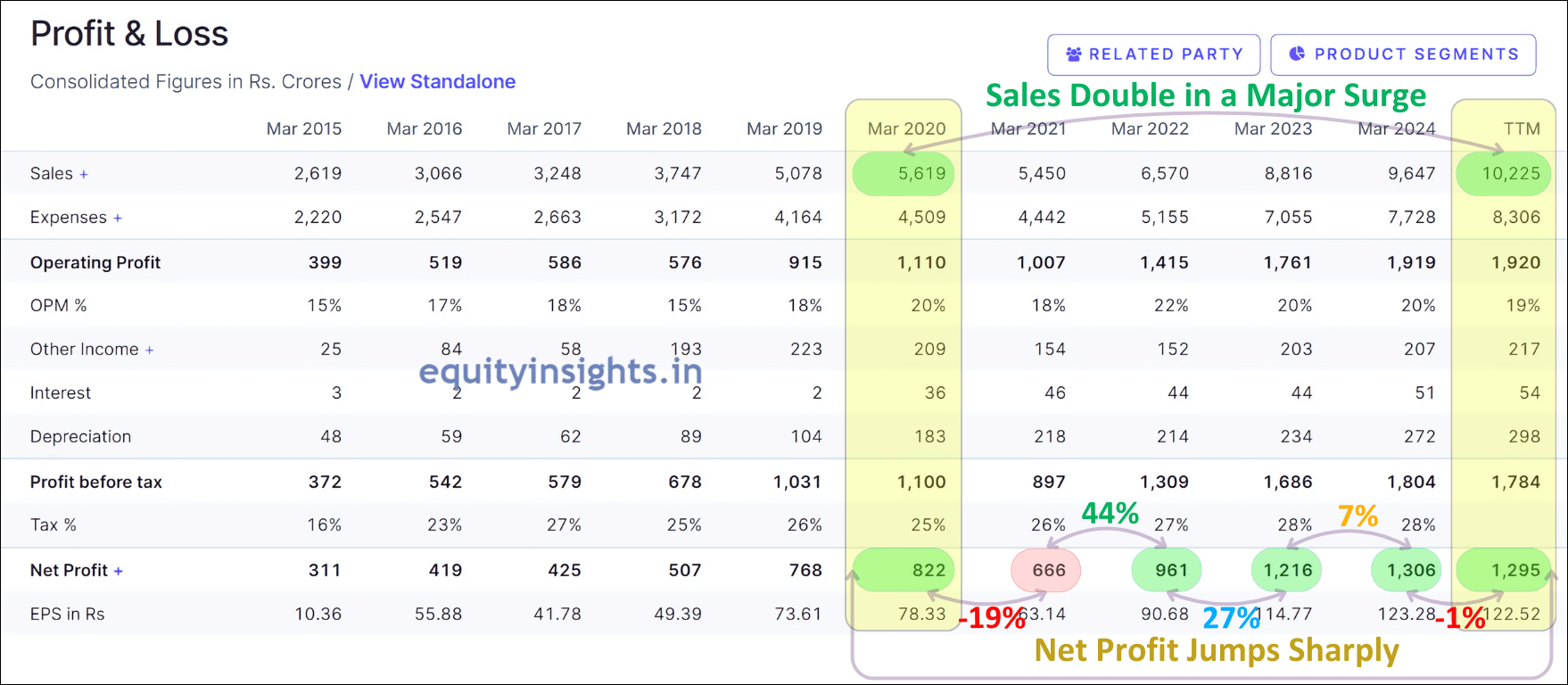

L&T Technology Services (LTTS) experienced impressive financial growth after the pandemic. The company’s revenue nearly doubled from ₹5,619 crore in 2020 to ₹10,225 crore in the trailing twelve months, driven by a surge in demand post-pandemic. During the same period, net profit rose from ₹822 crore to ₹1,295 crore, reflecting strong operational performance.

Due to the exceptional financial performance, its share price surged from ₹1099.60 in March 2020 to an all-time high of ₹5980.70 in August 2024. At its peak, LTTS’s P/E ratio surged to around 75, showcasing strong investor confidence and lofty market expectations. However, recent quarters have seen a sharp decline in profits, signaling growing challenges. Now, as of March 23, 2025, LTTS share price is at ₹4670.40 and P/E has cooled to 40, indicating a more cautious market outlook as earnings growth slows.

Despite these headwinds, the company remains optimistic. LTTS recently raised its revenue growth forecast for FY25 to nearly 10%, supported by its $110 million acquisition of U.S.-based software firm Intelliswift, which enhances its digital capabilities and strengthens its North American presence. Additionally, LTTS continues to invest in cutting-edge technologies. Its recent partnership with Intel to develop edge-AI solutions and its expansion into aerospace and clean mobility highlight its commitment to future growth. While short-term challenges remain, these strategic moves position the company for long-term success in the evolving technology landscape.

