In the series of fundamental analyses, this is going to be the third article which explains how trading economics and economic events impact stock market. In the previous two articles, I shared the importance and need for investment today, how Indian companies are the bright spot for investors and how you can contribute to the Indian economy by investing in Indian companies. Additionally, I shared several examples of how a company’s sales and profitability may be impacted due to inflation along with highlighting the number of points to sustain in the market in the long term.

If you haven’t read my previous article yet, you can check it out here: Stock Analysis: Things to Follow & Avoid in the Stock Market

In this article too, I will be sharing some really good examples that could help you improve your knowledge base and get an understanding of how news impacts the stocks opposite of what people think. So, let’s start the article with an insightful set of data highlighting the growth potential in India.

Table of Contents

Per Capita Income of India

India’s per capita income currently stands at $2400 (USD), while for China it is $12000 and the U.S. has the highest at approximately $75,000. Historically, any country that has surpassed the mark of $2000 per capita income has shown consistent growth until they achieved the $10000 figure in per capita income, as crossing this threshold brings about self-sustainability.

As of now, it looks unlikely that India will experience any bear market similar to the 2008 crisis or the pandemic period because of domestic factors or the financials of Indian companies. The Indian market can only fall because of external reasons or issues in other countries such as economic challenges in the U.S. or other influential countries which has a contribution to the Indian stock market.

Types of Changes in the Stock Market

There are three kinds of changes in the stock market:

- Business change – This means an increase or decrease in the demand for the product, which directly impacts the sales of a company.

- Financial change – It means when the business and industry are good but the financial condition of the company is poor due to the high debt of the company.

- Change in stock prices – It means the business and financials of the company are good but the stock price is down and this presents an opportunity to buy that stock. For example – If the net profit of a company is at an all-time high and its business is also doing good but the stock price is down by 25-30% from its high then that is an opportunity to invest.

Also Read: Investment: The Key to Secure Your Financial Future

Shareholding Pattern

In the stock market, two types of participants appear in the shareholding pattern:

- Strong hands – As the name suggests, this is a group of strong people who are directly responsible for the movement in stock price. It includes Promoters, Foreign Institutional Investors (FIIs), Domestic Institutional Investors (DIIs), and High Net-Worth Individuals (HNIs).

- Weak hands – The participants who enter the market with little amount in hand are considered to be weak hands and this group includes retail investors.

Types of HNIs

According to the Securities and Exchange Board of India (SEBI), High Net-Worth Individuals (HNIs) are those individuals who hold 1% or more of the equity or shares in a company.

High net-worth individuals are commonly categorized into three types based on their total net worth. Here’s a quick look at the three different types:

- High Net worth Individuals (HNIs) – These are the individual investors with a net worth of up to ₹5 crores.

- Very High Net worth Individuals (VHNIs) – These individual investors have a net worth between ₹5 crores and ₹25 crores.

- Ultra-High Net worth Individuals (UHNIs) – Individual investors with a net worth of more than ₹25 crores are considered as UHNIs.

VHNIs and UHNIs are also classified as b-HNIs, which stands for big High Net Worth Individuals.

The strong hands are further classified into two categories:

- Investors

- Traders

Promoters are considered investors as they hold the shares of their companies for the long term and do not trade frequently. Therefore, promoters do not play a role in the movement of stock’s price on a daily basis.

Among FIIs, DIIs, and HNIs, some are investors while others are traders. For example – Norway Sovereign Pension Fund is totally into investing and rarely engages in frequent trading in the Indian stock market. So, they fall under the category of investors and have no to very little role in the daily movement of stock’s price. However, not all FIIs, HNIs, and DIIs are investors. If we take the example of the late Mr. Rakesh Jhunjhunwala, even though he was primarily seen as an investor in Tata Motors but used to trade frequently with some fractions of his holdings in Tata Motors.

