Hey everyone! Welcome to the third and last article of our series on spotting multibagger opportunities! In the first part, we explored 5 top FIIs and their portfolios. In the second part, we covered 6 elite DIIs and India’s super fund managers known for creating massive wealth. Now, in this exciting third part, we’ll dive into the portfolios of 6 top High Net Worth Individuals (HNIs) or Ace Investors to identify multibagger ideas.

Earlier, I had four names in the ace investor’s list but I have decided to add two more names. Now, before we discuss the 6 ace investors and their portfolios, I would like to set the context here. The idea behind this three-article series is to help you track top investment firms and individual investors, guiding you to find multibagger opportunities but that doesn’t mean you should follow them blindly because at the end of the day, it’s your money and only you are responsible for your failure and success.

I always say that if you want to create wealth in the stock market, you need to learn how to study the company because during the bull run every stock looks great but the real test happens during the bear market or when a specific sector or stock falls. In that case, if the company is fundamentally strong, that correction will only create a buying opportunity but if you don’t understand the business, you will panic and sell stocks and that particular decision would separate the winners from the losers in the stock market.

I get attracted by many top FIIs, DIIs and ace investors but rather than blindly following their moves, I use their investments as a starting point for my research. I take the idea to study the company in detail by understanding its business model, leadership, future prospects, financials, key risks and valuation. Then I analyze my risk appetite and only after that do I decide whether to add the stock to my portfolio. After all, these big investors have an enormous risk tolerance, frequently investing in small-cap and micro-cap companies. Therefore, even if they lose a few hundred crores it won’t make any difference in their lifestyle but we can’t afford to lose that significant sum.

That’s why everyone must focus on making a balanced portfolio blending large, mid and small-cap stocks so that risks can be managed effectively and can help in maximizing long-term potential.

The second big lesson from this entire exercise of tracking the portfolio of these strong hands and investors is that each one of them has different winners in their portfolio, yet they all have created amazing wealth because they do their research, build conviction before investing and stick to their conviction and that’s what I expect from you as well. Get ideas from these investors and then do your research to build conviction on a selected few companies that can become your multibaggers. With this, let’s get started with the list of 6 ace investors.

Read More: Zaggle Prepaid Share: A Promising Investment or Risky Bet?

Table of Contents

Top 6 Ace Investors to Track for Multibagger Ideas

1. Ashish Kacholia

The first HNI whom I track very closely is Mr. Ashish Kacholia. I’m sure you all would be aware of him. Even though he doesn’t often interact with the media on TV and other platforms, he does have an X handle where he remains active. Talking about his background, He holds a Bachelor’s degree in Engineering from Mumbai University and later pursued a Master’s from the prestigious Jamnalal Bajaj Institute. As far as experience is concerned, he started his career in 1993, so it’s been more than 30 years now. He served as Head of Research at Edelweiss, then in 1999, he co-founded Hungama Digital with Rakesh Jhunjhunwala and in 2003 started Lucky Securities.

As of today (2nd March 2025), his net worth stands at ₹2,384.86 crores, a sharp decline from over ₹3,000 crores before the recent market downturn. This significant drop highlights how even High Net Worth Individuals (HNIs) are facing substantial losses amid the heavy selling pressure driven by Foreign Institutional Investors (FIIs) in the Indian market. Now, how can you view his portfolio? As I mentioned in the previous article, you can use Screener.in and Trendlyne to explore the portfolios of ace investors with ease. To learn how to search for these investors, you can refer to the first article in this series here: Top 5 FIIs You Can’t Miss For Multibagger Ideas

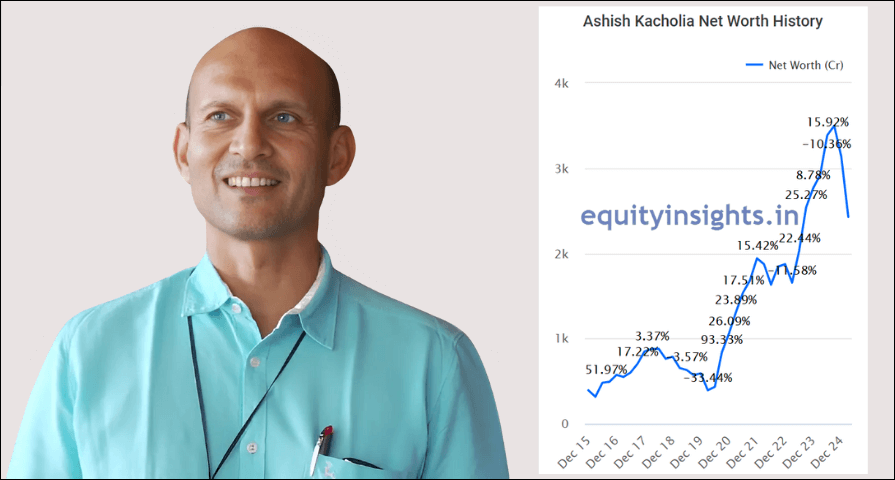

To understand Ashish Kacholia’s journey and the growth of his portfolio over the years, let’s look at the chart shared above along with his image. For a more detailed analysis, you can explore this chart directly on Trendlyne.com using the following link: Latest Ashish Kacholia shareholdings and portfolio

In December 2015, his net worth was ₹393 crores. Over the next 2-3 years, it surged to ₹877 crores. However, by the end of March 2020, his net worth dropped back to ₹393 crores—essentially returning to where it was in December 2015. This shows a period of no significant returns over five years. This highlights an important lesson about the stock market: while it’s often seen as a way to make quick money, in reality it’s highly volatile and generating consistent returns is a challenging task.

Take a moment to process this. Imagine you invested ₹10 lakh in 2015 and by 2018, your investment doubled to ₹20 lakh. But then, over the next two and a half years, your ₹20 lakh dropped back to ₹10 lakh. How many of you would have had the courage to stay invested after such a roller coaster ride? Your first reaction might be frustration, thinking that after five years, you’re back at square one, making those years feel like a waste. This is where most people lose their patience and conviction. But what sets investors like Ashish Kacholia apart is that despite seeing his wealth drop from ₹877 crores to ₹393 crores, he didn’t lose hope.

As a result, his perseverance paid off and his wealth surged to ₹3,300 crores by June 2024. Even with a major correction recently, his wealth still stands over ₹2,300 crores. Since he invested in small-cap and mid-cap so he got the beautiful advantage of that because of the rally in these spaces over the last 4 years. The important point to remember here is that the stock market doesn’t offer linear returns, it’s inherently volatile. However, those who stay patient, remain invested in strong companies and hold their conviction are the ones who ultimately get rewarded. Mr. Ashish Kacholia is a perfect example of that principle in action.

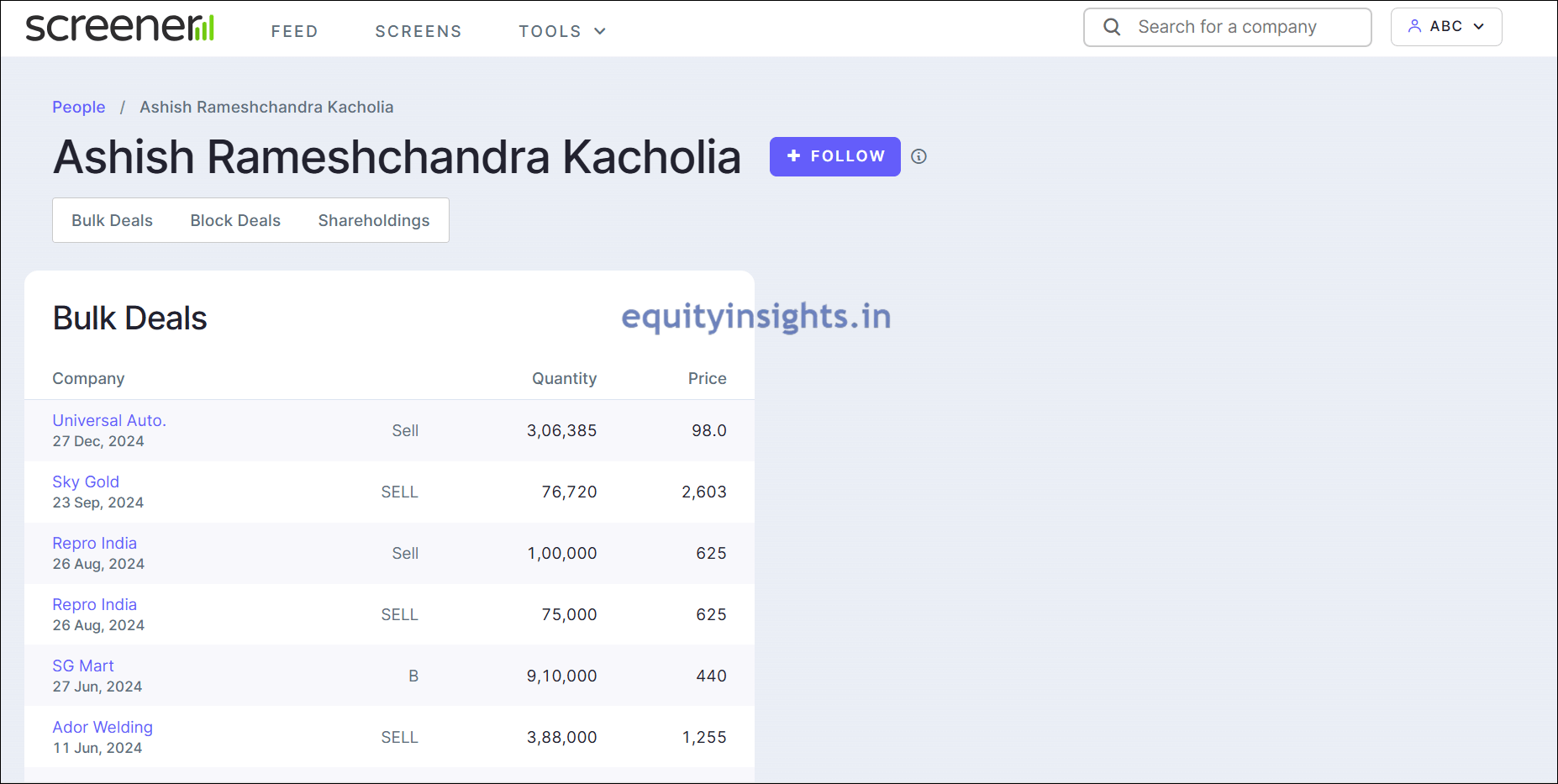

Coming to his portfolio, you can get all these details on screener.in. Here’s a direct link for quick access: Ashish Rameshchandra Kacholia – Investments – Screener

As you open the link, you’ll notice a significant number of bulk deals he’s been a part of. For instance, in the December 2024 quarter, he sold over 3 lakh shares of Universal Autofoundry at ₹98 and nearly 80,000 shares of Sky Gold at ₹2,603, among others. From this, you can infer that over the last six months, he’s been more focused on selling stocks than adding new ones—likely to lock in profits. Next, as you scroll down the page, you’ll also find detailed block deals data right there for you to explore.

