The stock market is not just about studying the stock’s financials, charts, candlestick patterns, or drawing lines on the chart to identify support and resistance levels; rather, it is much more related to the psychology of money. Morgan Housel, in his book “The Psychology of Money,” described how human psychology plays a vital role in emphasizing personal finance more than technical knowledge or economic principles.

The psychology of money, or more broadly, human psychology, plays a crucial role in trading and investing, as emotions such as fear and greed can significantly impact decision-making. Market volatility is usually full of tension for most traders, and this sense of tension leads to impulsive or hesitant steps by a trader that undermine the overall strategy. In addition, overconfidence and fear of loss are a few of the cognitive biases that affect individuals while trading. Therefore, understanding the psychology of money is crucial for everyone engaged in trading or investing, as it provides insights into why people make certain decisions under various market conditions.

This article examines the psychology of money in detail, examining its impact on market strategies, emotional responses, and social influences within the stock market.

Table of Contents

Principles of Trading

Trading and investing in the stock market are all about psychology, risk management, and money management. Adhering to these three principles is the only way to become a profitable trader. By creating emotional awareness and developing a strong mind, a trader can enhance his performance and navigate the complexities of the market with more confidence.

We all know that any setup or strategy works only 60–70% of the time. Therefore, anything that could make us profitable traders or investors is our mindset, risk management, and money management. So, this article is all about how you should follow risk management to have a calm mindset and have a good trading career.

For that reason, it is important that we plan the trade and then trade the plan on D-day, for which we must adhere to the three principles mentioned above. Right risk management and money management, empower us to stay in a trade to capture the big movement in the market while also helping us feel more confident about hitting our stop-loss levels. By understanding our risk parameters before entering a trade—such as how much we’re willing to risk per trade or day—we can approach trading with a clear strategy and less fear.

Before we go into the risk management part, let’s understand how the psychology of money and more broadly human psychology impacts the decisions of individuals in the market for traders and investors.

Understanding the Psychology of Money

Morgan Housel in his book “The Psychology of Money” described the term “psychology of money” as complex relationship people have with their money and how it affects their financial decisions or trading decisions. This relationship is influenced by various factors like emotions, personal experiences from the market, etc. Therefore, understanding these psychological factors can help us maintain discipline, stick to a trading plan, and manage risk effectively.

Also Read: Investment: The Key to Secure Your Financial Future

Emotions in the Stock Market

Be fearful when others are greedy, and be greedy when others are fearful.

~Warren Buffett

Did you ever see the game of Tug of War? Well, I am sure, many of you must have seen this game which is often referred to as the game of strength, where two teams stand against each other and pull on opposite ends of a rope to pull the majority of it over their side of the center line or marker. The reason to remind you of this game is that the stock market is similar to this tug-of-war game where buyers and sellers fight against each other and those who appear in larger volume drive the market in their direction, but what influences these market participants to be either buyers or sellers?

Well, it is emotions that play a vital role in the psychology of money and in driving the market. Fear and greed are the two primary emotions that drive investor behavior. Understanding how these emotions operate within the framework of the psychology of money is essential for a successful investing and trading career.

1. Fear

We do hear about news like “2 lakh crores wiped out in a single day due to the blood bath in the market“. Well, this all happens because of the fear factor in the market, which is responsible for panic selling during market downturns. This reaction is a clear example of how the psychology of money can manifest in detrimental ways. The fear of losing money is what prompts panic selling from the market participants, and they start selling their shares often at a loss.

One of the best examples of fear driving the market is the market crash during COVID-19, where fear drove investors and traders to sell their stocks at unprecedented rates, due to which the market declined rapidly. There was nothing wrong with the fundamentals of most of the companies but still the market crashed because of fear, and those who succumbed to fear often missed out on the subsequent recovery.

2. Greed

Another emotion that drives the market is greed. However, unlike fear, it comes into play during the bull market. The psychology of money suggests that as prices rise, traders and investors become overconfident, believing that the upward trend will continue indefinitely and this often results in overvalued stocks and bubbles in the market.

The dot-com bubble of the late 1990s which peaked on Friday, March 10, 2000, serves as a historical example, where greed led many to invest heavily in overvalued technology stocks without considering their financials.

Greed can also cloud judgment, where traders and investors in the rush to earn quick money, fail to conduct proper market analysis.

