Hi there and welcome back! This is the second article in our exciting three-part series where we uncover the portfolio of the most successful investors in the market. In the first article, we explored the portfolios of the top 5 Foreign Institutional Investors (FIIs). If you missed it, no worries – I highly recommend checking it out first to get a solid foundation before we dive deeper into today’s insights: Top 5 FIIs You Can’t Miss For Multibagger Ideas

In today’s article, we will discuss 6 Domestic Institutional Investors (DIIs) that I closely track, especially to identify new investment opportunities. In the case of DIIs, I don’t just track the fund house or a specific fund within that fund house. More than that, I track the investment style of the fund manager or the Founder, CEO or MD of the fund house as their approach is often the key to uncovering those hidden multibagger opportunities, making it an essential step for any serious investor looking to maximize returns.

A majority of retail investors simply invest in mutual funds that have generated high returns in the last 1-3 years but there is no guarantee that a mutual fund that has outperformed recently will continue to outperform in the future. If I compare it with Cricket, a cricketer might score a century in a match or take five wickets, but there is no guarantee that he will continue to score centuries or take five wickets in every match.

That’s where you bet on cricketers who have a strong history of good performance, because in cricket as it is said “Form is temporary, class is permanent.” With that mindset, I have identified six super fund managers that have a great track record of outperformance in the past and so I look at them beyond return percentage in the last 1-3 years. All six fund managers or DIIs in this list are value investors, with one exception – which you’ll discover as you read through the article. Now, let’s get into the details of these incredible DIIs for the game-changing multibagger opportunities.

Also Read: Sensex Historical Data: Sectors that can Outperform in 2025

Table of Contents

Top 6 DIIs and Fund Managers to Track Closely for Investment Opportunities

1. Parag Parikh Mutual Fund

The first DII that I track very closely is Parag Parikh Mutual Fund which is part of Parag Parikh Financial Advisory Services (PPFAS) and within that, I track Parag Parikh Flexi Cap Fund. In my opinion, Parag Parikh is one of the most ethical and genuine mutual fund houses in our country and the reason is quite simple. Unlike other mutual fund houses which have multiple mutual funds across categories, including large-cap, mid-cap, small-cap, multi-cap and flexi-cap value funds, and then within the sector, they get funds across defence, infra, power and so on, Parag Parikh has only got two equity-based mutual funds. One is Flexi Cap and the other is Tax Saver which shows that they are extremely focused.

Even though they could easily launch multiple mutual funds across various categories to mint money, they choose not to and one of the key reasons for this is their strong foundation set by the late Mr. Parag Parikh. Unfortunately, he is no longer with us as he met with an accident in 2015, but his thoughts and value investment style are always with us via his book “Value Investing and Behavioral Finance”. If you are a long-term investor, willing to create wealth in the stock market over the long term then this book is a must-read. I am sure this will set a very solid foundation in your investment journey and set you on the path to success!

Apart from him, another person that I track closely from Parag Parikh is Mr. Rajeev Thakkar, who is the CIO of Parag Parikh Financial Advisory Services and again a great value investor. He is quite vocal in various media interactions. So, if you’re curious to dive deeper into his investment philosophy, I highly recommend checking out his interviews on YouTube – they’re packed with valuable wisdom. Now, let’s dive into the stock holdings of the Parag Parikh Flexi Cap Fund. To explore their portfolio and see the stocks they’re backing, simply click here to check out the detailed list on Screener: Parag Parikh Flexi Cap Fund – Investments – Screener

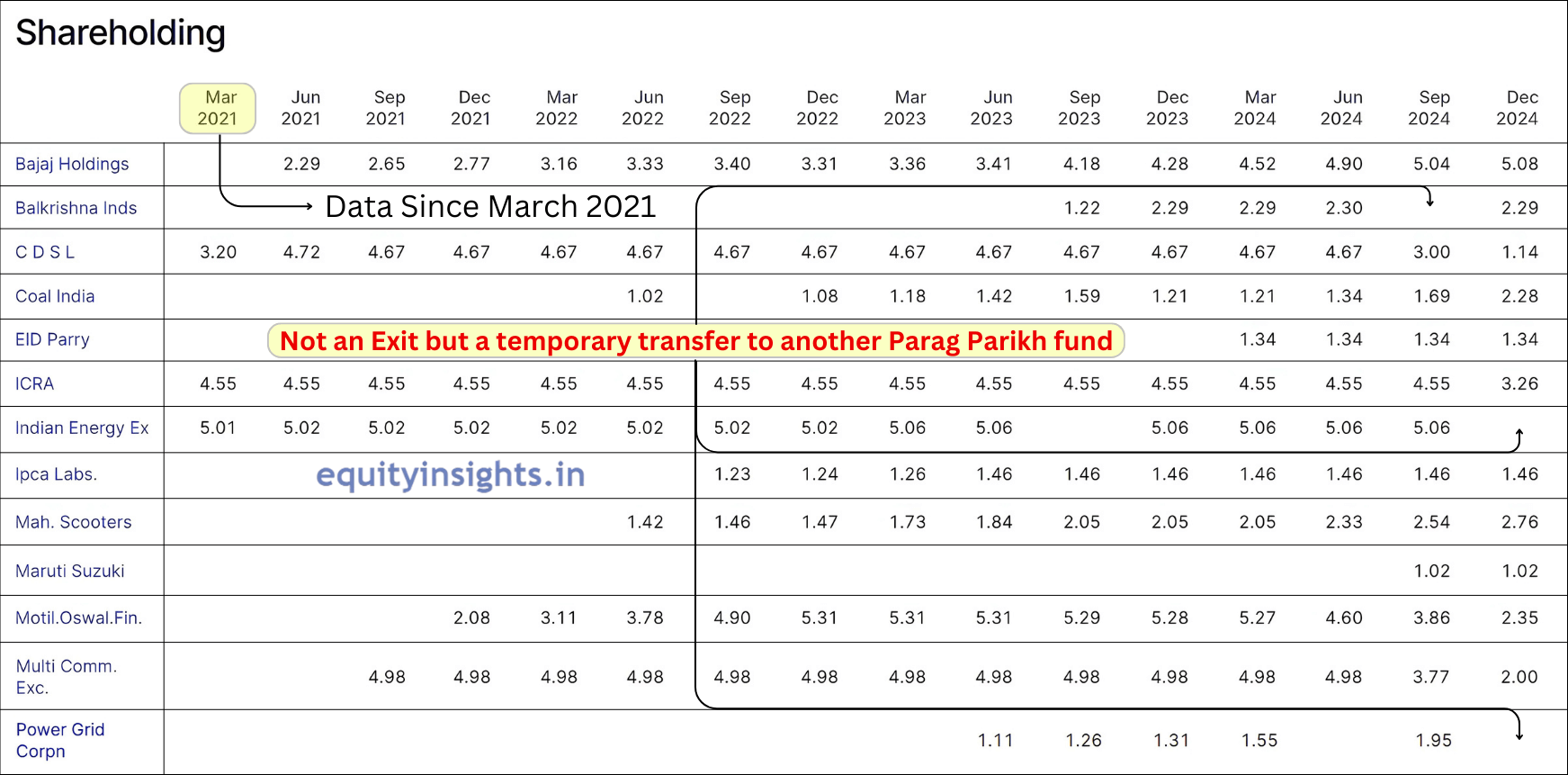

If you check the shareholdings of Parag Parikh Flexi Cap Fund on Screener, you’ll notice that it shows their holdings from March 2021 onward only. This means there could be several companies that the Parag Parikh Flexi Cap Fund has held for a longer period and continues to retain in its portfolio. Returning to the shareholding details, according to this data, Bajaj Holdings is one of the key stocks in their portfolio, where they have consistently increased their stake every quarter till December 2024.

Then there’s Balkrishna Industries where they invested in September 2023 at around ₹2300, boosted their investment in December 2023 to 2.29% and still hold onto it. Looking back, the company had a sharp rally until September 2022 but then didn’t generate any returns for the next two years. Yet, this fund house chose to invest in September 2023, recognizing its potential. Imagine investing in a company that gave no returns for two years. How many would have that courage? Even after their entry, Balkrishna didn’t rise immediately but eventually delivered decent returns in July 2024. However, now with the Indian stock market correcting for six months, Balkrishna has once again entered an attractive zone, making it worth a closer look.