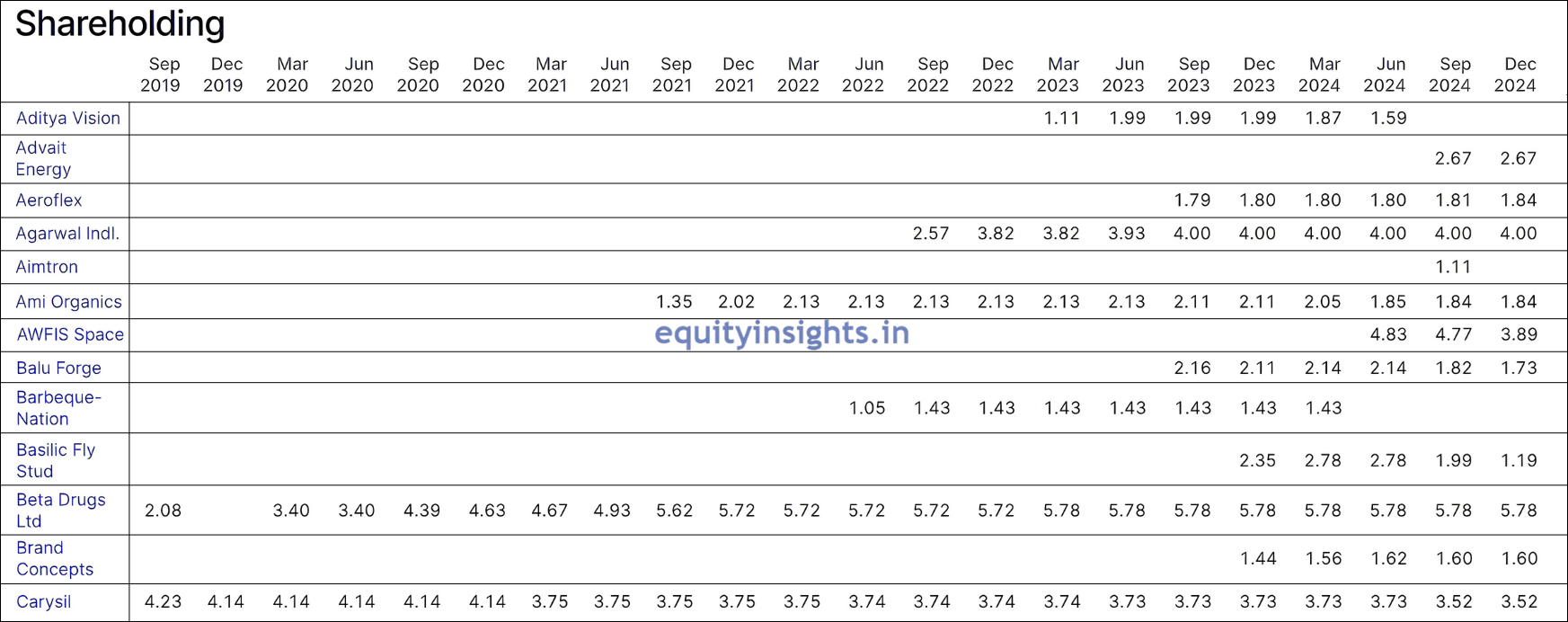

Next up is the most exciting part—Ashish Kacholia’s portfolio. If you look at his shareholdings, he had invested in Aditya Vision in March 2023 but seems to have exited in the September 2024 quarter. This stock has created a very good wealth for him. At the time of his investment in March 2023, it was at levels of around ₹1,400 and by the time he booked his profits, it had soared to ₹4,500—before the 1:10 stock split announced in July 2024. So, in around two years his wealth has zoomed to nearly three times but then it is not the case always.

I’ll give you an example where he bought Ami Organics in September 2021 with a 1.35% stake and later increased the stake. However, if you look at the share price movement of Ami Organics then at the time of his entry, it was at the level of around ₹1200 and then for the next 3 years, it showed no returns. This shows that even when an ace investor like Ashish Kacholia enters a stock, it doesn’t guarantee an instant surge. The share price can remain stagnant or even decline. The key takeaway here is the importance of conviction. You need to trust your research and remain patient, even when the stock doesn’t show immediate returns.

NOTE: Since Ashish Kacholia has invested in SME companies as well, some of his holdings may not appear in the December 2024 quarter. Unlike regular companies that update their quarterly results and shareholding details every quarter, SME companies disclose theirs only twice a year—in the March and September quarters. As a result, their December and June shareholding data often remain unreported. However, to provide a comprehensive view, I have included SME stocks in his portfolio where the latest available shareholding pattern (September 2024) confirms his investment.

In addition to Ami Organics, Ashish Kacholia’s portfolio now proudly features a recent addition—Advait Energy Transitions. Alongside this, the portfolio includes Aeroflex, Agarwal Industrial Corporation and Aimtron Electronics (SME). Also added to the mix is AWFIS Space Solutions which is a strategic pick made during the market downturn.

Another standout name in his portfolio is Balu Forge, where he has created significant wealth. It’s another great example of his approach. When he entered Balu Forge in September 2023, the stock was priced at around ₹174. By that time, it had already risen considerably from ₹56 but Ashish didn’t focus on past returns, unlike many retail investors who avoid a stock after a huge rally. Instead, Ashish focuses on the company’s future potential and it is because of this principle that the stock continued to climb from ₹174, reaching ₹400 and transforming it into a wealth-generating asset for him.

Sometimes, investors must accept losses, a reality clearly seen in Ashish Kacholia’s portfolio. He exited Barbeque-Nation at a loss, as the stock has been on a consistent downtrend following his investment. The company’s poor financial performance and repeated yearly net losses contributed to this decline, showcasing how even seasoned investors must occasionally cut their losses.

Then, he has been holding Basilic Fly Studio since its IPO, strategically booking profits as the stock soared post-listing. Beta Drugs, a long-term bet in his portfolio, with a steady 5.78% stake maintained over the past few quarters. Last year, Kacholia made a savvy move by acquiring a 1.44% stake in Brand Concepts, later increasing his holding to 1.60%. Meanwhile, he identified Carysil’s potential early, adding it to his portfolio back in 2016. Despite his long-term investment in Carysil, the stock hasn’t delivered significant returns. Over the past three years, the stock’s performance has been flat. This makes for an interesting case study and the lesson here is clear—conviction and patience are key to successful investing.

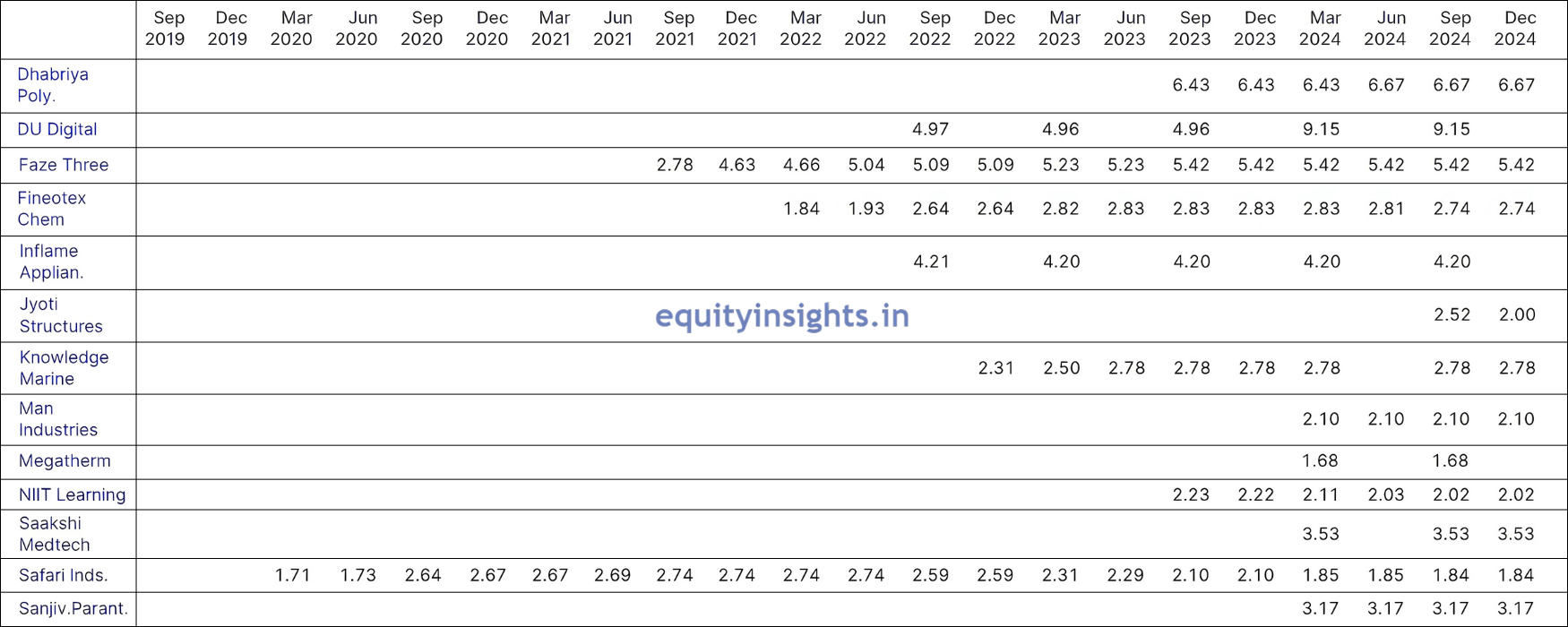

Ashish Kacholia’s portfolio boasts an impressive lineup of notable names across various sectors. Some of his key holdings include Dhabriya Polywood, DU Digital Global (SME), Faze Three—a promising textile company poised for future growth, Fineotex Chemical, Inflame Appliances and Jyoti Structures — an infrastructure firm. His investments also span Knowledge Marine, Man Industries, Megatherm Induction, NIIT Learning, Saakshi Medtech, Safari Industries and Sanjivani Paranteral.

Other standout stocks in his portfolio include SG Finserve, Shaily Engineering, Shree OSFM E-Mobility, Stove Kraft, Tanfac Industries, TBI Corn, Texel Industries, Universal Autofoundry, Vasa Denticity, Walchandnagar Industries, XPRO India, Yasho Industries and Zaggle Prepaid Ocean Services—a diverse mix of high-potential businesses reflecting his keen investment strategy.

So these are the companies that are probably worth studying. If I just summarize the portfolio of Ashish Kacholia, below is the list of companies that he’s holding for a long time with a consistent stake or has increased the stake compared to the previous quarter (September 2024) and if you look at the market cap they’re all small-cap companies:

| Stock Name | Market Cap (in Cr.) | Investment Month | Latest Holding (%) |

|---|---|---|---|

| Aeroflex | ₹2,221 | September 2023 | 1.84% |

| Agarwal Industrial | ₹1,327 | September 2022 | 4.00% |

| Aimtron (SME) | ₹894 | September 2024 | 1.11% |

| Ami Organics | ₹8,877 | September 2021 | 1.84% |

| Beta Drugs | ₹1,586 | March 2020 | 5.78% |

| Brand Concepts | ₹394 | December 2023 | 1.60% |

| Carysil | ₹1,464 | March 2018 | 3.52% |

| Dhabriya Polywood | ₹333 | September 2023 | 6.67% |

| DU Digital Global (SME) | ₹405 | September 2022 | 9.15% |

| Faze Three | ₹801 | September 2021 | 5.42% |

| Fineotex Chemical | ₹2,617 | March 2022 | 2.74% |

| Inflame Appliances (SME) | ₹181 | September 2022 | 4.20% |

| Man Industries | ₹1,380 | March 2024 | 2.10% |

| Megatherm Induction (SME) | ₹505 | March 2024 | 1.68% |

| NIIT Learning Systems | ₹5,712 | September 2023 | 2.02% |

| Safari Industries | ₹10,442 | March 2020 | 1.84% |

| Sanjivani Paranteral | ₹322 | March 2024 | 3.17% |

| SG Finserve | ₹2,266 | December 2023 | 1.14% |

| Shaily Engineering | ₹6,978 | March 2018 | 3.22% |

| Stove Kraft | ₹2,365 | March 2022 | 1.75% |

| Tanfac Industries | ₹3,086 | December 2023 | 1.19% |

| Vasa Denticity | ₹958 | March 2024 | 3.80% |

| XPRO India | ₹2,328 | September 2021 | 4.13% |

| Yasho Industries | ₹2,105 | December 2021 | 4.17% |

As far as new stocks are concerned, in the last few quarters Ashish Kacholia has added a few stocks taking advantage of the market fall. Over the last three quarters, since June 2024, he has either added to, increased his stake in or maintained his holdings in the following stocks:

| Stock Name | Market Cap (in Cr.) | Investment Month | Latest Holding (%) |

|---|---|---|---|

| Advait Energy | ₹1,321 | September 2024 | 2.67% |

| Knowledge Marine | ₹1,635 | September 2024 | 2.78% |

| Saakshi Medtech | ₹265 | September 2024 | 3.53% |

| Shree OSFM (SME) | ₹155 | September 2024 | 3.63% |

| TBI Corn (SME) | ₹202 | September 2024 | 4.22% |

| Texel Industries | ₹118 | December 2024 | 7.86% |

Although I like Ashish Kacholia’s portfolio, one of the best things is he always tried to identify fundamentally strong companies with very solid financials whereas a lot of ace investors try to identify companies that have turnaround stories but they don’t have very strong financials in the present so that can be very risky but Ashish Kacholia’s approach is quite different from other High Net Worth Individuals (HNIs).