Read More: FIIs and DIIs Buy Big in Market Correction: Stocks to Watch!

Reasons for Slowdown in Earnings Growth

Now, let’s dive into the key reasons behind the slowdown in earnings growth. One clear trend stands out—all these companies experienced extraordinary growth following the COVID-19 pandemic, but that momentum has since faded, leading to a sharp slowdown in earnings growth. So, the key question is—what caused this sharp slowdown in earnings growth?

Several factors could explain this shift:

- Demand Normalization: The post-COVID growth of 40-50% was an exception and was mainly due to pent up demand after COVID. The long-term growth of the industry is in the range of 15-20%, which is again on the higher side. So, there’s a good growth in this industry.

- Higher Base Effect: After record-breaking growth, maintaining the same pace became challenging. As the revenue and profit base grew larger, delivering high percentage growth naturally became tougher.

- Rising Costs and Inflation: Increasing operational expenses, talent costs and global inflation have squeezed profit margins, impacting bottom-line growth despite steady revenues.

- Client Spending Cuts: Another reason is globally, companies have reduced their spending on ER&D work temporarily and one of the key reasons for the reduction in spending is the slowdown in demand. Macroeconomic factors like interest rate hikes, geopolitical tensions and slower global GDP growth have caused reduced investments in innovation and digital projects, which resulted in project delays and directly affected these companies’ revenue pipelines. However, the long-term growth story is 100% intact and this is one very exciting area that will continue to grow at good rate.

- Increased Competition: With more players entering the ER&D and digital services market, competition has intensified, reducing pricing power and profit margins.

Now, the important question is how long would this slowdown persist. Well, that is something nobody knows and hence we need to track the performance of these ER&D companies on a quarter-on-quarter (QoQ) basis. Another important point is valuation. While the post-pandemic rally certainly resulted in an expensive valuation, the recent correction has cooled off some of the froth. So, is it a good time to buy them and if yes which is the better option among all four?

Let us do a quick comparative analysis of all four companies.

Comparative Analysis: KPIT vs Tata Elxsi vs Tata Tech vs L&T Tech – Which ER&D Stock Stands Out?

The big question now—Is a P/E of 48 justified for KPIT Technologies? Does Tata Elxsi still hold its charm or is the golden run fading? Can Tata Technologies sustain its strong performance and continue to deliver growth? And what’s next for L&T Technology Services? Investors are eager to see how these tech giants navigate the road ahead. Let’s break down how these four major players—KPIT Technologies, Tata Elxsi, Tata Technologies and L&T Technology Services—stack up against each other.

Market Cap & Growth Comparison

IMAGE

All four companies are nearly at par in terms of market capitalization:

- KPIT Technologies – ₹36,280

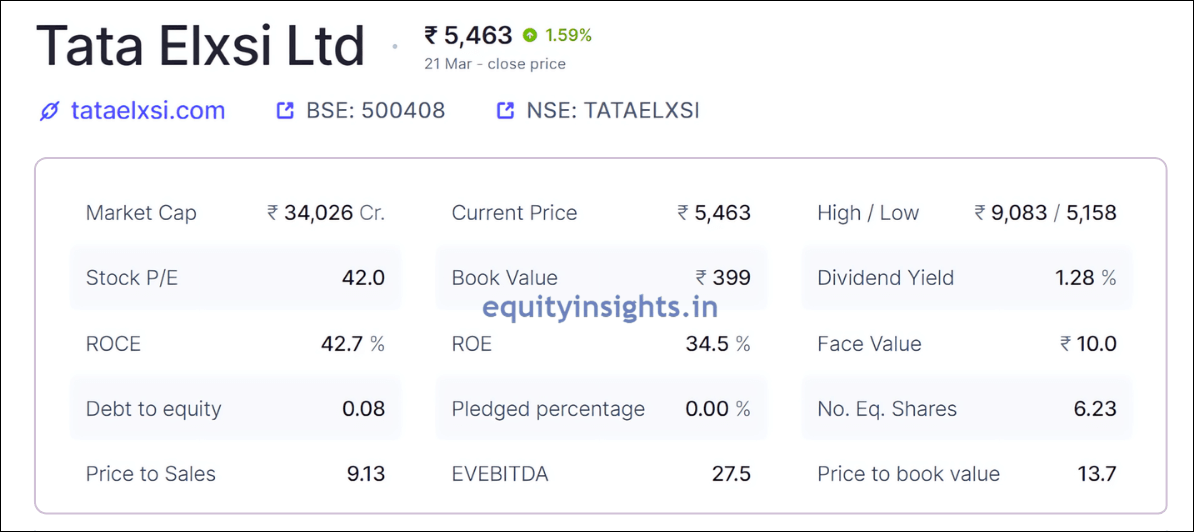

- Tata Elxsi – ₹34,026 crore

- Tata Technologies – ₹27,819 crore

- L&T Technology – ₹49,450 crore

However, growth tells a different story. Over the last three years, here’s how they’ve performed:

