Have you ever seen a stock suddenly shoot up or crash without any big news? The secret behind these wild moves is often strong hands or big-money investors. These heavyweights trade in massive amounts, pushing stock prices up when they buy and dragging them down when they exit. Their actions shape market trends and understanding their moves can give you a serious advantage in the stock market!

Mr. Mohnish Pabrai, an Indian-American businessman and successful value investor, has built a remarkable fortune with a net worth approaching $2 billion. Known for his sharp investment acumen, Pabrai is the author of the insightful book “The Dhando Investor“, which delves into the principles of value investing. A devoted follower of Warren Buffett, he has openly acknowledged that his investment strategies are heavily inspired by the legendary investor, even going so far as to describe himself as a “shameless copycat.” While he may draw from Buffett’s ideas, Pabrai’s success demonstrates that applying these strategies requires more than just imitation. Pabrai takes the time to thoroughly understand the businesses he invests in before making any decisions.

The reason for discussing Mr. Mohnish Pabrai is to give you an example that if you follow the right set of people, you can get many multibagger ideas and that’s where I want to discuss top FIIs, fund houses and investors, I follow in my investment journey to get ideas for investment. I’ve created three categories of investors: Foreign Institutional Investors (FIIs), Domestic Institutional Investors (DIIs) and High Net Worth Individuals (HNIs). I closely monitor specific FIIs, DIIs and HNIs to track the stocks they buy or sell in their portfolios.

I focus only on institutions and individuals with a long-term investment mindset, filtering out those who trade frequently for short-term gains. Based on years of close tracking, I have identified 15 key investors—a mix of 5 FIIs, 6 DIIs and 4 HNIs. While there are many market players, this carefully curated list includes only those with a strong commitment to long-term wealth creation.

Since covering all 15 investors and their stock holdings in a single article would make it too lengthy. So, I’ve divided them into three separate articles—one each for FIIs, DIIs and HNIs—to provide a clearer and more in-depth analysis. In this first article, I’ll focus on 5 FIIs that I closely monitor and analyze their portfolios. The second article will cover the top DIIs while the third will delve into the most prominent HNIs.

I’ll also share how you can track their investments to identify multibagger ideas. However, it is important to note identifying a multibagger idea is only the first step. You also need to deep dive into the business to understand its potential and build confidence before investing your money. Moreover, you don’t need to buy every company that FIIs, DIIs or HNIs are buying as their investments don’t always guarantee success. Yet, this approach is a great way to identify fundamentally strong companies across categories.

Also Read: Breakout Stocks: The Secret to Spotting Big Market Moves!

Table of Contents

Introduction

Before we dive in, let me give you a quick preview: since this article will reveal the investment portfolios of the top 5 FIIs and highlight their key holdings, it would require you to access their shareholdings page. Now, you might be wondering how to access the latest shareholdings of these strong hands in Indian companies. The answer is simple—you can use two fantastic platforms: Screener and Trendlyne, which can provide you with all the insights you need to track their investments.

How to access the latest shareholdings of Investors using Screener and Trendlyne?

I. Screener

To explore the investments of top FIIs, DIIs or renowned investors on Screener, simply head to screener.in. At the top of the page, you’ll find the “Tools” option. Click on it, then select “Search Shareholders”. This will take you to a page with a search bar, where you can enter the name of any investor to land directly on their investment page. But that’s not all—on the same page, under “Trending Investors”, you’ll discover a list of India’s most influential investors and with just one click, you can access their complete holdings. It’s a quick and seamless way to track the investments of the market’s big players!

Breadcrumbs for Screener:

screener.in < Tools < Search Shareholders < [Investor Name]

OR

screener.in < Tools < Search Shareholders < Trending Investors < [Investor Name]

Here’s something important to keep in mind: sometimes, accessing the holdings of FIIs or top investors on Screener might require a premium subscription. But don’t worry—I’ve got you covered! To make this task easier for you, I’ll include direct links to Screener pages showing the stock holdings of each of the top 5 FIIs separately. These links will be placed right under each FIIs information in this article, allowing you to dive straight into their specific investment pages with ease.

II. Trendlyne

Now, if you want to check the same data on Trendlyne, head over to trendlyne.com. On top, there’s a section called Superstars. Here, you’ll find details about individual investors, institutional investors (DIIs) and FIIs. Since we’re discussing FIIs, click on the FIIs tab to see the names of all FIIs invested in the Indian market. You can view their portfolio value, number of stocks and sector preferences—many of which favour banking and finance. Additionally, you can see the top holdings in their portfolios, including stocks they’ve recently bought or sold. All you have to do is click on the name of the FII to get detailed information about the companies in their portfolio.

Breadcrumbs for Trendlyne: trendlyne.com < Superstars < FIIs < [FII Name]

Although I’ve shared the steps to access the shareholdings of top investors on both platforms, however since Screener offers a more user-friendly experience, I’ll be using images from Screener throughout this article to showcase the shareholdings of all the FIIs. However, you can also use Trendlyne using the above steps. So, let’s get started.

Also Read: Trading Economics: How Economic Events Impact Stock Market?

Top 5 FIIs to Track Closely for Multibagger Ideas

1. Massachusetts Institute of Technology (MIT)

The first FII that I track very closely is the Massachusetts Institute of Technology (MIT). MIT needs no introduction as it’s the world’s number one university, especially for technical courses. But did you know, they also have an investment arm actively involved in the global market, including India? They currently hold over ₹7,000 crores of investments in listed Indian companies, with more than 1% holdings. Here’s the direct link to MIT’s portfolio on Screener: Massachusetts Institute Of Technology – Investments – Screener

It is important to note here that if a company or HNI holds more than 1% of a company, then only its name is visible in the shareholding pattern, otherwise it’s not. Therefore, MIT might also have stakes below 1% that aren’t publicly disclosed.

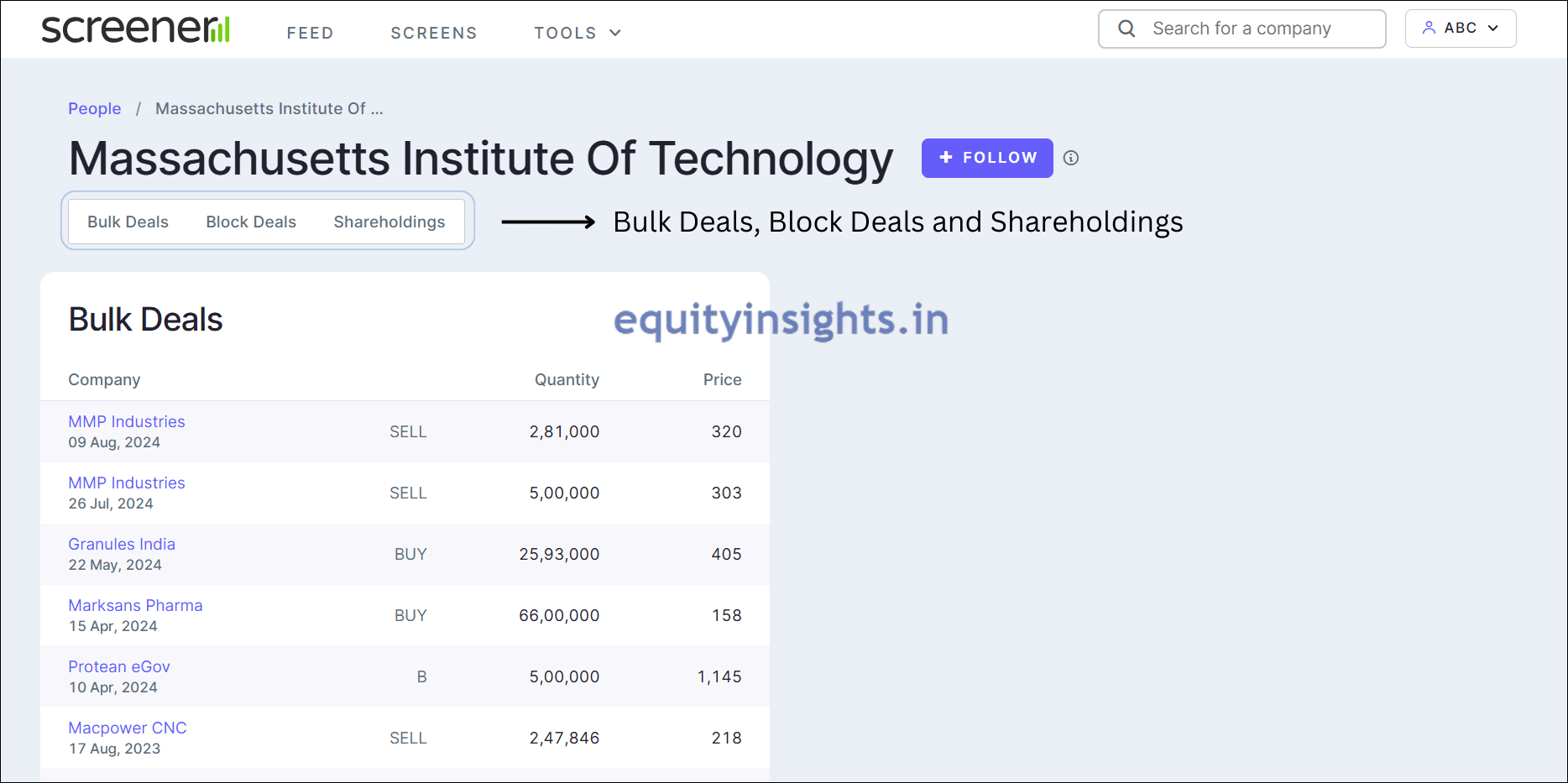

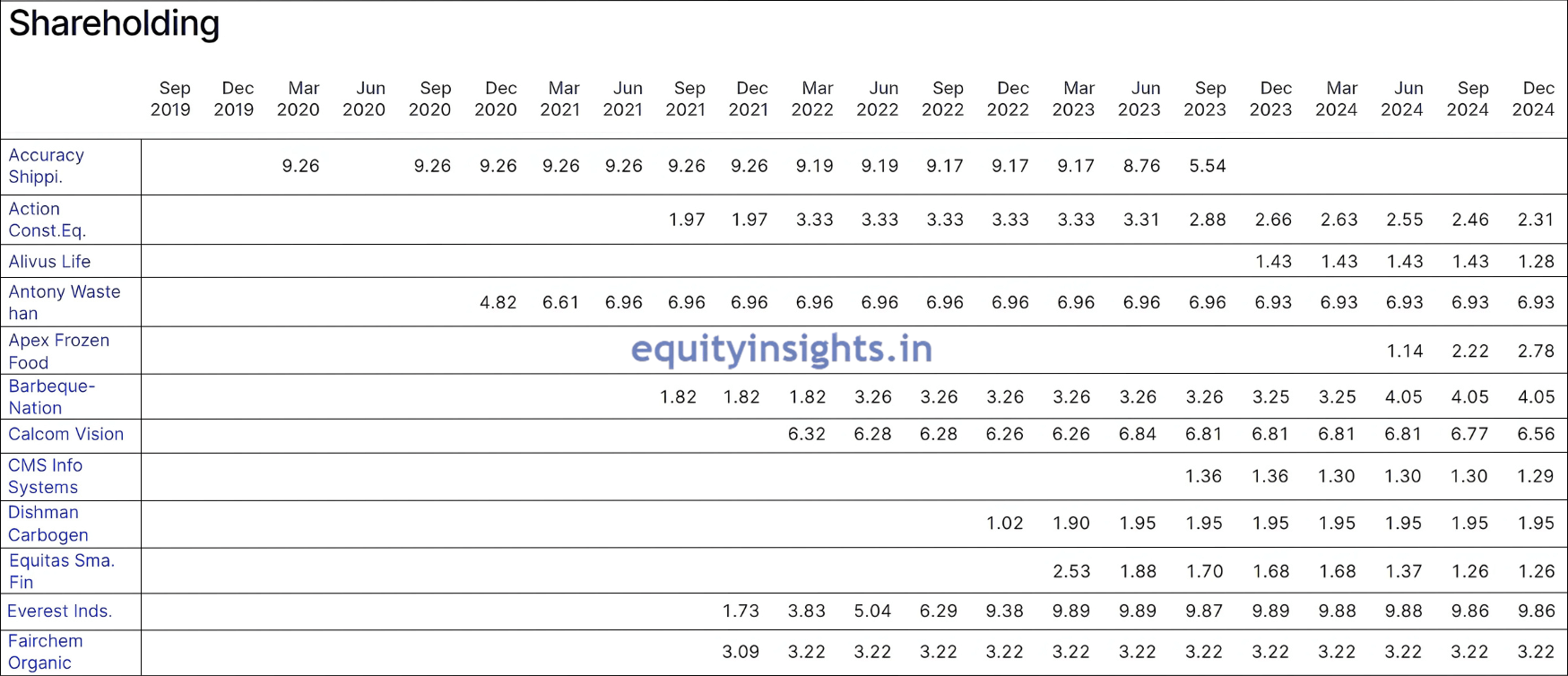

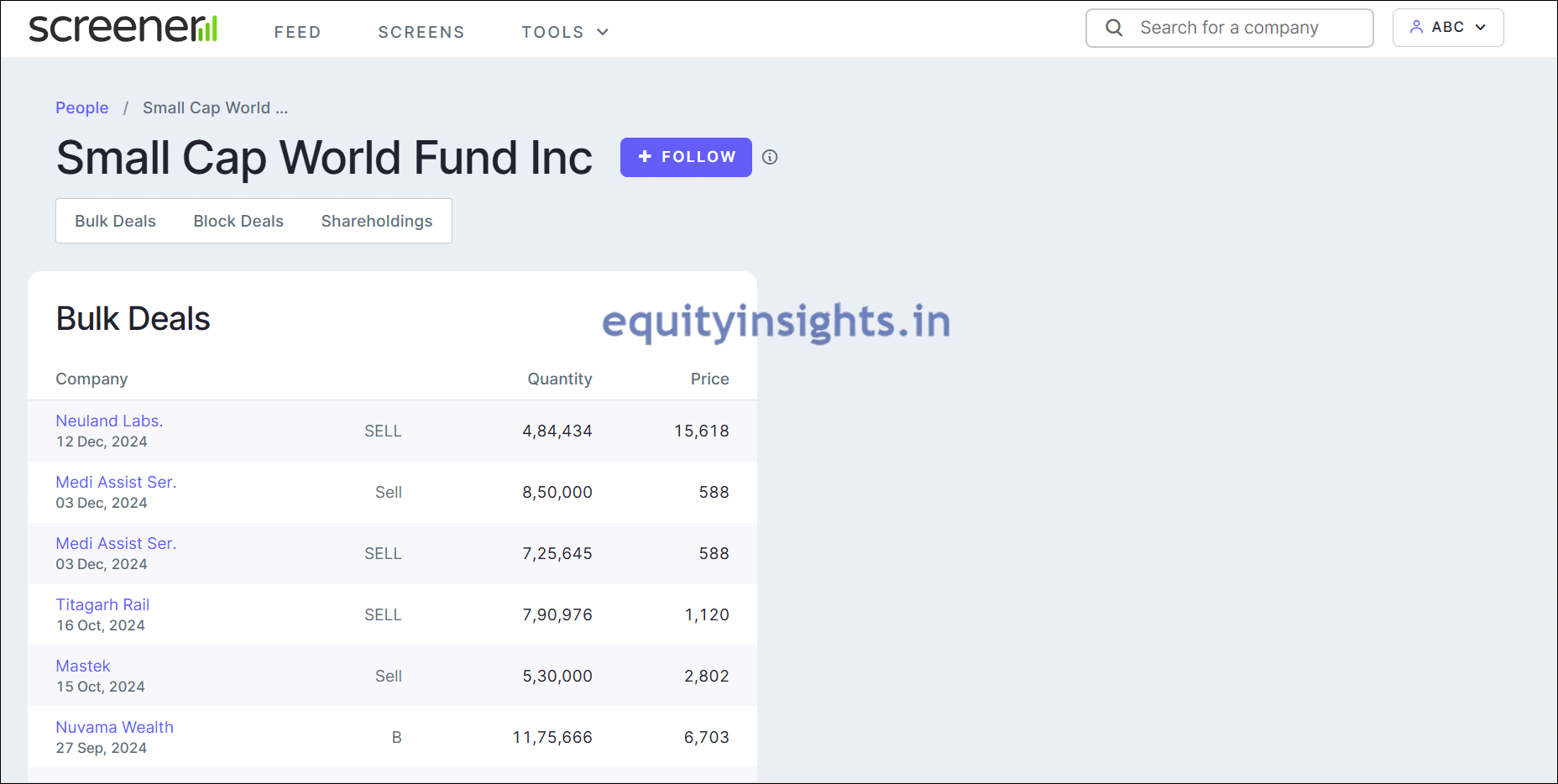

So, if you click on Screener’s link of the MIT’s portfolio, you will get a particular screen like that of the image shared above. This is where you will get access to all the stocks that are part of MIT’s portfolio. Now on top, you can see something called Bulk Deals, Block Deals and Shareholdings.

