As the stock market braces for a new wave of investment opportunities, one of the most anticipated IPOs in recent times is the upcoming listing of Transrail Lighting Limited. With a strong reputation in the engineering and construction sector, specializing in power transmission, distribution and infrastructure, the company is gearing up for its Initial Public Offering (IPO) and is ready to open its doors to public investors.

The Transrail Lighting IPO offers investors the chance to invest in a well-established company in the engineering sector. As the company prepares to hit the stock market, the IPO promises not only potential financial gains but also the chance to be a part of nation-building efforts that impact sectors ranging from utilities to urban development.

In this article, we will explore the key aspects of the Transrail Lighting IPO, its potential, and what makes it an exciting investment opportunity for both seasoned and new investors.

Also Read: Identical Brains Studios IPO Date, Review, GMP, Price & More

Table of Contents

Transrail Lighting IPO Details

Transrail Lighting IPO is a book-built issue valued at ₹838.91 crore, comprising both a fresh issue of 0.93 crore new shares of ₹400 crore and an offer for sale (OFS) of 1.02 crore existing shares of ₹438.91 crore. This dual structure allows the company to raise capital through the issuance of fresh equity while providing an opportunity for existing shareholders to monetize their holdings.

Transrail Lighting’s ₹838.91 crore IPO opens for subscription on Thursday, December 19, 2024 and will close on Monday, December 23, 2024. The allotment for Transrail Lighting IPO is expected to be finalized on Tuesday, December 24, 2024 with a tentative listing date on the stock exchanges set for Friday, December 27, 2024. The price band for Transrail Lighting shares has been fixed at ₹410 to ₹432 per share.

| IPO Name | Transrail Lighting Limited |

| IPO Open Date | 19 December 2024 |

| IPO Close Date | 23 December 2024 |

| Price Band | ₹410 to ₹432 per share |

| Lot Size | 34 shares |

| Face Value | ₹2 per share |

| Total-Issue Size | 1,94,19,259 shares (aggregating up to ₹838.91 Cr) |

| Fresh Issue | 92,59,259 shares (aggregating up to ₹400.00 Cr) |

| Offer for Sale | 1,01,60,000 shares of ₹2 (aggregating up to ₹438.91 Cr) |

| Share Holding Pre Issue | 12,49,96,767 shares |

| Share Holding Post Issue | 13,42,56,026 shares |

| Share Allotment Date | 24 December 2024 |

| Initiation of Refund | 26 December 2024 |

| Credit of Shares to Demat | 26 December 2024 |

| Listing Date | 27 December 2024 |

| UPI Cut Off Time | 23 December 2024 – 5 P.M. |

| Listing Exchange Name | BSE, NSE |

| Lead Manager(s) of Issue | Inga Ventures Private Limited, Axis Capital Limited, HDFC Bank Limited, IDBI Capital Market Services Limited |

| Registrar of Issue | Link Intime India Private Limited |

For detailed information, you can refer to Transrail Lighting IPO RHP.

Transrail Lighting IPO GMP

Prior to its opening, the IPO has received a positive response in the unlisted market, where it is currently trading at a premium of approximately 28%. The latest Grey Market Premium (GMP) stands at ₹120, indicating an estimated listing price of ₹552.

Check IPO Live GMP: View now for Real-Time Updates

Transrail Lighting IPO Lot Size

Transrail Lighting Limited has issued 1,94,19,259 shares worth ₹838.91 Cr for both fresh and offer for sale issues. The minimum lot size for an application is 1 lot (34 shares) and the minimum amount of investment required by retail investors is ₹14,688.

The minimum lot size investment for s-HNI (Small High Net Worth Individual) is 14 lots (476 shares), amounting to ₹2,05,632, while the maximum is 68 lots (2,312 shares), amounting to ₹9,98,784.

For b-HNI (Big High Net Worth Individual), the minimum lot size is 69 lots (2,346 shares) amounting to ₹10,13,472.

| Category | Lots | Shares | Amount |

|---|---|---|---|

| Retail(Min) | 1 | 34 | ₹14,688 |

| Retail(Max) | 13 | 442 | ₹1,90,944 |

| s-HNI(Min) | 14 | 476 | ₹2,05,632 |

| s-HNI(Max) | 68 | 2,312 | ₹9,98,784 |

| b-HNI(Min) | 69 | 2,346 | ₹10,13,472 |

Transrail Lighting IPO Reservation Details

Below are the limits for the shares offered in the different investor categories for this IPO:

