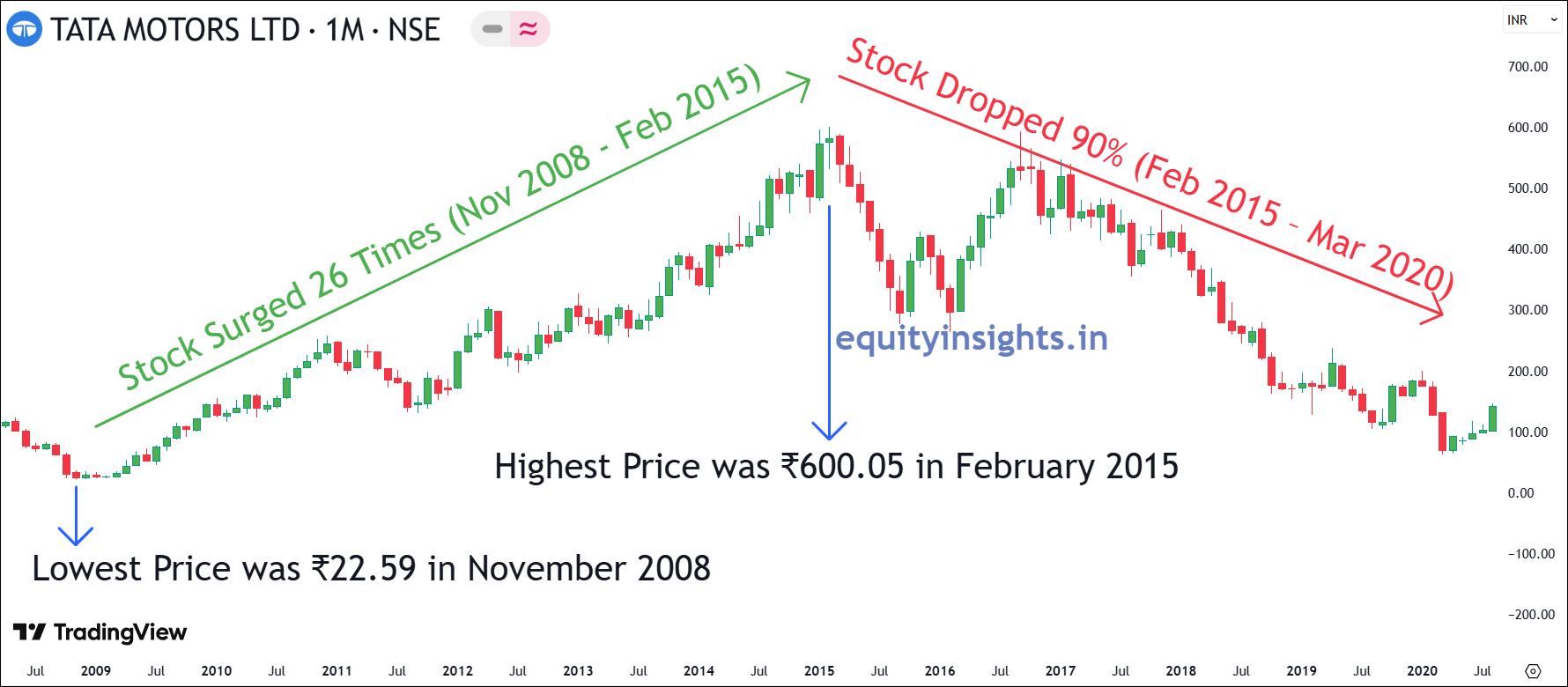

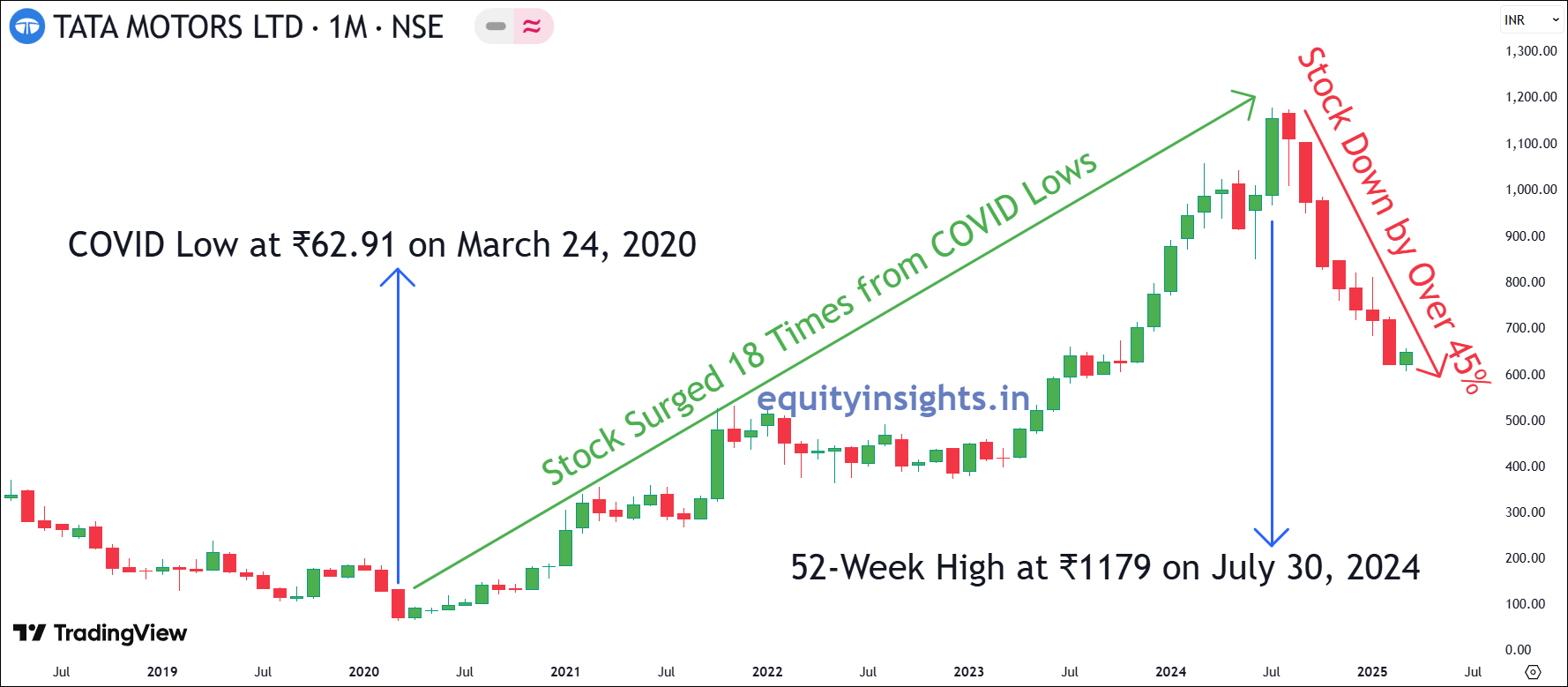

Hello everyone! If I have to pick one stock that truly defines the roller coaster journey of share price movement then Tata Motors would be on top of that list. It has been a massive wealth creator in the last few years where its stock price surged 18 times from COVID lows of ₹62.91. However, after that phenomenal rise, it has now plunged over 45% from its peak. An important point to note here is that Tata Motors is a large-cap company and 45% correction in a large-cap company is not very common but the interesting part is, that it’s not the first time Tata Motors has corrected such sharply.