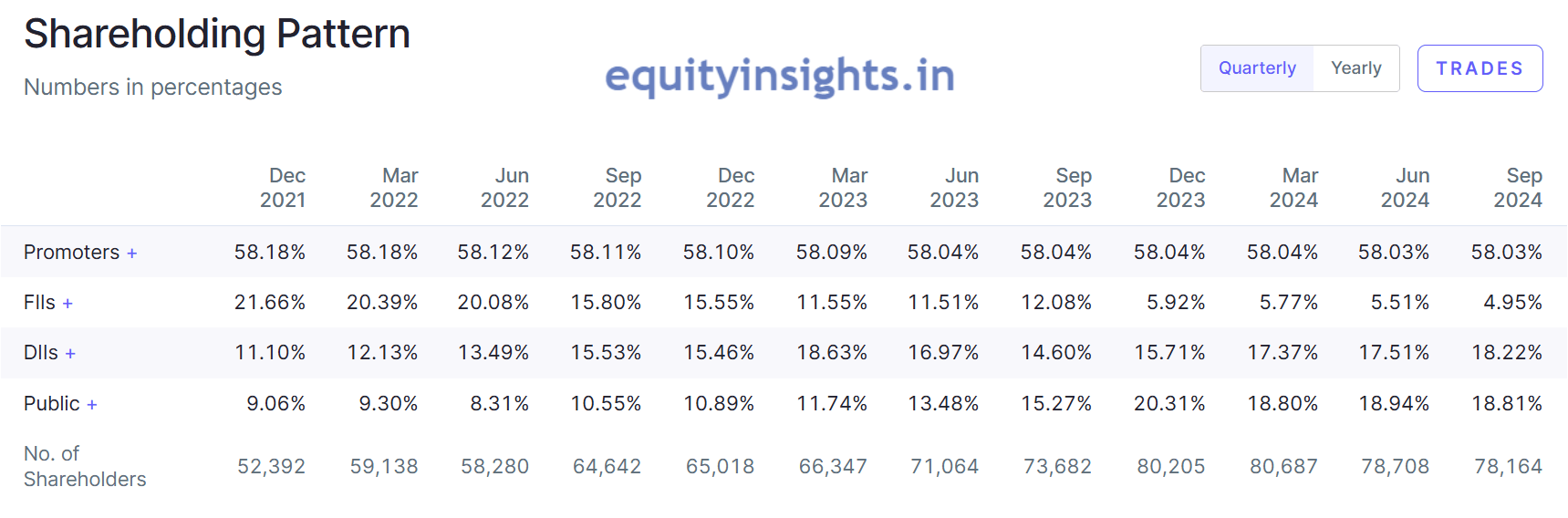

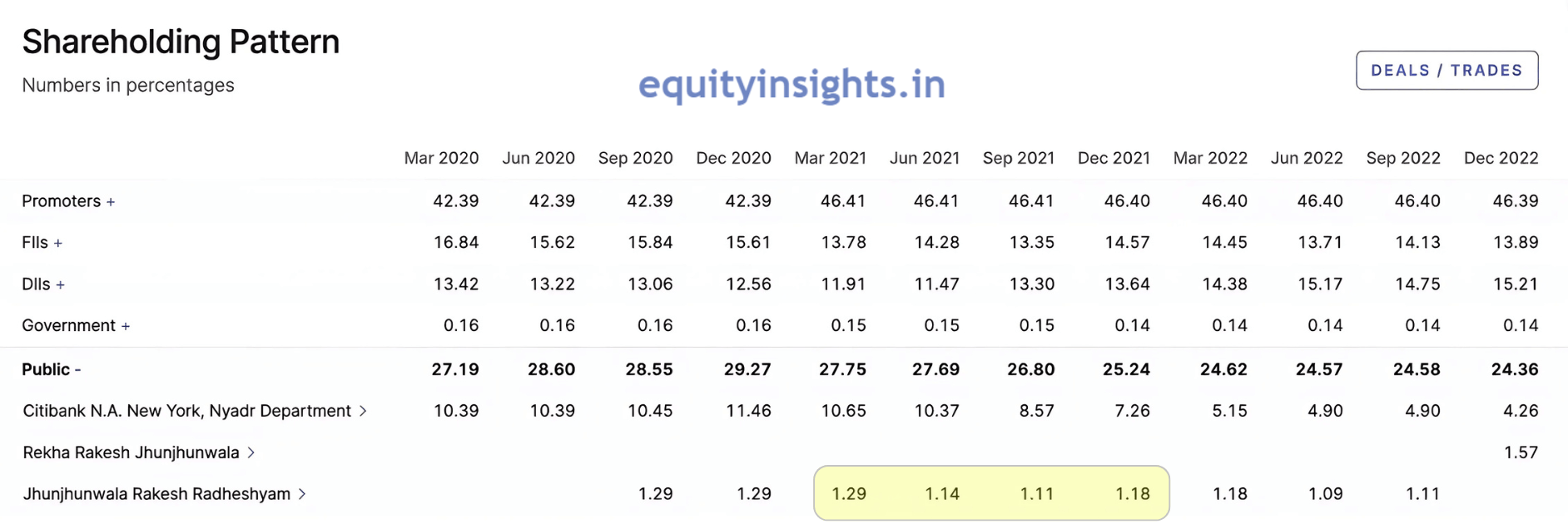

Let’s look at the data to analyze:

Rakesh Jhunjhunwala held a 1.29% stake in Tata Motors in March 2021, which he reduced to 1.14% and 1.11% in the June and September quarter of 2021 respectively. However, he again increased his stake to 1.18% in the next quarter which indicates that he was using some portion of his holdings in Tata Motors to trade. While major of his portion in Tata Motors was investment, he was directly responsible for the frequent movement in stock’s price as he was still involved in trading.

Just like the classification of strong and weak hands into investors and traders, both investors and traders can also be further divided into two categories:

- Those who invest their own money – This category includes HNIs and Promoters.

- Those who use other’s money to invest in market – This group includes FIIs and DIIs.

Those who invest their own money, benefit from the rising market because eventually rising market will help in their wealth building.

On the other hand, those who don’t use their money in the stock market like the fund managers, their earnings also rely on a rising market to make a profit as they charge a certain percentage on the assets they manage as per current market value which they call Asset Under Management (AUM). Let’s understand this with an example – Suppose FIIs have invested ₹3000 crores in the stock market, and the fund managers charge a certain percentage as expense ratio to manage the funds. Let’s assume they charge 1% yearly on the Net Asset Value (NAV) which is the current value of the market and the similar way Indian investors are charged by fund managers investing in mutual funds.

As the market rises, the NAV increases and when the market falls, the NAV drops. Since fund manager’s earnings depend on this, any FIIs and DIIs would never want the markets to remain negative for the long term. While the market may fall anytime this is seen as an opportunity by these institutions to buy the shares in bulk at a lower price. So, the market may fall but can’t remain negative for long.

What Comparison should be Made?

You should compare the returns of Nifty 50 with the Nasdaq and not the Dow Jones Industrial Average Index of the US market. Although the Nasdaq consists of only IT companies, it is tech companies that are the highest profit-making companies, responsible for driving the GDP of the United States. Similarly in India, it is the companies in the Nifty 50 Index which is directly responsible for driving the economy.

Also Read: 10 Trading Rules That Make a Trader Successful

How Trading Economics Impact Stock Market?

1. Why do Crude Oil Prices Fluctuate?

One major factor driving the stock market is Crude Oil, with its price fluctuations playing a direct role in shaping share market movements. Therefore, it is crucial to understand how this relationship works.

The countries directly linked with the production of crude oil like the UAE, and the US (Texas) consume less crude oil. These countries have less arable (agricultural) land available to them due to their focus on oil production and because of this, they have smaller populations living in their country.

While if we look at countries like India and China, the production of crude oil is very less here due to which these countries have more of arable land present which is directly responsible for the large population living in these countries and eventually it demands more of crude oil for consumption. Therefore, these countries import oil from oil-producing nations and that is how crude oil comes into the picture creating a link between crude oil prices and inflation.

Now, an important point to note here is that a country can’t store produced crude oil for long periods as a result oil-producing countries only produce that much oil, which can be immediately exported for consumption. Every country imports the oil based on the calculation of +2% standard deviation. In India, there’s a dedicated ministry that tracks daily consumption data, ensuring oil imports are aligned with demand.

Have you ever pondered, given that the calculations are so precise, why do crude oil prices still fluctuate? The reality is that the demand and supply are not creating any variation in the prices of the crude oil, rather the price of crude oil is directly being controlled by the strong.

For countries like UAE, Iran, Iraq and Russia, exports of crude oil are the main source of income. These countries need U.S. dollars to buy goods from other countries like any other country (U.S. dollars being the global currency), and they earn those dollars by exporting oil (the main source of their income). As they produce as much oil as they can export (due to storage limitations), fluctuations in oil prices suggest that the market isn’t truly following supply and demand principles.