As you click on Bulk Deals, you’ll see MIT’s savvy moves. In August 2024, they sold 2.81 lakh shares of MMP Industries at an average price of ₹320. But that’s not all—they also made a bold acquisition of over 25 lakh shares of Granules India at ₹405 each in May 2024 and 66 lakh shares of Marksans Pharma at ₹158 each in April 2024. Fast forward to February 15, 2025, Granules India shares are now trading at ₹512.85 and Marksans Pharma shares are at ₹230.69, showing the power of MIT’s strategic plays!

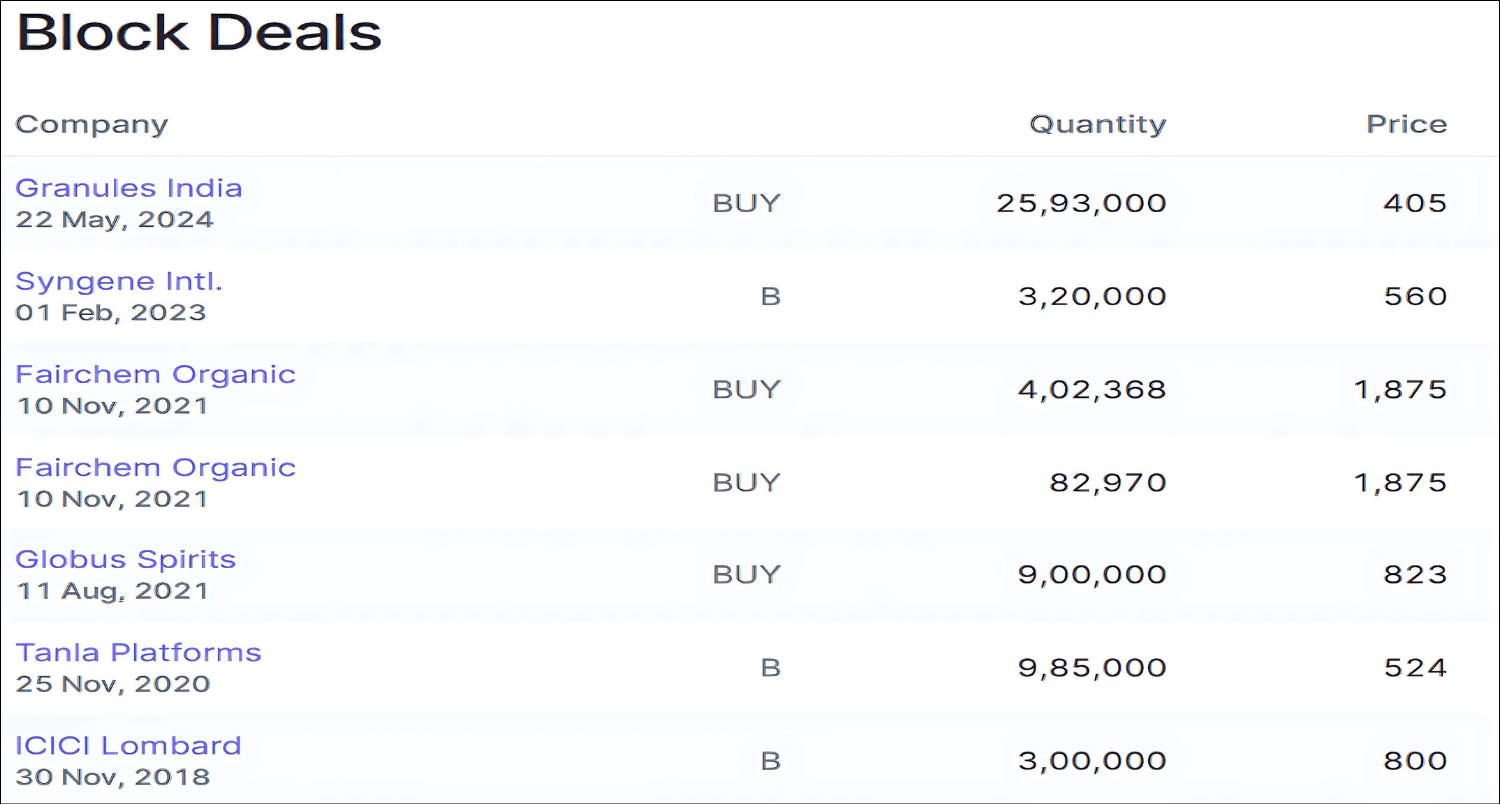

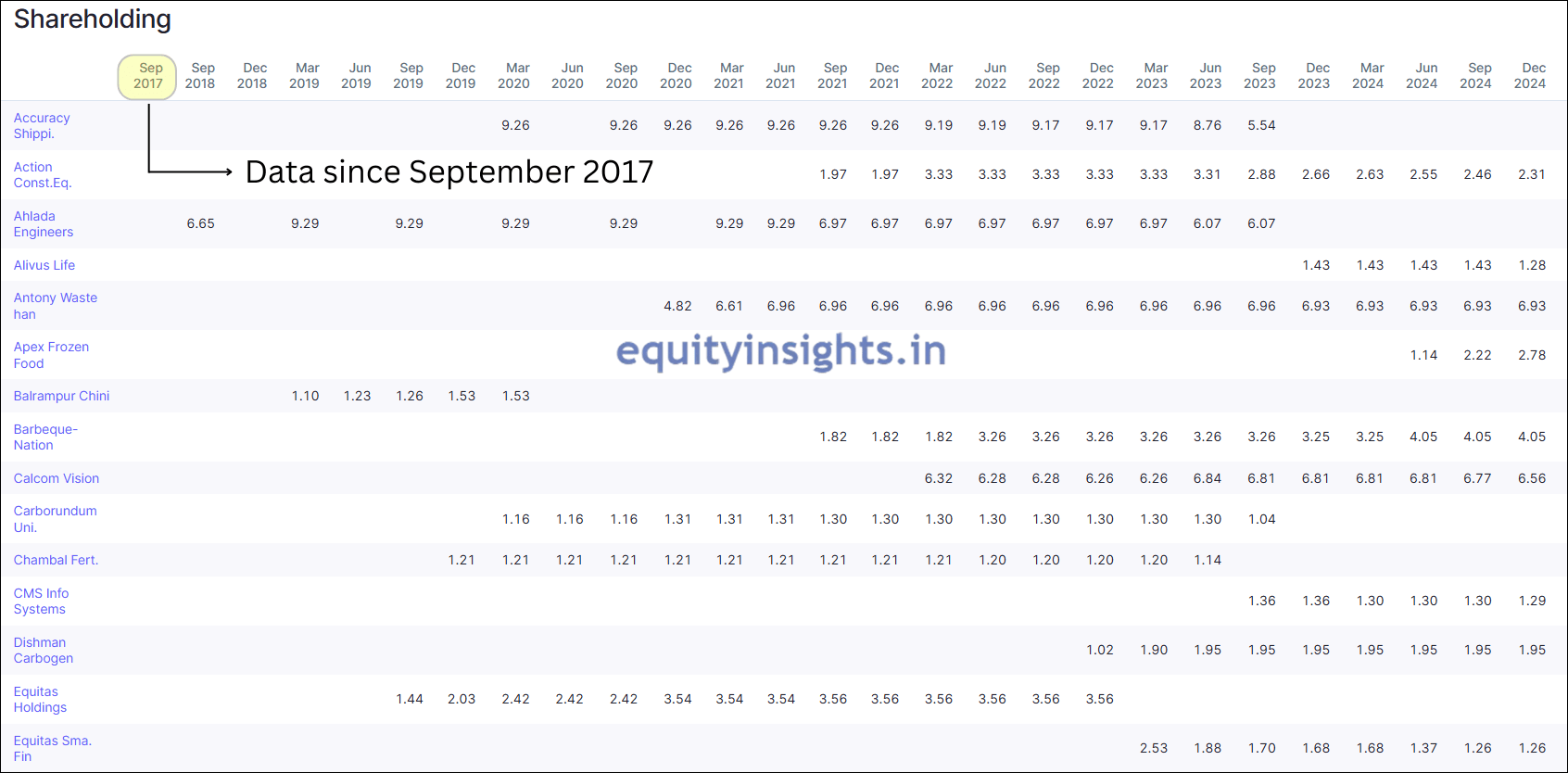

Then, if you scroll down, you can see a few block deals as well as the entire shareholdings. Keep in mind that this data of the shareholdings of MIT is available from September 2017, so there might be a case where the company is holding the stocks even before that.

Now, let’s explore a few of the stocks of MIT. So, if you look at the shareholdings, you could see a company called Accuracy Shipping where MIT invested in March 2020 but then it consistently reduced the stake and after September 2023, it appears to have exited the company. Next up is Action Construction Equipment, making quite a buzz lately. MIT steadily increased its stake for a few quarters but in the last four quarters, there’s been a reduction.

NOTE: The December 2024 shareholding pattern might not be visible for a few companies as many companies have yet to declare their shareholding pattern for that quarter. In such cases, we’ll reference the latest holding available, which is from September 2024.

Then MIT has got names like Alivus Life where they invested in December 2023 and are currently holding a 1.28% stake as of the December 2024 quarter. Among MIT’s intriguing picks is Antony Waste Handling Cell which is again making a lot of buzz these days, especially in the recycling space and it was identified by MIT in December 2020. A recent addition to MIT’s radar where they are consistently increasing their stake is Apex Frozen Food which they identified in June 2024 and is holding 2.78% as per the December 2024 quarter.

Barbeque-Nation has also been on MIT’s radar since September 2021, making it over three years now. However, it has turned out to be a wealth destroyer during this period. MIT also invested in Calcom Vision in March 2022 which is a micro-cap company with a valuation of just ₹146 crores, demonstrating MIT’s willingness to invest in smaller companies. MIT’s diverse portfolio also includes Dishman Carbogen which they have been holding consistently since December 2022. Equitas Holding was another key investment, now merged with Equitas Small Finance Bank. Everest Industry sees a notable 9.86% stake held by MIT, while Fairchem Organics has consistently stayed in its portfolio for the past couple of years.

