Hello everyone! After many years of analyzing business performance and the shareholding pattern, I’ve come to the conclusion that fundamentally strong companies with bright growth prospects show a trend where promoters, DIIs and FIIs would increase their stake in the company and public holding would reduce. On the flip side, when fundamentals weaken, institutional investors pull back and public shareholding rises. While there can be a few exceptions, this thesis works well in the majority of cases.

That’s why, every quarter I do this exercise of identifying companies where smart money is flowing—focusing on companies where promoters and institutional investors are increasing their holdings while public shareholding declines. This exercise provides valuable insights into fundamentally strong stocks available at attractive valuations. I also pay close attention to the pedigree of FIIs and DIIs increasing their stakes in a company. In my previous articles, I’ve shared a curated list of top FIIs and DIIs I closely track. If you haven’t read those yet, I highly recommend checking them out—they provide an in-depth analysis of the portfolios of Top 5 FIIs and 6 DIIs, helping you discover potential multibagger opportunities:

- Top 5 FIIs You Can’t Miss for Multibagger Ideas

- Top 6 DIIs and Elite Fund Managers Making Market Waves!

Over the last few months, the Indian stock market has been witnessing some volatility due to expensive valuation compared to the earnings growth and relentless selling pressure from foreign institutional investors (FIIs). Having said this, I believe that there are ample bottom-up opportunities where good small-cap and mid-cap companies have corrected recently from the peak.

It’s important to remember that as the stock market is in a declining trend today, some of these stocks might continue to decline—especially with the heavy selling in mid and small-cap stocks in recent weeks, which has created extreme fear and a clear bearish sentiment. However, what truly matters is the long-term outlook. If a company is fundamentally strong, market corrections can present great buying opportunities. That’s where, I did an extensive analysis and identified nine mid and small-cap companies that have seen significant corrections from their peaks (mostly in the range of 30-50%)—yet, FIIs and DIIs remain confident, steadily increasing their stakes.

This exercise has helped me identify some great names and build my conviction. But before we discuss the stocks, an important disclaimer—just because FIIs and DIIs have been accumulating a stock doesn’t guarantee they will continue doing so. This article serves as a great starting point for generating investment ideas, but thorough research is essential before making any financial decisions. You don’t need to directly jump and buy all the stocks at once. Given the current market conditions, there’s enough time in 2025 to research and understand business fundamentals, future growth drivers and evaluate key risks. So, take this time to gradually build conviction before investing, ensuring every decision is backed by knowledge and confidence.

Ultimately, successful long-term investing is built on strong conviction—and that only comes when you invest with knowledge. So, use this correction in 2025 as an opportunity to study great businesses and narrow down a handful of promising stocks to add systematically over time. With that in mind, let’s explore the 9 fundamentally sound and favourite stocks of FIIs and DIIs that they have been actively accumulating or have added recently in the market fall.

In this list of nine stocks, there may be companies where the promoter holding has reduced but that could be because the promoter of a company is a private equity firm and is booking profit. Also, sometimes promoters raise funds through QIP (Qualified Institutional Placement) to fuel future growth, which results in stake dilution and a decline in promoter holding. Therefore, in my analysis, I have focused on companies where FIIs and DIIs are gradually increasing their stakes, while public shareholding is on a downward trend.

Read More: Zaggle Prepaid Share: A Promising Investment or Risky Bet?

Table of Contents

1. Medi Assist Healthcare Services

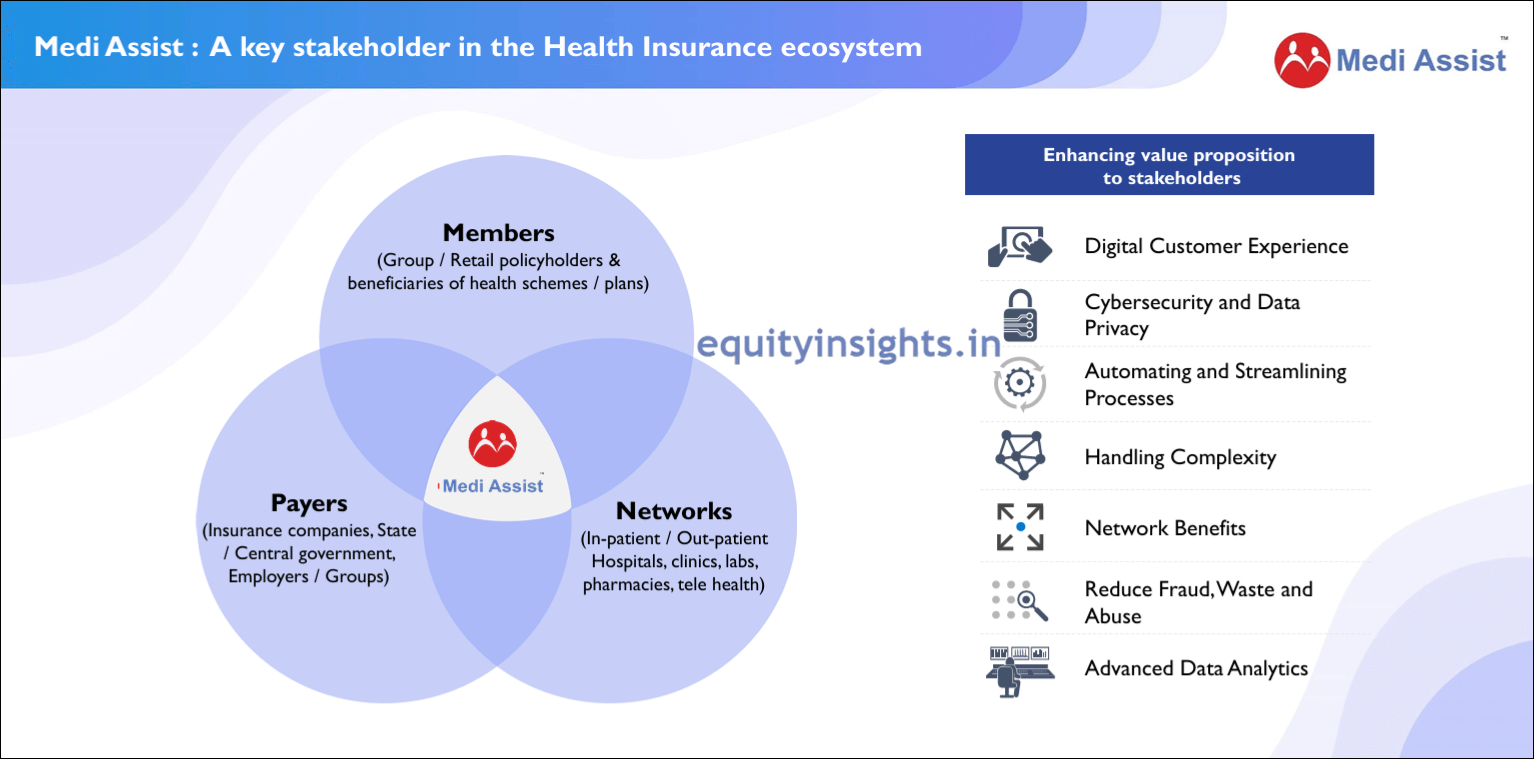

Medi Assist Healthcare Services is a small-cap health-tech and insurance-tech company. It is the largest Third-Party Administrator (TPA) in the Indian health insurance sector. Third-party administrators basically act as a link between a policyholder, insurance firm and hospital. There are many administrative roles that are performed by TPA:

- Claim processing of health insurance policies.

- Resolving customer queries.

- Fraud detection in the claim.

- Process automation.

- Network management between hospitals and insurance firms.

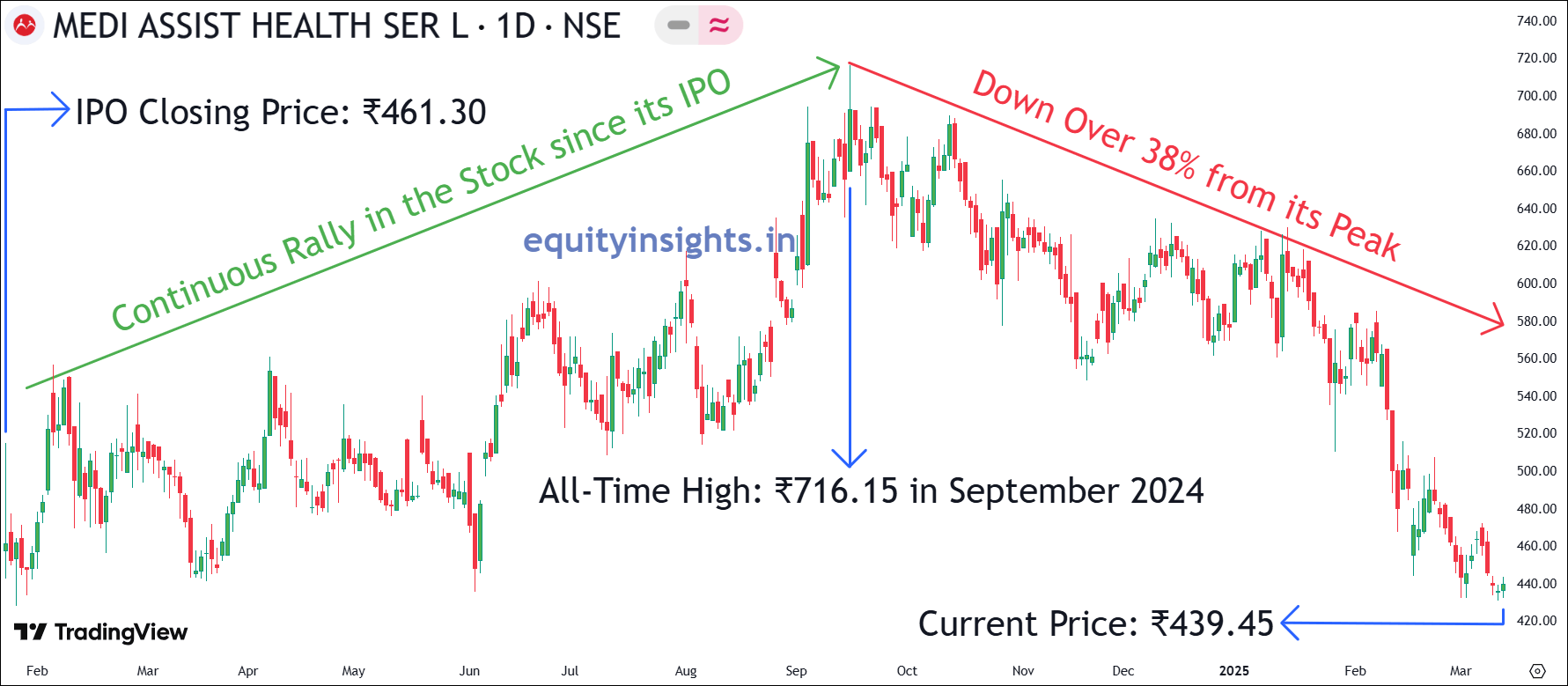

So, given the complexity of these operations, insurance companies often outsource their administrative and operational tasks to Third-Party Administrators (TPAs) like Medi Assist Healthcare Services. This collaboration allows insurers to streamline processes, enhance efficiency and focus on core functions, while TPAs manage claims processing, customer service and other critical aspects of healthcare management. The company was listed in January 2024 at ₹460 per share on NSE, which was an impressive 10% premium over its issue price of ₹418. The stock closed at ₹461.30 on its first trading day and later surged over 70%, hitting an all-time high of ₹716.15 in September 2024.

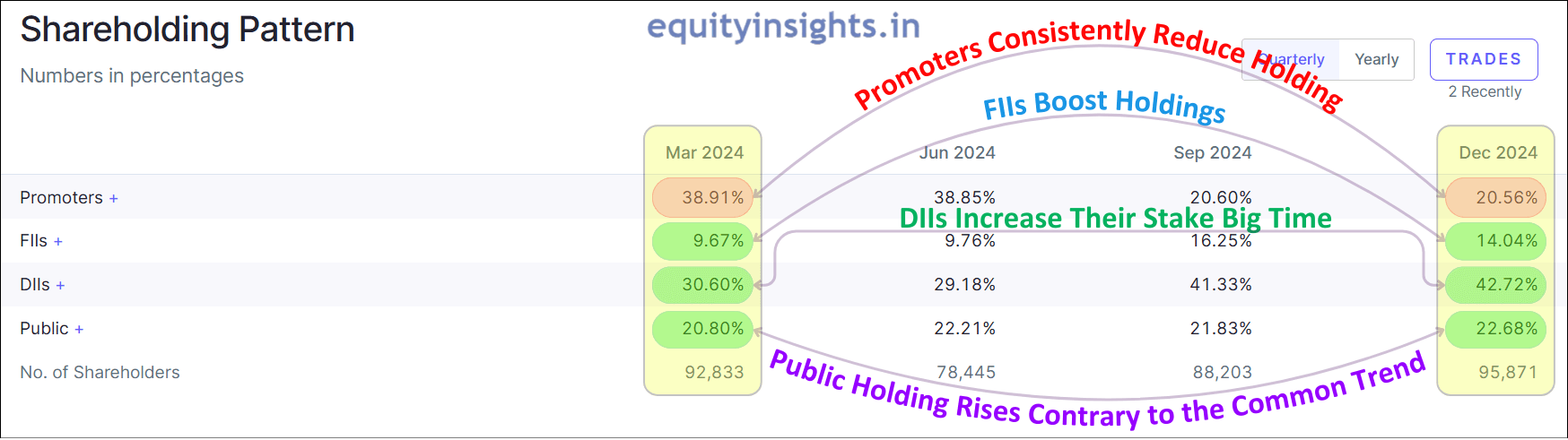

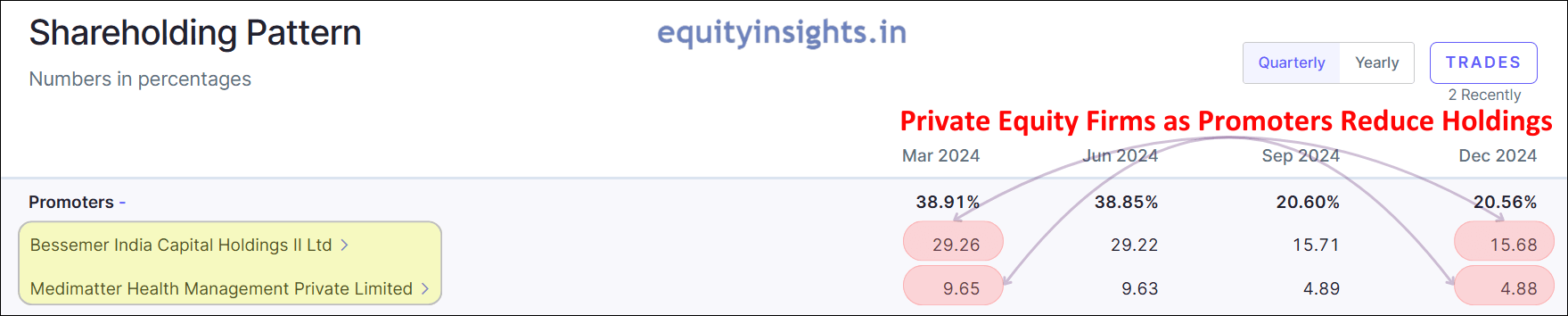

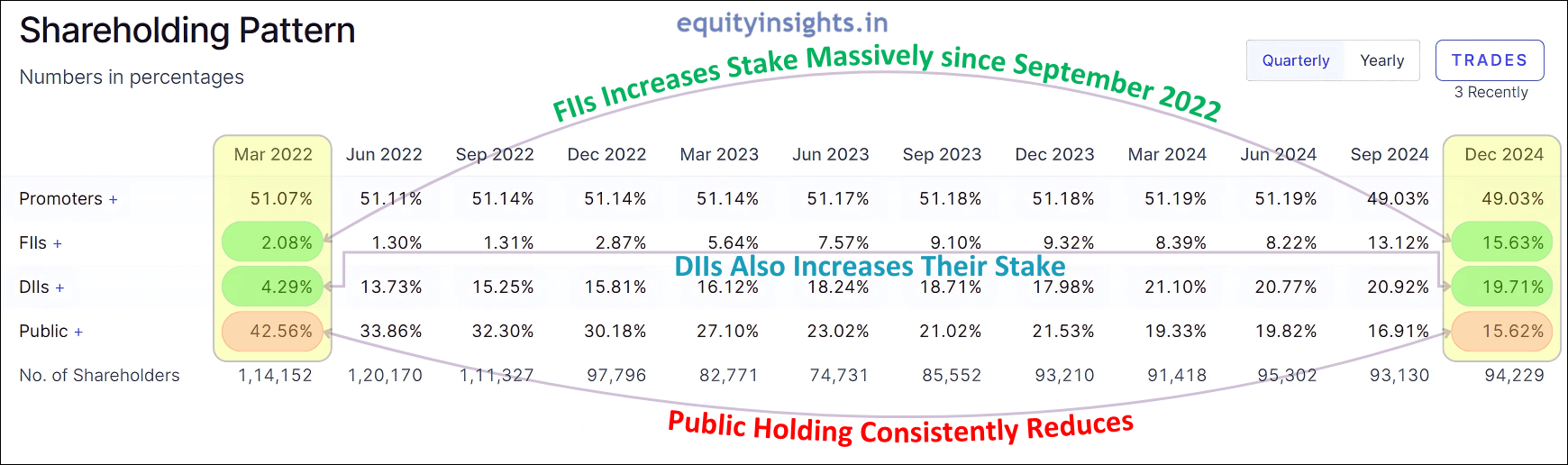

Now, if you look at the shareholding pattern of the company, it shows that promoter holding has fallen. However, an important point to note here is that its promoters are private equity firm that invested long back and made good profit, so they are booking profits. Now, the important question is who is buying the stake. In Medi Assist, its promoter firms Bessemer India Capital Holdings and Medimatter Health Management have reduced stake but that has been completely absorbed by both strong hands (FIIs and DIIs).

