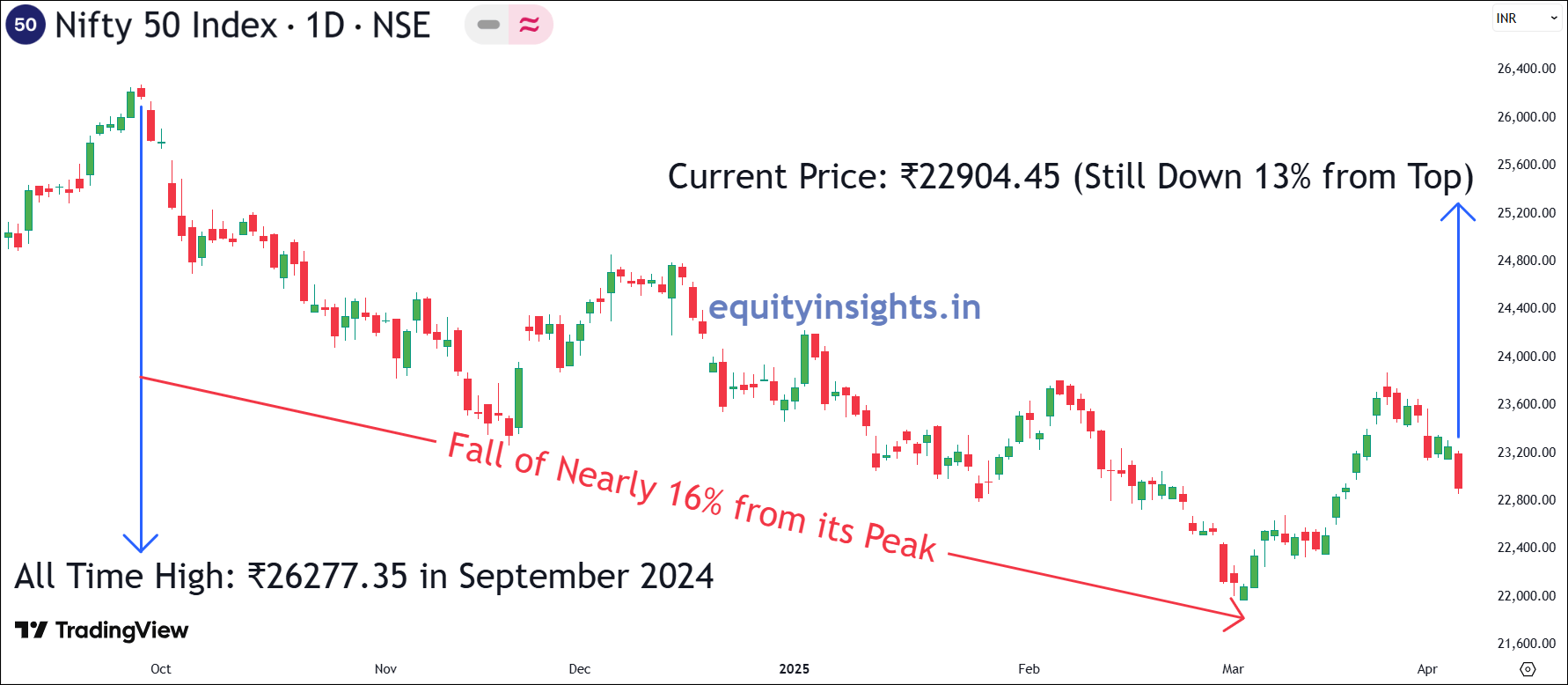

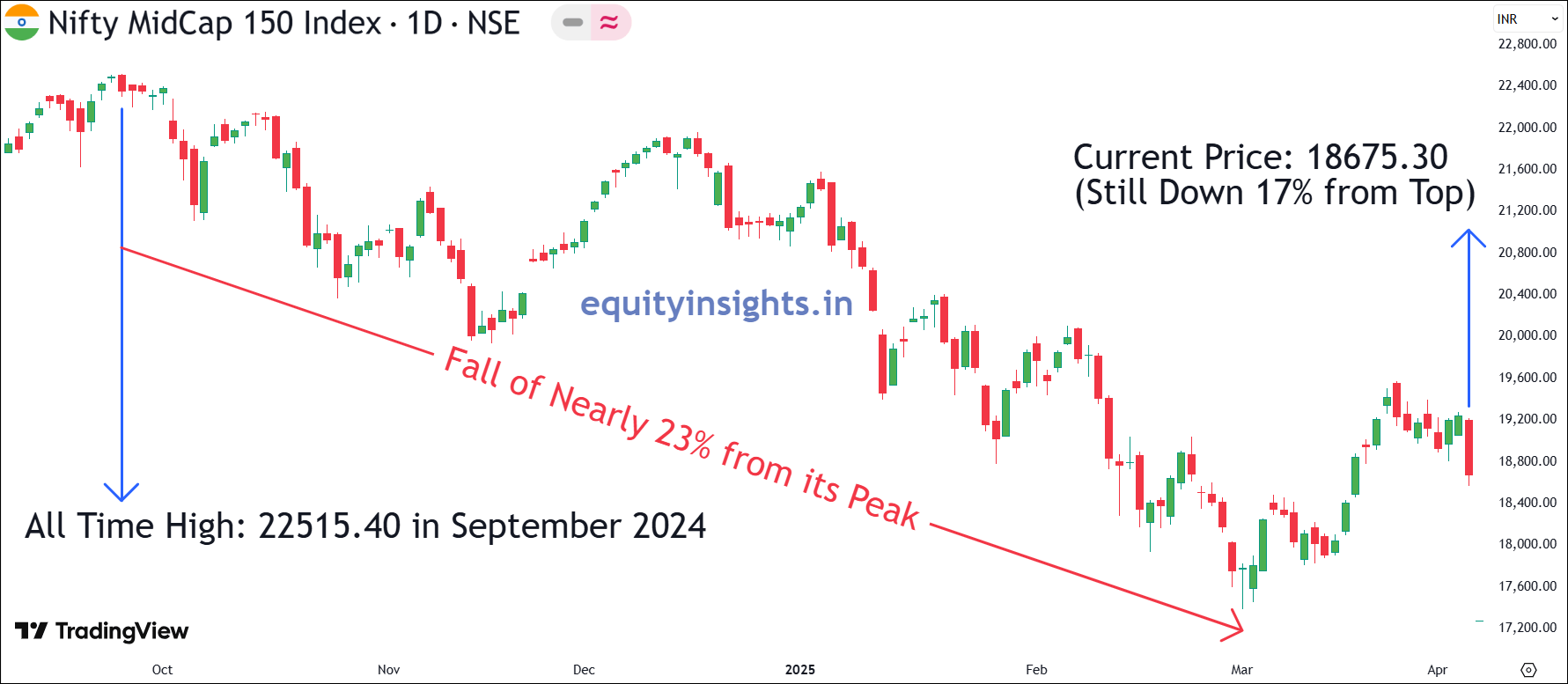

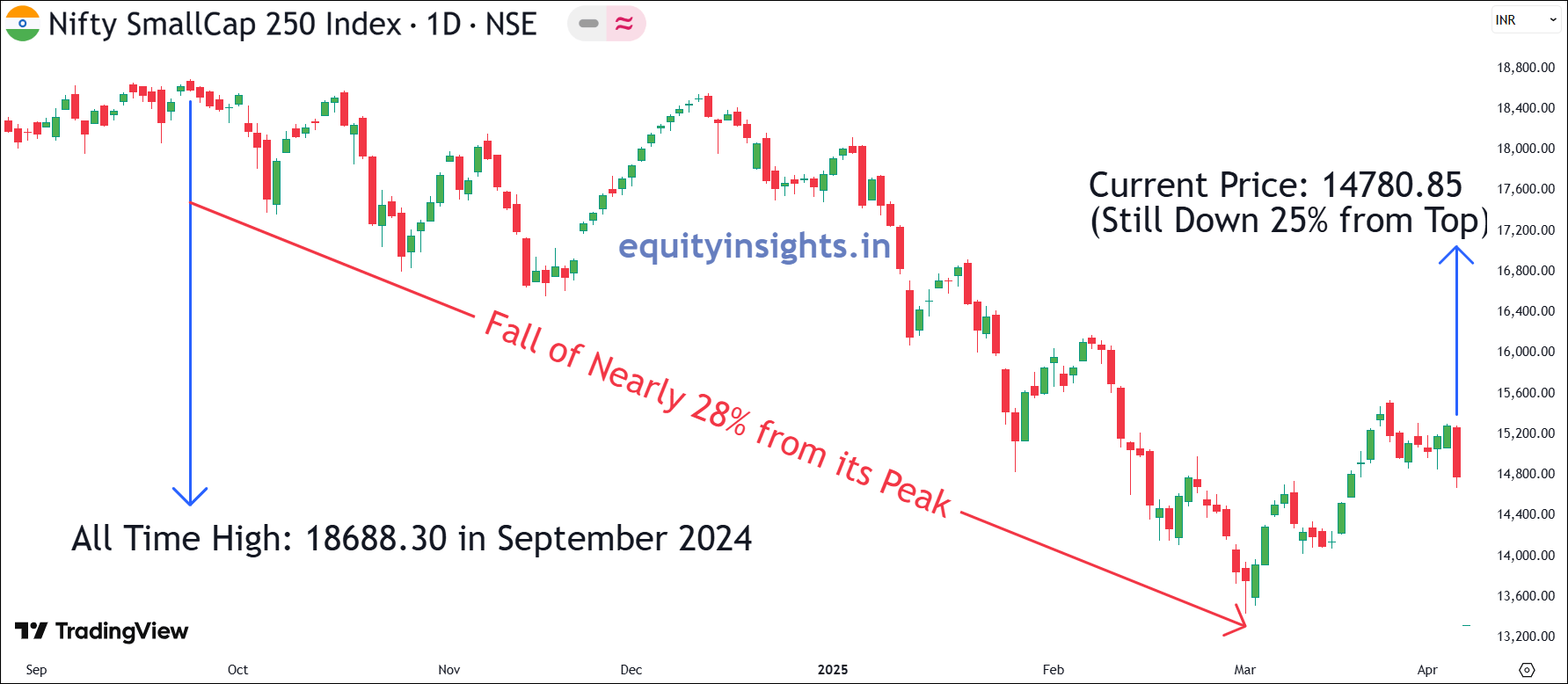

There has been a sharp correction in the Indian stock market, with the Nifty 50 slipping around 16% from its peak. Meanwhile, the mid-cap and small-cap indices have taken an even bigger hit, tumbling nearly 23% and 28%, respectively, from their all-time highs. While there has been a recovery at the index level, they still remain a long way from reclaiming their peak.