Tata Motors share has seen wild swings over the years, testing the patience of its investors. The stock tanked nearly 90% between February 2015 and April 2020. Imagine how difficult it would have been for Tata Motors investors when stock kept on falling for 5 years wiping out around 90% of their capital. But before that, from 2009 to 2015, the stock skyrocketed 26x, only to suffer another 90% plunge during the housing bubble burst.

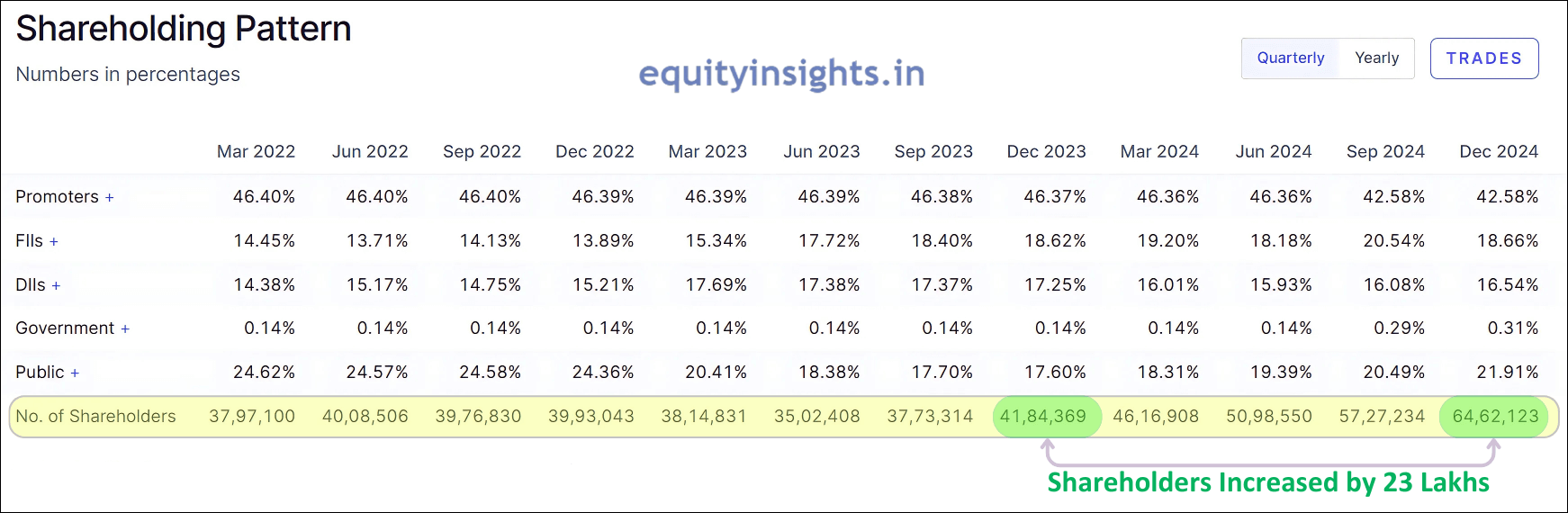

Even now, history seems to be repeating itself—Tata Motors share price has dropped over 45% from its peak and in the last year alone, it was down by around 37%. Interestingly, in the last one year, the total number of shareholders of the company has zoomed from 41.8 lakh to 64.6 lakh. So, nearly 23 lakh people invested in the company, when its share price kept falling. By the way, Tata Motors has the highest number of individual shareholders followed by Yes Bank, Tata Steel, Vodafone Idea and IRFC.

Now, the big question is—why has Tata Motors plunged over 45% this time? An even bigger question—given its history of massive 80-90% corrections, could it happen again or has the stock finally bottomed out?

I have divided this article into six key sections:

- Business Model of Tata Motors – Understanding how the company operates and generates revenue.

- The 90% Crash (2015-2020) – Exploring the factors that led to this massive downfall.

- The 18x Rally (2020-2024) – Analyzing what fueled this extraordinary surge.

- The Recent 45% Decline – Examining the reasons behind the latest drop

- Shareholding Pattern of Tata Motors – Exploring how Tata Motors’ shareholding evolved through different market phases.

- More Correction Ahead or Worst is Over – Analyzing whether more pain lies ahead or stock has bottomed out.

All right let’s get started!

Read More: Zaggle Prepaid Share: A Promising Investment or Risky Bet?

Table of Contents

Business Model of Tata Motors

Tata Motors has a huge business that is broadly divided into four categories:

- Tata Commercial Vehicles: Tata Motors is India’s largest commercial vehicles (CV) manufacturer offering the widest range of products and service portfolio catering across cargo and public mobility segments including trucks, buses, commercial vehicles and so on.

- Tata Passenger Vehicles: Tata Motors has a strong presence in both electric and non-electric vehicle segments. It ranks third in India’s overall passenger car market, covering categories like Hatchbacks, Sedans and SUVs. When it comes to electric vehicles (EVs), Tata Motors is the undisputed leader, dominating the Indian EV space with popular models like Punch, Nexon, Tiago and more.

- Jaguar Land Rover: Jaguar Land Rover is a British brand that Tata Motors acquired long back in 2008 for $2.3 billion. It basically caters to the luxury segment with four Brands: Range Rover, Defender, Discovery and Jaguar.

- Vehicle Financing Business: Tata Motors operates as an NBFC (Non-Banking Finance Corporation) to provide financing-related solutions.

