Trading requires good trading rules. In the previous blog, I shared the importance of building a strong mindset and creating a plan that includes risk and money management, specifically by setting fixed daily stop-losses. Now, this is in continuation of the same topic where we would be going a step ahead and looking at the top 10 trading rules, without which a trader can’t get success and the best example of this case is Jesse Livermore.

Jesse Livermore, often regarded as one of the greatest stock traders of all time, went bankrupt three times in his life. Yet, he managed to rebuild his fortune twice, with his peak wealth reaching around $100 million during the 1929 Great Depression—equivalent to roughly $1.5 billion today, adjusted for inflation. Tragically, he took his life after facing bankruptcy for the third time. Even though he had a very deep understanding of how to make money in the stock market, he never adhered to any consistent trading rules or discipline, which ultimately led to his downfall.

Whether you are a seasoned trader or just starting, having a set of trading rules is essential for maintaining consistency, managing risks, and improving your chances of success. So, let’s learn from the mistakes of experienced traders and build discipline by following the trading rules so that you can shape a good trading career for yourselves.

Table of Contents

Six Mistakes that Every One of Us Commits Initially

In the stock market, our psychology evolves with time as we begin to follow trading rules. To assist you on this journey, let’s look at six common mistakes that many traders, including myself in the early stages have made and how through trading rules you can avoid repeating these mistakes. I’m confident that you’ll find some of these resonate with your own experiences:

1. Money Management

Money management is a key parameter that most traders ignore specifically those who have just entered the market. New traders put all the money of the trading account in a single trade, with the hope of getting maximum profit out of it and without analyzing the risk and loss that they may incur if the trade goes against their expectations. Eventually, this approach backfires and leads to loss, after which not only does it lower the trader’s morale but also they get scared from taking the next trade because of fear of loss.

2. Recovery Mode

When money management is not followed, a significant loss can trigger novice traders to commit a series of mistakes. After a big loss from putting all the money in a single trade, a trader tends to enter into revenge mode where he decides to recover all the loss from the market from a single trade and this again results in a loss.

3. Going against the Trend

When a trader misses the opportunity, they often start reacting impulsively, such as considering a short position when the market is rising, or going long when the market is falling and this tendency to trade against the trend of the market again leads to a loss. Therefore, the key to improving such behavior is to focus on trading with the trend, rather than seeking revenge against the market as the market is supreme and no one can beat it anytime.

4. Convert Intraday Trade into Delivery to avoid Stop Loss

The biggest challenge with many of the new traders is the fear of hitting a stop-loss and to avoid this, they only prefer buying shares with the mindset that if the stock doesn’t give them an intraday profit, then they could take the delivery of those shares and hold onto it but this approach often leads to problems as they don’t follow the trading rules and this mindset traps them in a position longer than intended, transforming a quick trade into a long-term investment in a company—only until the stock eventually turns into profit.

Many traders experience a frustrating cycle where their trades frequently hit stop-losses during the initial time, which can be incredibly demotivating and to avoid this situation they decide to hold the losing intraday stocks rather than exiting and believing that it will spare them from further losses. However, this often results in much larger losses down the line.

After this, when they see a negative return on that stock, they get into the phase of fear where the anxiety of losing all their money is accompanied by growing frustration, and then even when the stock finally returns to its entry price, they exit with no gain and then that stock shoots up and creates a cycle of guilt and regret, as they grapple with missed opportunities, despite having held onto the stock for so long when it was in the red. It’s a tough emotional roller coaster that many traders experience on their journey.

5. Risk Management

A common scenario for many traders in stock market is that they are ready to take a big loss if a trade goes against their expectations, but when the trade moves in their favor, they hesitate to let the profit run. Instead, they close the position early for a small gain, driven by the fear that the profit will disappear. This fear factor comes into play because of the wrong position sizing (trading with excessive quantity without analyzing the risk).

6. Overtrading

There are two types of overtrading that traders go through:

- Overtrading in number of trades per day

- Overtrading in terms of position sizing (quantity)

Overtrading in Number of Trades per Day

New traders tend to make the mistake of overtrading and this is among the biggest mistakes that can haunt them for a long time. Even experienced traders often face this problem. The main reasons for overtrading can be understood through this example which is common to all of us:

You must have witnessed that when you start the day with a profit then you start trading recklessly out of excitement, neglecting proper analysis, which eventually leads to losses. As a result, even though you started your day with profit but ended it with loss. On the other hand, if you experience a loss right away, you impulsively try to recover that loss, which often results in overtrading and ultimately a much larger loss by the end of the day than what you should have got in your first trade.