Cognitive Biases

Another critical aspect of the psychology of money is Cognitive biases which can lead to wrong decisions in the stock market. Three main types of biases are:

1. Confirmation Bias

Confirmation bias occurs when people seek information that supports their existing beliefs regarding the market while disregarding what’s going on in their front and because of this it can lead to poor decision-making. For example, an investor who believes in the long-term potential of a particular stock may only focus on positive news or trends while ignoring negative reports. This way, it may result in an investor holding onto a poorly performing stock.

2. Overconfidence Bias

Whether it is a novice trader or an experienced one, five to six good bets land them into the situation of overconfidence where they start believing that they can predict the market every time which results in a lack of diversification in case of the investor while excessive risk-taking by the traders. In the context of the psychology of money, overconfidence leads to irrational decisions and heavy losses in the stock market.

3. Loss Aversion

One key concept in the psychology of money is loss aversion, which says that the emotional pain of losing money is more intense than the pleasure of gaining money. As a result, traders may hold onto losing stocks too long, hoping for a recovery in the stock but selling the best-performing stocks too early to lock in small profits.

Also Read: Stock Analysis: Things to Follow & Avoid in the Stock Market

Social Influences

The stock market is not only driven by individual emotions and biases but also by social influences. The behavior of peers and news sources along with social media can significantly impact investment decisions.

1. Herd Behavior

Herd behavior is a phenomenon where individuals try to copy the actions of the larger group ignoring their analysis and believing that the majority wins every time. This tendency leads to both bubbles in the market and market crashes as an enormous number of traders and investors enter the market at a one-time to copy the larger group disregarding the financials and when this bubble bursts, it results in panic selling and eventually a blood bath in the market.

In the context of the psychology of money, herd behavior often drives stock prices away from their intrinsic values. Once again, the perfect historical examples of herd behavior could be the market volatility created during the COVID-19 pandemic and the dot-com bubble where many investors followed the herd, and at last, the bubble burst out.

2. Impact of Social Media

In today’s world, social media has become a powerful force in shaping behavior of the people where people are getting information real quickly from platforms like Google, Twitter, and Meta which can rapidly spread information and opinions, influencing investor’s sentiment. One of the examples of the impact, social media can bring on human psychology, prompting the buying and selling of shares based on opinions rather than the fundamentals of the share, is the rise of meme cryptocurrency like Doge Coin.

Even though social media provide valuable insights, market participants must conduct their research rather before taking a trade or making any investment decision than just relying solely on trending topics or popular opinions.

Now, as we talked about all the factors affecting the decisions of the people in the stock market, it is necessary to know how to mitigate the above factors so that it can help us make better and more informed decisions in the stock market. So, let’s explore the solutions.

Important Guidelines for your Journey

1. Set Clear Financial Goals

Entering a war zone without a plan is extremely risky, and it goes the same with the stock market, where it’s impossible to build wealth without a plan. Therefore, the first step to preparing a strategy in the market must be to set clear financial goals and how you want to proceed, that is with trading or investing. In other words, which suits you better? Once you decide, make a goal as per your trading style or comfort as goals can help both investors and traders to remain focused during turbulent market periods, reducing the emotional swings.

2. Diversification and Risk Management

Whether you are an investor or trader, diversification is one of the important principles that can mitigate your risk during market volatility. In the world of the psychology of money, diversification, and risk management mitigate the emotional impact of significant losses. If you believe in investing then investments across various asset classes and sectors can protect your capital from significant losses. A diversified portfolio is less susceptible to market volatility while if you are a trader then diversification should be in the segment you are trading like 70% of the capital must be allocated for equity trading, 10% for derivatives trading, and similarly, rest can be allocated for commodities, currencies, etc. as per your comfort and risk management.

3. Regular Review and Re-balancing

While for an investor, the regular review of the portfolio is necessary to assess the performance of the stocks, the trader must also review his trading journal to analyze the past trades’ performance and then accordingly change the plan, should there be a need for the same.

4. Importance of Meditation and Emotional Regulation

A key takeaway from the psychology of money is the need to improve your mindset which can be easily achieved through meditation. Sitting in front of the screen the whole day to capture the trade at the right moment may result in several health issues that are not just limited to physical issues but also mental problems, so here meditation plays an important role in calming our mind and building patience.

You need to ensure that you do meditation for at least 15-20 minutes every morning before the market opens and make it your daily activity.