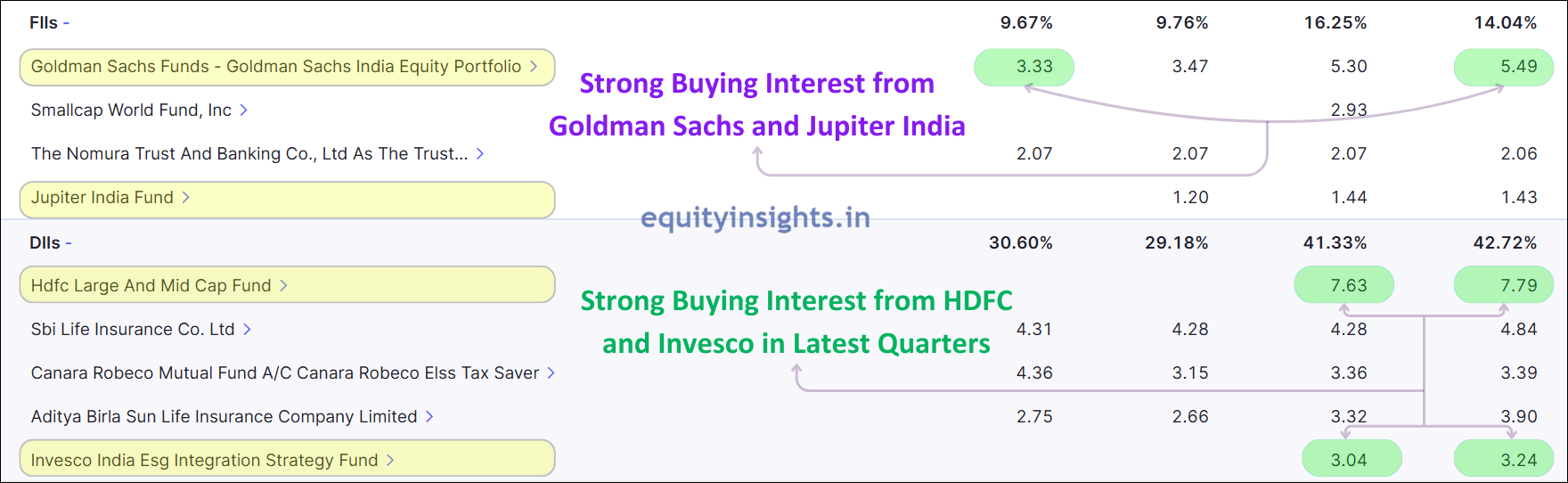

FIIs holding is up from 9.67% in March 2024 to 14.04% in December 2024 and it includes very reputed names like Goldman Sachs and Jupiter India Fund while DIIs stake in the company has jumped from 30.60% to 42.72% and include top DIIs like HDFC, SBI, Invesco, Canara, Aditya Birla, etc. Apart from this, an interesting trend witnessed in Medi Assist is that during the same period, not only did strong players increase their stake, but public holding also rose slightly from 20.80% to 22.68%, signaling broader investor interest.

The last buying in Medi Assist from institutional investors came on September 3, 2024, when renowned firms like Goldman Sachs (Gs India) and HDFC Mutual Fund acquired shares at ₹612 per share.

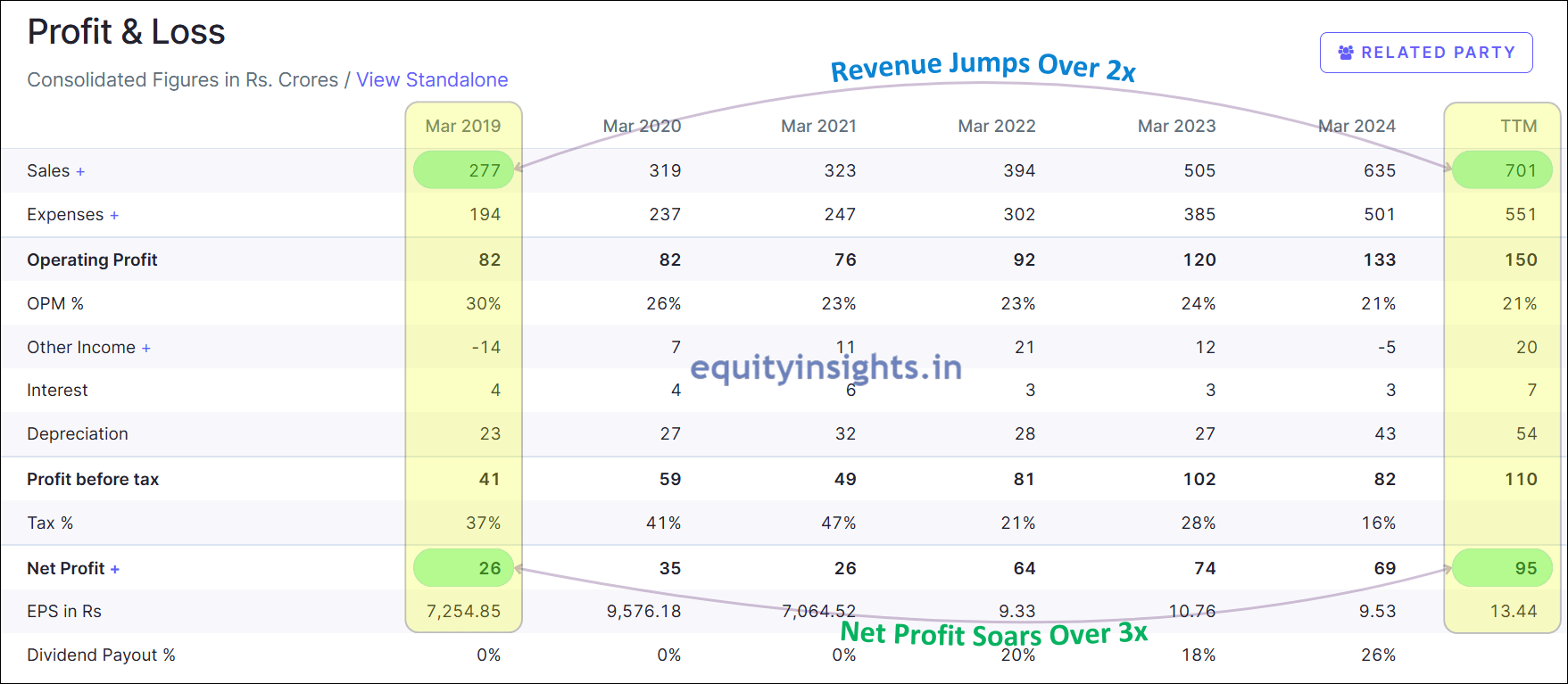

Medi Assist, an asset-light, tech-driven company, has demonstrated strong and consistent growth. Its revenue has surged from ₹277 crore in 2019 to ₹701 crore in the trailing twelve months (TTM), while net profit has jumped from ₹26 crore to ₹95 crore over the same period.

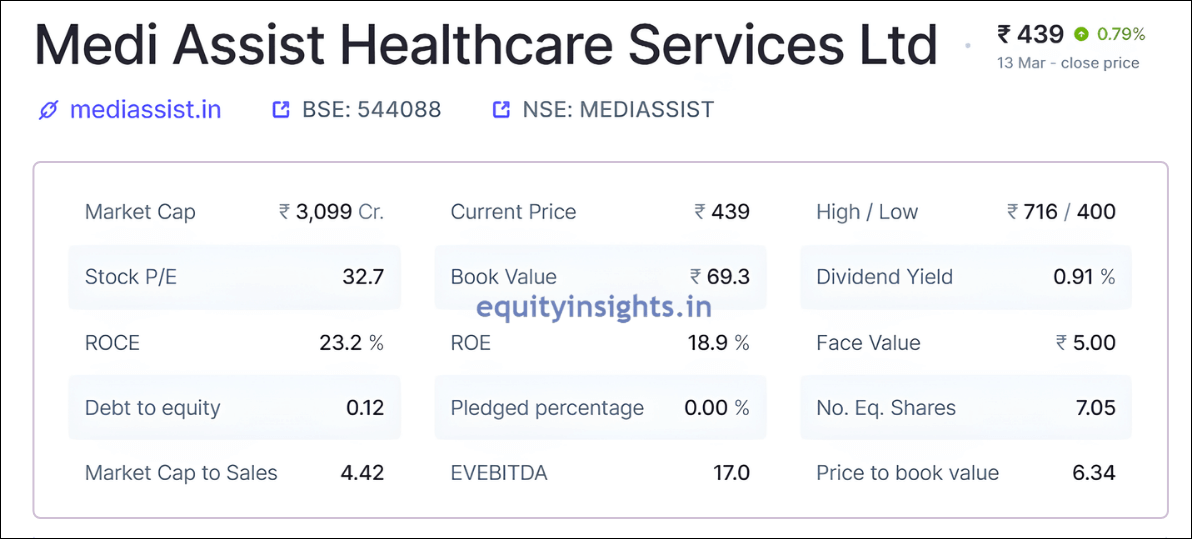

Medi Assist is a great proxy for growth in the healthcare insurance sector of India. As of March 16, 2025, Medi Assist share price is at ₹439.45, down by about 38% from its peak. The company holds a market cap of around ₹3,099 crore and trades at a P/E of 32.7 and an EV/EBITDA of 17. It enjoys a high Return on Equity (ROE) of 18.9% and a Return on Capital Employed (ROCE) of 23.2%, with negligible debt and healthy cash flow generation.

Considering the growth potential in the healthcare sector of India and the profitable business model of Medi Assist, the valuation looks quite tempting after the correction.

2. Mrs Bectors Food Specialities

The second stock in the list is Mrs Bectors Food, a company with a diverse product portfolio spanning two key categories—biscuits and bakery products. Founded in 1977 by Rajni Bector in Ludhiana, Punjab, the company has grown from a modest home-based venture into a publicly listed entity renowned for its quality offerings. It manufactures biscuits under the popular brand Cremica and bakery products under the English Oven brand.

Mrs Bectors Food Specialities Ltd. has established a significant market presence, exporting its products to over 60 countries. Apart from its B2C (Business-to-Consumer) model, the company also operates in the B2B (Business to Business) model, where it supplies Bakery and Frozen products to various government entities, including the Indian Railways and government canteens, top QSR (Quick Service Restaurant) chains of India like McDonald’s, Domino, Subway, cloud kitchens, multiplexes such as PVR as well as certain hotels and cafes.

From March 2022 to December 2024, Mrs Bectors shareholding dynamics have shifted significantly. Promoter holding declined from 51.07% to 49.03%, while public holding saw a sharp drop from 42.56% to 15.62%. Meanwhile, FIIs have massively increased their stake from a mere 2.08% to a significant 15.63% during the same period. DIIs also raised their holdings from 4.29% to 19.71%, although there has been a slight reduction in their holdings recently as FIIs have added stakes aggressively in the company.

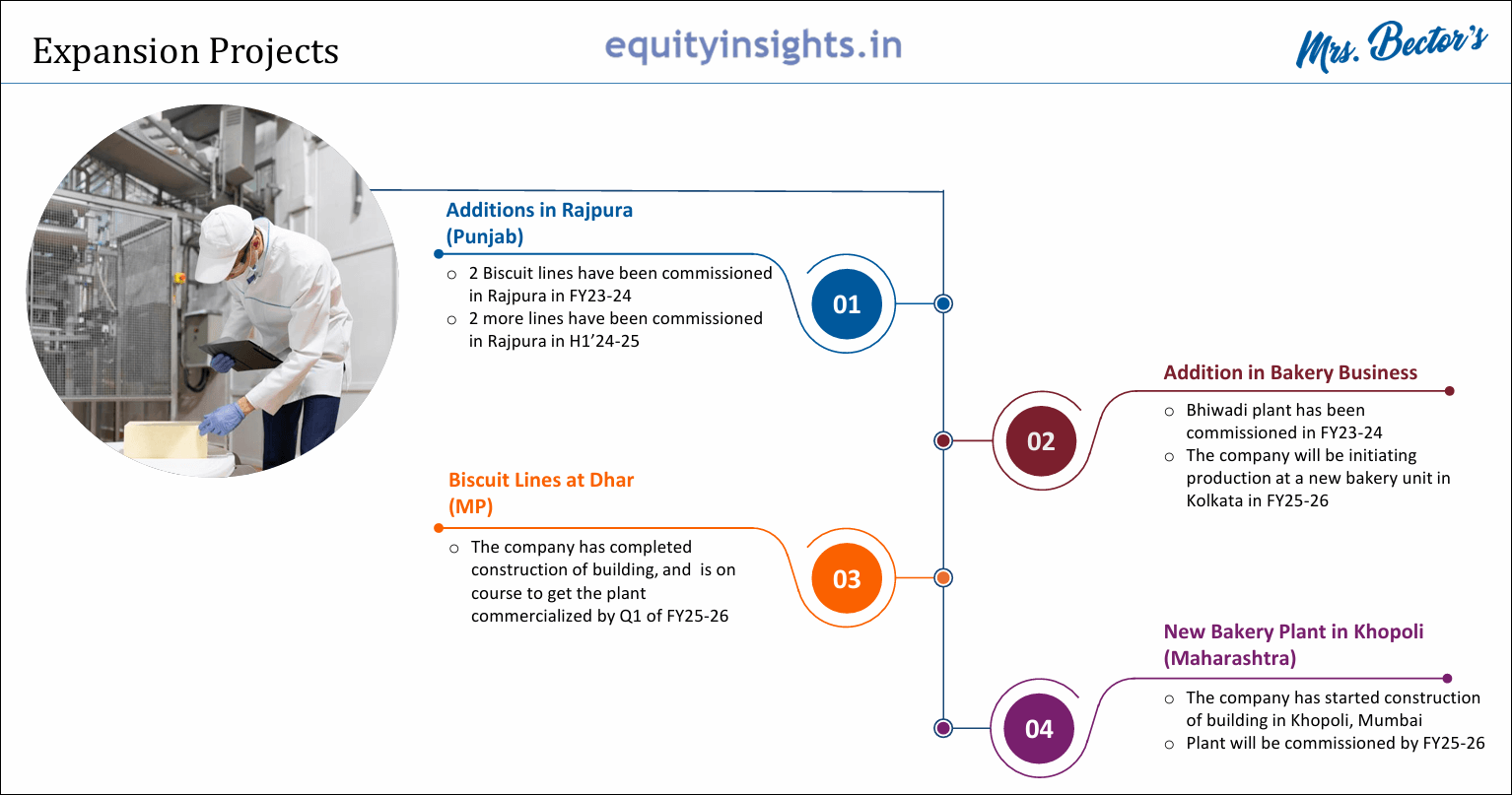

Although the bakery and biscuit segment is very competitive, Mrs Bectors has been growing at a good rate and management expects the company to grow at two times the industry growth rate. One of the key drivers of Mrs Bectors’ growth is its commitment to capacity expansion in both the bakery and biscuit segments. By increasing production capabilities, the company is better equipped to meet the rising demand for its products and cater to a broader consumer base. With advanced manufacturing facilities and a focus on maintaining high-quality standards, Mrs Bectors is well-positioned to scale operations and meet future growth targets.

The company has taken multiple other initiatives like expanding its geographical presence, new product launches including a healthy snack segment and ground level marketing to improve brand visibility.

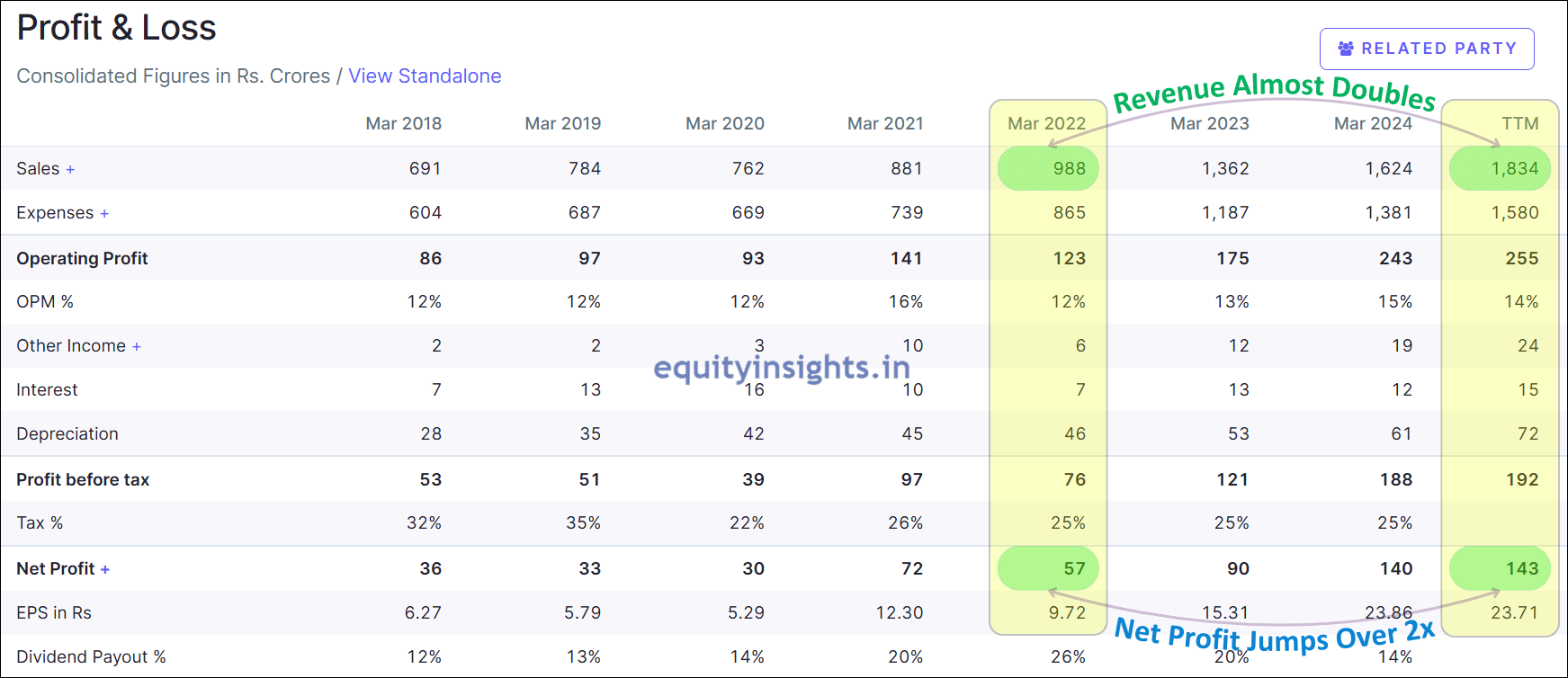

When it comes to performance, Mrs Bectors has shown remarkable financial growth, with revenues surging from ₹988 crore in 2022 to an impressive ₹1,834 crore on a TTM basis. Net profits have also surged consistently, rising from ₹57 crore to ₹143 crore during the same period.

The company boasts a robust return profile, with an impressive ROE of 23.2% and ROCE of 25.4%, while keeping debt at negligible levels. Despite these developments, Mrs Bectors share price has dropped nearly 32% from its peak, currently trading at ₹1,497.25 (as of March 16, 2025). Although the stock trades at a P/E of 64.5—seemingly on the higher side—the company’s strong growth trajectory makes it an attractive bet at current valuations.

Read More: Tata Motors Share Price Tanks 45% – Crash or Opportunity?