Overtrading in terms of Position Sizing (Quantity)

The second form of overtrading is based on quantity and results in increasing position sizes after a loss. Let’s understand this with an example:

If you trade 100 shares and incur a loss, you might then trade 200 shares (with double the quantity of your previous one) in an attempt to quickly recover that loss with a very minimal movement in your favor. However, if the trade goes against you again, you might increase your position size even further—say, to 500 shares. This escalating approach of increasing the quantity on every loss at last erodes your whole capital.

Also Read: Investment : The Key to Secure Your Financial Future

Key Considerations to Follow

- Prepare the 90-day trading journal with everything written in it about the trade.

- Whatever trade you enter into, you must have a reason for entry and exit, following your trading rules.

- 6-8 months of practice is a must on all setups by following the trading rules that will be discussed in this article and you don’t have to run after profit initially by trading with huge amounts.

NOTE: If the market is continuously going up or down, creating new swing highs or lows every day respectively then we often see heightened buying interest or panic selling when these levels are broken and so in such situations, instead of taking small profits, we should aim to stay in the trade to capture larger gains.

Trading Rules

Next, let’s explore the 10 essential trading rules that every trader should follow to achieve a successful trading career:

1. Focus on Capital Preservation and Risk Management

One of the important trading rules that is directly responsible for the profitability of the trader is capital preservation and risk management. As per this rule, you have to allocate the capital to trade in the following way:

- In the case of stocks, we will divide our capital into 3 parts.

- In case of options, we will divide our capital in at least 5 parts.

For example – If your trading capital is Rs 10000 and you are trading in stocks then you will divide this Rs 10000 capital into 3 parts which comes to Rs 3333. Now, this is the amount that you will use on every trade.

Similarly in case of options, if you divide 10000 into 5 parts, it gets you Rs 2000 which is the amount you have to use for every trade in options (derivatives).

2. Limit Losses – Set a Stop Loss on Each Order

Having a stop-loss is one of the primary trading rules. It’s your responsibility to set a fixed stop-loss before entering any trade to protect your capital from significant damage. Now, as for determining how much loss you can tolerate each day, consider this: if you continuously make a loss for 20 days, then you should be able to trade on the 21st day with the same amount and quantities without any fear. This approach ensures you’re trading within your risk tolerance and can weather the ups and downs of the market.

One of the trading rules says that at maximum, you should have a risk of not more than 2% per trade that is, if you have Rs 10000 as your trading capital then your maximum loss per trade should be Rs 200. However, it depends on how much you are willing to risk daily. If Rs 200 is all you are eager to risk each day then only one trade can be taken a day and that makes your maximum loss of Rs 4000 in 20 days, if you make a loss every day in a single trade.

Since 2% is the maximum loss you are taking, you can decide the number of trades per day as per your risk management but the maximum should be 2% per trade only. Let’s understand how you can decide the number of trades to be taken every day with the daily risk example:

Suppose you are willing to risk Rs 400 per day on the trading capital of Rs 10000 (which is 4% of your trading capital), you need to decide how many trades you will take in a day. The maximum number of trades that you should take in a day must not be more than three if you want to get rid of overtrading.

Now, suppose you decide to take two trades every day, so following the above rule, your risk should not exceed in total of more than 2% in any trade. You can calculate the risk for each trade by dividing your total risk of Rs 400 by the number of trades which is two here and it gets you Rs 200 which is all you can risk per trade. This method substantiates the 2% rule and will keep you within your maximum risk limit.

So, by following this approach, you can plan the number of trades in a day based on your risk capacity with a maximum permissible risk limit of 2%.

3. Understand How to Use Margin Correctly

Overtrading and margin are the two biggest threats in the stock market which can only be overcome as we follow the trading rules. It has been found in the study that, just if we balance margin and overtrading, we could make our loss decrease by 60% if we follow risk management along with these two things then our chances to make a loss come down by 80%.

While margin has its advantages too, it can also be a threat during initial days. Hence, you must follow the below-mentioned points for margin:

- Don’t take margin till you learn completely.

- Once you become profitable then you may use margin. Take margin only when you become profitable for a continuous six months that is after you close each month in net-to-net profit.

- Ideal decision would be to avoid margin even if you are profitable but in case you want to take margin, use 1 to 2 times only after you close 6 months in net profit.

In essence, trade with the amount that you have and don’t take margin and leverage while you are learning (at least for 6 months) as using margin can give a dent in your whole capital.

However, once you start getting the desired results and you remain profitable for at least 6 months continuously after following the trading rules, then you can start taking a margin that is just 2 times your capital and not beyond that, although my opinion would still be to avoid this as if margin can make you rich, then it can also bankrupt you and we have to consider our risk side first.

