Hello everyone! I recently studied the research report titled “Fundamental New Year Picks 2025” by Axis Securities and found it very interesting. This report briefly reviews market performance in 2024 and shares the outlook for 2025, covering key factors that would drive market performance in 2025. Then, this report introduces 6 golden investment themes for the year and highlights 9 carefully selected fundamental stock picks—along with the reasoning behind each selection. I found this report quite interesting, so I thought of sharing it with you all. All right, let’s dive in!

Table of Contents

Market Recap of 2024 & Outlook for 2025

2024 was a year of mixed performance for the Indian stock market. The first half was fantastic with good growth in the large-cap index and excellent growth in the mid and small-cap index however, the second half witnessed correction and volatility driven by multiple factors:

- Earnings momentum slowed, raising concerns about future growth.

- The general election outcome fell short of expectations, adding political uncertainty.

- FIIs turned net sellers, shifting focus towards China within emerging markets.

- Sectoral slowdowns in FMCG, Auto and even weak deposit growth in banks added to the pressure.

- A surge in US bond yields and a rising dollar index further dampened investor sentiment.

The key question now is—what’s the outlook for 2025? As per the report by Axis Securities, the market will closely monitor the global development around events like policies in the US government during the Trump presidency, trade policy, further rate cut by the US Fed in 2025 and direction of currency and oil prices. On the domestic front, the market will closely monitor developments towards the earning growth, upcoming budget and rate cut trajectory in the Indian market.

As far as the budget is concerned, the last few years of budget were focused on capex and that was a key trigger for economic growth however this resulted in lower allocation to socio-economic schemes and resulted in challenges in rural parts of the country. Recently, the Maharashtra election witnessed schemes like Mukhyamantri Ladki Bahin Yojana that became a massive hit and the expectation is that social schemes would play a key role in the upcoming election in Indian politics.

Considering all these factors, the first half of 2025 is expected to remain volatile, specially because the current valuation offer limited scope for further expansion and that’s where corporate earnings would be the most important factor.

Read More: The Power Players: 6 Top HNIs Influencing the Stock Market!

How Accurately Axis Securities Identified Key Market Drivers?

Since, Axis Securities published this report on 26th December, 2024, well before these major events unfolded, making it worth noting how accurately they identified key market drivers.

The markets had already reacted with a sell-off after Donald Trump took office, driven by concerns over a potential trade war sparked by his tariff policies. Investor sentiment took another hit with disappointing December quarter earnings as companies failed to meet expectations. On top of this, Finance Minister Nirmala Sitharaman, in the Union Budget 2025-26, introduced bold tax reforms aimed at boosting middle-class savings and consumption.

Key Tax Reform Highlights:

- Zero Tax Liability up to ₹12 Lakh – Individuals earning up to ₹12 lakh annually will now pay zero tax.

- Enhanced Standard Deduction – With the revised deduction of ₹75,000, income up to ₹12.75 lakh is effectively tax-free.

Meanwhile, the trend of financial assistance schemes for women gained momentum across states, following Maharashtra’s initiative. Similar schemes emerged in Jharkhand and Delhi during their respective elections:

- Jharkhand – Mukhyamantri Maiya Samman Yojana: Originally offering ₹1,000/month, the ruling JMM government increased it to ₹2,500/month during the 2024 election campaign, effective December 2024.

- Delhi – Mahila Samriddhi Yojana: The newly elected BJP government introduced financial aid of ₹2,500/month for economically weaker women.

With these significant developments shaping market sentiment, Axis Securities proved to be spot-on in identifying key trends ahead of time!

So, going forward, in 2025 focus should be on bottom-up stock picking with growth at a reasonable price strategy and that’s where Axis Securities has identified six themes for 2025, which include structural play in premium consumption, the growth story of the Indian healthcare industry, companies with higher growth potential in the infrastructure value chain, pharma and telecom as a defensive play, real estate led by demand visibility and reasonable valuation play in BFSI (Banking, financial services and insurance) and the right mix of rate cut cycle –defence, infra and consumption. Based on these six themes, Axis Securities shortlisted nine stocks with buy on dip strategy for 2025. Let’s have a look at the list.

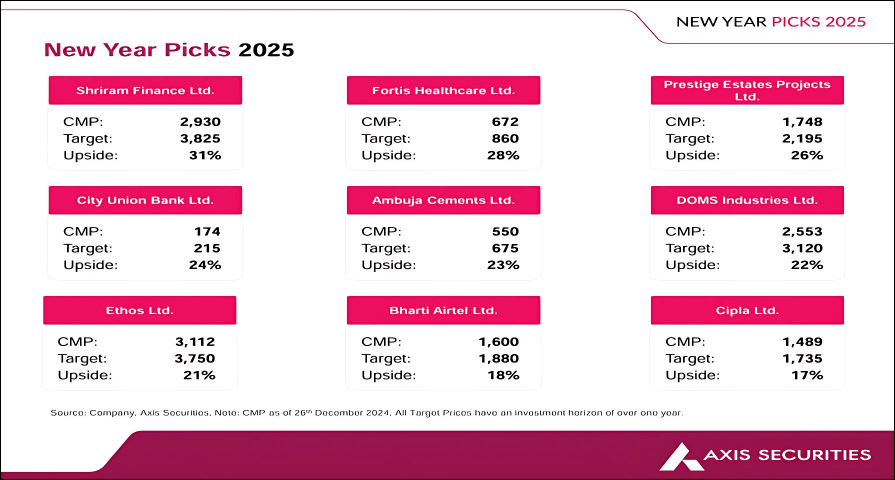

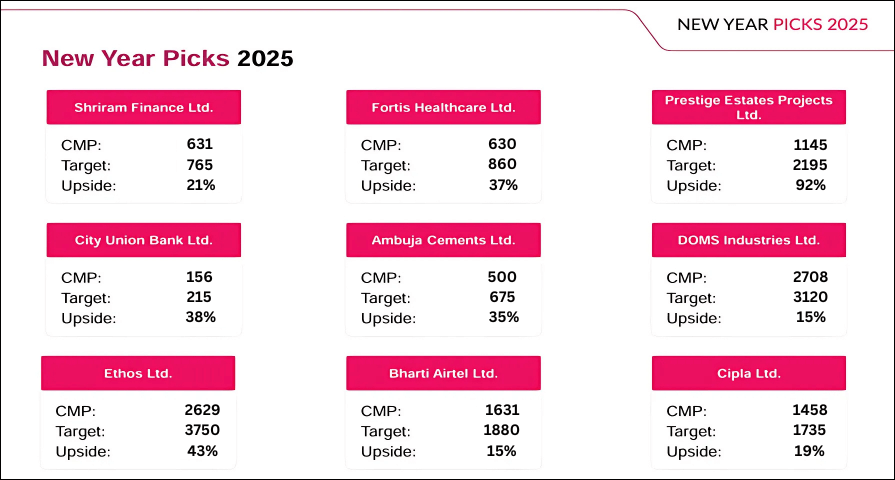

NOTE: This report was originally published on December 26, 2024 by Axis Securities, when share prices were significantly higher. So, in the report, the target price percentages were calculated based on the market prices at that time. Below is the image that shows the stocks recommended by Axis Securities as per the share prices as of December 26, 2024:

However, with the market experiencing a major correction since then, this presents a golden opportunity to buy these stocks at a much lower price than stated in the report. While we continue to aim for the same targets across all stocks as outlined in the report, with the recent dip in stock prices, we have recalculated the target percentages based on share prices as of March 8, 2025.

Read More: Top 6 DIIs and Elite Fund Managers Making Market Waves!

Axis Securities Stock Recommendations for 2025

1. Shriram Finance

The first pick from Axis Securities for 2025 is Shriram Finance. Shriram Finance (SFL) is the flagship company of the Shriram Group, born out of the merger of Shriram Transport Finance (SHTF), a pioneer in used commercial vehicle (CV) financing and Shriram City Union Finance (SCUF). It’s a diversified retail-focused NBFC with a dominant position in used CV financing. Used CV financing market remains dominated by unorganized players, that command nearly 50-55% market share. So, there’s a lot of scope for the growth of organized players.

Shriram Finance has an AUM of ₹2.43 lakh crore as of September 2024 and operates through an extensive network of nearly 3,149 branches and 679 rural centres. Beyond CV financing, the company has strategically expanded into gold loans, two-wheeler loans, MSME and personal loans, creating a more diverse and resilient portfolio with reduced dependency on commercial vehicles. Additionally, Shriram Finance maintains a strong asset quality with a lower proportion of unsecured loans, ensuring stability and long-term growth.