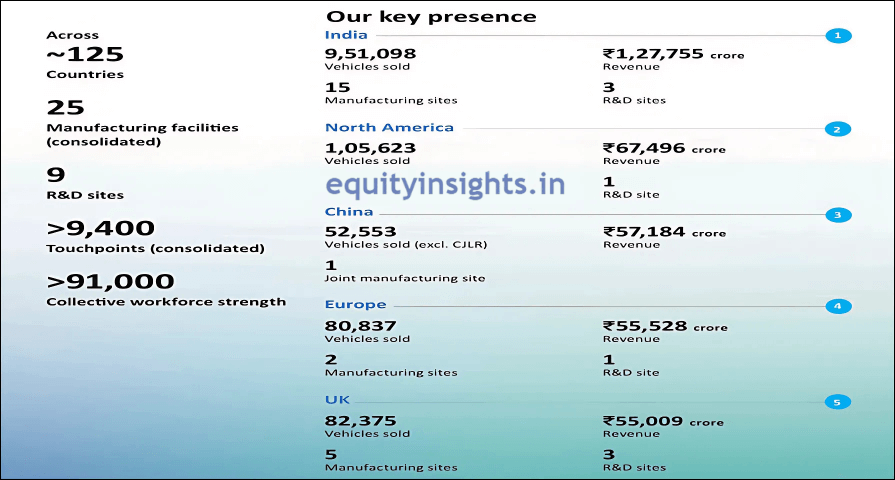

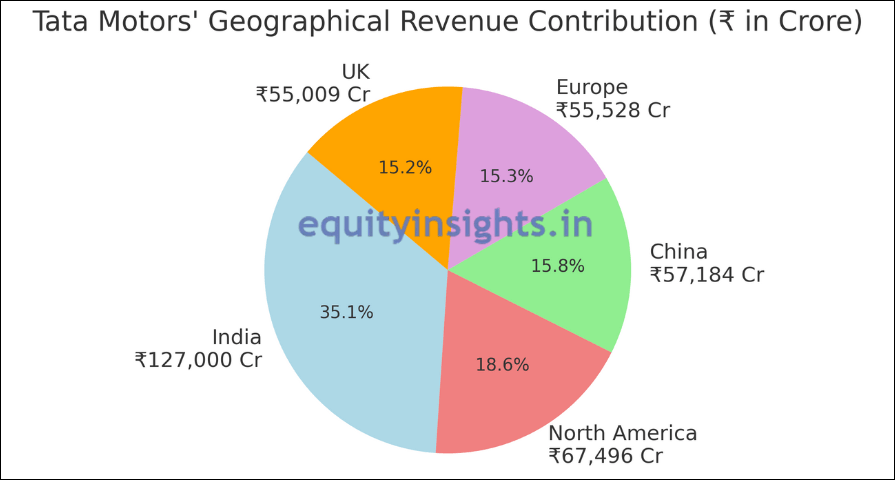

The company has a presence all over the world. Above is the image of the data from the FY24 Annual Report, where the key presence of Tata Motors has been shown. Tata Motors cars are sold in more than 125 countries. It has 25 manufacturing sites, 9 R&D sites and more than 9,400 touchpoints. India stands as Tata Motors’ largest revenue contributor, generating a massive ₹1.27 lakh crore. Following India, the key markets include North America (₹67,496 crore), China (₹57,184 crore), Europe (₹55,528 crore) and the UK (₹55,009 crore). These regions play a crucial role in the company’s global business footprint.

So, when it comes to Geographical Revenue Contribution, India takes the lead with 35.1% of total revenue. North America follows with 18.6%, while China, Europe and the UK each account for approximately 15%, showcasing a well-diversified global presence.

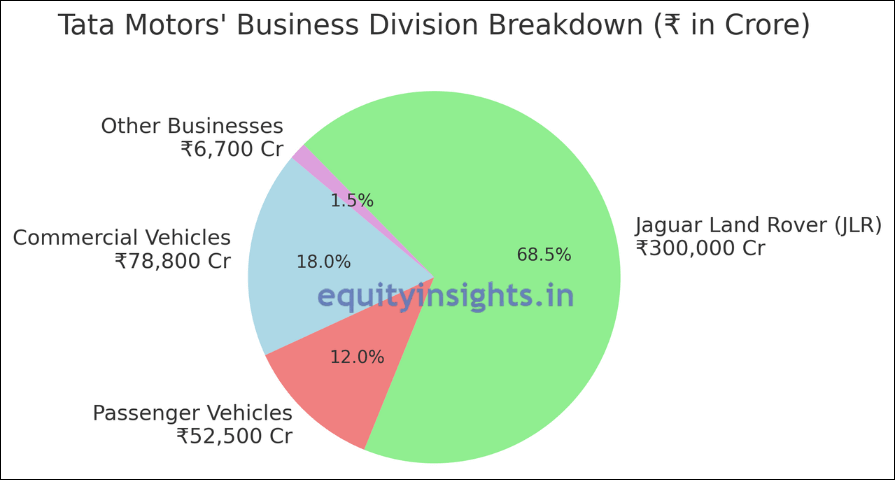

Now, when you look at the Business Division Breakdown (FY24) of Tata Motors, it highlights the company’s diverse business strengths. The company reported a total revenue of ₹4.38 lakh crore, with the following contribution in revenue:

- Commercial Vehicles: ₹78,800 crore (18%)

- Passenger Vehicles: ₹52,500 crore (12%)

- Jaguar Land Rover (JLR): ₹3 lakh crore (68.5%)

- The remaining share by other businesses (including NBFC)

Jaguar Land Rover remains the dominant force, driving nearly two-thirds of the company’s total revenue.

Read More: The Power Players: 6 Top HNIs Influencing the Stock Market!

The 90% Crash Between 2015-2020 & The Reasons for Fall

Now, let us try to understand the reason behind the 90% fall in the company’s share price between 2015 to 2020 as that would give a good idea of what went wrong that time. So, multiple factors resulted in sharp fall in Tata Motors share price from 2015-2020:

1. Trouble with Jaguar Land Rover Business: One of the biggest setbacks for Tata Motors was the struggles of Jaguar Land Rover (JLR). During 2015-16, Jaguar Land Rover contributed around 75-80% of the company’s revenue and it struggled badly due to weak demand from China and Europe, which are key markets for Jaguar Land Rover.

Several factors contributed to Jaguar Land Rover’s struggles during this period:

- Rising Competition & Changing Consumer Preferences – The luxury car market became more competitive and shifting consumer trends impacted demand.

- Brexit Uncertainty – Political and economic instability in the UK created challenges for JLR.

- Quality Issues & Brand Image – Recurring quality concerns declining customer satisfaction led to higher warranty costs and negative sentiments among consumers which negatively affected brand perception and JLR’s profitability.

- Decline of Diesel Vehicles in Europe – From 2015 to 2020, Europe saw a major shift away from diesel cars, which formed a significant part of JLR’s portfolio, further squeezing its profitability.

These factors collectively weighed down JLR’s performance, dragging Tata Motors along with it.

2. Slowdown in Indian Automobile Industry: 2015 to 2020 was the phase when Indian auto industry witnessed slowdown. There was demonetization, followed by IL&FS and Yes Bank crisis which resulted in liquidity crunch for NBFC sector. So, overall sentiment and economic growth was on slower side, that impacted both passenger and commercial vehicle sales in India. Additionally, Tata Motors faced stiff competition from players like Maruti Suzuki and Hyundai.