4. Avoid Overtrading

Overtrading can be avoided by following strict trading rules on trade frequency. Already shed light on overtrading, that you need to conduct your analysis before you enter the trade, and if that trade gives you a profit, then you need to avoid dwelling on the market after the exit, even if the price rises beyond your exit price as overthinking lead to feelings of guilt for missing out on further gains, which may prompt you to make poor decisions and overtrade as a result.

How to Stop Overtrading?

To get rid of overtrading, you will only be taking a maximum of 3 trades/day and that has to be based on your risk-taking capacity. You can calculate your risk per trade for 3 trades/day through the similar method that has been mentioned above by deciding your maximum loss per day as per your risk appetite.

To control overtrading, there are a few conditions that you can follow if you are thinking of trading more than once a day:

- If you make a loss in the first two trades then you must not trade for the third time.

- If the first trade remains profitable and the second trade ends with a loss then you can take the third trade.

- If the first two trades remain profitable, then you should keep 80% profit aside and use 20% for your risk in the third trade.

Also, to control overtrading on quantity, one must focus on taking trade the same way as the three rules have been mentioned above and you have to trade every time with the same amount and risk so that your quantity doesn’t differ in any trade.

By setting these orders in advance, you remove emotion from the decision-making process, helping you stick to your trading rules.

Also Read: Stock Analysis: Things to Follow & Avoid in the Stock Market

5. Lock In your Profits

The common scenario in the market which happens with almost all traders and may resonate with your own experiences is that after you take a trade, it may show you a profit but waiting for the target vanishes that profit. Therefore, one of the crucial trading rules says to lock in your profits. When we talk about the target that you should aim for in each trade, then you must focus on the rule mentioned above to clutter through your losses and chase the momentum when the condition is in favor, to fetch the highest profit.

However, chasing the momentum doesn’t mean that if the market is giving a profit good enough, then you leave it and rather take the stop loss if the market reverses. To avoid this situation, you need to ensure that after you have entered the trade and if that trade shows a gain of at least 0.7% and 7% in stocks and options respectively, then you won’t have to let that convert into a loss. Instead, you can adjust your stop loss just above your entry price (which was below your entry price earlier). For short positions, you can move your stop loss slightly below your entry level.

This strategy allows you to exit without profit or loss if the trade reverses while if the trade moves in your favor then you can continue to chase the price for a larger target.

6. Always Trade within your Trading Style and Strategy

One of the essential trading rules is to be selective with the trades you take, which requires following trading rules based on your trading style. The trader can be of any type as mentioned below:

- Either an individual is a buyer or seller. So, you will have to check what suits you more. Initially, you can trade both for about 6 months and then analyze what better works for you, whether it is buying or short selling after looking at your successful trades and profit earned. Once done, you should focus on that micro part that is either selling or buying and if both strategies work for you, then consider trading both.

- The second point is that trading isn’t limited to intraday or derivative instruments like futures and options; positional and swing trading are also integral forms of trading. The only thing that differs here is the time frame. So, after analyzing the trades for 6 months, if the intraday trading is not working for you, then better switch to positional or swing trading to check if that is suitable. You can practice this along with intraday trading by allocating a separate capital for the positional and swing trade, and then take the trade as per this for the next 6 months in a separate account so that both accounts remain separate in terms of records and you can analyze it better after 6 months.

- The next type of trader is a breakout trader and support/resistance trader. The breakout trader is the one who takes position in swing and intraday once the stock crosses its major resistance (a level that has prevented the stock from going up or down at least 3-4 times) while support/resistance trading involves entry in the stock, once the stock comes to a level from where it has been going up (due to support) or coming down (due to resistance) repeatedly. So, one would use that support level to buy the stock or the resistance level to sell the stock. In essence, a support/resistance trader is the opposite of a breakout trader.