So, the point is that these fund houses understand fundamentally strong companies and they invest when they are available at good prices. On the flip side, a majority of retail investors try to chase after stocks that have already performed well, hoping for continued success which highlights the critical difference between how fund houses and retail investors approach investments.

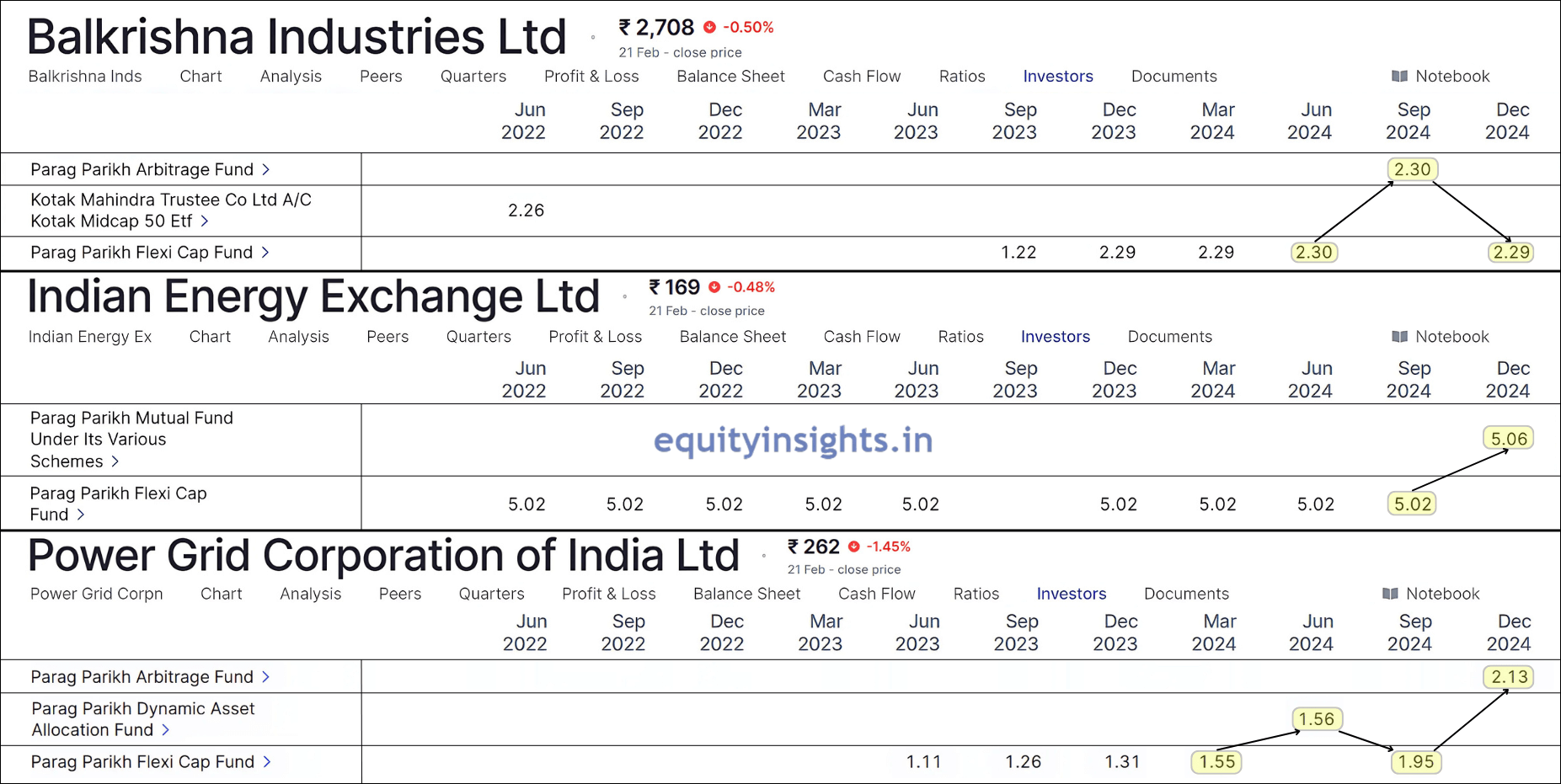

NOTE: In September 2024, you’ll notice that the company exited its position in Balkrishna Industries, but here’s where it gets interesting. In the very same month, the Parag Parikh Arbitrage Fund unexpectedly picked up the same amount of stake. What’s even more intriguing is that just a few months later, in December 2024, that stake was transferred back to the Parag Parikh Flexi Cap Fund. Quite a strategic move, don’t you think? Well, such movements from one arm to another typically reflect internal strategic decisions aimed at optimizing returns, risk management or regulatory compliance. You’ll see a similar trend with Indian Energy Exchange (IEX) and Power Grid Corporation in the December 2024 quarter.

In IEX, you will notice that Parag Parikh Mutual Fund invested in March 2021 and exited in December 2024 quarter but like Balkrishna Industries there has been an arm transfer to Parag Parikh Mutual Fund Under Its Various Schemes in December 2024 quarter with the same percentage of stake i.e. 5.06%. I am sure, you all would be aware of what has happened with IEX and their roller coaster ride! This stock skyrocketed during the COVID rally, only to plummet more than 50%. There were whispers of new regulations threatening their moat, but guess what? Parag Parikh Mutual Fund remains undeterred. They’re still holding a significant amount of IEX shares, standing firm in their confidence in the company.

Similar to IEX, in Power Grid Corporation, the stake has been moved to another fund of PPFAS named Parag Parikh Arbitrage Fund and increased to 2.13%. Now, since IEX and Power Grid Corporation aren’t in the Parag Parikh Flexi Cap Fund in the December 2024 quarter, we’re leaving them out and focusing solely on the fund’s current holdings. However, I’ve shared a simple way to track if a stock has moved within the same mutual fund, ensuring you stay informed and make the right call when monitoring a specific fund.

Coming back to the holdings of Parag Parikh Flexi Cap Fund, one of the long-term holdings in their portfolio is CDSL, where they’ve been steadily booking profits since June 2024. Alongside that, they are holding Coal India where they can be seen increasing its stake consistently, signaling their continued confidence in the stock and EID Parry – a company involved in sugar, nutraceuticals and ethanol production. Other standout holdings include ICRA. Additionally, Parag Parikh remains optimistic about Ipca Labs and Maharashtra Scooters, while the portfolio also features notable stocks like Motilal Oswal and Multi Commodity Exchange (MCX).

So, a quick overview of the above information has been put into the table that highlights the stocks where Parag Parikh Flexi Cap Fund has increased or maintained its stake compared to the last quarter of September 2024. I’ve not included the stocks where Parag Parikh has reduced its stake. The table also shows the current market capitalization of the companies, the timeline when the stocks have been added to their portfolio along with their latest holding percentage. Check it out for a quick and clear overview!

| Stock Name | Market Cap (in Cr.) | Investment Month | Latest Holding (%) |

|---|---|---|---|

| Bajaj Holdings | ₹1,35,861 | June 2021 | 5.08% |

| Coal India | ₹2,27,990 | December 2022 | 2.28% |

| EID Parry | ₹12,372 | March 2024 | 1.34% |

| Ipca Labs | ₹36,659 | September 2022 | 1.46% |

| Maharashtra Scooters | ₹10,960 | June 2022 | 2.76% |

The table below highlights companies newly added to the Parag Parikh Flexi Cap Fund portfolio over the last three quarters (since June 2024), focusing on those where stakes have been increased or held steady—without any reductions:

| Stock Name | Market Cap (in Cr.) | Investment Month | Latest Holding (%) |

|---|---|---|---|

| Maruti Suzuki | ₹3,87,452 | September 2024 | 1.02% |

Also Read: Zaggle Prepaid Share: A Promising Investment or Risky Bet?