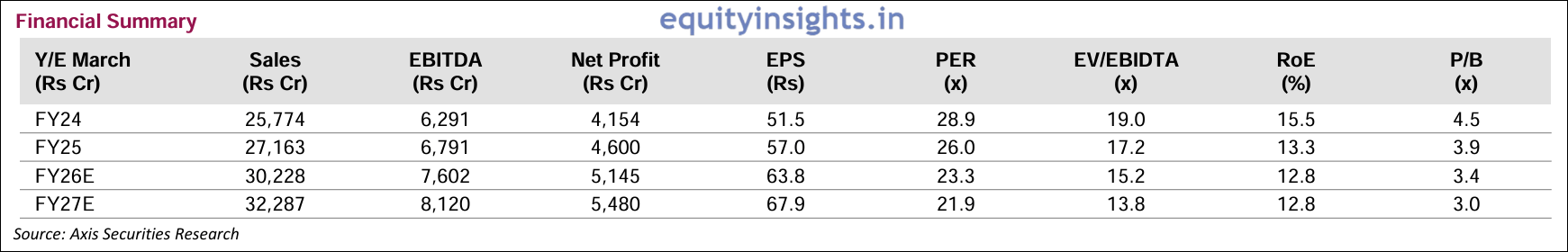

However, a few macro challenges persist, including lower government capex and weaker urban consumption, as reflected in slowing volumes, which impact the CV portfolio. Despite these hurdles, the management remains confident in navigating the challenges while sustaining asset quality and credit costs at current levels. Axis Securities projects Shriram Finance to achieve impressive growth over FY24-27, with AUM and net interest income (NII) expanding at a robust 17% CAGR, while earnings surge at 19% CAGR. This strong momentum is expected to drive a healthy ROA of 3.3-3.4% and ROE of 16-17%, reinforcing its profitability and long-term value creation.

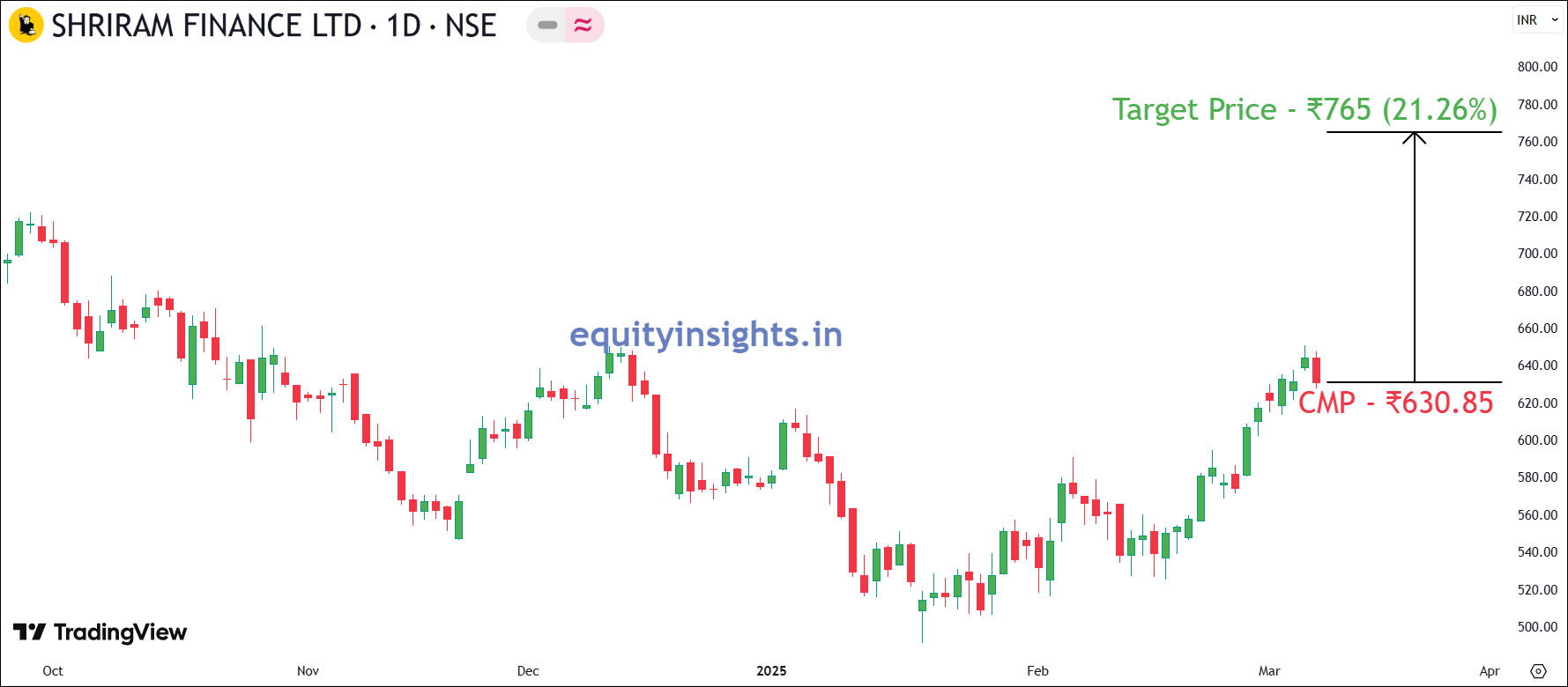

Based on robust growth projections, Axis Securities has set a target price of ₹3,825 for Shriram Finance, indicating a potential upside of over 21% from the current market price (CMP). However, with Shriram Finance’s 1:5 stock split (where 1 share of ₹10 face value was split into 5 shares of ₹2 each) effective from January 10, 2025, the revised target price now stands at ₹765 (equivalent to ₹3825) post-split.

2. Fortis Healthcare

The second top pick comes from the hospital sector—Fortis Healthcare. The company operates 28 healthcare facilities, over 4,500 operational beds and more than 400 diagnostics centres, making it one of the largest healthcare organizations in the country. Fortis is renowned for its expertise in complex medical procedures, excelling particularly in cardiac surgeries, radiation therapies and robotic surgeries.

Fortis Healthcare has shown impressive operational growth, with its occupancy rate rising from 55% in FY21 to 65% in FY24 and expected to stabilize at 68% by FY27. Meanwhile, its Average Revenue Per Occupied Bed (ARPOB) has surged at an 8.7% CAGR, reaching ₹61,000, and is projected to climb further to ₹70,000 over the same period.

Additionally, the health insurance market, growing at an 18% annual rate, will add another ₹15,000 crore in premiums and would cover another 33 million people. Fortis has planned to add 2,000 beds over 4 years boosting its capacity by 45% to over 6,000 beds, primarily through quicker break-even brownfield projects. The expected improvement in occupancy rate along with rising ARPOB and strategic brownfield expansion are set to significantly enhance its profitability. By FY27, Fortis Healthcare’s revenue is expected to reach ₹10,661 crore levels and PAT to grow more than two times to levels of ₹1421 crore.