2. Trading Economics which Impacted Shares of Truck Manufacturing and Transport Finance Companies

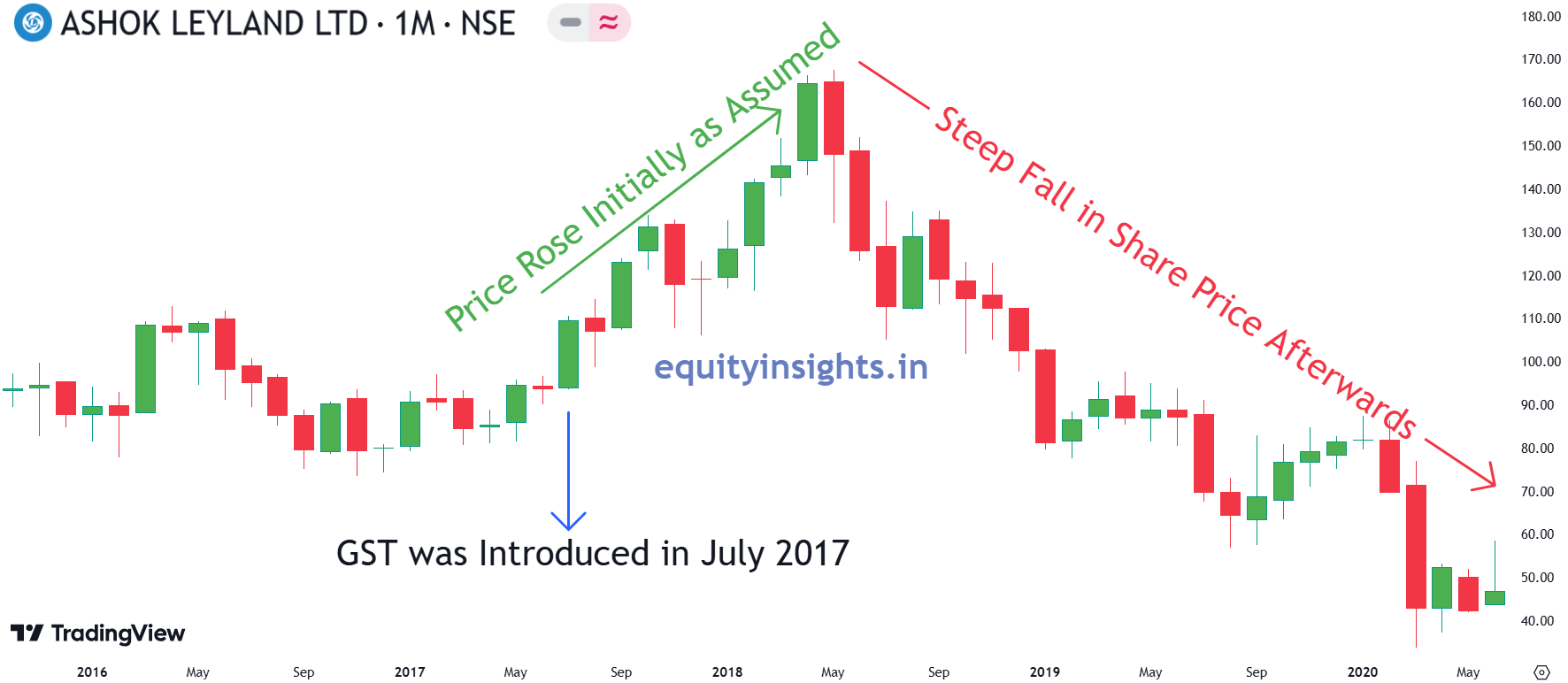

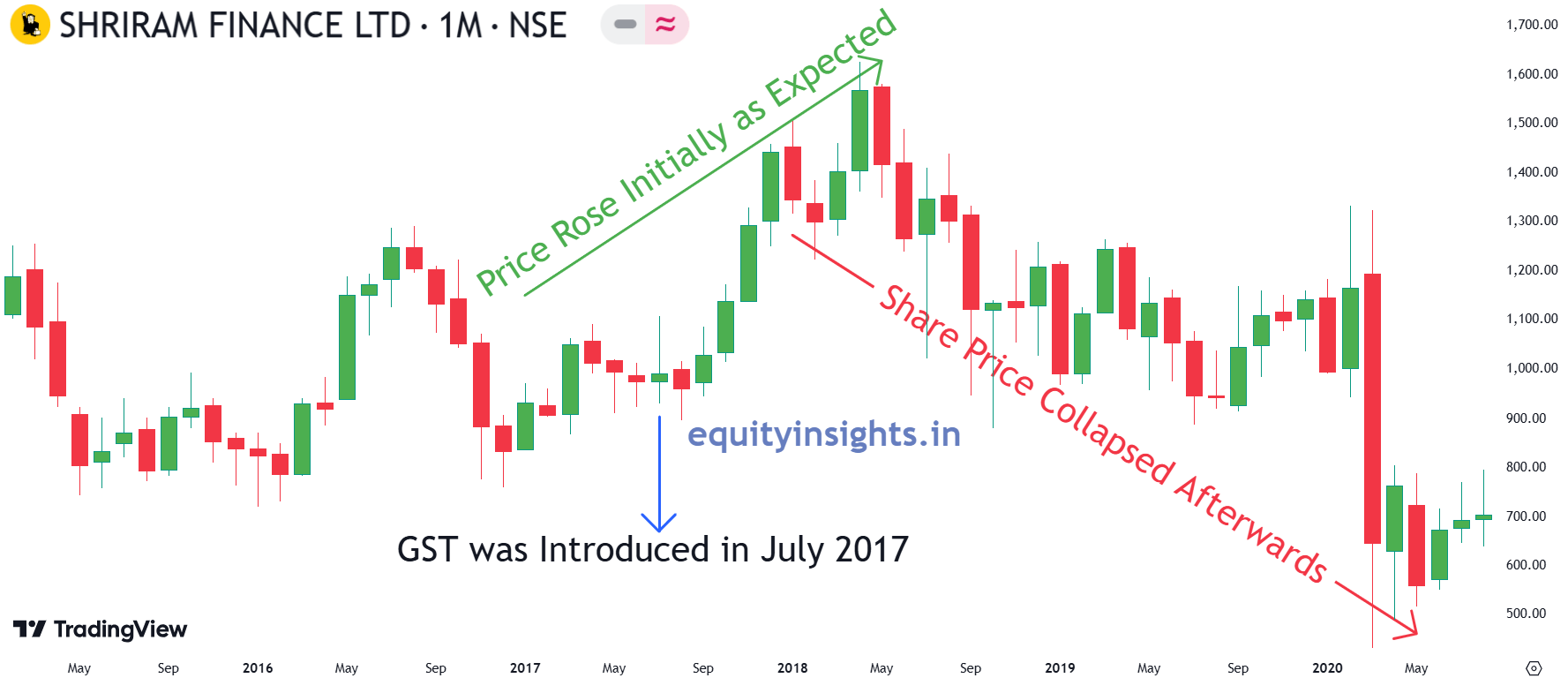

Let me share another example of Trading Economics which worked opposite and impacted the shares of Truck Manufacturing companies like Ashok Leyland and Transport Finance Companies like Shree Ram Finance.

When Goods and Services Tax (GST) was introduced in India on July 1, 2017, everyone assumed that truck businesses would prosper now as the time taken by truck to go from the Gurgaon plant to Kerala was 30 days earlier, now it will be able to do it in only 15 days because GST is all India tax, so the same set of documents which is required at the border of one state will be applicable in all the other states.

It was assumed that there would be no need to pay any separate sales tax or no check-in would be required at every border and the truck does not have to spend any unnecessary time in any state. The process of document checking will be reduced to a great extent which in some cases used to take 1-2 days and the truck will move more freely. Business and industrialization will become easier and demand for commercial vehicles will increase because business will grow this way.

However, despite all these assumptions proving correct, the demand for commercial vehicles declined for a brief period. The reason for same was because a vehicle which was taking twice the time to cross a certain distance earlier was reduced to half the time and because of this, the same vehicle started performing the duty of two vehicles and even though the demand reduced for a brief period, it resulted in the collapse of stock price of Ashok Leyland and Shree Ram Finance which is directly involved in the manufacturing and financing of trucks respectively.