Read More: Sensex Historical Data: Sectors that can Outperform in 2025

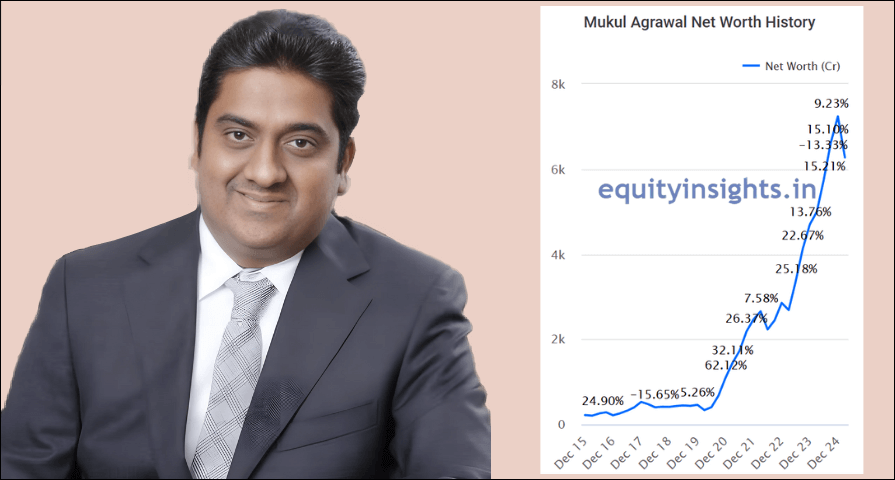

2. Mukul Agrawal

The second HNI in the list that I track very closely is Mr. Mukul Mahavir Agrawal widely known as Mukul Agrawal. He has more than 30 years of experience in the stock market. He began his investment journey in the late 1990s and has since developed a reputation for aggressive investment strategies, thorough analysis and a willingness to take calculated risks on penny stocks with multibagger potential. As of March 2, 2025, his net worth with stocks more than 1% holding is more than ₹6,000 crores.

In addition to his investment activities, Mukul Agrawal holds several notable positions. He serves as an Independent Non-Executive Director at Supreme Infrastructure India Ltd. He is also a member of the Multi Commodity Exchange of India Ltd., the National Stock Exchange of India Ltd. and the derivatives segment of the Bombay Stock Exchange. His academic background includes an undergraduate degree from the University of Mumbai.

To understand Mukul Agrawal’s journey and the growth of his portfolio over the years, look at the chart shared above alongside his image. His wealth has skyrocketed from approximately ₹200 crores in 2015 to an impressive ₹6,000 crores today, which depicts humongous wealth creation. Interestingly, it has a somewhat similar story to that of Ashish Kacholia. Mukul Agrawal’s portfolio value also surged from ₹200 crores in 2015 to ₹500 crores in 2017 but then fell to ₹337 crores in March 2020. However, despite facing a sharp correction, he remained steadfast in his strategy and conviction and that resilience paid off as over the last 3-4 years, his wealth has skyrocketed more than 20 times to an astounding ₹6,000 crores.

You can also check the net worth history of Mukul Agrawal through this direct link of Trendlyne: Latest Mukul Agrawal shareholdings and portfolio.

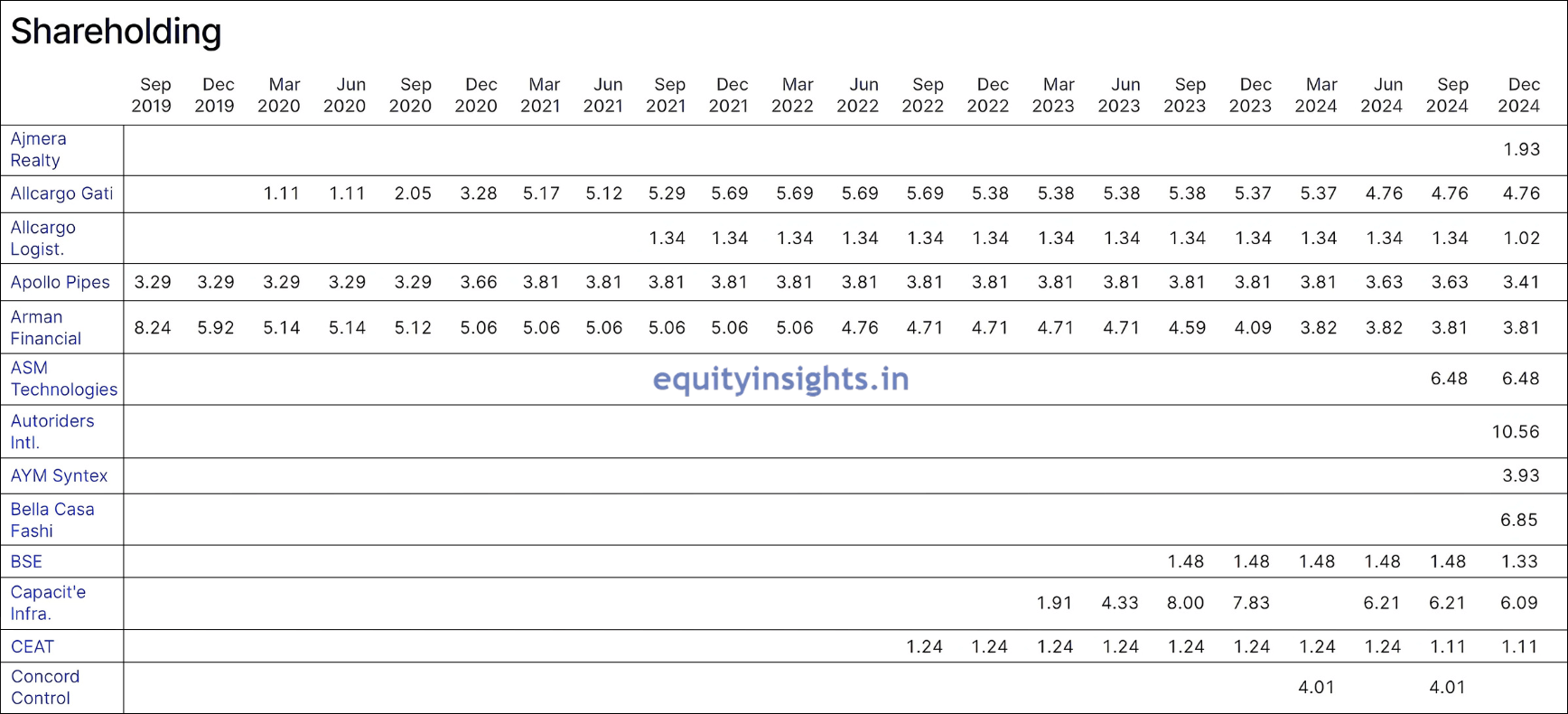

Now, let’s cut to the chase and dive into Mukul Agrawal’s portfolio and the key stocks he’s betting on. You can discover Mukul Agrawal’s portfolio with this direct link on Screener: Mukul Mahavir Agrawal – Investments – Screener. Mukul Agrawal, known for his sharp market acumen, has been actively reshuffling his portfolio to capitalize on market opportunities. His latest moves suggest a strategic approach, with several new additions reflecting his confidence in select sectors. Let’s break down his holdings and see where he’s placing his bets.

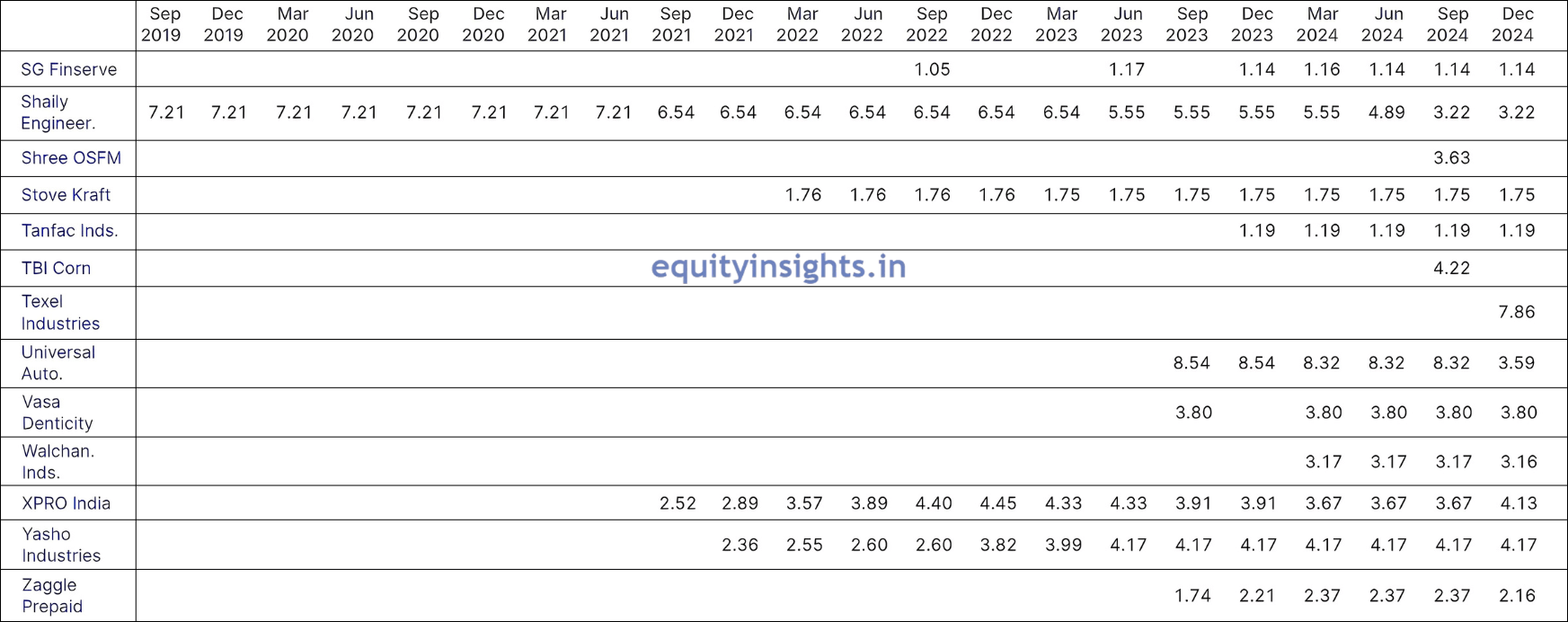

Among his latest additions, Ajmera Realty stands out as a fresh inclusion in December 2024, signaling confidence in the real estate sector. He has also invested in Allcargo Gati and Allcargo Logistics, reinforcing his faith in the logistics industry, while Apollo Pipes has remained a long-term bet since March 2018. Other recent entries include Arman Financial, ASM Technologies, Autoriders International, AYM Syntex and Bella Casa Fashion & Retail, suggesting that Mukul Agrawal has taken full advantage of the market correction. His strategic picks across sectors include BSE, which was added in September 2023, reflecting a move into India’s stock exchange ecosystem while Capacite Infraprojects, Concord Control and CEAT strengthen his presence in infrastructure and automotive sectors.