2. Mirae Asset Group

Let’s dive into the next domestic institutional investor I track closely—Mirae Asset Group, specifically their Mirae Asset Large and Midcap Fund (formerly Mirae Asset Emerging Bluechip Fund). The Mirae Asset Large & Midcap Fund is an open-ended equity scheme that invests in both large-cap and mid-cap stocks. It mandates investing at least 35% of its assets in large-cap and 35% in mid-cap stocks. As of January 9, 2025, the fund has ₹38,680 Crores in assets under management (AUM). The CIO, Mr. Neelesh Surana, who is also a Co-Fund manager of this fund oversees an intriguing portfolio.

If you check Screener, you’ll notice two separate links due to a recent name change. However, with this transition, all new stock additions are now being made under the Mirae Asset Large & Midcap Fund (appear as Mirae Asset Large Cap Fund under the DIIs section in Screener for stocks where the fund has invested.) To get a complete picture of their holdings, simply keep an eye on the Mirae Asset Large & Midcap Fund. For instant access to their updated portfolio, just click on the first link below and explore the latest stocks in their investment basket. I’ve also included the old link in case you’d like to explore their previous portfolio:

- Mirae Asset Large & Midcap Fund – Investments – Screener

- Mirae Asset Emerging Bluechip Fund – Investments – Screener

NOTE: It may happen that a stock that was once part of the Mirae Asset Emerging Bluechip Fund may no longer appear after its merger with the Mirae Asset Large Cap Fund. This could be due to either the fund completely exiting that stock or an internal transfer of holdings between different Mirae Asset mutual fund schemes.

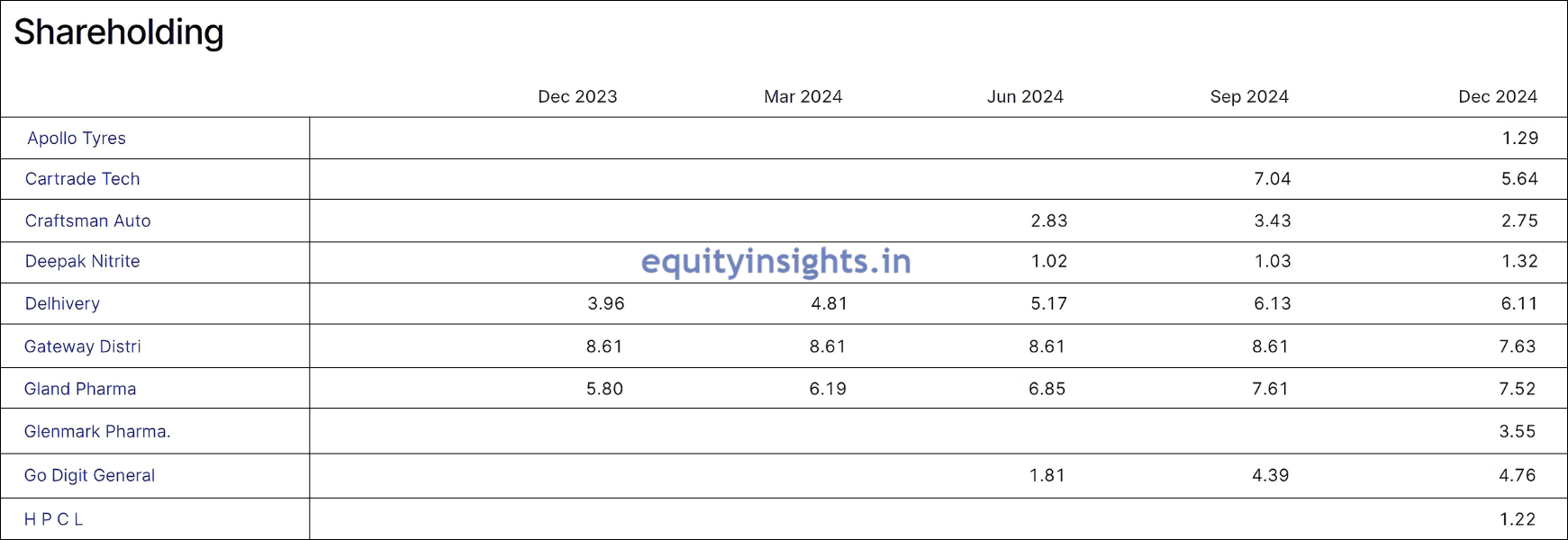

Mirae Asset’s portfolio features a diverse mix of stocks, including Apollo Tyres and CarTrade Tech—a stock already backed by two prominent FIIs, signaling growing confidence from DIIs as well. Other key holdings include Craftsman Automation, Deepak Nitrite and Delhivery, an intriguing pick added back in December 2022, before the fund’s name change. Despite its under-performance and flat trajectory post-IPO, Mirae Group saw potential and increased its stake from 1.97% to 6.11% in December 2024, with just a small reduction in December 2023. This highlights Mirae Asset Group’s strategic maneuvers and resilience, even amid shifting market tides. Pretty compelling, right?

Another interesting pick is Gateway Distriparks with a notable 7.63% stake, adding another key position to their diverse portfolio. Their keen focus on the pharmaceutical sector is evident with a bold move into Gland Pharma, where they made a bold entry in March 2023, buying up shares when the stock fell blindly and now holds a sizable 7.52% stake. More recently, they’ve expanded their pharma play with an investment in Glenmark Pharmaceuticals, reinforcing their confidence in the sector’s long-term potential. Beyond that, their portfolio also boasts positions in Go Digit General Insurance and HPCL, adding even more depth to their strategic bets.

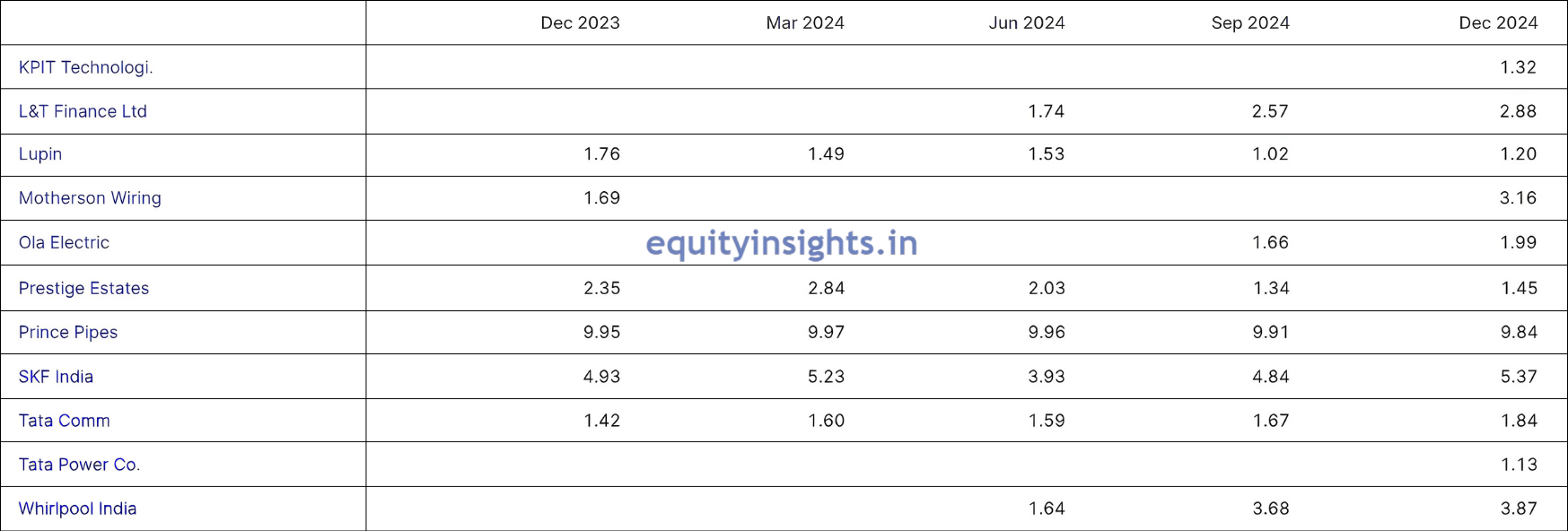

Other notable names in their portfolio include established players like KPIT Technologies, L&T Finance, Lupin and Motherson Wiring. Motherson was once a part of Mirae Asset’s portfolio in December 2023 but they later exited the stock. However, it seems they saw an opportunity in the recent market downturn, strategically re-entering the stock in the December 2024 quarter, capitalizing on its renewed potential. The investment giant has also strengthened its position in Ola Electric, increasing its stake from 1.66% to 1.99% in the latest quarter—a clear sign of their growing confidence in the EV sector’s potential.