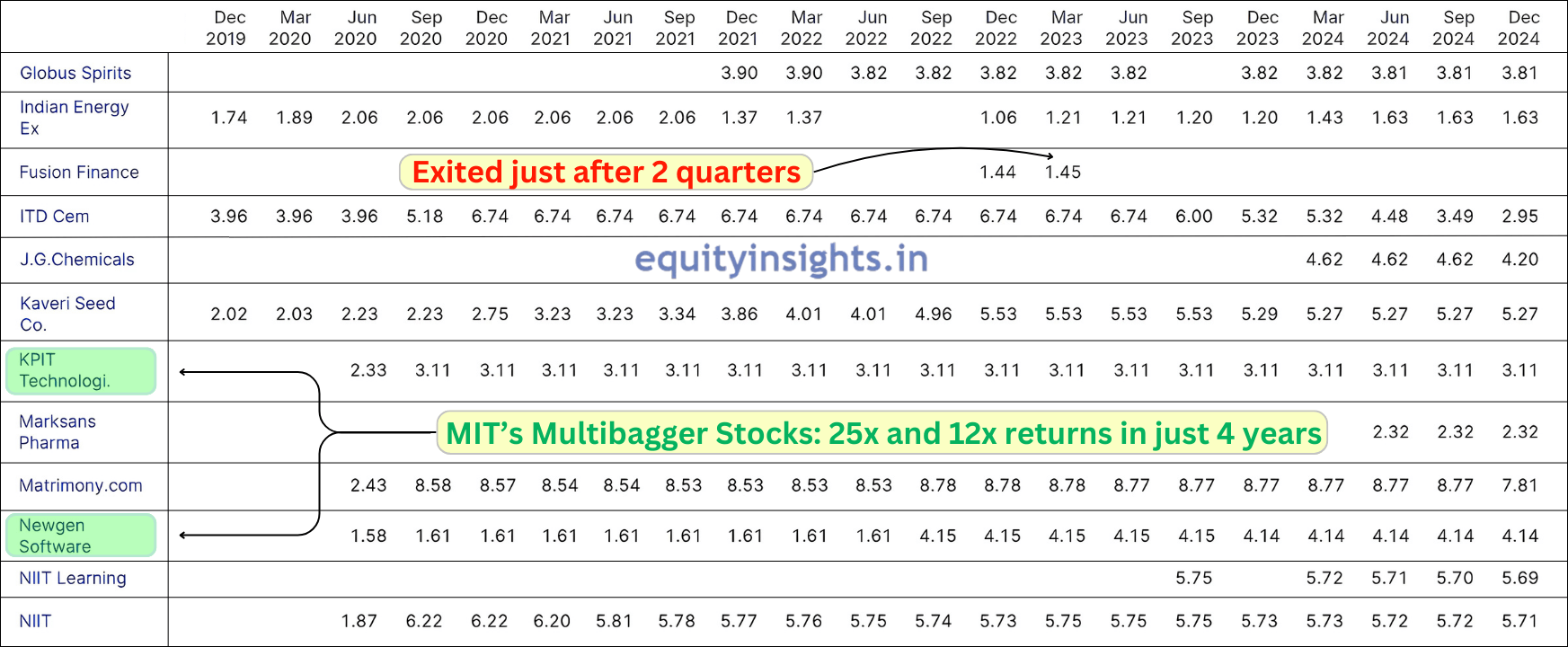

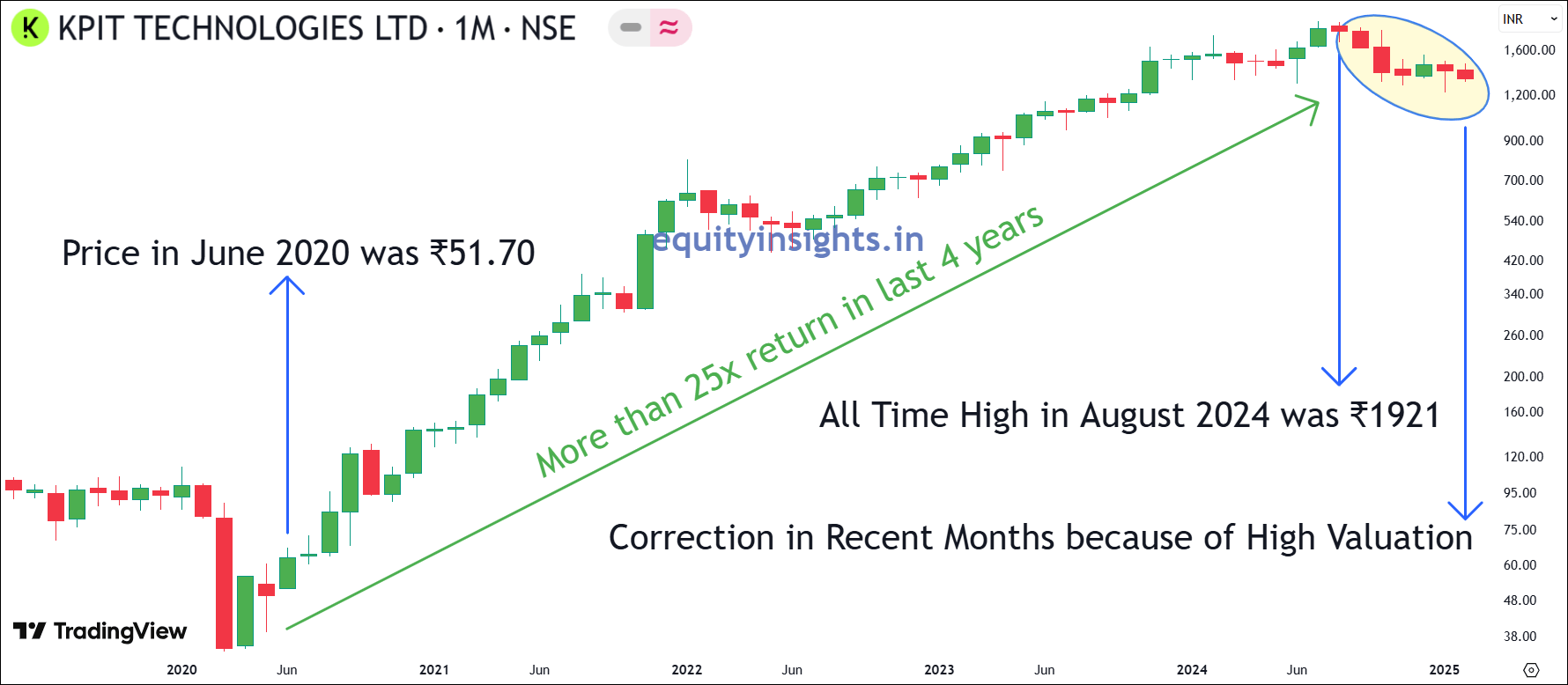

So, try to understand what they are doing — MIT invests in companies at low valuations and exits when valuations rise significantly. One of the examples of this case is KPIT Technologies where MIT acquired a 2.33% stake in June 2020, increasing it to 3.11% when it used to trade at the levels of ₹52 in June 2020 and today (as of February 15, 2025) it is above ₹1,340 which is more than 25 times return and they’re still holding this company. That’s what is called wealth creation.

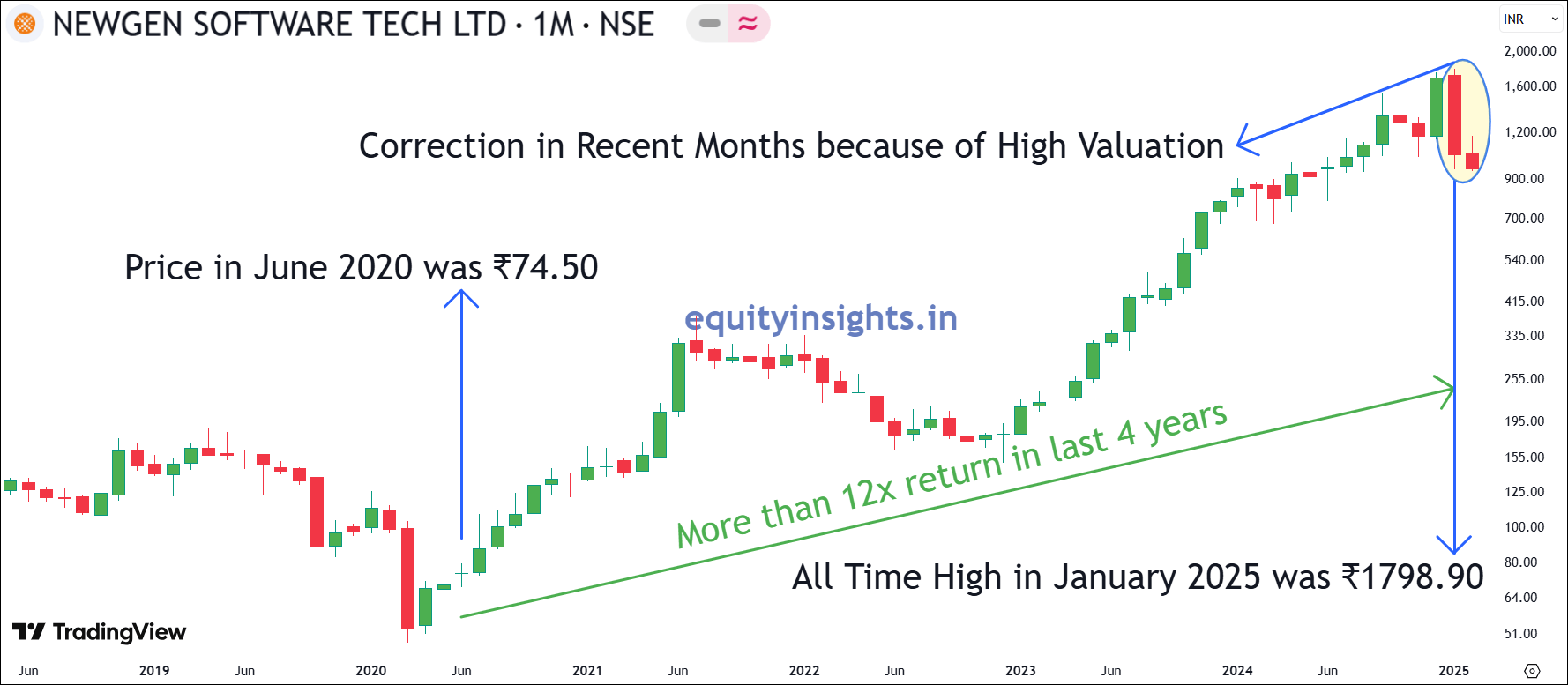

Another multibagger spotted by MIT was Newgen Software, which they identified in June 2020, initially acquiring a 1.58% stake and later increasing it to 1.6%. After MIT’s investment, during one phase i.e. from June to September 2022, the stock was trading near its all-time low and this was when MIT boosted its stake by 2.5 times increasing it to 4.15%. This shows MIT possesses deep knowledge and the confidence to increase their allocation when the stock is at its bottom.

As of February 15, 2025, they hold a 4.14% stake in Newgen Software. Since MIT’s initial investment in June 2020, when the stock was priced at ₹74.50, it soared to an all-time high of ₹1,798.90 before settling above ₹950 today. This translates to an impressive 12-fold return on their original investment at the current price, while at its peak, the stock delivered a staggering 24x return.

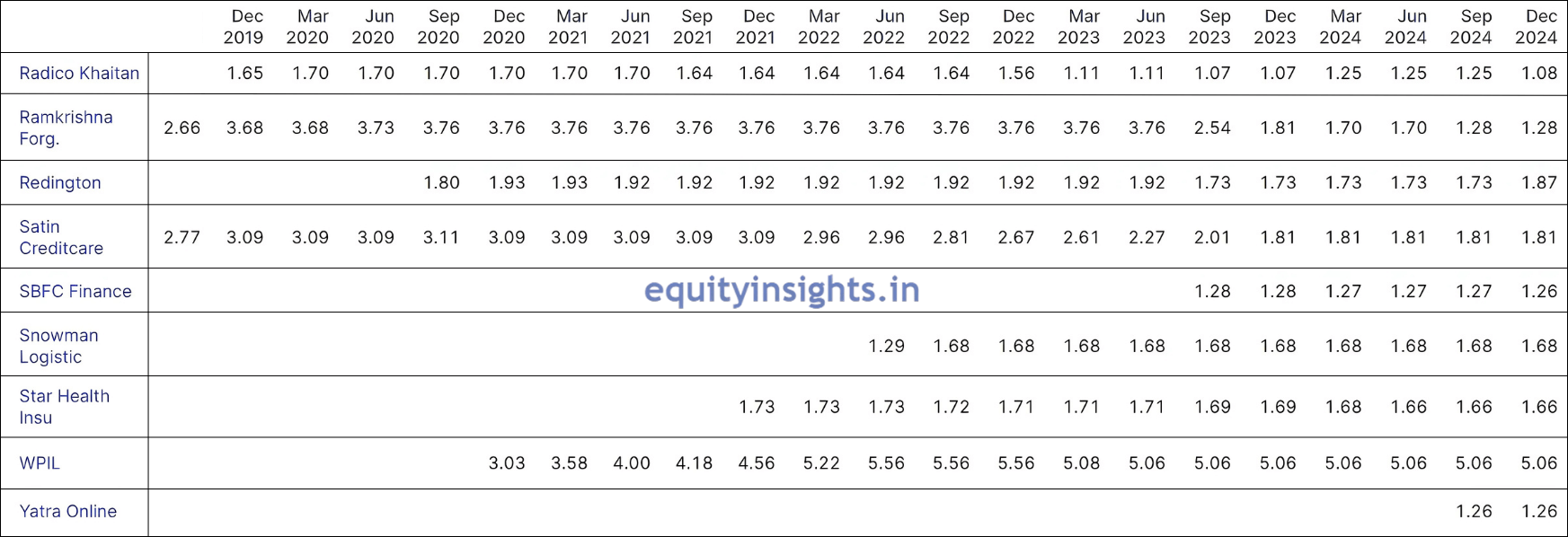

Other standout multibaggers from MIT include names like Radico Khaitan and Ramkrishna Forgings. Also, MIT cuts stake in the company when it finds issues with their management or fundamentals like they invested in Fusion Microfinance but then later exited from it, after which the company found out to be a massive wealth destroyer. However, there are a few companies like Va Tech Wabag which they identified long way back but then exited early and today it is making a lot of buzz because of the government’s focus on water treatment. So, MIT’s early exit from this company shows that even these top investors make the mistake of exiting early.

So, if you make an inference out of it then MIT’s long-term investment in the Indian market is notable. However, over the last few quarters, it has been reducing its stake in a number of companies and in my opinion, the primary reason for this is the overvaluation of the Indian market. It appears they are booking profits, which is reasonable given that they made significant gains from their initial investments.

So through the images, I have shared the names of all the companies that MIT is holding. Additionally, I’ve compiled all this valuable information into the table that highlights the stocks where MIT has increased or maintained its stake compared to the last quarter of September 2024. I’ve not included the stocks where MIT has reduced its stake. The table also shows the current market capitalization of the companies, the timeline when the stocks have been added to their portfolio along with their latest holding percentage. Check it out for a quick and clear overview!

| Stock Name | Market Cap (in Cr.) | Investment Month | Latest Holding (%) |

|---|---|---|---|

| Antony Waste Handling Cell | ₹1576 | December 2020 | 6.93% |

| Barbeque-Nation | ₹1150 | September 2021 | 4.05% |

| Dishman Carbogen | ₹3187 | December 2022 | 1.95% |

| Equitas Small Finance Bank | ₹7136 | March 2023 | 1.26% |

| Everest Industries | ₹931 | December 2021 | 9.86% |

| Fairchem Organics | ₹1320 | December 2021 | 3.22% |

| Globus Spirits | ₹2,470 | December 2023 | 3.81% |

| Indian Energy Exchange | ₹14,626 | December 2022 | 1.63% |

| Kaveri Seed | ₹4,811 | March 2019 | 5.27% |

| KPIT Technologies | ₹1,343 | June 2020 | 3.11% |

| Newgen Software | ₹13,595 | June 2020 | 4.14% |

| Ramkrishna Forgings | ₹11,453 | March 2019 | 1.28% |

| Redington | ₹19,170 | September 2020 | 1.87% |

| Satin Creditcare | ₹1,568 | December 2018 | 1.81% |

| Snowman Logistics | ₹840 | June 2022 | 1.68% |

| Star Health Insurance | ₹23,046 | December 2021 | 1.66% |

| WPIL | ₹3,895 | December 2020 | 5.06% |

The table below highlights the companies that MIT has recently added to its portfolio over the last three quarters or since the June 2024 quarter:

| Stock Name | Market Cap (in Cr.) | Investment Month | Latest Holding (%) |

|---|---|---|---|

| Apex Frozen Food | ₹646 | June 2024 | 2.78% |

| IRM Energy | ₹1,182 | December 2024 | 1.29% |

| Marksans Pharma | ₹10,443 | June 2024 | 2.32% |

| Yatra Online | ₹1,317 | September 2024 | 1.26% |

This wraps up our analysis of MIT. All these stocks warrant an in-depth analysis before you decide to invest. Remember, thorough research is key to making informed investment decisions. Hence, invest only after you research in that company.

Also Read: Zaggle Prepaid Share: A Promising Investment or Risky Bet?

2. Goldman Sachs

The second FII in the list is Goldman Sachs. Goldman Sachs has an India Equity Portfolio and is one of the world’s biggest investment banking firms that manages a total AUM of $2.8 trillion. Just to give you a sense of how huge this figure is, you can compare it with the Indian GDP which is around $4 trillion. So that’s the kind of scale Goldman Sachs operates in. As far as the Indian market is concerned, Goldman Sachs holds investments worth around ₹8,000 crores, with more than 1% stake.