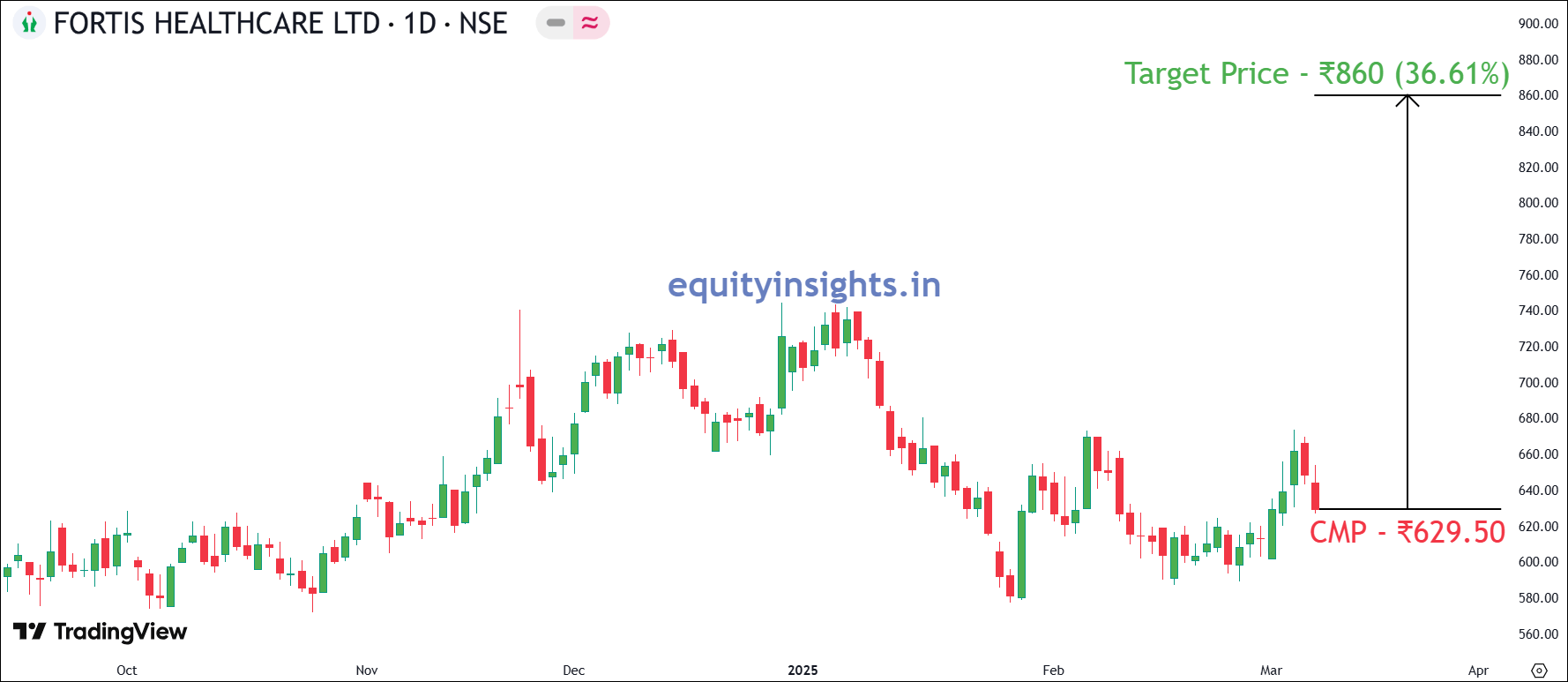

Based on these growth projections, Axis Securities has recommended a buy rating on Fortis with a target of ₹860 per share, implying an upside potential of over 36% from its current market price (CMP) of ₹629.50.

Read More: Top 5 FIIs You Can’t Miss For Multibagger Ideas

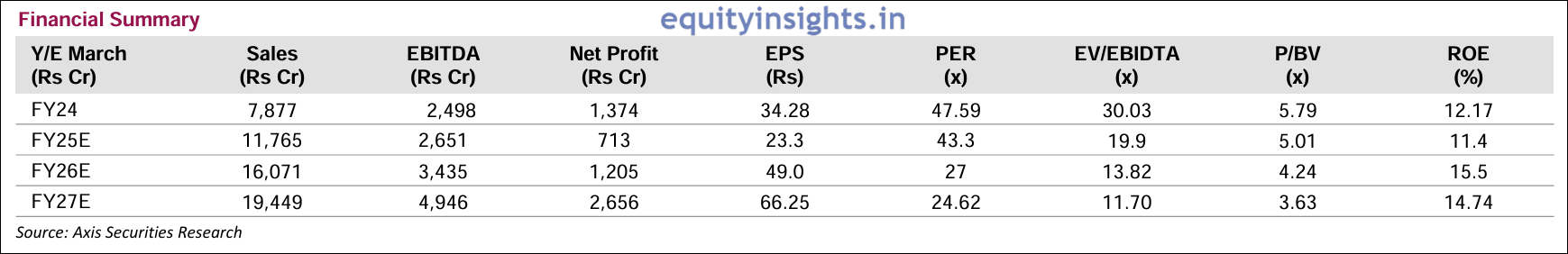

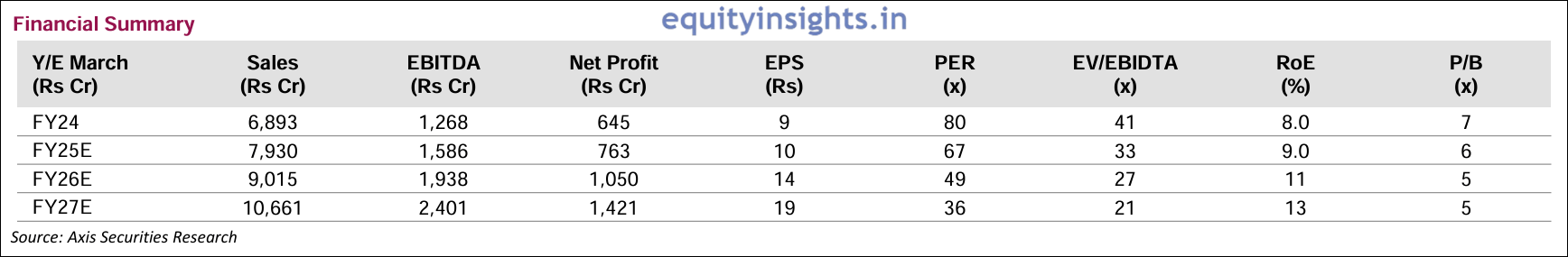

3. Prestige Estates

The third stock in the list comes from the dynamic real estate sector—Prestige Estates, also known as Prestige Estate. As a leading real estate developer based in Bengaluru, it stands out for its strong market presence and growth potential. Established in 1986, the group has pioneered many landmark developments. The company boasts a diversified portfolio that includes residential projects (villas, apartments, townships), commercial projects (corporate offices, IT parks, SEZs), retail businesses (shopping malls, multiplexes, luxury retail) and hospitality ventures (hotels, service apartments and resorts).

The first rationale behind investment in Prestige Estates in 2025 is key launches in H2 FY25. Management has guided a pre-sale of ₹24,000 crore in FY25. Out of this company has already achieved pre-sales of ₹8,000 crore in H1 FY25 and management is confident of reaching its guidance and launching major projects in the remaining quarters. These launches will include projects such as Prestige Southern Star, Prestige City-Indirapuram and Pallava Gardens. The remaining launches are expected to have a Gross Development Value (GDV) of ₹52,000 crore, which could result in pre-sales of ~₹20,000 to ₹22,000 crore. This aligns with the management’s guidance for pre-sale numbers, with the potential to exceed it during FY25.

On top of this, the company has completed its QIP of ₹5,000 crore. These funds would be utilized for debt repayment, business development and construction for rental assets. The expected free cash flow from ongoing projects stand at ₹13,863 crore while those from upcoming projects are projected at ₹32,037 crore, resulting in a total free cash flows of ₹45,000 crore over the years. The company’s total debt is around ₹10,000 crore at the moment, with net debt at ₹3,592 crore, which indicates a net debt-to-equity ratio of 0.21, which is within their guidance. This level of debt will comfortably fund the future capex of around ₹13,000 crore for their annuity portfolio buildup.

The company’s sales are expected to grow from ₹7,877 crore in FY24 to ₹19449 crore by FY27 and PAT is expected to grow from ₹1374 crore to ₹2656 crore during the same period. Considering these factors, Axis Securities has given a buy call on the stock with a target price of ₹2,195, implying more than 91% upside from its current market price of ₹1144.85.