3. Nuvama Wealth Management

The third stock in the list is Nuvama Wealth. Nuvama Wealth Management Limited, formerly known as Edelweiss Securities Limited, is a prominent financial services company in India specializing in wealth management, asset management and capital markets services. Established in 1993 and headquartered in Mumbai, the company underwent a rebranding to Nuvama Wealth Management Limited in August 2022. Nuvama Wealth is one of India’s premier wealth management firms, specialized in catering to affluent HNI and Ultra HNI clients. As a registered Trading cum Clearing Member with NSE, BSE, MSEIL, MCX, and NCEIL, the company is deeply entrenched in the broking and trading of equity securities for both institutional and non-institutional clients.

Additionally, the company is registered with SEBI to carry on business as a Research Analyst, Investment Advisor and Merchant Banking, further strengthening its foothold in the financial ecosystem. Nuvama Wealth, through its subsidiaries, offers a wide range of financial services, including debt advisory, clearing services, portfolio and wealth management, asset management and custody services. It also facilitates securities and derivatives trading. As of March 2024, Nuvama serves an elite clientele of 1.2 million affluent and high-net-worth investors, along with 3,600+ distinguished families.

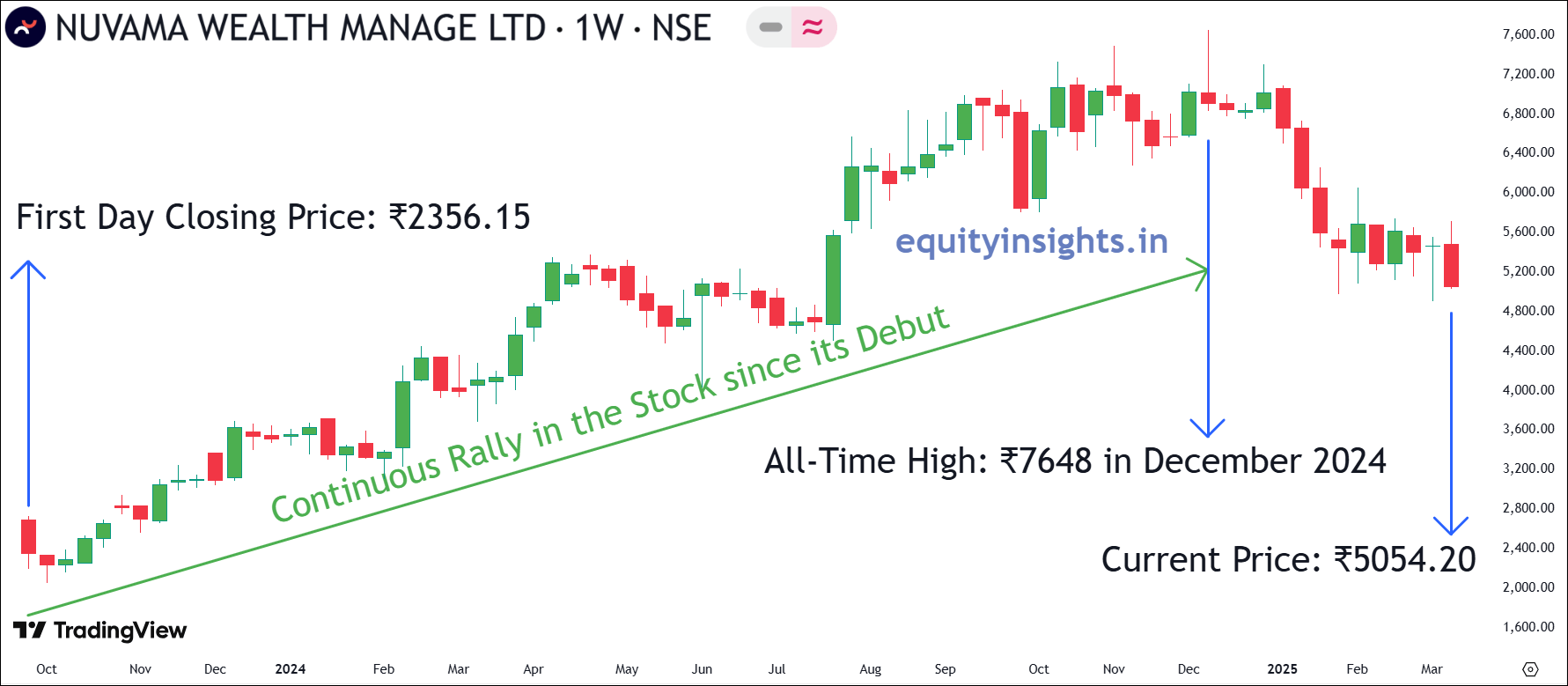

Nuvama Wealth Management Limited became a publicly listed company through a demerger from Edelweiss Financial Services Limited. The demerger received approval from the National Company Law Tribunal (NCLT) on April 27, 2023, and came into effect on May 18, 2023. Subsequently, Nuvama Wealth Management made its stock market debut on September 26, 2023, listing at ₹2,750 and closing at ₹2,356.15 on the first day of its listing on the NSE.

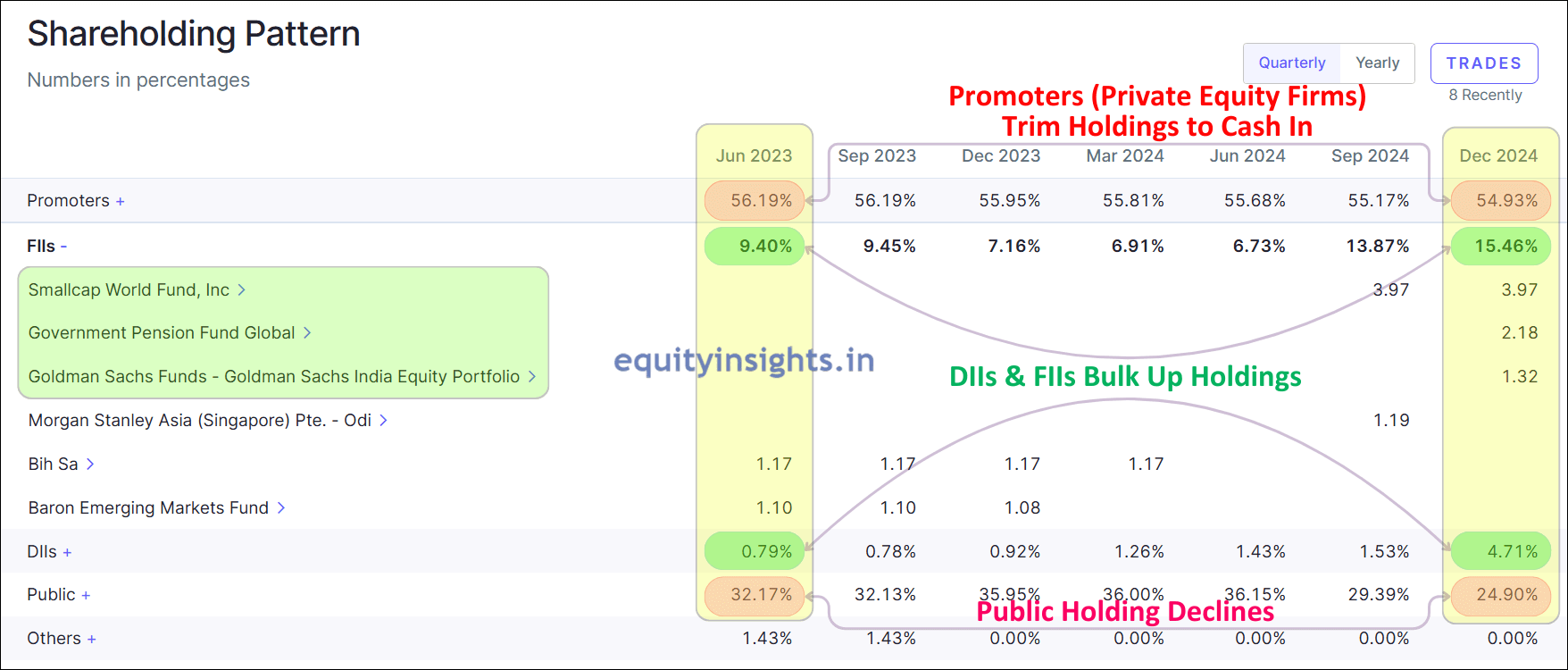

Nuvama Wealth’s shareholding pattern has undergone a notable transformation. In June 2023, public holding stood at 32.17%, with the rest held by promoters and FIIs. Then public holding kept on increasing till June 2024 to 36.15% however the last two quarters saw a sharp decline in public ownership. On the flip side, both FIIs and DIIs have significantly increased their stakes, signaling strong institutional confidence in the company. In fact, FIIs have more than doubled their stake in just two quarters and include reputed names like Small Cap World Fund, Government Pension Fund and Goldman Sachs.

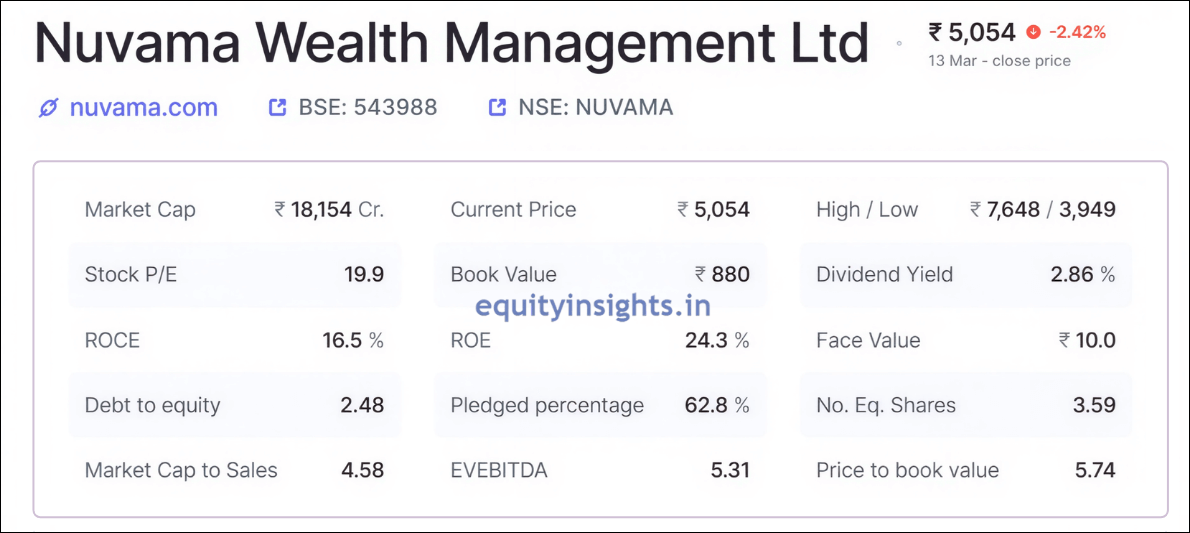

As per the latest shareholding data, promoters hold 54.93% of the company’s shares, of which 62.8% are pledged, FIIs now own 15.46%, DIIs hold 4.71% and the public holds the remaining 24.90%.

According to Goldman Sachs’ report, The Rise of Affluent India, India’s affluent population currently stands at around 60 million and is projected to reach 100 million by 2027. Obviously, when people earn money, they need professionals to manage it and that’s where Nuvama can be a strong beneficiary of this trend. But there’s one key risk with wealth management firms like Nuvama. The risk is wealth management firms’ earnings growth is linked directly to market performance. When the stock market does well, people invest more and this has been clear in recent years, especially after COVID-19. The rise in Demat account openings hit a major milestone, driving more investor participation. This is why wealth management firms performed so well.

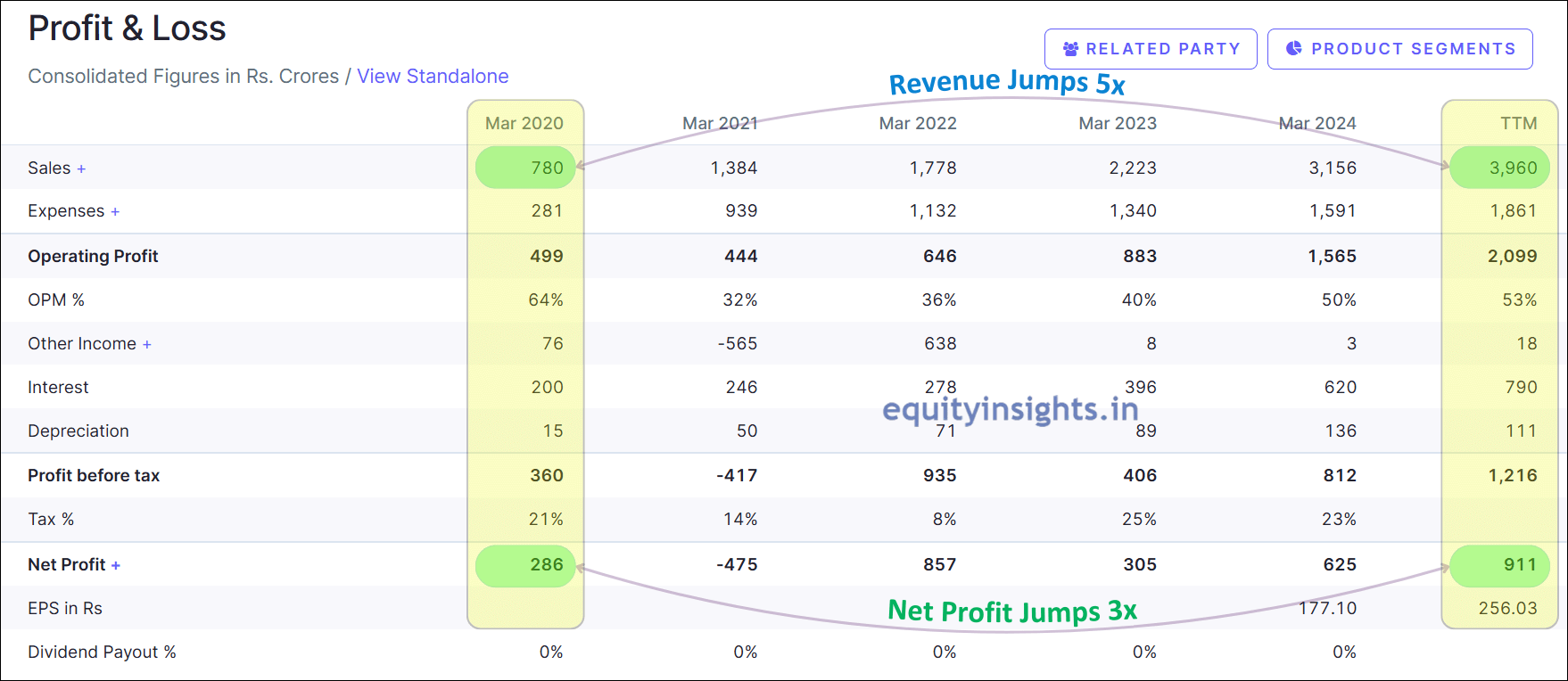

Nuvama has outperformed exceptionally with sales skyrocketing five-fold from ₹780 crore in March 2020 to ₹3,960 crore in the trailing twelve months and operating profit growing more than three times from ₹286 crore to ₹911 crore during the same period. This impressive performance has also been reflected in its stock price, soaring from around ₹2,400 to over ₹7,600. However, it has witnessed a correction because of the recent market downturn.

Now, let’s understand how Nuvama Wealth operates. Wealth Management firms like Nuvama Wealth operate on a business model with largely fixed expenses, primarily employee salaries. However, as the business scales up with the increase in assets under management (AUM), operating profits rise and that’s called operating leverage, which has played out for Nuvama as well, with its margins expanding from 32% in 2021 to 53% in the trailing twelve months (TTM). Similarly, if the stock market underperforms, investment flows can also reduce and that can impact the operating margins and earning growth.

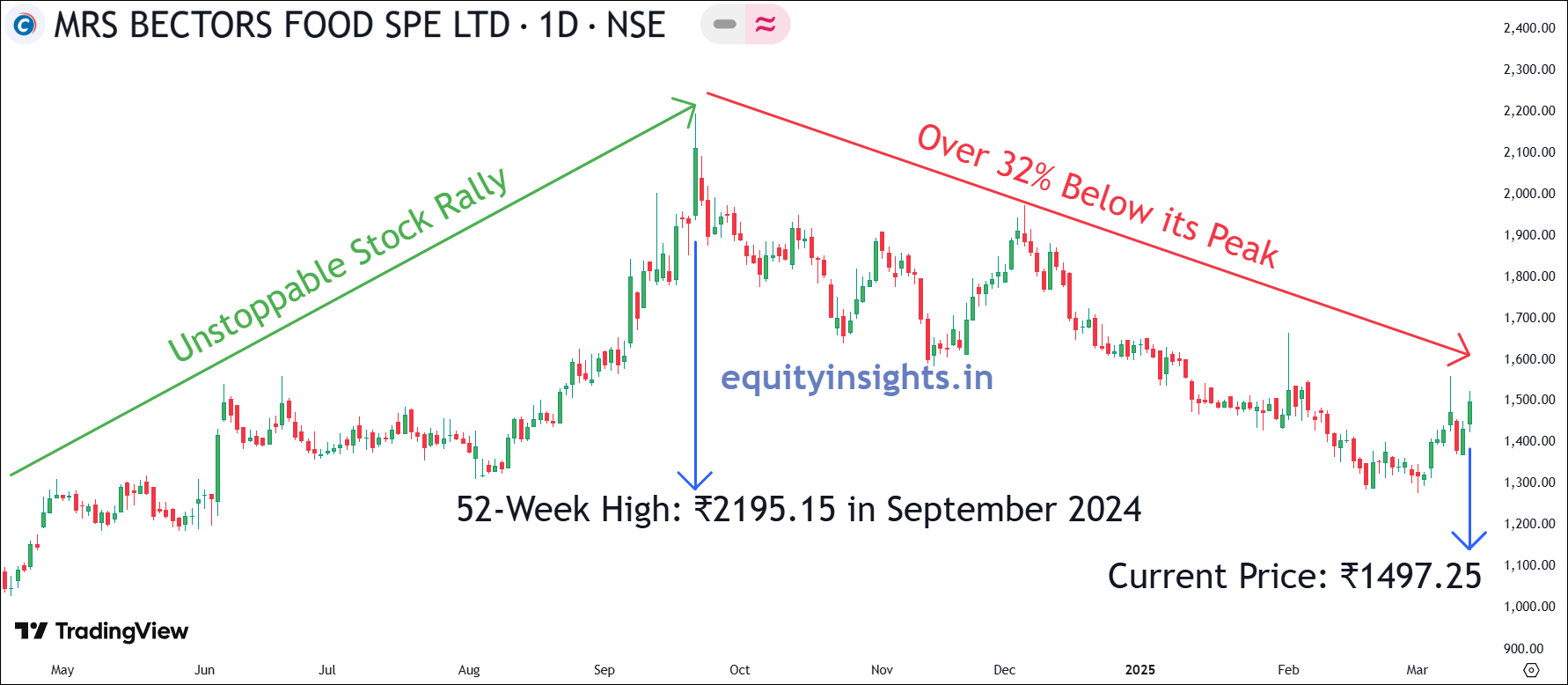

Since we have seen the market correction in the last few months, it would be interesting to see how firms like Nuvama navigate this phase. In my opinion, if India’s economic slowdown persists, Nuvama could face margin pressure and slower earnings growth, as wealth management is closely tied to market performance and it is one of the key reasons, Nuvama Wealth’s stock has dropped around 34% from its peak, currently trading at ₹5,054.20 as of March 16, 2025.