Note: Just like IEX and Power Grid in the Parag Parikh Flexi Cap Fund, Gujarat State Petronet shares have moved to another arm of Mirae Asset, so we’re leaving it out as it’s absent in the December 2024 quarter.

Mirae Asset also holds significant stakes in Prestige Estates, Prince Pipes, which has been a key part of their portfolio since March 2022. Notably, Prince Pipes stands out with the largest stake of 9.84%, the highest among all their holdings. Other standout investments include SKF India, Tata Communications, Tata Power and Whirlpool of India, a truly dynamic mix of companies, showcasing their strategic vision for the future and all contributing to the diverse strength of their portfolio.

Take a look at the table below to see the list of stocks that have been newly added, had their allocations increased or maintained compared to the previous quarter, along with their latest holdings:

| Stock Name | Market Cap (in Cr.) | Investment Month | Latest Holding (%) |

|---|---|---|---|

| Lupin | ₹86,976 | December 2023 | 1.20% |

| Prestige Estates | ₹52,390 | December 2023 | 1.45% |

| SKF India | ₹18,872 | December 2023 | 5.37% |

| Tata Communications | ₹41,329 | December 2023 | 1.84% |

The table below highlights the companies that Mirae Asset Large & Midcap Fund has recently added to its portfolio over the last three quarters (since the June 2024 quarter) and has maintained or increased its stake:

| Stock Name | Market Cap (in Cr.) | Investment Month | Latest Holding (%) |

|---|---|---|---|

| Apollo Tyres | ₹25,953 | December 2024 | 1.29% |

| Deepak Nitrite | ₹26,361 | June 2024 | 1.32% |

| Glenmark Pharmaceuticals | ₹36,707 | December 2024 | 3.55% |

| Go Digit General Insurance | ₹27,621 | June 2024 | 4.76% |

| HPCL | ₹68,729 | December 2024 | 1.22% |

| KPIT Technologies | ₹35,916 | December 2024 | 1.32% |

| L&T Finance | ₹33,865 | June 2024 | 2.88% |

| Motherson Wiring | ₹21,708 | December 2024 | 3.16% |

| Ola Electric | ₹26,862 | September 2024 | 1.99% |

| Tata Power | ₹1,14,138 | December 2024 | 1.13% |

| Whirlpool of India | ₹12,425 | June 2024 | 3.87% |

Also Read: Trading Economics: How Economic Events Impact Stock Market?

3. Alternate Investment Fund

The third fund house I track is an Alternative Investment Fund (AIF) and the main reason I keep an eye on it is because of Mr. Prashant Jain. He is one person I have been tracking for almost three years now and in my opinion, he is one of the best fund house managers in our country. He is the ex-CEO of HDFC Mutual Fund from 2004 to 2022—so 18 years, he led this group and made it what it is today. He is an IIT Kanpur and IIM Bangalore alumnus and a fantastic value investor.

One notable example of his work is that he was the first to identify PSU stocks between 2018 and 2020. Unfortunately, during that time PSU stocks were underperforming which impacted HDFC AMC’s performance however we all know where PSU stocks stand today—they’ve outperformed in the last 3 years. It’s just that he recognized the opportunity a bit early. Now, he has launched a new fund house called has launched a new fund house called 3P Investment Managers Private Limited, which oversees the 3P India Equity Fund 1—a premier Alternate Investment Fund (AIF) designed for long-term wealth creation through high-quality Indian equities. The “3 P’s” stand for:

- Prudence: Building a portfolio of sustainable and reasonably valued businesses.

- Patience: Being patient with businesses and markets, as the risk in equity decreases over a longer investment horizon.

- Performance: Achieving strong outcomes.

Here are direct links to view the complete list of stocks in their portfolio on Screener: 3P India Equity Fund 1 – Investments – Screener and 3P India Equity Fund 1M – Investments – Screener

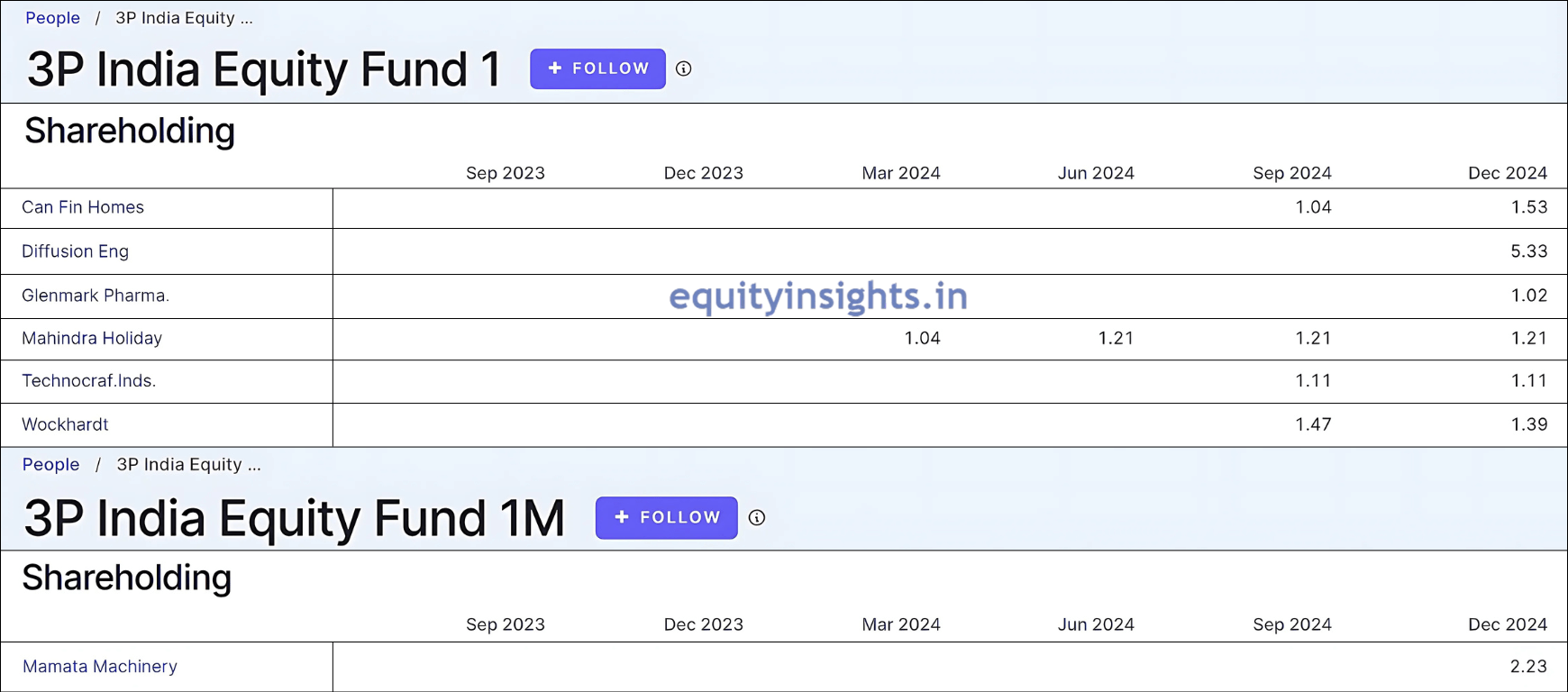

The 3P India Equity Fund 1 manages approximately ₹11,000 crores as of April 30, 2024 and is already making waves with its selective stock picks. It has strategically acquired stakes in a few standout companies that reflect a promising investment outlook. Among them, Mahindra Holidays stands out with a consistent holding of 1.21%. The fund has also shown confidence in the growing housing finance sector and capital goods sector, particularly through its increased stake in Can Fin Homes while acquiring the highest stake in Diffusion Engineers respectively, which aligns with their bullish stance on both the capex and infrastructure themes.