I was looking at the total number of Demat accounts in India, which zoomed from 4 crore in March 2020 to nearly 18 crore today. This means 3 out of every 4 people have started their stock market journey post-COVID. So, technically, for many new investors, this is their first real stock market correction. With the majority focused on high-growth small-cap mutual funds, the sharp 28% drop has left them confused about what to do next.

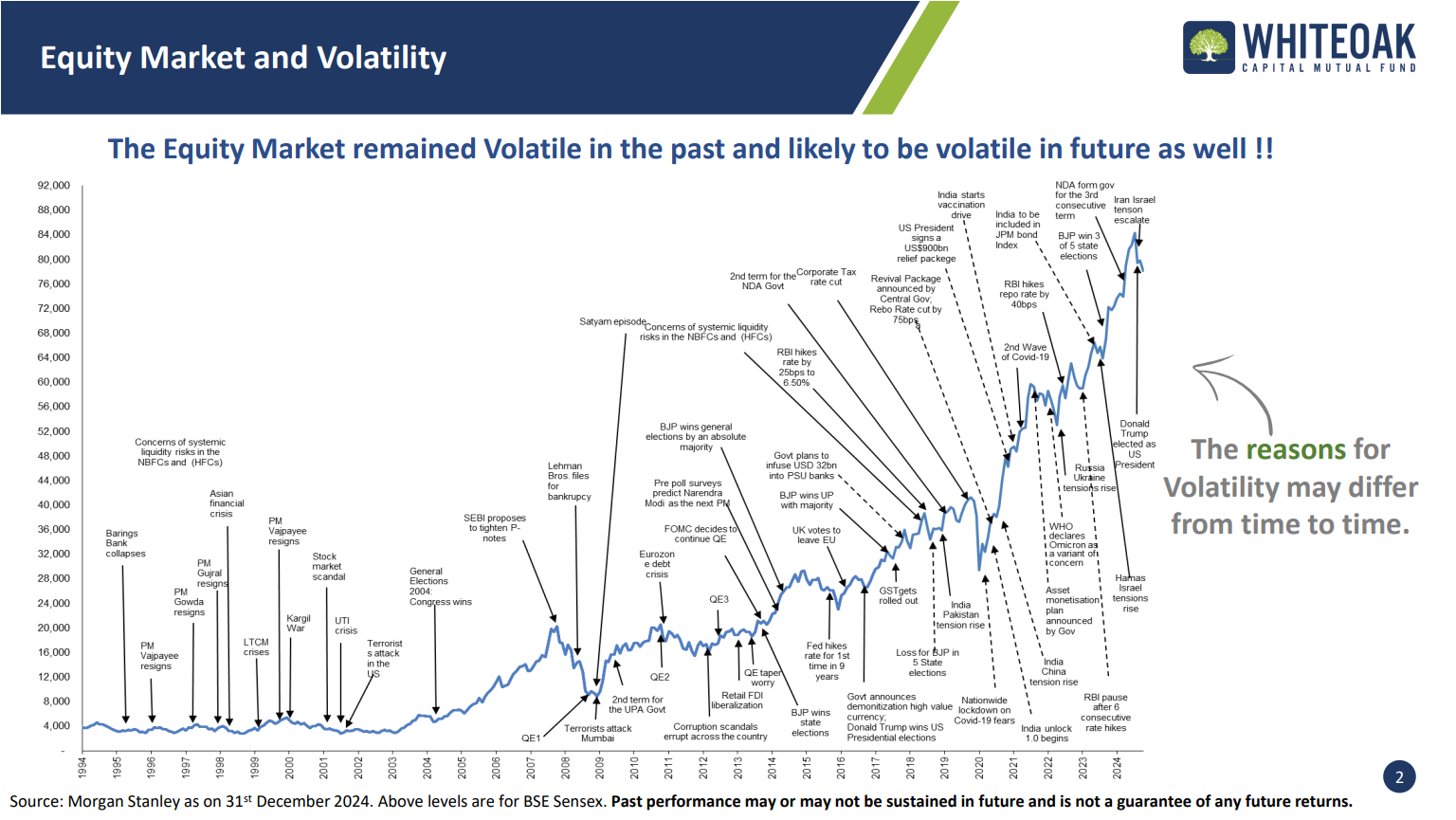

So, here I want to tell you that this is not the first time we have seen a correction in the market. This correction is part of our investment journey. Equity markets have been volatile in the past and will remain volatile in the future as well, but in spite of all the corrections, if you look at the long-term trajectory, it’s always upward. So, there’s no need to panic.

Another point is, there are a lot of discussions around closing the SIP (Systematic Investment Plan) but in my opinion, SIP is the best tool to invest in the equity market because nobody can time the market. During the pandemic when the market tanked sharply, a lot of people stopped their SIPs and some even withdrew their money but after that the market staged a massive rally and they missed one of the biggest opportunities of a lifetime. Today, some of you might be thinking the same—pausing your SIPs or waiting for the “right time” to reinvest. But trust me, by the time you realize it’s a good opportunity, the market will likely be at an all-time high again.

So, the best advice here would be to stay invested and continue your SIPs as it is for your long-term goals and it will reward you in the long run. In fact, market corrections are the best times to keep investing monthly as you can buy at lower levels and maximize your returns. Additionally, for those looking to take advantage of this market volatility, the 2025 correction has opened up a fantastic opportunity to invest in equity mutual funds. In my view, this market dip is the perfect time to deploy funds systematically and capitalize on long-term growth. That being said, balancing risk and reward is crucial when investing.

So, in this article, I’ll highlight three mutual fund categories worth considering in 2025. All right, let’s dive in!

Read More: Zomato Share: Sizzling Opportunity or Overcooked Valuation?

Table of Contents

Mutual Fund Categories

1. Index Fund

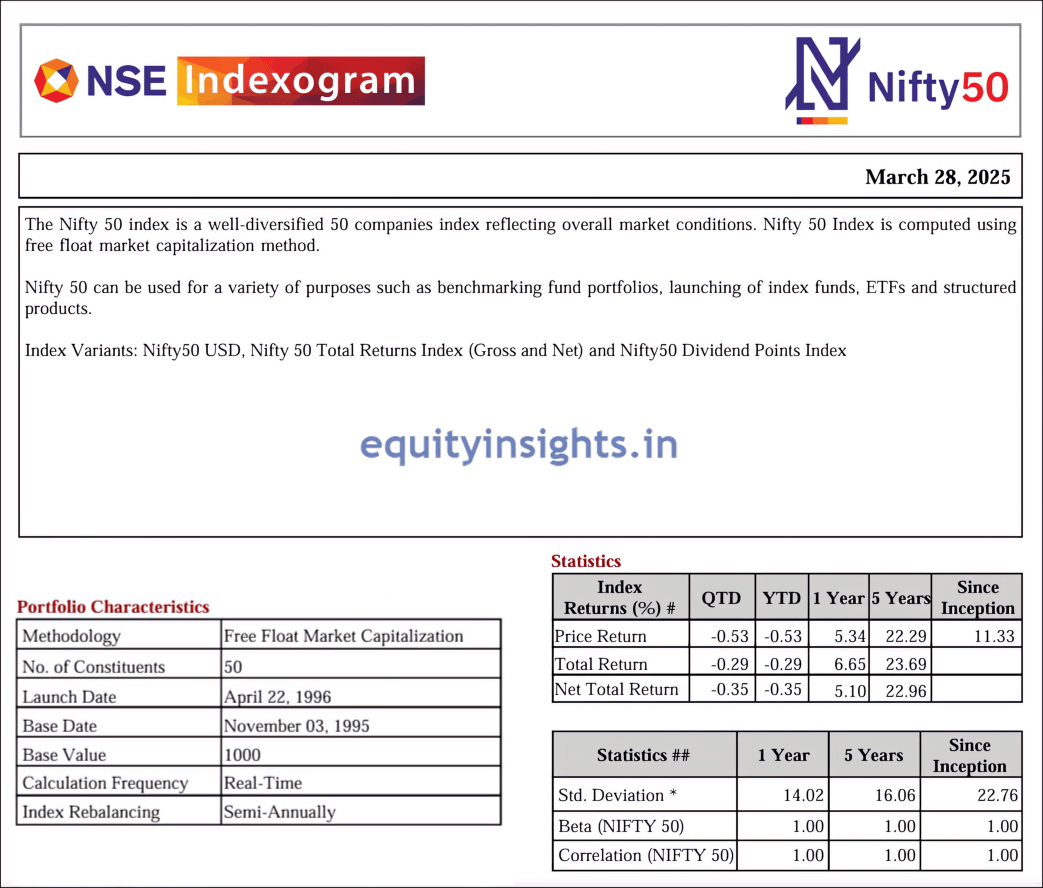

The first mutual fund category is Index Fund. There are two key reasons to invest in the Nifty 50 index fund:

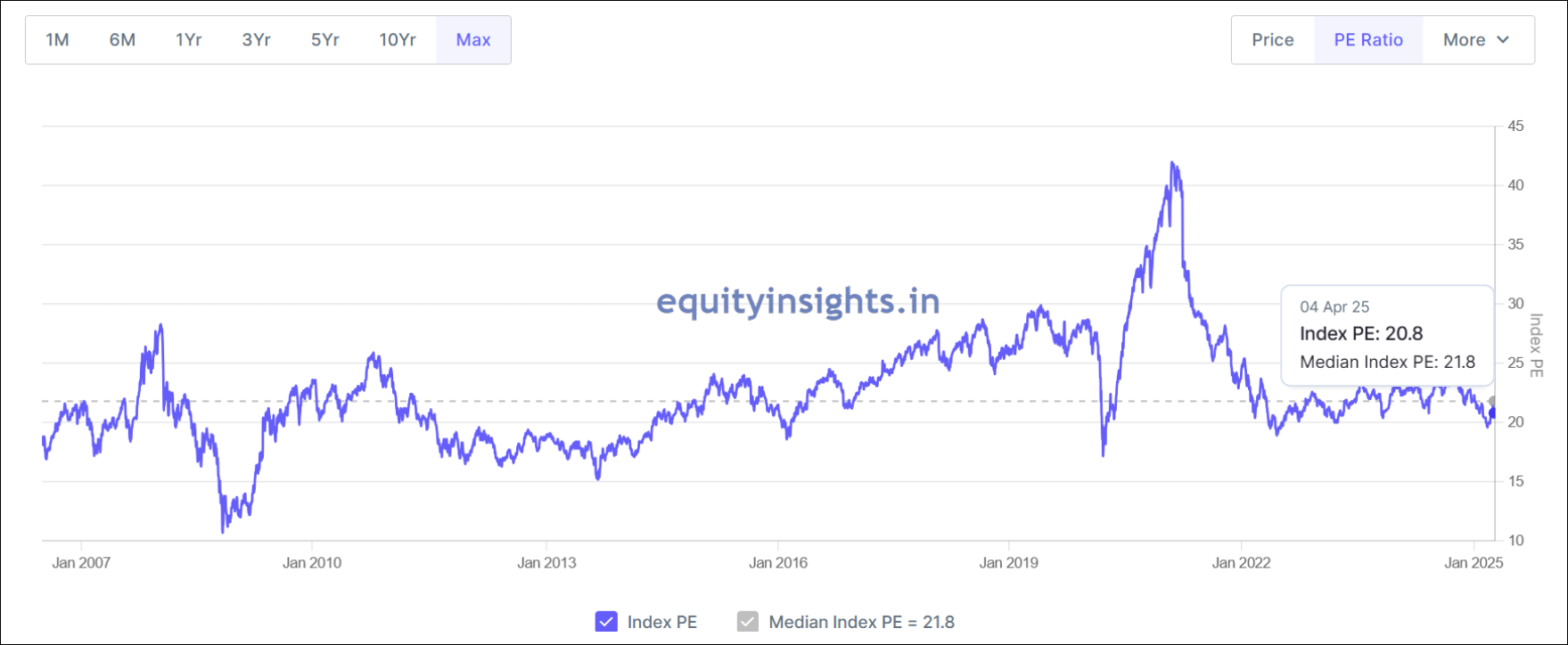

- Large cap index in India is trading at a decent valuation with a P/E of around 20.8 which is even below the historical median valuation of 21.8. So, the risk-reward is much more favourable in this category. In this volatile market, even if there’s further correction, I don’t expect more than a 5-10% correction because the valuation in the Large-cap index is already reasonable and another 5-10% correction would make the valuation quite attractive and history suggests that whenever valuations of Nifty 50 have fallen below P/E of 20, it has created great wealth for investors from those levels.

- The second reason to pick the Nifty 50 index fund is due to its low-cost structure. An important parameter while selecting a mutual fund is its expense ratio. Nifty 50 index fund has a very low expense ratio — in the range of 0.1-0.4% as compared to active funds expense ratio of 0.5-1.5%. While this difference may look very small, in long-term it creates a huge difference.

Another very important aspect is a lot of active mutual funds fail to beat the benchmark today. The majority of retail investors start SIP based on past performance, often shortlisting funds that have generated the highest return over the past 1-3 years but there have been many cases where after 2-3 years, they realize that their mutual funds are not doing well and they get confused whether to stop or continue the SIP. This unpredictability is the core issue with actively managed funds. While some active mutual funds will outperform, there’s no guarantee that the ones you invest in will continue to do so and that’s where index fund comes into picture — offering low-cost, reliable exposure to the broader market.

If you’re confident about India’s growth story, you must have a Nifty 50 index fund in your core portfolio. I’m not completely against active funds and you can still allocate a percentage of your portfolio to active funds but a good allocation should be in index funds.

Remember, index funds are also dynamic by nature. So, if a company underperforms, it’s replaced by a stronger performer, ensuring the fund stays aligned with market trends. This means you don’t have to worry about constantly reshuffling your portfolio by replacing the underperformers as it would be taken care of by the index fund itself. As far as returns are concerned in the last 20-30 years, Nifty 50 has generated around 13-14% CAGR return and given India’s promising growth outlook, I expect that over the next 10-20 years, it should generate similar returns.