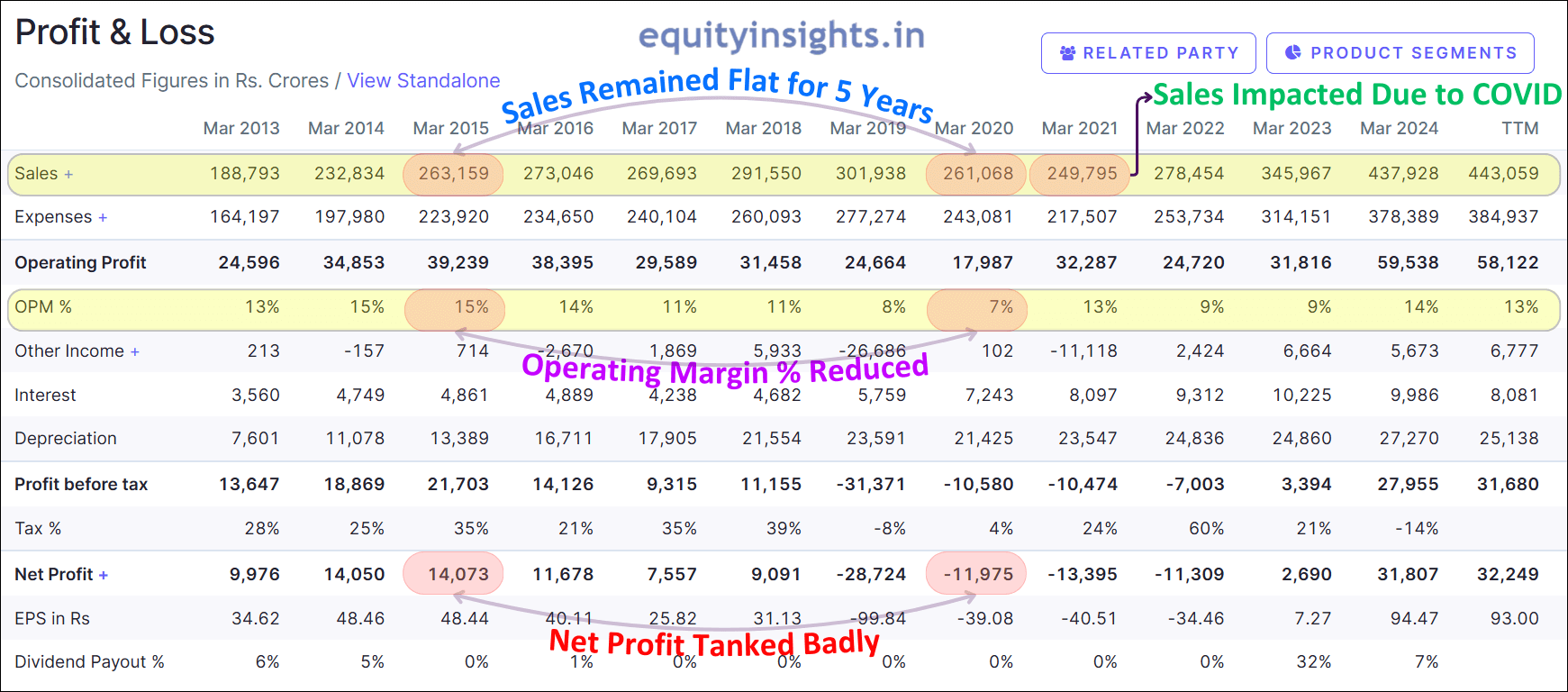

Another reason was the transition in emission norms from BS4 to BS6. As a result, demand for BS4 vehicles declined sharply, which is reflected in Tata Motors’ P&L statement from March 2015 to March 2020, where sales remained stagnant for five years. Adding to the challenges, the COVID-19 pandemic further disrupted the auto industry, leading to a significant slowdown in sales during the June and September 2020 quarters.

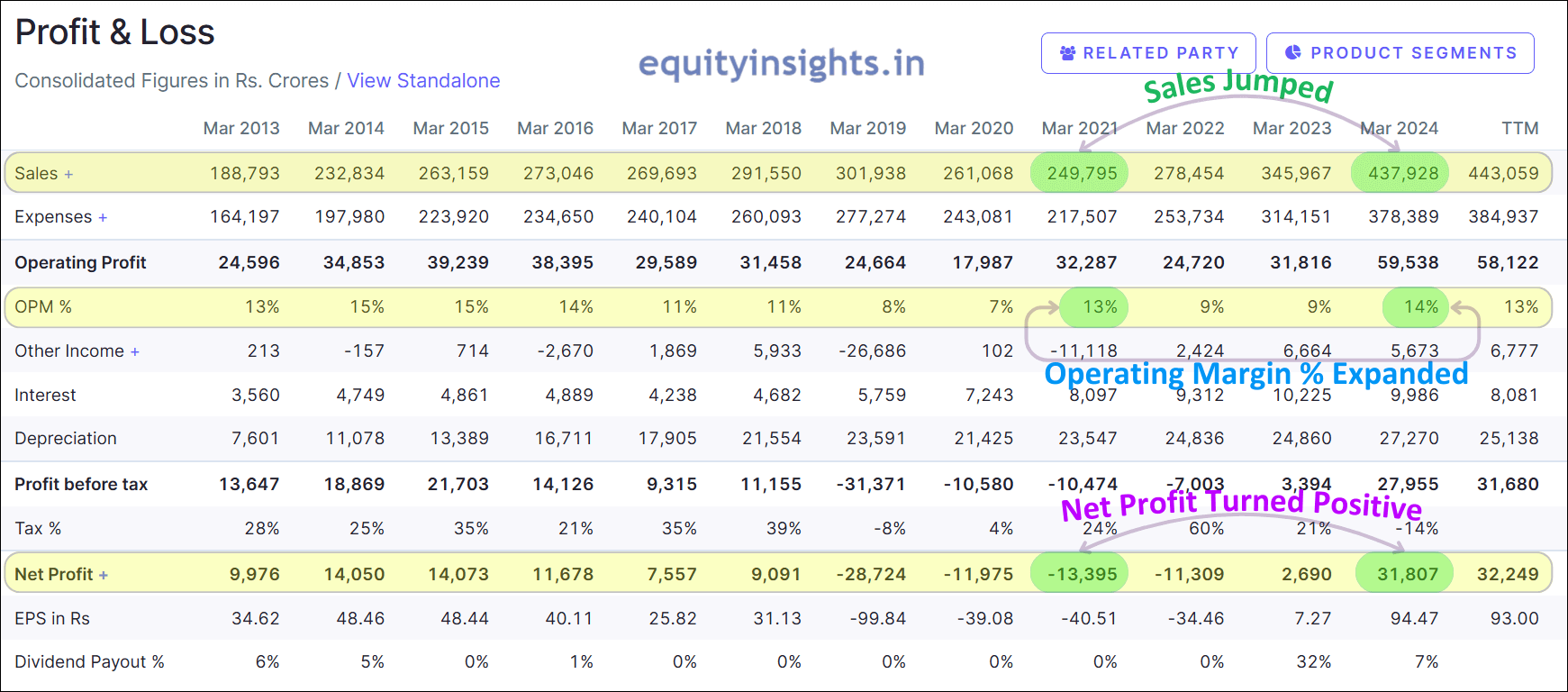

3. Increase in Raw Material Prices Impacted Operating Margins: Unfortunately 2015-2020 was also the phase when raw material prices increased a lot and that put a lot of pressure on the company’s margin. On top of that, Tata Motors was investing significantly in future car technologies around connected, safe and electric cars. As a result, the company’s margin tanked badly from a peak of 15% to a low of 7% and that hit the company’s operating profit which went down from a peak of ₹39,239 crore to ₹17,987 crore, that’s more than 50% decline.