Glenmark Pharmaceuticals, a prominent name in the pharmaceutical sector, adds a layer of stability to the portfolio, while their latest investment, Mamata Machinery and Technocraft Industries, are an intriguing one, with the fund taking a 2.23% and 1.02% stake in the company respectively. Another key holding is Wockhardt, reflecting the fund’s diversified approach. As the Three P India Equity Fund 1 continues to build its portfolio, these early investments hint at a calculated strategy poised to tap into India’s growing sectors.

The table below highlights the stock where the Alternate Investment Fund has increased or maintained its stake compared to the last quarter of September 2024:

| Stock Name | Market Cap (in Cr.) | Investment Month | Latest Holding (%) |

|---|---|---|---|

| Mahindra Holidays | ₹6,407 | March 2024 | 1.21% |

Below is the table that shows the names of the companies that the Alternate Investment Fund has added recently (in the last 3 quarters or since the June 2024 quarter) to its portfolio with no reduction in its stake:

| Stock Name | Market Cap (in Cr.) | Investment Month | Latest Holding (%) |

|---|---|---|---|

| Can Fin Homes | ₹7,970 | September 2024 | 1.53% |

| Diffusion Engineers | ₹977 | December 2024 | 5.33% |

| Glenmark Pharmaceuticals | ₹36,707 | December 2024 | 1.02% |

| Technocraft Industries | ₹6,000 | September 2024 | 1.11% |

| Mamata Machinery | ₹955 | December 2024 | 2.23% |

Also Read: Candlestick Patterns: Definition, History and Its Types

4. HDFC Mutual Fund

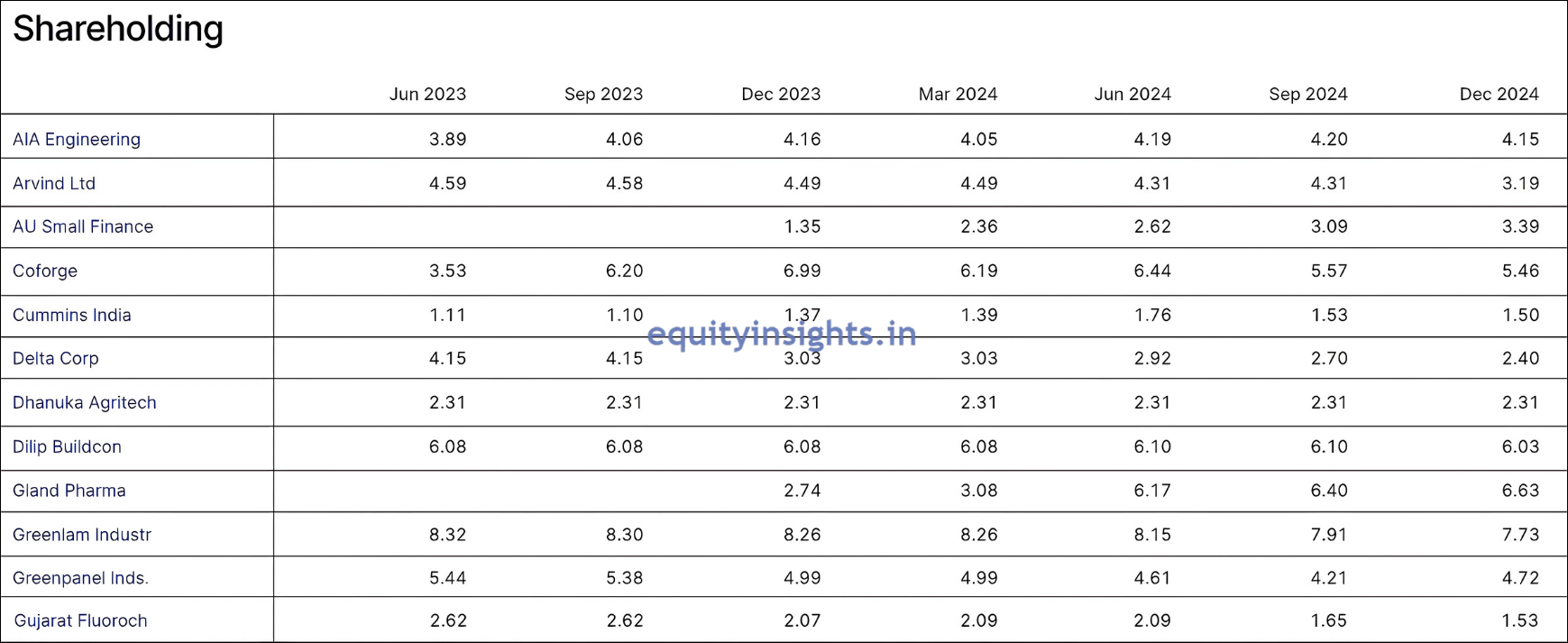

The fourth mutual fund is HDFC Mutual Fund and within that, HDFC Mid-Cap Opportunities Fund which is managed by Mr. Chirag Setalvad, who has got more than 25 years of experience is the best one to track. If you look at HDFC Mid-Cap Opportunities Fund shareholdings, which you can directly access on Screener through this link: HDFC Mutual Fund – HDFC Mid-Cap Opportunities Fund – Investments – Screener, you will find that it is making some fascinating moves in its portfolio, offering a glimpse into its strategy and the sectors it’s betting on. At the heart of its holdings, you’ll find a diverse mix of companies, each reflecting a unique growth story.

Its portfolio includes names like AIA Engineering—a long-term holding, Arvind Limited, AU Small Finance where they are increasing the stake consistently in every quarter, Coforge, Cummins India and Delta Corp where they have been consistently reducing the allocation. Other notable names are Dhanuka Agritech, Dilip Buildcon and Gland Pharma where it increased the stake big time. As we studied several FIIs and DIIs, it appears that these institutions and fund houses are quite bullish on Gland Pharma in general and I also feel that the Pharma space is looking quite attractive. Then they’ve got Greenlam Industries, Greenpanel Industries and Gujarat Fluorochemicals – all strong players in the material and chemicals sectors, pointing to a consistent confidence in capex-heavy themes.