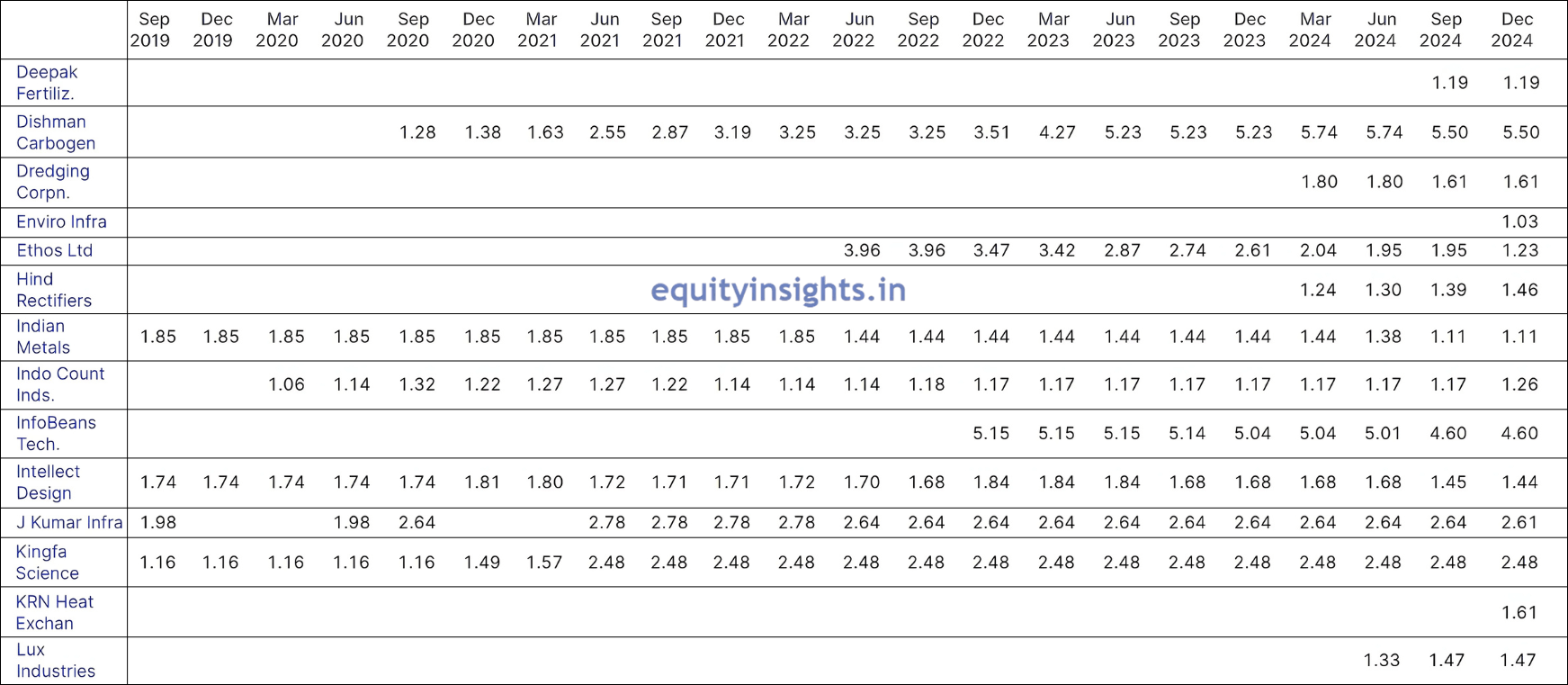

Other holdings such as Deepak Fertilizers and Dishman Carbogen highlight his focus on chemicals and pharma. Another notable addition in March 2024 is Dredging Corporation, which merits deeper research. Then Enviro Infra, Ethos, Hind Rectifiers and Indian Metals showcase a mix of industrial and manufacturing interests, while long-term investments in Intellect Design, J Kumar Infraprojects and Kingfa Science reinforce his strategic patience. His portfolio also includes Indo Count Industries, InfoBeans Technology and KRN Heat Exchanger broadening his exposure to textile, IT and manufacturing industries.

Then he has got the Lux Industries which is again a recent addition to his portfolio in the June 2024 quarter and if I share its share price journey, it’s been a big wealth destroyer. If you look at its last three years, so after generating humongous returns during COVID, its stock crashed from a peak of ₹4500 to ₹1000. However, a recent sharp rally and promising signs in the textile sector make this a stock worth taking a closer look at. Other notable holdings include MPS, Neuland Labs and Newgen Software — though he exited the latter a few quarters ago.

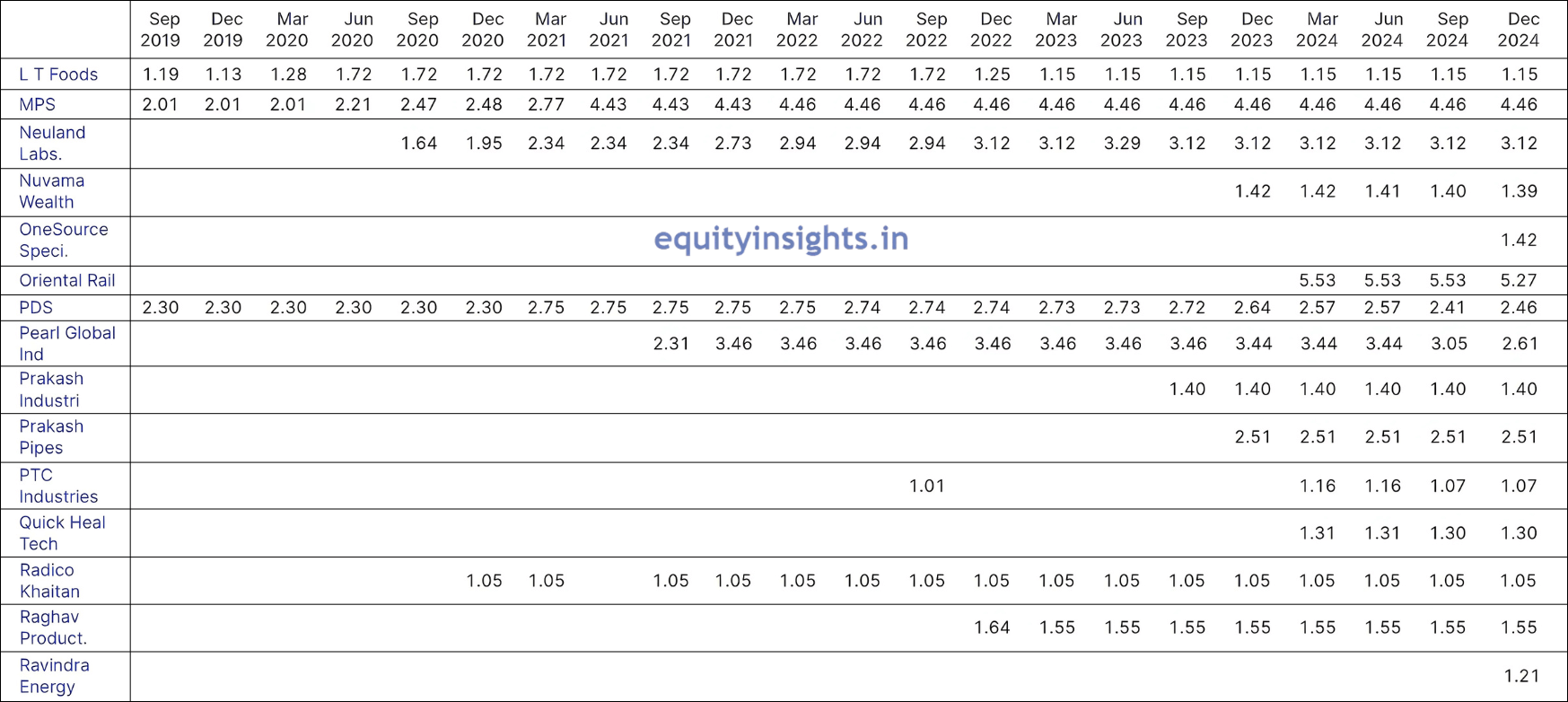

Other names in the portfolio include LT Foods, MPS, Neuland Labs, Nuvama Wealth, OneSource Specialty Pharma, Oriental Rail (added in March 2024), PDS, Pearl Global, Prakash Industries, Prakash Pipes, PTC Industries, Quick Heal Technologies, Radico Khaitan, Raghav Productivity and Ravindra Energy.