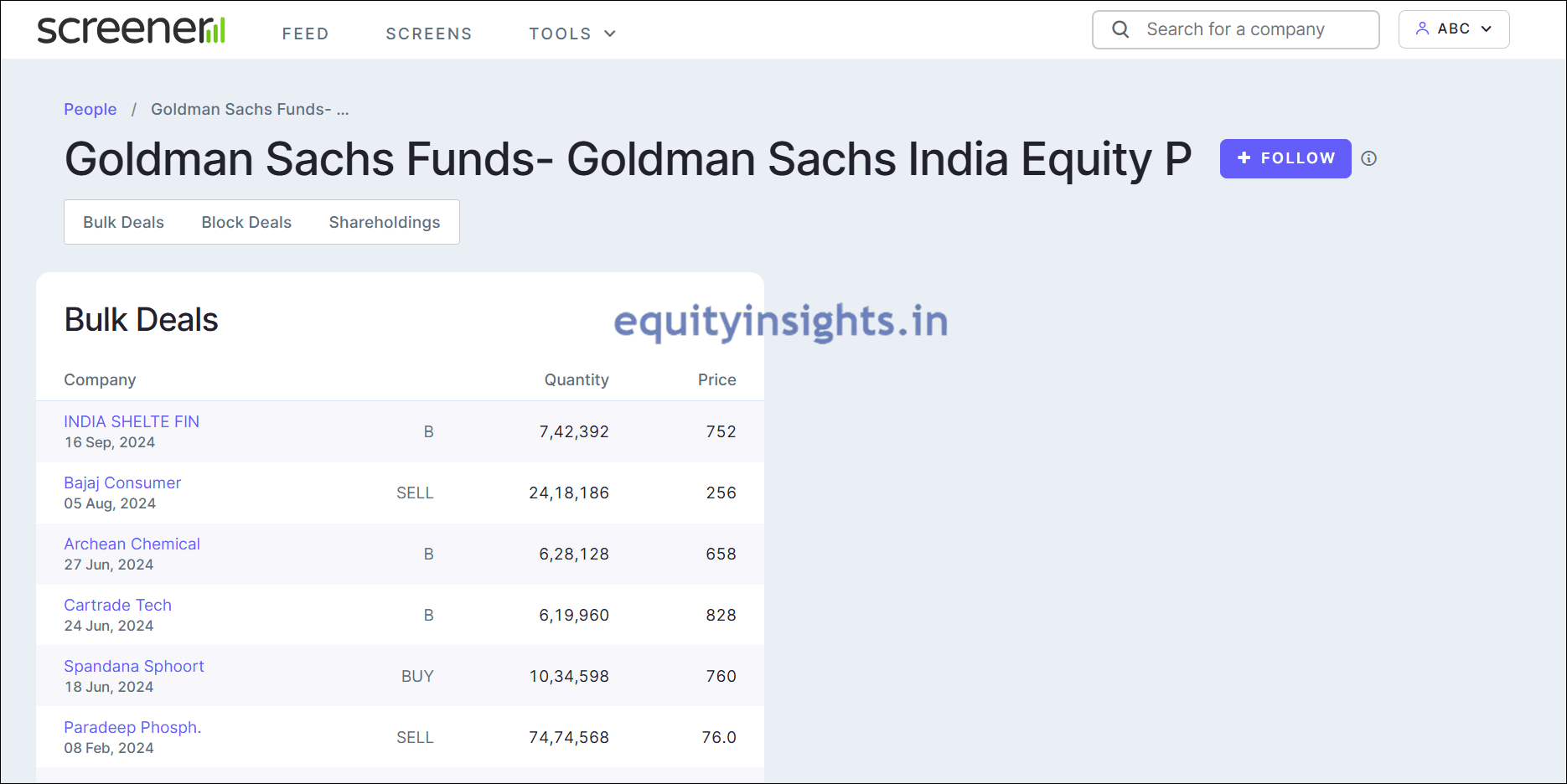

Goldman Sachs has been making strategic waves in India’s investment scene with some noteworthy bulk deals. You will find two Goldman Sachs portfolios on Screener. Here’s the direct link to explore both pages and dive into their holdings effortlessly:

- Goldman Sachs Funds- Goldman Sachs India Equity P – Investments – Screener

- Goldman Sachs Funds – Goldman Sachs India Equity Portfolio – Investments – Screener

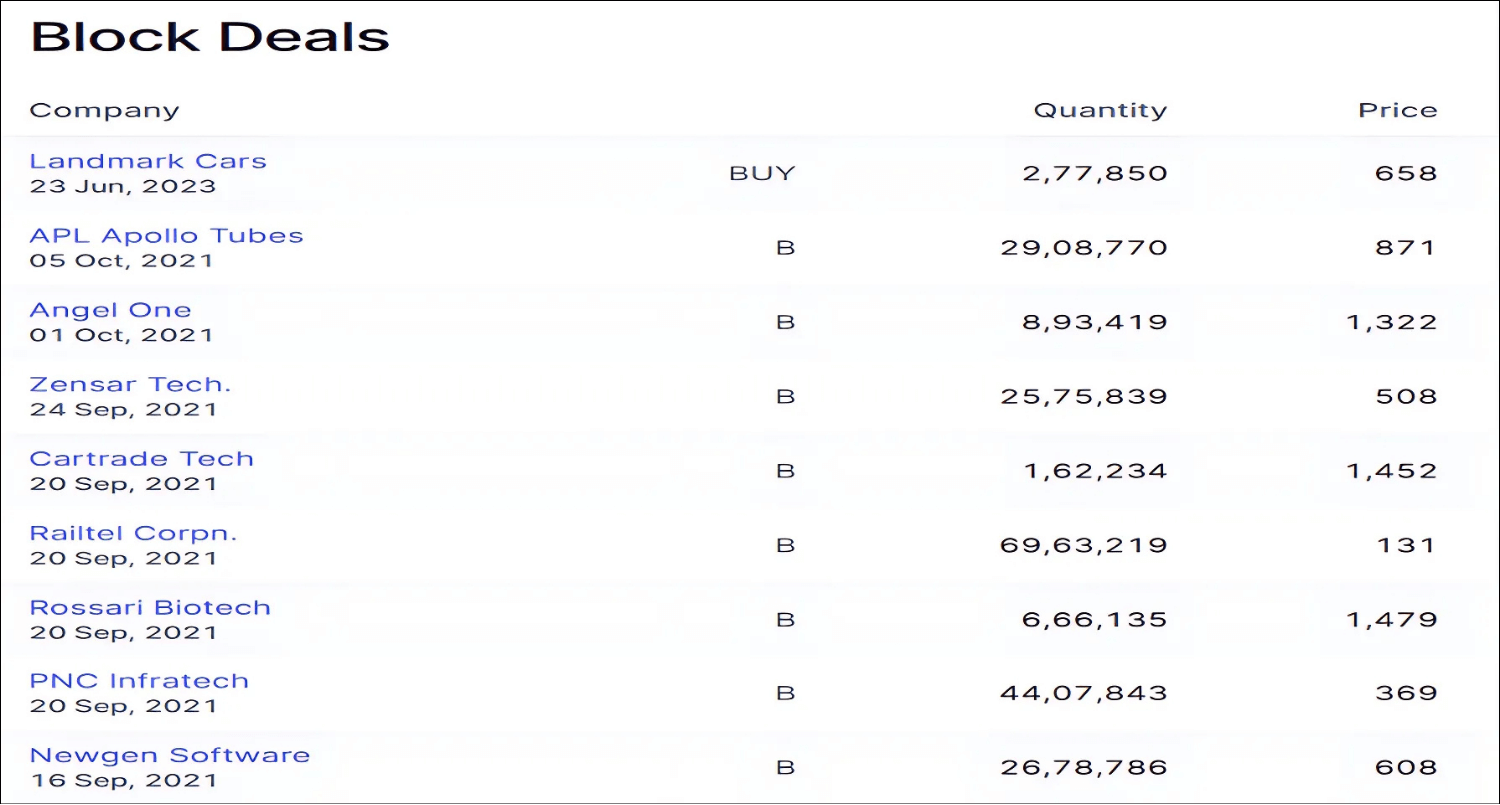

Now, when you click on the first link, you’ll see that in September 2024, they made a bold move by acquiring over 6 lakh shares of India Shelter Finance Corporation at ₹752 each and signaling a strong belief in the potential of the housing finance sector. Just a few months earlier, in June 2024, they snapped up another 6 lakh shares of Archean Chemical at ₹658 each, a move that highlights their confidence in India’s thriving chemicals market.

But that’s not all — Goldman Sachs has also been doubling down on its commitment to CarTrade Tech. In the same June 2024 quarter, they purchased 6 lakh shares of the online auto platform at ₹828 each, continuing their steady ramp-up of stakes in the company. This bulk deal further underscores their growing confidence in the online automotive marketplace. These strategic investments reflect Goldman Sachs’ keen eye for high-growth sectors and their unwavering belief in the Indian market’s potential. They’ve got certain block deals as well where they purchased Landmark Cars in June 2023, APL Apollo Tubes in October 2021 and so on.

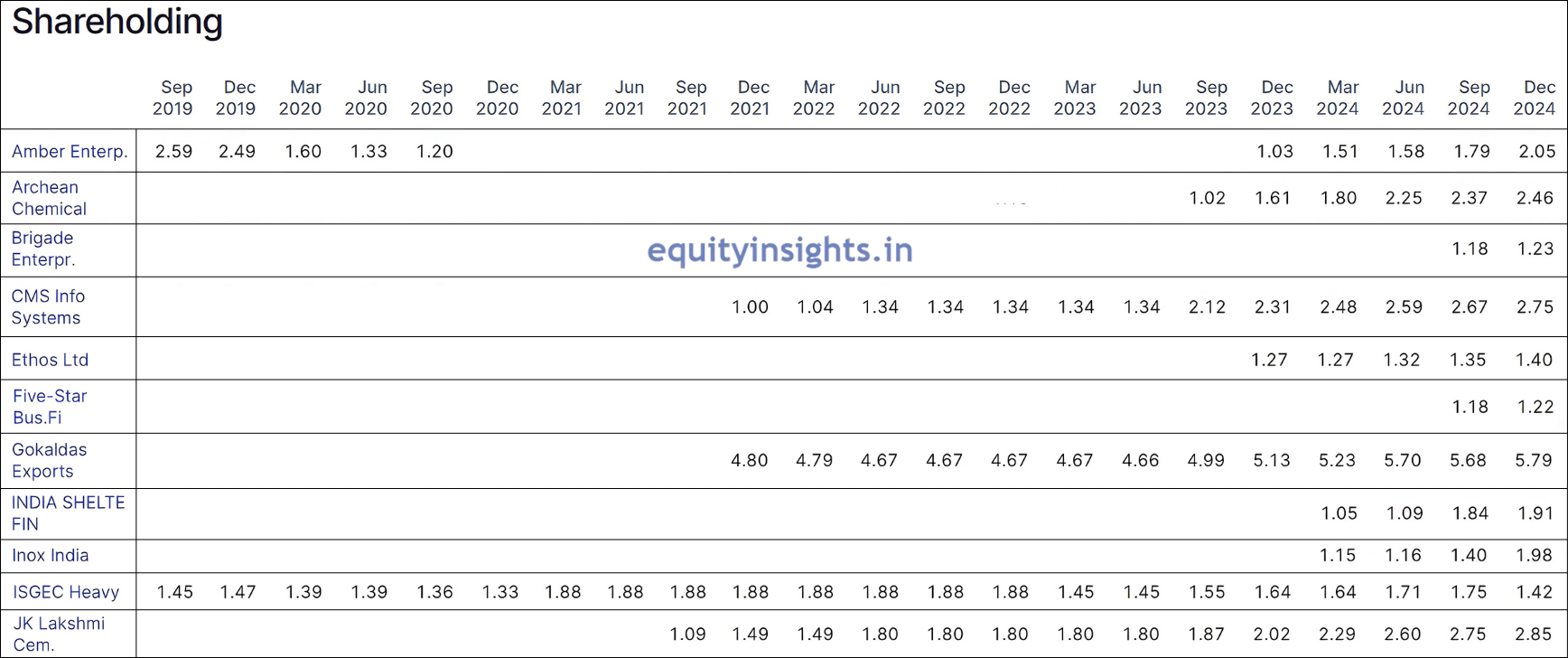

Now, if you look at the portfolio of Goldman Sachs, it is a testament to its strategic approach with some intriguing picks that are catching attention. Take Amber Enterprises for instance — Goldman Sachs held stake in this company long ago but then it reduced its allocation to below 1%. However, since December 2023, it has been again increasing its stake in Amber Enterprises every quarter with current holding at 2.05%, indicating renewed confidence in the company’s growth potential.

Similar to MIT, CMS Info Systems is part of Goldman’s portfolio, where they’ve been consistently increasing their stake. So, when multiple Foreign Institutional Investors (FIIs) are steadily increasing their stake in a single company, it sends a clear signal that the company is likely worth a closer look. Obviously, you need to deep dive to understand the business and then only you need to take a call. Other major names in its portfolio are Ethos and Gokaldas Exports — both of which have already generated a lot of wealth for them. Also, there is Inox India, identified by Goldman in March 2024, alongside ISGEC Heavy Engineering and JK Lakshmi Cement.