3. How Real Estate Work and How it Proved Beneficial for Housing Finance Companies in 2014-15?

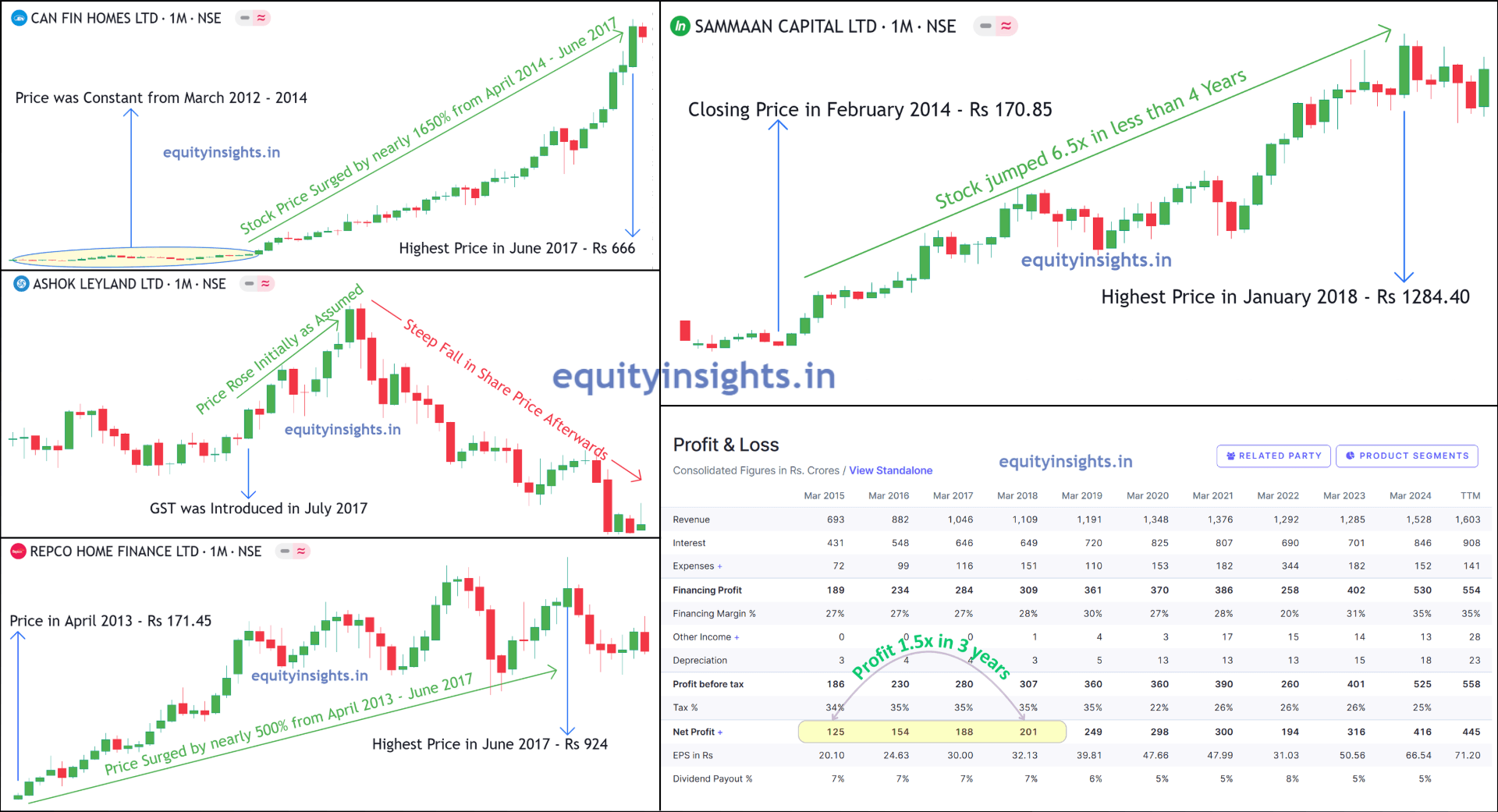

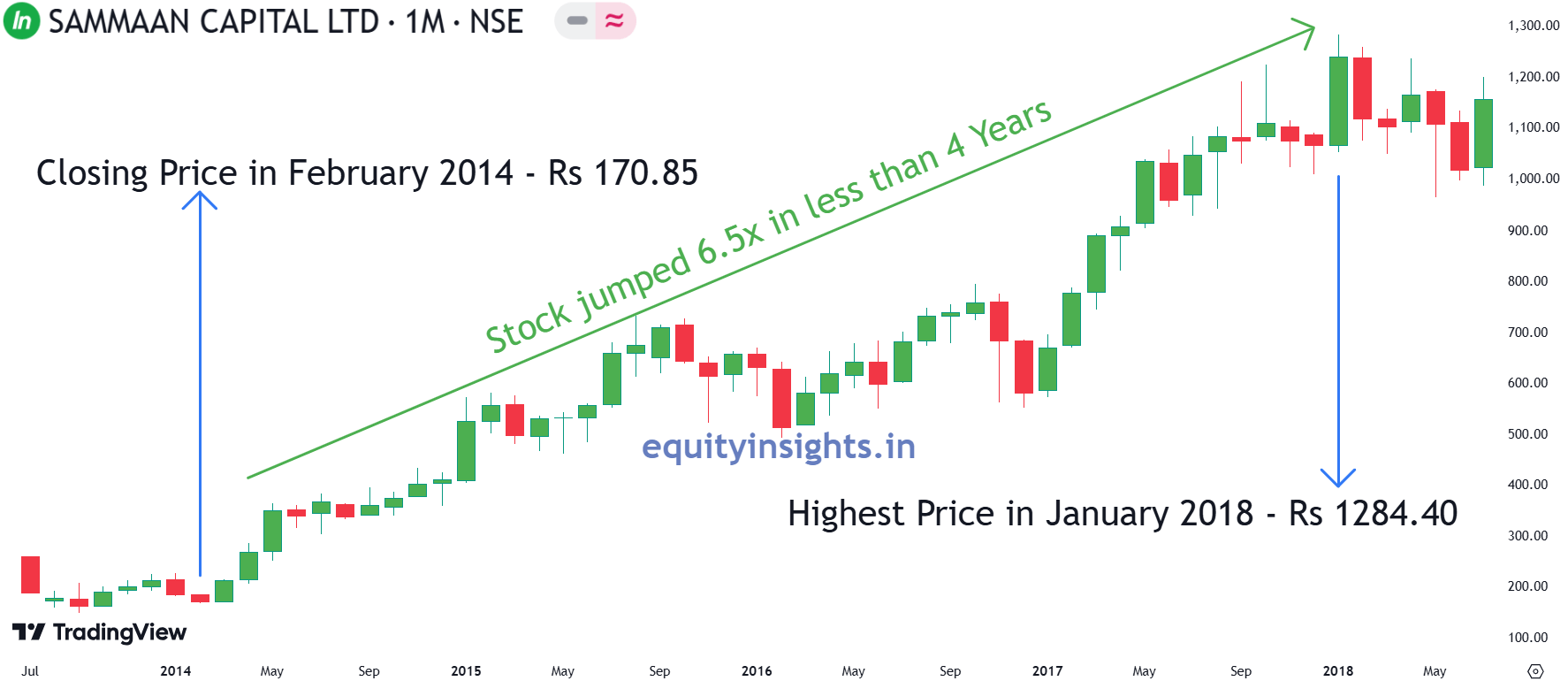

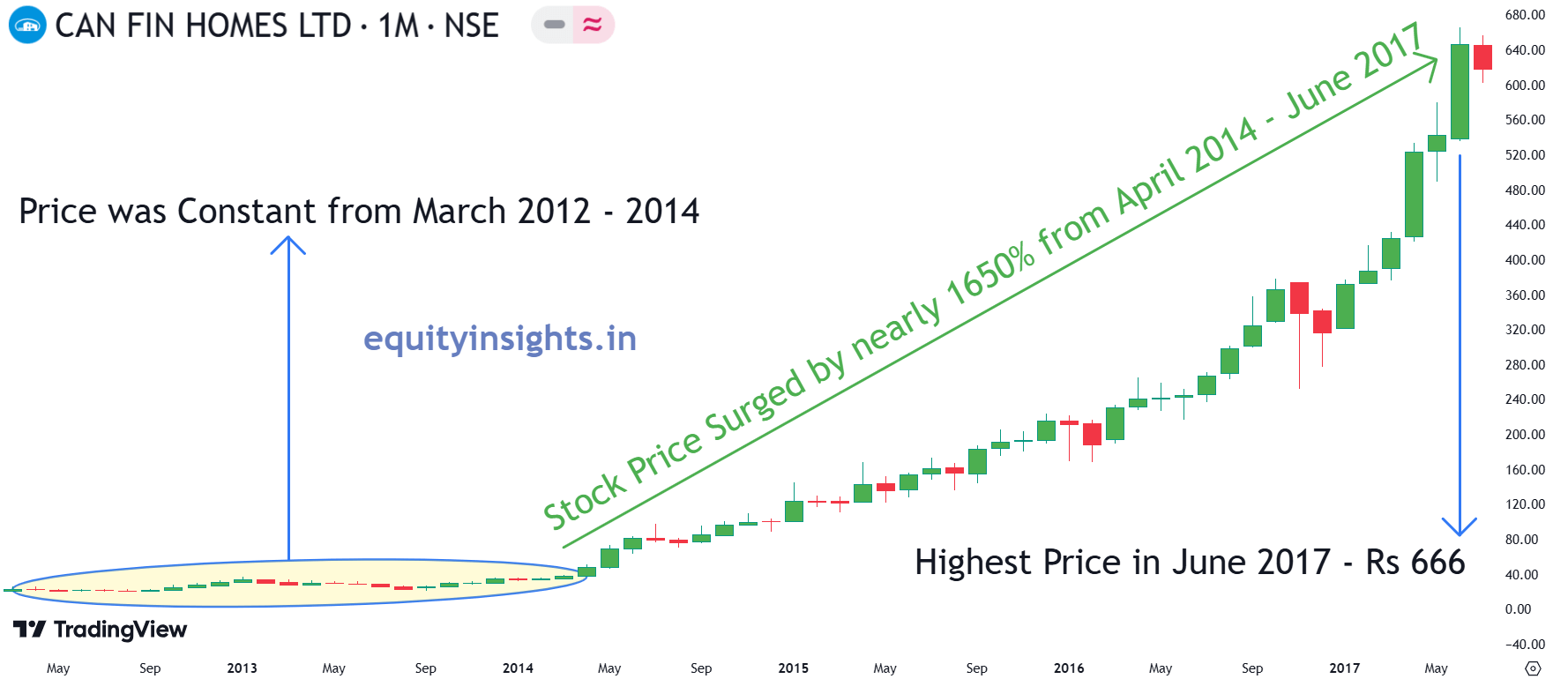

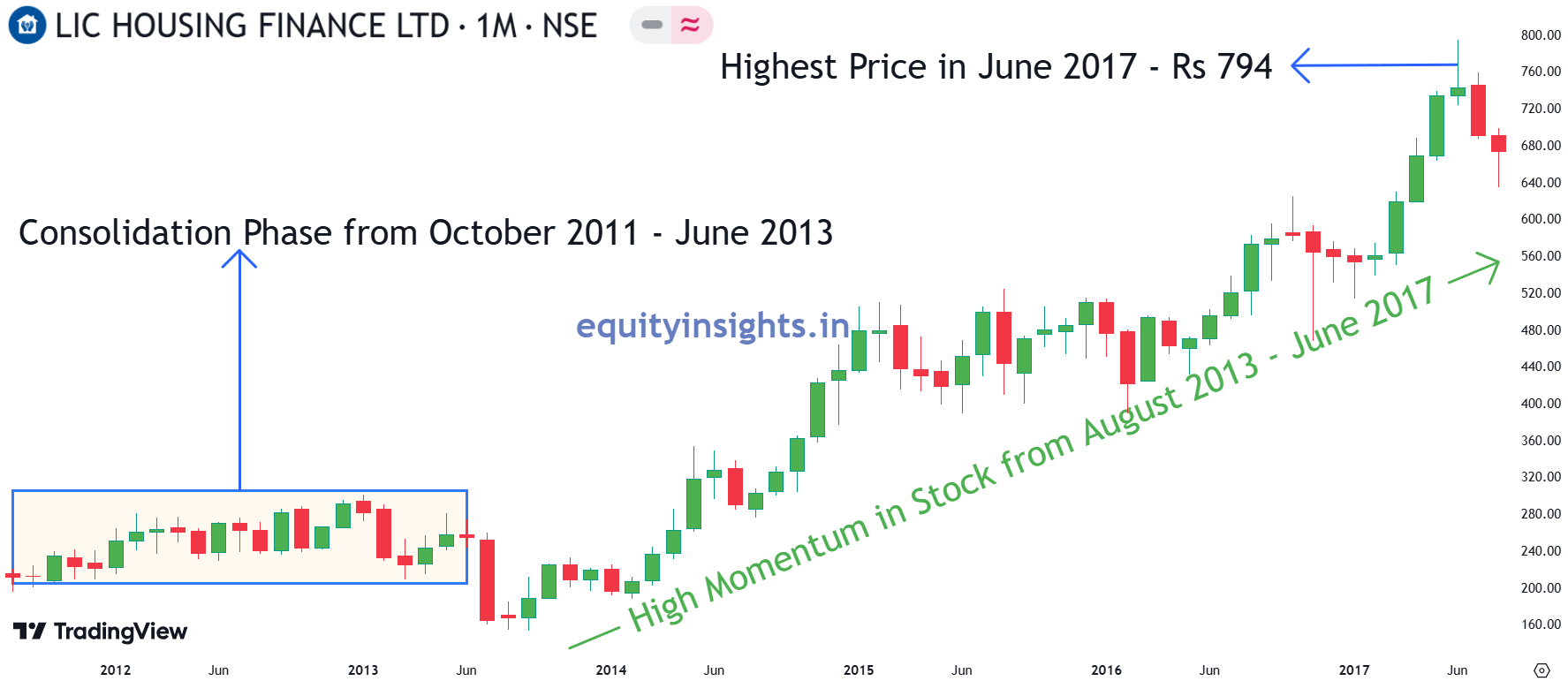