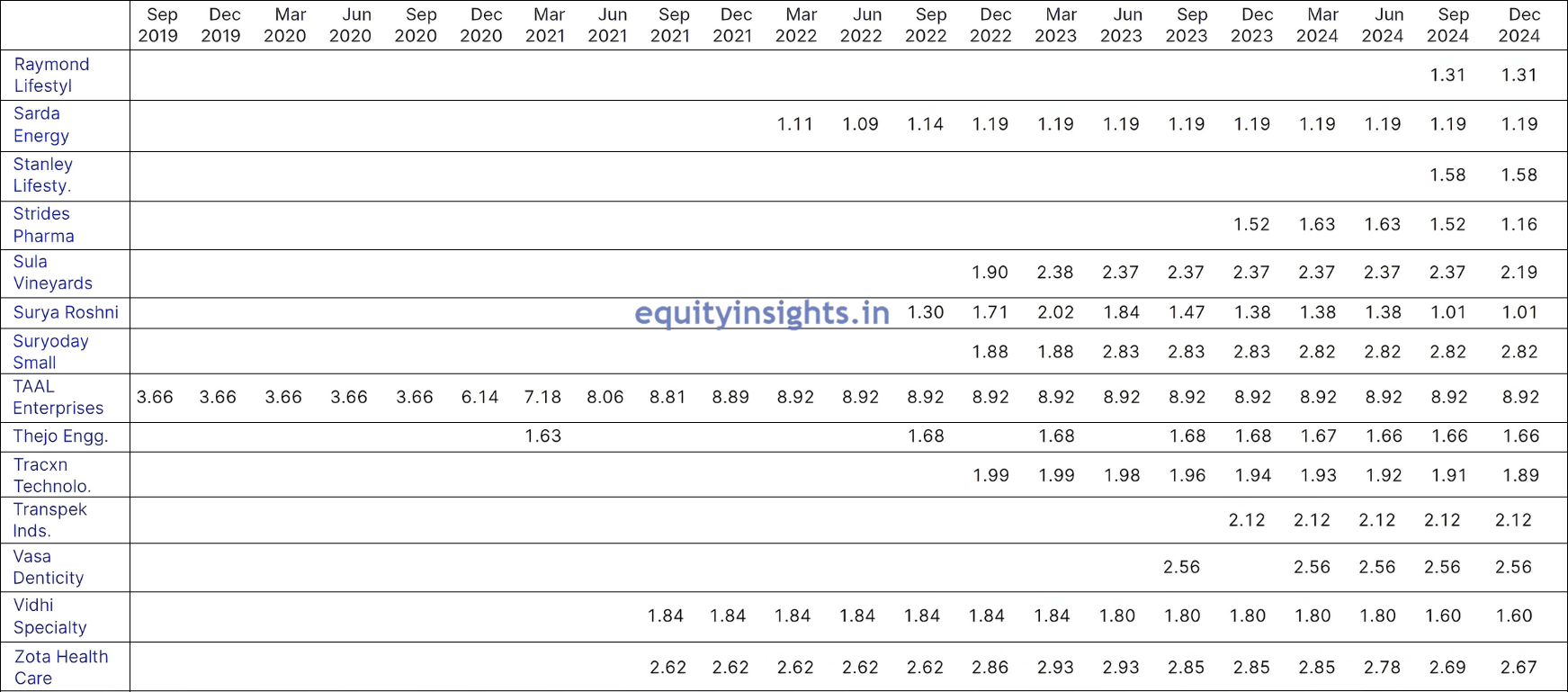

Raymond Lifestyle, Sarda Energy, Stanley Lifestyles and Strides Pharma highlight a blend of textile, infrastructure and pharma. So quite a few pharma stocks have been added by him to his portfolio, which aligns with broader institutional trends. Then Sula Vineyards is part of his portfolio where he slightly reduced allocation in December 2024, while Surya Roshni and Suryoday Small Finance Bank continue to be promising turnaround candidates. Further strengthening his portfolio, he maintains long-term conviction in Taal Enterprises. Thejo Engineering, on the other hand, has been a stock he has repeatedly entered and exited, returning to it three times since March 2021.

Other reputed names are Tracxn Technologies. Despite holding it for nine quarters without significant returns, he remains invested. Other key investments are in Transpek Industry, Vasa Denticity, Vidhi Specialty and Zota Health Care which are adding diversity to his portfolio.

To identify the stocks this HNI has consistently held without any changes or those where he has increased his stake compared to the previous quarter (September 2024), I have compiled all the relevant information in the table below:

| Stock Name | Market Cap (in Cr.) | Investment Month | Latest Holding (%) |

|---|---|---|---|

| Allcargo Gati | ₹939 | March 2020 | 4.76% |

| Arman Financial | ₹1,341 | September 2016 | 3.81% |

| CEAT | ₹10,244 | September 2022 | 1.11% |

| Concord Control | ₹704 | March 2024 | 4.01% |

| Dishman Carbogen | ₹3,123 | September 2020 | 5.50% |

| Dredging Corporation | ₹1,441 | March 2024 | 1.61% |

| Hind Rectifiers | ₹1,449 | March 2024 | 1.46% |

| Indian Metals | ₹3,352 | September 2018 | 1.11% |

| Indo Count Industries | ₹5,236 | March 2020 | 1.26% |

| InfoBeans Technologies | ₹764 | December 2022 | 4.60% |

| Kingfa Science | ₹3,507 | June 2017 | 2.48% |

| LT Foods | ₹11,791 | December 2018 | 1.15% |

| MPS | ₹4,045 | September 2018 | 4.46% |

| Neuland Laboratories | ₹13,614 | September 2020 | 3.12% |

| PDS | ₹6,015 | March 2018 | 2.46% |

| Prakash Industries | ₹2,547 | September 2023 | 1.40% |

| Prakash Pipes | ₹958 | December 2023 | 2.51% |

| PTC Industries | ₹15,291 | March 2024 | 1.07% |

| Quick Heal Technologies | ₹1,598 | March 2024 | 1.30% |

| Radico Khaitan | ₹27,738 | September 2021 | 1.05% |

| Raghav Productivity | ₹2,290 | December 2022 | 1.55% |

| Sarda Energy | ₹15,982 | March 2022 | 1.19% |

| Surya Roshni | ₹4,653 | September 2022 | 1.01% |

| Suryoday Small Finance Bank | ₹1,201 | December 2022 | 2.82% |

| TAAL Enterprises | ₹740 | June 2016 | 8.92% |

| Thejo Engineering | ₹1,775 | September 2022 | 1.66% |

| Transpek Industry | ₹735 | December 2023 | 2.12% |

| Vasa Denticity | ₹958 | March 2024 | 2.56% |

| Vidhi Specialty | ₹2,214 | September 2021 | 1.60% |

To check the recent additions made by Mukul Agrawal in the last three quarters (Since June 2024), you can refer to the table below:

| Stock Name | Market Cap (in Cr.) | Investment Month | Latest Holding (%) |

|---|---|---|---|

| Ajmera Realty | ₹2,881 | December 2024 | 1.93% |

| ASM Technologies | ₹1,379 | September 2024 | 6.48% |

| Autoriders International | ₹13.8 | December 2024 | 10.56% |

| AYM Syntex | ₹1,138 | December 2024 | 3.93% |

| Bella Casa Fashion & Retail | ₹611 | December 2024 | 6.85% |

| Deepak Fertilizers | ₹12,032 | September 2024 | 1.19% |

| Enviro Infra Engineers | ₹3,631 | December 2024 | 1.03% |

| KRN Heat Exchanger | ₹5,428 | December 2024 | 1.61% |

| Lux Industries | ₹3,883 | June 2024 | 1.47% |

| OneSource Specialty | ₹14,169 | December 2024 | 1.42% |

| Ravindra Energy | ₹1,974 | December 2024 | 1.21% |

| Raymond Lifestyle | ₹6,620 | September 2024 | 1.31% |

| Stanley Lifestyles | ₹1,569 | September 2024 | 1.58% |

Mukul Agrawal’s portfolio is a masterclass in strategic investing. Known for his aggressive yet strategic investment approach, he focuses on mid-cap and small-cap stocks with strong growth potential, often identifying emerging companies before they gain widespread market attention. Mukul Agrawal believes in diversification while maintaining high conviction in select stocks, balancing risk and reward. His investment philosophy revolves around thorough research, patience and capitalizing on market inefficiencies to generate long-term wealth. He has shown a keen ability to capitalize on market dips, a strong inclination towards pharma and infrastructure and patience with underperforming stocks, indicating a long-term growth outlook. Whether you’re looking for high-growth potential stocks or undervalued gems, his selections offer plenty of insights.

Read More: Candlestick Patterns: Definition, History and Its Types

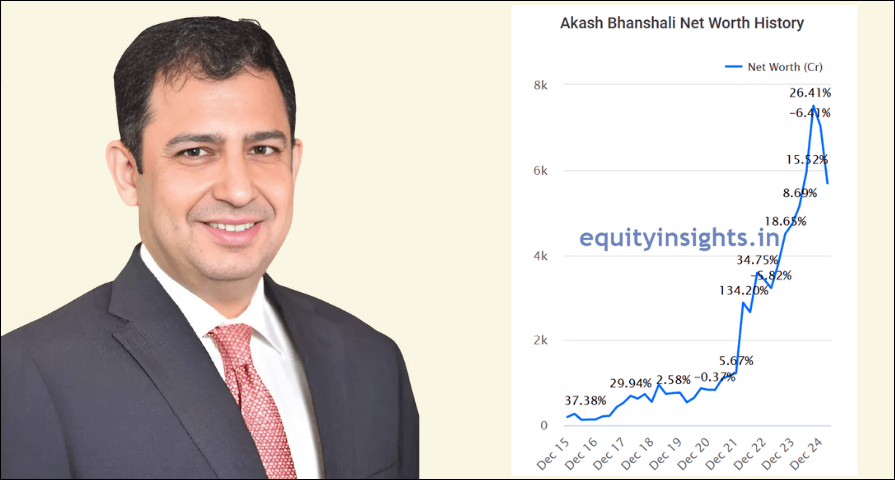

3. Akash Bhanshali

The third HNI that I track closely is Mr. Akash Bhanshali. He is a prominent Indian investment banker, investor, venture capitalist and capital markets expert. He holds a Master’s degree in Commerce and is a qualified Chartered Accountant. As a key member of the management team at ENAM Holdings Pvt. Ltd., Bhansali has played a significant role in identifying and investing in business leaders across various industries, contributing to their evolution into sector icons. Bhanshali’s current investment portfolio is valued at more than ₹5,400 crores.

If you take a quick look at the chart depicting Akash Bhanshali’s journey of wealth creation, you’ll see that his success is truly remarkable. If you glance at his portfolio’s growth trajectory, you’ll notice the same striking pattern seen with the two High Net-worth Investors (HNIs) discussed above. His wealth has skyrocketed from ₹195 crores to a staggering ₹5,400 crores today—an exponential rise that speaks volumes about his sharp market instincts and strategic investments. His portfolio reflects a deep conviction in sectoral leaders and long-term value plays.

You can explore Akash Bhanshali’s investment journey with a direct link to his portfolio on Screener: Akash Bhanshali – Investments – Screener. Let’s dive in and uncover his wealth-building strategies.