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50.00% of the Net Issue |

| Retail Shares Offered | Not less than 35.00% of the Net Issue |

| NII (HNI) Shares Offered | Not less than 15.00% of the Net Issue |

Category Reservation Details

| Application Category | Maximum Bidding Limits | Bidding at Cut-off Price Allowed |

|---|---|---|

| Only RII (Retail) | Up to ₹2 lakhs | Yes |

| Only s-NII | ₹2 lakhs to ₹10 lakhs | No |

| Only b-NII | ₹10 lakhs to NII Reservation Portion | No |

| Only Employee | Up to ₹5 lakhs | Yes |

| Employee + RII/NII | Employee limit: Up to ₹5 lakhs (In certain cases, employees are given a discount if the bidding amount is up to ₹2 lakhs) If applying as RII: Up to ₹2 lakhs If applying as NII: sNII > ₹2 lakhs and up to ₹10 lakhs and bNII > ₹10 lakhs | Yes for shareholder/RII |

About the Company

Next, let’s shift our focus to explore more about the company’s background, operations, strengths and risks, financial statements, and key highlights.

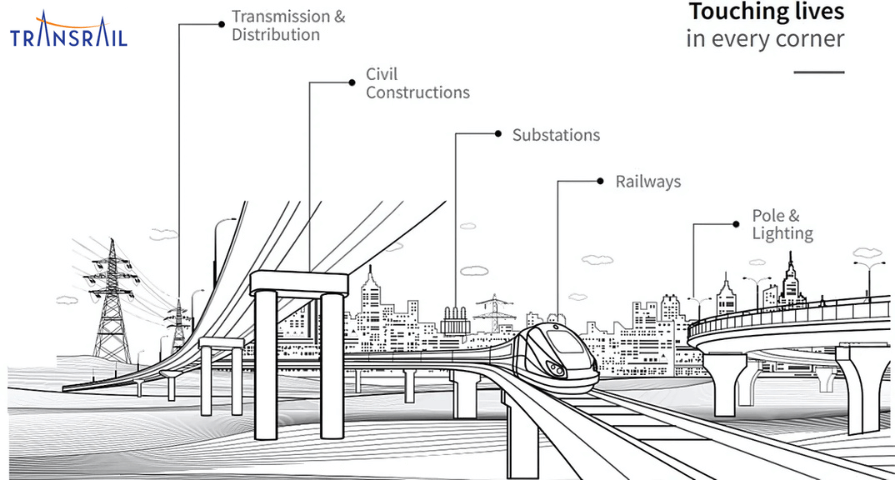

Incorporated in February 2008, Transrail Lighting Limited is a prominent Indian engineering, procurement and construction (EPC) company, focused on power transmission and distribution and manufacturing lattice structures, conductors, and monopoles.

The company provides the following services:

- Supply, engineering, procurement and construction of transmission lines and distribution lines.

- EPC services in civil construction, including design work for bridges, tunnels, elevated roads and cooling towers.

- Act as manufacturers and service providers in the poles and lighting segment, offering supply, installation, and testing.

- The company offers railway services such as overhead electrification, signaling, telecommunication, earthworks and track linking.

Since its inception, the company has completed over 200 power transmission and distribution projects. Transrail Lighting has a presence in 58 countries including Bangladesh, Kenya, Tanzania, Nigeria, Poland, Finland, Cameroon and Nicaragua, where it undertakes turnkey EPC projects and supply operations.

As of June 30, 2024, the company has supplied 1.3 MMT of towers, 194,534 kilometres of conductors, and 458,705 poles and has successfully executed EPC projects covering 34,654 circuit kilometres of transmission lines and 30,000 circuit kilometres of distribution lines, both domestically and internationally. The company also provides EPC services for substations up to 765 kilovolts (kV), further strengthening its expertise in the field. As of the same date, the company has 114 employees in the design and engineering team.

Transrail Lighting Limited operates across all segments of power transmission and distribution, with a significant focus on high voltage (HV) and extra high voltage (EHV) segments. In addition to the core power transmission and distribution business, it also operates in other verticals such as civil construction, poles lighting and railways.

With over four decades of experience, Transrail has earned a reputation as a trusted partner globally, offering comprehensive turnkey solutions. In the financial year ending March 31, 2023, they achieved remarkable growth, with revenue from operations soaring by 35.1%, outpacing their peers as reported by the CRISIL report. This growth underscores their strong position in the industry.

As of December 2024, the company operates four manufacturing units. The first is located in Vadodara, Gujarat, the second in Deoli, Maharashtra, and the third and fourth in Silvassa and Dadra & Nagar Haveli respectively.