Along with meditation, you can practice other techniques like journaling or taking breaks from trading to manage your emotions and develop a more balanced perspective.

5. Learn from the Mistakes

I am not afraid of making mistakes. But my mistakes were those that I could afford. That’s very important: mistakes will happen but you must ensure that you keep them within limits you can afford.

~Rakesh Jhunjhunwala

It’s good to make mistakes as it helps us learn from them and strive for perfection. However, when it comes to the stock market, it is often seen that people get stuck in the cycle of repeating the same mistakes. Instead of learning from them, they get stuck in the loop of failures and eventually give up on trading, abusing that no one can earn from it.

Therefore, you must focus on learning, not just from your own mistakes but also from the mistakes and experiences of the traders who achieved great heights of success, overcoming their failures as doing this will eventually shorten your journey of becoming a successful trader.

So, for this, you will need to do two things:

(i) Firstly, you will enter the stock market with a fixed amount of loss every day, so that it gets into your mind that you need to have limited losses every day. However, since we are all humans, there may come some days when you forget your risk management principle and make a loss of more than what you had decided for a day.

In that case, you should look at your average daily profit from trading. Then, take the amount of your significant loss and divide it by this average daily profit. After completing this, the result that you get is the number of days you will take to recover that big loss.

The logic for this strategy is that if we make a big loss in the stock market, we decide to cover that in a single day and eventually erode our whole capital, as this recovery theory at one go never works in the market. So, in case of a big loss, we never have to work on this mindset to recover the loss in a single day. Rather we will recover that big loss as per the above mentioned rule.

Let me share it with one of the examples for a better understanding:

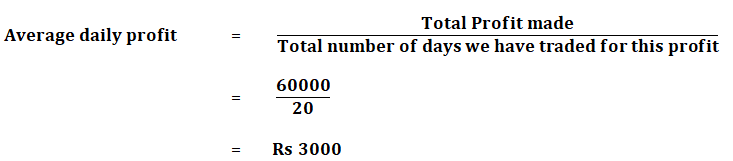

Suppose we enter into the market with a fixed loss of Rs 2000 every day, that means we won’t be making a loss greater than this per day. However, after taking this much risk, if we are making a profit of Rs 4000 per day and suppose in 20 days we make a profit of approximately Rs 60000 (including both losses and profits made on some days).

That makes our average daily profit of:

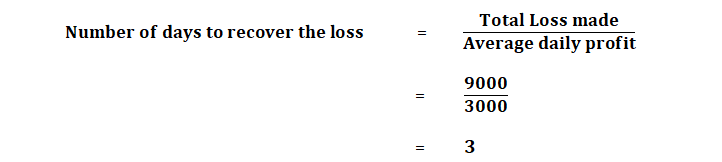

So, here our daily average profit is Rs 3000. Now, suppose even after following the risk management principle, someday we make a mistake which is very common in markets, and make a big loss that is of Rs 9000 against our fixed expected loss of Rs 2000.

By using this method, you’ll find that it will take you three days to recover from the loss, rather than trying to make it up in just one day and below is the calculation for that:

The above-mentioned method should be practiced daily for 30 days so that this inculcates the habit of fixed loss in your mind.

(ii) The second thing is that you have to analyze your trades every day and every month, which can only be done when you make a trading journal that shows each trade like stock name, what made you enter into that trade, entry price, exit price, which strategy was used on the trade and profit or loss in amount.

This way it will give you a clear picture of how your trades are going, which strategy works for you, how many times you enter into the trade without any planning or strategy etc., and this way you can learn from your mistakes to not commit it again.

NOTE: Take the risk of only that amount which you can afford to lose and as per your risk management as this is just being done for practice, without any strategy.

Understanding the psychology of money in the stock market is important to handle the market sentiments. By recognizing the emotional and cognitive factors that have a major impact on your decisions, you can develop strategies to mitigate their impact. Having discipline and curiosity for continuous learning are key drivers to enhance your investing and trading career. Ultimately, a strong grasp of the psychological aspects of trading can lead to more informed decisions and greater profitability.

Trading and investing is as much about mastering your mindset as it is about learning the market. So, as you enter into the world of stocks, keep the psychology of money in mind, and let it guide your journey toward financial success.

Disclaimer: The information provided in this article is intended solely for educational, illustrative and awareness purposes. Nothing contained herein should be construed as a recommendation. Users are encouraged to seek professional financial advice before making any decisions based on the content provided.