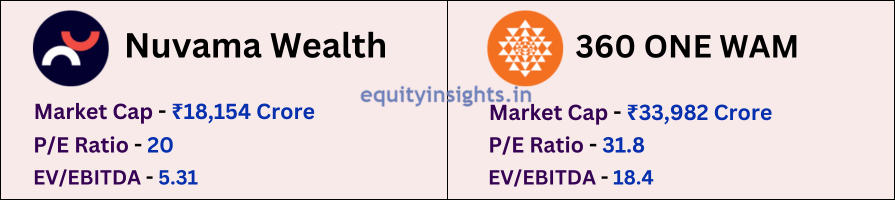

Nuvama Wealth currently holds a market capitalization of approximately ₹18,154 crore and trades at a P/E ratio of around 20 with an EV/EBITDA of 5.31. In comparison, its competitor, 360 ONE, boasts a much higher market cap of ₹33,982 crore while trading at a P/E of 31.8 and an EV/EBITDA of 18.4. This valuation gap highlights the relative positioning of Nuvama in the wealth management space. So, valuation at the moment is quite reasonable for Nuvama but if earnings growth in the near future falls, P/E can rise. So, it would be interesting to see how institutional investors react to upcoming quarterly earnings.

Having said this, in my opinion, wealth management as a sector is still in a nascent stage in India and has immense growth potential for the next few decades and Nuvama Wealth should be a strong beneficiary of this structural trend. So, correction in this stock would create opportunity especially investment done during the bear market phase would reward investors in the long run. While a prolonged market slowdown may test patience and conviction, Nuvama remains a strong SIP-grade stock with long-term potential—making it worth a closer look.

4. Gokaldas Exports

The fourth stock is Gokaldas Exports. It is a premier apparel manufacturer in India, operational since 1979. It specializes in designing, manufacturing and exporting wide range of garments for men, women and children to 50+ countries and caters to the needs of several leading international fashion brands and retailers. The company serves some of the world’s most prestigious fashion brands with a workforce of over 54,000 employees, 75% of whom are women.

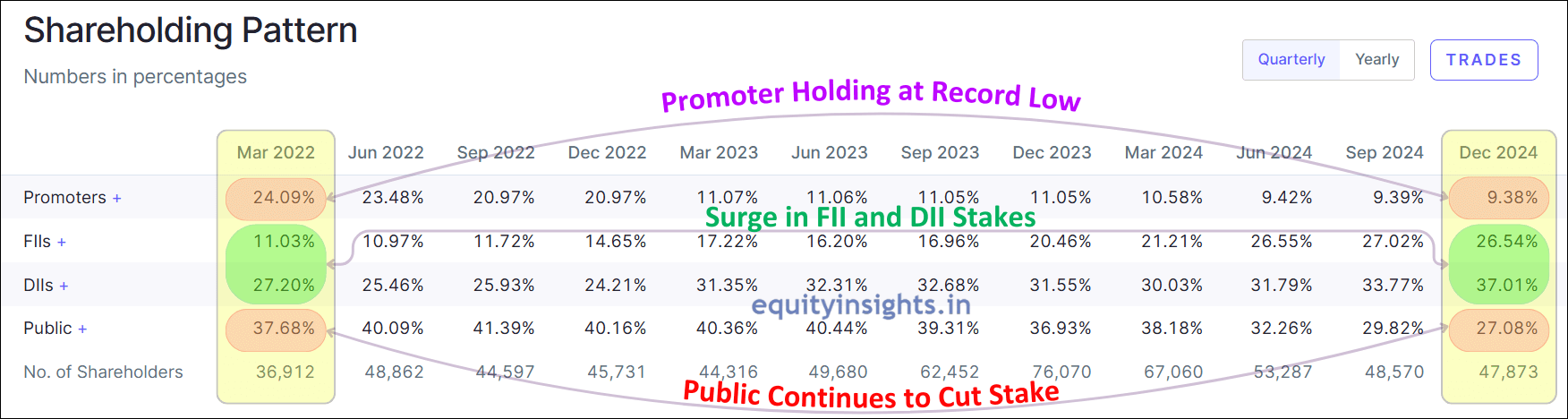

An analysis of the company’s shareholding pattern shows a steady decline in public ownership over the past 12 quarters, sliding from 37.68% in March 2022 to 27.08% by December 2024, despite reaching a peak of 41.39% in September 2022. However, FIIs and DIIs are betting big! Their stakes have soared—FIIs jumped from 11.03% to 26.54%, while DIIs surged from 27.20% to 37.01%. Promoter holding in the company remains low at 9.38% and has declined over the past several quarters—largely due to Gokaldas’ long history of underperformance. However, in 2017, the company had a huge reshuffling where experienced professionals got into the company board to run the organization.

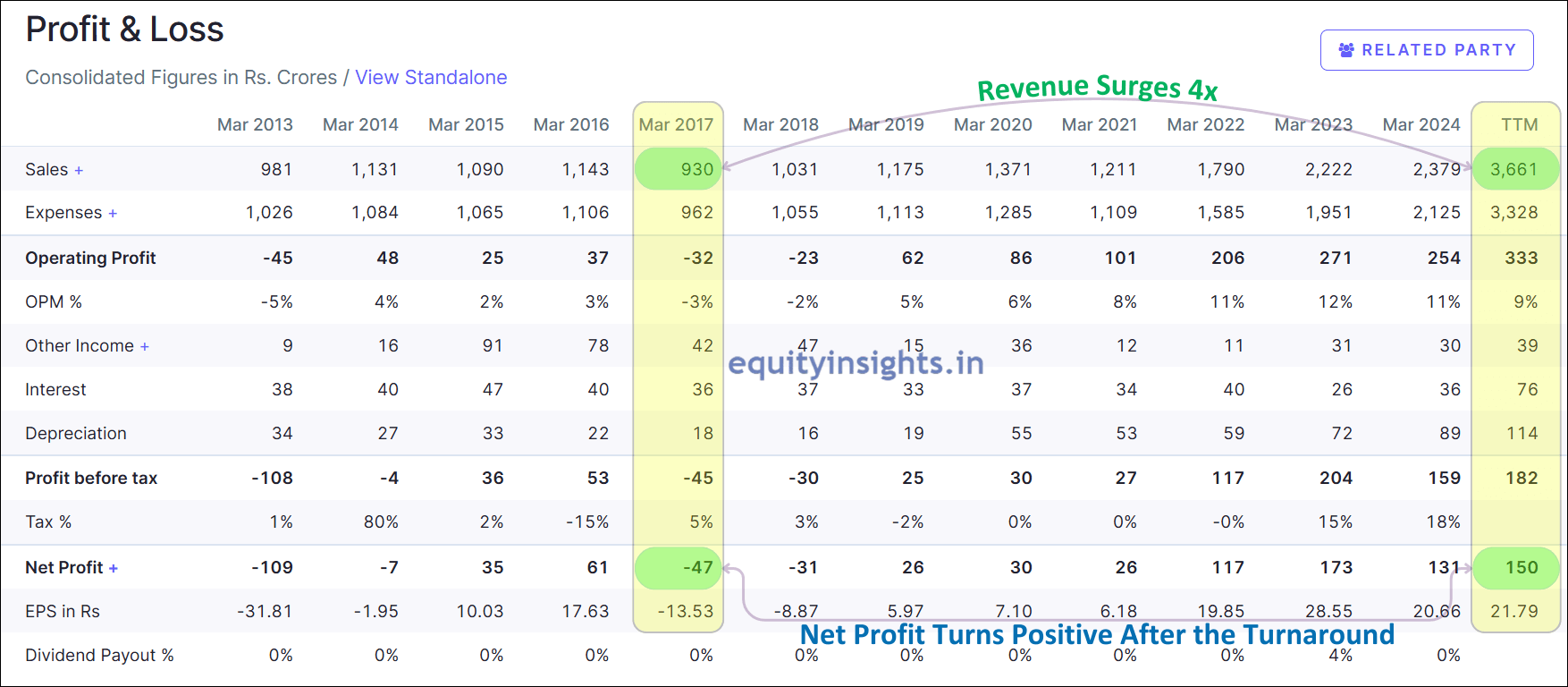

After the reshuffle, the company had a great turnaround story where revenue skyrocketed from ₹930 crore in 2017 to an impressive ₹3,661 crore on a TTM basis. Meanwhile, operating profits made a dramatic comeback, surging from a loss of ₹47 crore to a staggering ₹150 crore profit over the same period, after which it resulted in a consistent increase in FIIs and DIIs stake, backed by top-quality institutional investors.

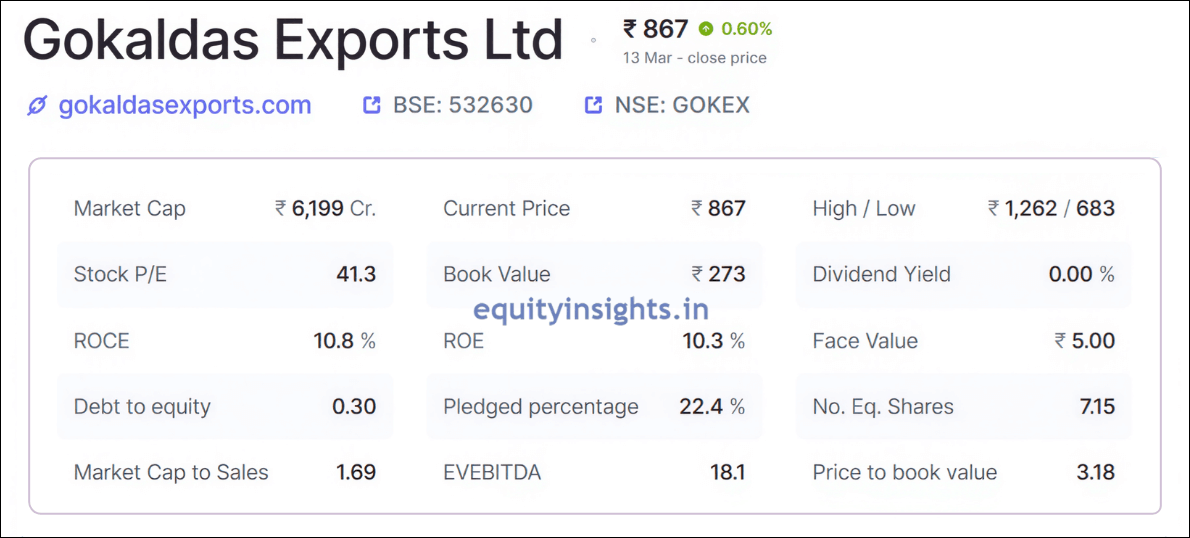

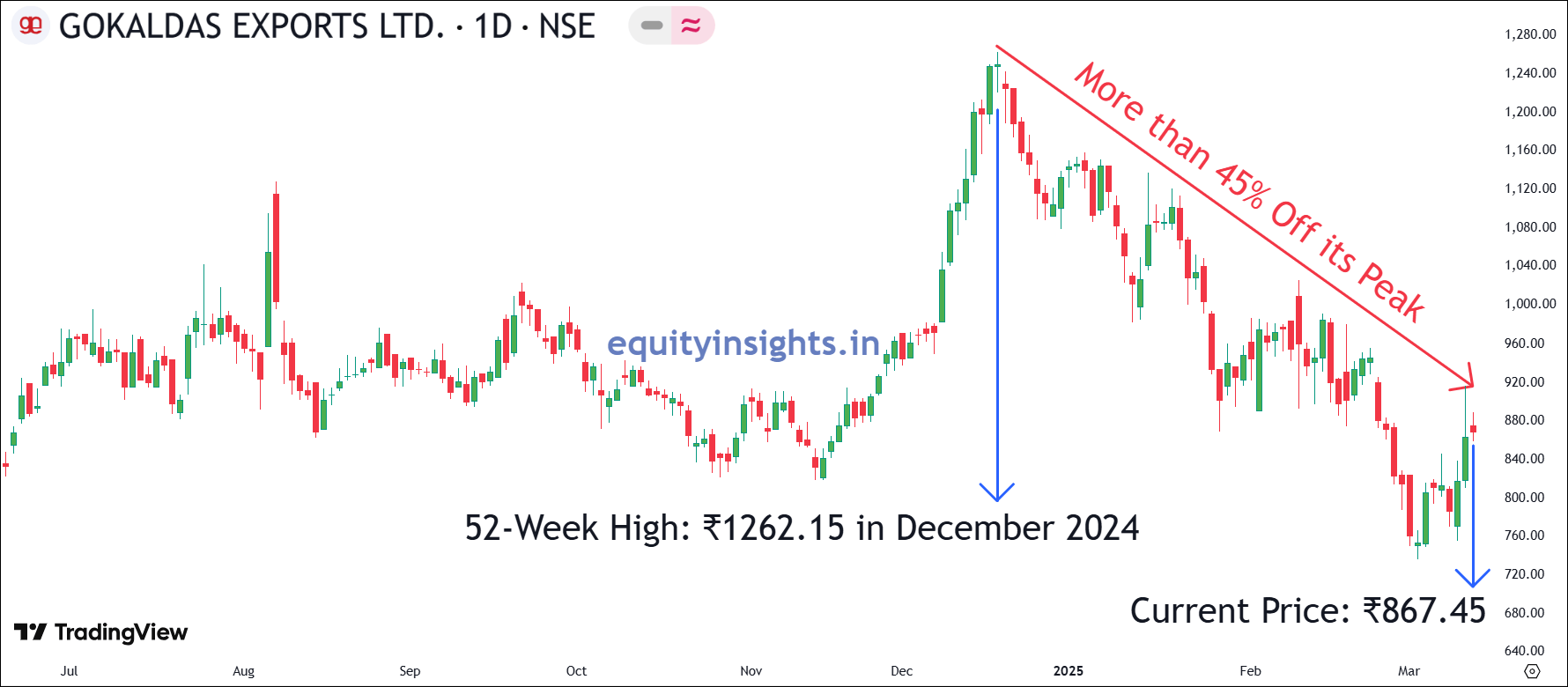

Recently, Gokaldas share price has plunged approximately 45% from its peak, now trading at ₹867.45 with an EV/EBITDA of 18.1 and a market cap of around ₹6,199 crore. P/E is showing high levels of 41.3 but that is due to recent acquisitions as well as capacity ramp-up. So, going forward as the capacity ramp up will complete, margin should expand and PE should come down.

That said, the near-term outlook for Gokaldas could be highly volatile, as its key market—the US—faces increased uncertainty following Donald Trump’s return to the presidency. So, any negative news from the US economy in the near term can impact Gokaldas Exports share price but the long-term story for this company looks quite promising. Hence, this correction in 2025 should create a good investment opportunity for the company as it continues to strengthen its position in the global textile industry, leveraging its expertise, scale and commitment to quality.

Read More: Trading Economics: How Economic Events Impact Stock Market?

5. Newgen Software Technologies

The fifth stock in the list is Newgen Software. Newgen Software Technologies is a global software company and is engaged in the business of software product development including designing and delivering end-to-end software solutions covering the entire spectrum of software services from workflow automation to document management to imaging.

The company has the following revenue streams:

- Annuity-Based Revenue: The company receives recurring fees/charges from the following:

- SaaS: Subscription fees for cloud-based and on-premise platform licenses.

- ATS/AMC: Charges for annual technical support and maintenance (including updates) of licenses and installation.

- Support: Charges for support and development services.

- Sale of Software Products: One-time upfront license fees for on-premise platform deployment.

- Sale of Services: Milestone-based fees for implementation, development and scanning services.

As of FY24, company has 17 verticals including majors like Banking & Financial Services, Insurance, Government etc.