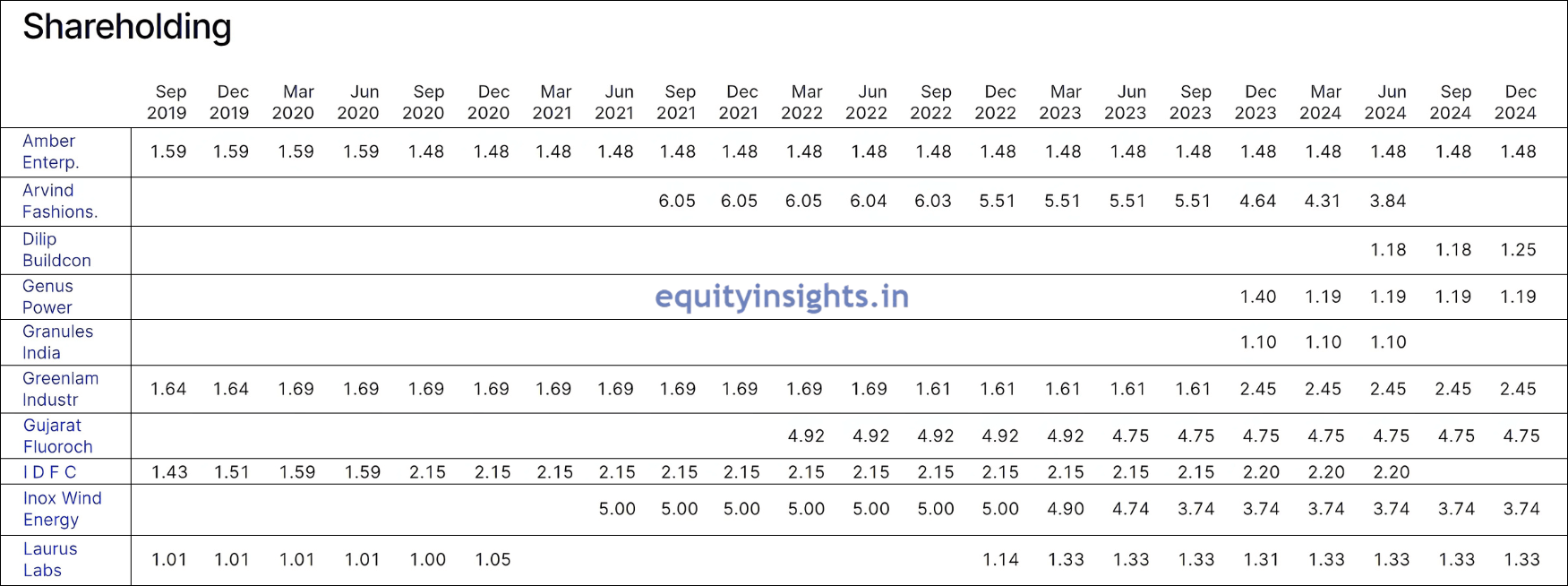

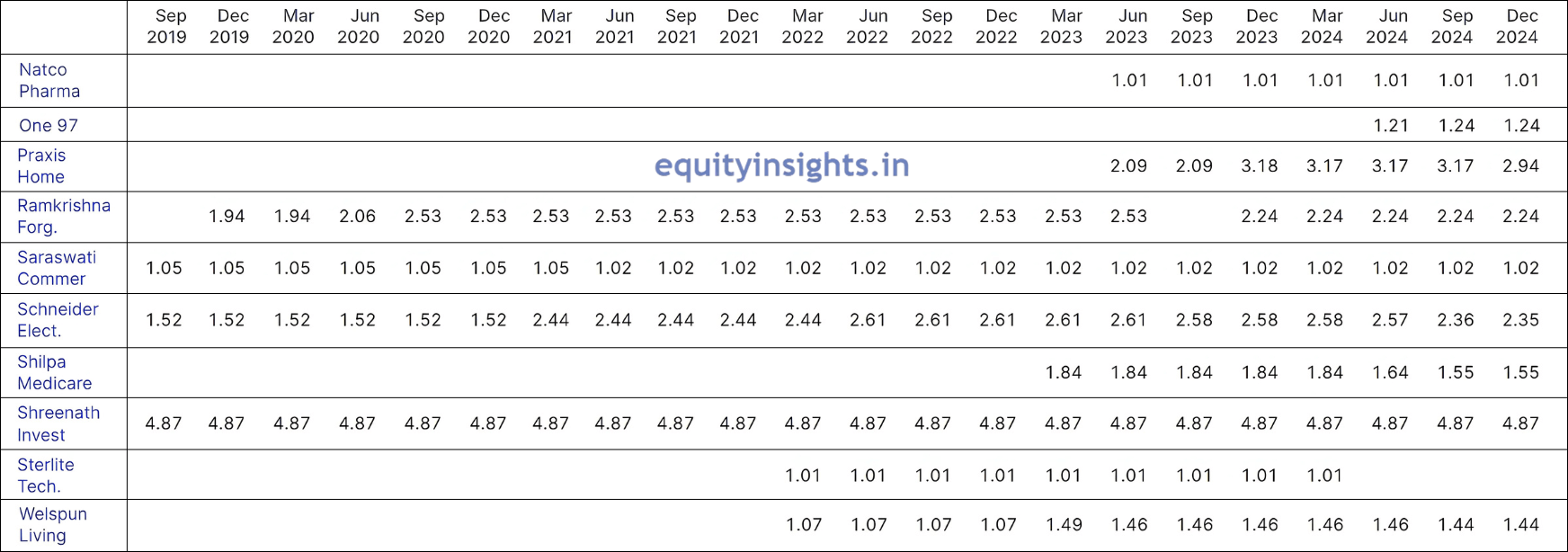

Highly selective in his stock picks, his portfolio features far fewer stocks compared to the top two investors discussed earlier. One of his standout bets is Amber Enterprises, a company he has been invested in since March 2018, underscoring his faith in the consumer electronics and manufacturing space. Arvind Fashions was part of his portfolio since September 2021 but then he exited completely from this stock in September 2024 quarter. Then his portfolio includes a recently added stock—Dilip Buildcon, which he added in the June 2024 quarter, so probably worth studying.

Other notable holdings include Genus Power, Greenlam Industries which he has been holding for many years now, Gujarat Fluorochemicals, Inox Wind Energy and Laurus Labs is again a long-term holding. Although he was holding it a long time ago, then he reduced the allocation to below 1% but again increased his stake in the company, showing confidence at a time when the stock had been a wealth destroyer and was hated by the retail investors.

Other small caps in his portfolio are Natco Pharma, One 97 Communications widely known as Paytm— he added it in the June Quarter of 2024, Praxis Home, Ramakrishna Forging, Saraswati Commercial, Schneider Electric, Shilpa Medicare, Shreenath Investment and Welspun Living. Also, Akash Bhanshali has exited from a few companies in the last 3 quarters, probably to book profits after watching the current market situation and these include names like Granules India, IDFC and Sterlite Technologies.

The table below highlights the stocks where Akash Bhanshali has either maintained or increased his stake compared to the previous quarter (September 2024):

| Stock Name | Market Cap (in Cr.) | Investment Month | Latest Holding (%) |

|---|---|---|---|

| Amber Enterprises | ₹19,038 | March 2018 | 1.48% |

| Genus Power | ₹7,765 | December 2023 | 1.19% |

| Greenlam Industries | ₹5,747 | June 2016 | 2.45% |

| Gujarat Fluorochemicals | ₹39,380 | March 2022 | 4.75% |

| Inox Wind Energy | ₹9,714 | June 2021 | 3.74% |

| Laurus Labs | ₹28,429 | December 2022 | 1.33% |

| Natco Pharma | ₹13,804 | June 2023 | 1.01% |

| Ramkrishna Forgings | ₹11,738 | December 2023 | 2.24% |

| Saraswati Commercial | ₹967 | June 2017 | 1.02% |

| Shilpa Medicare | ₹5,966 | March 2023 | 1.55% |

| Shreenath Investment | ₹2.06 | June 2016 | 4.87% |

| Welspun Living | ₹10,391 | March 2022 | 1.44% |

The table below showcases his recent additions over the last three quarters (since June 2024):

| Stock Name | Market Cap (in Cr.) | Investment Month | Latest Holding (%) |

|---|---|---|---|

| Dilip Buildcon | ₹6,041 | June 2024 | 1.25% |

| One 97 Communications (Paytm) | ₹45,590 | June 2024 | 1.24% |

Overall, Akash Bhanshali’s investment approach combines meticulous research, strategic diversification and a willingness to explore unconventional opportunities, solidifying his reputation as a proficient and forward-thinking investor in the Indian financial landscape.

Read More: 10 Trading Rules That Make a Trader Successful

4. Sunil Singhania

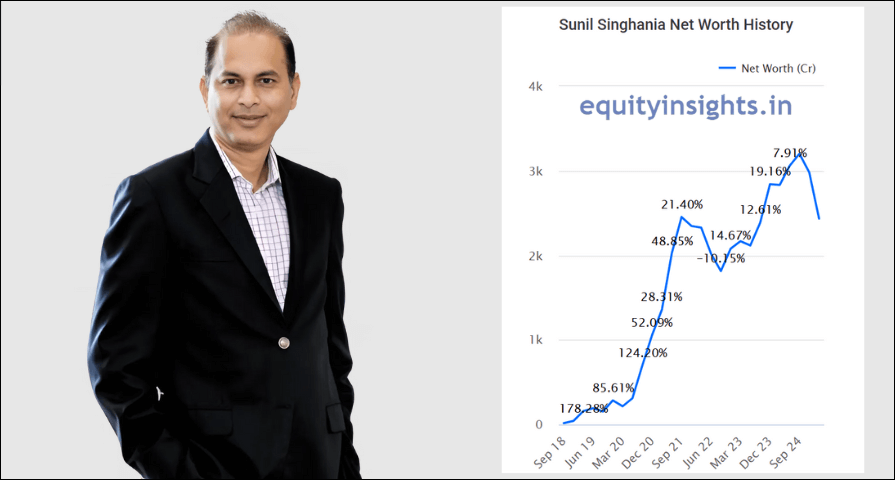

Sunil Singhania, a distinguished HNI, Chartered Accountant and CFA charter holder, has made significant strides in the Indian investment landscape. With over two decades of experience, he founded Abakkus Asset Manager LLP in 2018, focusing on identifying high-potential companies across various sectors. He is Ex Global Head of Equities at Reliance Mutual Fund and was one of the key people responsible for humongous growth in Reliance Capital Asset Management. Despite the ongoing market downturn, his net worth remains strong at over ₹2,300 crores.

Sunil Singhania’s investment journey from 2018 to 2024 is a testament to strategic investing and resilience. It has been an exponential wealth generation for him from the levels of around ₹15 crores in 2018 to more than ₹2,300 crores today. Starting with ₹15 crore in September 2018, his portfolio surged to ₹158 crore by March 2019, before facing a slight dip to ₹153 crore later that year. A strong recovery followed, pushing his holdings to ₹284 crore by December 2019.

The real exponential growth came between 2020 and 2021, as his portfolio skyrocketed to ₹2,452 crore by September 2021, driven by high-growth stock picks. However, market corrections saw it dip to ₹2,211 crore by August 2023. Despite the volatility, Singhania’s disciplined approach and sectoral bets helped him bounce back, with his portfolio reaching ₹3,022 crore by September 2024. Now, let’s have a quick look at his portfolio: Latest Shareholdings & Portfolio of Sunil Singhania

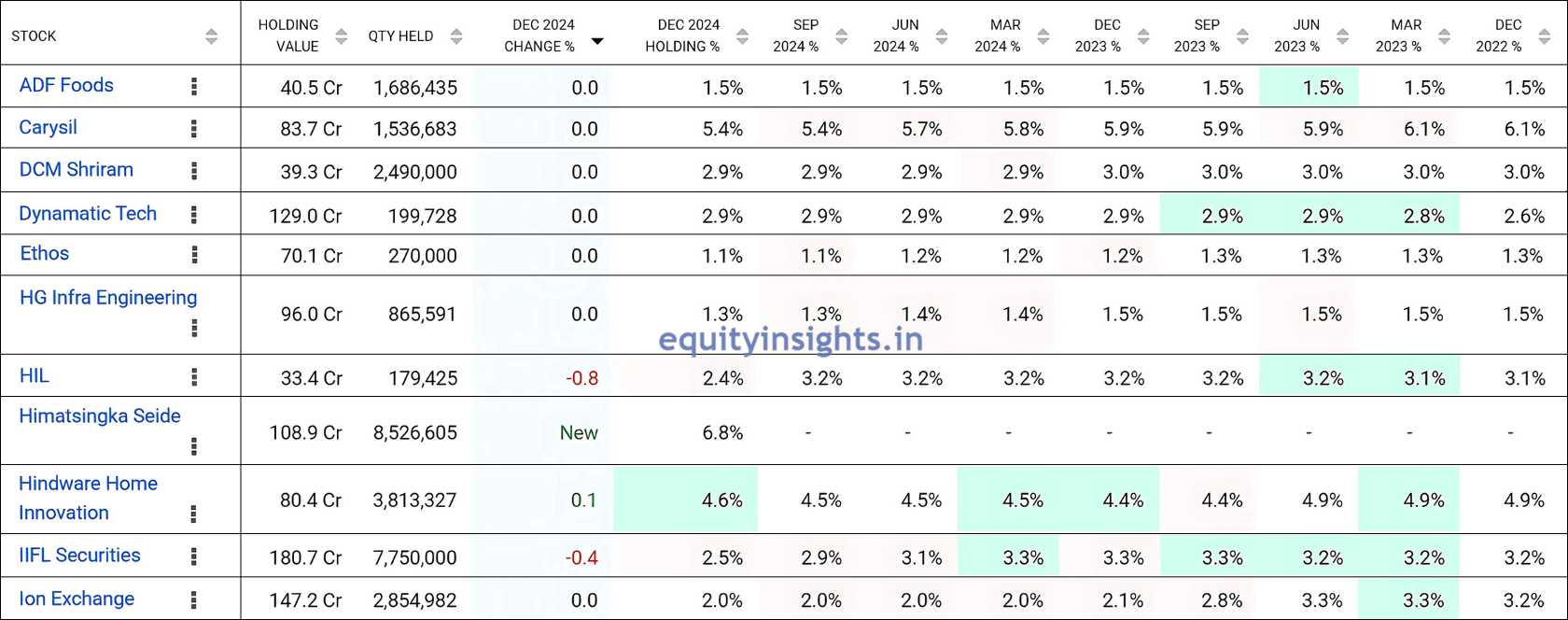

In his portfolio, he has got ADF Foods, Carysil, DCM Shriram, Dynamatic Technologies — an IT company where he increased allocation from 2.5% to 2.9%, Ethos, HG Infra Engineering, HIL Limited and Himatsingka Seide — a recent addition in December 2024 quarter. Other notable holdings include Hindware Home Innovation, IIFL Securities and Ion Exchange.