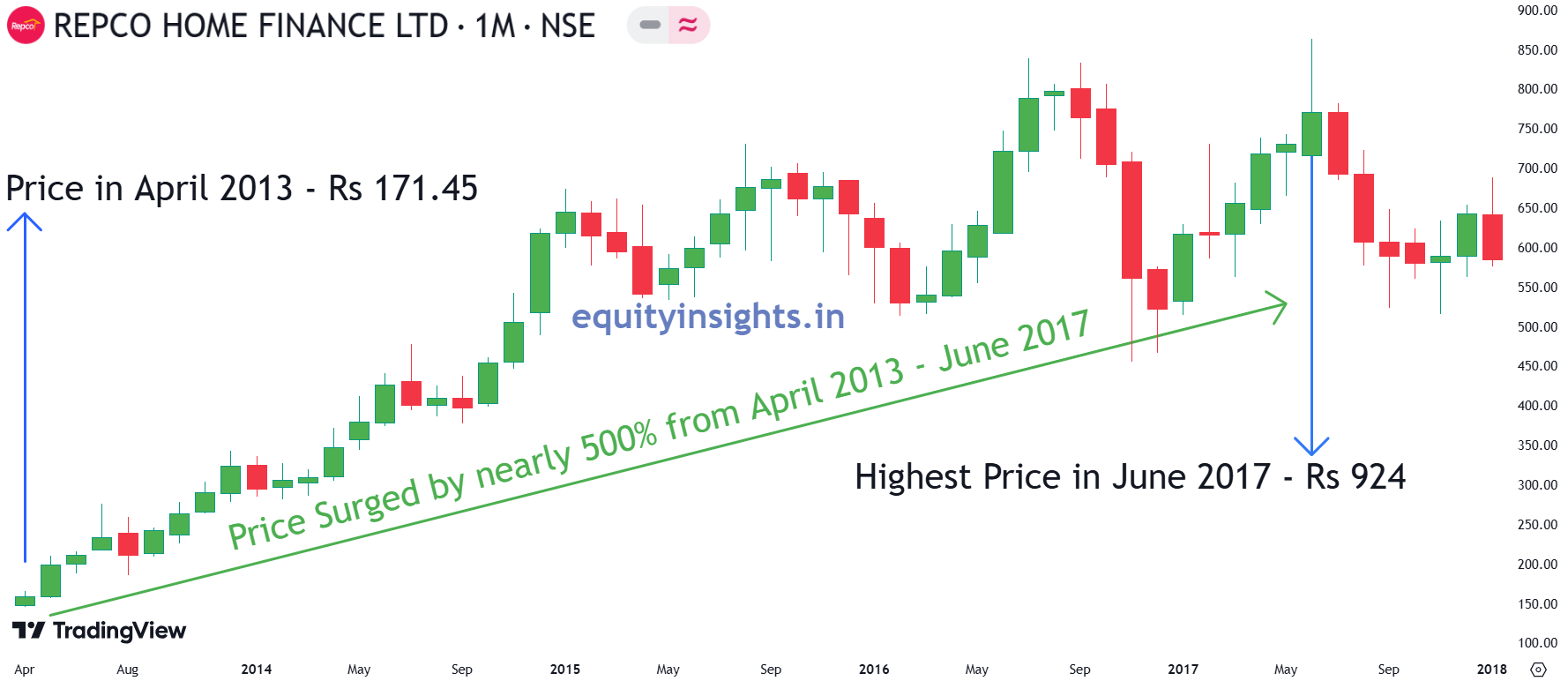

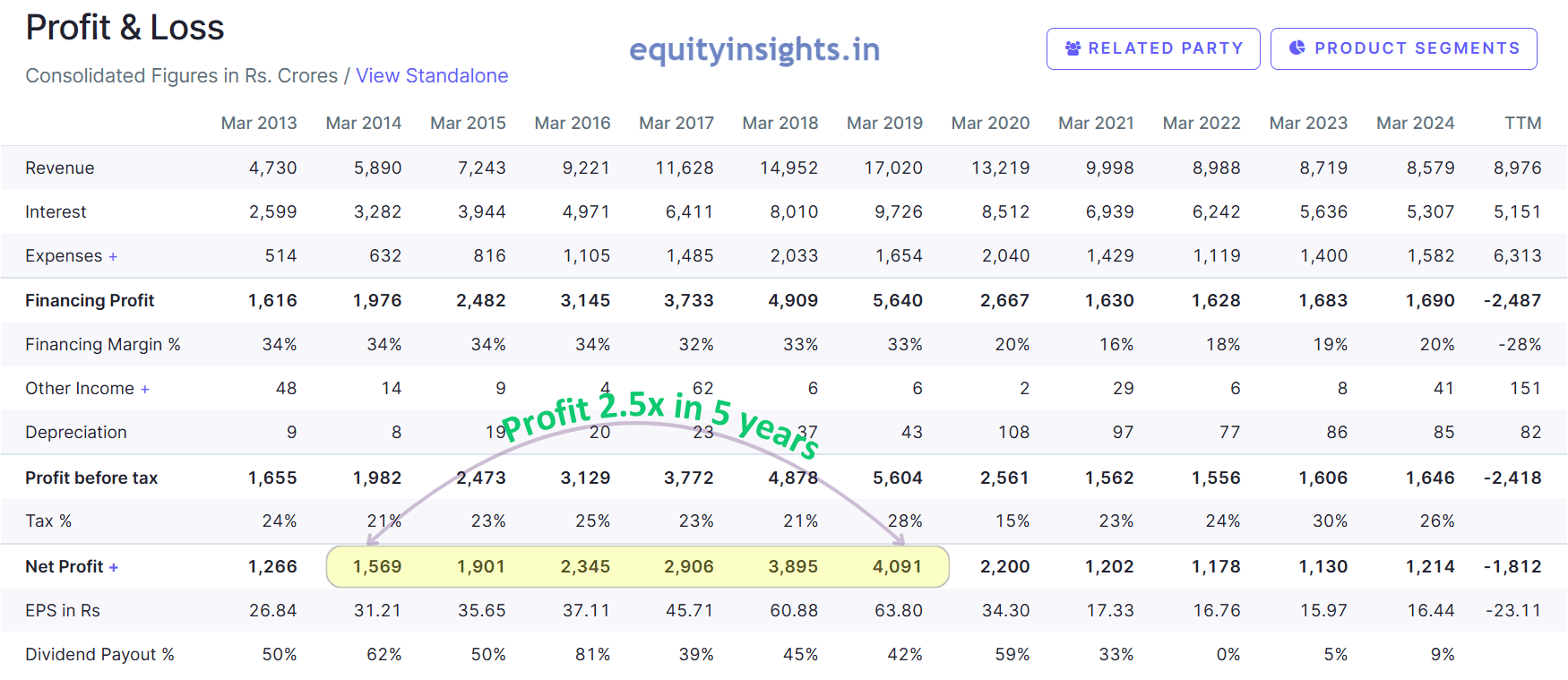

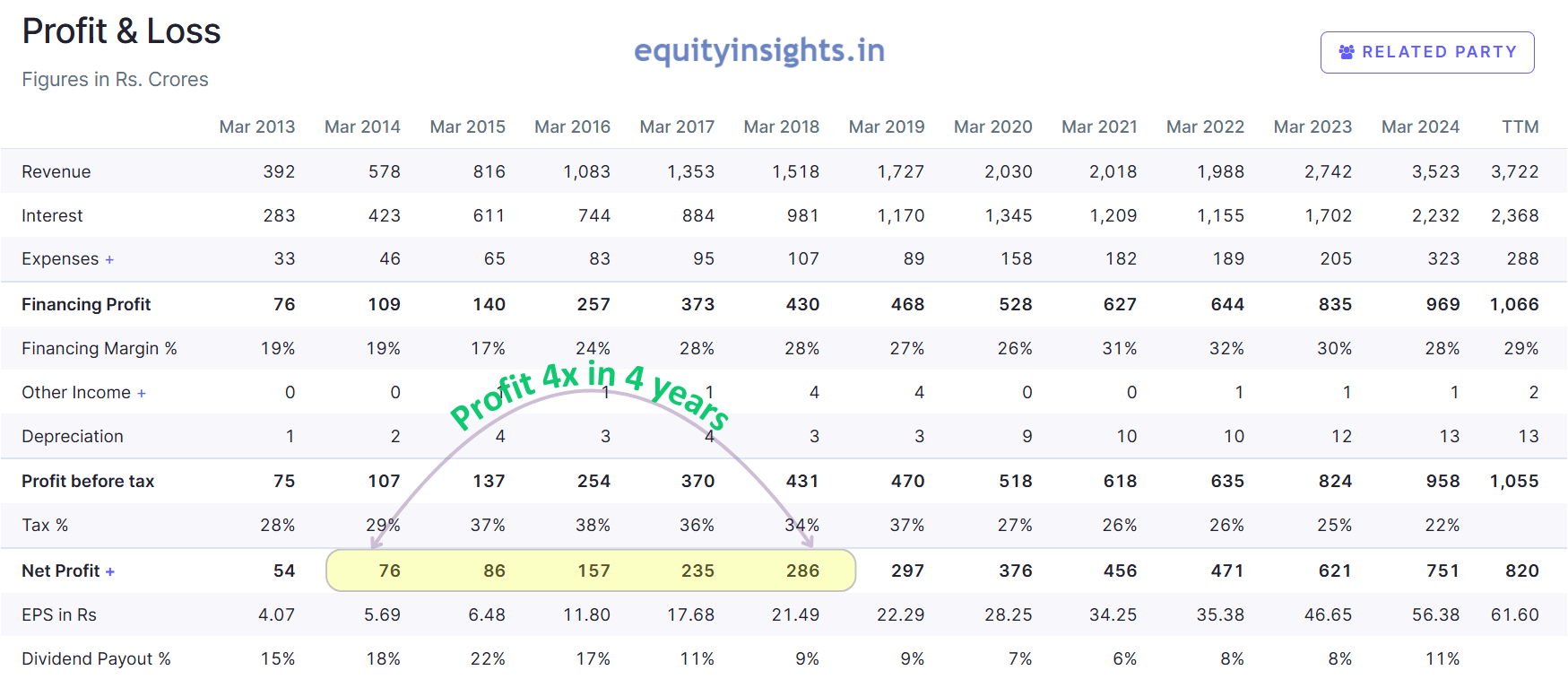

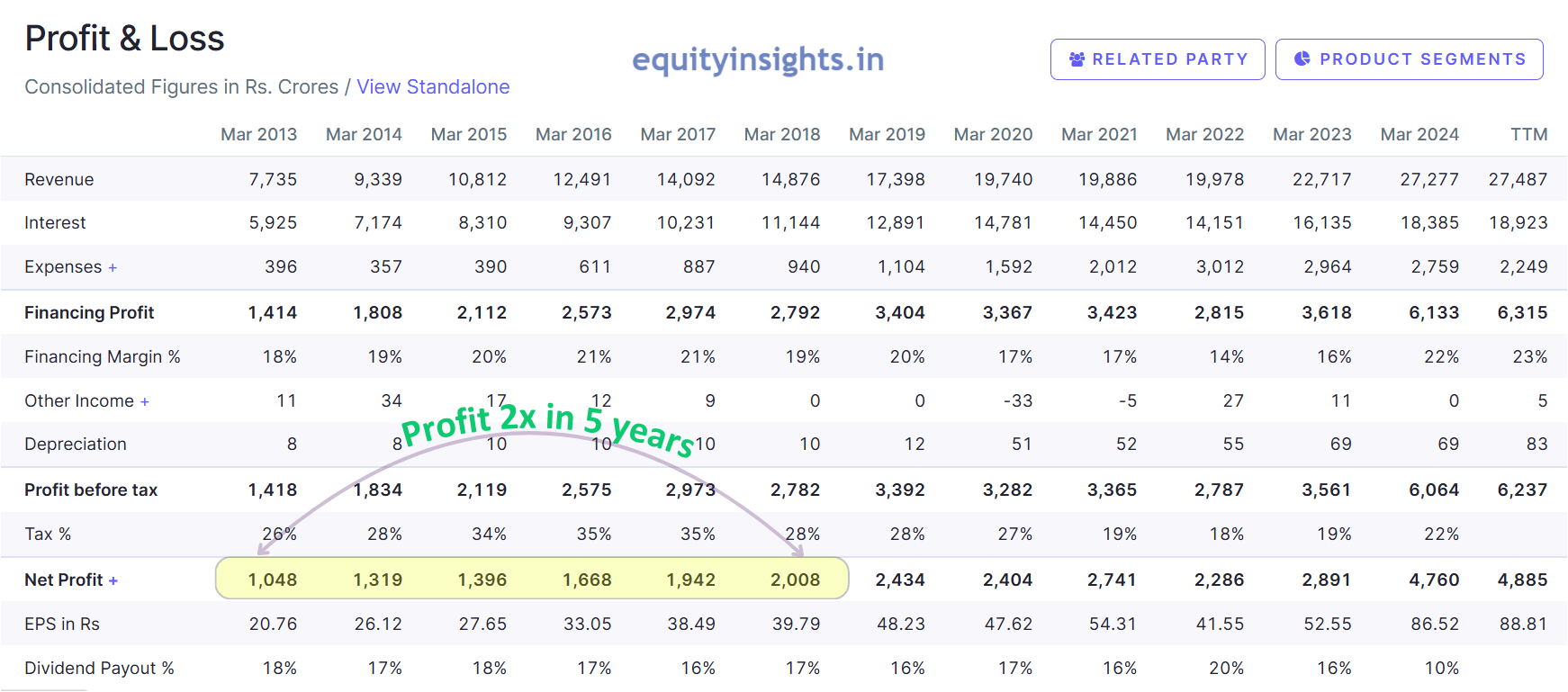

The growth of the real estate sector in 2014–15 led to the expansion of housing finance companies, leading to a surge in their stock prices over the next 3–4 years. Housing finance companies that benefitted the most from this were: Sammaan Capital Limited, earlier called Indiabulls Housing Finance Limited, Can Fin Homes Limited, LIC Housing Finance Limited and Repco Home Finance Limited. Let’s understand how this occurred.

In 2014-15, real estate prices began to drop, leading many to believe that housing finance companies would suffer or even collapse. But surprisingly, the opposite happened. Instead of being negatively affected, the business of housing finance companies tripled.