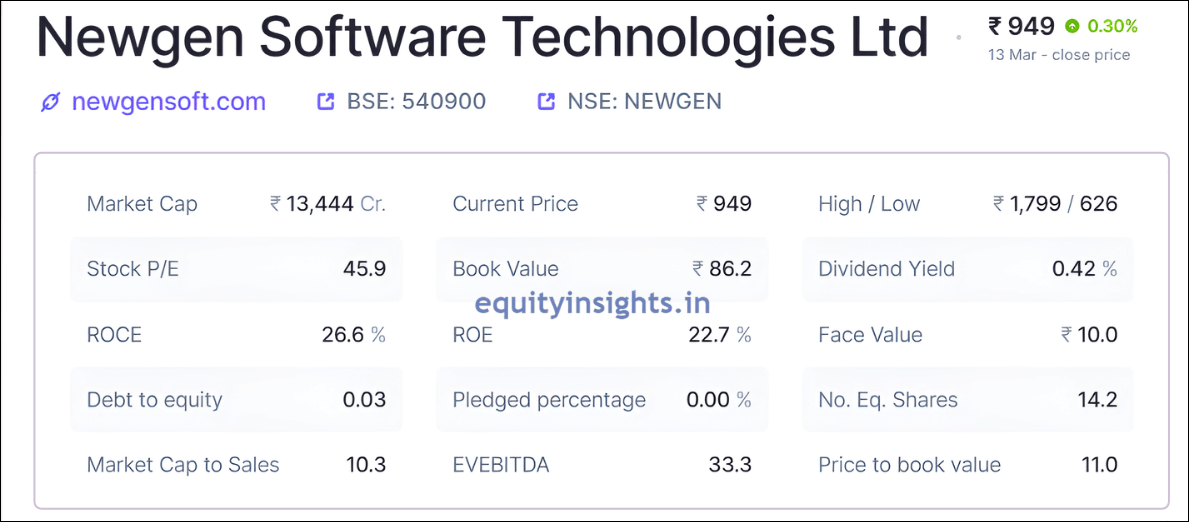

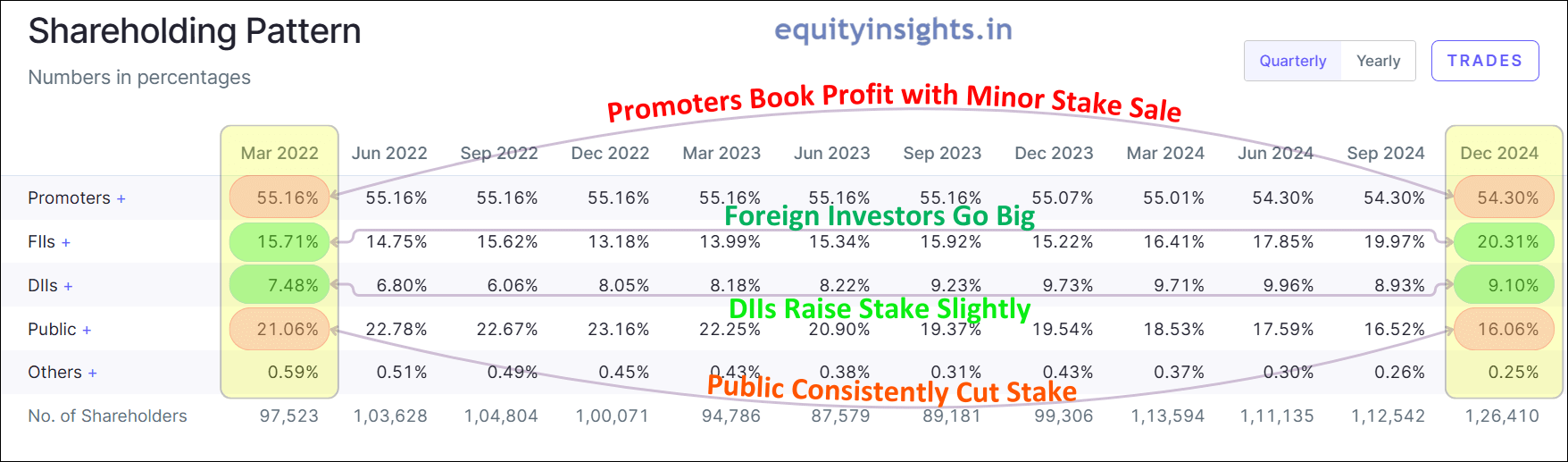

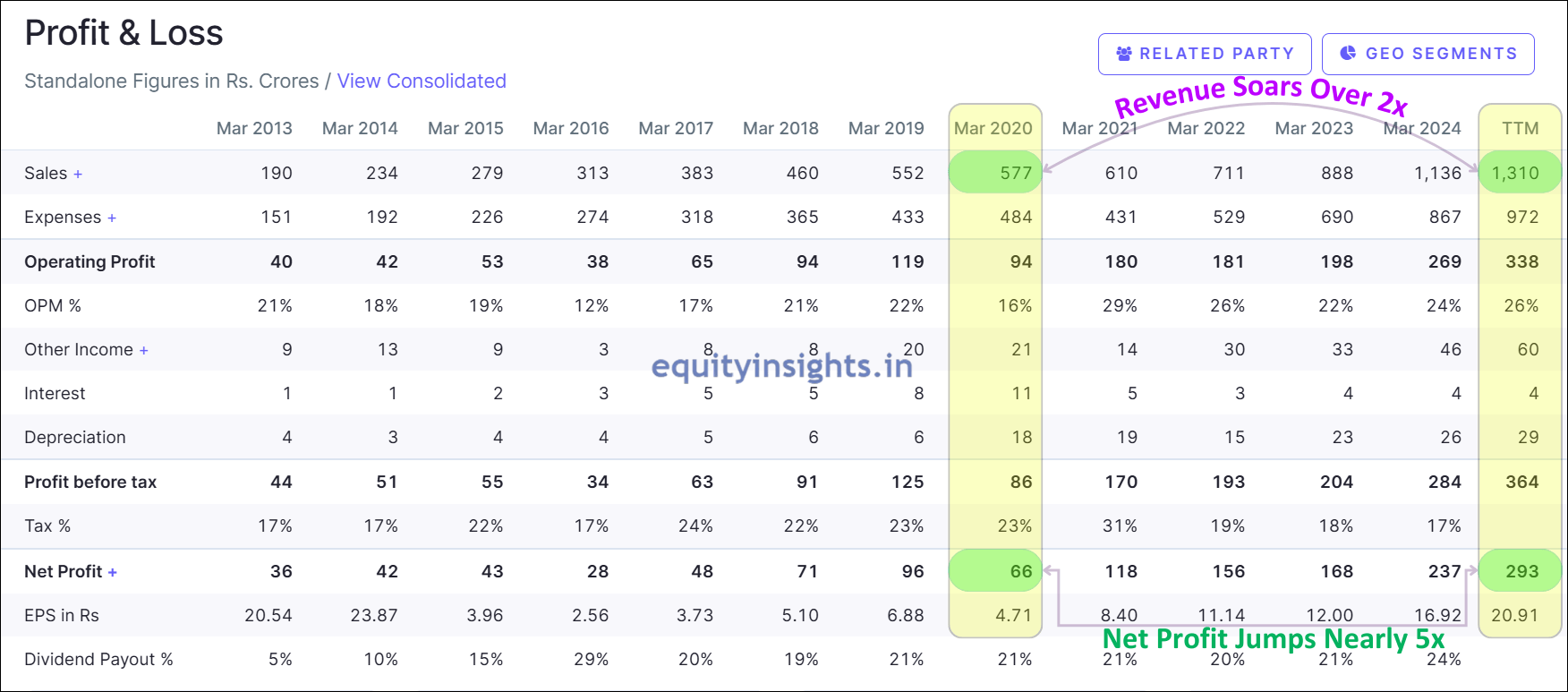

A closer look at the shareholding pattern of Newgen reveals that public holding in the company has been consistently falling from 21.06% in March 2022, all the way to 16.06% in December 2024. While DIIs have not increased much stake, FIIs have consistently increased their stake from 15.71% to 20.31% during the same period. Over the last four years, the company has delivered impressive growth, with revenue more than doubling — from ₹577 crore in 2020 to ₹1,310 crore on a trailing twelve-month basis and net profit surging nearly five times from ₹66 crore to ₹293 crore during the same period.

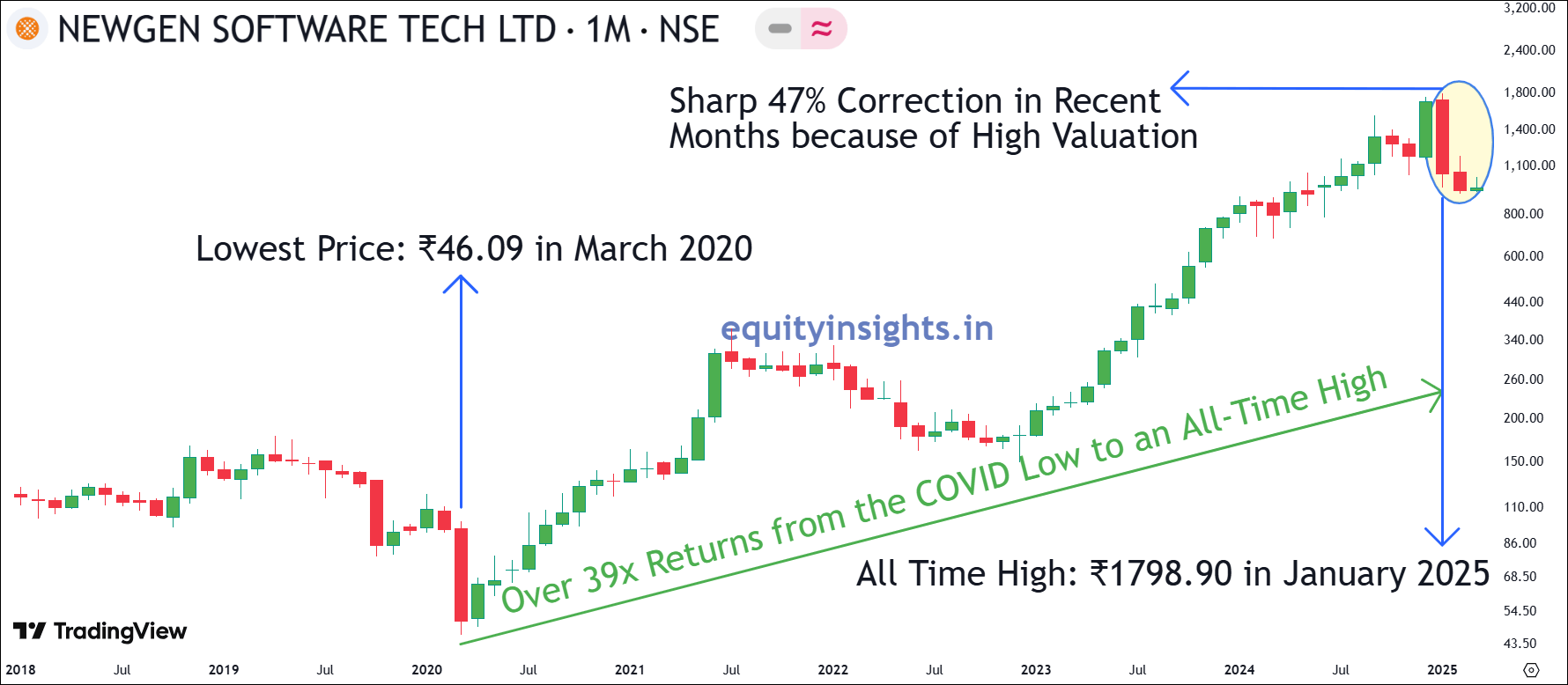

Newgen Software has been a massive wealth creator over the past few years, with its share price skyrocketing from ₹46.09 in March 2020 to an all-time high of ₹1,798.90 in January 2025. However, the stock has since faced a sharp 47% correction due to two key reasons—first, valuations became stretched, reaching a peak P/E of 86.3, when Newgen share price was at an all-time high and second, the announcement of China’s new AI revolution, Deep Seek, raised concerns. This is significant because AI is the core technology behind Newgen Software, driving automation of repetitive tasks within business workflows. However, after the recent correction, Newgen is now trading at a PE of 46.

Given the company’s strong performance—growing at over 25%, boasting excellent return ratios, negligible debt, and high cash conversion—it certainly deserves a premium valuation. However, with a P/E of 46, the stock appears slightly expensive. In my view, a P/E closer to 40 would present a more attractive entry point and so till that time, the stock can be kept on the radar.

Read More: Stock Analysis: Things to Follow & Avoid in the Stock Market

6. Federal Bank

The sixth stock in the list comes from the banking sector—Federal Bank, a well-established private sector bank in India. It was incorporated in 1931 as Travancore Federal Bank Limited. It offers a range of services, including retail and corporate banking, para-banking activities like debit cards and third-party product distribution, as well as treasury and foreign exchange operations. It is the second-largest bank and the largest private-sector bank in Kerala. Known for its strong financials, steady growth and efficient management, Federal Bank has built a reputation for stability and resilience in the ever-evolving banking industry. Its consistent performance and strategic initiatives make it a notable player in the Indian banking space.

Recently, Federal Bank had got a very prominent Banker Mr. KVS Manian as its Managing Director & CEO. He joined Federal Bank after an illustrious career spanning over two and a half decades at Kotak Mahindra Bank. During his tenure at Kotak, he played a pivotal role in the bank’s transformation from a Non-Banking Financial Company (NBFC) to one of India’s leading private-sector banks. His leadership was instrumental in driving the growth and profitability of Kotak’s Corporate, Institutional and Investment Banking, as well as Wealth Management divisions.

Under his guidance, these businesses achieved a high-quality, integrated and profitable franchise. He recently held an analyst meet where he shared the future road map for Federal bank and called it era 4.0. Federal Bank inspires to be among top five private banks of India. With a solid presence across retail, corporate and digital banking, the bank continues to expand its market share while maintaining healthy asset quality.

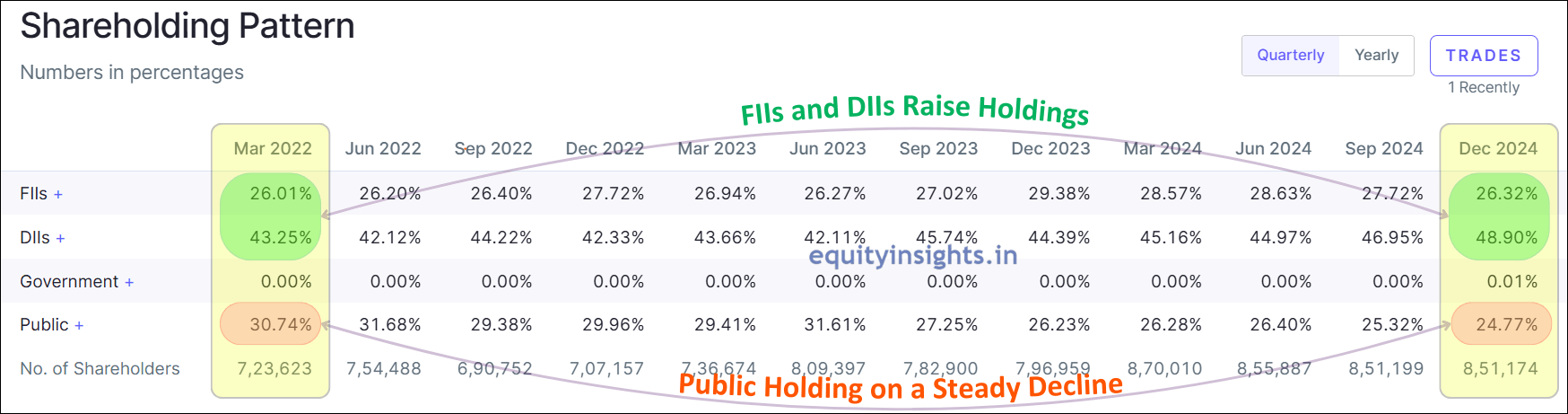

Now, if you look at its shareholding pattern, a closer look reveals the absence of promoters—this company is steered by the strong hands of FIIs and DIIs. While FIIs have made a slight increase in their stake from 26.01% in March 2022 to 26.32% in December 2024, the real momentum comes from DIIs, which have consistently raised their holdings from 43.25% to 48.90% during the same period, absorbing shares from the public and reinforcing confidence in the stock as a result public holding has steadily declined, dropping from 30.74% to 24.77%.