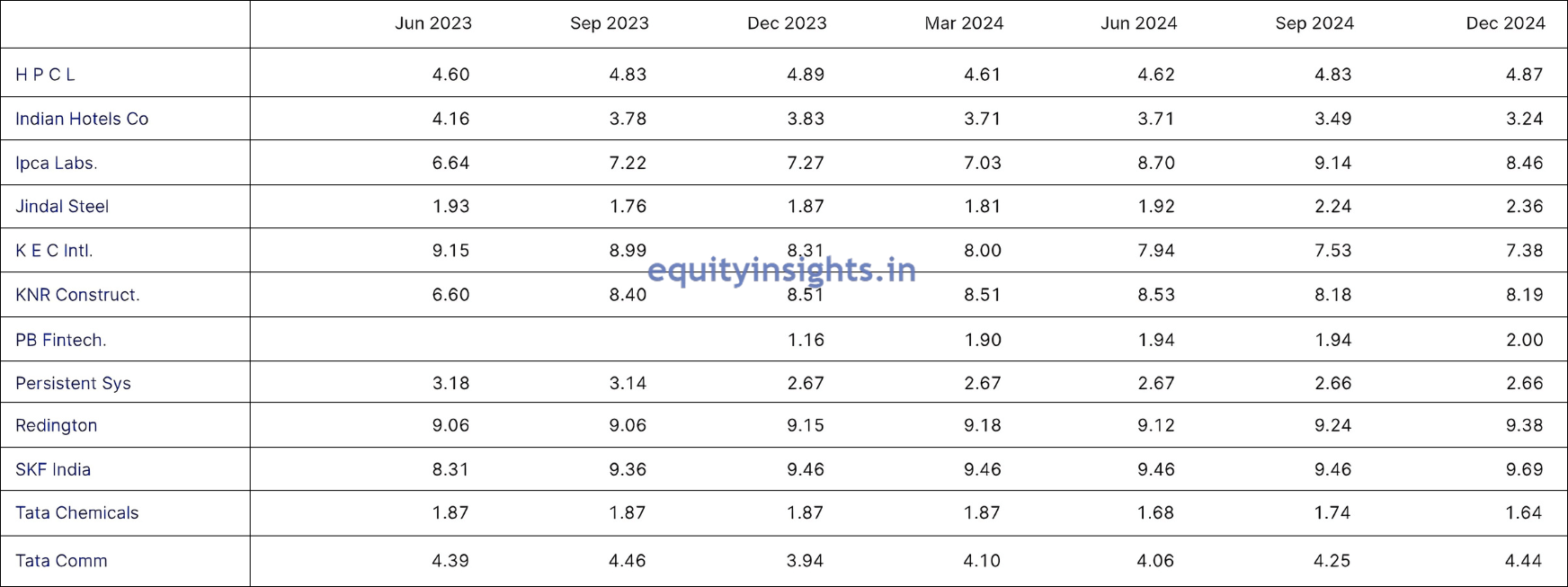

The investment giant doesn’t stop there. The Fund is also backing some high-profile names in the energy, hospitality and pharma spaces: HPCL, Indian Hotels and Ipca Labs. They seem to have a keen eye on sectors that could benefit from a post-pandemic bounce back or strong structural growth. Capex and infrastructure remain a key theme with investments in Jindal Steel, KEC International and KNR Constructions. Their nearly 8% stake in KNR Constructions, reflects their belief in the long-term construction and infrastructure boom and that they are positioning themselves for the rise of India’s growing urbanization and infrastructure needs.

The portfolio also embraces the tech and innovation space, featuring PB Fintech, Persistent Systems and with over 9% stake in both Redington and SKF India which highlights a strong commitment to technology, e-commerce and industrial engineering, reinforcing a forward-thinking investment strategy. A bit of a wild card? Tata Chemicals. Despite its long-standing underperformance, this fund continues to hold steady here, potentially betting on a turnaround or long-term strategic shift in the chemical sector and alongside that, Tata Communications also gets a nod by the fund house, showing faith in the telecom giant’s future prospects.

In short, HDFC Mid-Cap Opportunities Fund is actively placing its chips in areas it believes will drive India’s next wave of growth—whether through industrial powerhouses, tech innovators or infrastructure leaders. It’s a portfolio that’s built on confidence and a strong belief in the future of India’s economy. Here’s a quick snapshot of the portfolio—highlighting the stocks where this fund has either raised its stake or held steady compared to the previous quarter — September 2024:

| Stock Name | Market Cap (in Cr.) | Investment Month | Latest Holding (%) |

|---|---|---|---|

| AU Small Finance Bank | ₹40,018 | December 2023 | 3.39% |

| Dhanuka Agritech | ₹6,108 | June 2023 | 2.31% |

| Gland Pharma | ₹25,151 | December 2023 | 6.63% |

| Greenpanel Industries | ₹3,731 | June 2023 | 4.72% |

| HPCL | ₹68,729 | June 2023 | 4.87% |

| Jindal Steel & Power | ₹89,803 | June 2023 | 2.36% |

| KNR Constructions | ₹6,570 | June 2023 | 8.19% |

| PB Fintech | ₹71,770 | December 2023 | 2.00% |

| Persistent Systems | ₹88,995 | June 2023 | 2.66% |

| Redington | ₹19,662 | June 2023 | 9.38% |

| SKF India | ₹18,872 | June 2023 | 9.69% |

| Tata Communications | ₹41,329 | June 2023 | 4.44% |

While the HDFC Mid-Cap Opportunities Fund continues to hold its stocks with conviction, it hasn’t made any new additions to its portfolio in the last three quarters since June 2024.

Also Read: Stock Analysis: Things to Follow & Avoid in the Stock Market

5. Kotak Mutual Fund

The fifth DII that I track very closely is Kotak Mutual Fund. Within that, I track Kotak Emerging Equity Fund also called Kotak Emerging Equity Scheme as I like its investment style and overall fund philosophy, and it is all because of Mr. Nilesh Shah, MD of Kotak AMC. He frequently shares his insights through media interactions, thereby offering a great opportunity to understand his investment philosophy and approach. As I mentioned above in the context of Cricket “Your form is temporary, class is permanent.” Similarly, a stock or a mutual fund might underperform for six months, one year or two years but if a fund has a solid manager, it will eventually perform.

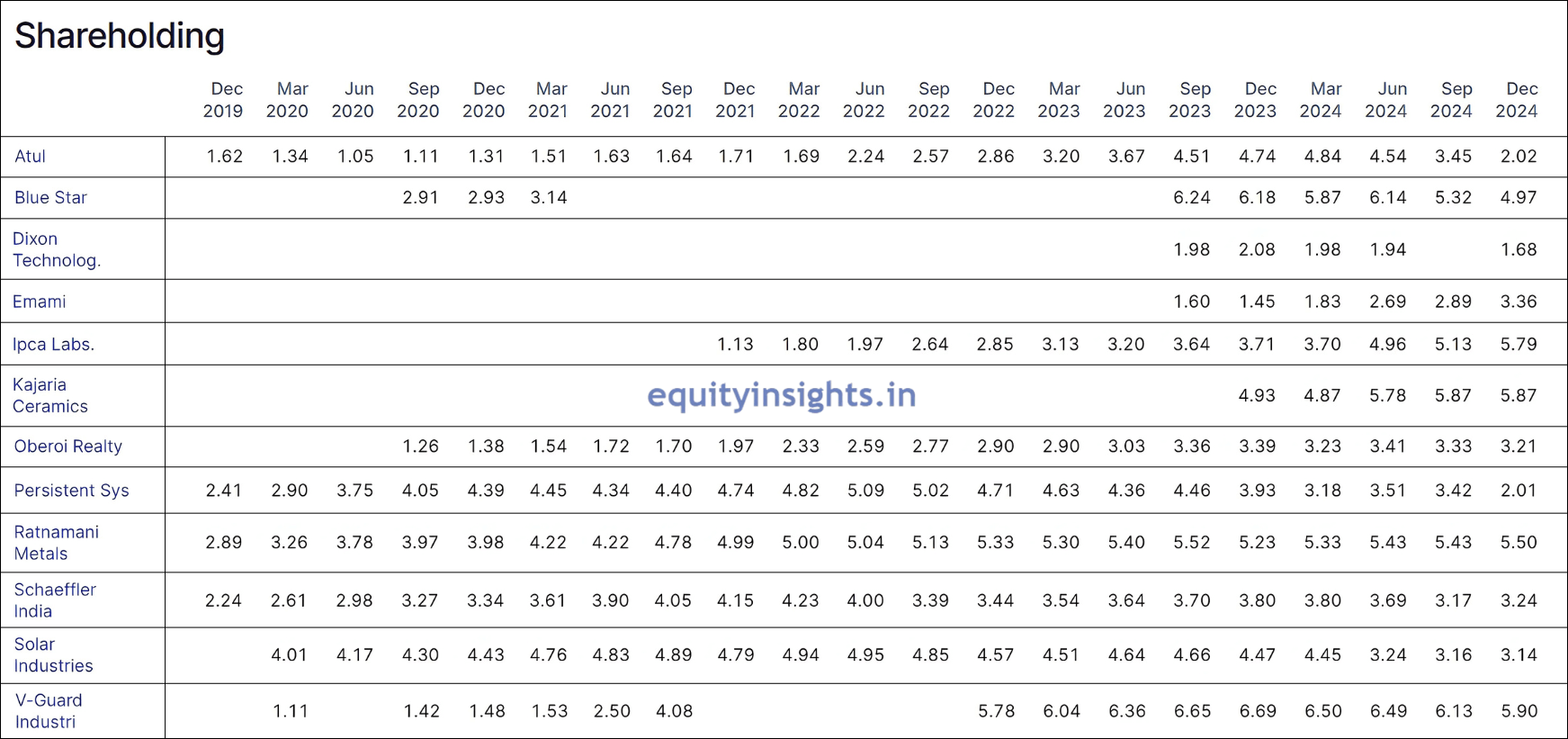

That’s why I focus more on the fund manager rather than the fund itself. If you dive into the details of the Kotak Emerging Equity Fund, you’ll notice some intriguing moves that reflect both strategic profit-taking and a strong belief in future growth. One such example is Atul Limited, where the fund has been consistently reducing its stake. This could be an attempt to lock in profits, considering they’ve held onto the stock since September 2017, riding its growth wave for quite some time.