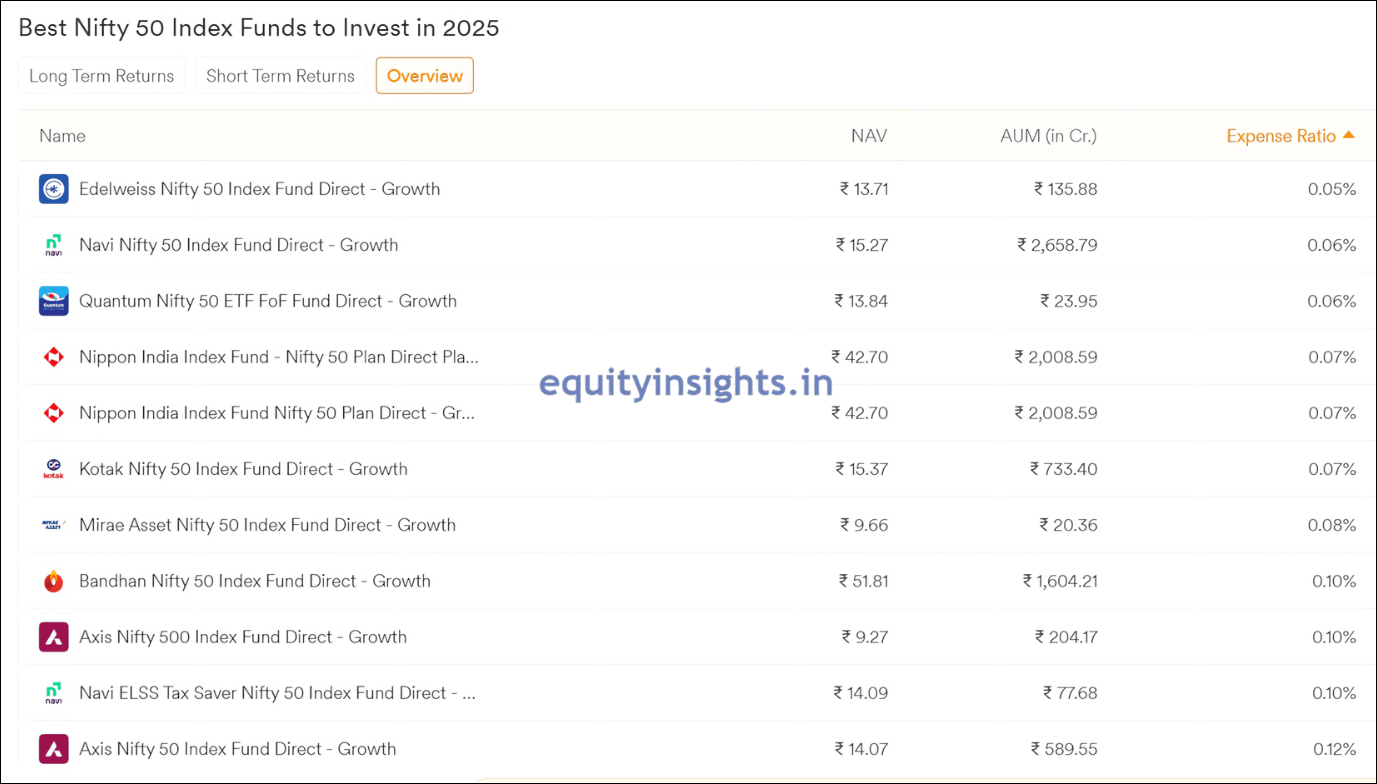

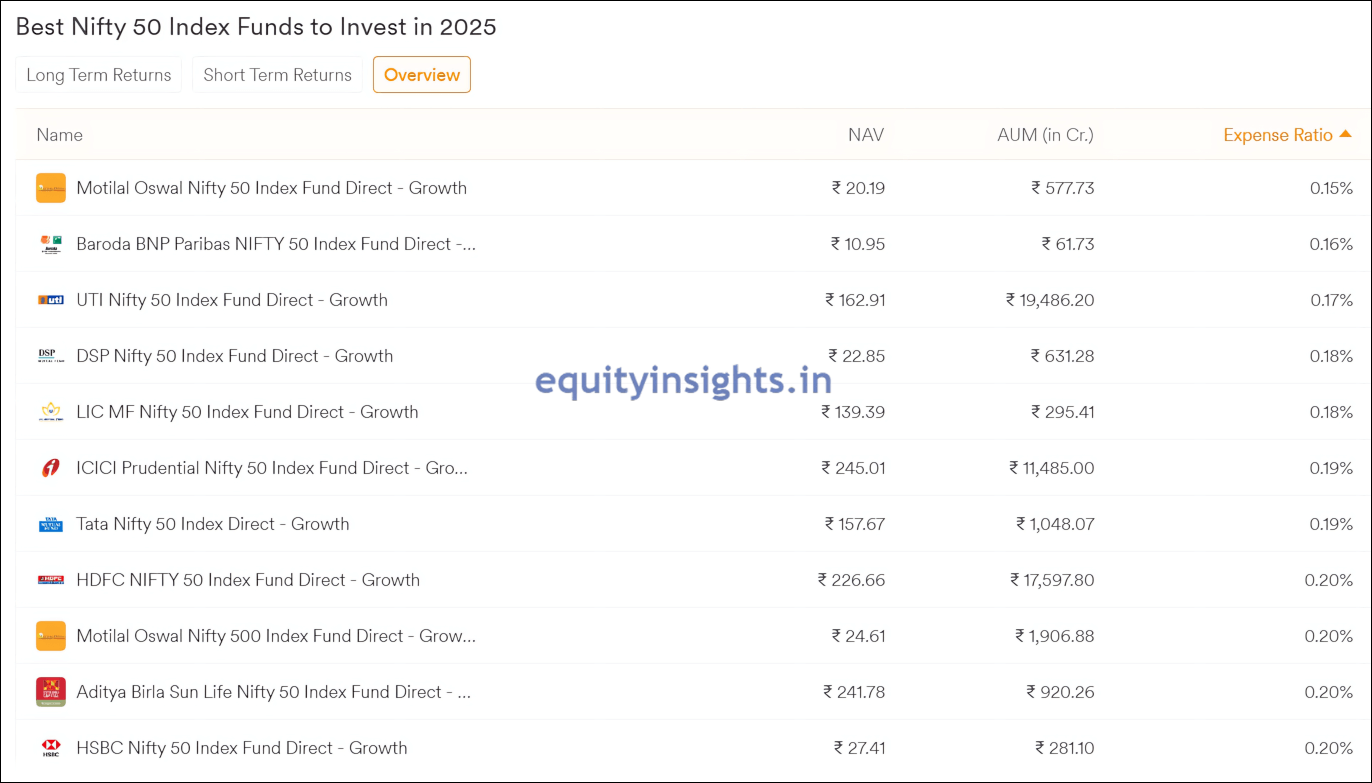

Now, let’s dive into some of the top Nifty 50 index funds in India. With several options available in the market — all aiming to replicate the same index — their returns are largely similar. So, how do you pick the right one?

The secret lies in the expense ratio. The lower the expense ratio, the higher your potential returns. So, if you’re planning to invest in the Nifty 50, don’t overlook this crucial detail — it’s the smart investor’s advantage.

Here’s a breakdown of some of the best-performing Nifty 50 index funds categorized by their expense ratios:

1. Ultra-Low Expense Ratio (0.05% – 0.14%)

| Fund Name | Expense Ratio |

|---|---|

| Nippon India Index Fund Nifty 50 Plan Direct – Growth | 0.07% |

| Kotak Nifty 50 Index Fund Direct – Growth | 0.07% |

| Bandhan Nifty 50 Index Fund Direct – Growth | 0.10% |

| Axis Nifty 50 Index Fund Direct – Growth | 0.12% |

Best For: Investors who want to minimize costs and keep more of their returns.

2. Low Expense Ratio (0.15% – 0.20%)

| Fund Name | Expense Ratio |

|---|---|

| Motilal Oswal Nifty 50 Index Fund Direct – Growth | 0.15% |

| UTI Nifty 50 Index Fund Direct – Growth | 0.17% |

| DSP Nifty 50 Index Fund Direct – Growth | 0.18% |

| ICICI Prudential Nifty 50 Index Fund Direct – Growth | 0.19% |

| Tata Nifty 50 Index Fund Direct – Growth | 0.19% |

| HDFC Nifty 50 Index Fund Direct – Growth | 0.20% |

Best For: Investors looking for a balance between low fees and well-known brands.

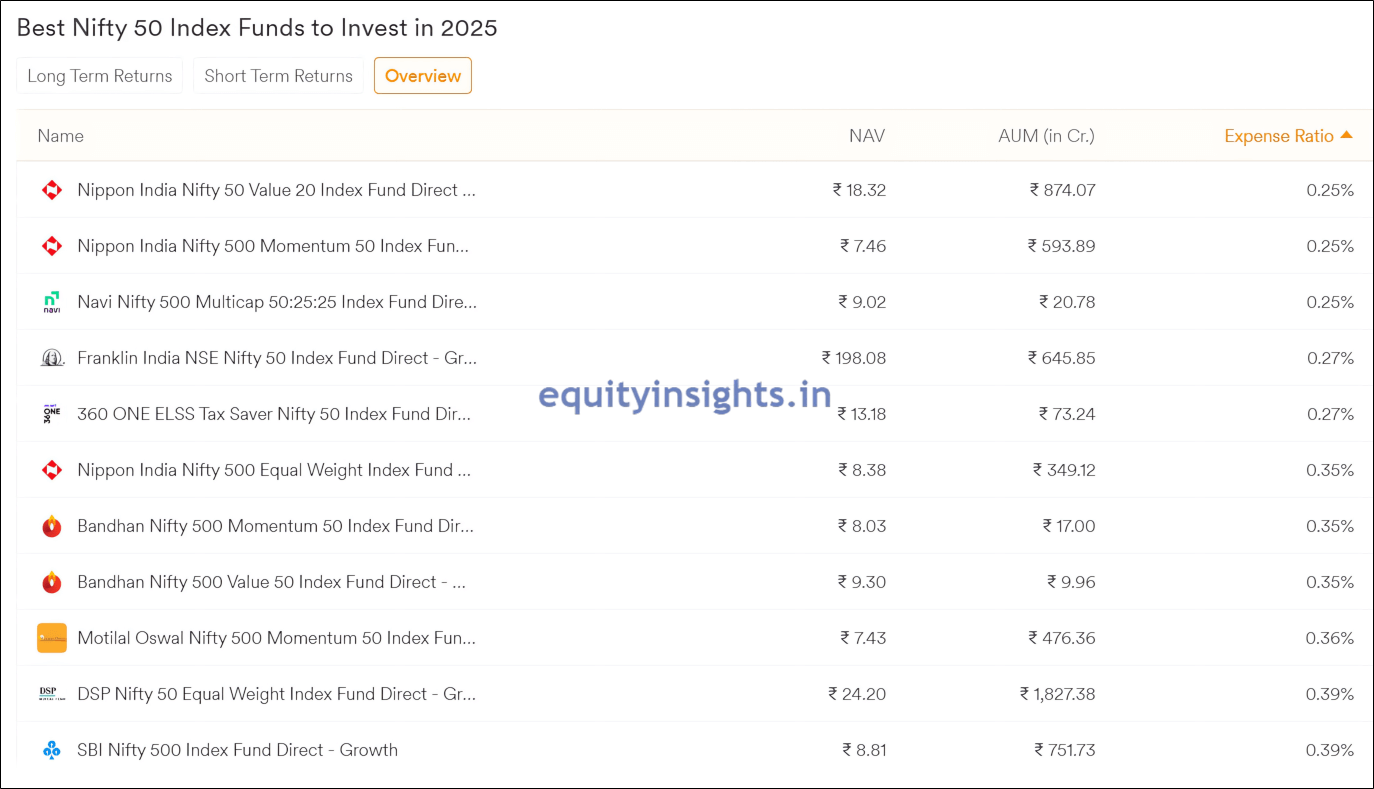

3. Moderate Expense Ratio (0.21% – 0.39%)

| Fund Name | Expense Ratio |

|---|---|

| Nippon India Nifty 50 Value 20 Index Fund Direct – Growth | 0.25% |

| Franklin India NSE Nifty 50 Index Fund Direct – Growth | 0.26% |

| DSP Nifty 50 Equal Weight Index Fund Direct – Growth | 0.39% |

Best For: Investors who are open to paying a bit more for specialized strategies.