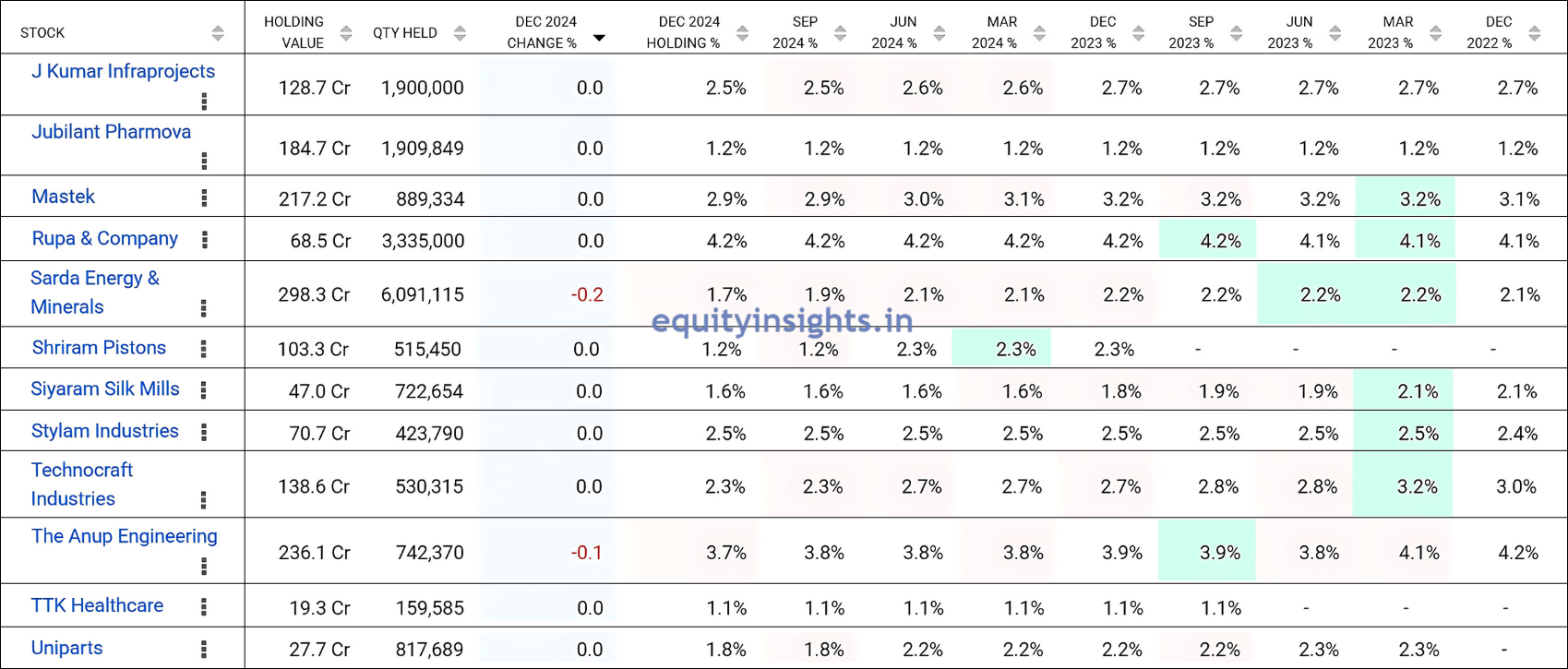

Other key holdings in his portfolio include JK Infraprojects, Jubilant Pharmova, Mastek Limited, Rupa & Company from textile space, Sarda Energy and Minerals, Shriram Pistons, Siyaram Silk Mills, Stylam Industries, Technocraft Energies, Anup Engineering, TTK Healthcare and Uniparts.

To identify the stocks he has consistently held without any changes or those where he has increased his stake compared to the previous quarter (September 2024), I have compiled all the relevant information in the table below:

| Stock Name | Market Cap (in Cr.) | Investment Month | Latest Holding (%) |

|---|---|---|---|

| ADF Foods | ₹2,585 | June 2020 | 1.54% |

| Carysil | ₹1,464 | December 2020 | 5.41% |

| DCM Shriram | ₹14,939 | June 2021 | 2.86% |

| Dynamatic Technologies | ₹4,602 | September 2021 | 2.94% |

| Ethos | ₹6,166 | June 2022 | 1.10% |

| HG Infra Engineering | ₹6,285 | December 2020 | 1.33% |

| Hindware Home Innovation | ₹1,674 | December 2019 | 4.56% |

| Ion Exchange | ₹7,332 | September 2020 | 1.95% |

| J Kumar Infraprojects | ₹5,092 | June 2022 | 2.51% |

| Jubilant Pharmova | ₹14,380 | September 2022 | 1.20% |

| Mastek | ₹6,873 | March 2019 | 2.88% |

| Rupa & Company | ₹1,516 | December 2020 | 4.20% |

| Shriram Pistons | ₹8,139 | December 2023 | 1.17% |

| Siyaram Silk Mills | ₹2,719 | March 2020 | 1.59% |

| Stylam Industries | ₹2,672 | June 2022 | 2.50% |

| Technocraft Industries | ₹5,684 | December 2020 | 2.34% |

| TTK Healthcare | ₹1,653 | September 2023 | 1.13% |

| Uniparts | ₹1,461 | March 2023 | 1.81% |

Here is a list of the most recent additions to his portfolio since the June 2024 quarter, selected from the stocks mentioned above:

| Stock Name | Market Cap (in Cr.) | Investment Month | Latest Holding (%) |

|---|---|---|---|

| Himatsingka Seide | ₹1,418 | December 2024 | 6.8% |

Singhania’s disciplined investment approach and keen market insights have solidified his reputation as a forward-thinking investor. His diversified portfolio serves as a testament to his ability to navigate the complexities of the financial markets, making him a prominent figure in India’s investment community.

Read More: The Psychology of Money: Key to Stock Market Success

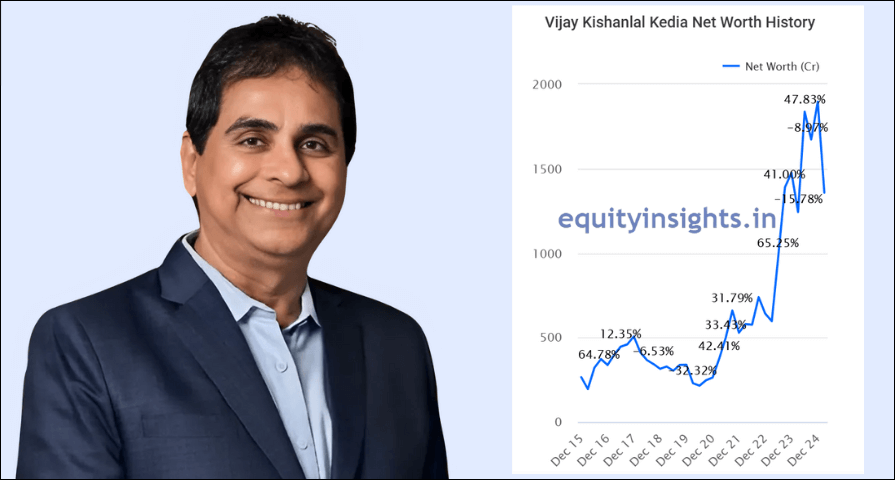

5. Vijay Kedia

The fifth HNI in the list is Mr. Vijaylal Kishanlal Kedia, widely known as Vijay Kedia. With over 30 years of experience, he has mastered the art of picking struggling companies with the potential for a strong turnaround. Unlike many investors who play it safe, Kedia thrives on identifying hidden gems before the market catches on. One of the aspects of Vijay Kedia is, he has been very vocal about risks in the market and I love his thought process. He actively shares his views on X, YouTube and other platforms, often reminding investors that no stock is a guaranteed success—even if he has invested in it. His honesty and deep market knowledge have earned him a loyal following.

Currently, even after the massive correction, his net worth stands at around ₹1,300 crores, built through years of strategic investing. His portfolio includes a mix of micro-cap and mid-cap stocks, which are often overlooked but have huge potential. Now, let’s take a look at his portfolio. You can access the same on Screener through this link: Vijay Krishanlal Kedia – Investments – Screener

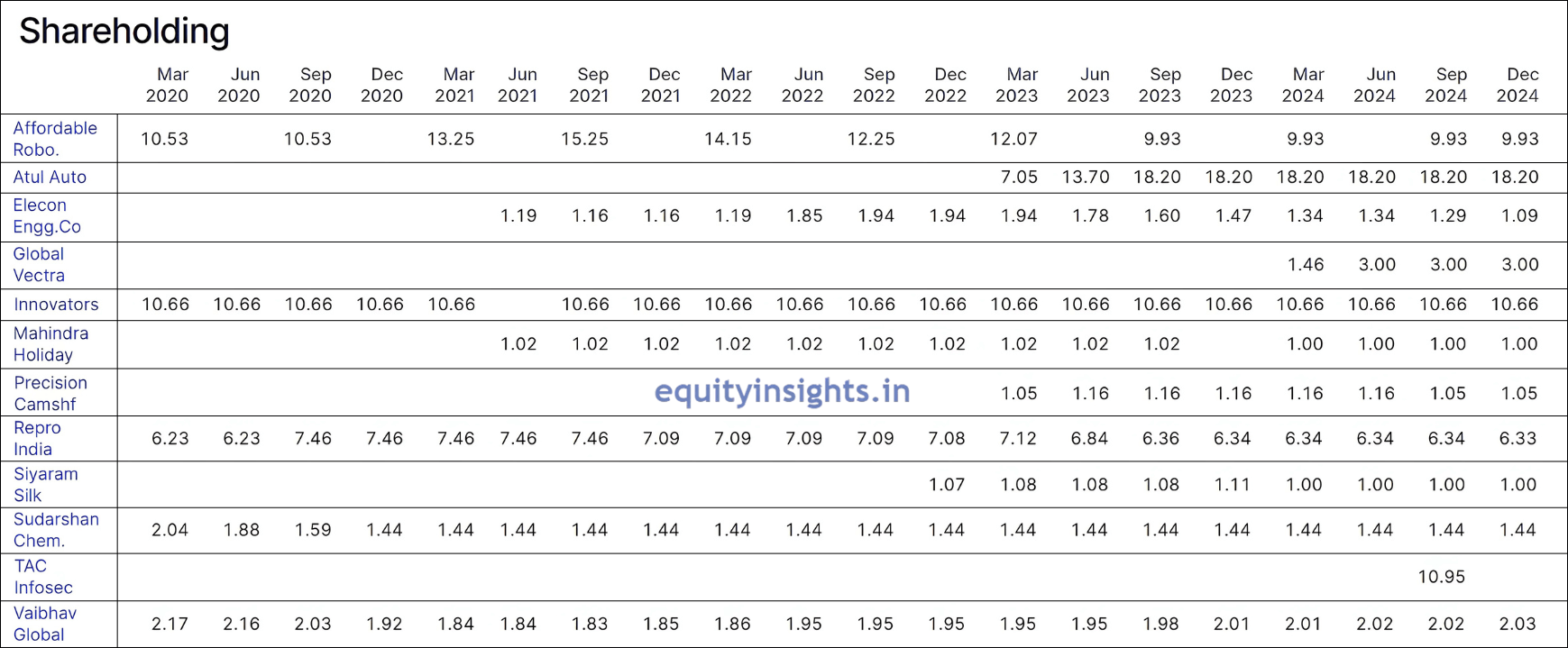

In his portfolio, he has Affordable Robotics and Automation, a small-cap company where he has been holding a 9.93% stake, Atul Auto where he’s also a director, is a stock he has increased stake big time, showing strong conviction. Elecon Engineering is another company he has backed and in March 2024, he added Global Vectra to his portfolio. These companies are risky but have the potential for massive returns if things go right.