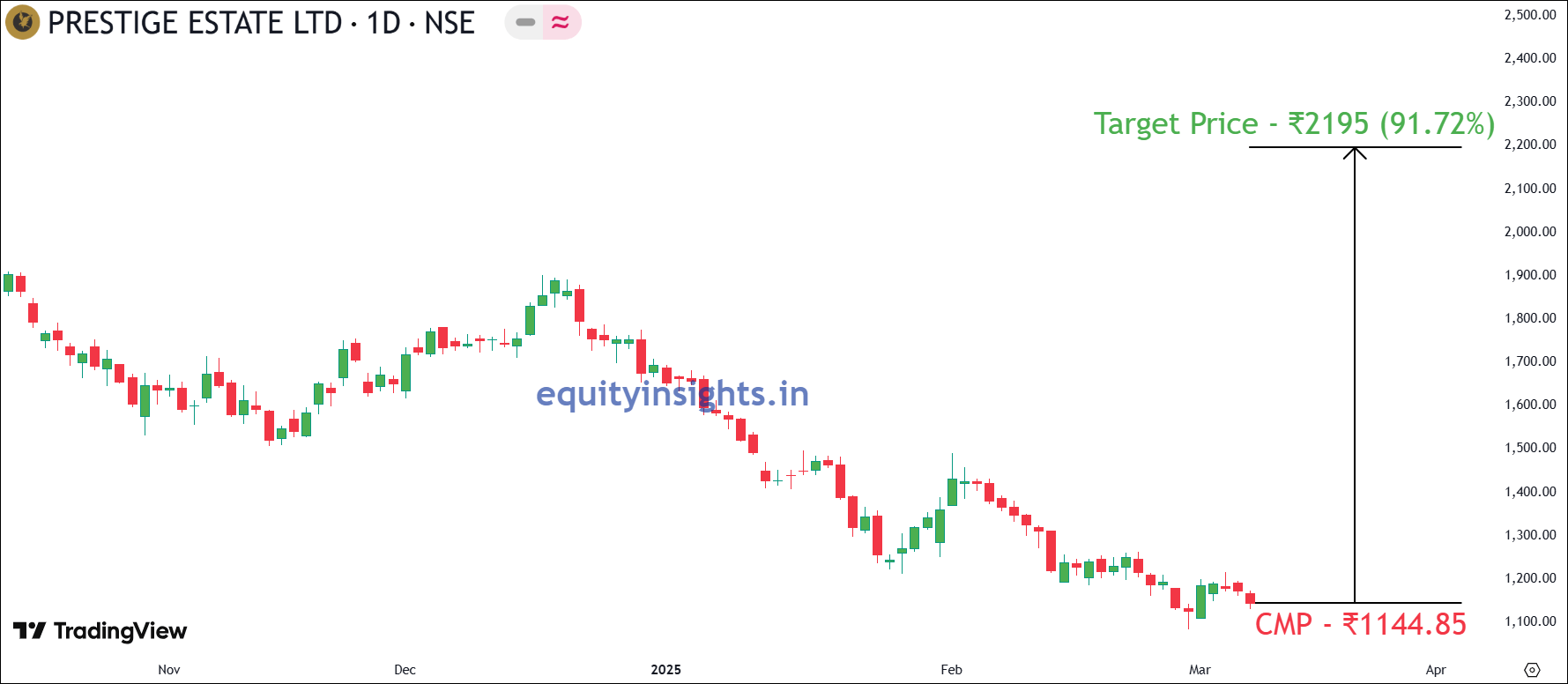

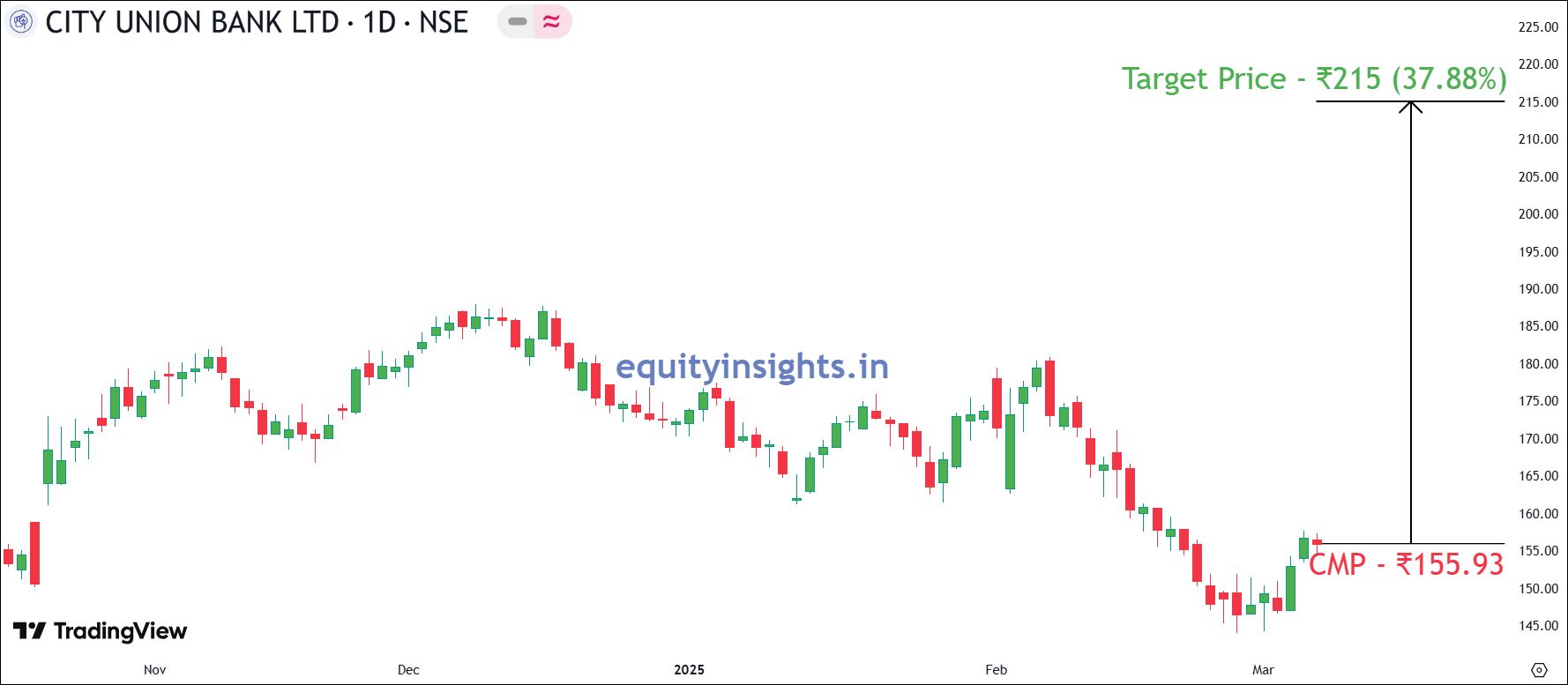

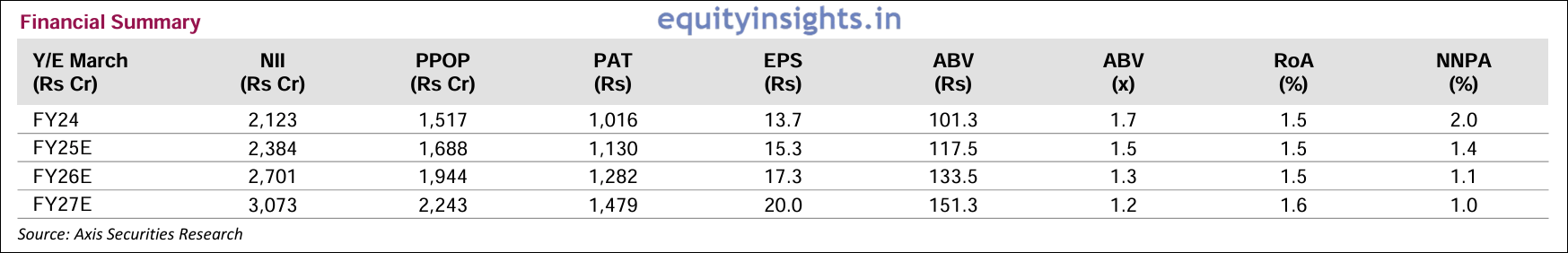

4. City Union Bank

The fourth stock picked by Axis Securities for 2025 is from the banking sector and it’s City Union Bank (CUB). Incorporated in 1904, City Union Bank is a mid-size private sector bank headquartered in Kumbakonam, Tamil Nadu and operates its business through 812 branches, with a strong presence in South India, having around 700 branches. Tamil Nadu accounts for around 65% of the branch network, 80% of deposits and 66% of the advances portfolio.

The bank’s main focus is lending to MSME and retail/wholesale trade with a granular asset profile including providing short-term and long-term loans to the agricultural sector. The focus remains on trading and MSME loan segments, which constitute ~41% of advances and around 99% of their loan book is secured. CUB’s growth is rebounding with new initiatives and a tech overhaul, driven by strong MSME & gold loan demand. Credit growth is set to align with the system in FY25E and accelerate from FY26E. Expanding into retail secured loans, it aims for 7-8% portfolio share in 3-4 years. With a focused strategy and strengthened team, CUB is on track for ~14% CAGR growth (FY24-27E).