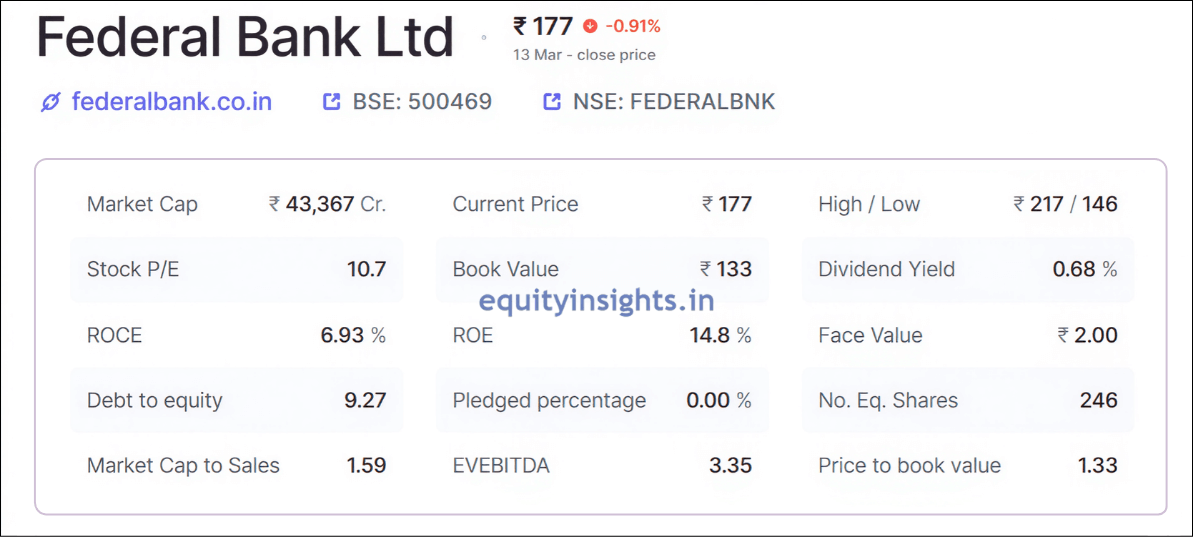

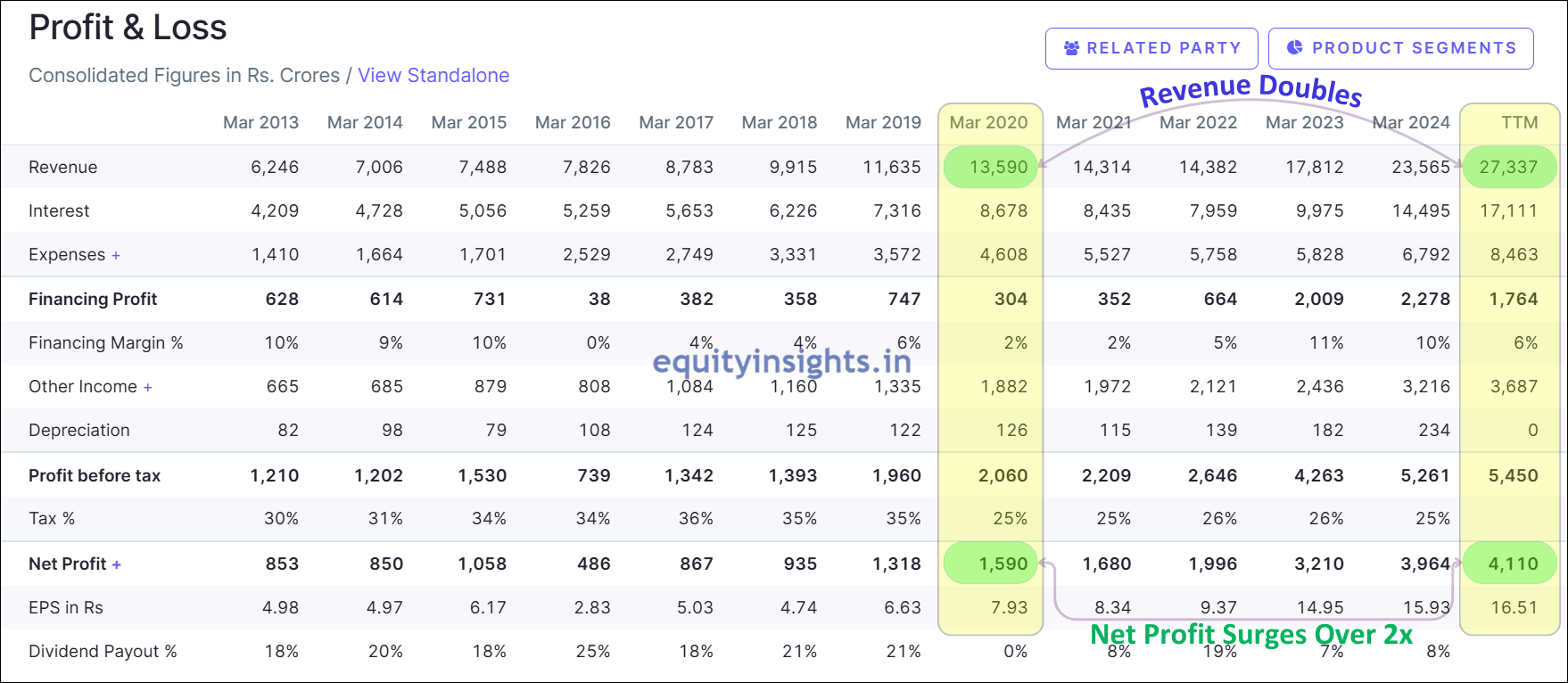

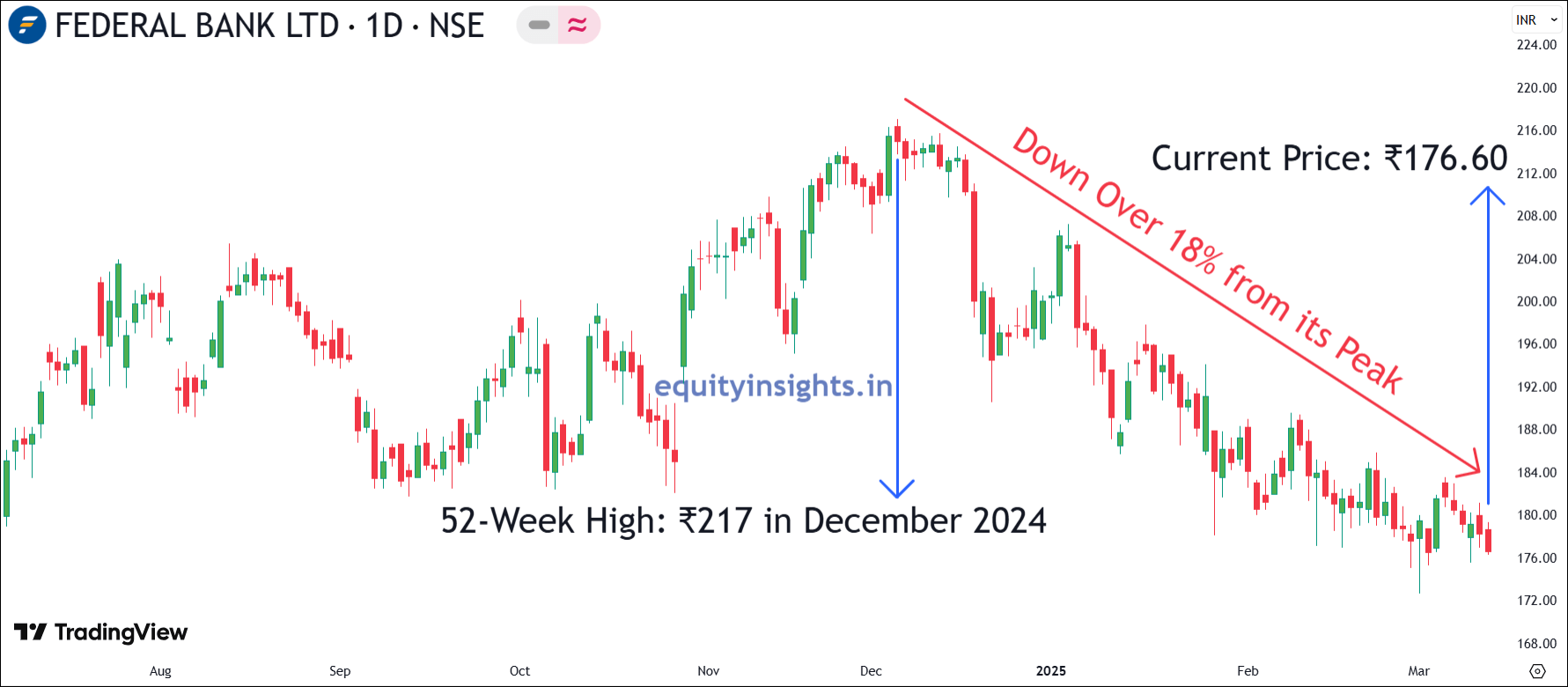

The company’s revenues have consistently grown from ₹13,590 crore in 2020 to ₹27,337 crore in the trailing twelve months and net profits have grown from ₹1,590 crore to ₹4,110 crore which reflects a fantastic growth rate. Federal Bank enjoys a high ROE of 14.8% which makes it a good proxy for growth in the banking space. Interestingly, Federal Bank share price has not corrected much in this market sell-off and is currently trading at ₹176.60. The key reason is the bank has been growing consistently with very good asset quality and valuations are quite reasonable at a P/E of 10.7 and P/B of 1.33.

So, this could be the right time to consider investing in this bank, as private sector banks have significantly underperformed over the last 3-4 years. With the potential for a turnaround, the chances of outperformance in 2025 look even stronger for Federal Bank. Also, I’ve analyzed sectoral trends using historical data to highlight the sectors poised to outperform this year—be sure to check out the detailed insights in this article: Sensex Historical Data: Sectors that can Outperform in 2025

7. Ganesha Ecosphere

Ganesha Ecosphere was established in 1987 with a vision to create a sustainable solution for plastic waste by recycling PET (Polyethylene Terephthalate) bottles into polyester fibers. Ganesha Ecosphere was earlier known as Ganesha Polytex but the company later rebranded to reflect its commitment to sustainability and the circular economy in the polyester recycling industry. Over the years, the company has evolved into India’s largest producer of recycled polyester staple fiber (rPSF) and has captured a 25% market share. It is also engaged in the manufacturing of spun yarn and dyed texturised yarn in India, contributing significantly to the circular economy.

In its early years, Ganesha Ecosphere focused on setting up small-scale operations, but with the increasing demand for eco-friendly textiles, the company expanded its manufacturing capacities. By the 2000s, it had established multiple recycling plants and started catering to a diverse range of industries, including textiles, automotive, home furnishings and non-woven fabrics. The company has continuously invested in technological advancements and capacity expansions, ensuring that it remains at the forefront of the sustainable fiber industry. It currently operates large-scale recycling units in Kanpur, Rudrapur and Bilaspur, with a strong supply chain network across India.

Its diverse product portfolio includes solid fiber, short-cut fiber, microfiber, mélange, single yarn, and filament yarn among others, which are used in various applications like spinning, body warmers, flooring and dress materials. Ganesha Ecosphere has a strong network of more than 270 suppliers that mobilize around 350 tons of waste every day. Company has more than 400 clients in India as well as globally that include more than 20 countries.

It uses waste PET bottles as raw material and recycles them to produce recycled PET fibre, yarn and recycled PET chips. The company has pioneered the manufacturing of recycled polyester staple fibre (RPSF) and recycled polyester spun yarn (rPSY) from pre and post-consumer PET bottle scrap. Ganesha Ecosphere has played a pivotal role in promoting environmental sustainability by recycling billions of PET bottles annually, reducing plastic waste and minimizing carbon emissions. To put things into perspective, Ganesha Ecosphere recycled over 7.5 billion PET bottles in FY24 alone. This staggering number highlights the massive scale at which the company operates and its significant contribution to sustainability.

With growing awareness of sustainability and government initiatives supporting plastic recycling, the company is well-positioned for long-term growth. Today, it stands as a key player in the recycled textile industry, supplying top brands while maintaining a strong commitment to ESG (Environmental, Social and Governance) principles.

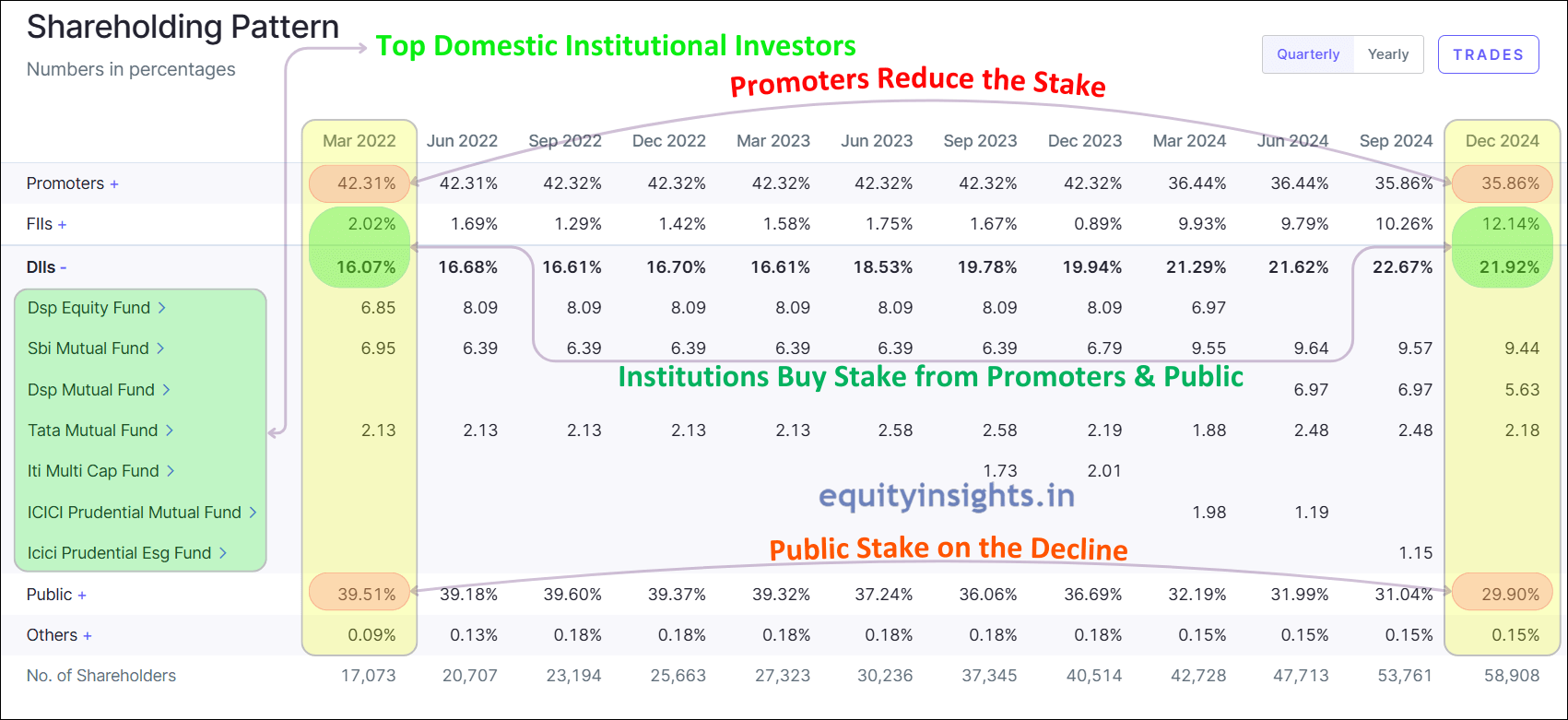

Now, if you look at its shareholding pattern, you will notice that promoter holding has declined significantly since March 2022 from 42.31% to 35.86% in the December 2024 quarter. However, an important point to note here is that its promoter is an investment firm that invested long back and now booking profits. What’s truly noteworthy and remarkable is that the entire stake sale has been absorbed by FIIs and DIIs.

FIIs have significantly increased their stake from 2.02% in March 2022 to 12.14% in the December 2024 quarter, while DIIs have also raised their holding from 16.07% to 21.92%. This strong institutional backing includes prestigious names like Goldman Sachs and SBI Mutual Fund, Tata Mutual Fund and many more, reflecting their confidence in the company’s growth potential. On the other hand, public holding has steadily declined from 36.51% to 29.9% over the same period, signaling strong institutional confidence in the company’s future.

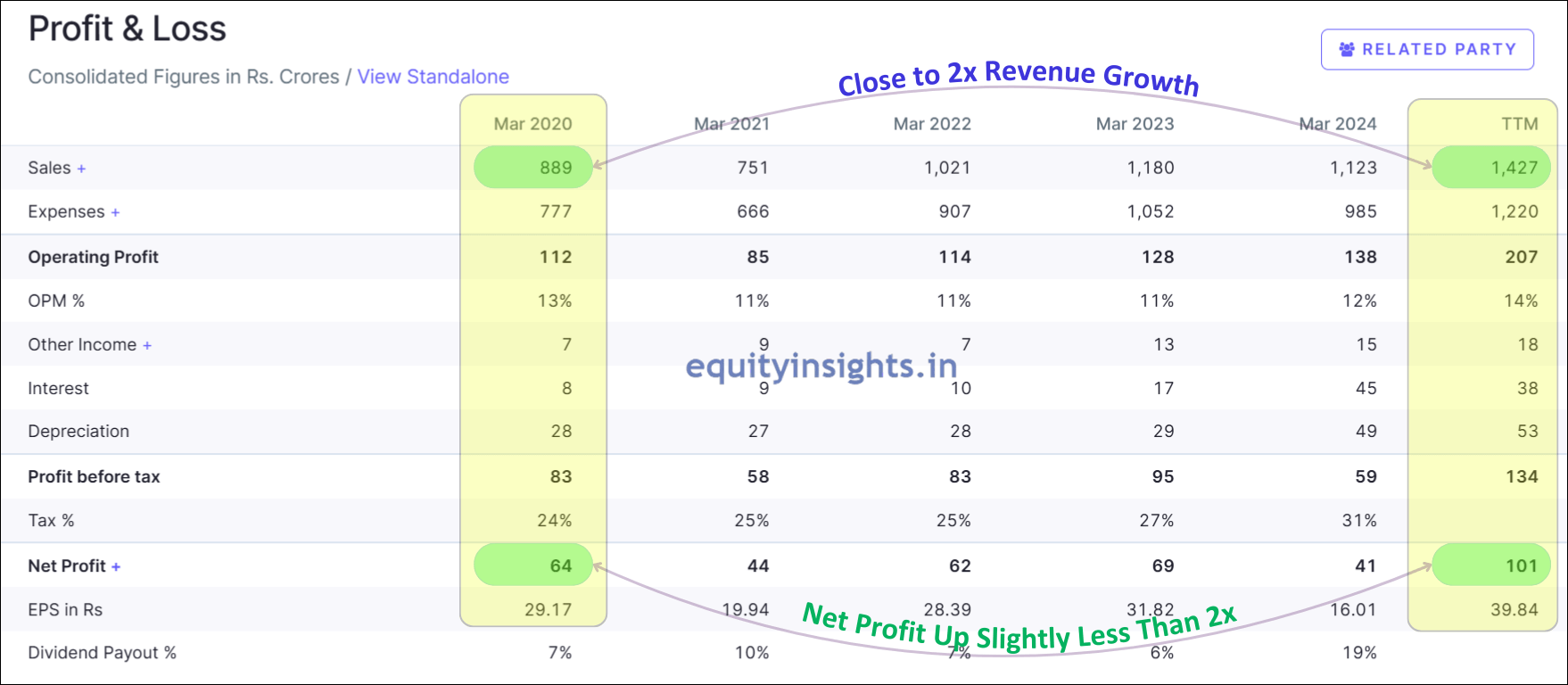

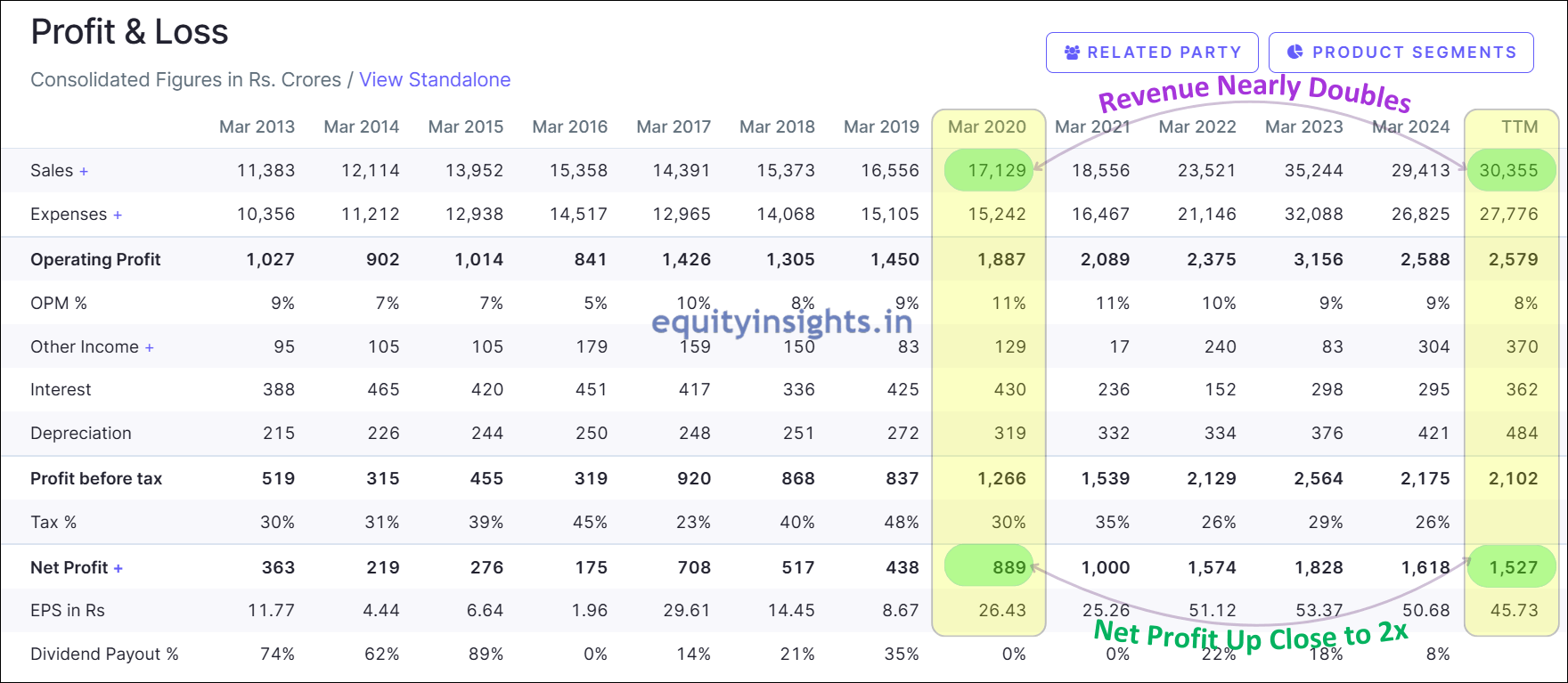

The company has delivered exceptional financial growth, showcasing its strong business momentum. Revenue has nearly doubled, soaring from ₹889 crore in 2020 to an impressive ₹1,427 crore on a trailing twelve-month (TTM) basis. Even more remarkable is the spectacular rise in net profit, which has surged from ₹64 crore to ₹101 crore during the same period. This significant jump in both top-line and bottom-line performance highlights the company’s robust expansion, operational efficiency and growing market dominance, making it a compelling story for investors.