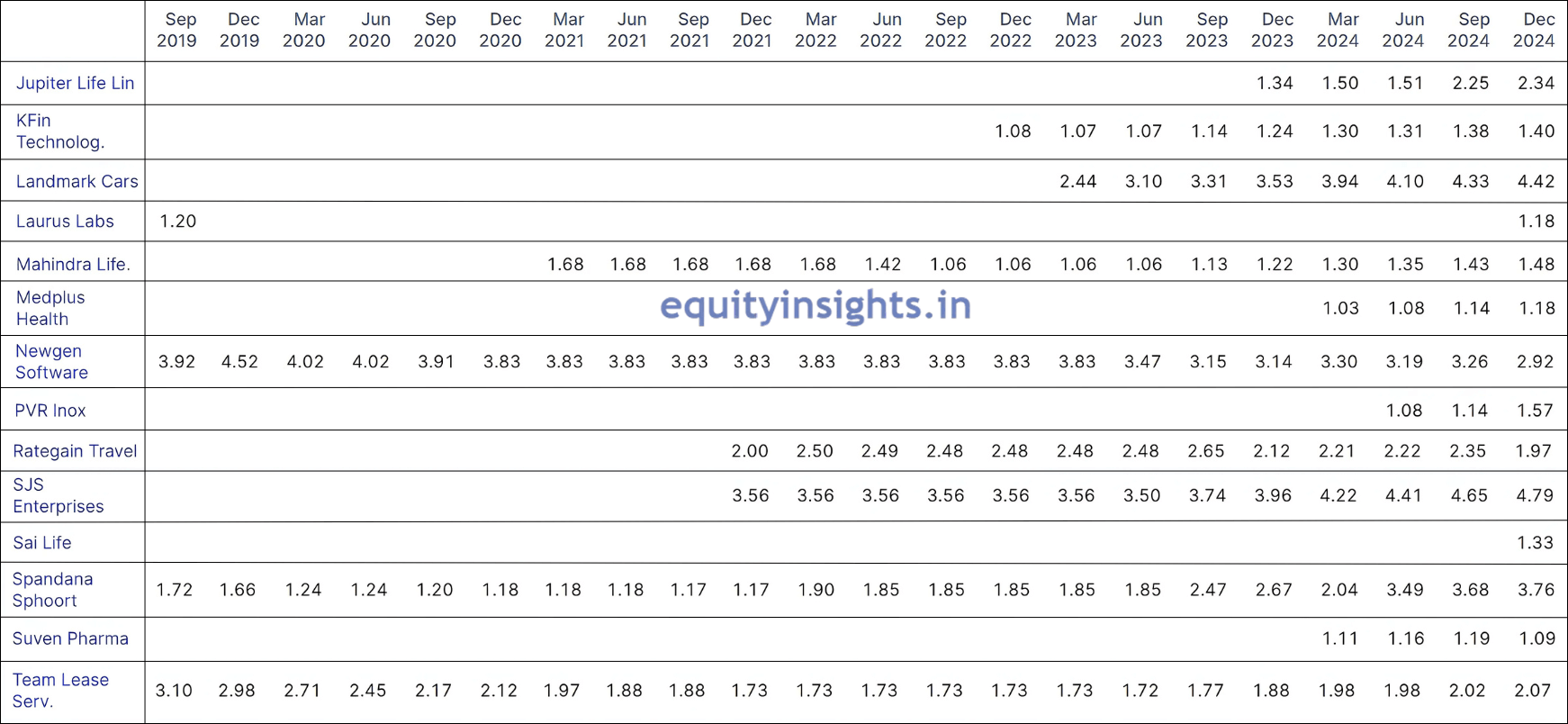

Beyond that, the investment giant has stakes in Jupiter Life Line Hospitals, KFin Technologies, Mahindra Lifespace Developers, Medplus Health Services and more. Similar to CMS Info Systems, Goldman Sachs’ portfolio also includes Newgen Software, a noteworthy name that is part of MIT’s holdings as well. Although the highest stake in Newgen Software was once 4.52%, it has since been reduced, yet a substantial quantity is still being held.

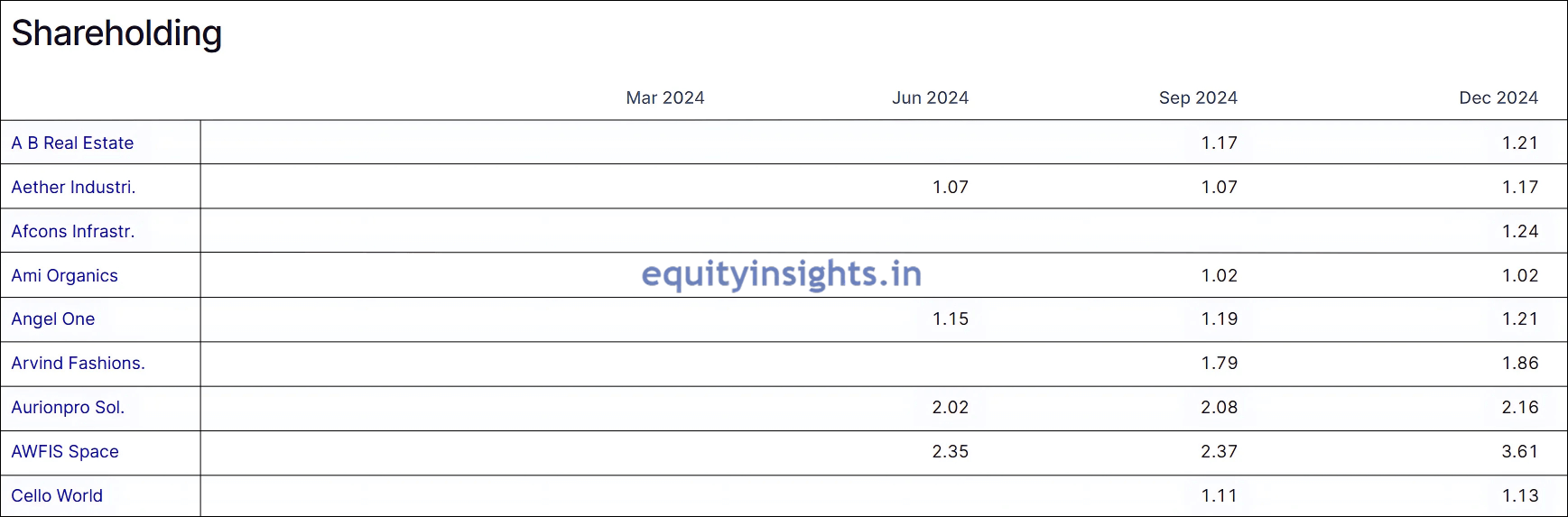

When you explore the second portfolio link on Screener, you’ll find that Goldman Sachs made fresh investments in stocks like Aditya Birla Real Estate, Aether Industries and Afcons Infrastructure. Alongside these, the portfolio also includes notable names such as Ami Organics, Angel One, Arvind Fashions, Aurionpro Solutions, AWFIS Space and Cello World.

Other names in the portfolio include Coforge, Eureka Forbes, JNK, Kajaria Ceramics, Nuvama Wealth and many more, showcasing a well-diversified and strategic approach to market opportunities.

So, a closer look at Goldman Sachs’ portfolio reveals that it increased its stake in almost all of its holdings during the December 2024 quarter, except for ISGEC Heavy, Newgen Software, Rategain Travel and Suven Pharma. Notably, several new additions have been made, suggesting that Goldman Sachs is capitalizing on the ongoing market correction. This move signals that this FII is still very bullish in the Indian market and taking advantage of buying the dip.

To give you an overview of Goldman’s portfolio, you can check the table below where you’ll find a list of companies that Goldman Sachs has held onto for a long time and remains optimistic about (either increased or maintained its stake compared to the last quarter of September 2024). These mentioned companies can help you gain insights into potential market opportunities:

| Stock Name | Market Cap (in Cr.) | Investment Month | Latest Holding (%) |

|---|---|---|---|

| Amber Enterprises | ₹19,684 | December 2023 | 2.05% |

| Archean Chemical | ₹5,238 | September 2023 | 2.46% |

| CarTrade Tech | ₹7,431 | December 2021 | 2.91% |

| CMS Info Systems | ₹7,027 | December 2021 | 2.75% |

| Ethos | ₹5,985 | December 2023 | 1.40% |

| Eureka Forbes | ₹9,514 | March 2024 | 1.76% |

| Gokaldas Exports | ₹6,578 | December 2021 | 5.79% |

| India Shelter Finance | ₹7,187 | March 2024 | 1.91% |

| Inox India | ₹8,148 | March 2024 | 1.98% |

| JK Lakshmi Cement | ₹8,782 | September 2021 | 2.85% |

| Jupiter Life Line Hospitals | ₹9,834 | December 2023 | 2.34% |

| KFin Technologies | ₹15,912 | December 2022 | 1.40% |

| Landmark Cars | ₹1,871 | March 2023 | 4.42% |

| Mahindra Lifespace Developers | ₹5,551 | March 2021 | 1.48% |

| Medplus Health Services | ₹8,681 | March 2024 | 1.18% |

| Medi Assist Healthcare Services | ₹3,461 | March 2024 | 5.49% |

| SJS Enterprises | ₹2,727 | December 2021 | 4.79% |

| Spandana Sphoorty | ₹2,132 | September 2019 | 3.76% |

| Team Lease Services | ₹3,451 | September 2016 | 2.07% |

| Zensar Technologies | ₹18,843 | June 2021 | 2.25% |

The table below highlights the companies that Goldman Sachs has recently added to its portfolio over the last three quarters or since the June 2024 quarter:

| Stock Name | Market Cap (in Cr.) | Investment Month | Latest Holding (%) |

|---|---|---|---|

| Aditya Birla Real Estate | ₹23,089 | September 2024 | 1.21% |

| Aether Industries | ₹10,239 | June 2024 | 1.17% |

| Afcons Infrastructure | ₹15,593 | December 2024 | 1.24% |

| Ami Organics | ₹8,871 | September 2024 | 1.02% |

| Angel One | ₹19,956 | June 2024 | 1.21% |

| Arvind Fashions | ₹5,314 | September 2024 | 1.86% |

| Aurionpro Solutions | ₹7,487 | June 2024 | 2.16% |

| AWFIS Space Solutions | ₹4,554 | June 2024 | 3.61% |

| Brigade Enterprises | ₹24,865 | September 2024 | 1.23% |

| Cello World | ₹13,508 | September 2024 | 1.13% |

| Coforge | ₹52,129 | June 2024 | 1.28% |

| Five Star Business Finance | ₹20,574 | September 2024 | 1.22% |

| JNK | ₹2,264 | June 2024 | 2.26% |

| Kajaria Ceramics | ₹14,506 | December 2024 | 1.02% |

| Laurus Labs | ₹29,456 | December 2024 | 1.18% |

| Nuvama Wealth | ₹18,986 | December 2024 | 1.32% |

| Pearl Global Industries | ₹6,531 | September 2024 | 2.77% |

| PVR Inox | ₹10,007 | June 2024 | 1.57% |

| R Systems International | ₹4,362 | December 2024 | 2.44% |

| Sai Life Sciences | ₹13,775 | December 2024 | 1.33% |

| Transformers & Rectifiers India | ₹12,090 | June 2024 | 2.64% |

| Whirlpool of India | ₹12,731 | June 2024 | 1.10% |

Also Read: Candlestick Patterns: Definition, History and Its Types

3. Capital Group

The third FII that I track closely is Capital Group. They have a fund called Smallcap World Fund Inc. that invests in small-cap companies across the world including India and have got an AUM of $2.5 trillion in India. Capital Group has a holding of more than ₹40,000 crores in the Indian listed companies, with more than 1% holding.

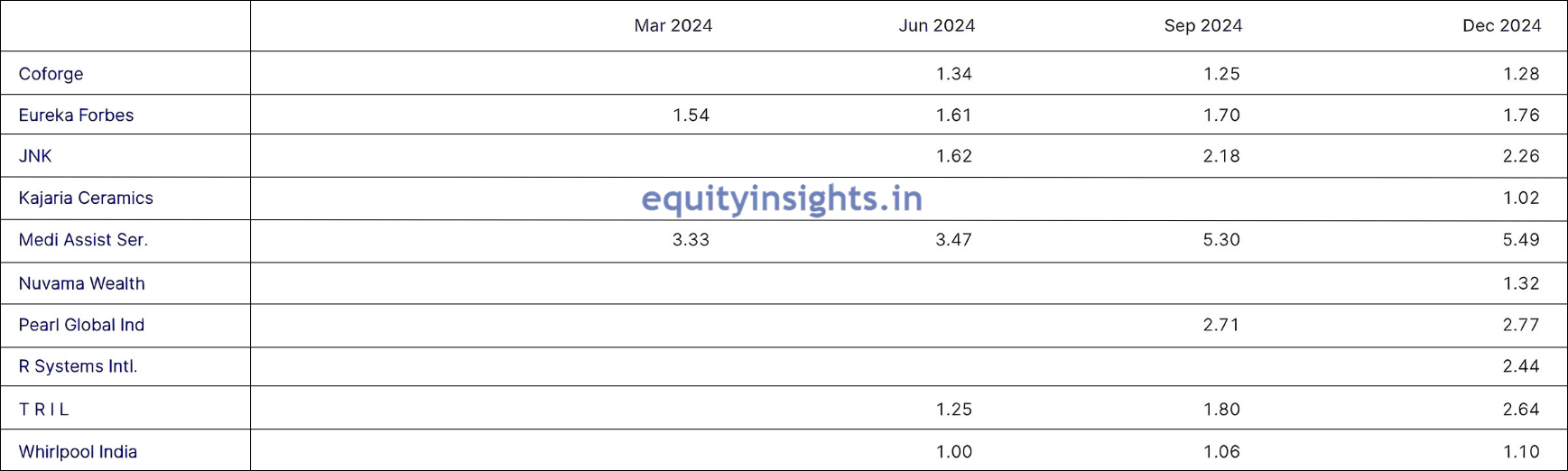

If you take a glance at the bulk deals on Screener which you can access using this link: Small Cap World Fund Inc – Investments – Screener, you’ll notice Capital Group has been quite active in recent months — but not in the buying sense. Over the last three months, they’ve been making a series of notable sales. In December 2024 alone, they offloaded 4.84 lakh shares of Neuland Laboratories at ₹15,618 each and more than 15 lakh shares of Medi Assist Healthcare Services at ₹588 each.

Back in October, they also sold around 8 lakh shares of Titagarh Rail Systems at ₹1,120 and 5.3 lakh shares of Mastek at ₹2,802 each. These moves raise some interesting questions about their strategy and whether these stock sales signal a shift in their outlook on these companies.

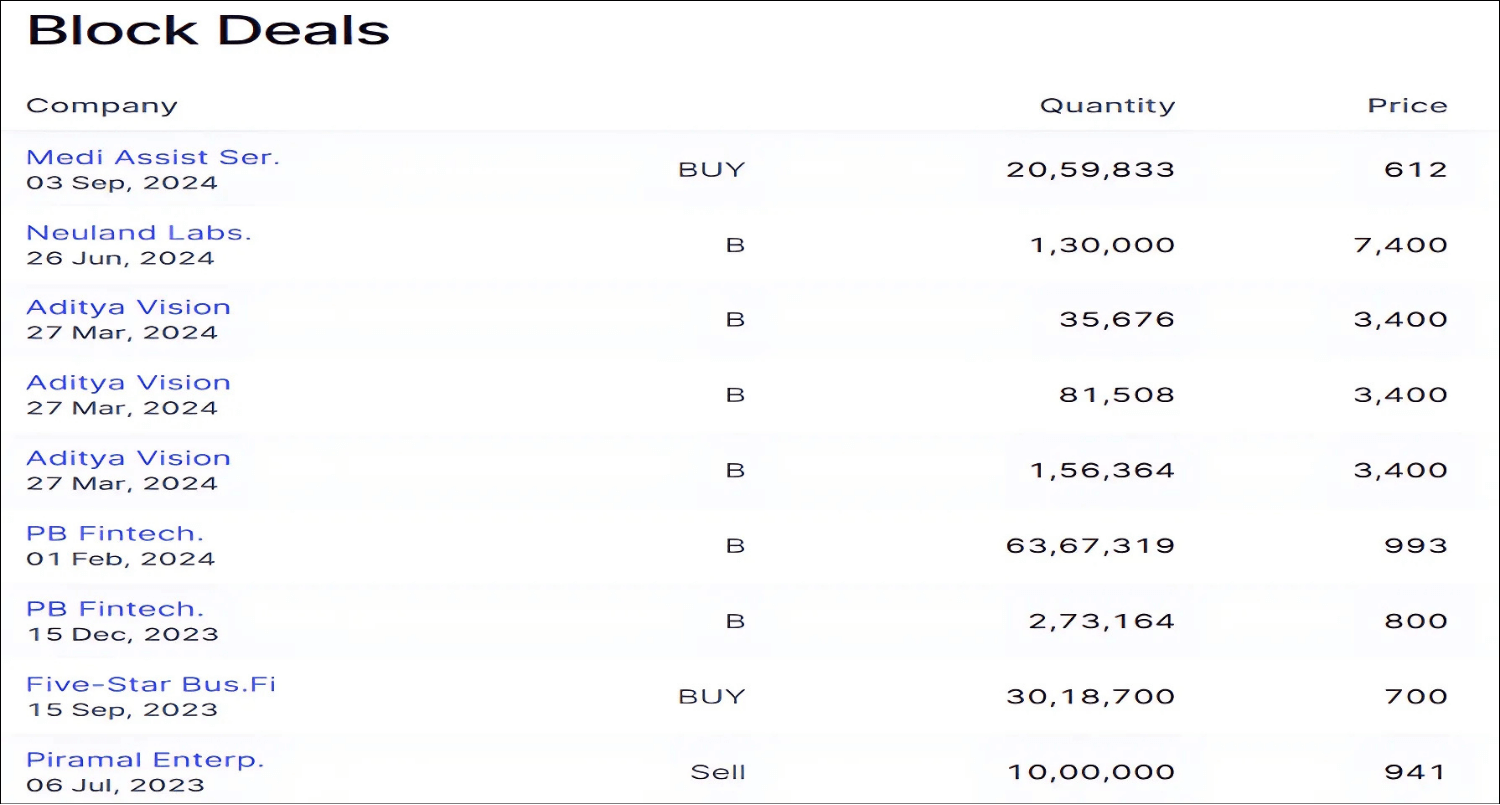

They have got few block deals as well where they bought more than 20 lakh shares of Medi Assist Services in September 2024 at ₹612 and 1.3 lakh shares of Neuland Labs in June 2024 at ₹7400 and many more.