The management expects the slippages to trend downwards, as it expects to cap its FY25 slippages at ₹800 crore. The bank expects to exit FY25 with NNPA ranging between 1-1.25%, thereby strengthening its PCR and bringing it in line with peers. On top of this, the bank intends to transition its gold loan book into a fixed rate book, from a floating rate currently, as it would bode well from a margin perspective in a rate cut cycle. Currently, ~25-30% of the book has already transitioned towards a fixed rate and the management expects ~50-60% of the book to transition by the start of the rate cut cycle. CUB has guided NIMs at 3.6% (+/-5bps).

Overall, the expectation is that City Union Bank will continue to grow at a healthy rate due to good credit growth in its core segment. CUB faces no challenges with deposit growth, ensuring a stable Loan-to-Deposit Ratio (LDR), while its asset quality continues to improve. Backed by strong fundamentals, Axis Securities has given a buy call with a target price of ₹215, signaling a potential upside of over 37% from current levels of ₹155.93.

Read More: Top 5 FIIs You Can’t Miss For Multibagger Ideas

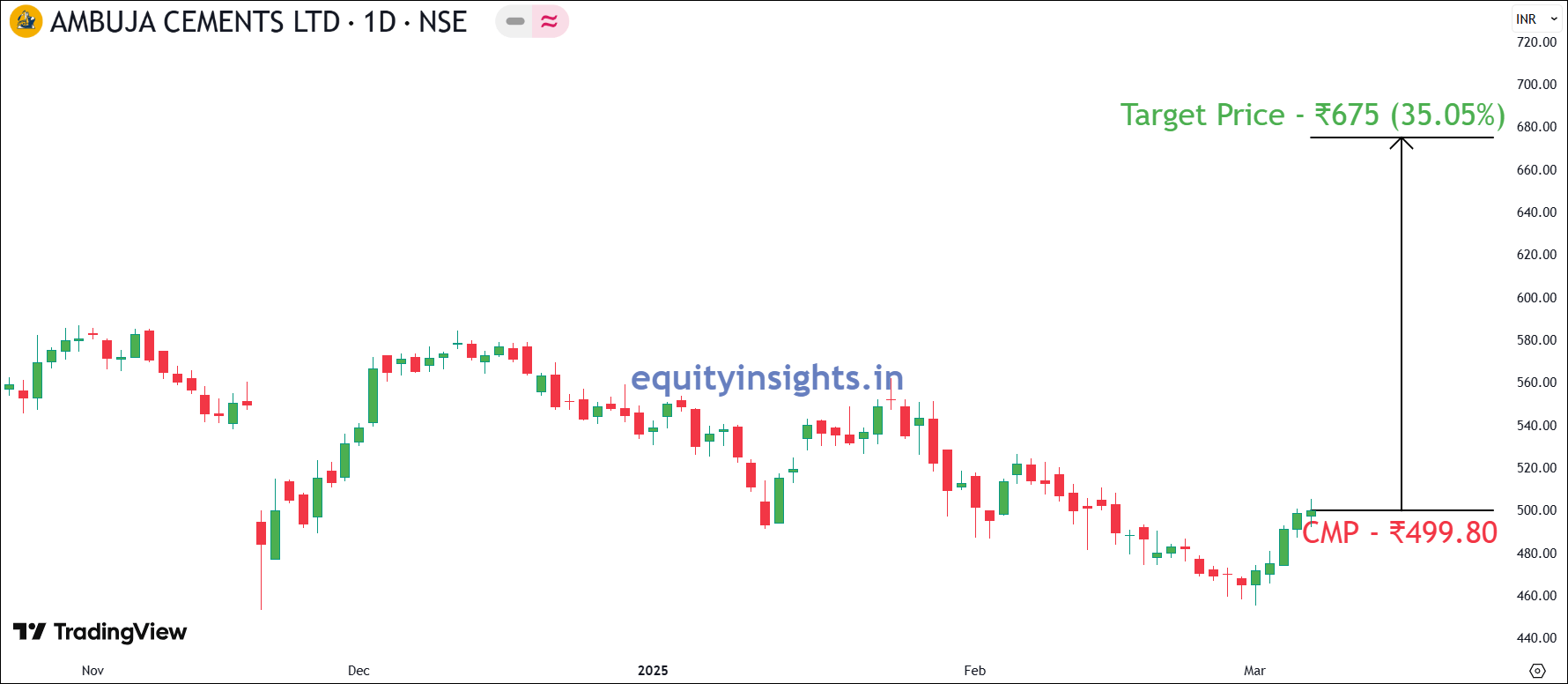

5. Ambuja Cements

The next stock comes from the cement sector—Ambuja Cements also known as Ambuja Cement, now a part of the Adani Group. It is a leading cement manufacturer in India which has a consolidated cement capacity of 97 million tonnes, with a widespread operational presence across the country.

The first rationale behind investment in Ambuja Cement is the capacity expansion to drive volume and revenue growth. Ambuja Cement’s capacity is expected to increase from current levels of 97 MTPA (including 8.5 MTPA from Orient Cement) to 118 MTPA (million tonnes per annum) over FY25-FY26 and reach a combined capacity of 140 MTPA by FY28. As a result, between FY24-FY26E, Ambuja Cement is set to achieve 10% volume growth and an 8% CAGR in revenue. On top of this, the company’s margins are expected to improve from current levels of 18% to 19-20% due to various cost optimization measures taken by the company. Also, there’s consolidation happening in the cement industry which is positive for Ambuja Cement.

As far as demand is concerned, it is expected to remain strong driven by increased capital spending by the central government on infrastructure projects such as roads, railways and housing, along with robust real estate demand. Ongoing investments in infrastructure development are expected to further boost cement demand. The industry is projected to grow at a CAGR of 7-9% during FY24-FY26. So, for all these reasons, Axis Securities has given a buy call on the company with a target price of ₹675, which implies more than 35% upside from current levels of ₹499.80.