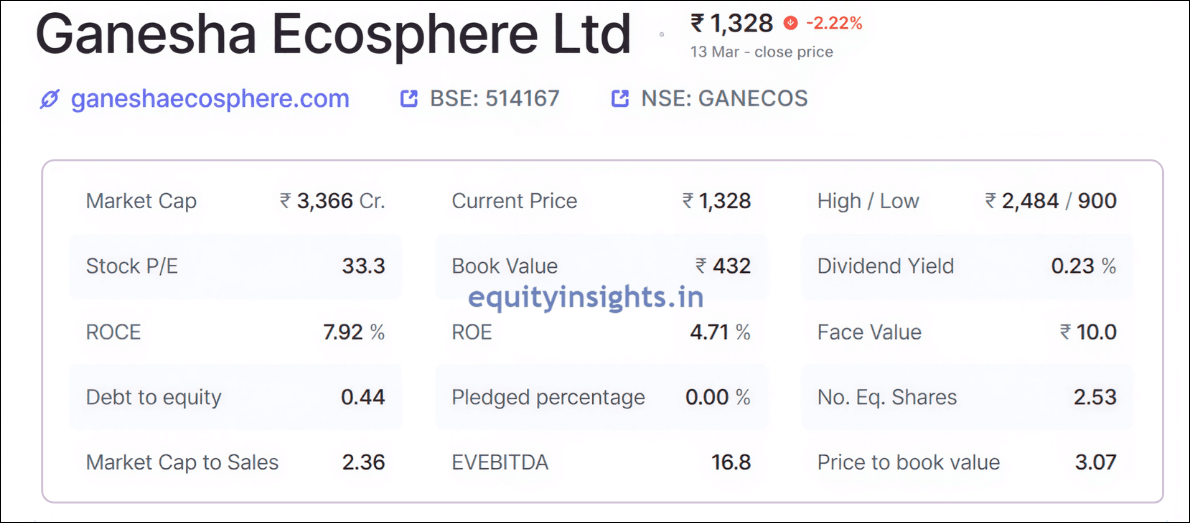

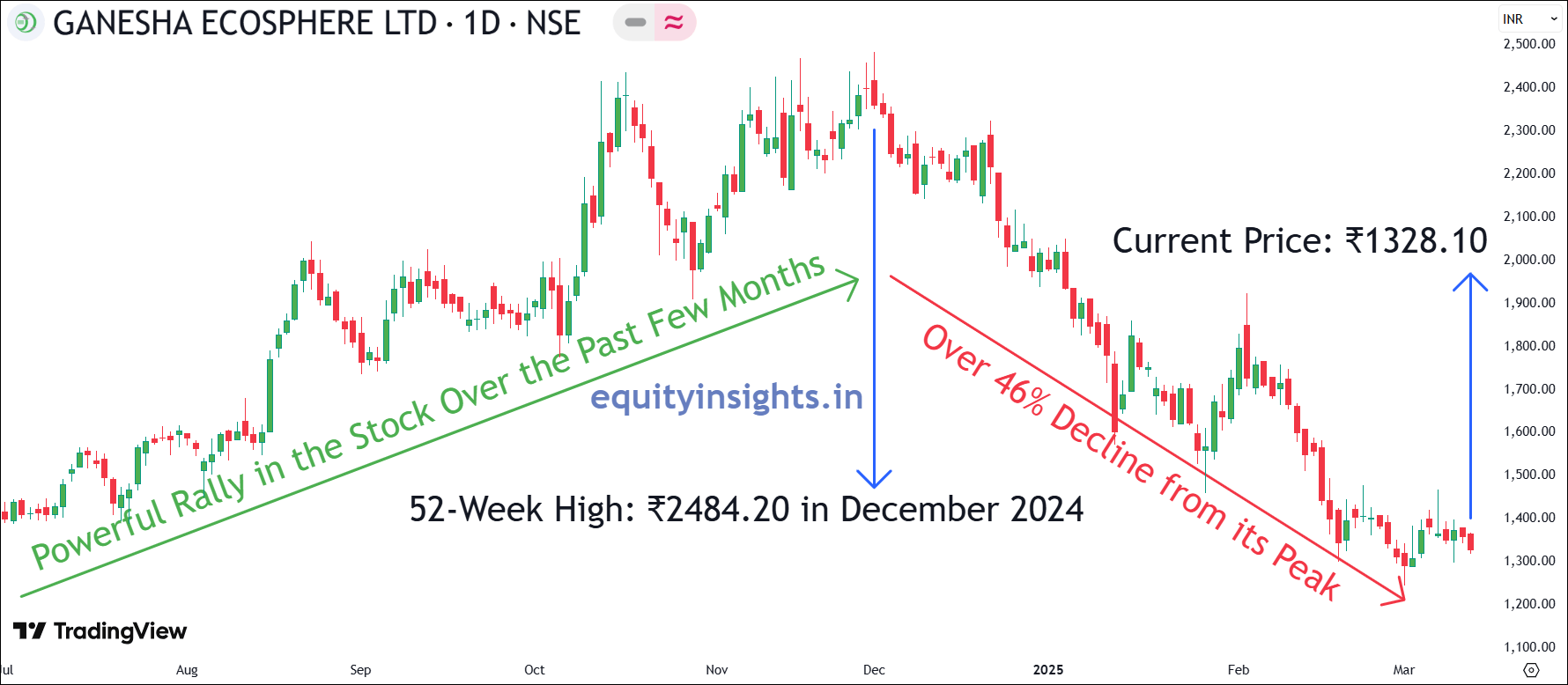

However, despite strong institutional backing and solid financial performance, in the recent correction, Ganesha Ecosphere share price has fallen 46% and now trading at ₹1328.10 at a P/E of 33.3 with a market cap of ₹3,366 crore. The company’s management has guided for ₹1,800 to ₹1,900 crore of revenue for FY26. So, excellent growth is expected in the near term. Additionally, the company is now focusing on increasing contribution from value-added products, that is rPET granules from current levels of 40% to 60-65% in the next 2-3 years and these value-added products have a better margin of more than 20% as compared to company’s current margin of 14%. So, as the value-added contribution increases, the margin should also increase.

However, a key challenge for the business today lies in the fluctuating crude oil prices. Fall in crude prices can negatively impact the profitability of company’s legacy business which is recycled polyester staple fiber (rPSF). Having said this, recycling is a big theme for long-term and there are multiple tailwinds for the company where the focus is on sustainability.

Read More: Top Investment Picks for 2025 by Axis Securities

8. EID Parry

EID Parry is part of the Murugappa group of companies, which is a 123-year-old conglomerate with a presence across India and the world with diverse businesses in agriculture, engineering, financial services and more. EID Parry is engaged in Sugar, Nutraceuticals and Ethanol production. It also has a significant presence in the farm inputs business including Bio pesticides through its subsidiary, Coromandel International Limited.

EID Parry operates across the following Business Segments:

- Nutrient & Allied Business (67% in FY24 vs 71% in FY22): The company operates under the Nutrient segment via its subsidiary Coromandel International which engages in fertilizers and specialty nutrients. Coromandel International is the largest NPK (Nitrogen (N), Phosphorus (P) and Potassium (K)) player in the private sector and the largest single super phosphate player.

- Sugar (21% in FY24 vs 15% in FY22): The company operates six sugar plants across South India with a combined sugarcane crushing capacity of 40,800 TCD (Tonnes of Cane per Day). It offers customized grades of pharmaceutical sugar, pure brown sugar and branded sugar under Parry’s Vita. It also holds a 100% stake in Parry Sugar Refinery India Pvt Ltd, which is engaged in the business of sugar refinery with an installed capacity of 3,000 TPD melting rate. Overall cane crush sales marginally declined from 50.2 LMT (Lakh Metric Tonnes) in FY22 to 50 LMT (Lakh Metric Tonnes) in FY24, while institutional sugar sales increased from 1.63 LMT to 1.09 LMT and retail sugar sales increased from 266 MT to 522 MT during the same period.

- Crop Protection (8% in FY24 vs 11% in FY22): The company has a significant presence in the farm inputs including crop protection and bio-products business through its subsidiary, Coromandel International.

- Distillery (2%): The company operates five distilleries having a capacity of 582 KLPD (Kilo Litres Per Day), it offers distillery products in various forms like Rectified Spirit, Extra Neutral Alcohol, Ethanol, etc. The distillery volume increased from 847 lakh litres in FY22 to 1,242 lakh litres in FY24 and distillery realizations increased from ₹57.1/litre in FY22 to ₹62.2/litre in FY24.

- Co-generation (1%): The company has a total power generation capacity of 140 MW, which it sells to state government utilities, third parties and electricity exchanges.

- Nutraceuticals (1%): The company manufactures spirulina, a nutrient-dense nutraceutical protein supplement. Its specialized manufacturing plants are located in Tamil Nadu.

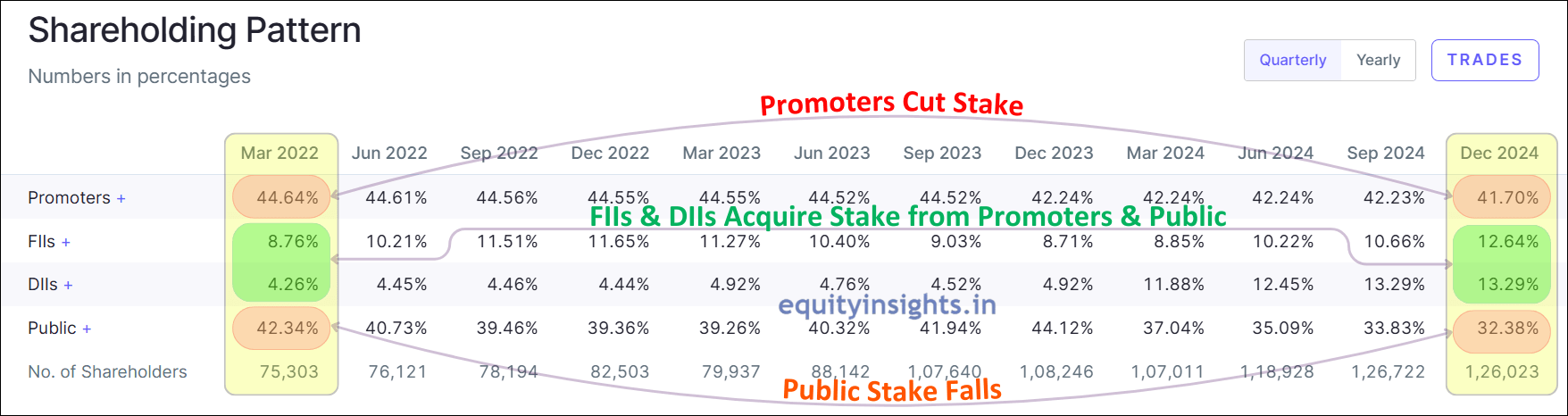

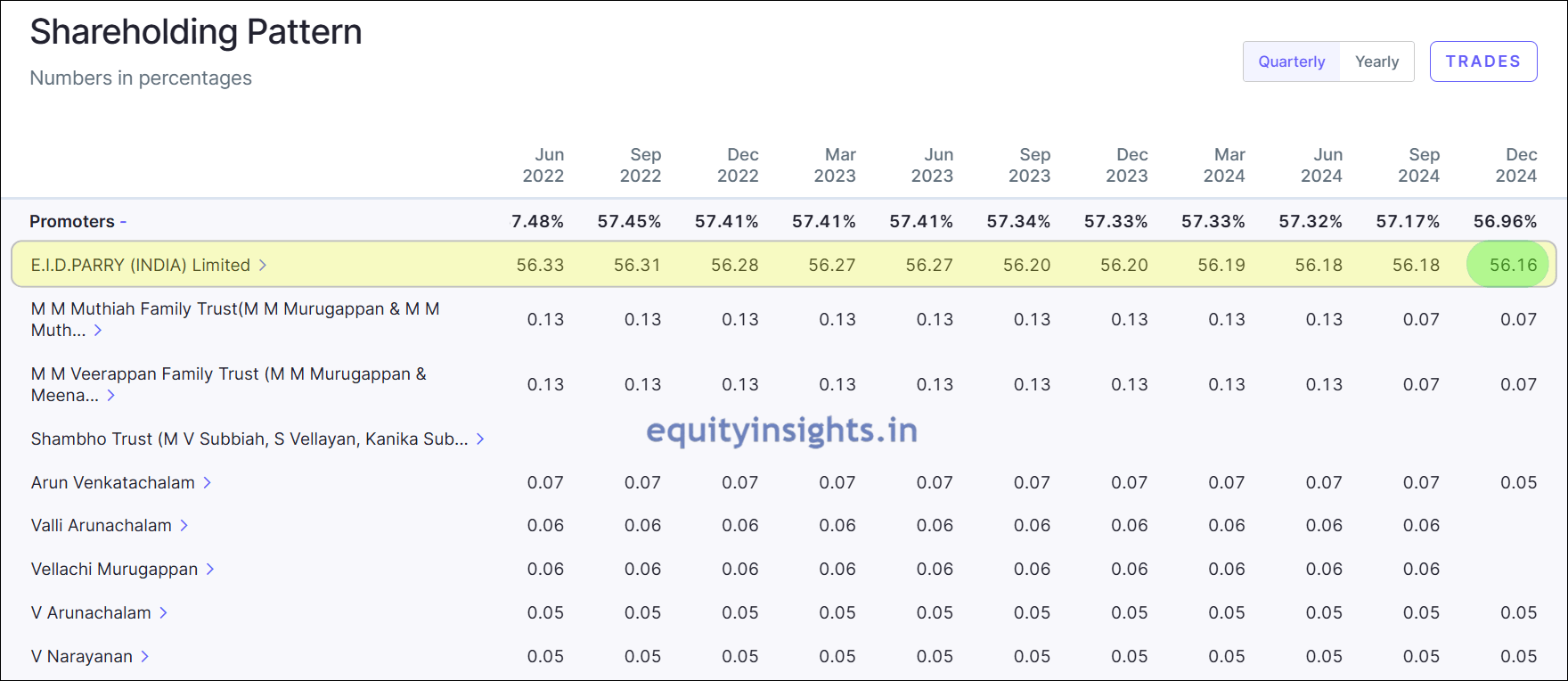

Let’s move to the shareholding pattern of EID Parry. The promoter is the private equity firm that has been holding the stake for a long time and so booked profits by selling some percentage from its stake and that resulted in the reduced promoter’s holding from 44.64% in March 2022 to 41.70% in December 2024. However, like that of Ganesha Ecosphere, the entire selling by promoter has been absorbed by the FIIs and DIIs, which led to the increase in FIIs holding percentage from 8.76% to 12.64% and DIIs holding percentage from 4.26% to 13.29% during the same period.

Similar to Ganesha Ecosphere, EID Parry has witnessed a steady decline in public holding, dropping from 42.34% in March 2022 to 32.38% in December 2024—a trend that signals growing institutional confidence in the company. While public holding initially trended downward from March 2022 to March 2023, retail investors became more active, pushing it back up from 39.26% in March 2023 to 44.12% in December 2023. However, this surge was short-lived as FIIs and DIIs stepped in aggressively, accumulating shares and reaffirming their conviction in EID Parry’s potential. This increasing institutional interest serves as a strong positive indicator for investors, highlighting the stock’s attractiveness in the market.

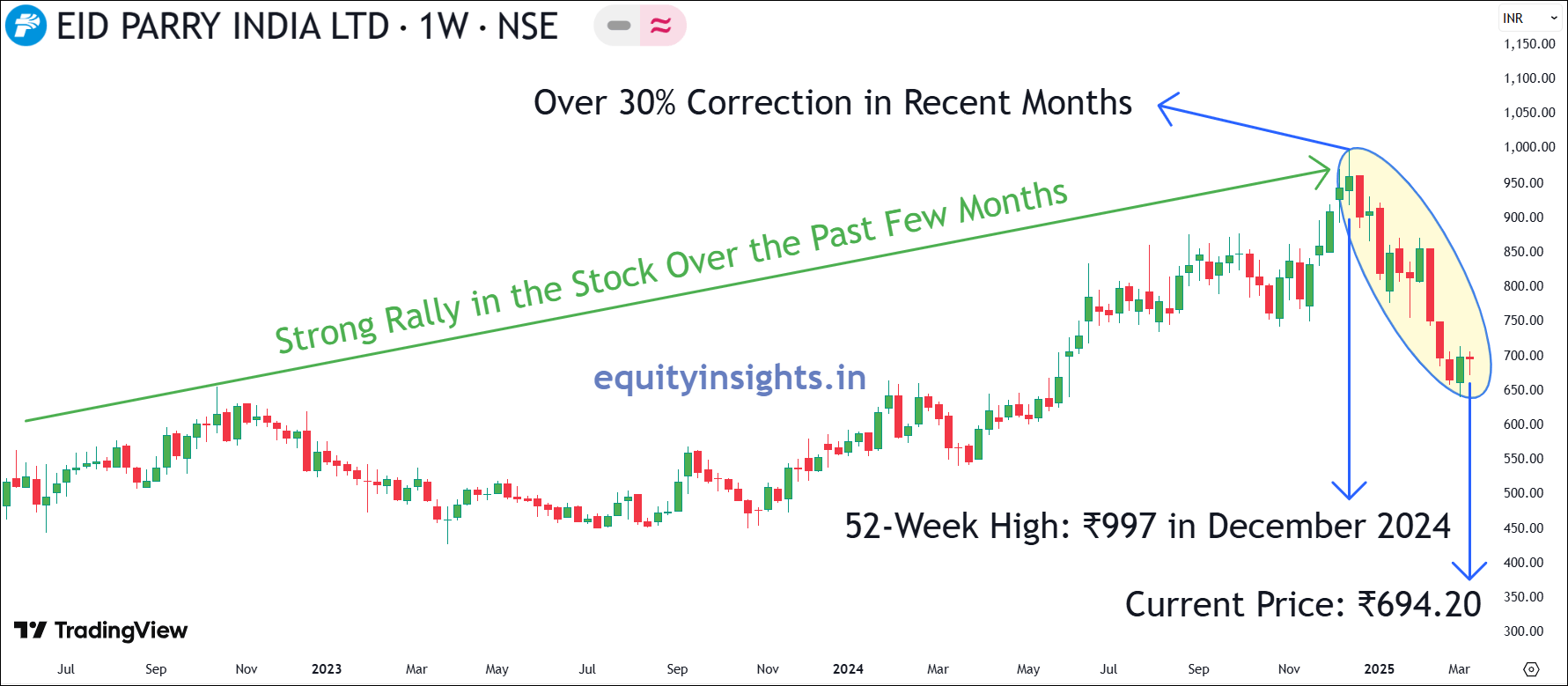

EID Parry has delivered impressive growth, with revenues soaring from ₹17,129 crore in 2020 to ₹30,355 crore on a TTM basis. Currently, EID Parry share price is at ₹694.20. Now, let’s dive into the calculated fair value of EID Parry’s share price.