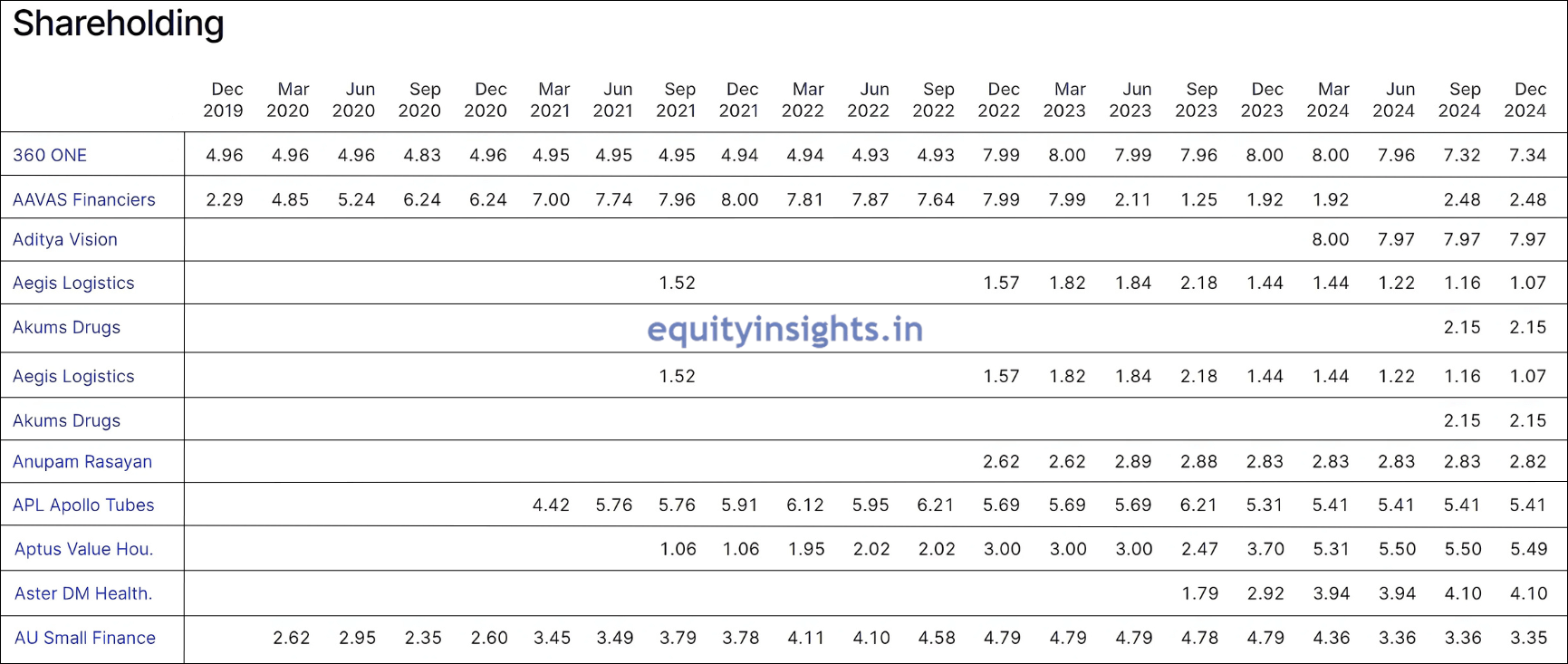

Now, let’s go through its portfolio. So, one company where the Capital Group is quite bullish on is 360 ONE which they identified in September 2019 and since then they’ve increased the stake big time. Other notable names in their portfolio include Aavas Financiers where they invested long back but then exited its position in June 2024 but again entered in September 2024 with a 2.48% stake, Aditya Vision where they invested nearly 8% stake in March 2024, Aegis Logistics, although they’ve consistently reduced its stake, Anupam Rasayan with a holding of 2.82% since a long time, APL Apollo Tubes, Aptus Valley Housing Finance India, Aster DM Healthcare and AU Small Finance Bank.

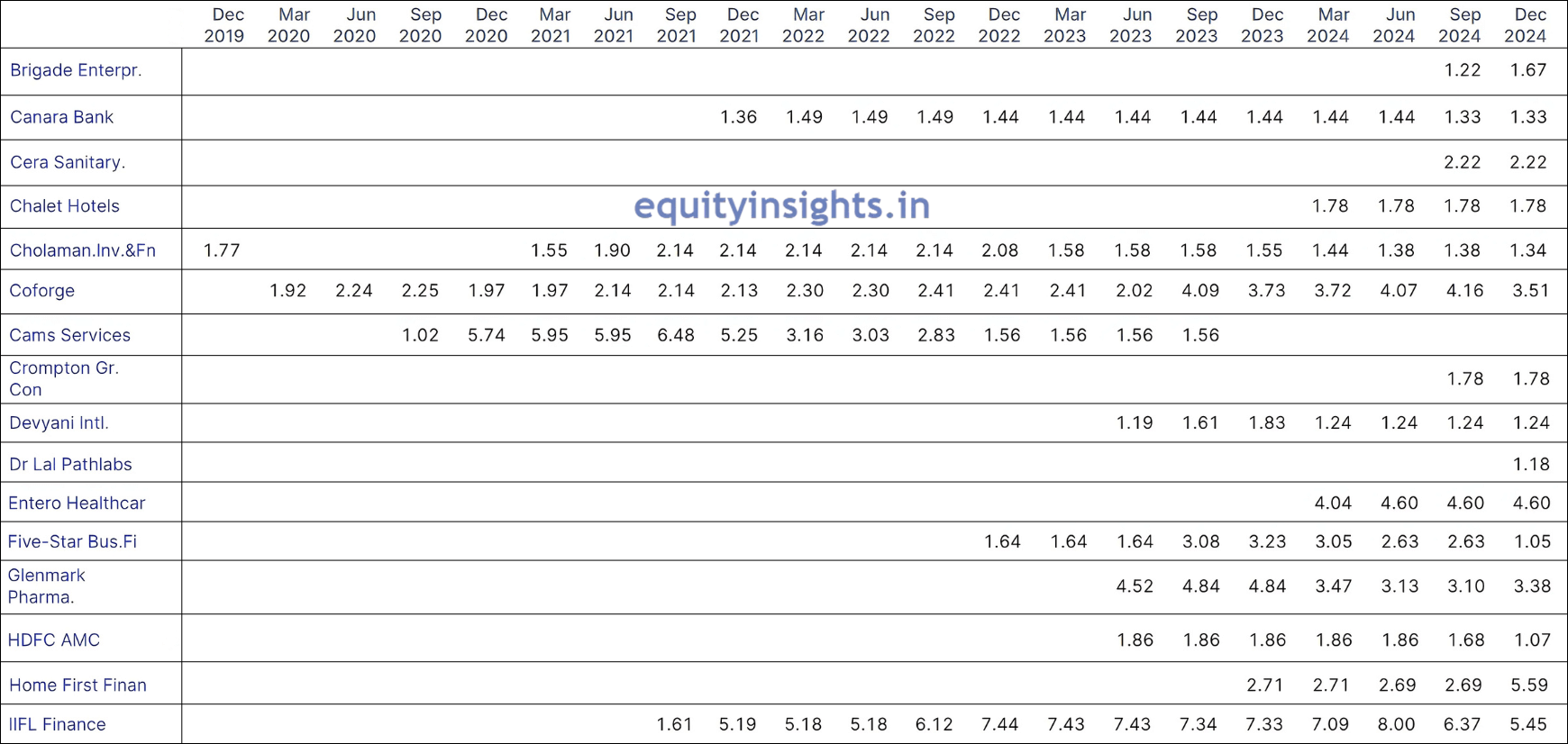

Other companies in the portfolio include Brigade Enterprises which is again a stock that has been on the radar of many FIIs, Canara Bank which has generated a lot of wealth and has been still holding a 1.33% stake in Canara Bank for a few quarters, Chalet Hotels, Cholamandalam Investment & Finance Company, Coforge, Devyani International, Entero Healthcare, Five-Star Business Finance, Glenmark Pharmaceuticals, HDFC AMC, Home First Finance and IIFL Finance despite what has happened recently with their gold loan business.

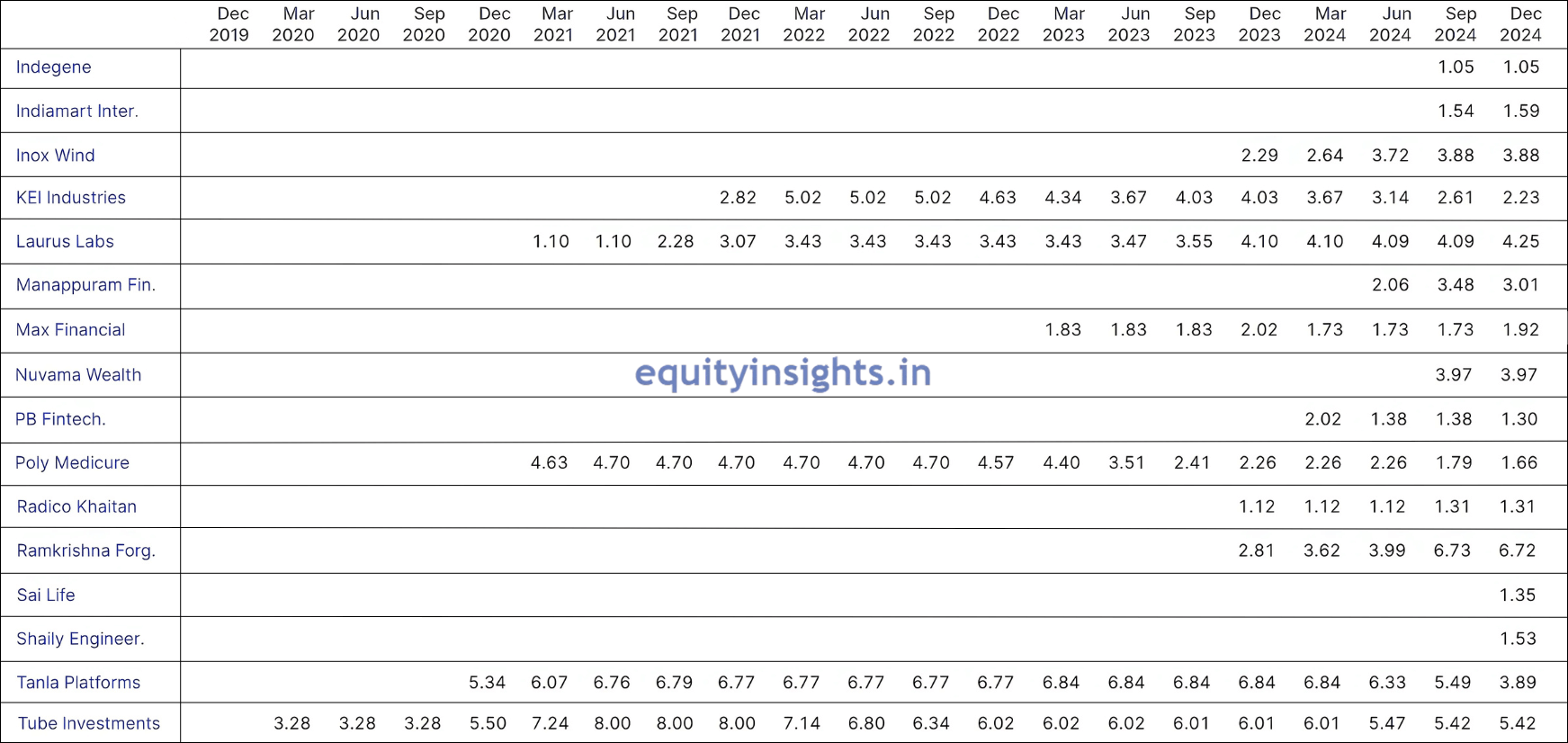

The investment giant has also invested in Indegene, Indiamart, Inox Wind, KEI Industries and Laurus Labs where the company is increasing its stake against the popular opinion of retail investors, where they hate this company because it’s been a wealth destroyer in last 2-3 years, Max Financial, Radico Khaitan and Ramkrishna Forgings. So, this shows Capital Group’s confidence in these companies.