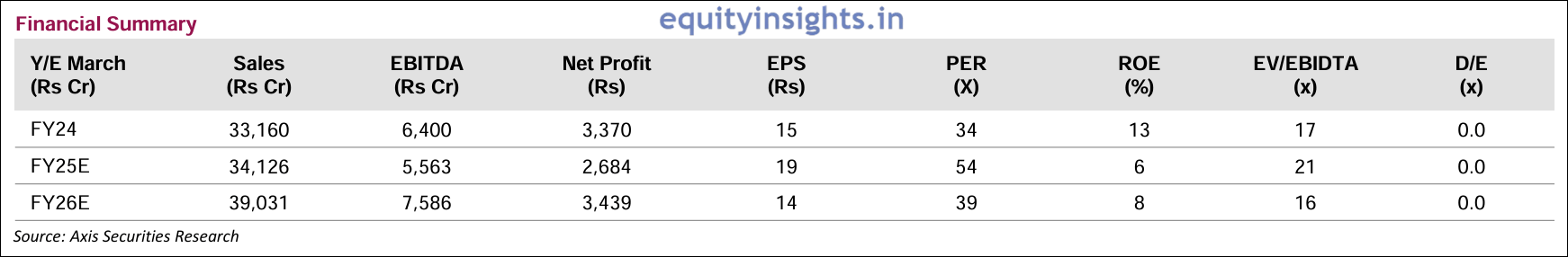

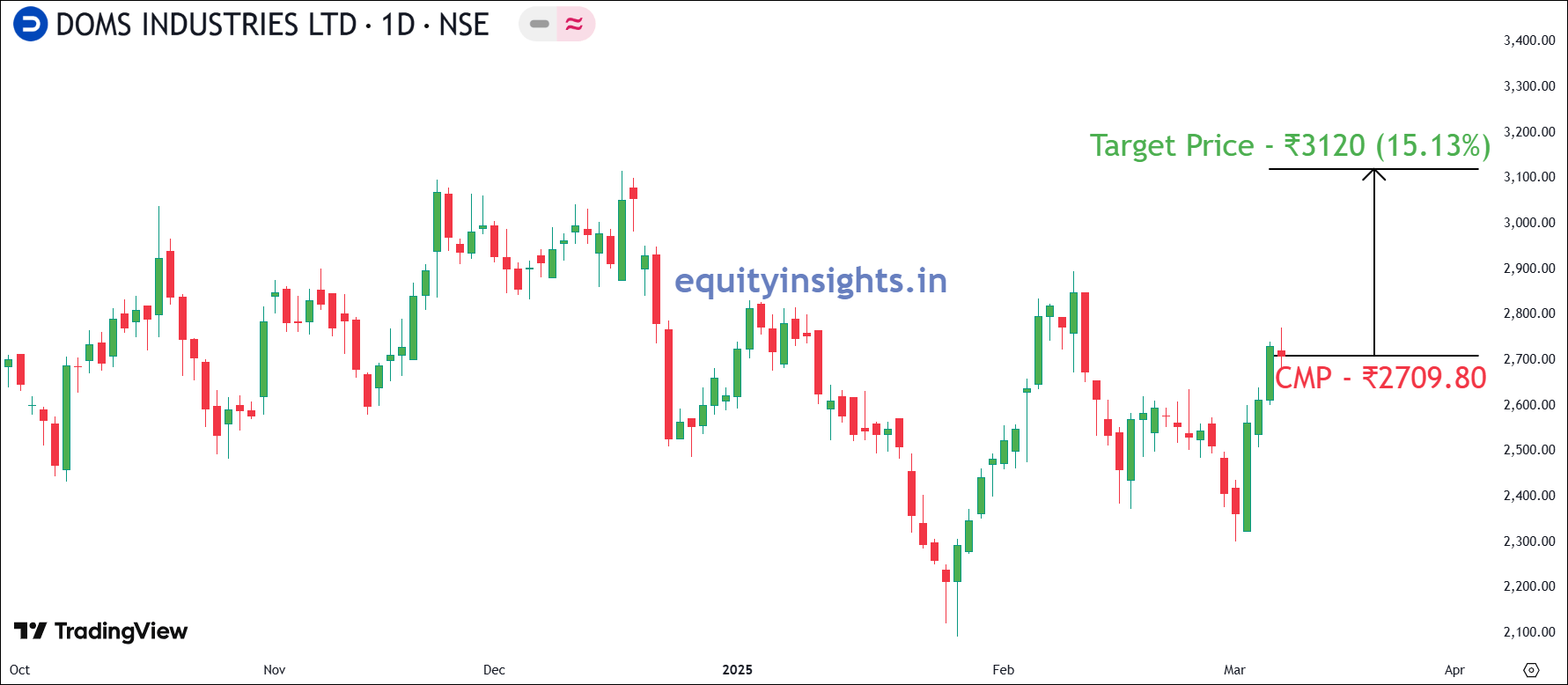

6. DOMS Industries

The sixth stock picked by Axis Securities is DOMS Industries, one of India’s leading names in stationery and art supplies. Renowned for its high-quality products, the company designs, develops, manufactures and sells a diverse range of well-designed quality stationery and art products, spanning scholastic stationery, scholastic art materials, paper stationery, kits & combos, office supplies, hobby & craft essentials and fine art products. Expanding beyond stationery, the company has now ventured into the baby hygiene segment, marking an exciting new chapter in its growth.

There’s a structural growth trend in the stationery and art materials and the sector is expected to grow at 13% CAGR from FY23-FY28, reaching a market value of ₹71,600 crore by FY28 from ₹38,500 crore in FY23. DOMS is consistently increasing its product portfolio and expanding its distribution network, growing from 1.225 lakh outlets to a projected 3-3.5 lakh outlets. Its strategic partnership with FILA enables global reach while leveraging FILA’s R&D expertise, giving DOMS a strong long-term edge in the market.

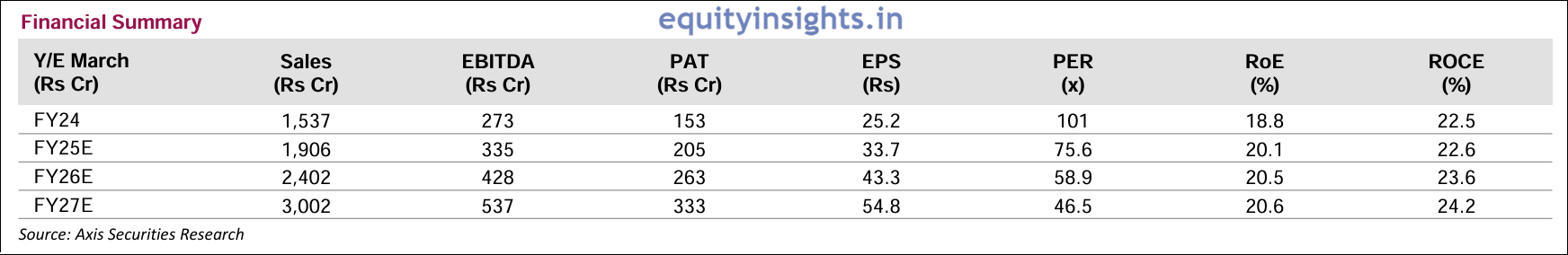

Also, there’s scope for margin expansion driven by operating leverage through increasing capacity utilization, improving product mix, stable raw material prices and improving on-ground execution. DOMS revenue is expected to double to ₹3,002 crore and net profit to grow more than two times at ₹333 crore by FY27. Similarly, its ROCE will likely improve from 22% in FY24 to 25% in FY27. Based on these growth projections, Axis Securities valued the company at around 60 times the December 2026 earnings to arrive at a target price of ₹3,120/share, implying an upside of around 15% from the current levels of ₹2709.80.

Read More: Sensex Historical Data: Sectors that can Outperform in 2025

7. Ethos

The next stock in the list comes from the luxury retail sector — Ethos Limited. Established in 2003, Ethos is one of India’s largest luxury and premium watch retailers with a 20% market share in the luxury segment and 13% in the premium watch segment. The company is a subsidiary of KDDL and has a presence in 26 cities in India with 72 stores as of September 2024. It also has an omnichannel presence and offers products through its websites and social media platforms. In India, the company caters to over 60+ premium and luxury watch brands, which includes 55+ exclusive brands that are available exclusively at Ethos.

The first key factor to consider Ethos is structural growth trend in the luxury space. As per estimate, the luxury market in India will expand 5x in the next decade as number of affluent consumers continue to grow with higher aspiration and disposable income.

Premiumisation has become a massive trend in the country where sales of luxury products have been at an all-time high in many segments like luxury cars, luxury real estate, premium clothing and so on. Moreover, the demand for luxury products is not restricted to metros but has extended to Tier 2 and Tier 3 cities. So, there’s an amazing opportunity for retailers of premium and luxury products like Ethos.

Currently, it operates around 72 stores and has guided for opening nearly 22-23 stores in FY25. Out of this, they’ve added 12 stores in H1 and in next 5 years, the company plans to reach 150 stores. It has also opened a Messika jewellery store in New Delhi in January 2025 and targets 8-10 stores in the next five years. Moreover, the company is also discussing to onboard several luxury brands to India in the next few years.