Industry Outlook:

- The rapid expansion of India’s power transmission and distribution network presents lucrative growth opportunities. Significant increases in both domestic transmission and distribution lines over recent years, coupled with estimated investments of around ₹2.30 trillion in transmission and ₹3 – 3.50 trillion in distribution over the next 5 years, make the industry outlook appear promising.

- Beyond India, there is a substantial need for electricity infrastructure in regions like Africa, Latin America and the Caribbean. With a considerable portion of the African population lacking access to electricity, there is a pressing demand for the deployment of new transmission and distribution networks. Similarly, power sector investments in Latin America and the Caribbean are expected to rise, to meet increasing electricity demand and modernize grid infrastructure.

Competitive Strengths:

- Strong and diversified order book.

- Established manufacturing facilities in four strategic locations.

- Proven track record of growth and established presence in the power transmission and distribution sector through effective implementation and execution skills.

Objectives of Transrail Lighting IPO

The company plans to allocate the net proceeds from the issue for the following purposes:

- The funds will be utilized to support incremental working capital needs, ensuring smooth business operations and financial flexibility.

- Proceeds will be allocated towards capital investments to enhance operational efficiency and expand infrastructure.

- The remaining funds will be allocated towards general corporate purposes.

Also Read: Trading Economics: How Economic Events Impact Stock Market?

Transrail Lighting Limited Financial Information (Restated Consolidated)

Transrail Lighting Limited’s revenue increased by 30.2% and profit after tax (PAT) rose by 116.8% in the FY 2023-24 (April 1, 2023 to March 31, 2024).

| Period Ended | 31 Mar 2022 | 31 Mar 2023 | 31 Mar 2024 | 30 Jun 2024 |

| Assets | 2,841.87 | 3,445.49 | 4,620.61 | 4,836.17 |

| Revenue | 2,357.20 | 3,172.03 | 4,130.00 | 929.70 |

| Profit after Tax | 64.71 | 107.57 | 233.21 | 51.74 |

| Net Worth | 599.32 | 709.15 | 1,075.87 | 1,140.65 |

| Total Debt | 469.12 | 604.92 | 643.19 | 603.43 |

| Amt in ₹ Crore | ||||

Key Performance Indicators

Transrail Lighting Limited has a market capitalization of ₹5,799.86 crore. As of March 31, 2024, the company’s key performance indicators (KPIs) include an impressive Return on Capital Employed (ROCE) of 24.33% and profit after tax (PAT) margin of 5.65%.

| Key Performance Indicators | Value |

|---|---|

| ROE | 24.41% |

| ROCE | 24.33% |

| Debt/Equity | 0.56 |

| RoNW | 21.68% |

| Price to Book Value | 4.70 |

| PAT Margin | 5.65% |

The EPS and PE ratios before and after the Transrail Lighting IPO issue are detailed in the list below:

| Ratios | Pre IPO | Post IPO |

| EPS (₹) | 18.66 | 15.42 |

| P/E (x) | 23.15 | 28.02 |

- The Pre-IPO EPS is calculated based on the pre-issue shareholding as of the RHP date and the latest FY earnings available in the RHP, as of March 31, 2024.

- The Post-IPO EPS is calculated based on the post-issue shareholding and annualized FY earnings as of June 30, 2024, as provided in the RHP.

Also Read: Stock Analysis: Things to Follow & Avoid in the Stock Market

Transrail Lighting IPO Review (Apply)

The review of the Transrail Lighting IPO has been done based on the following points:

- Revenue Growth: Revenue nearly doubled from ₹2,357.20 crore in FY22 to ₹4,130.00 crore in FY24 (75% growth), with Q1 FY25 already at ₹929.70 Cr. This reflects steady growth and a strong market presence.

- Profit Growth: PAT grew significantly from ₹64.71 crore in FY22 to ₹233.21 crore in FY24 (260% growth), with Q1 FY25 contributing ₹51.74 crore. With a PAT margin of 5.65%, the company demonstrates good profitability, which is good for the infrastructure sector.

- Valuation Metrics: Pre-IPO P/E: 23.15 | Post-IPO P/E: 28.02

As per the RHP, the company has shown KEC International Limited, Kalpataru Projects International Limited and Patel Engineering Limited as their listed peers. They are trading at the P/E of 91.95, 36.72 and 15.57 (as of December 16, 2024) respectively. However, they are not truly comparable on an apple-to-apple basis. The IPO seems to be undervalued compared to the average P/E ratio of around 37x for the infrastructure sector.