4. High Expense Ratio (0.40% – 0.65%)

| Fund Name | Expense Ratio |

|---|---|

| Aditya Birla Sun Life Nifty 50 Equal Weight Index Fund Direct – Growth | 0.40% |

| UTI Nifty50 Equal Weight Index Fund Direct – Growth | 0.61% |

Final Thoughts:

- Want the lowest fees – Choose Nippon India or Kotak at 0.07%.

- Looking for reliable brands – Motilal Oswal, HDFC and ICICI are good choices under 0.20%.

- After something unique – DSP Equal Weight Fund (0.39%) offers a different approach to the Nifty 50.

Why Expense Ratios Matter: A lower expense ratio means fewer fees, which can significantly boost your long-term returns. By selecting funds with competitive expense ratios, you can maximize your investment gains while tracking the performance of the Nifty 50 index.

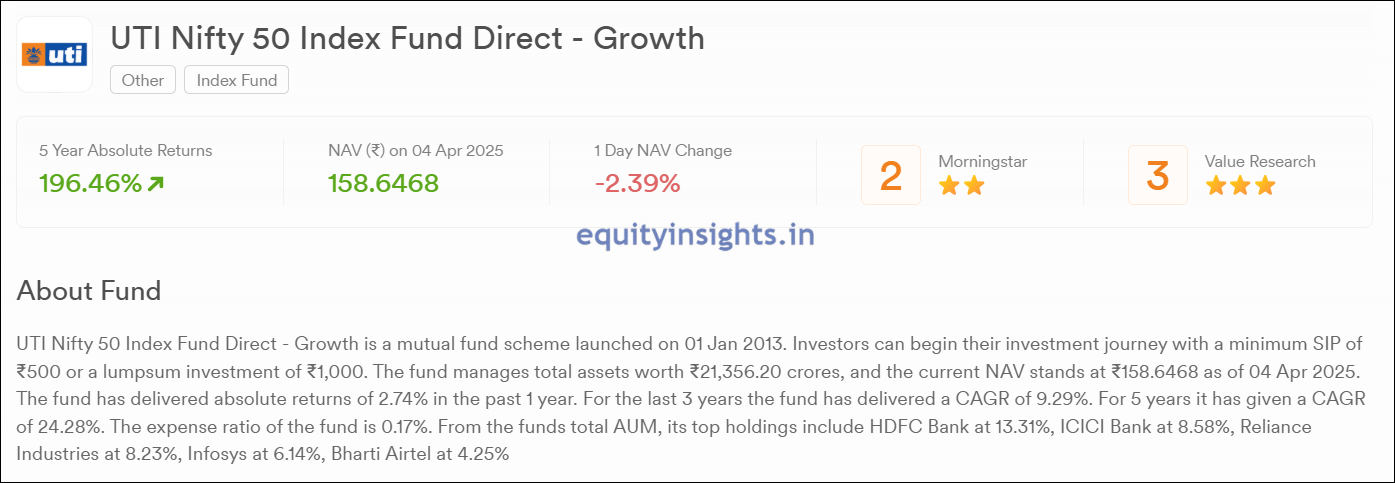

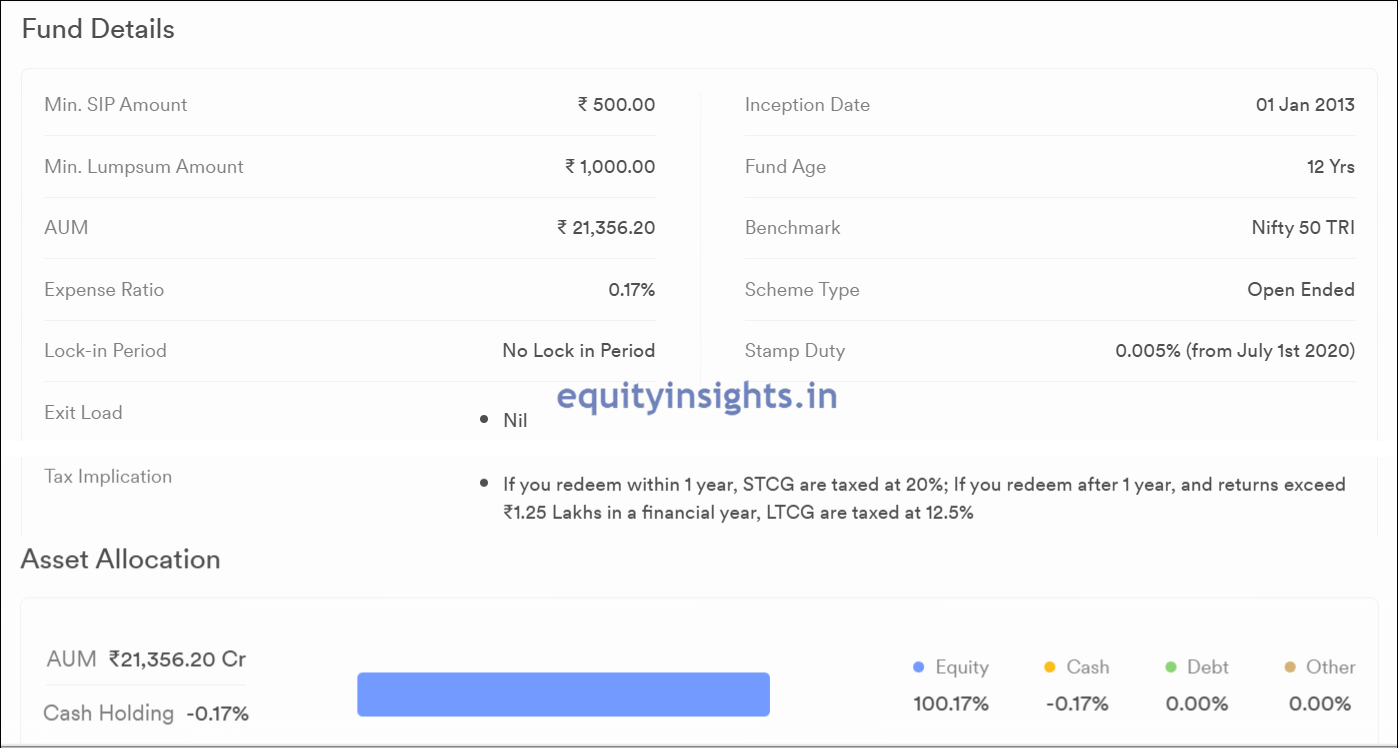

Now, if you’re looking to dive deeper into a specific fund, simply click on it to uncover a wealth of detailed insights. For instance, take the UTI Nifty 50 Index Fund (Direct – Growth), you’ll find comprehensive information about the fund and asset allocation.

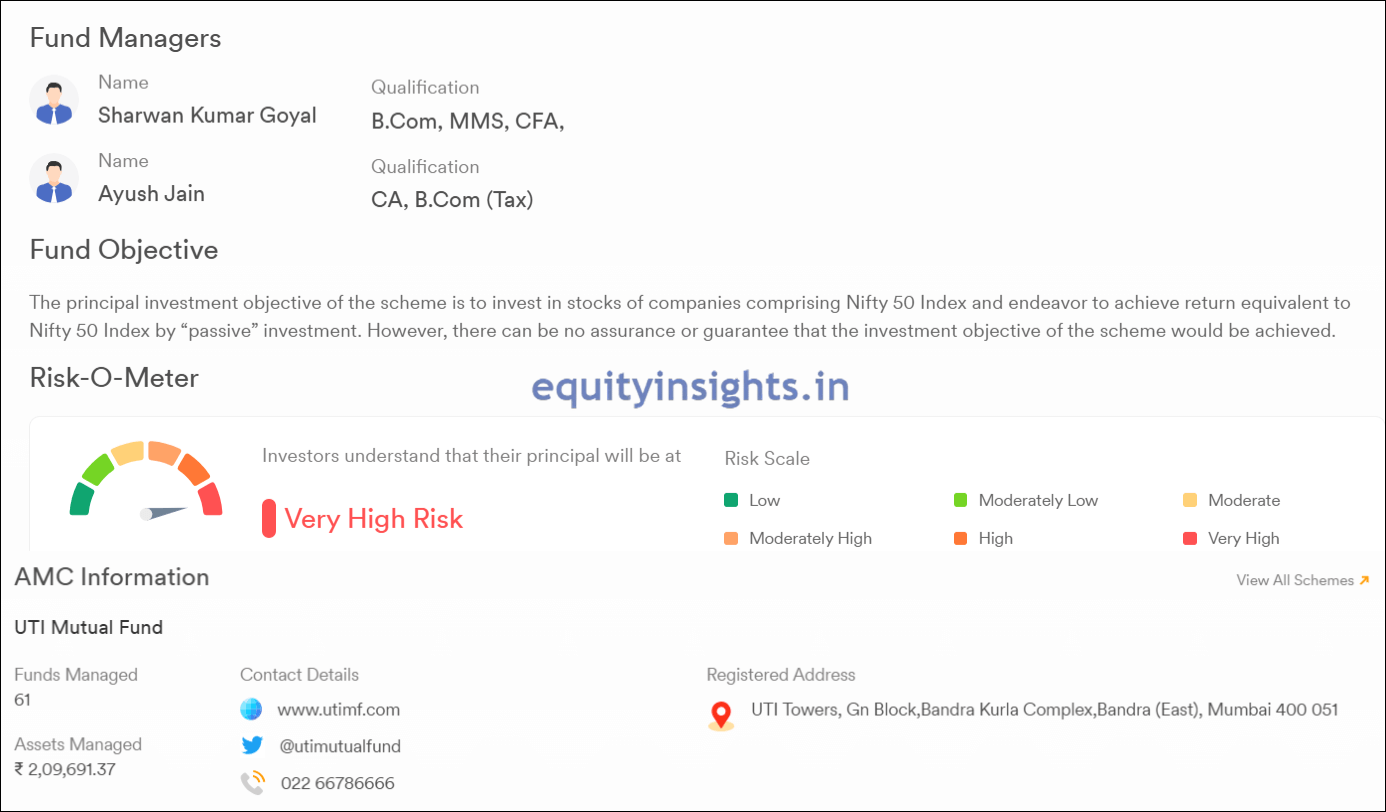

You’ll also get to know the people behind the fund—the fund managers—along with the fund’s objective, its placement on the risk-o-meter and key details about the Asset Management Company (AMC).