Capital Group has either completely exited or significantly reduced its stakes in companies like City Union Bank, Titagarh Rail Systems, Tanla Platforms and Neuland Labs, indicating that the stock valuations rose insignificantly and were unjustifiable as per them. However, there are some exciting new additions to their portfolio, including Akums Drugs, Brigade Enterprises, Cera Sanitaryware, Crompton Greaves, Dr. Lal Pathlabs and Shaily Engineering Plastics. For a detailed list of companies where Capital Group has maintained or increased its stake compared to the previous quarter of September 2024, check out the table below:

| Stock Name | Market Cap (in Cr.) | Investment Month | Latest Holding (%) |

|---|---|---|---|

| 360 ONE | ₹35,252 | September 2019 | 7.34% |

| Aditya Vision | ₹5,193 | March 2024 | 7.97% |

| APL Apollo Tubes | ₹36,164 | March 2021 | 5.41% |

| Aster DM Healthcare | ₹20,764 | September 2023 | 4.10% |

| Canara Bank | ₹77,698 | December 2021 | 1.33% |

| Chalet Hotels | ₹15,151 | March 2024 | 1.78% |

| Devyani International | ₹19,089 | June 2023 | 1.24% |

| Entero Healthcare | ₹5,358 | March 2024 | 4.60% |

| Glenmark Pharmaceuticals | ₹37,369 | June 2023 | 3.38% |

| Home First Finance | ₹8,404 | December 2023 | 5.59% |

| Inox Wind | ₹22,442 | December 2023 | 3.88% |

| Laurus Labs | ₹29,456 | March 2021 | 4.25% |

| Max Financial | ₹36,535 | March 2023 | 1.92% |

| Radico Khaitan | ₹27,285 | December 2023 | 1.31% |

| Tube Investments | ₹49,990 | March 2020 | 5.42% |

Below is the table that shows the names of the companies that Capital Group has added recently (in the last 3 quarters) to its portfolio:

| Stock Name | Market Cap (in Cr.) | Investment Month | Latest Holding (%) |

|---|---|---|---|

| Aavas Financiers | ₹13,337 | September 2024 | 2.48% |

| Akums Drugs | ₹8,241 | September 2024 | 2.15% |

| Brigade Enterprises | ₹24,865 | September 2024 | 1.67% |

| Cera Sanitaryware | ₹8,030 | September 2024 | 2.22% |

| Crompton Greaves | ₹21,289 | September 2024 | 1.78% |

| Dr. Lal Pathlabs | ₹ 21,891 | December 2024 | 1.18% |

| Indegene | ₹13,645 | September 2024 | 1.05% |

| Indiamart Intermesh | ₹12,776 | September 2024 | 1.59% |

| Nuvama Wealth | ₹18,986 | September 2024 | 3.97% |

| Sai Life Sciences | ₹13,775 | December 2024 | 1.35% |

| Shaily Engineering Plastics | ₹7,076 | December 2024 | 1.53% |

Also Read: 10 Trading Rules That Make a Trader Successful

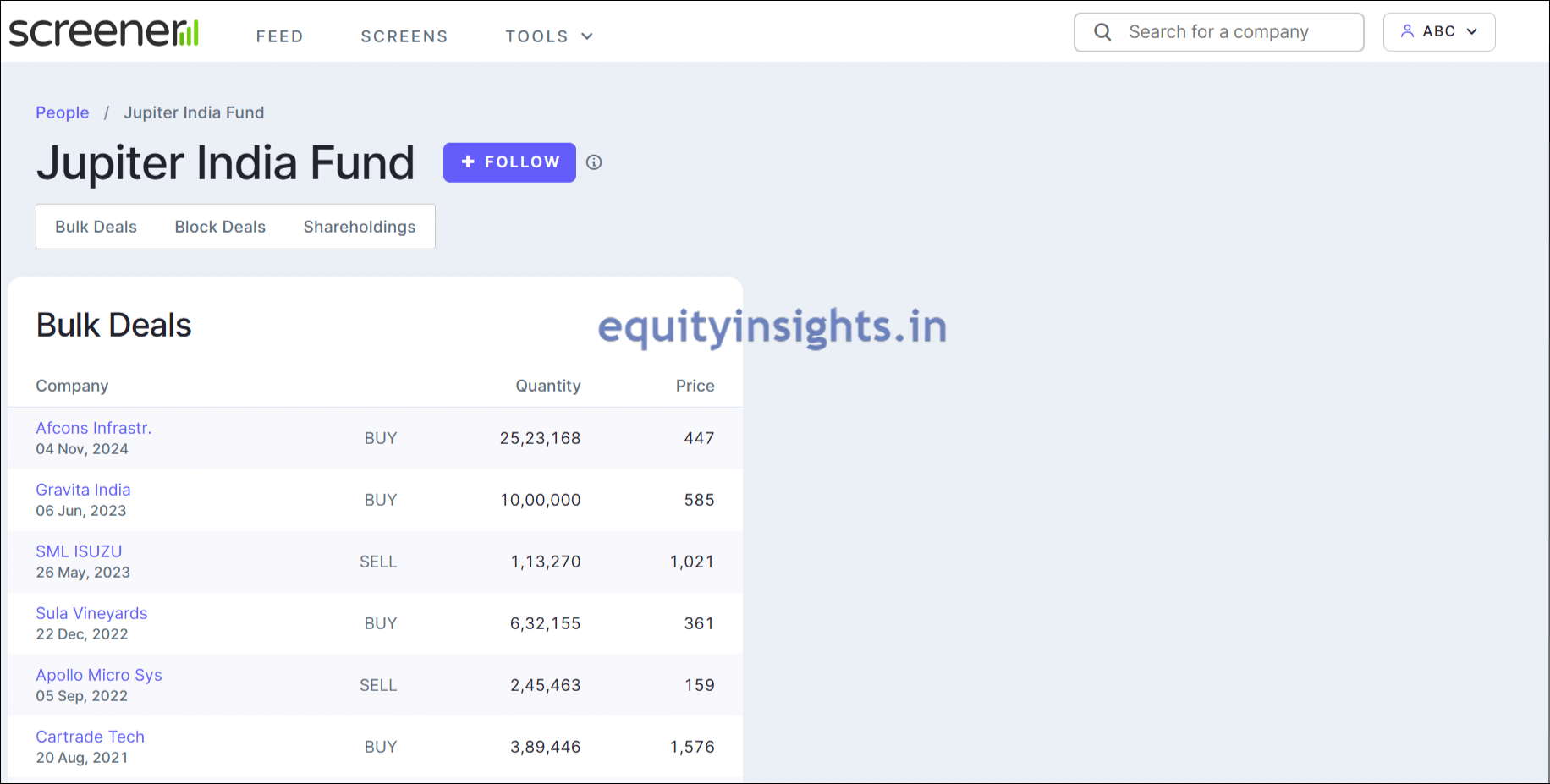

4. Nalanda Capital

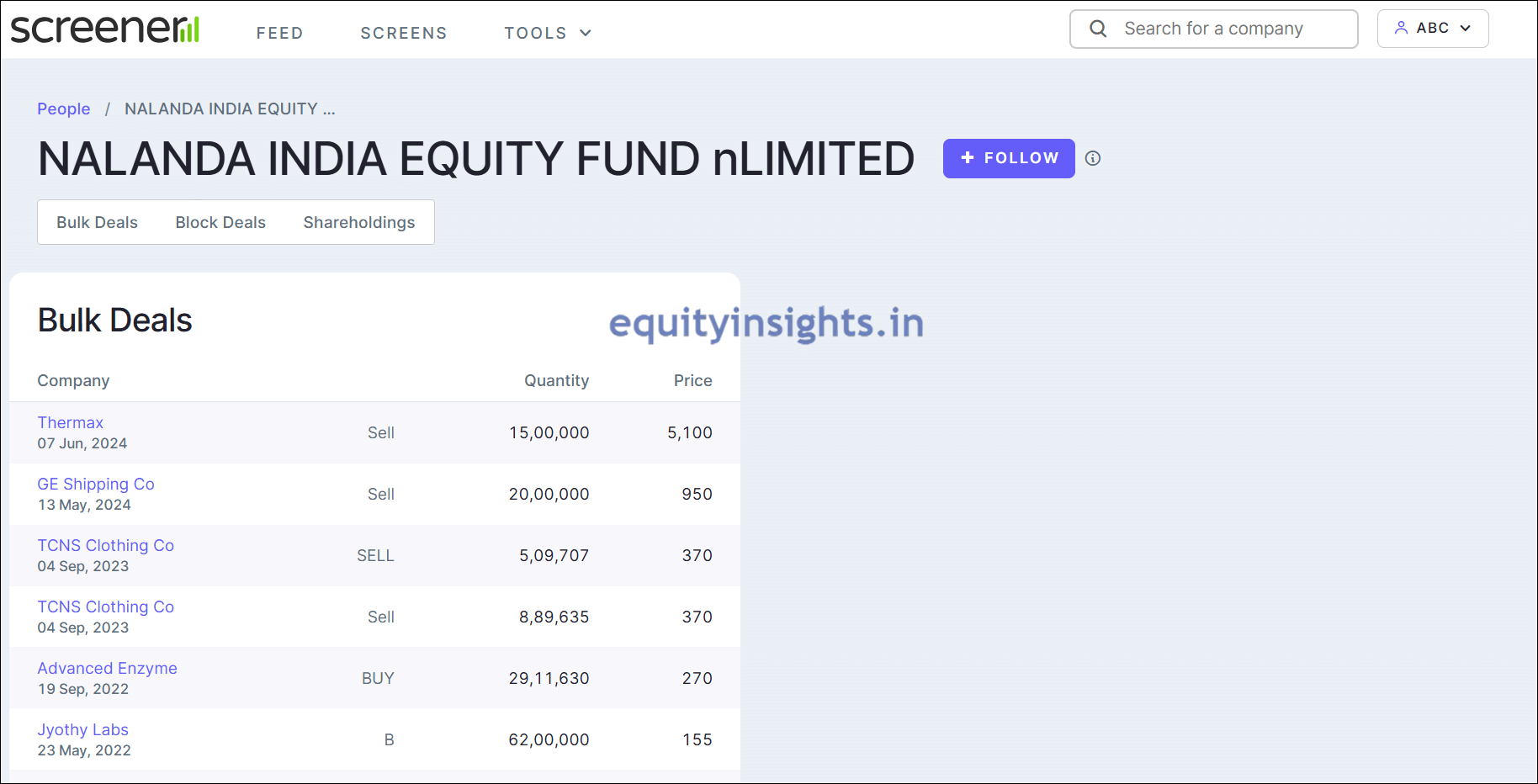

Moving on to the fourth name, we have got Nalanda Capital on the list. It is founded by Mr. Pulak Prasad who is an IIT Delhi and IIM Ahmedabad alumini and has work experience with Mckinsey and Ex-Warburg Pincus. He’s also the author of a very interesting book on investment “What I learned about investing from Darwin“. So, if you are enthusiastic about investment, you should probably read it. Nalanda Capital invests in India through its flagship fund, Nalanda India Equity Fund Limited, which holds a massive portfolio of over ₹42,000 crores in Indian companies, showcasing its strong conviction in the market’s growth potential.

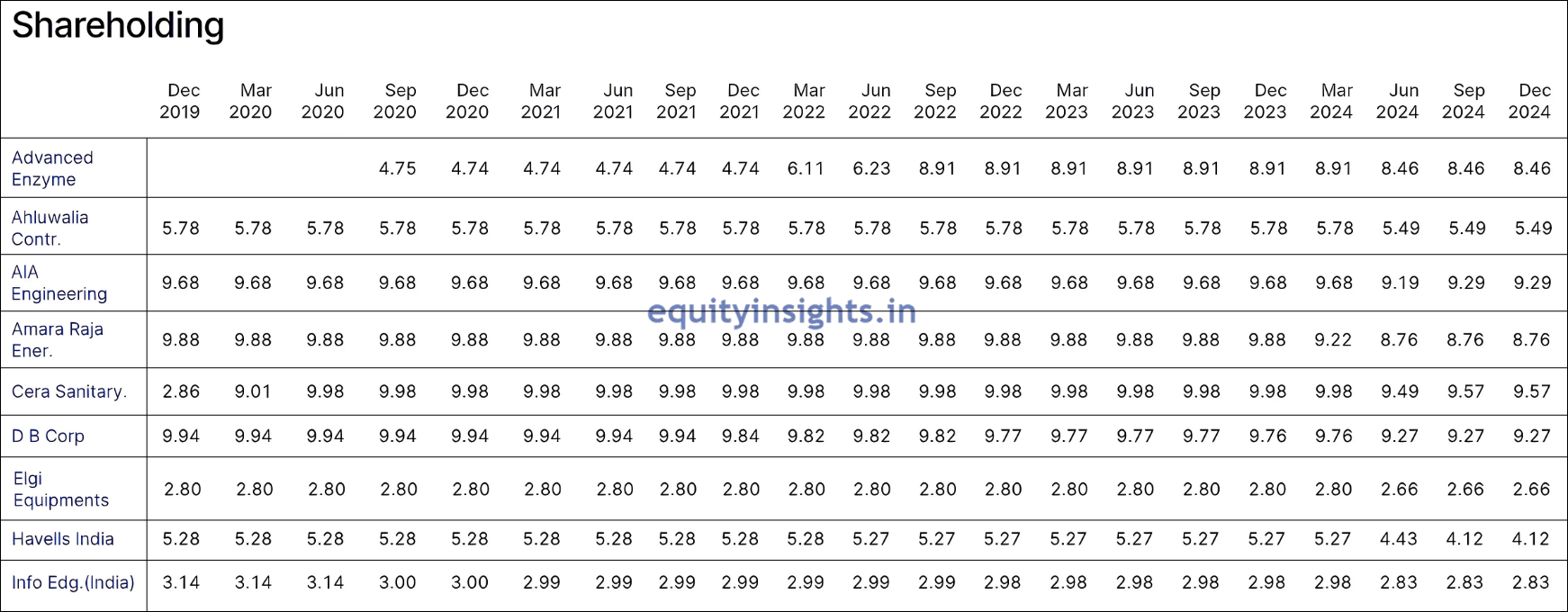

Nalanda Capital’s investment strategy is a masterclass in long-term commitment and confidence. Here’s a direct link to view the complete list of stocks in their portfolio on Screener: Nalanda India Equity Fund Limited – Investments – Screener. Their portfolio boasts names like Advanced Enzyme, held since September 2020, Ahluwalia Contracts and AIA Engineering, both held since June 2016 with nearly a 9% stake in the latter.

Their dedication to Amara Raja Energy & Mobility is evident, which they have been holding since September 2017 and increased their stake to 8.76%. Cera Sanitaryware and D B Corp are other long-term commitments with a 9.57% and 9.27% stake held steadfastly over the years. This clearly illustrates that Nalanda Capital doesn’t just dabble in minor investments of 1-2%. Instead, they acquire significant stakes of 8-9% and hold onto them for the long haul. This approach is the epitome of long-term investing.

Nalanda Capital holds a treasure trove of multibaggers. They invested in Elgi Equipments back in June 2016 and still hold a 2.66% stake. Other gems include Havells India, Info Edge, Jyothy Labs, Matrimony.com, MRF, NRB Bearings with a holding of nearly 9.5% stake, Ratnamani Metals, Sundaram Finance, Thermax, Triveni Turbine, TTK Prestige, V-Guard Industries and Voltamp Transformers are part of their portfolio since a long time. So, Nalanda’s long-term commitment to these companies showcases their knack for spotting and sticking with winners.