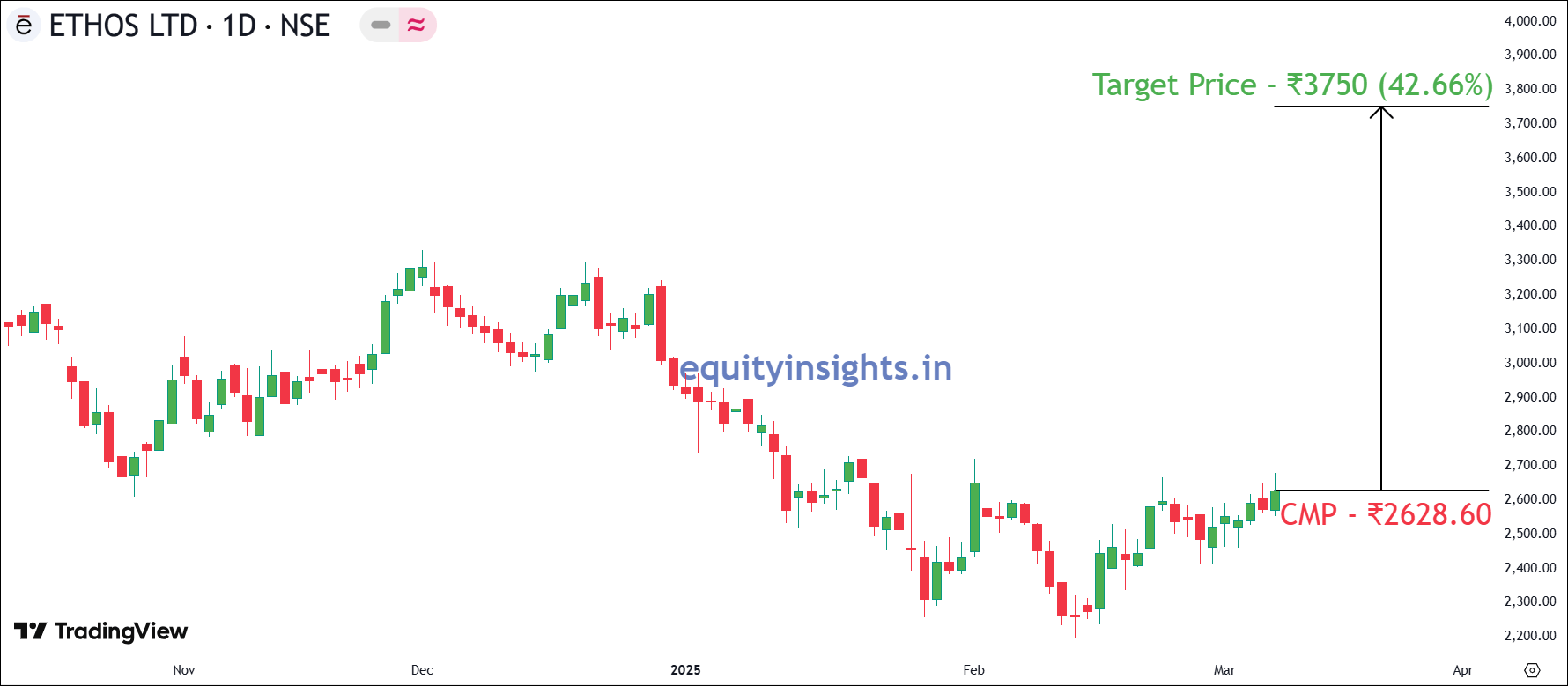

Based on these factors, Axis Securities anticipates the company to report robust revenue growth at 33% CAGR and PAT growth of 38% over FY24-27. They value the company at around 45 times December 2026 earnings to arrive at a target price of around ₹3750 per share, which implies around 42% upside from the current levels of ₹2628.60.

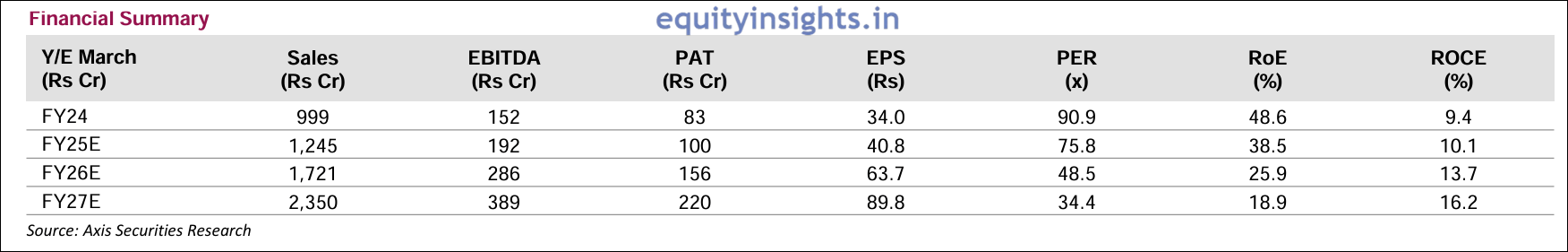

8. Bharti Airtel

The next pick by Axis Securities is a major player from the telecom sector—Bharti Airtel. It is an Indian multinational telecommunications services company headquartered in New Delhi and is India’s second-largest telecom operator, operating in 18 countries across South Asia, Africa and the Channel Islands. The company boasts a robust presence in India and offers a comprehensive digital services portfolio that includes fiber optic cables, desktop telephones, mobile phones and other offerings.

The first reason for selecting Bharti Airtel is its rising ARPU (average revenue per user). It leads the mobile services industry in ARPU, currently at around ₹233, higher than Jio’s ARPU of ₹195 and aims to increase it to around ₹300 in the future by growing its consumption of data and 5G services. Since it’s almost a duopoly market with Jio and Airtel, the company would continue to increase their ARPU, which in turn would continue to increase their profitability.

Management see a significant revenue and profit growth potential in the company fueled by expanding the rural distribution, network investments and increased 4G/5G coverage. Another important factor is moderation in capex. Going forward, Airtel do not expect significant capex in near term after the 5G roll out. It has identified over 2,500 sites for network cost reduction initiatives, which will help lower operating costs in the future.

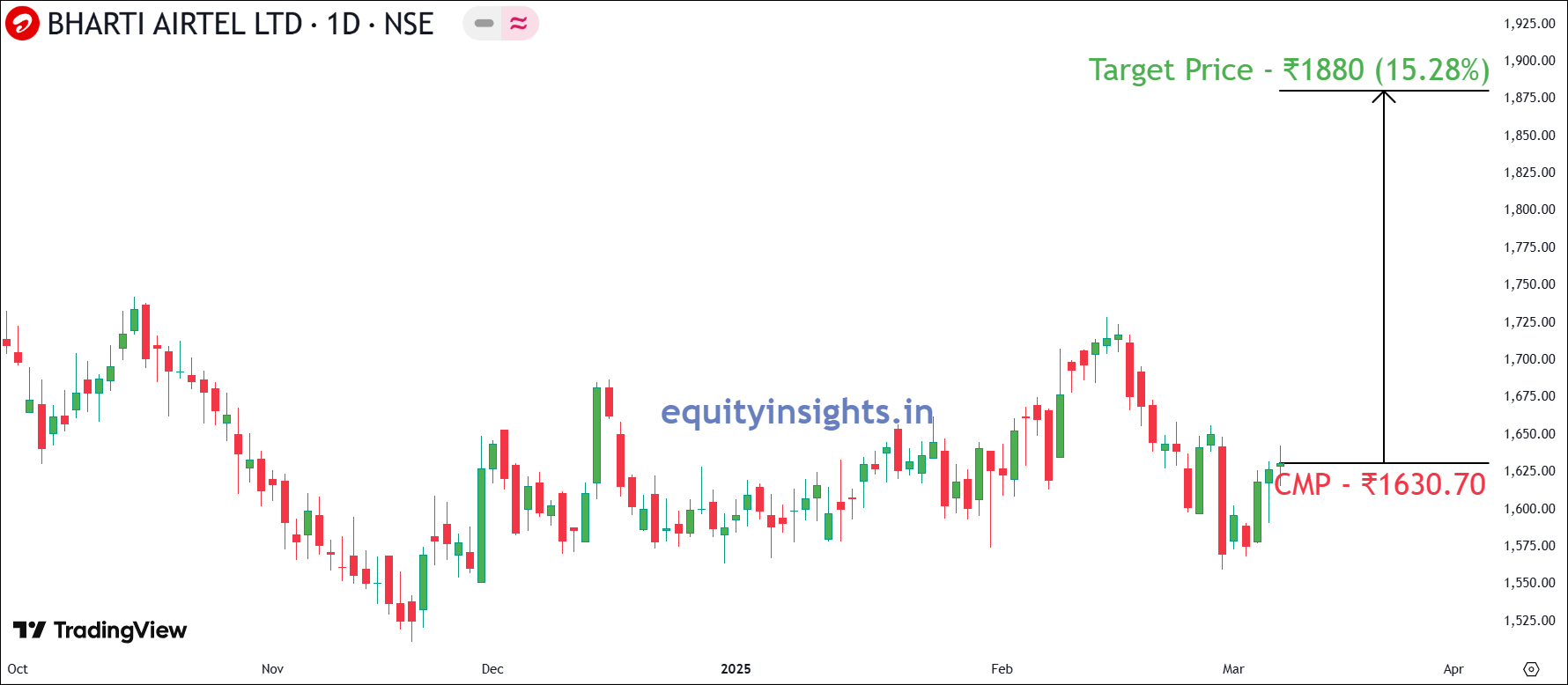

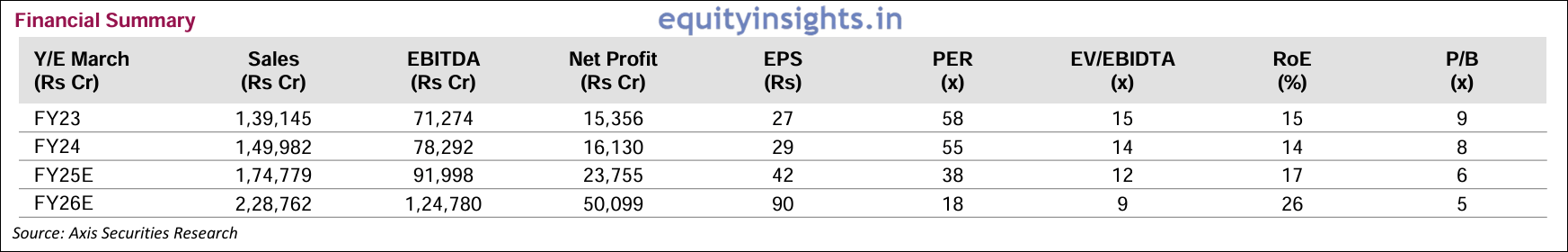

Axis Securities expect Airtel’s EBITDA to grow from ₹78,292 crore in FY24 to 1.24 lakh crore by FY26 and net profit to expand sharply from ₹16,130 crore to ₹50,099 crore during the same period. Based on these projected figures, they value stock at levels of around ₹1,880/share, suggesting a potential upside of 15% from its current share price of ₹1630.70.