This holistic view not only helps you assess whether the fund aligns with your risk appetite and financial goals, but also gives you confidence in the expertise managing your investments. After all, understanding who and what you’re investing in makes all the difference.

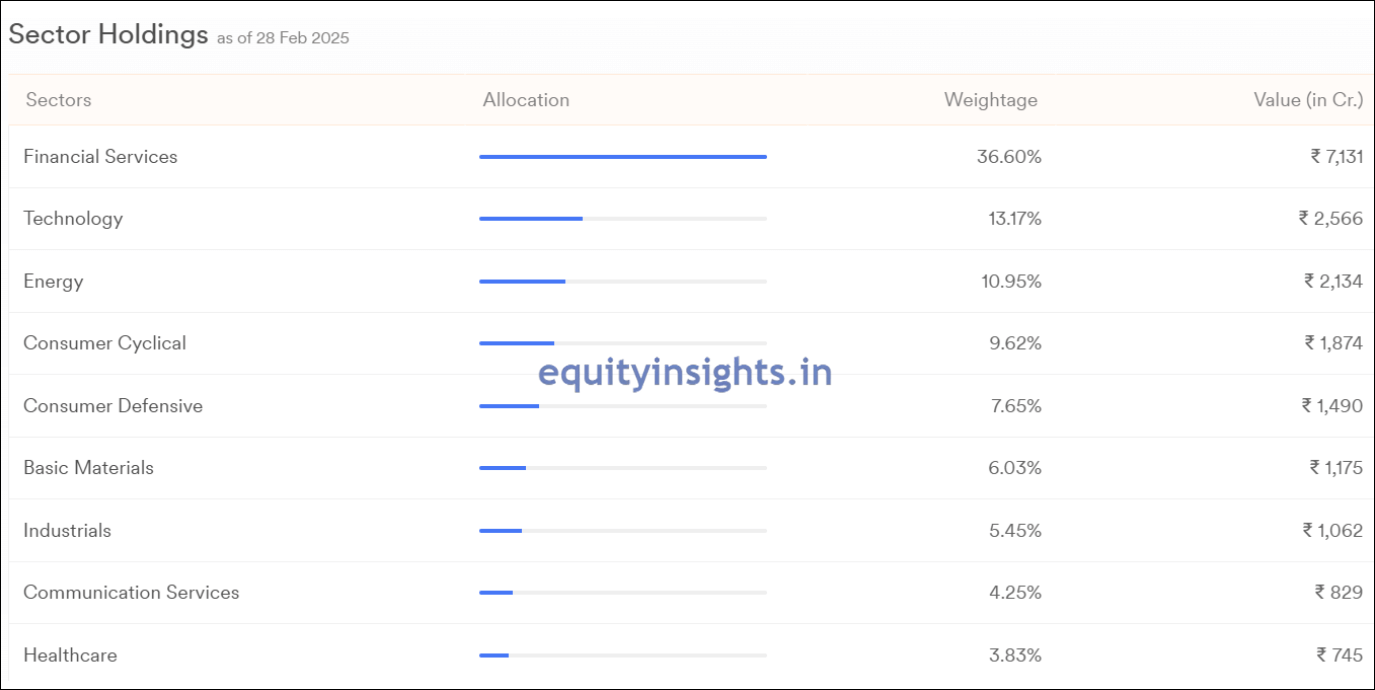

As of February 28, 2025, the fund shows a well-diversified asset allocation—36.60% exposure to financial services, 13.17% to technology, 10.95% to energy and 9.62% to consumer cyclical sectors, among others.

This diversified spread reflects a strategic approach to capturing growth across key segments of the Indian economy, while also managing sector-specific risks. It’s a smart mix that appeals to investors looking for both stability and long-term potential.

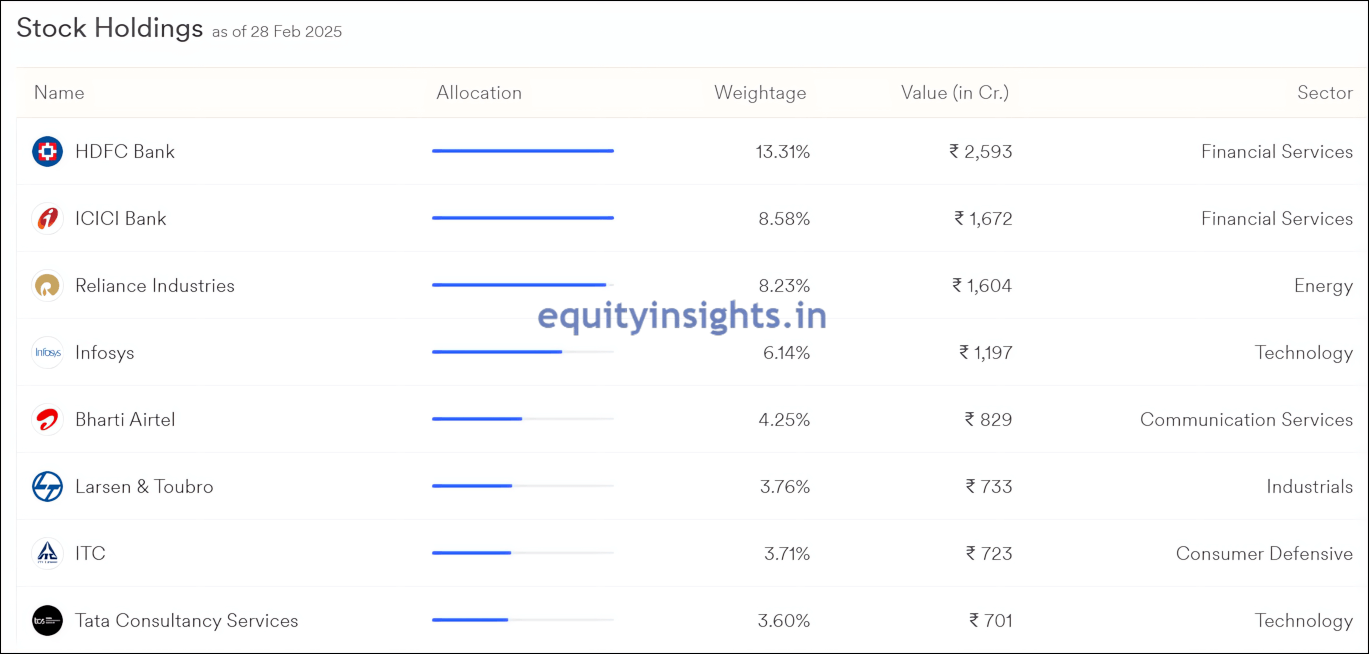

You can also view the top stock holdings in the fund—ranked by free-float market capitalization—giving you a clear picture of which companies carry the most weight in the portfolio.

This breakdown gives you a clear picture of where your money is going — helping you invest with confidence and clarity.

Read More: Zaggle Prepaid Share: A Promising Investment or Risky Bet?

2. Multi Cap Fund

The next mutual fund category is Multi Cap Fund. While Nifty 50 is a great investment option, the only issue with this index fund is, it does not have exposure to mid and small cap stocks that have high growth potential. Of course, it comes at its own risk of volatility but having some exposure in mid and small cap along with large cap provides a very fine balance in terms of stability and decent growth from large cap and potentially high growth from mid and small cap.