- Return on Capital Employed (ROCE) and Return on Net Worth (RoNW):

ROCE: 24.33% reflects the company’s capital efficiency.

RoNW: 21.68% is extremely good for long-term investors.

- GMP and IPO Price Band: With a price band of ₹410 to 432 per share and a GMP of ₹120, the market shows a great interest, suggesting a potential listing gain of around 28%.

Strengths

- Strategic Manufacturing Facilities: The company leverages four strategically located manufacturing units across Gujarat, Maharashtra and Silvassa, supported by a skilled team of 114 design professionals ensuring innovative solutions and quality project delivery.

- Diverse Service Portfolio: Comprehensive offerings across power transmission, railway electrification and pole manufacturing, reducing sector dependency. Their ability to complete large-scale projects efficiently has built a strong reputation and steady order pipeline.

- Infrastructure Focus: Strong positioning in high-growth sectors like power transmission and railway electrification.

- Financial Performance: Transrail Lighting has demonstrated robust growth with revenue reaching ₹4,130 crore in FY24, representing a 30.2% CAGR since FY22. The company’s PAT surged to ₹233.21 crore in FY24, showing 116.8% growth over FY23. Their assets expanded to ₹4,836.17 crore while maintaining a healthy PAT margin of 5.65%. With a net worth of ₹1,140.65 crore and a conservative debt-to-equity ratio of 0.56, the company exhibits strong financial health and prudent management.

- Global Presence & Track Record: Their diverse revenue streams encompass power transmission, railway electrification and lighting segments, while their established presence in 58 countries with 200+ completed projects demonstrates strong global market penetration and proven execution capabilities.

- Growth Strategy: The company plans to capitalize on growing industry opportunities through strategic expansion using IPO proceeds. Their plans include establishing new branches in Andheri and Lucknow, investing in advanced technology and equipment, and diversifying service offerings. This positions them well to capture opportunities in the expanding power transmission and distribution sector, driven by global energy demand and infrastructure upgrades.

Risks

While Transrail Lighting presents a compelling investment case, potential investors should consider certain risks. Here are some of the risk factors involved in the IPO that investors should know before subscribing to the issue. These risk factors have been highlighted by the company in its Red Herring Prospectus (RHP):

- High Dependence on Government Contracts: The company’s business depends on tenders issued by government authorities, public sector undertakings and utilities, which account for a significant part of the revenue from operations. Government clients contributed ₹624.27 crore (69.60%) for the three months ended June 30, 2024, and ₹1,850.97 crore (81.04%), ₹2,541.46 crore (82.35%) and ₹3,313.95 crore (82.66%) in FY22, FY23 and FY24 respectively. Any delays or absence of tenders from these entities could materially impact the company’s operations and financial results.

- Regulatory Investigations may lead to Penalties or Disruptions: Transrail Lighting was previously a subsidiary of Gammon India Limited (GIL) and is therefore responsible for any pending legal proceedings. Any adverse judgments in these proceedings against GIL could harm the company’s reputation, adversely affecting its business.

Also, the company is involved in a First Information Report (FIR) filed by the Central Bureau of Investigation (CBI), Anti-Corruption Bureau, Lucknow, Uttar Pradesh, concerning the Gomti River Project. Any adverse developments or judgments in this matter could harm the company’s prospects and reputation.

- Revenue concentrated from a few Countries poses Geographic Risks: A substantial portion of the company’s revenue comes from international clients, especially from Bangladesh, Mali and Niger, which contributed 29% to the revenue from operations for the three months ended July 30, 2024. Apart from this, in total foreign clients contributed ₹47.44 crore (49.89%) of revenues for the three months ended June 30, 2024, and ₹867.11 crore (37.96%), ₹1,647.30 crore (53.38%) and ₹2,347.31 crore (58.55%) in FY22, FY23 and FY24 respectively. Any challenges in managing risks associated with foreign operations could negatively affect its business, client relationships, and assets in these countries.

- Economic Sensitivity: Demand for power transmission projects may fluctuate with macroeconomic conditions.

- High Competition: The power transmission and distribution sector faces intense competition from established and emerging players.

All the above-mentioned risks should be considered by investors before deciding to invest in the IPO.

Opinion

Given the company’s financial growth, strong fundamentals and high listing gain potential, the IPO appears attractive and therefore can be applied for both listing gains and investment. You can go through the points mentioned below to plan accordingly:

- Long-Term Investors: Based on the company’s performance in Q1 FY25, the issue seems reasonably priced. Therefore, investors might consider holding their investments for the long term.