Read More: Zaggle Prepaid Share: A Promising Investment or Risky Bet?

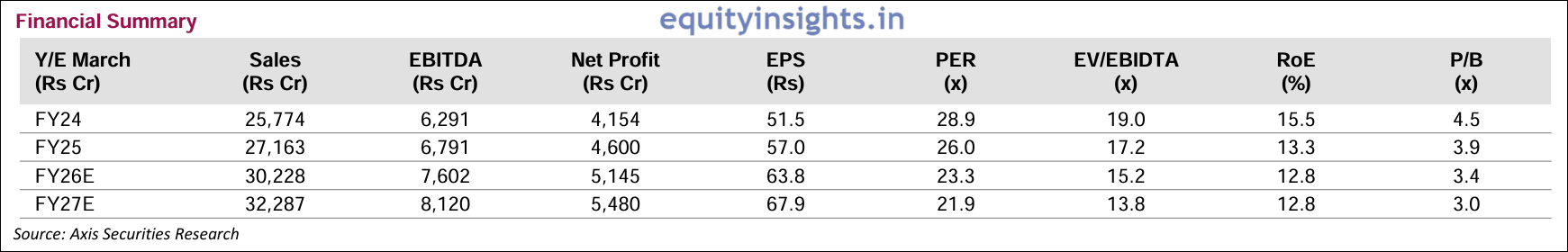

9. Cipla

The final stock in Axis Securities’ report comes from the promising pharma sector — Cipla. It is one of the leading generic pharma companies in India with a presence in respiratory, antiretrovirals, urology, cardiology, anti-infectives and CNS segments. Cipla operates 47 manufacturing facilities producing over 50 dosage forms and over 1500 products utilizing advanced technology platforms to cater to over 80 markets. Cipla’s US revenue stood at $237 million, impacted by lower gLanreotide sales due to a partner’s manufacturing expansion. Sales are expected to rebound in Q4 FY25, with Q3 FY25 projections at $220 million. Cipla has maintained a 15% market share in Albuterol and 35% in gLanreotide.

The key rationale behind investment in Cipla includes growth in US business due to the approval of four new generic drugs, including Calcitonin Salmon Injectable, Dihydroergotamine Mesylate Injectable, Nicardipine Hydrochloride and Hydrocortisone Lyophilized Injection, further boosting growth potential. The company’s India business grew 4.7% YoY, driven by branded prescriptions & trade generics. The Chronic segment now contributes 61% of revenue, outpacing IPM growth. A revamped trade generics (Gx) distribution model enhanced efficiency, while gross margins improved 226 bps YoY. The company posted its highest-ever EBITDA margin (26.7%), with PAT surging 13% YoY to ₹1,305 crore.

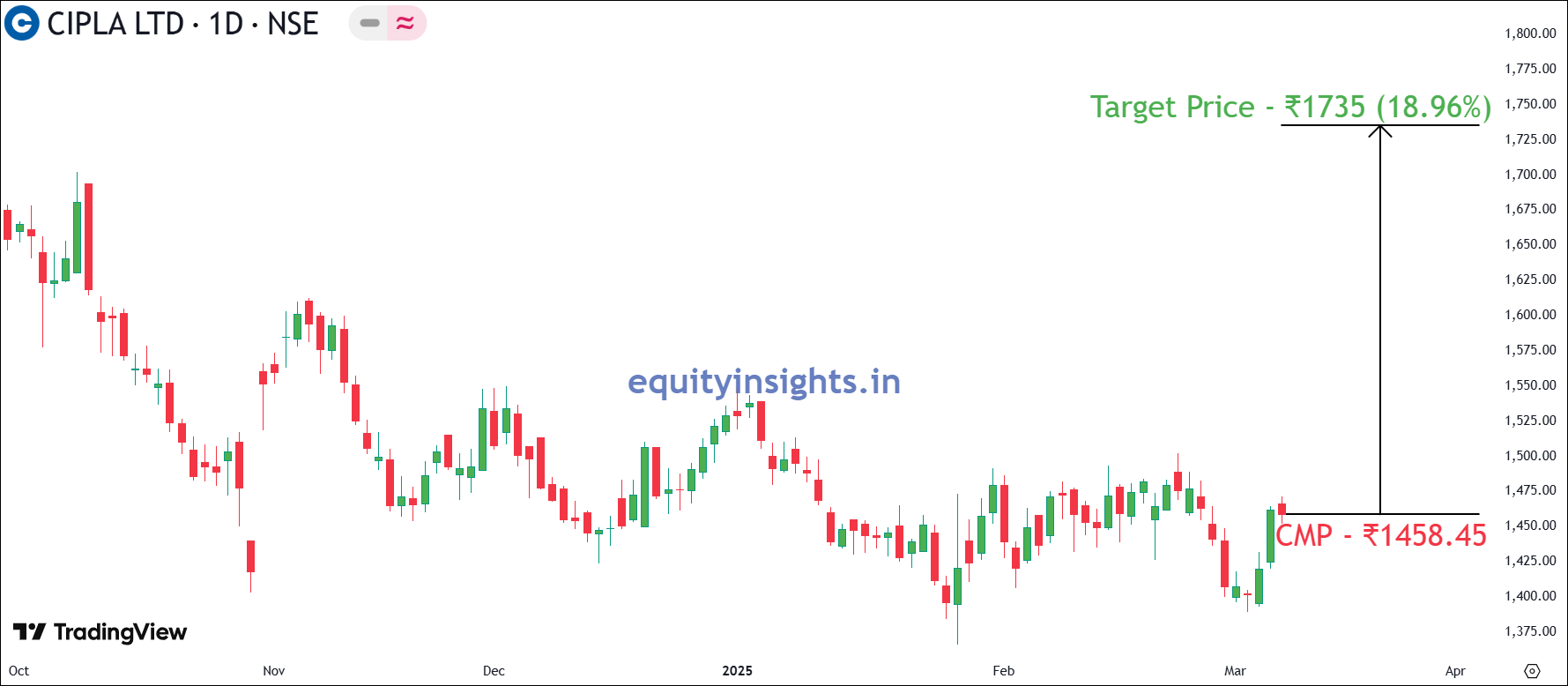

The key catalysts for the company going forward would be the approval for gAbraxane, respiratory and other peptides in US markets and the revival of the domestic branded formulation space. Additionally, company is sitting on cash of ₹8,400 crore that gives the opportunity to take inorganic initiative for mid to long-term growth. Based on all these figures and factors, Axis Securities has recommended a buy with a target price of ₹1735 that implies around 19% upside from current levels of ₹1458.45.

Overview of Stock Recommendations with Revised Target Percentages

Lastly, the image above provides a comprehensive view of each stock’s current price, target price (as recommended by Axis Securities), and the potential upside based on the latest market prices.

Wrapping Up! In this article, we explored Axis Securities’ research report, which provided a compelling outlook for 2025 and highlighted the key drivers shaping market movements. We also explored nine high-potential stock recommendations from Axis Securities, each offering strong upside potential. Now, if you’re eager to dive into the full report, you can download Fundamental New Year Picks 2025 and explore these exciting market insights!

Now, tell me in the comments which stock from this list you believe, holds the most promise for 2025? I’d love to hear your insights! If you found this article valuable, don’t forget to share it with your friends and fellow investors to keep them informed. Stay tuned for the next article, where we’ll uncover more exciting market opportunities.

Until then, invest wisely, stay ahead of the curve and happy investing!

Disclaimer: The information provided in this article is intended solely for educational, illustrative and awareness purposes. Nothing contained herein should be construed as a recommendation. Users are encouraged to seek professional financial advice before making any decisions based on the content provided.