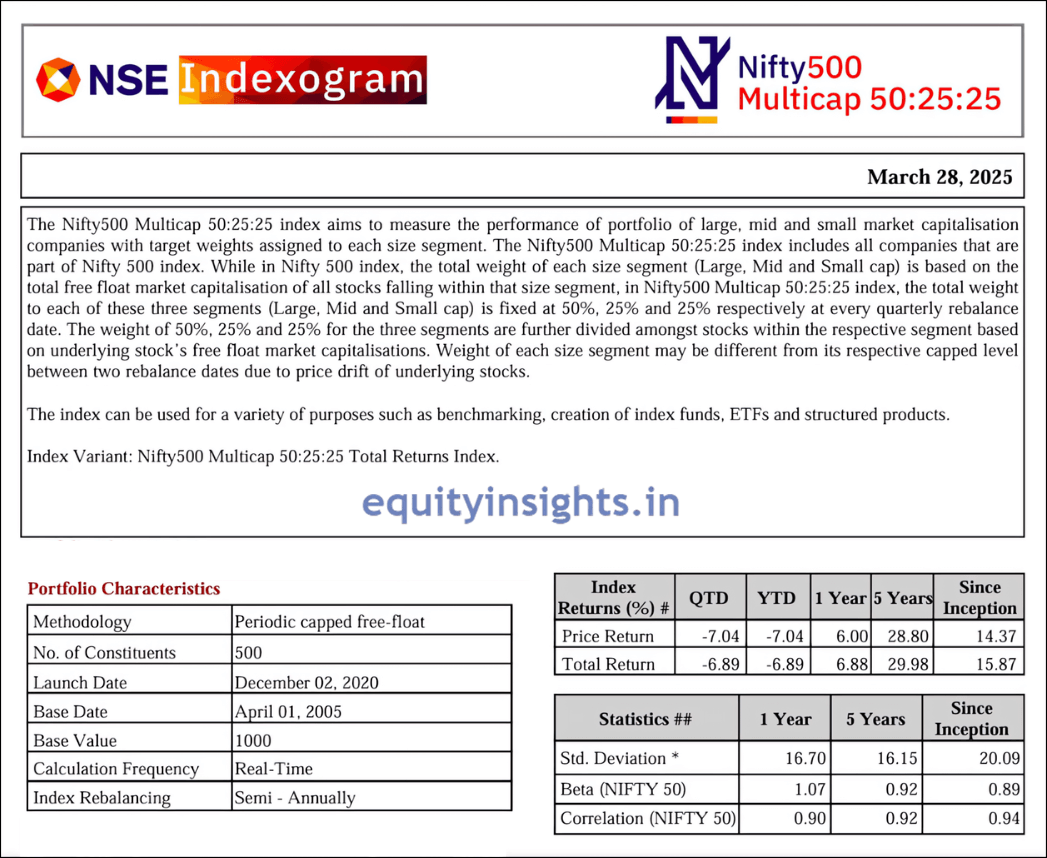

Now, the biggest challenge here is how should you allocate funds across the large, mid and small cap. Obviously, it’s not an easy task to pick individual stocks and that’s where I like the multi cap fund category. Here you have a benchmark called Nifty Multicap 50:25:25 where 50% would be invested in large cap, 25% in mid cap and 25% in small cap. That way, it helps in providing a nice diversification to your portfolio and balances your risk and reward, where a large cap provides stability, a mid cap offers growth potential and a small cap can deliver a high return over time.

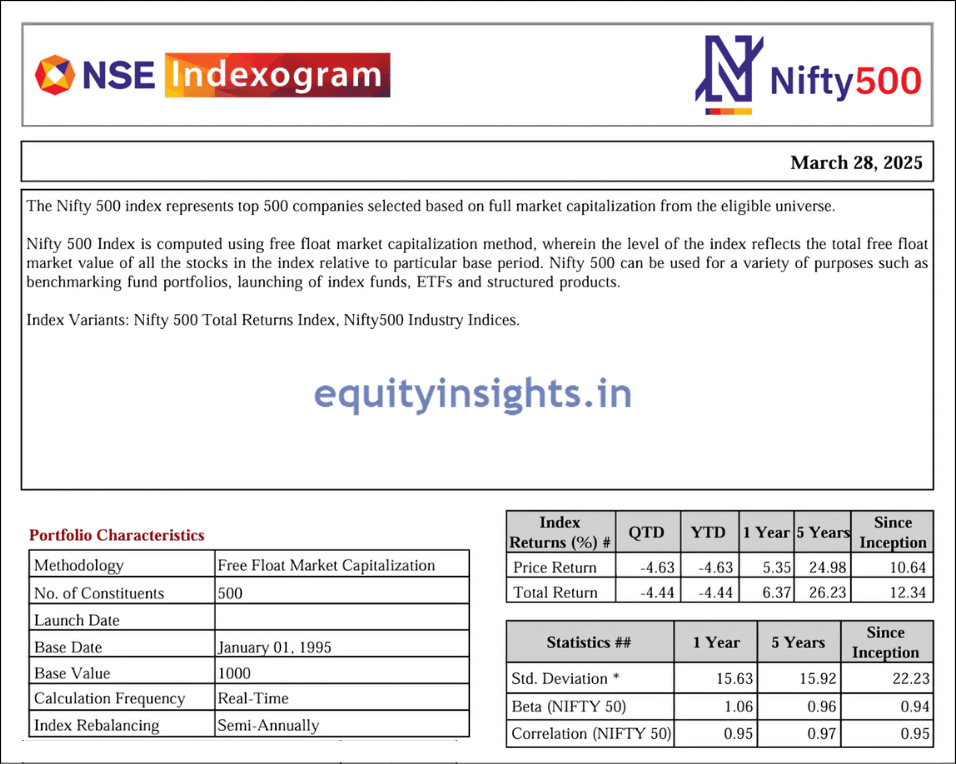

If you look at the returns in the last 5 years, Nifty Multicap 50:25:25 has generated 29.98% return versus Nifty 50 returns of 22.96% and Nifty 500 returns of 26.23%. However, the problem is Nifty Multicap allocation of 50% in large, 25% in mid and small cap each is very rigid. That’s where, rather than going for the passive investment route, I prefer the active investment route in multi cap fund.

Securities and Exchange Board of India (SEBI) mandates that multi cap funds must allocate at least 25% of their asset in each category, that is large, mid and small cap. It means remaining 25% is up to the fund manager to decide and that’s where well-managed multi cap funds can generate a decent alpha over Nifty 50 and Nifty 500 Index.

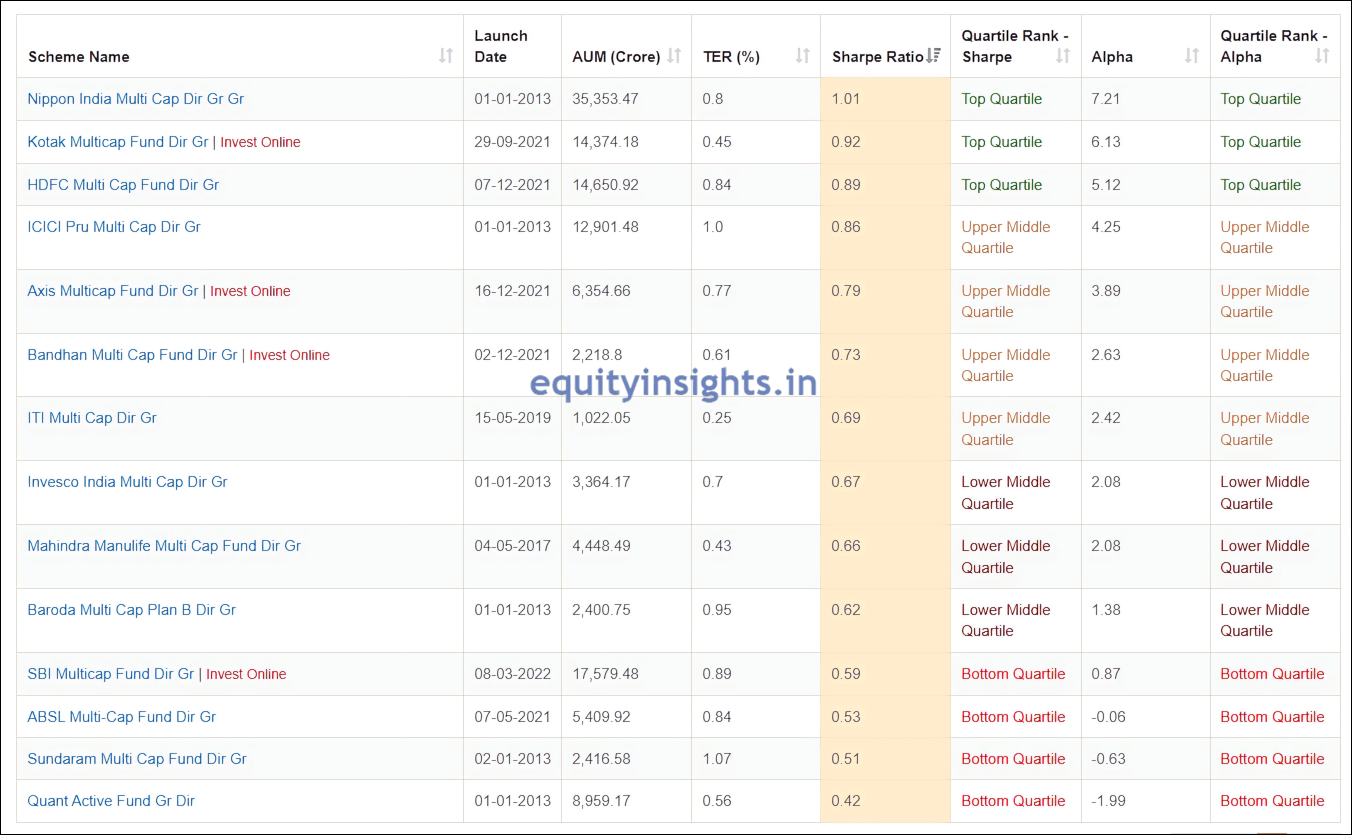

Now, the big question is how to identify good multicap funds. So, you need to look at two things:

- Lower Expense Ratio: Needless to say, the lower the expense ratio, the better it is.