You can’t rely solely on financial metrics like market cap, PE ratio or ROE to evaluate these small companies. High-net-worth investors (HNIs) have both the risk appetite and deeper insights into many small companies, allowing them to invest in these businesses despite uncertainties. Therefore, it’s important to assess your risk tolerance before making any investment decisions in these micro-cap and small-cap companies. Coming back to his portfolio, some of his long-term holdings include Innovators Facade Systems, Mahindra Holidays, Precision Camshafts, Repro India, Siyaram Silk Mills and Sudarshan Chemical which he’s held for many years now. TAC Infosec (SME) and Vaibhav Global are also part of his long-term bets, reflecting his patience in waiting for businesses to grow.

Let’s take a closer look at the table below, which highlights the stocks where Vijay Kedia has shown strong confidence—either by holding his stake consistently or increasing his investment compared to the previous quarter. These are the companies he believes in for long-term growth:

| Stock Name | Market Cap (in Cr.) | Investment Month | Latest Holding (%) |

|---|---|---|---|

| Affordable Robotic | ₹466 | September 2018 | 9.93% |

| Atul Auto | ₹1,223 | March 2023 | 18.20% |

| Global Vectra | ₹327 | March 2024 | 3.00% |

| Innovators Facade | ₹396 | September 2021 | 10.66% |

| Mahindra Holidays | ₹5,942 | March 2024 | 1.00% |

| Precision Camshafts | ₹1,578 | March 2023 | 1.05% |

| Siyaram Silk Mills | ₹2,719 | December 2022 | 1.00% |

| Sudarshan Chemical | ₹6,797 | June 2016 | 1.44% |

| Vaibhav Global | ₹3,755 | March 2017 | 2.03% |

Below is the table that highlights the stocks that have been recently added to his portfolio (since the June 2024 quarter):

| Stock Name | Market Cap (in Cr.) | Investment Month | Latest Holding (%) |

|---|---|---|---|

| TAC Infosec | ₹1,253 | September 2024 | 10.95% |

Vijay Kedia’s investing style is different from most. Instead of chasing well-known stocks, he looks for companies before they become market favorites. His approach isn’t for everyone—it requires patience, deep research, and the ability to handle market ups and downs. As Vijay Kedia himself says, “Stock market is all about patience and conviction.”

Read More: Trading Economics: How Economic Events Impact Stock Market?

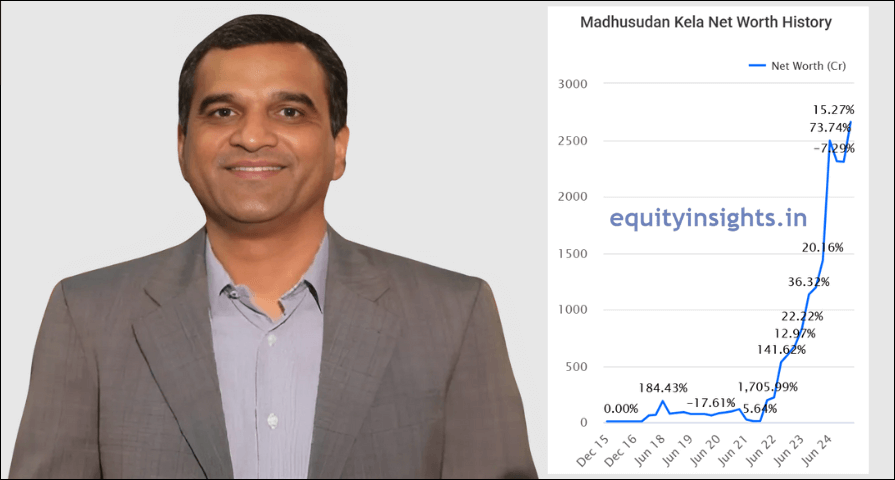

6. Madhusudan Kela

The final name in my list of HNIs is Mr. Madhusudan Kela. He holds a Masters degree from KJ Somaiya with experience of more than 30 years. He has worked with a lot of management firms in the past and is currently holding assets worth more than ₹2,500 crores in his portfolio. Despite the market downturn, Madhusudan’s portfolio has surged from ₹2,312 crores in September 2024 to ₹2,575 crores in March 2025, showcasing the strength and quality of the stocks he holds. If you take a look at his portfolio, you will see that it is not a big one but he has got fundamentally sound companies in his portfolio.

Here is the direct link to access the shareholdings of Madhusudan Kela on Screener: Madhuri Madhusudan Kela – Investments – Screener

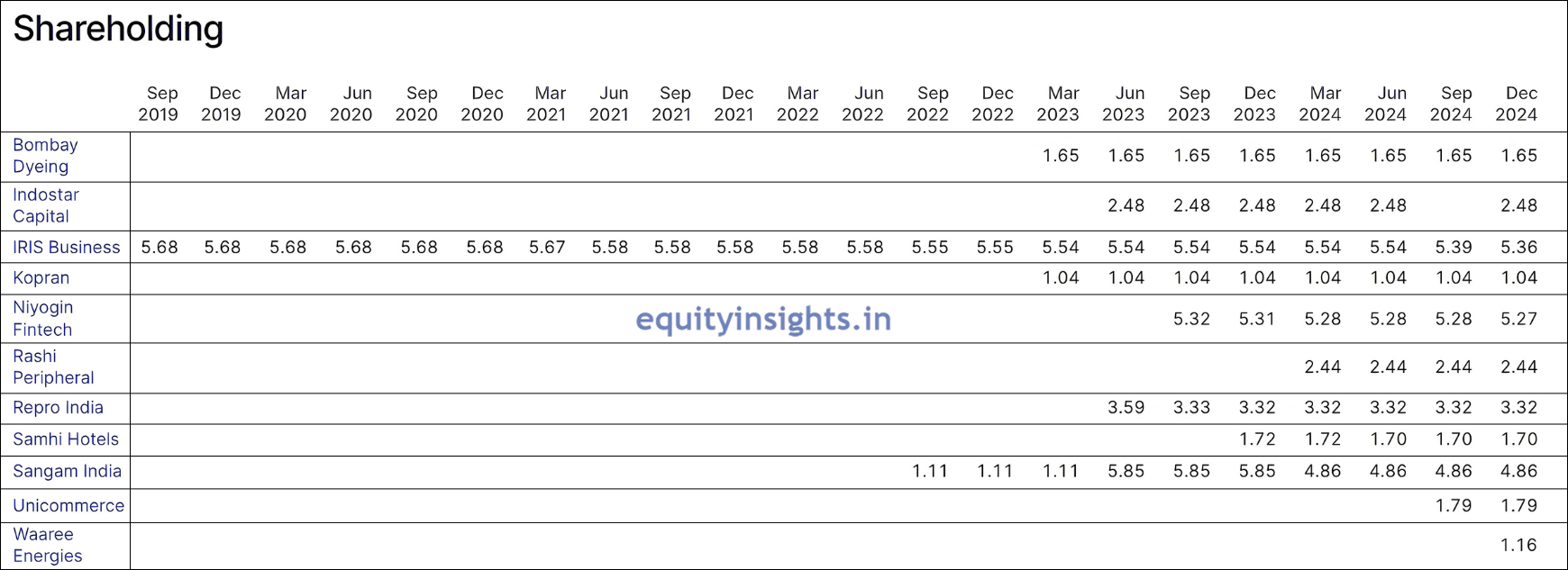

His portfolio includes companies like Bombay Dyeing and Indostar Capital where he has been consistently holding a 2.48% stake but in September 2024 reduced it to below 1% but then increased it again to 2.48%, signaling renewed confidence. IRIS Business Services has remained part of his holdings for many years now. Then he has got Kopran, Niyogin Fintech, Rashi Peripheral, Repro India, Samhi Hotels, Sangam India, Unicommerce and Waaree Energies.

Here’s a list of stocks where he has either maintained or increased his stake compared to the September 2024 quarter:

| Stock Name | Market Cap (in Cr.) | Investment Month | Latest Holding (%) |

|---|---|---|---|

| Bombay Dyeing | ₹2,621 | March 2023 | 1.65% |

| Kopran | ₹813 | March 2023 | 1.04% |

| Rashi Peripherals | ₹1,724 | March 2024 | 2.44% |

| Repro India | ₹627 | June 2023 | 3.32% |

| Samhi Hotels | ₹3,163 | December 2023 | 1.70% |

| Sangam | ₹1,601 | September 2022 | 4.86% |

The table below highlights the new additions to his portfolio since the June 2024 quarter:

| Stock Name | Market Cap (in Cr.) | Investment Month | Latest Holding (%) |

|---|---|---|---|

| Indostar Capital | ₹3,205 | December 2024 | 2.48% |

| Unicommerce eSolutions | ₹1,094 | September 2024 | 1.79% |

| Waaree Energies | ₹62,012 | December 2024 | 1.16% |

Madhusudan Kela follows a high-conviction, long-term investing approach, focusing on fundamentally strong companies with growth potential. He emphasizes deep research, sectoral trends and macroeconomic factors to identify multibagger opportunities. Madhusudan Kela is known for making bold bets on emerging sectors and undervalued stocks, often ahead of market trends. His investment philosophy revolves around patience, discipline and capitalizing on market cycles.

With this, we wrap up the final article in this three-part series, where we explored the portfolios of the top six HNIs/Ace Investors making waves in the market. As I’ve emphasized before, I never follow them blindly—I use their strategies as inspiration, conduct my own research and align investments with my risk appetite. While these ace investors have a high tolerance for risk, retail investors should take a more calculated approach. That said, analyzing their portfolios is a great way to spot potential multibaggers and refine your investing skills.

Of course, not every stock they pick will turn into a massive winner, but the insights gained from studying their moves can be invaluable for your investment journey.

I’d love to hear your thoughts! Which of these stocks are in your portfolio, and which ones do you find most promising? Drop a comment below and don’t forget to share this article with fellow investors. That’s it for this series—thank you for following along! Stay tuned for more insights, until then, happy investing!

Disclaimer: We are not a SEBI-registered research analyst. The information provided in this article is intended solely for educational, illustrative and awareness purposes. Nothing contained herein should be construed as a recommendation. Users are encouraged to seek professional financial advice before making any decisions based on the content provided.