So, EID Parry is a holding company of Coromandel International and both are part of the prestigious Murugappa group. With a 56.16% stake in Coromandel, which currently holds a market cap of ₹52,964 crore, EID Parry’s share in the business amounts to an impressive ₹29,744 crore. However, considering Coromandel’s P/E ratio is about 45% higher than its median valuation, adjusting for that brings EID Parry’s fair market cap from Coromandel alone to approximately ₹16,065 crore.

An important factor to consider is that holding companies typically trade at a 40% discount to their actual holding value. Applying this discount, EID Parry’s Coromandel stake translates to a market cap of approximately ₹9,600 crore. Additionally, EID Parry operates its own standalone sugar business, valued at around ₹3,000 crore. Given the nature of the sugar industry, a modest price-to-sales ratio of 1 to 1.5 times suggests that the sugar segment could contribute another ₹3,000 to ₹4,000 crore to EID Parry’s total valuation.

Combining the value of EID Parry’s standalone sugar business and its stake in Coromandel International, the company’s fair market cap falls between ₹12,600 crore and ₹13,600 crore. With the current market cap of around ₹12,341 crore, the stock is trading at a 2-10% discount to its fair value.

| EID Parry Holding in Coromandel International | 56.16% |

| Coromandel International Current Market Cap (Cr.) | ₹52,964 Crore |

| EID Parry Value in Coromandel International | ₹29,744 |

| Coromandel International Current Valuation Premium | 45% |

| EID Parry Fair Value in Coromandel International (Cr.) | ₹16,065 |

| Holding Company’s Discount | 40% |

| EID Parry Value after Holding Discount (Cr.) | ₹9,600 Crore |

| EID Parry Standalone Sugar Business Revenue (Cr.) | ₹3,000 Crore |

| Sugar Business Valuation (1x-1.5x sales) (Cr.) | ₹3000-4000 Crore |

| EID Parry Value = Coromandel International+Sugar Business | ₹12,600-13,600 Crore |

| EID Parry Current Market Cap | ₹12,341 Crore |

| Discount | 2-10% |

What makes EID Parry even more compelling is its ambitious goal to transition from its traditional sugar business to more of an FMCG player. The company has also moved up the value chain with branding of its sugar business along with launch of many consumer staples—though this transformation is a long-term journey and it won’t happen immediately. Having said this, the Murugappa group is known for creating immense wealth for its investors.

Read More: 10 Trading Rules That Make a Trader Successful

9. Praj Industries

Final stock in the list is Praj Industries. Founded in 1983, Praj Industries is a leading biotechnology and engineering company globally. It offers sustainable solutions in bio-energy, water purification, process equipment, breweries and wastewater treatment. The company is focused on the environment, energy and farm-to-fuel technology solution. It has global offices in Thailand, Philippines and the USA.

Praj Industries operates across the following Business Segments:

- Bio-Energy (74% of FY24 Revenue): This is the core segment of Praj Industries, contributing a significant portion of its revenue. The company provides technology and plants for producing biofuels and other sustainable energy solutions.

- 1G Ethanol Plants: Produces ethanol from food-based feedstocks like sugarcane, corn and grains.

- 2G Ethanol Plants: Advanced technology to produce ethanol from agricultural waste (straw, husk, bagasse).

- Compressed Bio Gas (CBG): Solutions for producing biogas from organic waste and converting it into clean energy.

- Future Fuels: Focus on advanced biofuels like Sustainable Aviation Fuel (SAF), Marine Biofuel, and BioHydrogen.

- High Purity Solutions (8% of FY24 Revenue): This segment serves industries requiring ultra-pure systems for critical processes. Praj offers advanced engineering and process technology solutions.

- Pharmaceuticals & Biotechnology: High-purity water systems for sterile drug manufacturing.

- Food & Beverage: Equipment for safe, contamination-free production.

- Cosmetics: Pure ingredient processing systems.

- Engineering Businesses (18% of FY24 Revenue): This segment has three sub-divisions: water & wastewater treatment (operates in the industrial wastewater systems), critical process engineering (provides high-end equipment and systems finding applications in industries such as oil and gas, petrochemical, fertilizer and chemicals industries) and Brewery & Beverage Engineering ( designs and implements modern brewing systems and provide solutions for high-quality alcoholic beverages.

The company has 4 manufacturing plants in India (Wada Unit, Jejuri Unit and Sanaswadi Unit in Maharashtra & Kandla Unit in Gujarat.) The dedicated manufacturing facility consisting of two separate workshops for carbon steel and stainless steel fabrication is located at Kandla Special Economic Zone in Gujarat on the western coast of India. This SEZ facility is right at Kandla port, facilitating speedy and hassle-free delivery. The other two manufacturing facilities are well connected to ports through national highways. Total fabrication capacity stands at over 16,500 tons per year. The company has 1000+ references in 100+ countries across all 6 continents with some reputed clients like Castilla, AB Sugar, Aemetis, Mayaguez, Super Green, Triveni and Bajaj Hindustan.

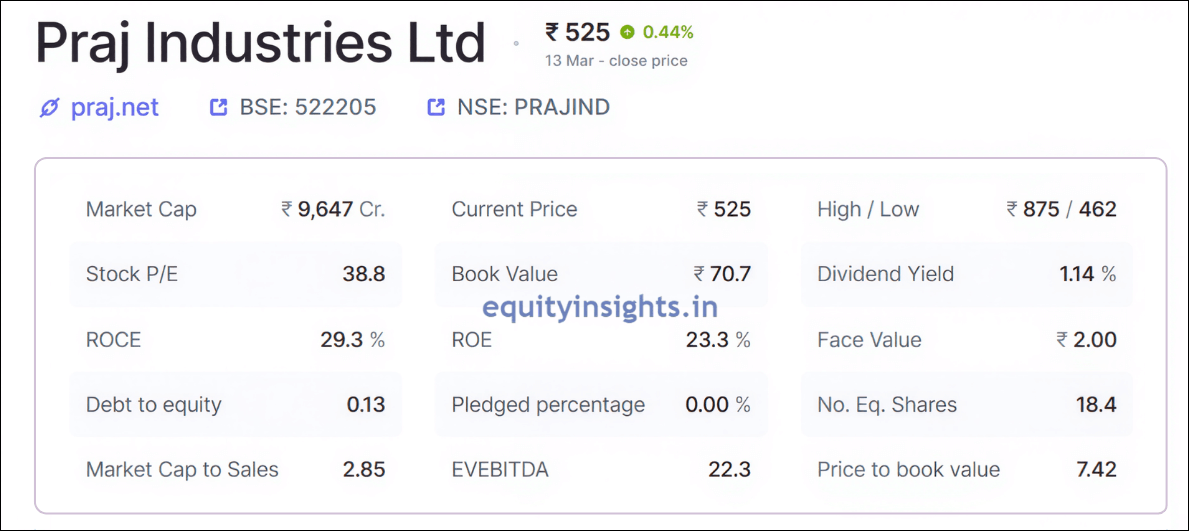

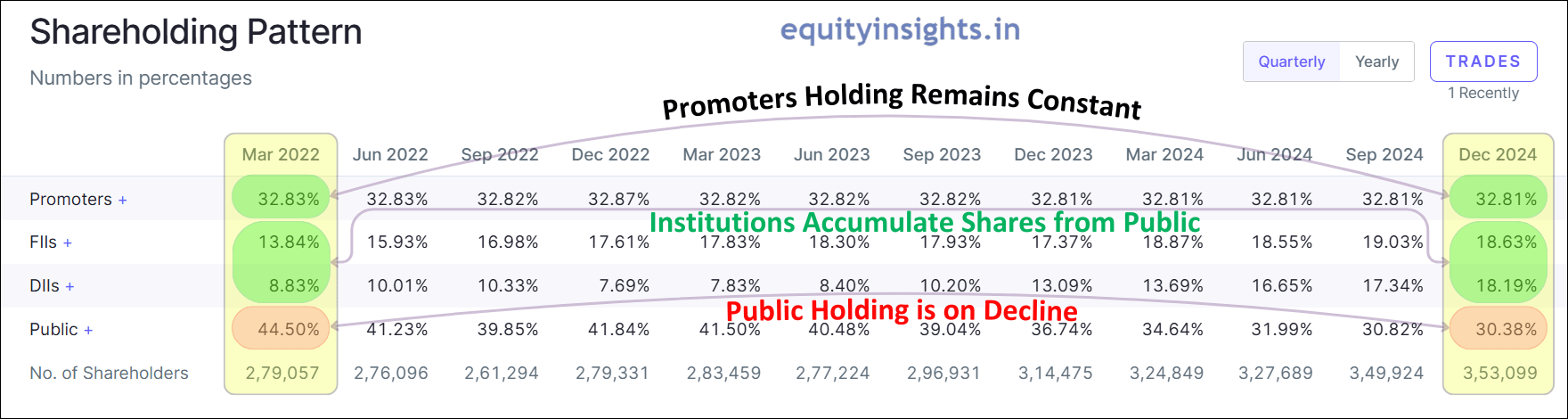

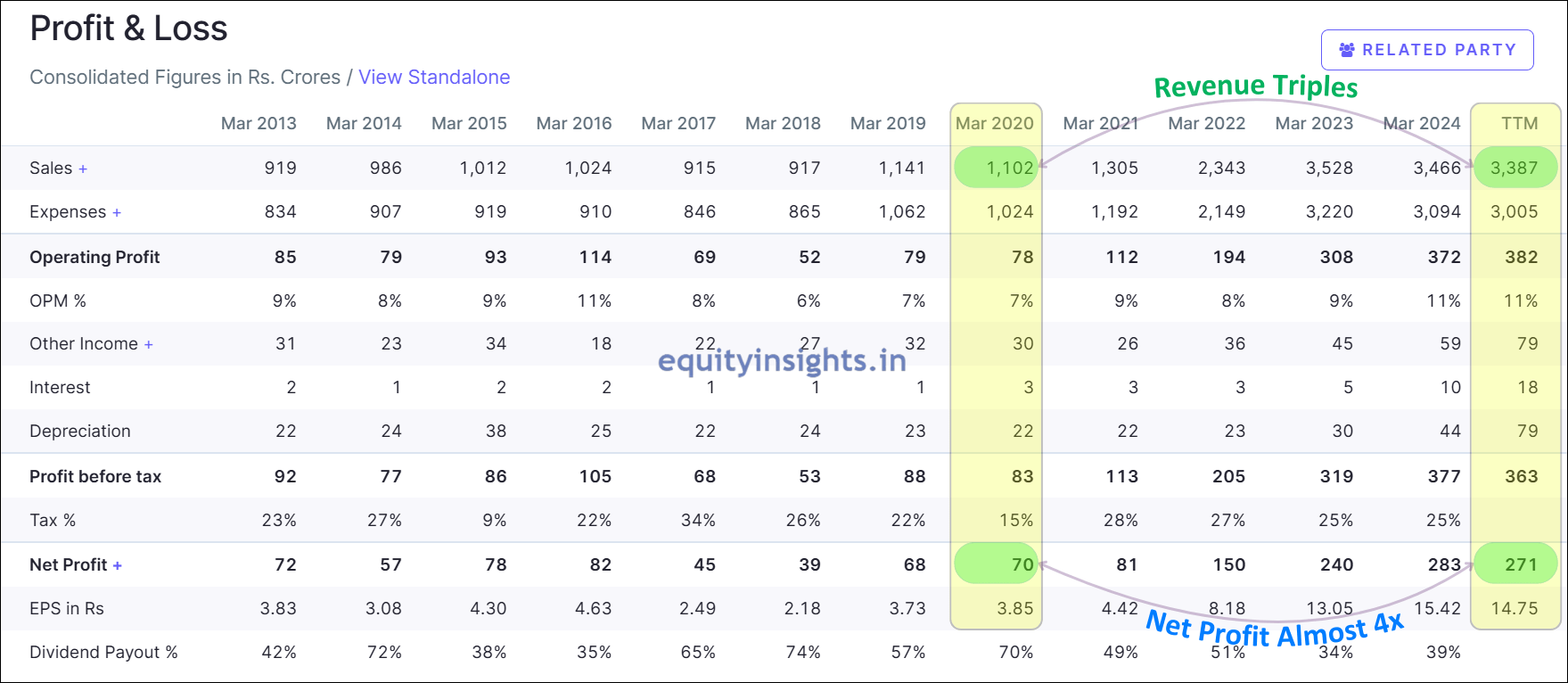

Shifting the focus to the shareholding pattern, promoter holding has remained somewhat the same in the last 2 years however public holding has seen a sharp decline, dropping from 44.50% in March 2022 to 30.38% in December 2024, signaling increased public distribution. While FIIs have raised their stake from 13.84% to 18.63% during the same period, their holdings have remained relatively stable in recent quarters. The real momentum comes from DIIs, who have been consistent net buyers, significantly increasing their stake from 8.83% to 18.19% over the same period. This sustained institutional interest reinforces strong confidence in the company’s future potential.

Looking at the company’s financials, its remarkable growth trajectory is evident. Since March 2020, revenue has tripled, surpassing ₹3,300 crore, while net profit has soared nearly fourfold to ₹271 crore on a trailing twelve-month (TTM) basis. This outstanding performance over the past five years highlights the company’s strong fundamentals and expansion strategy.

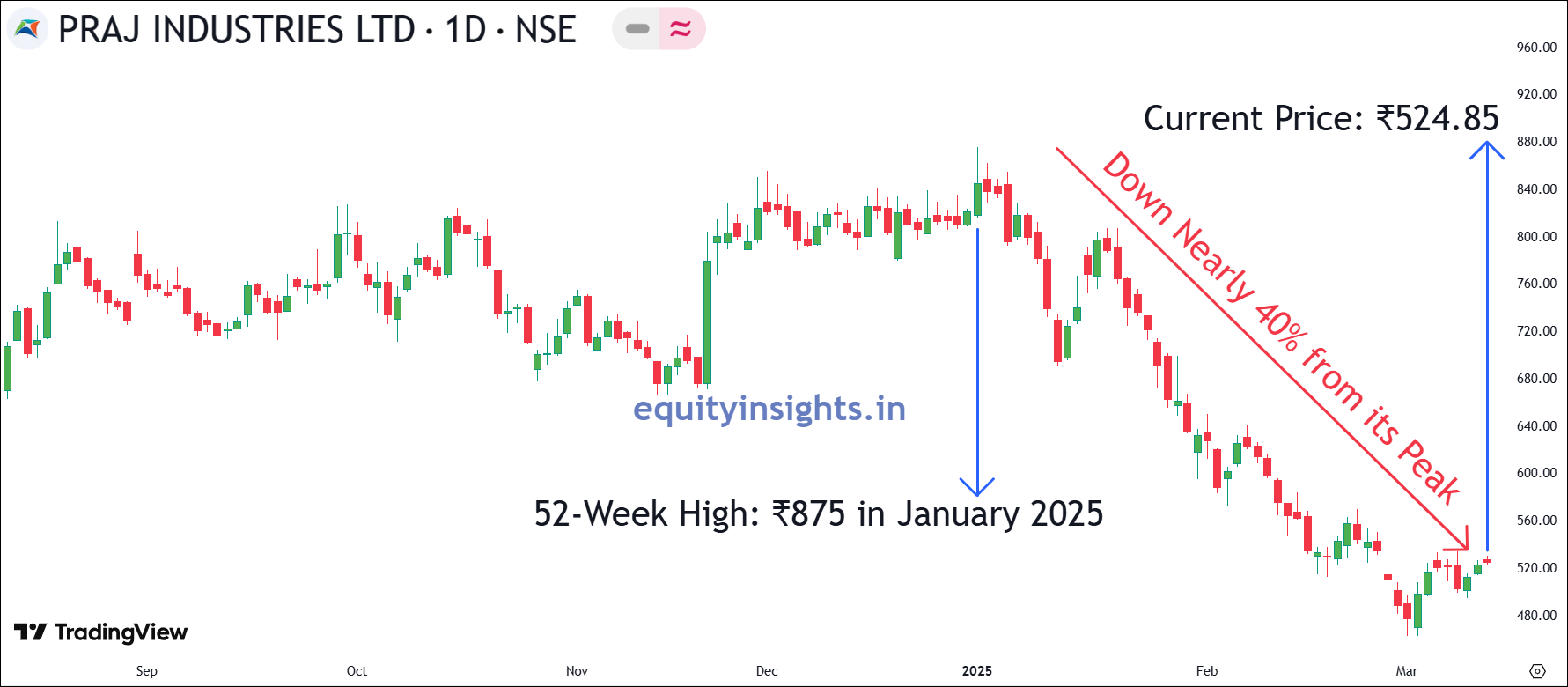

However, Praj Industries has faced some near-term challenges, with the last couple of quarterly results coming in weaker than expected, leading to a nearly 40% drop in its stock price from the peak. However, this remains a compelling long-term play on the biofuels revolution, backed by multiple growth drivers such as sustainable aviation fuel, low-carbon ethanol and compressed biogas. Additionally, the company is witnessing strong export momentum, with management aiming to boost export contribution from the current 27% to 50% by 2030, fueled by the global push for Energy Transition and Climate Action (ETCA).

Currently, the company commands a P/E ratio of 38.8, ROCE of 29.3% and ROE of 23.3% and is trading at ₹524.85 which makes this company attractive at its current valuation. Also, in the long run company’s management has guided for three times growth in top line by 2030 as compared to 2024 levels and five times growth in net profit. So, it is worth tracking the development closely.

That’s a wrap on this article! To sum it up, we explored fundamentally strong mid and small-cap stocks that have seen a sharp correction due to negative sentiment in the Indian market, stretched valuations, and fears of a trade war. Despite these challenges, institutional investors continue to increase their stakes—a clear signal of long-term confidence.

At times like these, when mid and small-cap stocks have faced a brutal sell-off and market sentiment is gripped by fear, most investors hesitate to step in. But remember—you never get good news and good prices together. The best opportunities often arise when the news is negative as that’s when the valuations become attractive. However, I’m not suggesting you to blindly buy all these stocks. Instead, this deep correction presents a great opportunity to study these companies, identify a few promising investment prospects and consider allocating capital in a systematic and disciplined manner.

So, what’s your take? Which of these stocks looks most promising to you after the correction? Share your thoughts in the comments—I’d love to hear from you! I’ll catch you in the next article—until then, stay curious, invest wisely and happy investing!

Disclaimer: We are not a SEBI-registered research analyst. The information provided in this article is intended solely for educational, illustrative and awareness purposes. Nothing contained herein should be construed as a recommendation. Users are encouraged to seek professional financial advice before making any decisions based on the content provided.