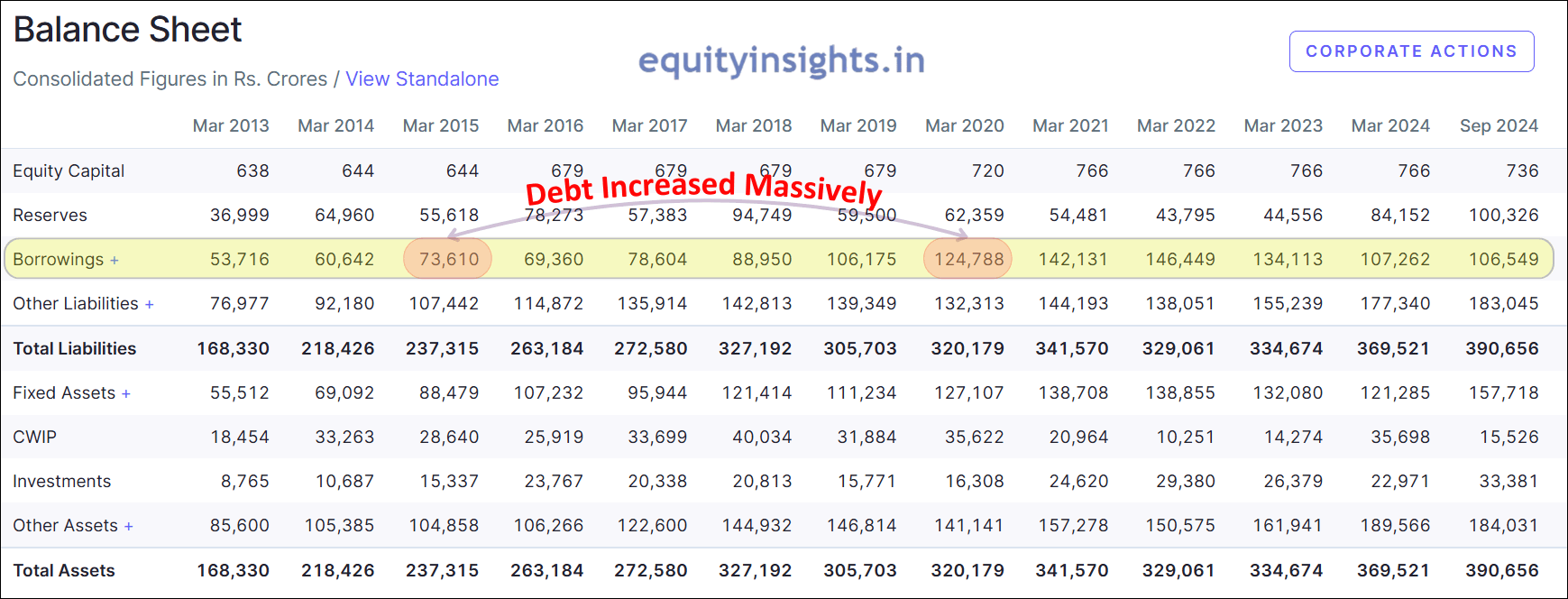

4. High Debt: Tata Motors was burdened with massive debt, standing at ₹73,610 crore in 2015 and due to continuous capital expenditure and investments, the debt kept rising, reaching a staggering ₹1,24,788 crore by 2020. This growing financial strain added further pressure to the company’s performance.

As a result of these factors, the company’s net profit plunged from ₹14,073 crore in 2015 to deep losses, marking a dramatic financial downturn. However, after this downturn, the company witnessed a turn around with profit jumping significantly and that resulted in extraordinary growth between 2020 to 2024. Let’s understand this turnaround period.

Read More: Top Investment Picks for 2025 by Axis Securities

The 18x Rally in Tata Motors Share Price Between 2020-2024?

Post-pandemic, three factors resulted in the extraordinary growth of Tata Motors:

1. Strong Rebound in Jaguar Land Rover Performance: Jaguar Land Rover witnessed a resurgence in demand, particularly from its newer models like Range Rover and Defender. This was driven by a combination of factors including pent-up demand after the pandemic, successful new product launches and a rebound in key markets like China. JLR also implemented cost-cutting measures to improve profitability, which further helped boost its financial performance. Additionally, JLR was strategically focused on selling higher-margin models which contributed to increased revenue and profitability.

2. Resurgence & Domestic Business: Tata Motors launched a series of successful new passenger vehicles like Nexon, Punch and Harrier which gained popularity in the Indian market. It helped company, gain market share in Indian passenger vehicles segment. Also post COVID-19, Electric Vehicles (EV) segment witnessed a strong growth and Tata became pioneer in Indian EV market with its Nexon EV becoming the best-selling electric car in the country. This early mover advantage gave Tata Motors a significant edge in this rapidly growing segment.

Also, Tata Motors commercial vehicles segment witnessed a strong growth due to growth in economy after pandemic. Company also took measures to reduce its debt burden and improve operational efficiency in its domestic business that helped reduce cost and improved profitability.

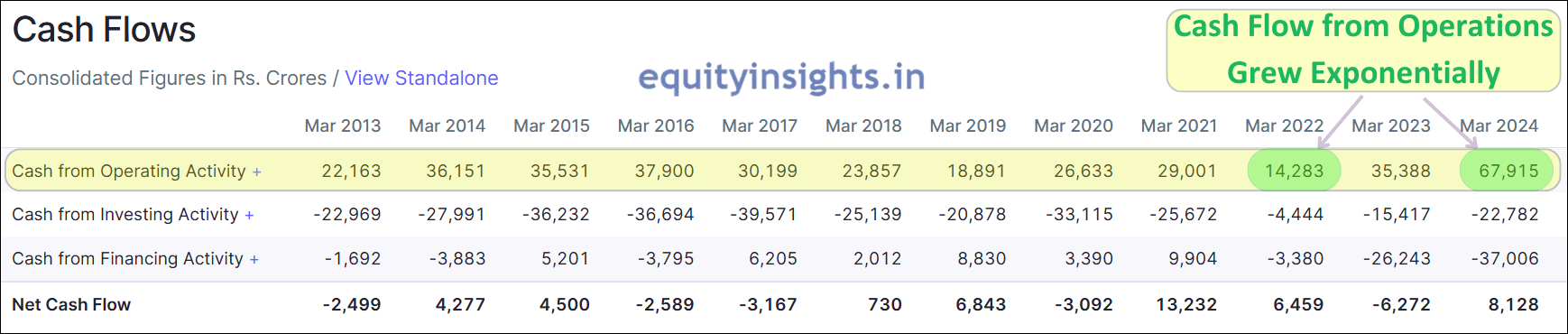

3. Positive Market Sentiment: Tata Motors experienced a stellar recovery after the pandemic, with its revenue surging from ₹2.5 lakh crore in 2021 to ₹4.38 lakh crore in 2024. This steady growth was accompanied by a sharp improvement in profitability. The company’s margins expanded from a COVID-era low of 7% to 14% during the same period, signaling strong operational efficiency. After four years of losses, the company finally turned profitable in 2023 and its net profit skyrocketed beyond ₹30,000 crore.

Additionally, cash flow from operations grew exponentially, rising from ₹14,283 crore in 2022 to ₹67,915 crore in 2024. This remarkable turnaround highlights the company’s strong resilience and strategic execution in navigating post-pandemic challenges.

During the COVID crash, the share price of Tata Motors plummeted to around ₹63, pushing its market cap to a mere ₹24,000 crore. With negative earnings at that time, the P/E ratio couldn’t even be calculated. Yet, despite the turmoil, the company was still generating annual sales of ₹2.5 lakh crore, making its valuation seem drastically undervalued compared to its revenue potential. Imagine a company doing a sale of ₹2.5 lakh crore and commanding a market cap of just ₹24,000 crore. Well, that is justified when the business is going downhill as obviously, nobody wants to touch the business at that time.

However, when the business turnaround, it creates extraordinary opportunities. So, during that time Tata Motors Market Cap to Sales ratio touched lows of 0.1 and then the entire Indian Auto sector witnessed excellent recovery along with a massive bull rally in the market. As a result, Tata Motors share price zoomed around 18 times from the lows of ₹63 in March 2020 to ₹1179 in July 2024.

I hope you now have a clear picture of what fueled Tata Motors’ remarkable share price surge. Here, I would also like to highlight the role of Mr. Natarajan Chandrasekaran in the turnaround of Tata Motors. He was the CEO of TCS and then became the Chairman of Tata group in 2017. His strategic vision and direction was instrumental in the turnaround story of Tata Motors that included focus on innovation in electric vehicles segment, technology upgrade across the company, new product launches and cost optimization.

Read More: Top 6 DIIs and Elite Fund Managers Making Market Waves!

The Recent 45% Decline

Now, let us understand the reason behind 45% correction in share price of Tata Motors in last 6 months and way forward. After an amazing growth journey post pandemic, the company is again facing headwinds.