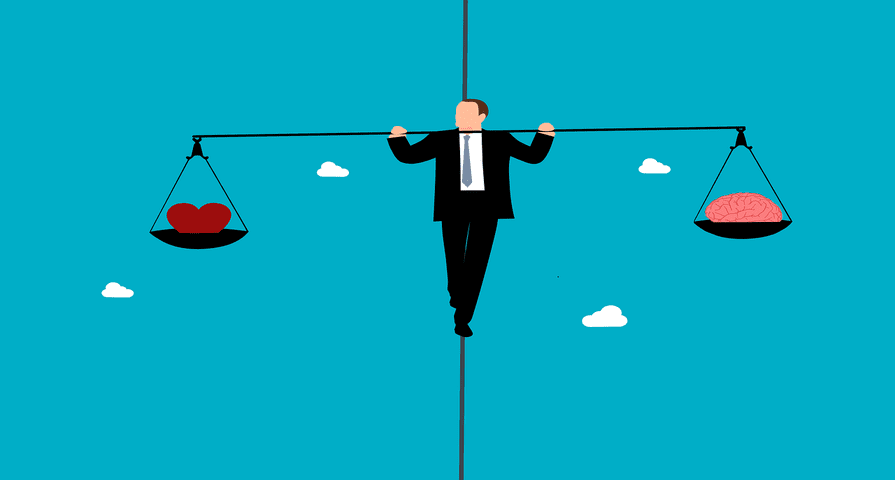

7. Don’t be Emotional

One of the fundamental trading rules is to not let emotions drive your decisions and it is among the toughest trading rules to follow. Don’t take a trade because you feel like it will give you a profit. Let the patterns get formed in the chart and wait for the setup to enter into a trade.

8. Plan your Trade and Trade your Plan

One of the crucial trading rules is called conditional trading. In other words, you can say it as plan your trade and trade your plan, which means you have to plan the trade as per your set up and conditions so that you trade in stocks that you have studied.

Example – Suppose the market closed today at 44514 and if you have made some conditions for tomorrow like:

- If the next day, the market opens between 44400-44500, and if after opening it consolidates for some time in the same zone and then crosses 44555, you will take a buy-side trade at 44555 with a minimum target of 44666 and 44777.

- If the next day, the market opens between 44300-44400 and reaches your level slowly and steadily that is 44555 level, so since here the market reached your entry-level after moving about 250 points hence you will not take trade in this case.

Now, you have made two conditions, one telling when to trade and the other telling when not to trade, so the next day you will have to execute your trade on this same plan. If the market doesn’t follow your rules then you must not take trade since it did not meet your conditions and rather you should wait for the next opportunity.

In essence, decide entry and loss per trade along with the target before you enter the trade. You must have an entry price so that you enter only when your price comes and not at any random level, and along with entry, your loss should also be pre-planned with maximum loss fixed for a trade and day both.

It is important to note that the target should be determined by market conditions after you enter a trade. If the trade goes against your direction, take the stop loss. Conversely, if the trade goes in your favor and reaches your target but the stock remains in momentum, you can adjust your strategy to maximize profits by trailing your stop loss.

NOTE: If the market has given a huge movement like more than 800 points in Nifty Bank, 300 points in Nifty 50, Nifty Financial, and more than 5% in stocks then you must follow the trading rules and trade with a small quantity the next day if you are taking the buy side trade.

9. Adapt to Changing Market Conditions

The market is dynamic and constantly evolving, and in this case, one of the best trading rules is to remain flexible and adapt to changing conditions. What works in one market environment (such as a trending market) may not work in another (such as a range-bound or choppy market).

- Know when to shift your strategy: If your current strategy is not yielding the desired results due to market conditions being changed, be ready to shift your strategy as discussed above in the section on Always trade within your trading style and strategy. For instance, if you are a trend trader but the market is ranging then you should think about changing your approach or rather take a step back from the market until the time market works as per your conditions.

- Stay updated: Keep an eye on economic news, corporate earnings, and other factors that can influence the markets. Being aware of major events can help you adjust your strategy in advance.

Having the capacity to adapt to situations is one of the most important trading rules to stay profitable in long-run dynamic markets.

10. Keep Records of Trading Results

Last but not the least. As previously mentioned, it’s essential to maintain a trading journal. This journal will help you review your trades on a monthly basis and conduct a more in-depth analysis every six months. Maintaining your trading journal is very important if you want to become a successful trader as analyzing these records regularly will allow you to refine your strategy and further strengthen your adherence to trading rules.

Success in trading is not about predicting the market with 100% accuracy; it’s about applying trading rules consistently, managing risks, and controlling emotions. By following these essential trading rules, you can increase your chances of success, avoid major pitfalls, and build a profitable trading career over time.

All things considered, I have been able to outline some key trading rules to help you strengthen your trading psychology and consequently make better decisions and good thing is that these intraday trading rules can also be used as swing or delivery trading rules. More so, by keeping to these trading rules, you will remain disciplined, avoid emotional mistakes, and be in a position to develop a healthier trading psychology that will contribute to long-term success.

Remember, trading is a journey, and developing the right mindset in the process is just as important as getting technical skills mastered. So, follow trading rules and enjoy this journey. Happy trading!

Disclaimer: The information provided in this article is intended solely for educational, illustrative and awareness purposes. Nothing contained herein should be construed as a recommendation. Users are encouraged to seek professional financial advice before making any decisions based on the content provided.