- For Short-Term Investors: Short-term traders or investors should pay attention to the GMP trend on the listing day for any short-term gains, which look really good as of now with a 28% return on the listing date.

The Government of India is highly focused on the engineering, power transmission and construction sector. So, if you believe in the infrastructure sector’s growth and the company’s ability to maintain its performance, you can consider applying for the IPO for both listing gains and investment.

Also Read: 10 Trading Rules That Make a Trader Successful

Additional Details

Promoter Holding

Ajanma Holdings Private Limited, Mr. Digambar Chunnilal Bagde and Mr. Sanjay Kumar Verma are the promoters of the company. Their shareholding before and after the issue is as follows:

| Pre Issue Shareholding | 84.50% |

| Post Issue Shareholding |

Transrail Lighting IPO Allotment Status: Check Now

Transrail Lighting Limited Contact Details

Address: 501, A, B, C, E Fortune 2000, Block G Bandra Kurla Complex, Bandra East Mumbai, Maharashtra – 400051

Phone: +91 2261979600

Email: [email protected]

Website: https://transrail.in/

Transrail Lighting IPO Registrar Details

Registrar: Link Intime India Private Limited

Address: C 101, 247 Park, L.B.S.Marg, Vikhroli (West), Mumbai – 400083

Phone: +91 2249186270

Email: [email protected]

Website: https://linkintime.co.in/Initial_Offer/public-issues.html

Disclaimer: We are not a SEBI-registered research analyst. This article is written solely for educational purposes and should not be interpreted as investment advice or recommendations. The stock market involves significant risks, so we encourage you to seek guidance from a financial advisor before making any investment decisions.

FAQs

Q1. What is Transrail Lighting IPO?

Transrail Lighting IPO is a book-built IPO of both fresh and offer for sale issue, where the company aims to raise ₹838.91 crore through this IPO.

Q2. What is the price band of Transrail Lighting IPO?

The price band of this IPO has been fixed at ₹410-432 per share. This price range presents a good opportunity for investors.

Q3. What are the important dates for Transrail Lighting IPO?

The IPO opens on 19 December 2024 and closes on 23 December 2024. The listing of shares will take place on 27 December 2024 on NSE and BSE.

Q4. How many shares are being offered in the Transrail Lighting IPO?

A total of 1,94,19,259 shares are being offered in the company’s IPO.

Q5. What is the lot size of Transrail Lighting IPO?

The lot size of the Transrail Lighting IPO is 34 shares.

Q6. What is the expected listing gain for Transrail Lighting IPO?

The Grey Market Premium (GMP) of the Transrail Lighting IPO has reached ₹120, indicating an expected listing gain of around 28%.

Q7. Who are the lead managers of Transrail Lighting IPO?

The lead managers of this IPO are Inga Ventures Pvt Ltd, Axis Capital Limited, HDFC Bank Limited and IDBI Capital Market Services Limited.

Q8. How to apply for the Transrail Lighting IPO?

You can apply for the Transrail Lighting IPO online through ASBA via your bank account. Alternatively, you can apply via UPI through your stockbroker or submit an offline application form through your broker. The deadline for submitting IPO applications is December 23, 2024.

Q9. How to apply for the Transrail Lighting IPO through Angel One?

To apply for the Transrail Lighting IPO through Angle One, first Log in to the Angel One application with your credentials. Select the IPO. You will see the IPO Name “Transrail Lighting IPO”. Click on the Bid button. Confirm your Application. Now go to your UPI app or Net Banking or BHIM app to approve the mandate.

Q10. How to apply for the Transrail Lighting IPO through 5 Paisa?

To apply for the Transrail Lighting IPO through 5 Paisa. First, log in to the 5 Paisa application with your credentials. Select the IPO. You will see the IPO Name “Transrail Lighting IPO”. Click on the Bid button. Confirm your Application. Now go to your UPI app or Net Banking or BHIM app to approve the mandate.

Q11. How to apply for the Transrail Lighting IPO through Upstox?

Log in to the Upstox application with your credentials. Select the IPO. You will see the IPO Name “Transrail Lighting IPO”. Click on the Bid button. Confirm your Application. Now go to your UPI app or Net Banking or BHIM app to approve the mandate.

Q12. How to apply for the Transrail Lighting IPO through IIFL?

Log in to the IIFL application with your credentials. Select the IPO. You will see the IPO Name “Transrail Lighting IPO”. Click on the Bid button. Confirm your Application. Now go to your UPI app or Net Banking or BHIM app to approve the mandate.