Then there’s Bluestar, which continues to remain a part of their portfolio, signaling confidence in the company’s prospects. In December 2023, it added Dixon Technologies and Emami to its portfolio. Although Dixon underwent an arm transfer in the September 2024 quarter, the fund swiftly reacquired it—albeit with a slightly lower stake than in June 2024. Meanwhile, its growing conviction in Emami is evident, as it has consistently increased its stake, signaling confidence in its long-term growth potential. Ipca Labs is another key player in their portfolio, a stock that’s consistently favored by both FIIs and DIIs alike, signaling its strong fundamentals and growth potential.

So, if you try to take an inference out of it, the majority of these fund houses are quite bullish on the pharma theme and within that they have got Ipca Labs and a lot of them have got Gland Pharma. Other names in the portfolio are Kajaria Ceramics —invested in the December 2023 quarter and increased the allocation, Oberoi Realty, Persistent Systems, Ratnamani Metals, Schaeffler India, Solar Industries and V-Guard Industries.

Overall, Kotak Mutual Fund exemplifies how to identify fundamentally strong companies at attractive valuations and remain committed to their convictions. Instead of panicking during a stock correction, they increase their allocation, as a dip in a solid company’s stock makes it even more appealing.

If you take a closer look at the stocks where Kotak Emerging Equity Fund has either raised or held its stake since the September 2024 quarter, the following table reveals some compelling insights:

| Stock Name | Market Cap (in Cr.) | Investment Month | Latest Holding (%) |

|---|---|---|---|

| Emami | ₹24,298 | September 2023 | 3.36% |

| Ipca Labs | ₹36,659 | December 2021 | 5.79% |

| Kajaria Ceramics | ₹14,037 | December 2023 | 5.87% |

| Ratnamani Metals | ₹17,528 | March 2019 | 5.50% |

| Schaeffler India | ₹49,995 | December 2017 | 3.24% |

In the last three quarters, there’s been just one addition—and it’s a re-entry by Kotak Emerging Equity Fund into the stock:

| Stock Name | Market Cap (in Cr.) | Investment Month | Latest Holding (%) |

|---|---|---|---|

| Dixon Technologies | ₹83,931 | December 2024 | 1.68% |

Also Read: Investment: The Key to Secure Your Financial Future

6. Quant Mutual Fund

The final fund house that I track very closely is Quant Mutual Fund and within that, I track Quant Small Cap Fund. Now, this is a very interesting mutual fund, quite different from the five fund houses that we have discussed. The five that we have discussed are more of value investment funds and of course, a mix of value and growth but Quant is different in a way as they believe in investing based on data, so very less human intervention and more of data-oriented investment and this fund house is the exception among all these DIIs that I mentioned earlier, who are not focused on value investing.

In addition to this, they are more into momentum investing — they identify opportunities, invest and don’t mind exiting. So, they do a lot of churning in their portfolio. One of the risks associated with this fund is that you cannot follow them blindly as they might enter a particular stock in one quarter and exit in the second quarter which is very interesting in my opinion. Mr. Sandeep Tandon is the Founder and CEO of Quant and in the last few years, it has outperformed the industry from ₹100 crores AUM to today nearly ₹1 lakh crore AUM which implies massive growth.

Quant Mutual Fund’s portfolio reveals a thoughtful mix of companies across diverse sectors. Here is a direct link to access their shareholdings on Screener: Quant Mutual Fund – Quant Small Cap Fund – Investments – Screener

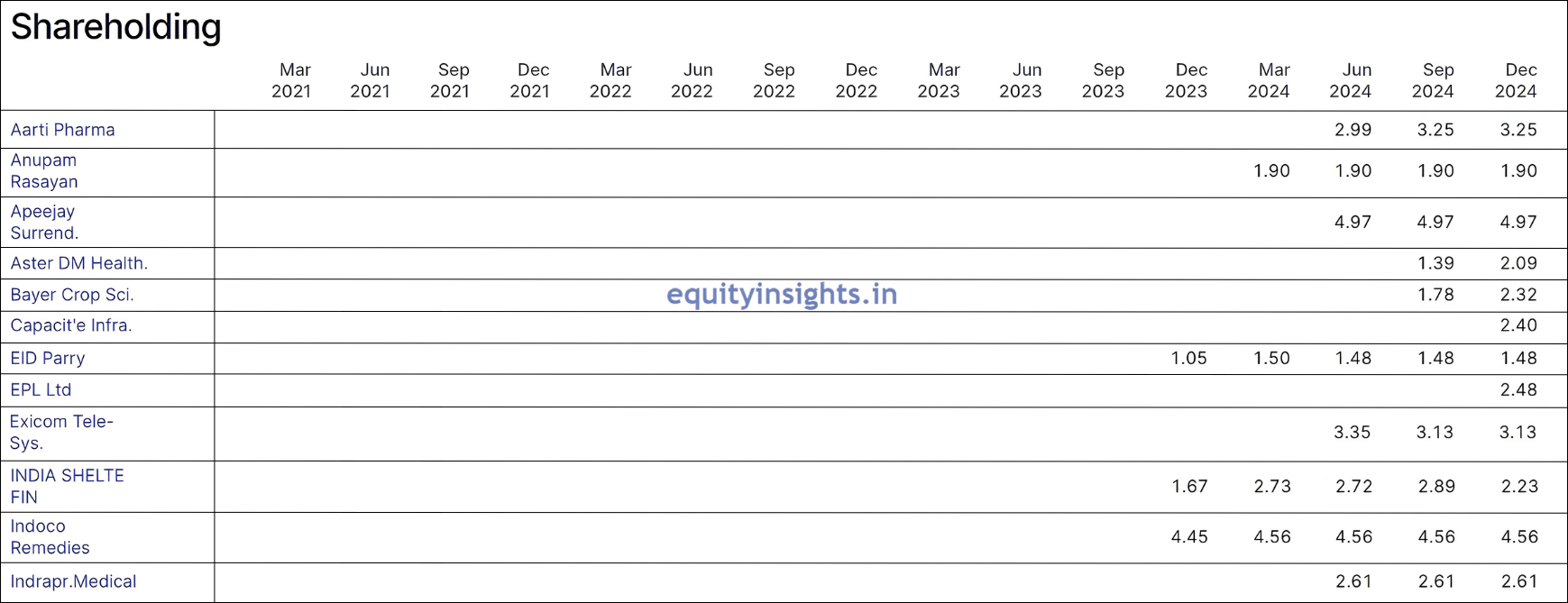

When you click on the link, you will find out that Quant Mutual Fund has been actively reshuffling its portfolio, strategically capitalizing on the ongoing market downturn over the past six months. Seizing opportunities in undervalued stocks, the fund added Aarti Pharmalabs and Apeejay Surrendra Park Hotels in June 2024, while maintaining its position in Anupam Rasayan, which was first acquired in March 2024. In September 2024, the fund further expanded its holdings with Aster DM Healthcare and Bayer CropScience, reinforcing its confidence in the healthcare and agri-science sectors.