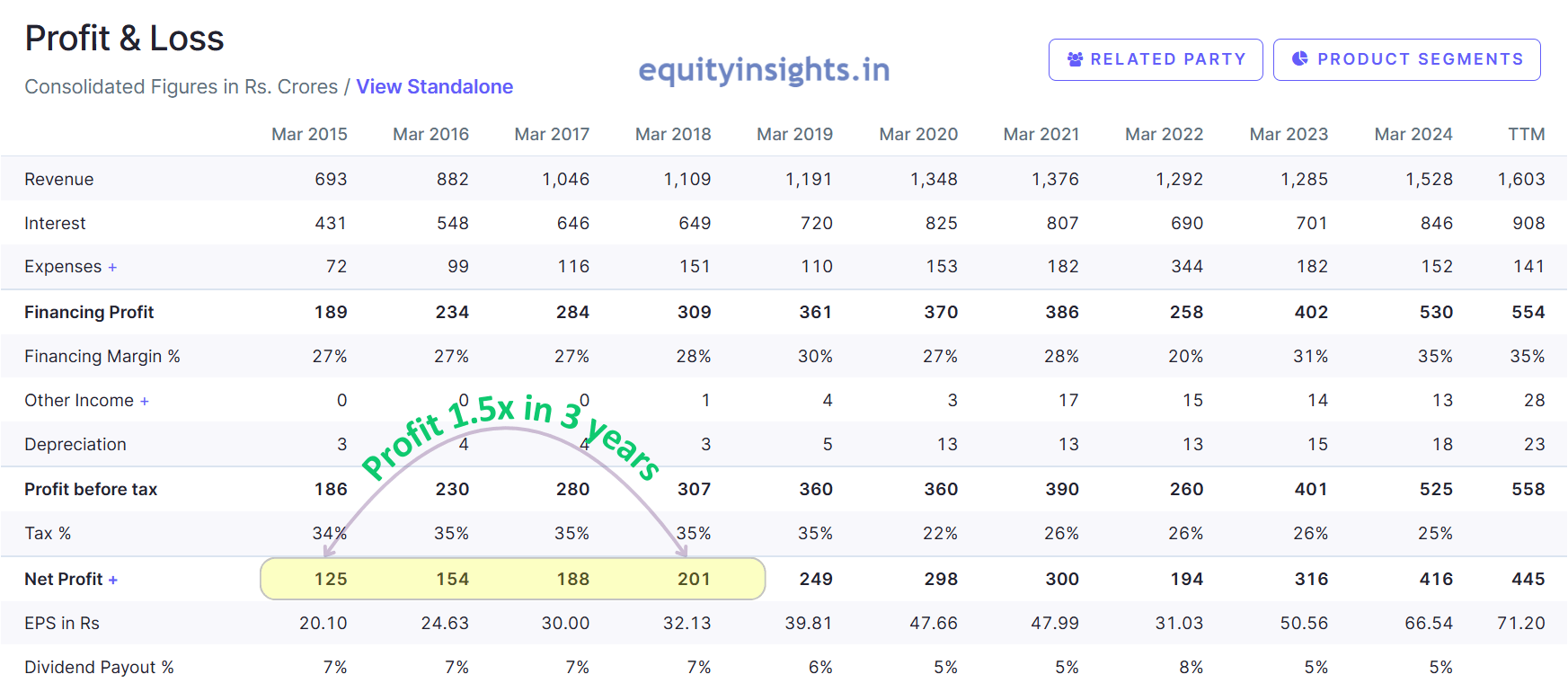

Look at the images of Profit and Loss statements of some of the housing finance companies:

The reason for this unexpected outcome lies in how people were purchasing properties at the time. Typically, when someone booked a property, they paid 10% upfront. After the booking, the allotment process would take place, during which the price of the property would usually rise. During this time, the buyer would pay an additional 10% so that a builder-buyer agreement would be made at the original lower price. Construction would then begin, and in the next 7-8 months, the property’s price would increase by another 10%.

Let’s break this down with an example. Suppose a property was worth ₹1 crore. The buyer would make an initial 10% payment or ₹10 lakhs. As the allotment of the property happened, the buyer would pay an additional ₹10 lakhs, locking in the original price of ₹1 crore in the builder-buyer agreement. While construction would continue, within 7-8 months the property value would appreciate by another 10% i.e. ₹10 lakhs. So, in total, the buyer had paid ₹20 lakhs so far (10 lakhs initially and another 10 lakhs later when the price of the property increased) and the property’s value increased by ₹20 lakhs.

Now, consider a buyer who wants to play it safe—someone who waits until all layout plans are approved and then wants to sign the builder-buyer agreement to purchase the property. This buyer has two options: they can either buy the property directly from the builder who is now selling it at the current market price of ₹1 crore 20 lakhs (after including the appreciation in the prices of the property), or they can buy it from someone who already made the initial payment and signed the agreement with the builder earlier (like the person who paid ₹20 lakhs in the example above).

The above person, having secured the property for ₹1 crore, would now look to sell this property at a profit to this buyer. Now, since the property’s market value has risen by ₹20 lakhs, the seller is likely to offer the property for ₹1 crore 14 lakhs, which is ₹6 lakhs less than the current builder price. In this scenario, the buyer benefits by paying less than the builder’s asking price, and the seller gains a profit of ₹14 lakhs from the appreciation.

So, this way the other person got the benefit of 70% within 7-8 months and this process was followed by these people involved in the buying and selling of real estate for years with limited funds of just ₹20 Lakhs however as the prices of real estate reduced so this dynamic worked in favor of housing finance companies, as more buyers were able to secure loans to purchase properties—even in a declining market. But the question is how? Let’s understand this with the same example.

So, as the person booked a property of ₹1 crore, they paid 10% upfront or ₹10 lakhs. After the booking, the allotment process takes place, during which the price of the property used to rise earlier but as the prices of the property collapsed so it resulted in the fall of prices by 10% i.e. 10 lakhs and since the person already paid 10% upfront, during allotment the buyer has to pay an additional 10% or 10 lakhs to sign a builder-buyer agreement at the original price otherwise his 10% upfront payment would be a loss.

After the allotment, construction would then begin, and in the next 7-8 months, the property’s price decreased by another 10% due to a collapse in real estate prices. Now, in total the person paid 20 lakhs and the price of the property decreased by 20%.

So, now the price of the property is 80 lakhs and if any safe buyer is planning to purchase it, he would get it at 80 lakhs from the builder as that is the current market value while the other person also has to offer the property on the same amount to sell it but no person would be willing to take the loss of that amount and since the funds are limited with that person (₹20 lakhs), so he can’t pay the full price. To come out of this situation, the only solution is to get it financed through home loan and this is where housing finance companies played a crucial role.

These examples help explain the trading economics behind market behavior. 90% of the time, trading economics works opposite in the stock market and the three examples above illustrate this perfectly. That wraps up this blog.

Before I sign off, I want to remind you again of something important: no day should go without chanting and meditation. You must take at least half an hour to chant and another half hour to meditate. These practices are not just for peace of mind—they’re key to helping you sustain and stay grounded in the market over the long term. They help you strengthen your subconscious mind, enabling you to analyze companies with clarity and precision. This approach can help you build both wealth and fortune. Happy Investing!

Disclaimer: We are not a SEBI-registered research analyst. This article is written solely for educational purposes and should not be interpreted as investment advice or recommendations. The stock market involves significant risks, so we encourage you to seek guidance from a financial advisor before making any investment decisions.