Nalanda Capital invested in major companies in June 2016 and showed incredible patience by holding their nerve for almost 5-6 years. Few can have that kind of courage but their patience paid off, creating significant wealth in the last 2-3 years which shows that it’s all about identifying strong companies and maintaining conviction, especially during tough times. The table below showcases the stocks where Nalanda Capital has either maintained or increased its stake compared to the last quarter of September 2024, reflecting its strategic investment decisions:

| Stock Name | Market Cap (in Cr.) | Investment Month | Latest Holding (%) |

|---|---|---|---|

| Advanced Enzyme | ₹3,450 | September 2020 | 8.46% |

| Ahluwalia Contracts | ₹4,454 | June 2016 | 5.49% |

| AIA Engineering | ₹32,418 | June 2016 | 9.29% |

| Amara Raja Energy | ₹17,454 | September 2017 | 8.76% |

| Cera Sanitaryware | ₹8,030 | June 2016 | 9.57% |

| D B Corp | ₹3,663 | June 2016 | 9.27% |

| Elgi Equipments | ₹15,484 | June 2016 | 2.66% |

| Havells India | ₹94,024 | June 2016 | 4.12% |

| Info Edge (Naukri) | ₹97,250 | June 2016 | 2.83% |

| Jyothy Labs | ₹13,196 | March 2022 | 5.72% |

| Matrimony.com | ₹1,125 | March 2019 | 9.76% |

| MRF | ₹46,457 | June 2020 | 4.13% |

| NRB Bearings | ₹2,211 | June 2016 | 9.49% |

| Ratnamani Metals | ₹17,480 | December 2016 | 2.97% |

| Sundaram Finance | ₹50,732 | June 2020 | 3.62% |

| Thermax | ₹37,078 | March 2020 | 5.13% |

| Triveni Turbine | ₹18,702 | June 2016 | 3.94% |

| TTK Prestige | ₹9,352 | June 2016 | 3.36% |

| Voltamp Transformers | ₹6,743 | June 2016 | 6.08% |

These are the stocks where they have either increased or maintained their stake compared to the previous quarter, with no new additions to their portfolio over the last three quarters.

Also Read: Stock Analysis: Things to Follow & Avoid in the Stock Market

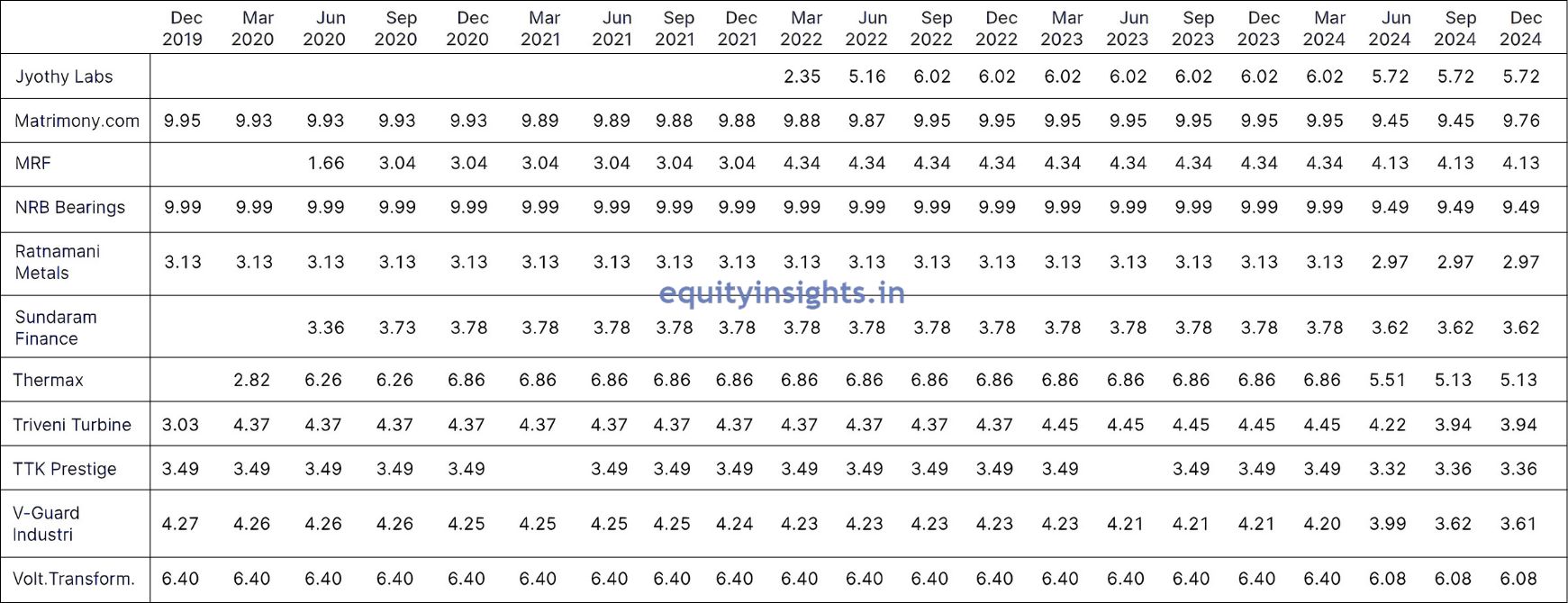

5. Jupiter Asset Management

The final FII that I closely track is Jupiter Asset Management which has a fund called Jupiter India Fund. This company has an AUM of $66+ billion and in the Indian market, they are holding investments worth more than ₹4,000 crores. Let’s have a look at the details of Jupiter India Fund. You can directly access the link of Jupiter India’s portfolio on Screener from here: Jupiter India Fund – Investments – Screener

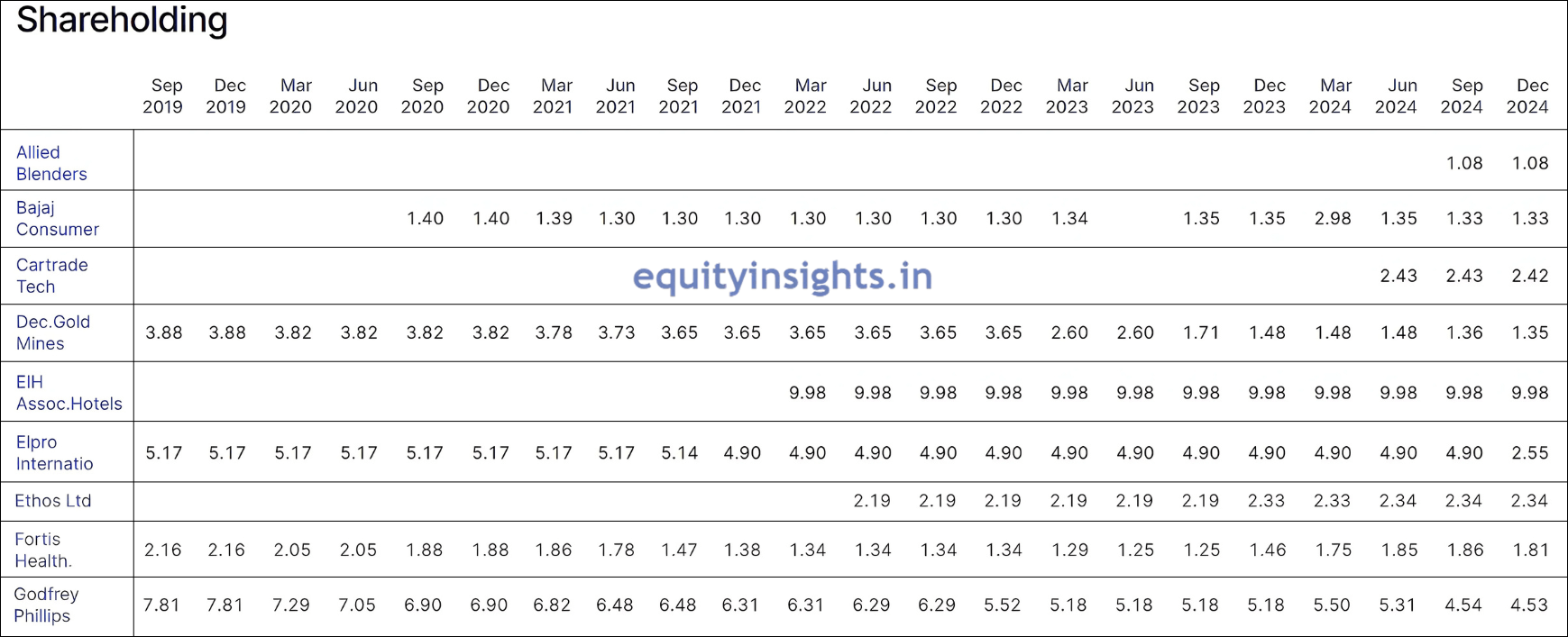

Jupiter India Fund includes companies like Allied Blenders which is their recent addition, Bajaj Consumer, CarTrade Tech, Deccan Gold Mines, Elpro International and Ethos ( the second FII to have invested in these two companies from this list). Then they’ve got EIH Associated Hotels from the hotel sector that has created humongous wealth. They were quite early in identifying the stock from this sector where they invested in the March 2022 quarter and still hold nearly a 10% stake in the company.

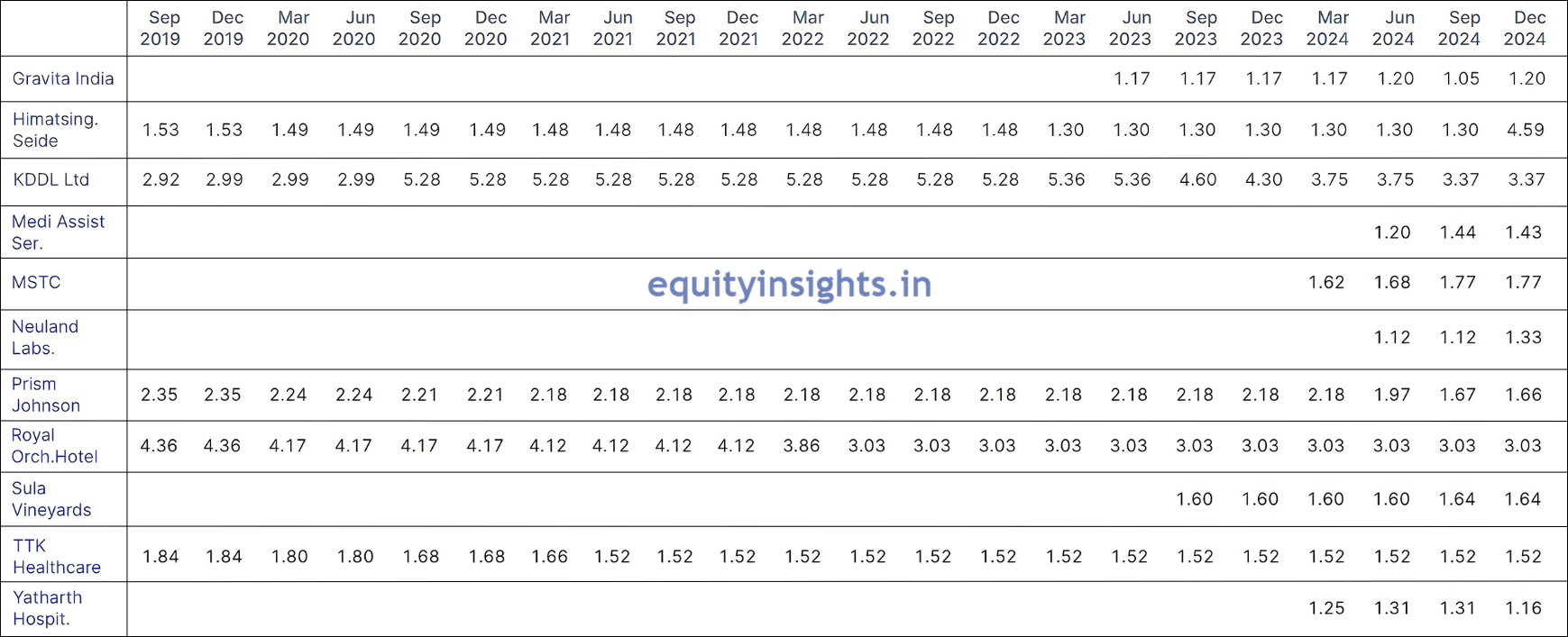

Other notable names include Fortis Healthcare, Godfrey Phillips, Gravita India, Himatsingka Seide (the company increased its stake big-time), KDDL, Medi Assist Healthcare Services, MSTC, Neuland Labs, Prism Johnson, Royal Orchid Hotel, Sula Vineyards (identified last year and still holding 1.6%), Tasty Bite Eatables, TTK Healthcare and Yatharth Hospital. You can check the table below for a detailed view of their latest holdings where they have either increased their stake or kept its stake constant:

| Stock Name | Market Cap (in Cr.) | Investment Month | Latest Holding (%) |

|---|---|---|---|

| Bajaj Consumer | ₹2,477 | September 2020 | 1.33% |

| EIH Associated Hotels | ₹2,176 | March 2022 | 9.98% |

| Ethos | ₹5,985 | June 2022 | 2.34% |

| Gravita India | ₹12,187 | June 2023 | 1.20% |

| Himatsingka Seide | ₹1,613 | September 2019 | 4.59% |

| KDDL | ₹2,652 | September 2019 | 3.37% |

| MSTC | ₹3,739 | March 2024 | 1.77% |

| Royal Orchid Hotels | ₹947 | September 2019 | 3.03% |

| Sula Vineyards | ₹2,642 | September 2023 | 1.64% |

| Tasty Bite Eatables | ₹2,297 | September 2019 | 2.70% |

| TTK Healthcare | ₹1,716 | September 2019 | 1.52% |

Below is the table that shows the names of the companies that Jupiter Asset Management has added recently to its portfolio over the last three quarters or since the June 2024 quarter:

| Stock Name | Market Cap (in Cr.) | Investment Month | Latest Holding (%) |

|---|---|---|---|

| Allied Blenders | ₹9,160 | September 2024 | 1.08% |

| Neuland Labs | ₹15,248 | June 2024 | 1.33% |

That’s the list of the top five FIIs that I believe are essential for long-term wealth creation. One trend that can be witnessed from these institutions is that most of these reputed institutions have reduced their stake in several companies recently and one of the reasons I could understand is because the Indian markets were trading at a higher PE multiple. So, probably they booked some profit but at the same time few FIIs like Goldman Sachs and Jupiter Asset Management took advantage of the fall and added a few stocks to the list or accumulated some of the fundamentally sound stocks.

That said, it’s important to emphasize once again that you shouldn’t blindly follow the moves of FIIs. While their data can offer valuable insights and point you toward potential multibagger opportunities, it’s crucial to do your own research before making any investment decisions. So, that wraps up this article. I’d love to hear your thoughts on these picks—do let me know in the comments which stocks you hold in your portfolio. In the next article, we’ll delve into the top DIIs that I closely track. If you found this article valuable, don’t forget to share it with your friends. Thanks for reading, I’ll see you in the next blog—until then, take care and happy investing!

Disclaimer: We are not a SEBI-registered research analyst. The information provided in this article is intended solely for educational, illustrative and awareness purposes. Nothing contained herein should be construed as a recommendation. Users are encouraged to seek professional financial advice before making any decisions based on the content provided.