- Risk-Adjusted Return: It’s not just about generating the alpha over benchmark. It’s also about having lower volatility and since here the goal is to identify mutual funds that not only generate good returns but are also less volatile, so one ratio that you must look for risk-adjusted return is Sharpe ratio.

Sharpe ratio is a measure of risk-adjusted return, showing how much excess return an investment generates per unit of total risk (measured by standard deviation.) In simple words, higher the Sharpe ratio, better is the risk-adjusted return.

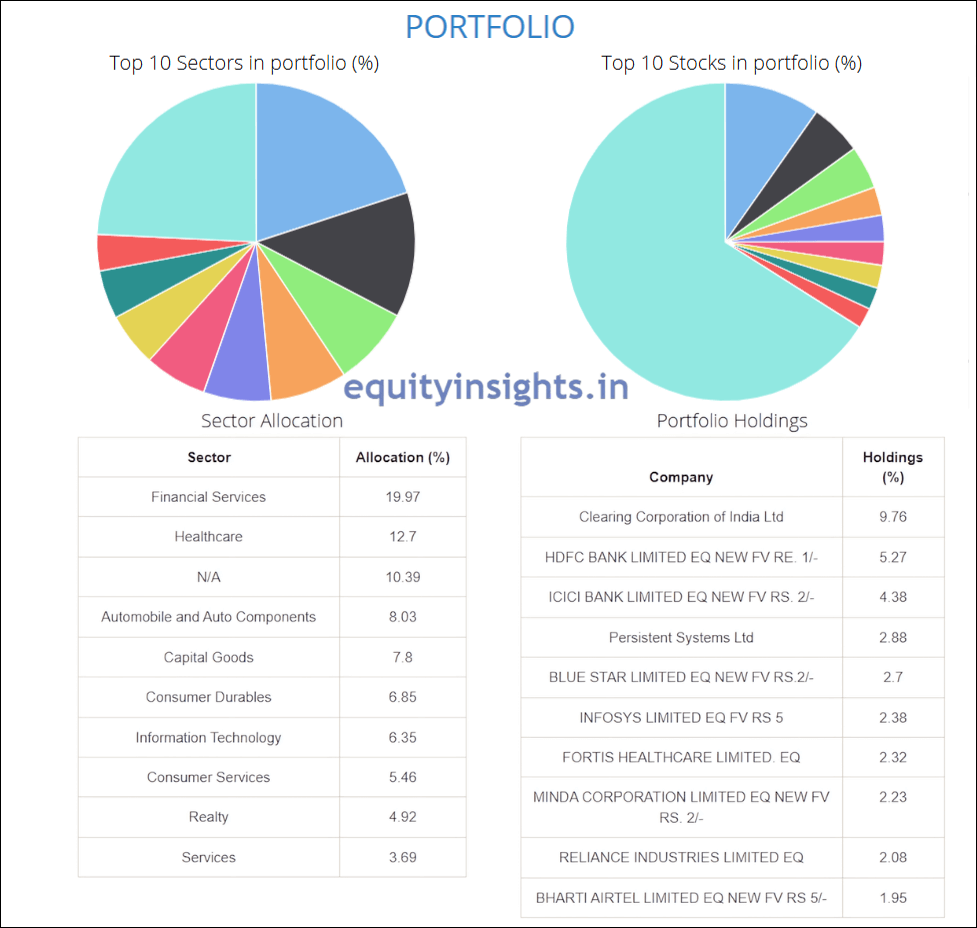

If you look at some of the top mutual funds in this category, it include Nippon India Multi cap Fund, Kotak Multicap Fund, HDFC Multi cap Fund, Axis Multicap Fund and many more. These funds have not only got a high Sharpe ratio but have also generated high alpha as compared to the benchmark. Here, if you click on Axis Multicap Fund, which has performed really well, you can easily see details like the portfolio breakdown, sector-wise allocation and the top stocks it holds. It’s a simple way to understand where the fund is investing your money.

Read More: Tata Motors Share Price Tanks 45% – Crash or Opportunity?

3. Flexi Cap Fund

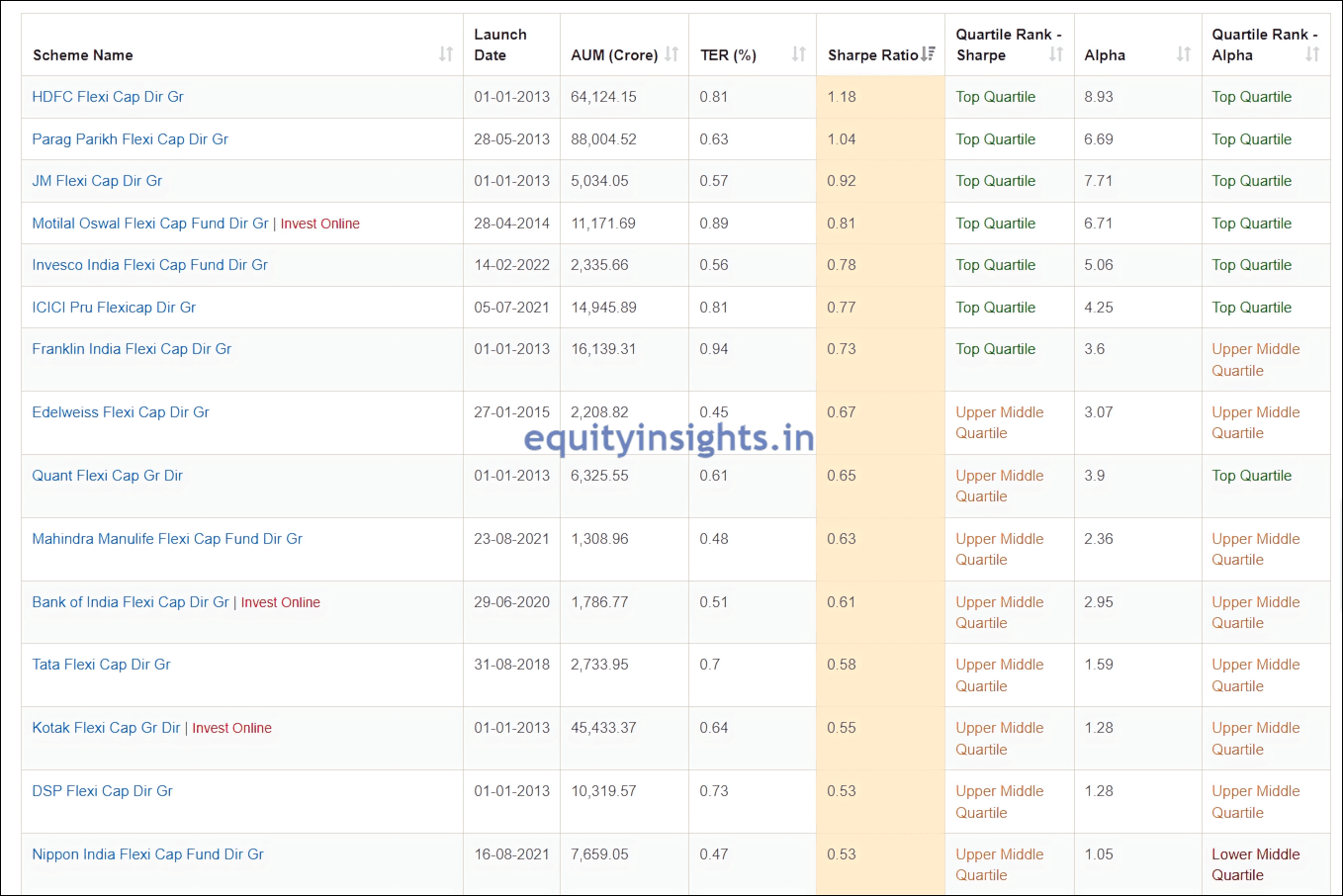

The third category I recommend is Flexi Cap Funds. Unlike multi cap funds, which must allocate a minimum of 25% each to large, mid and small caps, Flexi Cap Funds have no such restrictions. This gives the fund manager complete flexibility to adjust allocations based on market conditions, optimizing growth potential. Here the best flexi cap fund is the HDFC Flexi Cap Fund which has a Sharpe ratio of 1.18 and has generated alpha of 8.93%. One of my most preferred pick in this category is Parag Parikh Flexi Cap Fund which has a Sharpe ratio of 1.04 and has generated an alpha of 6.69%.

So, in this article, we explored three mutual fund categories worth considering in this volatile market: Index Fund, Multi Cap Fund and Flexi Cap Fund.

The Nifty 50 Index Fund is a passive investment category that would mirror the growth story of Indian economy. On the other hand within Multi Cap and Flexi Cap Funds category, I like the active fund route where the fund manager can provide a good risk-adjusted return by identifying large cap opportunities that provide stability to the portfolio and also identifying opportunities from mid and small cap segment to generate that alpha in the long-term for the investors.

So, if you’re a long-term investor, there’s no need to panic over this correction. Instead, see it as an opportunity—a chance to invest in mutual funds at lower NAVs and position yourself for strong future gains.

Now, I’d love to hear from you! Which mutual funds are in your portfolio? Drop a comment below and if you found this article helpful, share it with your circle. Happy Investing!

Disclaimer: We are not a SEBI-registered research analyst. The information provided in this article is intended solely for educational, illustrative and awareness purposes. Nothing contained herein should be construed as a recommendation. Users are encouraged to seek professional financial advice before making any decisions based on the content provided.