- KPIT Technologies – Fastest-growing with 34% top-line CAGR & 61% bottom-line CAGR

- Tata Elxsi – 25% top-line CAGR & 29% bottom-line CAGR

- Tata Technologies – 29% top-line CAGR & 42% bottom-line CAGR

- L&T Technology – 21% top-line CAGR & 26% bottom-line CAGR

Now, if we look at the latest trailing twelve months (TTM) performance, growth has slowed significantly for some:

- KPIT Technologies – Strong resilience with 23% revenue growth & 41% profit growth

- Tata Elxsi – Revenue up just 7% & net profit up only 2%

- Tata Technologies – 1% decline in revenue & a 13% drop in net profit

- L&T Technology – 8% revenue growth & negative 1% net profit growth

And when we zoom in on Q3 FY25 vs Q3 FY24, the trend is clear:

- KPIT Technologies – 18% revenue growth & 19% profit growth

- Tata Elxsi – 3% revenue growth & negative 3% net profit growth

- Tata Technologies – 2% revenue growth & negative 1% net profit growth

- L&T Technology – 10% revenue growth & negative 6% profit growth

So, among all these companies, KPIT Technologies continues to show the strongest resilience even in a challenging environment.

Margins, Profitability & Financial Health

- Operating Margin (TTM):

- KPIT Technologies – 21%

- Tata Elxsi – 28% (Highest)

- Tata Technologies – 18%

- L&T Technology – 19%

- Profitability:

- ROCE (Return on Capital Employed)

- KPIT Technologies – 38.4%

- Tata Elxsi – 42.7%

- Tata Technologies – 28.3%

- L&T Technology – 33.6%

- ROE(Return on Equity)

- KPIT Technologies – ROE – 31.2%

- Tata Elxsi – 34.5%

- Tata Technologies – 21.9%

- L&T Technology – 26.4%

- ROCE (Return on Capital Employed)

- Debt-to-Equity: All four have negligible debt, ensuring financial stability.

- CFO/EBITDA:

- KPIT Technologies – 95.60% (Best)

- Tata Elxsi – 60%

- Tata Technologies – 27.80% (Weakest in this area, but room for improvement)

- L&T Technology – 68.20%

Valuation

- Current P/E Ratio:

- KPIT Technologies – 47.8

- Tata Elxsi – 42

- Tata Technologies – 43.1

- L&T Technology – 40

- EV/EBITDA

- KPIT Technologies – 27.4

- Tata Elxsi – 27.5

- Tata Technologies – 26.4

- L&T Technology – 24

- Price-to-Sales Ratio:

- KPIT – 6.44

- Tata Elxsi – 9.13 (most expensive)

- Tata Technologies – 5.37

- L&T Technology – 5.30

Final Verdict

While all four are trading at similar valuations, KPIT remains the fastest-growing among them. However, given the recent earnings trends, these valuations are still on the higher side.

Read More: Top Investment Picks for 2025 by Axis Securities

Is KPIT Worth a P/E of 48?

Is KPIT Worth a P/E of 48? That’s the big question. A 48x P/E for a company guiding 20% growth may seem stretched as the ER&D market opportunity is massive and India’s cost advantage + expertise in this space ensures long-term growth. Expecting these stocks to trade at 25-30x P/E is unrealistic, as they command a premium valuation. The real question is how much premium is justified?

My Take – If the sector corrects another 10%, these stocks could present a fantastic long-term opportunity. But rather than waiting for the perfect entry point, a systematic investment approach could be a smarter play.

So, that wraps up our article. Which ER&D stock is your favourite? Are you buying or waiting for a deeper correction? Drop your thoughts in the comments! If you found this article insightful, share it with your network and stay tuned for more in-depth market analysis. Happy Investing!

So, that wraps up our analysis of the leading ER&D stocks! Each company—KPIT Technologies, Tata Elxsi, Tata Technologies and L&T Technology Services—presents unique opportunities and challenges as they navigate the evolving market. Now, tell me in the comments, which ER&D stock catches your eye? Are you adding to your portfolio or waiting for a better entry point?

If you found this analysis insightful, feel free to share it with your network and stay tuned for more expert takes on the latest market trends. Happy investing!