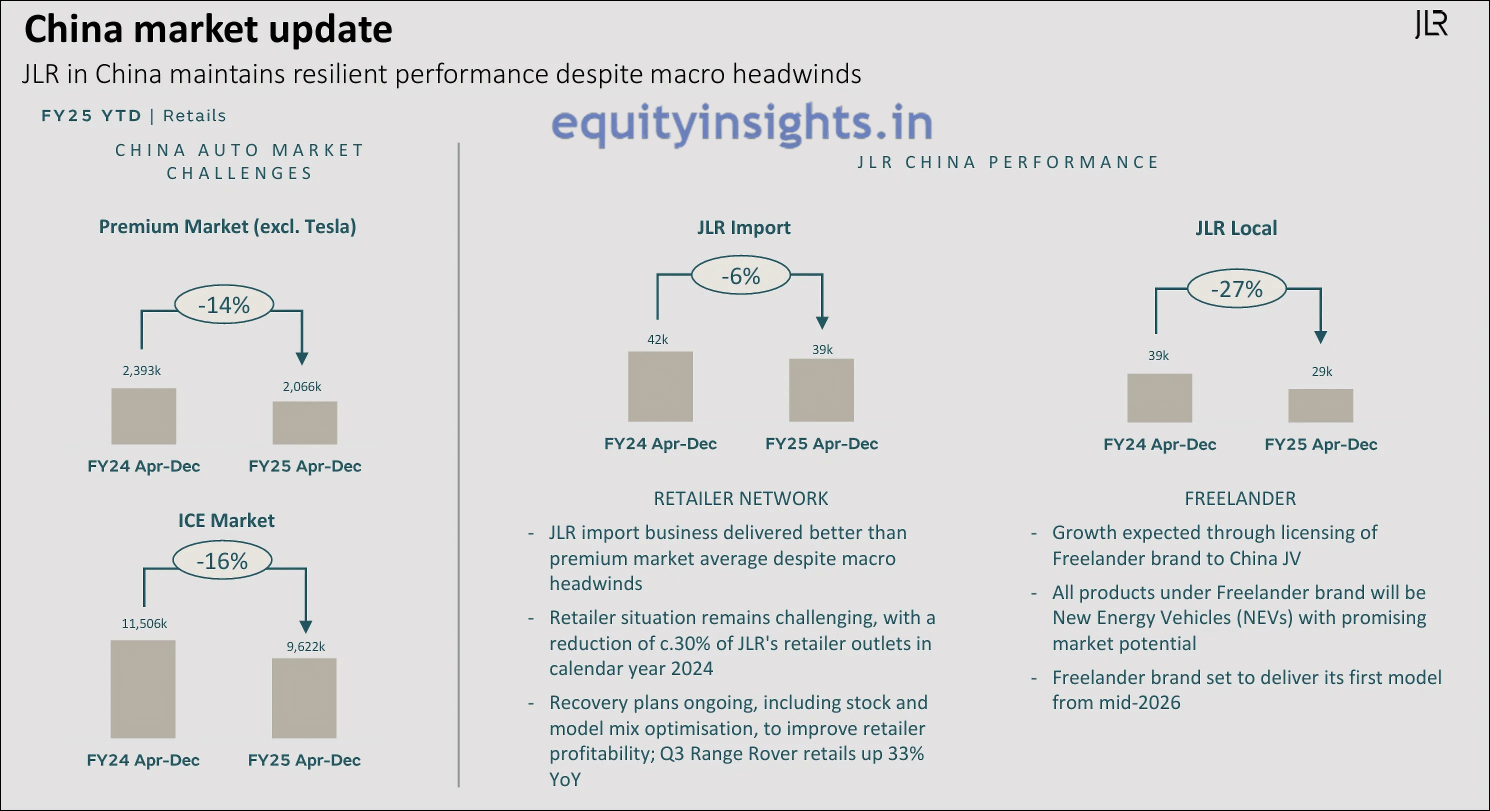

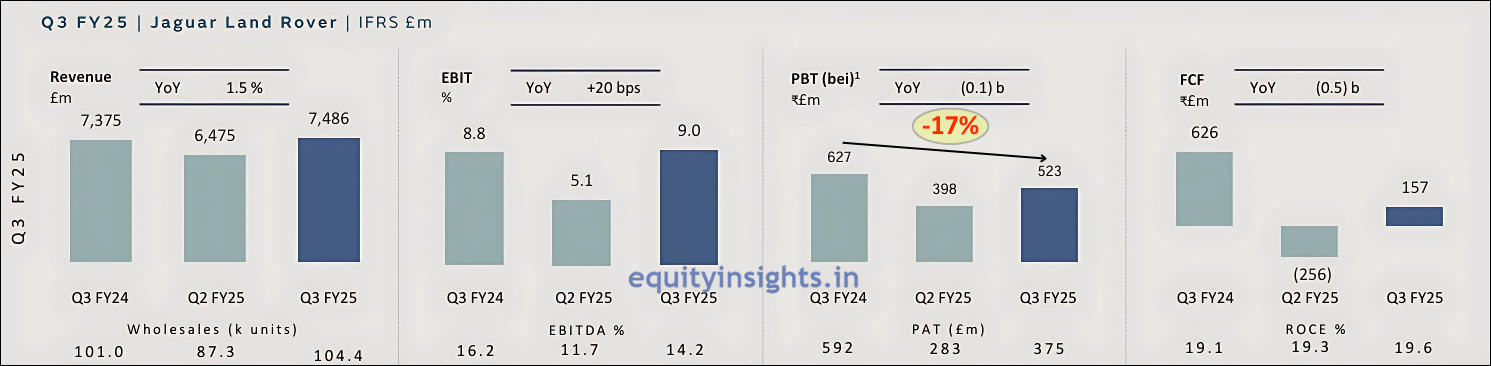

1. JLR’s Performance Issue: JLR has reported sluggish sales in the Chinese market which is a significant contributor to its revenue. The image above shows the latest data as of Q3 where the premium car market of China is down by 14% compared to the last year and the ICE market is down by 16%. As a result Jaguar Land Rover import is down by 6% and local sales are down by 27% YoY. By the way, China’s contribution is around 15% of FY24 revenue as mentioned above in the Pie chart.

Also, the rising inflation in Europe has impacted consumer sentiments. JLR also faced challenges with high warranty costs. As a result, JLR’s Q3 profit before tax (PBT) has fallen by around 17%. This downturn has raised concerns about JLR’s growth prospects and profitability. On top of this, the global auto sector is also facing an unpredictable market environment that includes tariffs, rising emission costs and a disconnect between consumer demand for EVs and government emission regulations.