December 2024 saw fresh investments in Capacite Infraprojects and EPL Limited, signaling a keen interest in infrastructure and packaging. Additionally, their September 2024 acquisition of EID Parry, a consumer-focused stock, highlights their belief in the potential of the sugar and consumer space. Another intriguing addition is Exicom Tele-Systems, a rising player in power systems for telecom and electric vehicle charging solutions, reflecting the fund’s forward-looking approach toward emerging technology sectors. Beyond that, their portfolio also boasts positions in India Shelter Finance, Indoco Remedies and Indraprastha Medical.

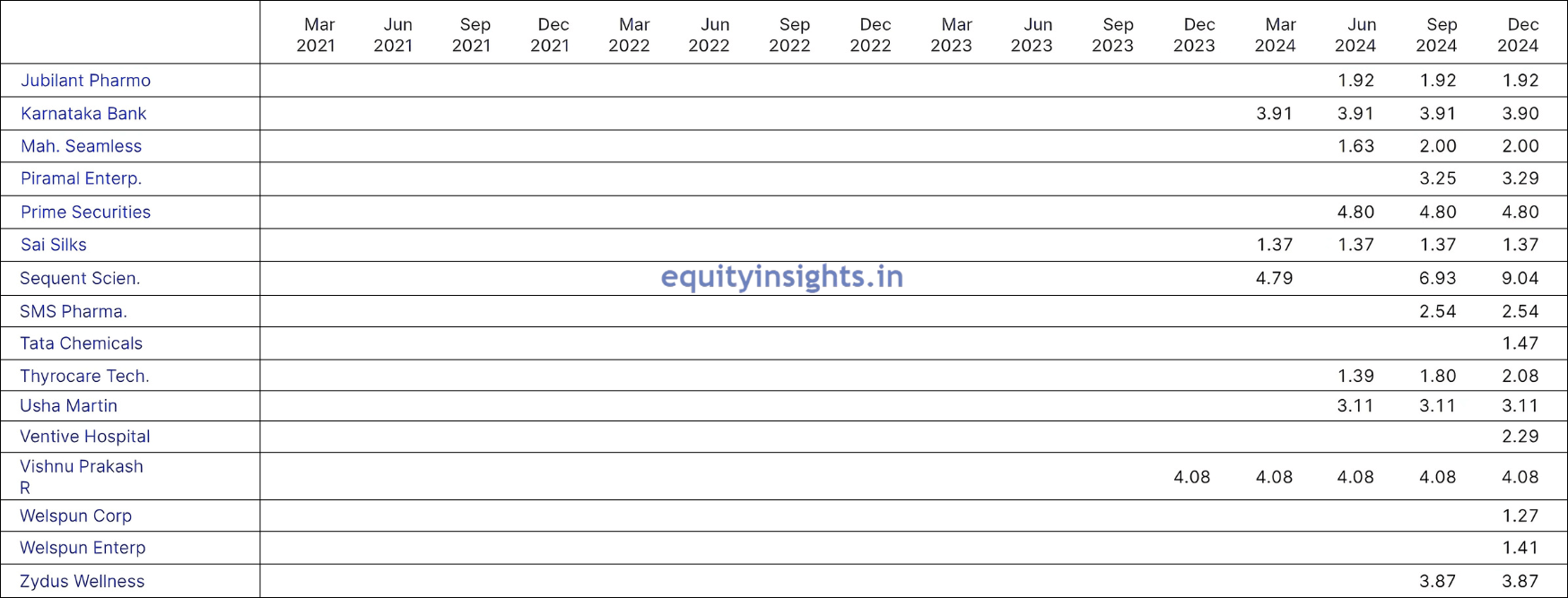

Other notable holdings include Jubilant Pharmova and Karnataka Bank. Additionally, they have stakes in Maharashtra Seamless, Prime Securities and Sai Silks, rounding out a diverse and promising portfolio. A few other noteworthy stocks are Sequent Scientific where they increased their stake big time, SMS Pharmaceuticals, Tata Chemicals and Thyrocare Technologies. It’s fascinating to observe that Thyrocare has experienced prolonged underperformance, much like IEX did. Both stocks saw a sharp correction in their share prices after significant outperformance during the Covid period. Thyrocare, for instance, dropped from ₹1500 highs to lows of ₹400 and has since recovered to ₹600. Additionally, they’ve included Usha Martin, Ventive Hospitality, Vishnu Prakash Punglia, Welspun Corp, Welspun Enterprises and Zydus Wellness in their portfolio.

You can check the table below for a detailed view of their latest holdings where they have either increased their stake or kept their stake constant:

| Stock Name | Market Cap (in Cr.) | Investment Month | Latest Holding (%) |

|---|---|---|---|

| Anupam Rasayan | ₹7,036 | March 2024 | 1.90% |

| EID Parry | ₹12,372 | December 2023 | 1.48% |

| Indoco Remedies | ₹2,159 | December 2023 | 4.56% |

| Sai Silks | ₹2,394 | March 2024 | 1.37% |

| Vishnu Prakash R Punglia | ₹2,192 | December 2023 | 4.08% |

Up next is a table highlighting recent additions in their portfolio (since the June 2024 quarter), focusing on stocks where stakes have either increased or remained steady:

| Stock Name | Market Cap (in Cr.) | Investment Month | Latest Holding (%) |

|---|---|---|---|

| Aarti Pharmalabs | ₹6,927 | June 2024 | 3.25% |

| Apeejay Surrendra Park | ₹3,461 | June 2024 | 4.97% |

| Aster DM Healthcare | ₹20,727 | September 2024 | 2.09% |

| Bayer CropScience | ₹21,687 | September 2024 | 2.32% |

| Capacite Infraprojects | ₹2,784 | December 2024 | 2.40% |

| EPL | ₹7,584 | December 2024 | 2.48% |

| Exicom Tele-Systems | ₹2,047 | June 2024 | 3.13% |

| Indraprastha Medical | ₹3,635 | June 2024 | 2.61% |

| Jubilant Pharmova | ₹15,404 | June 2024 | 1.92% |

| Maharashtra Seamless | ₹8,897 | June 2024 | 2.00% |

| Piramal Enterprises | ₹21,071 | September 2024 | 3.29% |

| Prime Securities | ₹766 | June 2024 | 4.80% |

| Sequent Scientific | ₹3,993 | September 2024 | 9.04% |

| SMS Pharmaceuticals | ₹1,816 | September 2024 | 2.54% |

| Tata Chemicals | ₹21,554 | December 2024 | 1.47% |

| Thyrocare Technologies | ₹3,846 | June 2024 | 2.08% |

| Usha Martin | ₹9,310 | June 2024 | 3.11% |

| Ventive Hospitality | ₹14,666 | December 2024 | 2.29% |

| Welspun Corp | ₹20,421 | December 2024 | 1.27% |

| Welspun Enterprises | ₹6,391 | December 2024 | 1.41% |

| Zydus Wellness | ₹10,581 | September 2024 | 3.87% |

The recent stock additions clearly show how Quant Small Cap Mutual Fund capitalized on the market downturn to scoop up quality stocks for its portfolio.

So, that’s the list of the top six DIIs who are key players in long-term wealth creation and this article highlights their strategic decisions, offering valuable insights into how these fund managers and domestic institutional investors shape the market. Their selections and allocations give valuable insights into emerging trends and potential opportunities in the market. As I said, it’s all about following the fund manager’s investment philosophy because if you are there in the long-term game of wealth creation, investment philosophy matters more than short-term performance because it might happen that the fund does not outperform for a brief period, but in the long term if the fund manager is strong, the fund would do well.

One of the observations from the above information is that these fund managers or DIIs are quite bullish on capex and infra themes. Apart from this, pharma has been an underperformer where a lot of fund houses have recently increased allocations. So, stocks from these sectors are worth studying for multibagger opportunities.

This is it from my side in this article. Now, tell me in the comments which stock from this entire list you have in your portfolio. Which sectors do you think are looking promising? Do share with your friend circle. I will see you in the next article. Until then, take care.

Disclaimer: We are not a SEBI-registered research analyst. The information provided in this article is intended solely for educational, illustrative and awareness purposes. Nothing contained herein should be construed as a recommendation. Users are encouraged to seek professional financial advice before making any decisions based on the content provided.