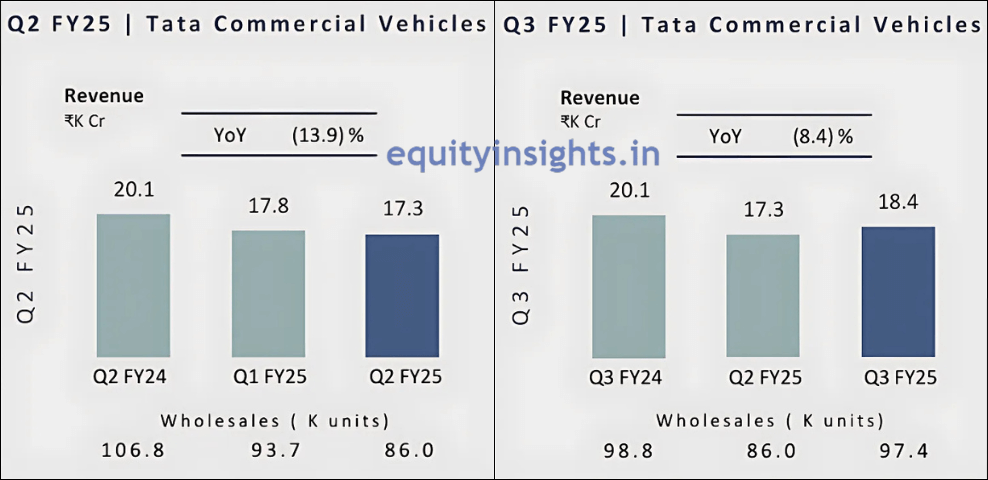

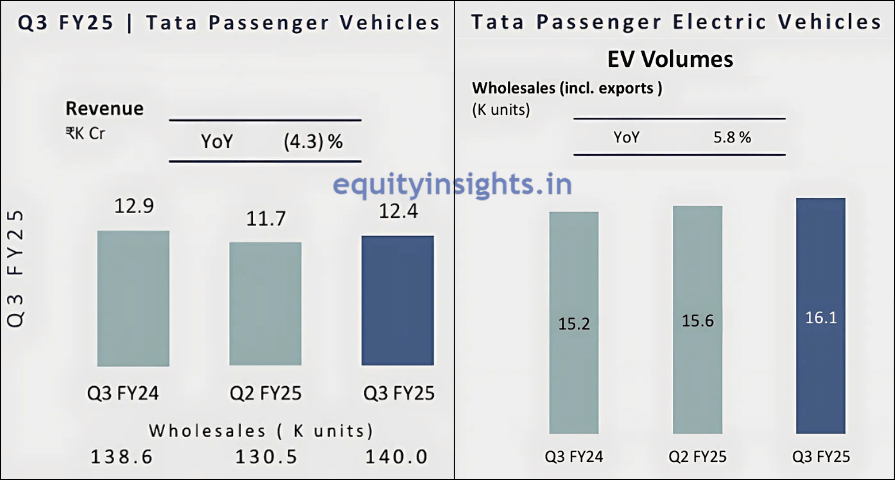

2. Domestic Market Challenges: Tata Motors’ commercial vehicles segment has witnessed a 13.9% year-on-year (YoY) decline in wholesale volume during Q2 and in Q3, it is down by 8.4%. Some key factors include delayed infrastructure projects, decreased mining activities and adverse weather conditions. Also, the growth in passenger vehicles and EV segment has been slower than anticipated with increased competition and market saturation affecting sales. Tata Motors certainly took the lead in EV cars in India but now other companies have also launched great EV cars in the Indian market. So, competition would be a key risk.

In the latest quarter, company’s passenger vehicle sales have fallen by 4.3% YoY and even EV segment growth is just 5.8%.

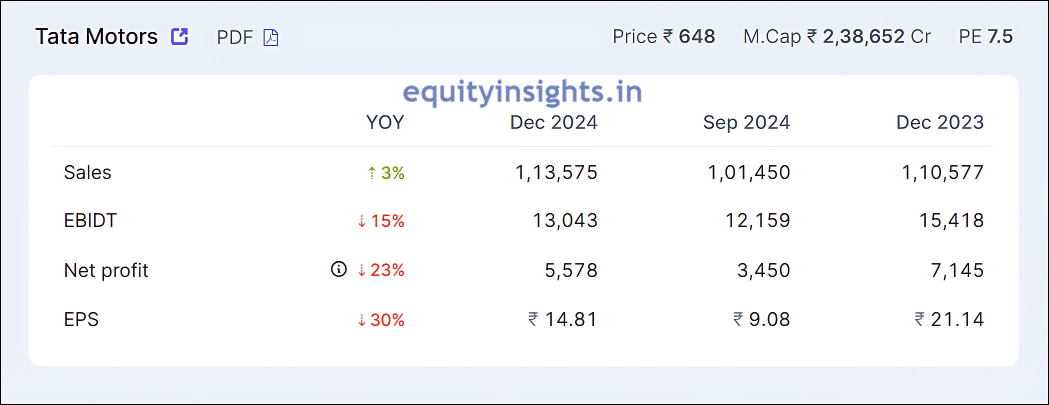

Tata Motors delivered a weak Q3 performance, with net profit plunging 23%, dampening investor sentiment and sparking profit booking.

Shareholding Pattern of Tata Motors

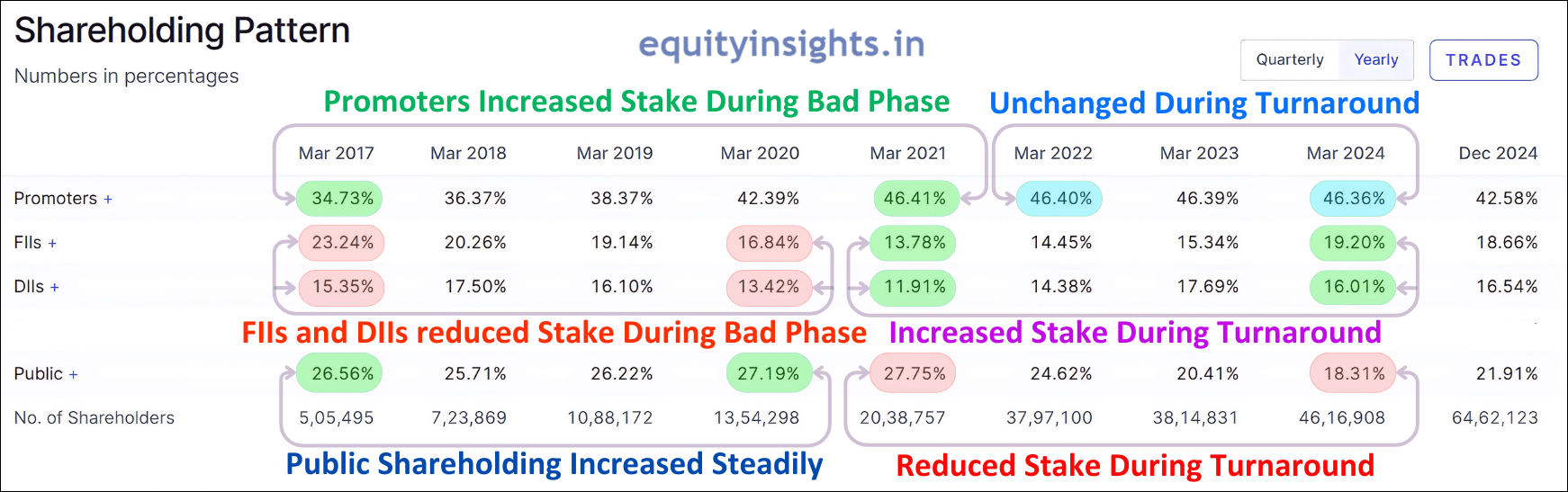

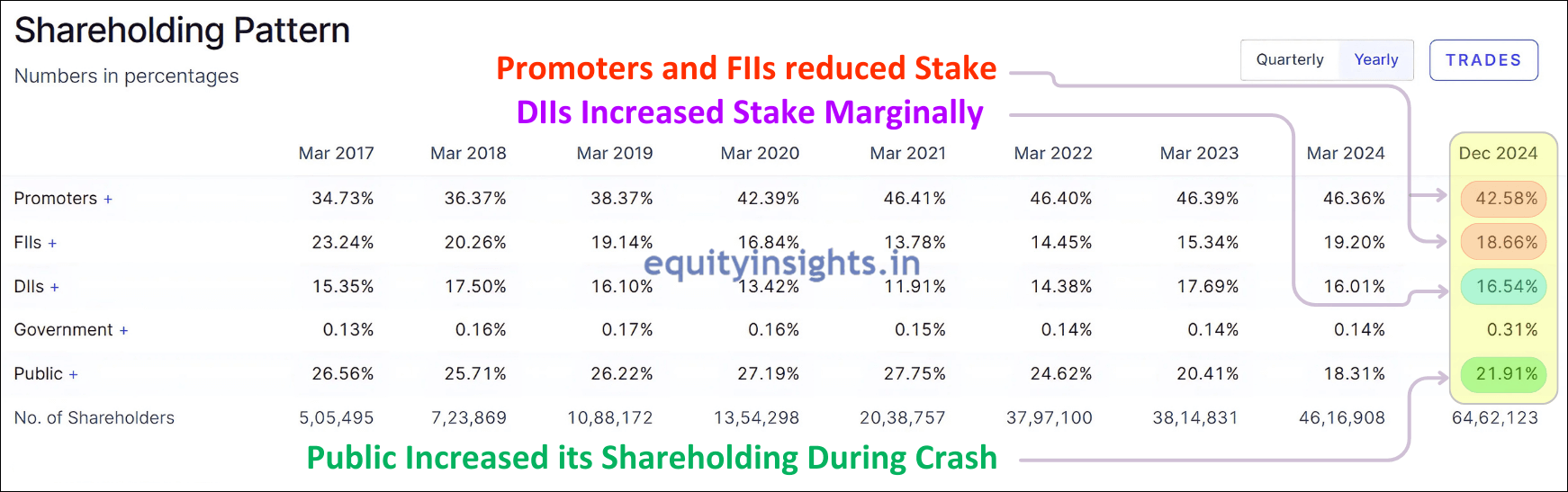

One fascinating aspect of Tata Motors is its evolving shareholding pattern, which reflects how the company has navigated various market phases over time. If you look at the company’s shareholding pattern, you will find it very interesting during the bad phase of the company. Between 2015 and 2020, as the company’s performance declined, both FIIs (Foreign Institutional Investors) and DIIs (Domestic Institutional Investors) offloaded their holdings, while public shareholding steadily increased. However, when the business staged a strong turnaround, the trend reversed—institutional investors rushed back in, while retail investors began booking profits. Interestingly, promoters displayed unwavering confidence, consistently buying shares between 2017 and 2021.

But more recently, between March 2024 and December 2024, there has been a shift—promoters have trimmed their stake, FIIs have slightly reduced holdings, DIIs have marginally increased their position and public shareholding has risen from 18.31% to 21.91%. These movements indicate evolving market sentiment and investor strategy around Tata Motors.

More Correction Ahead or Worst is Over?

The final question now is what can be the expectations from Tata Motors? Will it continue to fall further or has it bottomed out?

So, first of all, share price movement depends on two key factors: earnings growth and valuation. Earnings growth, in turn, is driven by the demand for the vehicles across all the geographies, the company operates in. However, some things are beyond the company’s control. For example, if demand in China slows down and the entire auto sector struggles, Tata Motors will also face challenges. Even the company’s management admits that they cannot predict when the situation will improve. In a recent conference call, they said: “We need some time to work out whether what’s going on in China is cyclical and it will rebounce, whether it will not rebounce or whether it will go further down from here.”

On top of this, competition is something that is again not in control of company and that’s where in the near term, Tata Motors share price would only depend on company’s Q4 performance which in turn would depend upon demand scenarios across India, China, Europe and the US. So, we need to keep a close eye on quarterly results.

In spite of all these challenges, I don’t think, the share price of Tata Motors would see a sharp correction of 80-90% like previous cycles as under the leadership of Mr. N. Chandrasekaran, the company has come a long way. Today, this company is generating the cash flow of more than ₹67,000 crore and is leading the EV car industry in India with many best sellers. In fact, Tata Motors’ Punch has become India’s most-selling car and has broken Maruti’s record of 40 years.

Not only that, company is investing significantly in building the car future technologies, launching multiple new products including EV version of Tata Harrier, Tata Sierra and Tata Avinya. Jaguar is also now re-positioned as a luxury car and entering into a new era of only electric versions. In the next few years, the company is going to launch multiple EV models across four brands of JLR.

The company is also working towards increasing EV adoption in the country with a plan to more than double its charging stations to 4 lakh by 2027. Additionally, the company is doing backward integration by investing $1.5 billion in a battery gigafactory that is planned to commence operation in 2026. This facility aims to reduce dependence on external suppliers and enhance competitiveness in the growing EV Market. As far as the near-term is concerned, Tata Motors is taking steps to mitigate the challenges where one key initiative is controlling the inventory levels. Management mentioned that “Going forward in Q4, a key focus is going to remain in terms of driving growth by capitalizing on low-channel inventories and healthier dealer network.”

Read More: Top 5 FIIs You Can’t Miss For Multibagger Ideas

Way Forward

By now, you should have got a clear understanding of the challenges Tata Motors faces and how the company plans to tackle them. As I mentioned earlier, not everything is within the company’s control, but the management is actively addressing the factors they can influence. I have strong confidence in the company’s leadership, especially given its dominant position in the fast-growing EV market, which is undoubtedly the future of the 21st century.

When it comes to growth, India remains one of the fastest-growing economies, far ahead of regions like Europe, the US and China. However, only 35% of Tata Motors’ revenue comes from India, with the majority generated in slower-growing international markets. This global exposure means it won’t command the same valuation as companies like Maruti Suzuki or Mahindra & Mahindra, which are primarily focused on India’s high-growth market.

Post-correction, Tata Motors share price today stands at ₹648.30, trading at a P/E ratio of 7.50 and a Market Cap-to-Sales ratio of 0.54 — slightly above its 10-year median of 0.50. This suggests that valuations remain reasonable at this stage. However, in the near term, everything would boil down to quarterly performance. That said, I’m quite confident in the company’s long-term story and this correction should not create panic. It may continue to test patience if the weakness persists in the coming quarters but in the long run, Tata Motors should reward the investors. Additionally, the company has also announced the demerger of its passenger and commercial vehicle businesses, scheduled for July 2025, which could unlock further value for investors.

I’ll wrap up this article here as I’ve shared all the key insights from my research over the past few days. My goal was to provide you with a clear understanding of Tata Motors’ current situation, its challenges and its growth prospects. I hope you found this analysis valuable. If you did, I’d truly appreciate it if you could share this article with your friends, fellow investors or anyone who might find it useful. Engaging in discussions and staying informed is the best way to navigate the ever-changing stock market. Thank you for taking the time to read this! I’ll be back with more insights in my next article. Until then, take care and happy investing!

Disclaimer: We are not a SEBI-registered research analyst. The information provided in this article is intended solely for educational, illustrative and awareness purposes. Nothing contained herein should be construed as a recommendation. Users are encouraged to seek professional financial advice before making any decisions based on the content provided.